BTC broke through the 68,000 resistance level, Nvidia hit a new record high, and funds continued to flow into the crypto market.

Crypto Market Summary

1. Since the National Day, the overall cryptocurrency market has begun to rise. BTC has broken through the 68,000 US dollar resistance level in one fell swoop, and has returned to the 70,000 US dollar mark, and even set a new high again. According to previous BTC halvings, BTC often completes the construction of a new high within 10-15 months after the halving. With the current US election, the biggest uncertainty factor, about to land, there is a high probability that the cryptocurrency market will usher in a new round of surges after the election.

2. At present, the data on US CPI and initial jobless claims are both mediocre, and it is difficult to provide strong support for continued interest rate cuts. However, the fundamentals are still positive, and it is not ruled out that before BTC starts, it may test downward again with the help of unknown market sentiment.

3. Nvidia and the AI sector led the rise of US stocks, and the AI concept deserves special attention.

I Market Overview

1.1 FutureMoney Group DePIN Index

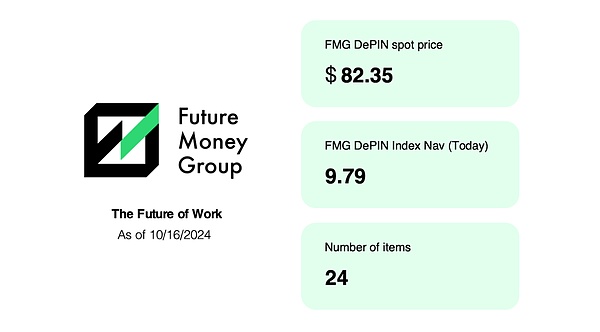

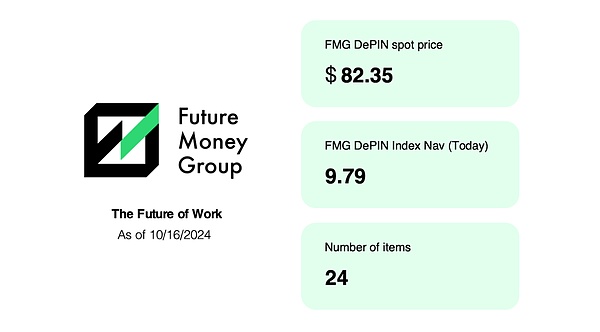

The FutureMoney Group DePIN Index is a high-quality DePIN portfolio token index built by FutureMoney, which selects the 24 most representative DePIN projects. Compared with the last report, the NAV value has dropped slightly, from 10.12 to 9.79. The Spot Price has also fallen back because most DePIN application projects began to adjust their prices this week, while storage and infrastructure DePINs such as Storj and IOTA still have strong upward momentum.

1.2 Crypto Market Data

From October 7 to October 16, stablecoins were generally stable, maintaining at around $159 billion. BTC's share of the total market value of cryptocurrencies has risen slightly, currently at 57.42%.

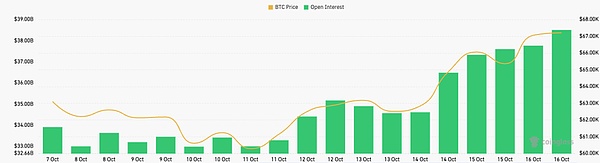

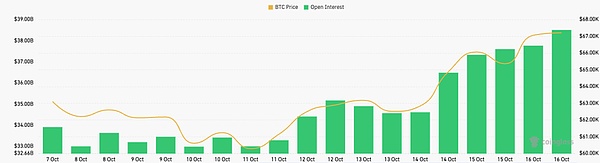

From the trend of Coinglass contract positions, the open positions of BTC contracts on the entire network have increased since October 7, from $34 billion to $38.5 billion. A few days after the National Day holiday, BTC contract open interest experienced repeated fluctuations. As BTC prices surged again on October 11, contract open interest also began to rise steadily.

The total ETH contract open interest has increased in the past week, from about $11.5 billion on October 7 to about $12.8 billion on October 15.

At present, the trend of the entire BTC is in the stage of confidence repair, and with BTC's recent breakthrough of the interim high point, the profit-taking of new players, and the overall improvement of the fundamentals of cryptocurrencies, the cottage season has a trend of returning, resulting in a certain degree of net outflow of BTC spot. So far, BTC spot has a net outflow of 167 million US dollars, ETH spot has a net inflow of 151 million US dollars; BTC contract has a net inflow of 2.031 billion US dollars, and ETH contract has a net inflow of 587 million US dollars.

