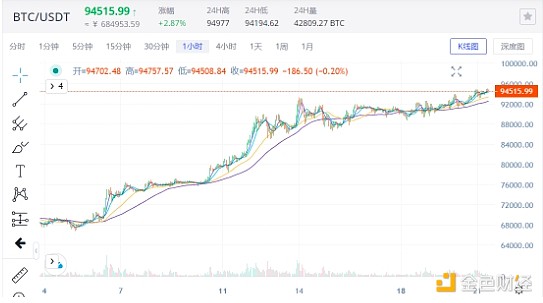

After Trump won the election, everyone expected the US government to accelerate its embrace of cryptocurrencies, making the Bitcoin market hot. On November 21, the price of Bitcoin hit a record high, approaching the $95,000 mark.

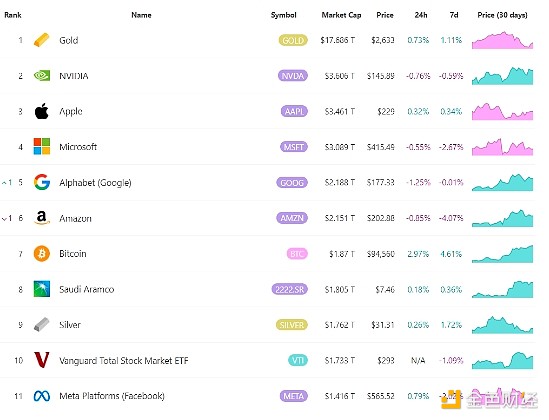

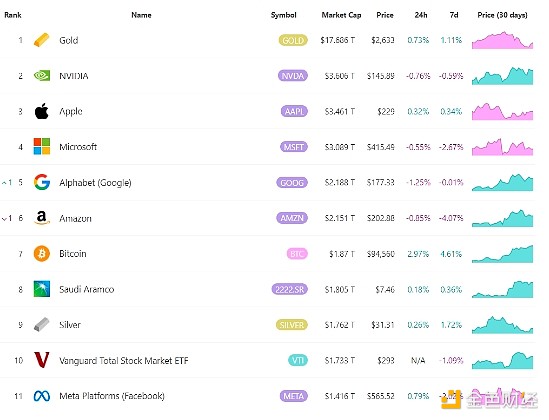

As the world's largest cryptocurrency, Bitcoin has played a central role in this "Trump market", and its price has risen by more than 35% since election day. The price of Bitcoin has doubled this year. At present, the market value of Bitcoin is 1.87 trillion, which is about 10% of the market value of gold. It has surpassed traditional giants such as silver and Saudi Aramco and has become the world's seventh largest asset.

Clear policy expectations accelerate the rise of Bitcoin

As the first US president who is very friendly to cryptocurrencies, Trump promised a number of measures to support cryptocurrencies during his campaign, such as incorporating Bitcoin into national reserves, making the United States the world's cryptocurrency capital, and relaxing regulations. With Trump's victory, coupled with the Republican sweep of the Senate and the House of Representatives, the three consecutive victories in the White House and both houses of Congress will give Trump great power to implement his agenda after he takes office on January 20 next year. Clearer policy expectations have accelerated the embrace of Bitcoin by traditional people.

Bitcoin spot ETF has become the most convenient channel for US stock investors. Data shows that BTC spot ETFs continue to see a large amount of capital inflows, and the overall inflows of the top ten ETFs have continued to increase within 7 days. Currently, Bitcoin spot ETFs have held more than 1 million Bitcoins.

In addition to ETFs, many institutions are also constantly buying. MicroStrategy, a "big Bitcoin holder", raised about $2 billion and purchased 272,000 new Bitcoins between October 31 and November 10. On November 16, it again purchased 51,780 Bitcoins at a price of about $4.6 billion. Management plans to raise $42 billion between 2025 and 2027 to further increase its holdings of Bitcoin. Currently, MicroStrategy owns about 1.67% of the world's circulating Bitcoin. In addition, other listed companies such as US stocks, Hong Kong stocks, and Japanese stocks have also disclosed their Bitcoin holdings in their latest financial reports. More and more listed companies are planning to use Bitcoin as a treasury reserve asset.

