CoinList: How Sybil Attacks Can Disrupt Token Offerings

This article will explore how sybil attacks can ruin token launches by looking at data from the two most recent zkSync airdrops and the LayerZero airdrop.

JinseFinance

JinseFinance

Author: Packy McCormick, Not Boring; Compiler: Sissi@TEDAO

Translation Author's introduction:

Web3 is not only a technological advancement, but also a new economic and social structure. possibility. In the article, the author takes the Braintrust project as an example to provide an in-depth analysis of how Web3 can reshape business models and value chains. His perspective gradually changed from initial doubts and curiosity about Web3 to recognition and belief in its profound potential. This process demonstrates the author's thorough insight into emerging business models.

The article explores in detail how Braintrust, as a decentralized user-owned talent network, uses blockchain technology to Innovate the cost structure of intermediate links to achieve growth and expansion. This case not only demonstrates the close integration of theory and practice, but also provides us with in-depth insights into the future development trends of Web3. The article analyzes how Braintrust has rapidly increased its market value through its innovative token model and community-driven strategy, and has shown adaptability and innovation in the face of real-world challenges.

In summary, this article not only provides an in-depth analysis of the Braintrust case, but also provides an in-depth analysis of the Web3 business model and tokens. Economics is comprehensively interpreted. It provides us with a unique perspective to understand the practical application of Web3 in the real world and its potential transformative power.

Note: The original article was published on January 31, 2022

>>Foreword

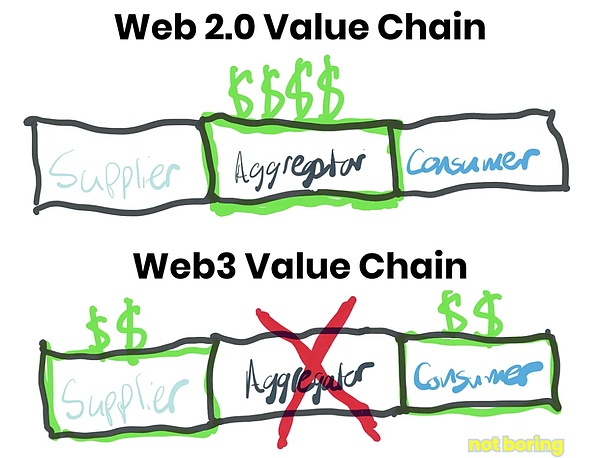

In the first article about Web3 written before, "The Open Metaverse" "Value Chain", I mentioned:

What excites me most about Web3 is the new business model it can inspire and the new value chain formed by removing “intermediaries”.

I wrote that article from the perspective of someone who was curious and skeptical about Web3. The first thing to realize is that as we invest more and more time online, especially in the metaverse, we will want to buy, own and trade our own digital items without relying on or more Importantly, there is no need to pay high commissions to middlemen.

Imagine a future where we are even more dependent on digital assets, a future where we want to be able to own and trade these assets anywhere in the digital space. This prospect is enough to convince me of the vision of Web3.

But I also understand that many people want to see some "real use cases" before getting really excited. These people legitimately ask: "Show me an example of something that regular people use in their daily lives, one that uses Web3 tools and is better than existing alternatives."

Here, I will introduce the Braintrust Web3 project.

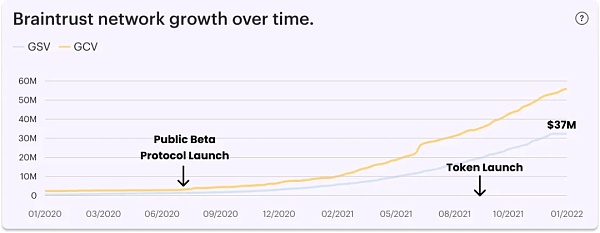

Braintrust is a user-owned talent network. Since launching public beta in June 2021, it has only taken eighteen It has grown rapidly within a few months and achieved significant scale growth. Already, $37 million in gross service value (GSV, or what clients pay talent, flows through the network) has flowed through the network, and over the coming months, signed contracts are expected to be worth double that number. times.

Braintrust Dashboard

This is not just theoretical or conceptual, it is actually happening, truly connecting talent with job opportunities at top companies stand up. You can watch this growth in real time on its public data dashboard. The data dashboard shows that a total of 2,373 jobs were completed, with an average project size of $72,474 and an average duration of 228 days.

Braintrust has a market cap of $315 million, and its fully diluted market cap is $896 million. In December, the company announced it sold $100 million worth of tokens to Coatue, Tiger, and existing investors to fund the growth of the ecosystem.

This is exactly what Web3 looks like in the real world.

Braintrust is not a disruptive new product or business model. It does not require you to believe that digital items have value, nor does it promise a return of thousands of times. Braintrust’s role is simply to connect employers looking for flexible technical talent with that talent and charge a fee for their services.

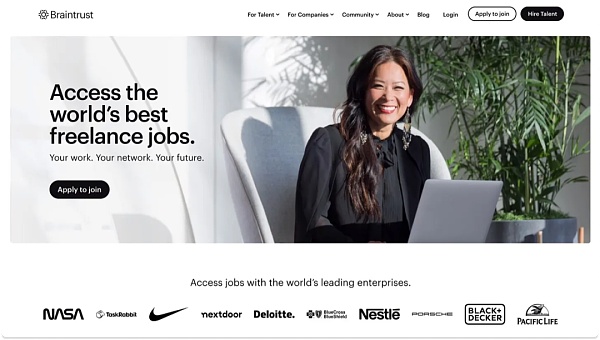

On the surface, it looks like an ordinary talent market platform. The following is its homepage:

Braintrust Home Page

This website did not directly state its connection to Web3 at the beginning. Readers need to scroll to Part Five to see the information for the first time, which reads: " Braintrust is powered by talented people like you, powered by the $BTRST token."

Tokens are just one of six reasons why you should choose Braintrust when pitching to professionals and employers.

