Author: Yohan Yun, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

From millions of dollars lost in hard drives in landfills to missing founders, the world of cryptocurrency is rife with tales of loss and deception.

These unforgettable stories offer a glimpse into the unexpected pitfalls of Bitcoin and cryptocurrencies, and the lengths to which people will go to recover their hard-earned wealth.

Hard Drives and Lost Bitcoins in Landfill

Deep in the UK's Newport landfill, a Bitcoin ghost has been lingering among the abandoned garbage heaps for more than a decade, growing in value.

In 2013, IT engineer James Howells accidentally dumped a hard drive into the wasteland. The device held 8,000 Bitcoins, worth $1 million at the time but now worth more than $500 million.

Searching for hard drives in a landfill containing 110,000 tons of garbage is like finding a needle in a haystack. Source: Bakhrom Tursunov

Howells had planned several expeditions to dig up his buried digital wealth. But each expedition was met with staunch resistance from the local council, the guardian of this technological treasure.

The landfill, filled with around 110,000 tonnes of rubbish, is the graveyard of Howells' bitcoins - lost but worth incomparable amounts.

Howells has sued Newport City Council for £495 million ($643 million).

His case, which goes to trial on December 3, will determine whether the ghost search for Newport's dump of bitcoins should be launched, or whether the desolate site should be left to linger forever.

'Zombie Bitcoins' in the Immutable Ledger

Like the Howells' abandoned fortune, every lost Bitcoin tells a story - forgotten passwords scribbled on scraps of paper, wallets damaged by wind and rain, and investors taking their crypto secrets to the grave.

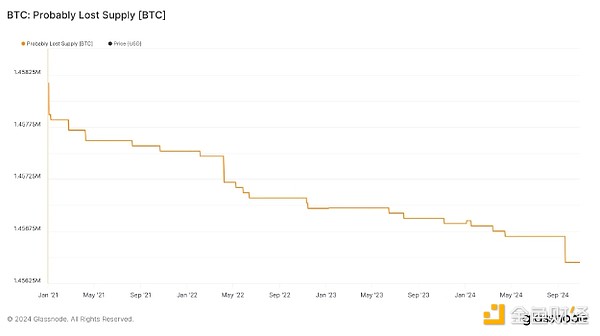

According to Glassnode data, an estimated 1.5 million BTC are "probably" lost forever.

Bitcoin, thought to have disappeared, is waking up. Source: Glassnode

These dormant coins wake up from time to time. Coins that have been dormant for more than a decade quietly flow into exchanges, allowing anonymous millionaires to make money from their patience.

But some coins, no matter how long you wait, will never come back.

Bitcoin watchers frequently visit Satoshi Nakamoto’s wallet, said to contain more than 1 million BTC, in search of any signs of life from the mysterious Bitcoin creator.

But some coins are better left alone.

As Satoshi said,“Lost coins only make other people’s coins worth slightly more. Think of it as a donation to everyone.”

USDT Rumors

Tether’s influence is growing, with its stablecoin USDT now valued at more than $120 billion.

But beneath the stablecoin’s calm surface, rumors swirl like fog over a graveyard. Rumors tell tales of missing reserves, shady deals, and rumored regulators circling like vultures.

From time to time, as if prompted by some invisible hand, rumors circulate that Tether is not what it seems. Investigations creep into corners of the internet, sending shivers down the spines of investors and traders alike.

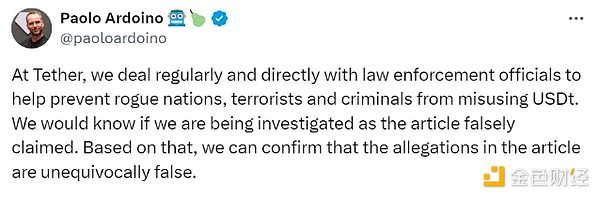

The latest came on October 25, when the Wall Street Journal exclusively reported that U.S. federal agencies were conducting a criminal investigation into Tether over allegations that third parties were illegally using USDT to launder money.

Tether CEO Paolo Ardoino dismissed the report as “cliche.”

Source: Paolo Ardoino

The fear is palpable: if Tether collapses, it could drag the entire industry into the abyss. The market crash triggered by the failure of stablecoins is still a fresh and painful memory for investors, and the prospect of reliving such a nightmare can be a break from reality.

As Bitcoin soars to all-time highs, the community gathers on forums and social media to recount the latest panic.

“Did you hear? Tether may be investigated again!” they say, their voices filled with both excitement and fear.

When Bitcoin cools, fears about Tether will fade, but neither will disappear entirely.