Trump's crypto-friendly stance not only affects US policies, but also promotes the layout of crypto assets in countries around the world. Currently, El Salvador continues to purchase 1 BTC per day, and its Bitcoin holdings have reached about 5,900 BTC. The Bhutanese government holds more than 12,000 Bitcoins, accounting for 34% of its GDP. Market news shows that Gulf oil-producing countries such as Saudi Arabia, the United Arab Emirates and Qatar may be investing in Bitcoin at the sovereign level.

Is there still room for growth? Counting the trends of BTC after previous elections

In this cycle, the market has reacted particularly enthusiastically due to Trump's support. Now its price is approaching 100,000 yuan. Does this mean that the policy benefits after the election are fully included in the price, and is the room for Bitcoin to rise limited?

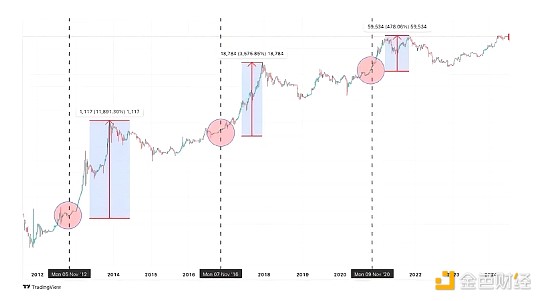

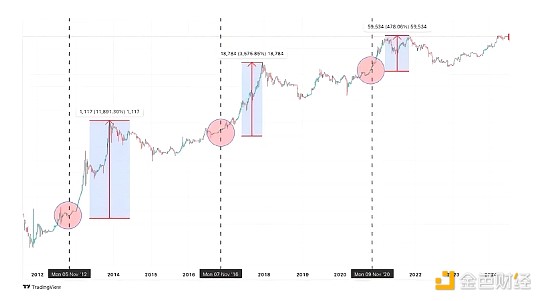

From the perspective of historical cycles, previous US elections have had a long-term impact on Bitcoin prices. During the 2012 election (November 5), the price of Bitcoin soared from around $11 before the election to a cyclical peak of more than $1,100 in November of the following year, an increase of nearly 12,000%. After Trump was elected as the US President in early November 2016, the price of Bitcoin started from around $700 and reached a peak of nearly $18,000 in December of the following year, an increase of about 3,600%. The November 2020 election coincided with the COVID-19 pandemic, and Bitcoin soared 478% in a year to a high of about $69,000.

According to the data, after the first three elections, Bitcoin has always maintained an upward momentum. Although the increase has shown a gradually decreasing trend, it has never fallen back to the price on election day, and finally reached a peak in the following year. If this trend reappears, the price of Bitcoin should reach its peak in about a year.

It should be noted that the US presidential election coincides with the halving cycle of Bitcoin. In the past, Bitcoin was a niche alternative investment market. Compared with the general election, the halving has a more direct impact on the price. But in this cycle, Bitcoin has been integrated into the US financial system and has become part of the policy. Therefore, this election has a more direct impact on its price, which undoubtedly provides new impetus for the rise in Bitcoin prices.

All signs indicate that the US election has become a key node in the development of cryptocurrency. Bitcoin may end with an overwhelming positive momentum in 2024, and 2025 will be more optimistic. As the official partner of the Argentine national team, 4E supports spot and contract trading of more than 200 crypto assets such as Bitcoin and Ethereum, covering all sectors, with high liquidity and low fees.

At the same time, 4E has also integrated traditional financial assets into the platform, and established a comprehensive one-stop trading system covering everything from deposits to crypto assets, to US stocks, indices, foreign exchange, bulk gold, etc., with more than 600 assets of different risk levels. You can invest at any time with one click by holding USDT. In addition, the 4E platform has a risk protection fund of US$100 million, which provides an additional layer of protection for the safety of users' funds. With 4E, investors can keep up with market trends, flexibly adjust strategies and capital allocation, and seize every potential opportunity.

Miyuki

Miyuki