Braintrust clearly demonstrates an extremely important point: Agoodtoken economics can amplify the value of a platform, but cannot completely replace it.

To be clear, there will be a lot of discussion about token economics next, so let’s define the concept first. I tend to think of it as designing an economy by setting the rules for how tokens are distributed, how participants use them, and how value is attributed to them. Tokenomics is one reason why tokens have an advantage over equity: they can be programmed to perform more functions. Okay, let’s continue.

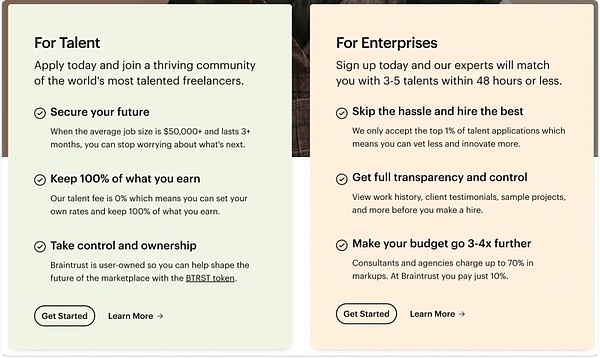

Even without mentioning tokens, the reasons for both sides of the market - employers and talent - to choose to use Braintrust are obvious:

Employers use Braintrust because they can quickly find and hire vetted technology and design talent globally and paythe lowest 10% fee in the industry commission. They can find the right talent in just days instead of weeks.

And talent uses Braintrust because they can find high-paying, flexible technology jobs at top companies like Nike and Porsche without Pay whatever fees they earn. They can choose to quit their full-time jobs, get jobs based on their needs, and have the freedom to go offline when they want.

Earn tokens and participate in voting on the future direction of the network. This is not just a side benefit, but a very important one. The advantages. When your life and work depend on a platform, you want it to be trustworthy.

Web3 is more than just Braintrust's raison d'etre; it's a toolset that helps implement long-term, sound strategic actions. Ideally, all markets should implement these behaviors. But many markets are unable to do this due to reward mechanisms and different views on time, such as their inability to maintain the lowest rake rates.

To be clear, using Web3 tools does not mean Braintrust is perfect. Tokens are not a panacea. One Redditor offers her firsthand experience of being a freelancer, including the pros and cons. Community governance can be messy and imperfect, and tokens can attract people to manipulate or defraud the system. I believe that there will be many dissatisfied customers and talents in the future.

Braintrust's success is not an established fact, but a venture based on several important assumptions:

1. A well-designed token economy can reduce costs, break conventions, and accelerate the growth of business models.

2. User-owned and controlled networks are more likely to maintain low rake rates over the long term than investor-controlled networks.

3. The network with the lowest commission is likely to be the most valuable.

4. Even with a low commission rate of only 10%, Braintrust is likely to occupy a significant share of the global talent market , thereby achieving huge economic benefits.

Although it is still in its early stages, these investments seem to be starting to bear fruit. Since its founding in 2018, co-founders Adam Jackson and Gabriel Luna-Ostaseski, along with the core team and community, have grown Braintrust into one of the most functional and fastest-growing Web3 businesses in the world.

But it still has a long way to go to realize its vision of integrating all talent network operations into its own agreement. Braintrust currently has total transaction volume of $37 million. By comparison, Web2's talent network Upwork had $904 million in transaction volume last quarter alone, and Fiverr had about $260 million. And Deloitte had revenue of $50.2 billion in 2021. Overall, global companies spend trillions of dollars on talent every year. In this case, Braintrust's trading volume to date may be just a small blip over a one- or ten-year time span. Now that Braintrust has fully transformed into a decentralized autonomous organization (DAO), its success will depend on the efforts of the community.

In short, Braintrust takes a familiar business model and applies it to one of the world’s oldest industries, while adding a few Modern innovative elements. Its success will depend on the competitiveness it demonstrates over time, particularly compared to existing public companies.

The key question facing Braintrust is:Can a network owned and controlled by users create better performance than competing networks owned by investors? and accumulate more value?

If you think after reading this article that the answer might be yes, then you truly understand the core of Web3. It can be said that Braintrust is a pioneer in guiding you into this field. Today, we’ll dive into how it works:

Braintrust Advocacy

The attractiveness of Web2 market and commission< /strong>

How Braintrust works< /p>

Value accumulation and protocol upgrade

Braintrust’s core thesis and the success of user-owned networks

>>Braintrust Claims

In October, Braintrust co-founder and CEO Adam Jackson attended my friends Ben and David's Acquired LP Show. In that episode, Ben asked him why he still held some radical views on the Web2 market despite having founded Web2 companies three times.

Adam's answer is very much like a modern version of the "greed is good" speech.

I call this "capitalism against capitalism." This is a very profound passage and worth reading.

I have always believed that if a business is good for the company but makes customers unhappy, there is a hidden opportunity for competition.

When a market operator, or any company, treats customers so harshly that customers want to legislate to change the situation, I think that's where the opportunity lies. I don't believe in government interference in such matters. I don’t think California’s AB-5 bill is well thought out and is problematic like other policies in the state. But these are problems caused by the market and should be solved by the market. Soif you operate in a market where half your customers are dissatisfied with you, that’s a dream opportunity for an entrepreneur.

This dream is to use new technology - blockchain to promote a new organizational model - user-owned, User control. SThis model will gradually erode rent-seekers who centralize and extract value disproportionately. Without blockchain, we simply wouldn’t be able to compete with these giants. DoorDash operates admirably and is not only a great app but also a very well managed company... but if they abuse a significant part of the market, that leaves the door open for disruptive innovation.

If Web3 needs a leader to appeal to the broadest audience, Adam might be the perfect fit. His approach is practical and straightforward. His speech sets the tone for the rest of the article and clearly communicates his goals.

Braintrust's purpose is to demand less value than other existing competitors, not out of charity but based on a deep understanding of capitalism. In practice, their high commission rates were my opportunity.

