Author: Ciaran Lyons, CoinTelegraph; Compiler: Baishui, Golden Finance

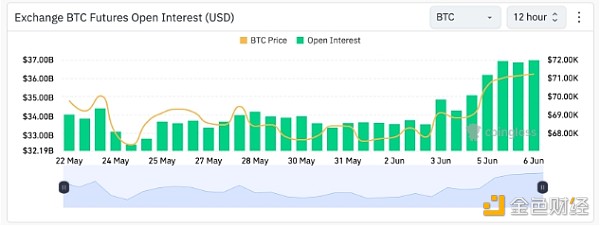

BTC’s open interest (OI) surged by more than $2 billion in just three days, leading traders to believe that this could trigger a sudden “shock” effect in its price.

“Bitcoin’s open interest has surged over the past 3 days,” noted anonymous cryptocurrency trader Daan Crypto Trades in an X post on June 5. Open interest is the total number of derivative contracts (such as options or futures) that have not yet been settled - an increase in open interest could indicate that more traders are speculating.

BitLab Academy Director Kelly Kellam explained that the sudden spike in Bitcoin open interest and the persistence of positive funding rates indicate a “likely” BTC price shock — a sudden surge in price that goes against the current trend.

“With the positive premium persisting (everyone is long leveraged) and open interest rising, it’s a recipe for a small BTC correction,” he added.

According to data from CoinGlass, Bitcoin’s open interest jumped by $2.02 billion in three days to $36.92 billion on June 6.

Bitcoin open interest has increased significantly over the past three days. Source: CoinGlass

Open interest is the total number of derivative contracts (such as options or futures) that have not yet been settled.

A large amount of open interest can increase price volatility, especially when traders hold multiple positions and decide to suddenly adjust their strategies.

It also affects the overall sentiment of traders who use open interest as a signal to decide whether to hold or sell crypto assets.

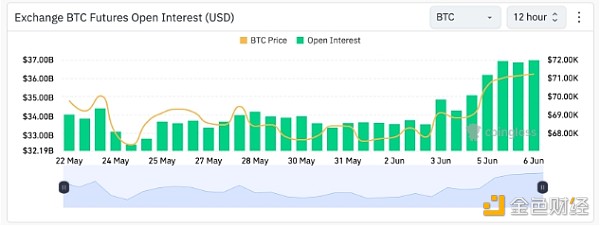

Bitcoin is currently trading at $70,890, up 4.23% over the past seven days, according to CoinMarketCap.

Bitcoin is up 10.42% over the past 30 days. Source: CoinMarketCap

Around $1.96 billion in long positions could be wiped out if the bitcoin price drops sharply by 4% to $68,000 — a possibility that cannot be ignored despite overall negative market sentiment, said anonymous crypto trader Jelle.

“While I believe bitcoin will soon enter a price discovery phase, I am certain that this will not happen without significant volatility,” they added.

Joy

Joy