Original: Liu Jiaolian

Overnight, BTC continued to strive upward, once approaching the historical high of 95,000. With BTC constantly reaching new highs and the crazy speculation of Meme coins, friends who are full of altcoins, especially those who hold a lot of ETH, feel their hearts bleeding every day.

The figure below is the monthly line of ETH/BTC in the past 6 years. When the wedge convergence comes to an end, it does not break upward, but breaks downward, and people's hopes are smashed. At this moment, even the KOLs who scolded the bullish ETH/BTC at the beginning of the year have no energy (refer to Jiaolian's article on February 28, 2024 "Many crypto people are bullish on ETH/BTC, which may promote the outbreak of the altcoin season"), which can really be called "exhausted".

Jiaolian is also one of those who have entered the game and fallen into the mud. There is no need to hide the fact that in the early stage of the bull market in 2021, Jiaolian also played DeFi and NFT. At that time, those things were all on the Ethereum chain, so naturally a lot of ETH was accumulated.

There is a kind of self-righteousness called "BTC is too expensive in the bull market, so let's buy some cottage (ETH)!" Jiaolian can't escape this kind of cleverness. In 2021, it stopped adding BTC at a high position and bought cottages including ETH.

Only when the tide receded did I realize that I was a fool swimming naked.

Although Jiaolian still has some risk control, in terms of US dollars, the ETH position is not currently losing money, but in terms of BTC, buying ETH instead of BTC that year really lost BTC.

On ETH, the teaching chain belongs to "knowing there is a tiger in the mountain, but still going to the tiger mountain", or it can be said to be "serving the tiger with one's body".

On the one hand, the teaching chain is well aware of and has publicly written many articles pointing out that the risk of holding ETH is extremely high. There are three main theories (judgments) formed in the past three years:

1. The EIP-1559 burning mechanism makes ETH "soft" and loses its value storage properties.

2. Abandoning PoW and switching to PoS will greatly reduce the ability of the ETH system to "absorb negative entropy", thereby damaging its long-term value.

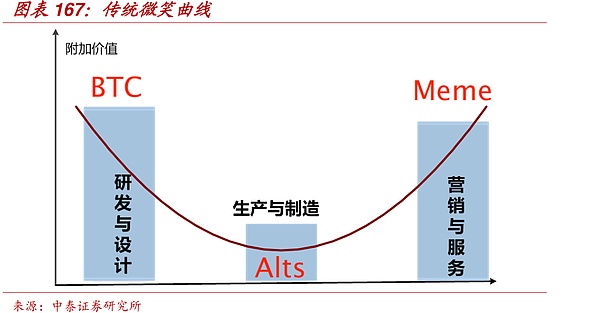

3. The value foundation of ETH-the Ethereum chain as the "web3 infrastructure" and "world computer" is positioned in the middle of the industrial chain. The middle of the industrial chain has the lowest moat and the lowest added value. This is the well-known "smile curve" in the industry.

In the past year, or even in the past two years, the BTC and Meme coin tracks at both ends of the smile curve have been pulling me up, so happy. Jiaolian thought of this theory again and drew a picture to illustrate the current situation of the two-tier differentiation in the crypto market: institutions are only concerned with increasing their positions in BTC, while retail investors are speculating in meme coins, and no one is playing copycats.

The left and right ends of the smile curve represent the core technology and brand marketing of the industrial chain. On one side, they master the "core technology" (PoW) and grasp the "core value" (the safest value storage and value transmission), such as BTC, while on the other side, they grasp the "user mind" (studying the return to poverty and getting rich, and the air coin has the least routine and is fairer), cater to "user needs" (speculating on coins to get rich), and only retain the "brand value" (there is no other value except brand marketing), such as Meme coins, so these links have higher added value. The middle part of the curve represents production and manufacturing. Although it has been developing, upgrading, and innovating (such as the first and second layers of public chain infrastructure), due to fierce competition, low moat, easy replication, and strong substitutability, the added value is usually the lowest.

In February this year, the teaching chain also talked about the low moat of ETH (see the screenshot of the chat record below):

The original words in the screenshot are as follows: "The use of eth is to provide an infrastructure for speculation... Although speculation is illusory, the demand generated by speculation is real... So eth's moat is not high..."

In the past, when new public chains such as Solana were not yet mature, and second-layer chains such as Arbitrum and Base had not yet been widely copied, Ethereum still had a leading technical advantage on the left, and the right side also occupied the mental high ground in the industry. However, since the bull market in 2021, new public chains have caught up, and then the second-layer chains have sprung up like mushrooms after rain, which has not only weakened the technical advantage of the Ethereum chain, but also the dazzling brands and names have greatly distracted the user's cognitive focus. Ethereum is "blocked at both ends", causing its value to shrink severely towards the middle of the smile curve!

On the other hand, despite the above cognition, Jiaolian did not "unify knowledge and action", but insisted on holding ETH positions, because he still had illusions about ETH in his heart and wanted to see whether ETH could maintain its status in the arena and not be surpassed by new public chains. In addition, Jiaolian itself is also doing some development work in the ETH ecosystem, so it still hopes that ETH can achieve the final victory.

Sharing these lessons learned honestly, first, is to do a self-reflection and dissection, and second, it shows that although Jiaolian has made some gains in the crypto market, it is by no means always correct. On the contrary, Jiaolian has made countless mistakes. Fortunately, these mistakes are not fatal and have not defeated Jiaolian.

However, reflecting so much is not any operational opinion. Jiaolian often analyzes the bearish theory of its holdings, such as BTC and ETH. This is to stress test its holdings. If you don't have the courage to withstand the stress test, maybe you shouldn't build a position and hold it from the beginning!

If you use the most logical theory to short your position every day, and you can still hold on firmly without cutting losses, then it is difficult for any superficial bearish voices in the market to shake your firm holding.

The most determined spot bull must be an expert who understands all kinds of bearish theories.

Since you have opened a position, you must have the determination to hold it until it returns to zero. This is the so-called "see death as if returning home".

Jiaolian will not cut losses and change positions at this time.

A principle is to never cut losses when the market is most pessimistic.

Of course, Jiaolian may be wrong again. But the biggest consequence of this mistake is that your ETH position will return to zero.

Before opening a position, you must think clearly. If it returns to zero, can such a large position be accepted? Unacceptable? Then reduce it a little, and then a little more. Until it can be accepted. This is called "risk control".

One of the main reasons for losses in the financial market is investing funds that you cannot afford to lose.

Never wait until a loss occurs before you start to regret.

Teaching chain says, be respectful of the market.

Never be complacent because of a little profit. Never think that you are smarter than the market. Never think that you have the ability to beat the market.

The market is effective after all. Trying to beat the market and be smarter than the market will only expose your ignorance.

You laugh at the market being too crazy, and the market laughs at you for not seeing through it.

Desperate to sell at a loss, buy high and sell low and lose everything.

Alex

Alex

Alex

Alex Miyuki

Miyuki Joy

Joy Weiliang

Weiliang Weatherly

Weatherly Anais

Anais Alex

Alex Miyuki

Miyuki Miyuki

Miyuki Alex

Alex