Adam hopes to earn substantial returns by holding $BTRST tokens over time, which means that value needs to gradually accumulate into token holdings in hands.

The remainder of this article explores whether Web3 can achieve these two seemingly contradictory goals: reduce extraction while increasing value capture.

To do this, we need to understand how markets generally work.

>>The appeal of the Web2 market and its commissions

The first thing I want to say is: I am very optimistic about the Web2 market. Just last night, I ordered dinner on DoorDash. I took an Uber home the night before and had booked accommodation on Airbnb for my trip next week.

Online marketplaces are some of the largest and most impressive businesses to have emerged in the past two decades. Even after the recent market sell-off, these companies still have a combined market capitalization in the hundreds of billions of dollars, and most of that value was created in the last decade or so (with the exception of eBay, which I believe originated at Bell Labs in the 1950s, But that's not actually the case).

These online marketplaces not only consolidate existing market shares but also make the markets in which they exist larger by their very existence. For example, the emergence of Airbnb has expanded the house rental market; the emergence of Uber has also made the shared travel market larger. If worked properly,markets can attract new supply and demand while reducing the friction and cost of transactions. These are all great things about the Web2 marketplace, and I really like it.

But this model also faces some challenges, or there is room for improvement:

For example, the market needs to invest a lot of money to continuously attract the supply side and the demand side. Just like the competition between Uber and Lyft.

Many successful online marketplaces eventually evolve into advertising-focused businesses, which may be good for business, but But it is a problem for consumers. Those ads for national fast-food chains you see on DoorDash, for example.

When the platform’s supply cannot meet demand, the platform may lower quality standards in order to increase supply . At this time, users have no choice but to leave the platform, such as when Amazon switched from completely self-operated to introducing third-party sellers.

Successful markets often raise fees to increase profits,especially when they believe users When you are dependent enough and won’t leave easily. Almost all markets have had such initiatives as they grew.

These changes do not mean that every Web2 market employs a ruthless Mr. Burns The character who takes everything from the little guy (except that DoorDash employee who decided to keep the driver’s tips).

This is due to the inherent nature of this business model. These businesses are run by executives and boards of directors who are charged with maximizing profits for shareholders. I want to emphasize that this is not a bad thing in itself, it is the essence of capitalism.

The problem is thatthese businesses often start extracting value too early, which is not the best path to long-term success as they need to prove themselves to shareholders Able to make a profit. Markets can have very high initial costs and they need to raise significant capital to start and maintain operations. Once the market starts functioning, they need to increase their share of economic activity on the platform to generate returns for investors.

This charging ratio is called the "commission rate". Bill Gurley of Benchmark defines it as: "The market is based on the percentage of gross merchandise sales (GMS). The fee charged, which generally represents the market's net revenue." For example, the 30% Uber charges drivers, the 30% Apple charges developers, and the 10% Braintrust charges customers are commission rates.

Increasing commission rates is not unethical or bad behavior, in fact, many companies often proudly talk about it in their earnings calls and letters to shareholders Increased rake rates. Fiverr, for example, increased commission rates by 140 basis points in its shareholder letter, calling it an "improvement."

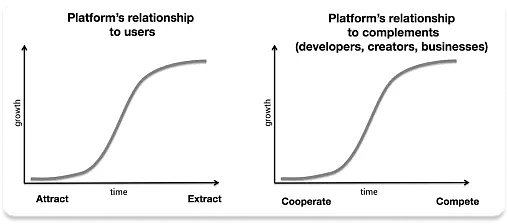

We can look at it from this perspective: Once these platforms lock in both market and platform participants, they may transition from the "attraction" stage to the "exploitation" stage. In the article "Value Chain", I quoted Chris Dixon's views in "Why Decentralization is Important" and wrote:

Once these networks have established network effects and are convinced that users, developers, and businesses have all been attracted, they move from “attracting” to “exploiting.”

A positive interpretation of increasing commission rates is that it indicates that the market is creating more value. This helps them find new customers for their users, reduce costs, or do other things that make them pay more. If a marketplace is able to increase commission rates from 10% to 20% without causing significant user churn, it may be because the previous commission rates were too low, or their product has become more valuable to users. .

However, the condition of "not causing too much user loss" is crucial in this case. Regardless of whether user churn occurs immediately, later or five years later, an increase in commission rates beyond what market participants consider reasonable could set the stage for the market's eventual downfall.

In his classic April 2013 blog post "A Rake Too Far: Optimal Platform Pricing Strategy" Gurley discussed how to set rake rates. Risks of being too short-sighted:

One might argue thata higher rake rate is always better - charge more It's better to charge less than to charge less. But the reality is often just the opposite. High pricing may be the most dangerous strategy for any platform company...

If you want to build a long-term presence For a platform to dominate the market, you need to create a platform with minimal friction on product and pricing…… in order to make your platform a transactional ’s preferred location, you need to offer industry-leading pricings – something that can’t be achieved if your high commission rates make your prices too high.

The entire article is well worth reading, but the core point is this:While increasing commission rates may seem attractive in the short term strength, but is strategically a sub-optimal choice if you want to build a market leader over the long term. Increasing commission rates may prompt supply and demand sides to look for other alternatives.

When a market charges more than the value it provides, participants often look for ways around the platform.

This was exactly the problem that many on-demand cleaning services encountered in the early 2010s. People take advantage of these services' free cleaning offers, find a cleaner they like, then ask for their contact details and agree to pay cash directly, avoiding the platform's fees. Beyond the initial matching service, these companies don't offer much more value to justify the fees they charge.

TaskRabbit encountered a similar problem. When I worked at Breather, I found Taskers that I liked and worked directly with them. TaskRabbit attempts to use penalties to prevent users from bypassing the platform and transacting directly, but this is actually the wrong approach. They should create incentives for Taskers to stay on the platform instead of treating them like naughty children. My guess is that IKEA ended up acquiring TaskRabbit because they were able to integrate Tasker more deeply into their ordering process, giving users a good reason to continue using TaskRabbit by giving Taskers IKEA-specific functionality.