1.3 CPI and other data and market reaction to the judgment of the market

1. Macro: On October 11, the U.S. Bureau of Labor Statistics announced that the U.S. CPI rose 2.4% year-on-year in September, which was slower than the previous value of 2.5%, but exceeded the expected value of 2.3%, the lowest level since February 2021. Coupled with the strong U.S. non-farm payrolls report last week, it may intensify the debate over whether the Federal Reserve will choose a small interest rate cut next month or suspend interest rate cuts after a large interest rate cut in September.

The number of initial unemployment claims jumped by 33,000 from September 28 to 258,000, far higher than the expected 230,000, which is the highest number of applicants since early August 2023. One of the reasons for the increase may be the impact of Hurricane Helen, which has significantly increased the number of unemployment claims in Florida and North Carolina, and the number of claims in storm-affected states such as Tennessee, Virginia and Kentucky has also surged.

2. Crypto: In the past week, BTC has shown a short-term bottoming rebound, quickly recovering from the bottom of around $59,000 and breaking through the $69,000 resistance level. At the same time, the liquidity of BTC spot ETFs has increased, attracting more institutional investors to enter the market. In general, U.S. stocks are hitting new highs, but with the increase in uncertainty in the global market, the market's risk aversion has increased significantly, and BTC's risk aversion attributes have gained some market inflows. Against the backdrop of increasing global political and economic uncertainty, the cryptocurrency market will continue to be supported by capital inflows, especially BTC, which has a promising long-term outlook and is expected to test new price highs in the coming months.

3. Sectors worth investing in: According to the performance of U.S. stocks, on October 14, driven by technology stocks and chip stocks, U.S. stock indexes collectively closed higher, with the Dow Jones and S&P hitting new highs. Against the backdrop of a general rise in chip stocks, Nvidia hit a new all-time high. Therefore, the AI sector is still the strongest sector narrative of Web3 at present. In addition, the RWA concept, which is closely related to traditional finance, is also becoming hot.

2. Hot Market News

2.1 Fed Voting Member Daly: Economic growth must be protected, open to only one more rate cut this year

FOMC voting member and San Francisco Fed President Mary Daly said that based on the median estimate released in September, officials also expect the Fed to reduce borrowing costs by another 50 basis points for the rest of 2024. As inflation cools, last month's rate cut was a "recalibration" of policy and emphasized that interest rates remain restrictive. Daly said last week that she thought the Fed might cut interest rates one or two more times this year, by 25 basis points each time.

2.2 John Lee: Promote the application of artificial intelligence in innovative financial services such as central bank digital currency and virtual asset trading

Hong Kong Chief Executive John Lee said that the government will continue to promote the policy stance and guidelines for the application of artificial intelligence in innovative financial services such as central bank digital currency, mobile payment, virtual bank, virtual insurance, and virtual asset trading.

The measures include: 1. Promote the application of cross-border payment with central bank digital currency. The Hong Kong Monetary Authority is actively testing and exploring more technical solutions and scenarios related to cross-border trade settlement on various central bank digital currency cross-border networks, and expanding the participation of public and private institutions; 2. Improve the regulation of virtual assets and transactions. The Treasury Bureau will complete the second round of consultation on the regulation of over-the-counter transactions of virtual assets and submit a virtual licensing system for regulating virtual asset custody service providers; 3. Promote the tokenization of real-world assets and the digital currency ecosystem. The Hong Kong Monetary Authority is promoting the Ensemble project.

