Author: Ciaran Lyons, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

The amount of Bitcoin on hand for sale by cryptocurrency miners has reached its highest level in more than two years, which could cause the price of Bitcoin to plummet in the short term if history repeats itself.

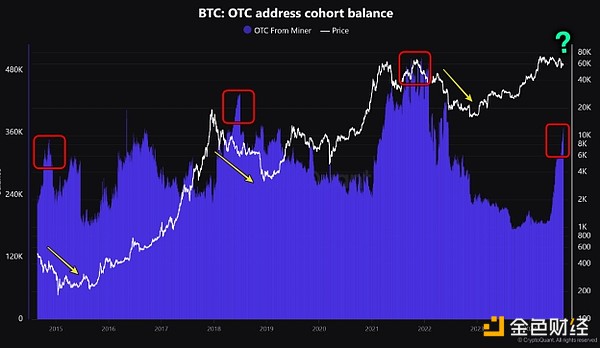

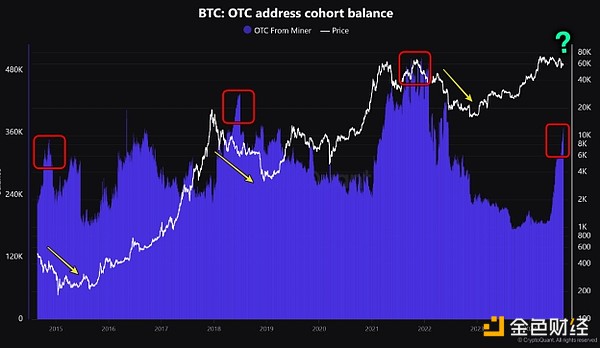

There have been several times when Bitcoin miners' OTC balances were high, followed by Bitcoin prices falling by as much as 63% in just a few months.

According to an August 21 report from CryptoQuant, "Historically, increases in Bitcoin OTC balances have been associated with declines in Bitcoin prices."

OTC balances may mean heavy selling

After a 70% surge in the past three months, miners' Bitcoin OTC balances have reached their highest level since June 2022.Data shows that it currently has reached 368,000 Bitcoin, or about $22.36 billion.

“The sharp increase in OTC balances indicates that miners’ selling activities are very active,” CryptoQuant added.

When miners’ Bitcoin OTC balances reach high levels, it usually leads to a plunge in Bitcoin prices. Source: CryptoQuant

In May 2018, after Bitcoin OTC balances surged to over 400,000 BTC, the price of Bitcoin was $8,475. By December 2018, the price had plummeted 63% to $3,183.

Similarly, in November 2021, when Bitcoin’s price was around $64,000, miners’ OTC balances reached an all-time high of nearly 500,000 Bitcoin, the asset’s price fell 45% to $35,058 two months later in January 2022.

CryptoQuant explains that miners choose OTC to sell Bitcoin because they seek “better operations” and want to avoid a significant impact on Bitcoin’s price like selling on cryptocurrency exchanges due to higher liquidity in the OTC market.

However, the recent decline in the supply of Bitcoin on cryptocurrency exchanges and the accumulation of 94,700 Bitcoins by Bitcoin whales in the past six weeks may balance the selling pressure and support the price of Bitcoin.

Miners Still Struggling After Bitcoin Halving

Since the Bitcoin halving in April, operating costs have continued to rise and mining rewards have decreased.

Currently, the average Bitcoin miner is producing at a loss. According to data from MacroMicro and CoinMarketCap, the average cost of mining one Bitcoin is $72,224, while the current price of Bitcoin is $60,797.

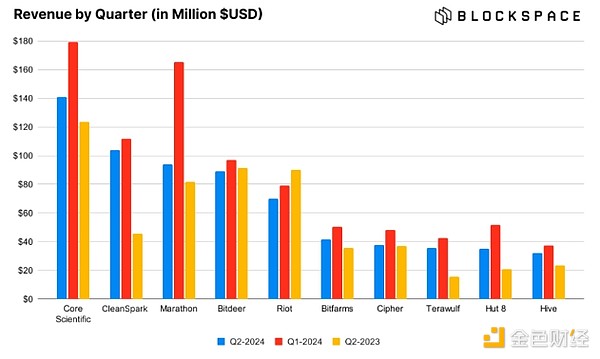

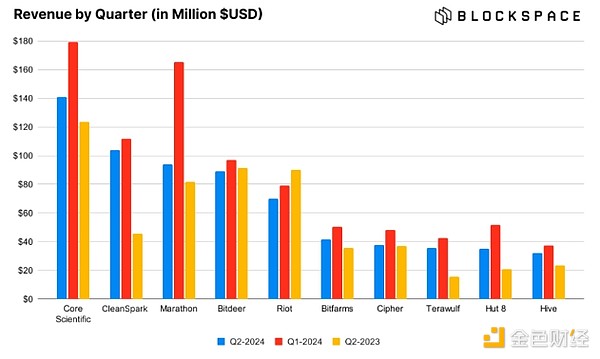

“Every miner’s revenue in the second quarter was lower than in the first quarter, but some miners made up for the reduced revenue better than others by expanding their hash rate during the quarter,” Bitcoin commentator Colin Harper explained in an August 22 X post.

Revenues for major cryptocurrency mining companies fell in the second quarter of 2024 compared to the first quarter. Source: Colin Harper

“Every public miner we update is doing their best to upgrade their mining machines to the latest equipment,” Harper added.

On August 18, VanEck said that if Bitcoin miners partially transform to provide energy to the artificial intelligence and high-performance computing (HPC) sectors by 2027, they have the opportunity to generate an additional revenue of about $13.9 billion per year.

“AI companies need energy, and Bitcoin miners have energy,” VanEck said.

JinseFinance

JinseFinance