Gurley suggested that the market should go beyond simply raising fees for all users and explore other ways to get more from those who want more services. More benefits. He cited advertising as an example at the time. If you can get some vendors in the market to pay for advertising, you can effectively increase revenue without raising fees for all users.

And Braintrust believes that using tokens will be a more effective method.

>>How Braintrust works

Braintrust's basic philosophy is thatit serves as a talent network, charging clients the industry's lowest commission of 10% and effectively rewarding talent with a negative commission in the form of tokens. The only way to change these rules is to let potentially affected users vote.

Here's how it works:

According to Braintrust's white paper, it is a decentralized talent network that replaces the traditional, fragmented labor market with a fluid, algorithmically controlled market managed by network participants.

The network consists of two parts:

Employers, such as Nike, Porsche, Atlassian, NASA, etc., look for talents by posting job requirements, which detail information such as required skills, geographical location (or working time zone), and rates.

Talents, mainly professionals in the field of engineering and design, at this stage, they respond to needs by submitting work proposals, put forward Their "offer".

Talents can set their own desired salary without paying any fees. Employers are required to pay 10% of the talent’s invoice amount as a service fee, which is used to support the operation of the network. In short, without this fee, the client would probably be willing to pay the talent more, so the end result is that the client pays about 10% of the fee and the talent gets what they are paid.

It’s important to note that all payments are made in local currencies – for example, clients in the US can pay in US dollars, and Braintrust will pay in the currency of where the talent is located Pay them. With Braintrust, neither clients nor talent need to involve cryptocurrencies.

Braintrust is able to charge such low service fees for several reasons:

Software: The Braintrust Protocol leverages software to automate many of the market's basic functions, such as matching talent, payment settlement, and incentivizing participants. Since the marginal cost of these software is almost zero, they significantly reduce operating costs.

Token: Braintrust has its own token $BTRST, which is used to promote business activities (generating a flywheel effect) and incentives that are beneficial to The behavior of the network and pay for tasks that would normally require hiring people to complete in traditional markets.

Funding sources: Braintrust's operating funds come from funds raised, 10% service fees paid by customers, and its treasury of $BTRST tokens.

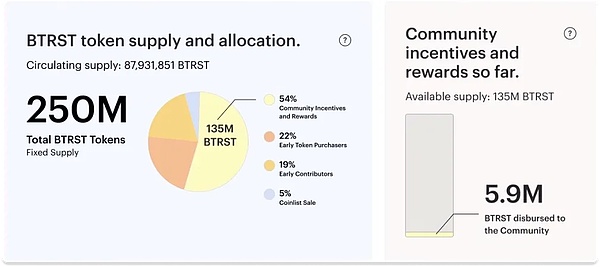

Currently, the holding situation of tokens is as follows:

To launch the network, Braintrust passed Coinlist last September A crowdfunding round was conducted, raising approximately $11 million. On top of this, they have raised approximately $24 million from venture capital firms, with Not Boring Capital investing on an Option 2 basis. Early angel investors and venture capital firms, including Variant, Multicoin, ACME, Hashkey, and others, collectively hold 22% of Braintrust tokens and plan to lock up the tokens for multiple years. Users who purchased through crowdfunding hold another 5%, and the lock-up period for this part of the tokens is 3 to 6 months. In December, Coatue and Tiger purchased $100 million worth of tokens from the company’s reserves.

There are indeed some important issues to pay attention to here:

1. Venture Capital Involvement vs. User Ownership: When venture capital is involved, does that really count as a reflection of user ownership? This relates to the so-called "Jack's Paradox": even in Web3, the real control seems to still be in the hands of venture capitalists and their limited partners, rather than ordinary users, because these entities are motivated by profit. However, as a Web3 venture capitalist who invested in Braintrust, there may be a bias here. What needs to be noted is:

When the business model has not yet been verified, these companies still need Capital to get started, and VCs are experts at this.

Holding 22% investor ownership and having 41% investor and team ownership, which is much lower Equity allocation for most companies when they go public.

Even in the Web2 space, few companies offer even close to half ownership to the community. Even the most forward-thinking companies only allow their best users to purchase limited pre-IPO shares.

More pressure may come from the company's choice of listing targets. Public market investors typically impose stricter requirements and expectations than venture capital firms. This pressure can affect a company's operations and decisions, and sometimes can even be contrary to the original mission and vision.

2. Venture capital and market profit pressure:Why venture capital will not require Braintrust to do The same thing investors claim to be asking Web2 Market to do? Most markets are feeling the pressure to turn a profit, not from their venture capital firms but from the public markets. Uber had planned to go public at a valuation of $120 billion, but public market investors pointed to its lack of profitability and the fact that it did not have a monopoly in the market and therefore could not raise prices. When Web2 companies exit the market, equity flows more to institutional investors; while Web3 companies become more reliant on user ownership when they launch tokens. Additionally, VC firms know that they will not be able to fund Web3 companies if they have a bad reputation in the community. The DAO typically votes on which venture capital firms should be allowed onto the company's capital table.

3. The difference between Web2 and Web3 user equity:Web2 companies do not also hold Share users? How is this different from Web3? Let’s say I own $10,000 worth of Amazon stock and am an Amazon customer, and let’s say Amazon puts the decision to raise the price of Prime by $10 up to a vote (although they won’t do that, but let’s assume). To me, that $10 increase is nothing relative to my stake. However, if I hold $10,000 worth of Braintrust and they propose a 10% fee increase and I make $72,000 per project on Braintrust, then this vote will cost me $7,200 per contract Impact. I would need a very good reason to vote for a fee increase - for example, the network may not be able to sustain operations at a 10% fee.