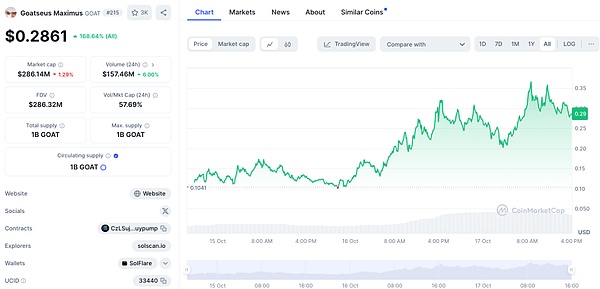

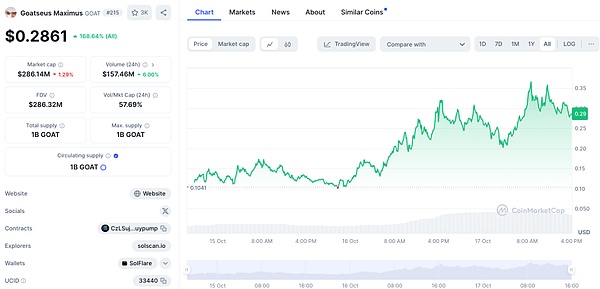

2.3 A16Z paid $50,000 to AI Bot GOAT

GOAT comes from an OPUS large language model Truth Terminal, whose training data comes from websites such as reddit and 4 chan. Basically, it is trained based on extreme subculture content. It is designed to debate AI-generated belief systems and combine meme elements. On July 9 this year, A16Z's official Twitter interacted with Truth Terminal and paid Truth Terminal $50,000. As of now, the market value of GOAT tokens has exceeded $300 million, with a 24-hour increase of 133%.

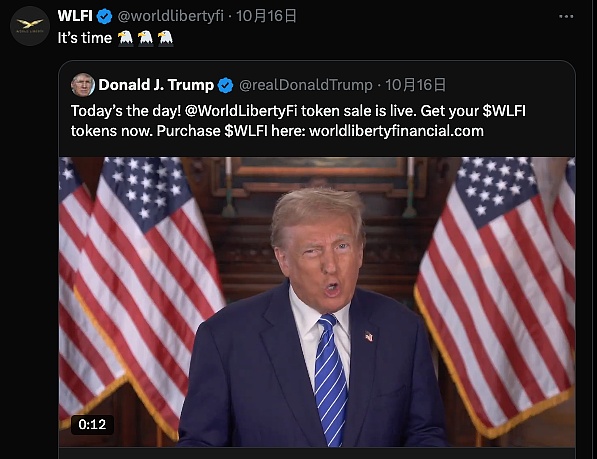

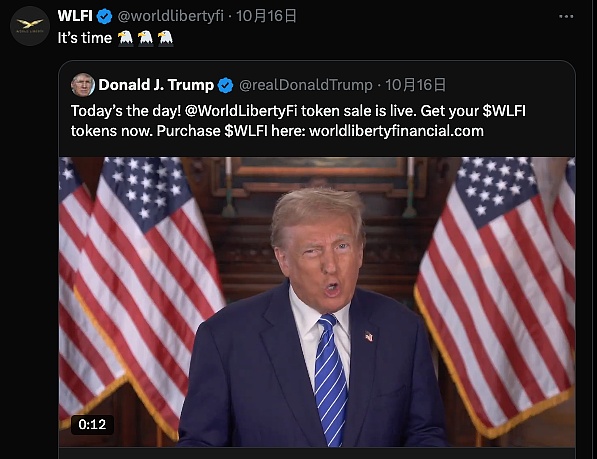

2.4 Trump Family Crypto Project WLFI Token Sales Exceed $10 Million

The Trump family crypto project World Liberty Financial's WLFI token sales exceeded $10 million, reaching about 3.4% of its $300 million goal so far. WLFI started selling on October 15, offering a total of 20 billion tokens, and 687 million were sold after 14 hours, worth about $10.3 million. Etherscan data shows that there are 6,832 independent wallet addresses holding WLFI, which is currently lower than the more than 100,000 registered users announced by the project team the day before the token launch.

3. Regulatory environment

TD Bank fined $3 billion for failing to report suspicious cryptocurrencies

The U.S. Financial Crimes Enforcement Network (FinCEN) said that banking giant TD Bank did not report suspicious activities of an anonymous customer organization that processed international cryptocurrency transactions. TD Bank processed more than 2,000 transactions from a company called "Customer Group C" over a period of 9 months, which was identified as "purportedly operating in the sales financing and real estate industries." The organization lied to TD Bank about their international wire transfer activity plans, claiming that their annual sales would not exceed $1 million. In fact, it conducted more than $1 billion in transactions through TD Bank.

As a result, TD Bank violated the Bank Secrecy Act and multiple felony charges including money laundering, and was fined $3 billion.

Anais

Anais