QuadrigaCX Founder Disappears

As the young CEO of QuadrigaCX, once Canada’s largest cryptocurrency exchange, Gerald Cotten managed millions in digital assets.

But in December 2018, his life ended abruptly, and with it, the keys to more than $190 million worth of cryptocurrency went missing.

Cotten’s death was as mysterious as it was sudden. The 30-year-old CEO, who was traveling in India ostensibly to open an orphanage, reportedly died of complications from Crohn’s disease.

It wasn’t until after his death that the truth was revealed: Cotten alone controlled access to QuadrigaCX’s crypto wallets. Not only were the funds inaccessible, but the investigation began to uncover a web of financial mismanagement.

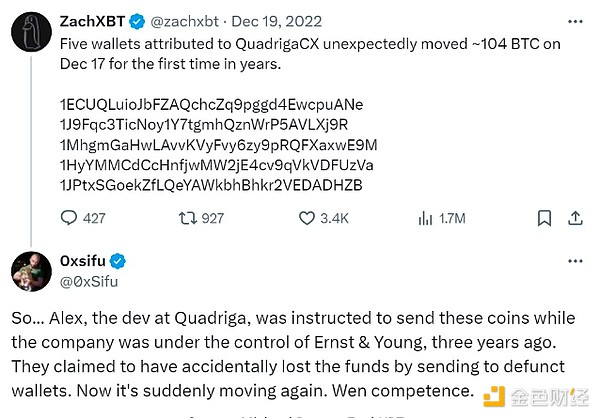

Ernst & Young, the court-appointed monitor overseeing QuadrigaCX's bankruptcy, found six wallets used to store Bitcoin, but when they examined five of them, they had been empty in the months before Cotten's death.

The remaining wallets contained only a small amount of Bitcoin.

Source: Michael Patryn, ZachXBT

Further investigation revealed that large amounts of cryptocurrency had been transferred from the platform to competing exchanges and into personal accounts controlled by Cotten. It is suspected that these funds were used to finance Cotten's lavish lifestyle and may have been used to trade on other exchanges.

To this day, some still believe Cotten faked his own death and absconded with the money.

The Disappearance of the Crypto Queen

Ruja Ignatova, also known as the “Crypto Queen,” was the infamous founder of OneCoin, a cryptocurrency that was later revealed to be a multi-billion dollar Ponzi scheme.

Ignatova disappeared from public view in 2017 as investigations into OneCoin intensified in multiple countries. Her current status—whether she’s alive or dead—is unknown.

OneCoin was promoted as a revolutionary digital currency that could rival Bitcoin, promising huge returns for investors. However, it lacked a true blockchain and was essentially selling worthless tokens. It is estimated that Ignatova and her associates were accused of defrauding investors of around $4 billion.

After her disappearance, various theories emerged about Ignatova's whereabouts. Some believe that she may have acquired a new identity with the help of complex forgeries and plastic surgery, and may be living a lavish life in an undisclosed location.

FBI Most Wanted List, Ignatova is in the middle of the bottom row. Source: FBI

Others speculate that she may have died due to dangerous criminal ties that may have been involved in the OneCoin scheme.

In 2022, Ignatova was added to the FBI's Ten Most Wanted Fugitives list, which lists charges against her, including wire fraud, securities fraud, and money laundering.

There is no hard evidence to confirm her identity or location.

Crypto Exchanges Go Dark

In cryptocurrency trading, big money can be made in the blink of an eye.

Losses don't necessarily happen due to a market crash or a sudden regulatory crackdown, but rather due to something far more unpredictable and terrifying: major exchanges suddenly going dark at the most critical moment.

In January 2018, an expected two-hour upgrade for cryptocurrency exchange Kraken turned into a terrifying 48-hour outage.

Meanwhile, in March 2021, Binance faced its own nightmare. Trading activity surged, and unprecedented frenzy gripped the exchange. Binance was mired in an outage, trading was in limbo, and hope vanished as quickly as the numbers on the trading board vanished.

These outages are not isolated incidents, nor are they limited to these examples or exchanges.

Blockchain networks like Solana have also experienced their own downtime.

However, as the industry matures, such events are becoming increasingly rare. No one can predict when and where the next outage will occur. For a trader who believes they have finally found a 1,000x memecoin, a single outage could completely turn their fortunes around.

Weiliang

Weiliang

Weiliang

Weiliang Anais

Anais Kikyo

Kikyo Anais

Anais Catherine

Catherine Joy

Joy Weatherly

Weatherly Catherine

Catherine Kikyo

Kikyo Anais

Anais