Coatue's $100 million investment round is an interesting example of how investors can become deeply involved in networks. Coatue and Tiger have long been investing in the Web2 market, actively seeking to purchase Braintrust tokens in excess of exchange supply. They reached an agreement to purchase $100 million worth of tokens from the treasury, with the proceeds going to fund rewards (partly paid in USDC and partly in BTRST). As part of the deal, Coatue, which has been acquiring recruiting companies for years, offered to provide recruiter resources to help build a network of recruiting talent. They participate in the network not only in the form of funds, but also in practical actions.

For now, this is all still developing in real time, and whether VCs actually won't (and more importantly can't) push the protocol for over-extraction, will is a very important observation point.

Early contributors hold 19% of the network. In fact, Braintrust is not a company in the traditional sense; most of the construction work on the project is done by six nodes - Freelance Labs, HexOcean, SnowFork, Accelerated Labs, Distributed Labs and Muses. These nodes are responsible for a variety of tasks, from designing the protocol and token economics to early-stage marketing and now also processing payments, currency exchanges, and more. More importantly, they are responsible for developing and managing business relationships with major customers like Nike and NASA. These clients often require heavily customized services, cumbersome paperwork, and strict compliance and security.

Adam and Gabe are actually members of Freelance Labs, which is responsible for designing many core contents such as token economics. The best customer sales team on the web is a node formed by three people on their own.

Braintrust is also practicing its own philosophy. The entire Braintrust website, including engineering and design work, is completed by professionals working on the Braintrust platform.

These nodes and early contributors are actually the founding teams scattered across different organizations, and together they own 19% of the tokens in the network. In addition, the 10% fee paid by the customer is used to pay for the ongoing work of the node, which the node can use to pay itself and pay talent, etc. Keep this concept in mind, we'll come back to what this 10% fee is used for later.

The remaining 54% of tokens belong to the community reward and incentive fund. These tokens are used to incentivize good behavior and reward individuals and businesses for completing tasks that typically require hiring people in traditional markets, such as recommending, developing, and bringing in new members. These rewards are issued in the form of BTRST tokens.

The main objects of community incentives and rewards include:

Connectors: Refers to those who refer talent or clients to the network. They are rewarded for referring new members and receive a portion of their referrals' bills. Anyone can become a connector, including individuals, professional recruiters or recruitment agencies.

Reviewer: Responsible for screening new candidates to ensure they meet Braintrust's quality standards. These individuals receive tokens upon completion of Braintrust Academy courses and BTRST tokens upon completion of audit work.

Talent: You can earn rewards by completing detailed profile and participating in courses (mini-learning) ) and successfully complete the job to earn tokens.

Grant recipients: Receive tokens for completing specific work on the network, including ambassador funding, construction Grants for educators and grants for educators. Part of the $100 million Braintrust raised from Coatue and Tiger was used to create a grant program that is currently in its preliminary pilot phase.

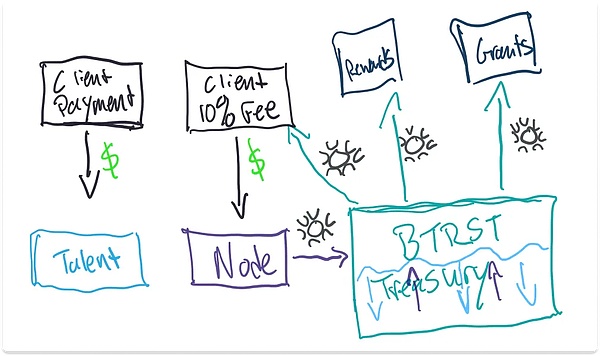

The illustrations in the following white paper provide a good representation of the overall core market dynamics, through which the BTRST token (marked with the logo in the figure place) to achieve.

The places with the "$" sign in the diagram represent traditional interactions between clients and talent, where they exchange work for cash.

The place with the Braintrust logo shows the uniqueness of the platform:

This is where talent gets an extra bonus — known as a negative rake rate — that rewards them for becoming certified or earning a five-star review.

Also, this is where connectors are rewarded for bringing supply and demand into the network - unlike traditional marketplaces, Braintrust Instead of paying expensive customer acquisition costs, these contributions are incentivized and rewarded through tokens.

This last point is very critical and complex. While Braintrust doesn’t pay its customer acquisition costs in cash, it does so in tokens. This means that the circulation of the token will increase. This system works as long as connectors are willing to accept BTRST tokens in return for their referrals. However, if the circulation increases too quickly or too much, the tokens may become worthless, causing connectors to no longer participate. Maintaining this balance is very delicate.

There is no free lunch here. Actions that are beneficial to the network, while increasing the supply of tokens, may be detrimental to investors who simply hold tokens. If you are a token holder active in the network, it is acceptable to accept a certain level of dilution to reduce the fees for economic activity. But for people who are just looking for a financial investment, the situation may not be ideal. The supply of tokens will double over the next few years, which coupled with the end of the investor lock-in period will further increase the circulating supply. But Braintrust will never exceed the cap of 250 million tokens. Financial investors need to take a very long-term view to believe that maintaining low fee rates through token inflation will ultimately contribute to the growth of the network's long-term value.

Indeed, what may seem like a problem is actually a strength of Braintrust: the network should be owned by its true owners. As more community tokens are issued, there will be a stage where the network is primarily user-driven; until then, it will be owned by users, contributors, and investors who resonate with the long-term vision.

This is a key reason why Braintrust is able to operate with such low cash expenses and remain sustainable. It has always been the plan to bridge the funding gap by issuing tokens. Token holders may expect these tokens to directly increase in value over time, but at the same time, they provide indirect financial value to network participants, mainly in the following three aspects:

1. Governance:This is the most important aspect. Governance has a financial value here, as it can mean decisions about whether to pay higher fees or even affect the future of the network. If the token value declines and the network relies more on fee revenue, participants may decide to pay higher (but still minimal withdrawal) fees to support the network’s cash needs.

2. Bid Staking: Employers and talents can prove their sincerity by staking BTRST tokens. For example, if an applicant does not show up for an interview, they lose these tokens. This approach is a new strategy for replacing the advertising model of Web2 marketplaces in Web3 marketplaces.

3. Career Benefits:While it’s not entirely clear yet, the Braintrust website hints that additional benefits may be available to token holders in the future. Benefits, which might include things like educational content, free software, or career coaching.

Taken together, these token incentive mechanisms enable Braintrust to operate at a lower cash commission rate while replenishing funds through token issuance to ensure the network long-term sustainable development. Token holders can not only directly benefit from a financial perspective, but also indirectly promote the growth and healthy development of the entire network by participating in network governance, bidding and staking, and enjoying professional benefits.

A completely different and extremely critical point is made here than traditional stocks:For active participants in the network, tokens should provide Greater value for investors thinking only from a financial perspective.

This is a critical part of well-designed token economics, and its importance is worth emphasizing:

For active participants in the network, the token should provide additional value beyond purely financial value.

Therefore, as an investor or participant, consider recommending talents to the network and helping them bid and pledge , helping them build their reputation within the network, and sharing the revenue when they succeed, becomes critical. This type of participation not only increases the value of the tokens, but also promotes the healthy growth of the entire network.

While this way of thinking is somewhat outside the realm of traditional financial investing, it highlights the fact that these tokens have unique benefits for some people. Value, not just because they represent partial ownership of the network. Until recently, there was no direct connection between the value of a token and the growth of the network, but now, with the implementation of this new type of token economics, the connection is becoming increasingly apparent.

Let's take a simple example.

For Investors: If you are solely a financial investor, the value of the BTRST token is limited to its market price, e.g. $3.60.

For active participants in the network: But if you are a talent on the Braintrust network and staking tokens can increase your win The opportunity for a job worth $72,000, then this coin is worth more than just $3.60 to you. Its value also includes increasing the potential benefit of winning the contract, such as an additional $7.20 in this hypothetical, bringing the total value to $10.80.

While the numbers in this example are hypothetical, it clearly demonstrates how active participation in a network can provide additional value to individuals. This also illustrates how user-owned networks can outperform purely investor-owned networks: by providing something more valuable to certain users than just financial value.

Furthermore,if token economics are designed properly, it should encourage purely financial investors to participate in the construction of the network in some way. For example, people who hold BTRST tokens but are not looking for jobs or talents in the network can consider recommending suitable talents to the network, staking for them, and receiving rewards when they succeed, thus increasing the value of their tokens .

In summary, although this topic is somewhat divergent, it reveals an important point: in addition to representing a part of the ownership of the network, these tokens have a significant impact on certain users. Do have unique value, especially when they are directly tied to the growth and success of the network.

>>Value accumulation and protocol upgrade

The 10% cash fee earned by nodes mentioned in the previous section actually reveals an important issue: there is a significant cash liquidity leak. In this case, cash flows in from customers and out to nodes that contribute to the network, while Braintrust uses its own treasury to pay out all community rewards and incentives.

This model of cash liquidity was necessary, especially before the introduction of the token last September, where nodes were required to pay real costs to do their work. However, this model is not sustainable and means that value is not really accumulated into the tokens.

In September last year, when Braintrust publicly launched its token and transformed into a decentralized autonomous organization (DAO), governance was transferred to the token holder. One of the first things that token holders decided to do was address this leak.

Last October, BTRST holders voted in favor of major changes to Braintrust token economics. Specifically, all fees on the network, including current customer success fees and any other fees that may be introduced in the future, must be paid in BTRST tokens. The purpose of this initiative is to introduce more value and liquidity into the token economy, thereby reducing reliance on traditional cash liquidity, enhancing the intrinsic value of the token, and better incentivizing participation and contribution within the network.

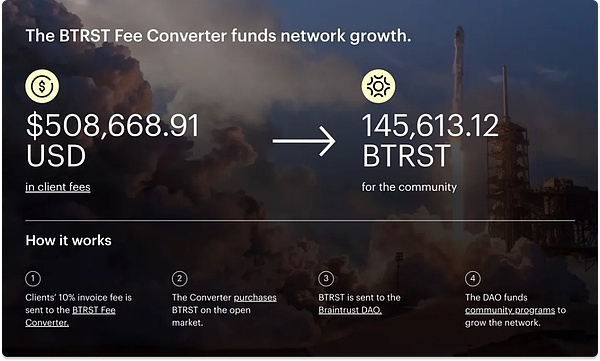

The 10% service fee paid by the customer does not need to be paid directly in BTRST tokens. Instead, when customers pay these fees, nodes convert these fees into the stablecoin USDC and convert them into BTRST tokens through a smart contract called a "fee converter." These tokens are then sent to the treasury to be used to pay community rewards.

The important thing about this protocol upgrade is that it changes the original way of fund flow. Instead of continuously consuming the resources of the treasury, funds will be re-injected into the treasury every time an invoice is paid, making the network more self-sufficient. Nodes still get paid from the 10% service fee, but no longer receive the full fee. They have been compensated for their previous efforts and work, and future work will be rewarded through BTRST tokens, just like other network participants.

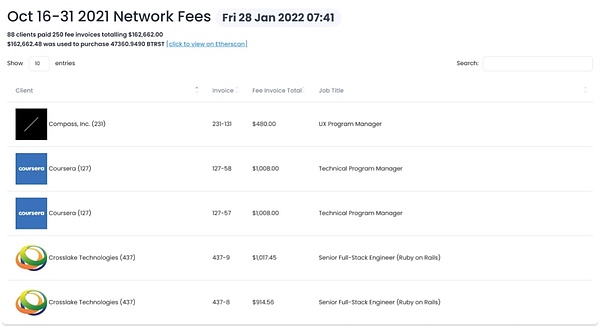

This feature is currently in a testing phase and is expected to last until early February, but even so, approximately $508,000 in service fees have been used to purchase approximately 145,613 BTRST tokens on the open market.

In the Braintrust network,transparency and traceability of information is one of its unique features. You can observe and understand the details of each client and payment for work in real time, a level of openness and transparency rarely seen in Web2’s talent platforms. Imagine if a Web2 talent platform, like Braintrust, made its client list and exact payment amounts public.

The Fee Viewer tool is a visual representation of how Braintrust's marketplace works, allowing you to search for specific clients to see how much they paid, when they paid it, and what work they were paid for. The upcoming Twitter bot will be able to tweet something like “Nike just paid a $1,000 invoice for 300 BTRST tokens for use in the DAO,” adding to the network’s transparency and traceability.

Overall, a direct link is established between token prices and network transaction volume. More trading volume means greater demand for the token. As the network expands, more fees will be used to purchase more tokens from the open market, driving network growth.

The key is that this model relies on fees rather than profits. Token holders who participate in the network will be rewarded with tokens, which should become more valuable as fee transaction volume grows. Braintrust’s model does not rely on any Ponzi scheme-like economic model, but forms a positive behavior by attracting external capital, using the fees paid by customers to repurchase BTRST tokens, and using these tokens to incentivize network growth. direction cycle.

If the number of tokens issued exceeds the number of tokens repurchased, Braintrust will pay the difference from the treasury. If the system is designed properly, this means that the circulating supply will only increase when participants perform activities that the network wishes to perform, even if the costs of those activities exceed what customer fees can cover.

This is a bit like Uber using its commission rate of about 30% to automatically buy back UBER shares, and then using these shares and a fund they set up to reward Those who bring in new passengers and drivers. This model sounds more sustainable, more attractive, and more likely to build loyalty than the status quo.

This is another reason why user-owned networks can be successful.

>>Braintrust Theory and the Triumph of the User-Owned Network

Braintrust’s philosophy is simple:Those networks that are least deprivative will win, and user-owned networks are more likely to achieve this.

It should be emphasized that this does not mean that the Web3 market will definitely succeed - they still need to provide excellent products and complete the requirements of operating the market. All the hard work required. Likewise, this doesn't mean that all Web2 markets will be replaced by Web3 competitors anytime soon.

On Means of Creation with Li Jin and Nathan Baschez, Adam explains his view on which existing markets will be disrupted first by the Web3 marketplace. He believes that the market exists on a spectrum from minimum drawdown to maximum drawdown, where “drawback” refers to the difference between the fee rate a market charges and the unique value it delivers. In other words,if a marketplace charges significantly more than the value it delivers to users, that marketplace is more susceptible to disruption by a Web3 marketplace with lower extraction rates and higher value offerings.

Adam's point is that the most exploitative companies, like DoorDash, will likely be the first to be eliminated from the market due to the damage they do to driver and restaurant profits (e.g. tipping issues). While this argument makes sense, there are some unconsidered dimensions, such as product complexity and average order value, which explain why we haven’t seen a decentralized Uber or DoorDash yet. But overall, this view has some validity.

On the other hand, Adam believes that companies like Airbnb, which bring great value to both markets and charge reasonable fees, will be more successful when facing Web3 competitors. Long life. He even believes that platforms like Facebook and Twitter are not suitable targets for Web3 because they do not charge fees.

Interestingly, as one of the least exploitative markets, Airbnb has the highest market capitalization in the new generation Web2 market and has no strong direct competitors (although The hospitality industry is a strong overall competitor) and is considered to have the strongest network effects of any Web3 market.

Braintrust is making a bet similar to Airbnb's - that the least exploitative network will gain market share in the areas in which it operates and become the most over the long term Valuable, and they guarantee that through code.

This bet does not necessarily involve tokens. Brian Chesky, for example, was able to support Airbnb's low commission rates and help hosts from company finances during the difficult early days of COVID. Jeff Bezos has been willing to lose money for years to keep profit margins low. Leaders and owners like Gurley, Chesky, and Bezos understand that low rake rates are often the right long-term strategy, creating long-term sustainability regardless of whether a token is used.

But in a user-owned network, it is easier for any organization to run like one run by a leader like Jeff Bezos, even if No one specific person controls the network. This model emphasizes that by providing low rake rates and high value, and ensuring user participation and ownership, the network can achieve long-term success and sustainability.

Back to our original question: whether user-owned networks can create and accumulate more value than investor-owned networks. Let’s analyze it from a value creation perspective.

According to Gurley, Bezos, and Chesky, markets that are able to maintain the lowest commission rates over the long term will be able to consolidate financial activity in their areas and create Get the most value. This theory also applies to Braintrust:

Maintenance of low commission rates: Because Braintrust handles traditional markets through automated protocols It’s able to keep fees low by manually performing tasks and being able to pay with tokens for work that other markets require cash. While this requires giving up some ownership to compensate, giving up ownership may actually create more long-term value. These owners benefit from low rake rates, which often outweighs the incentives of higher token prices.

More growth and overall fees: Keeping commission rates low over time may lead to more growth, which in turn can lead to more Much overall cost. Those additional fees could pay for more improvements and possibly even lower customer fees, helping Braintrust gain more market share.

Create real economic value: By efficiently matching talent with employers and extracting as little profit from the transaction as possible, Braintrust Created actual economic value. This makes it easier and more economical to find and hire for flexible work, potentially increasing the size of the freelance market.

To sum up, as long as Braintrust can continue on its current trajectory, the answer to the question of whether it can create more value seems to be yes. Its core strengths lie in maintaining low rake rates and automating operations, which not only improves efficiency but also makes the network healthier and more sustainable by distributing ownership and incentives more broadly.

Market development will always go through a stage from attracting customers to extracting value, even for companies like Amazon. Take Amazon, for example. Its marketplace for third-party sellers is somewhat cluttered, and its massive advertising business—albeit less well-known—makes it difficult for consumers to find the products that are best for them.

What we want to focus on is that market consolidation should aim to simplify the process of value capture, even in the long term. If the value of a business is based on expectations of future cash flows, then it must show investors huge future cash flow potential and invest in the future through currently low commission rates.

But what if you took a different valuation approach?

Braintrust’s token economics is exactly the application of such a scenario. I believe that in this way, Braintrust token holders will be able to benefit from the value created by the network.

Traditional stock prices are based on expected assessments of future cash flows. Owning Airbnb stock does not exchange you for free accommodation or reduced fees as a host, it simply represents partial ownership and voting rights in the company. And theBTRST token provides not only ownership but also utility, which has real and measurable financial value to network participants.

So, how much is this ownership and utility worth?

This is why it is extremely important to integrate as much economic activity as possible on the Internet. Consider an extreme scenario: What if Braintrust captured the entire talent market?

According to data from Harvard Business Review, the market size of the U.S. human resources and recruitment industry reached US$151 billion in 2019. The world's three largest institutions have combined annual revenue of about $70 billion, about a third of which comes from the United States. From this, we can surmise that the global human resources and recruitment industry has a market size of approximately $450 billion. Add to this the revenue of consulting firms such as Tata Consultancy Services (TCS), Deloitte (Deloitte), PricewaterhouseCoopers (PWC) and others - Deloitte, for example, had revenue of $50.1 billion in 2021 and TCS $22 billion.

We estimate the industry as a whole to be around $1 trillion, including recruiting, human resources and consulting. Although this figure is much lower than the total salary of knowledge workers worldwide, it is sufficient for our analysis.

Braintrust charges companies a 10% employment fee through its platform. If Braintrust can integrate the global marketplace for agile talent, it could have a theoretical potential revenue of $100 billion per year. This is a huge market potential and one that Braintrust believes will grow further as flexible work opportunities become easier to find. For example, technology spends $5.3 trillion annually.

However, even considering the revenue potential of $100 billion per year, we have to recognize that this would require the creation of 25 million Braintrust tokens based on current fees demand of US$100 billion. Additionally, network participants gain real financial benefits in the market by using these tokens, which also creates demand. Another important aspect is governance value: How valuable would it be to control the governance of a global market for flexible talent that attracts $100 billion in fees annually?

In summary, although this is an extreme assumption and may be far away in the most optimistic case, there are indeed many ways to achieve this without increasing rake. Allow tokens to capture the value created by the network at a certain rate.

However, the market we are discussing is only 18 months old, has a total service transaction volume of only $37 million, and the scope of services is limited to finding large companies. Small areas such as engineers, designers, and product people working flexibly. Many changes would need to occur for these theories to be of practical significance.

In the coming months, we can expect to see various projects launched by the community aimed at expanding market coverage and capturing a greater proportion of Flexible talent market.

For example, an expert who recently left the high-end IT consulting industry is preparing a proposal to create a new node - which is actually based on the Braintrust protocol. New startups, backed by grant funding - are taking on industry giants like Deloitte, PwC and Accenture. These traditional consulting firms often make profits of up to 70% by controlling the supply of talent and charging high commissions.

At the lower end of the market, similar proposals for low-value contracts such as Fiverr and Upwork are also expected.

As the market expands, providing freelancers with services and resources they may need, such as group health insurance or 401k retirement plans, is also an increase in economic activity and a great way to create value for the network.

These new nodes will benefit from the infrastructure, community and resources Braintrust has built over the past four years. They do not need to raise funds again to support token economics, protocol design, and smart contract auditing because the groundwork has already been completed. They can leverage existing networks of connectors and reviewers. At the same time, they do not need external venture capital because they can obtain subsidies from the treasury.

Of course, these developments also come with challenges.

For example, when Braintrust's token was listed on Coinbase, the price once exceeded $40, attracting many robots to watch short videos of its college library to earn BTRST Token. In this case, great care needs to be taken indesigning incentive mechanisms to avoid abuse.

Another challenge is that as a community grows and disperses, governance becomes more difficult. Even founder Adam admits that he doesn’t always agree with all the community’s decisions. But that’s the thing about a network: it’s governed by its users, regardless of the outcome.

Adam believes that the community will insist on lower fees, hold on longer than public market investors, and build a large network of talent. But it will be a journey full of challenges and twists and turns.

This article will explore how sybil attacks can ruin token launches by looking at data from the two most recent zkSync airdrops and the LayerZero airdrop.

JinseFinance

JinseFinanceTeleportDAO is an interoperability protocol that provides cross-chain application infrastructure from Bitcoin to EVM chains. TeleportDAO is also a Coinlist 2022 Fall Seed Batch Project.

JinseFinance

JinseFinanceDiscover the potential of Nibiru's NIBI token as CoinList hosts an exclusive sale on Feb 2, 2024. Join the crypto evolution with key details, participation requirements, and insights into Nibiru's promising journey and investor opportunities.

Weiliang

WeiliangJoin the pivotal moment in blockchain innovation with L1 Blockchain Nibiru’s community sale of NIBI tokens on CoinList. Discover the details of the sale, including token supply, pricing, and unlocking schedule. Don't miss out on your chance to be part of Nibiru's journey towards redefining the crypto space.

Brian

BrianzkLink develops zero-knowledge (ZK) blockchain solutions for the Ethereum ecosystem.

JinseFinance

JinseFinanceCoinList pays $1.2M to settle US claims of processing sanctioned Crimea transactions, while enhancing compliance measures.

Huang Bo

Huang BoCoinList settles with US regulators for $1.2 million over alleged sanctions violations involving 989 transactions in Crimea.

YouQuan

YouQuan3.6 million, or 6% of the total supply of 60 million BCUT tokens will be offered at a rate of 0.055 USDT per token.

Brian

BrianCoinList announces the launch of the BitsCrunch (BCUT) token sale on December 15th. BCUT, a decentralized AI data network, offers 60 million tokens at 0.055 USDT, with registration now open.

Xu Lin

Xu LinCosmos-inspired DeFi platform Umee set a record for a Coinlist public sale with nearly 1 million unique applicants and 63,000 total contributors.

Cointelegraph

Cointelegraph