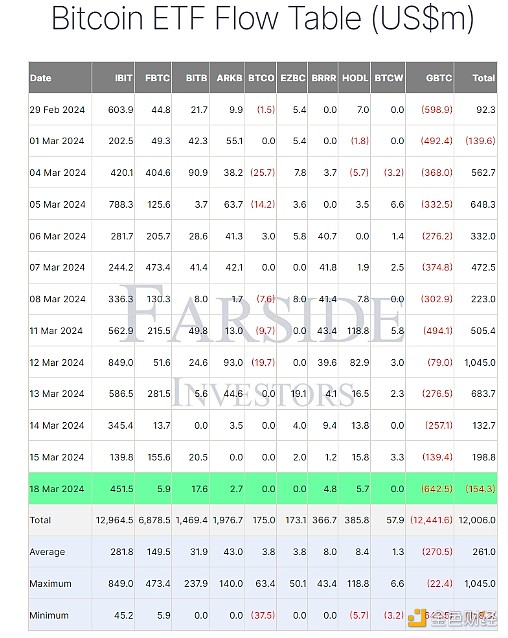

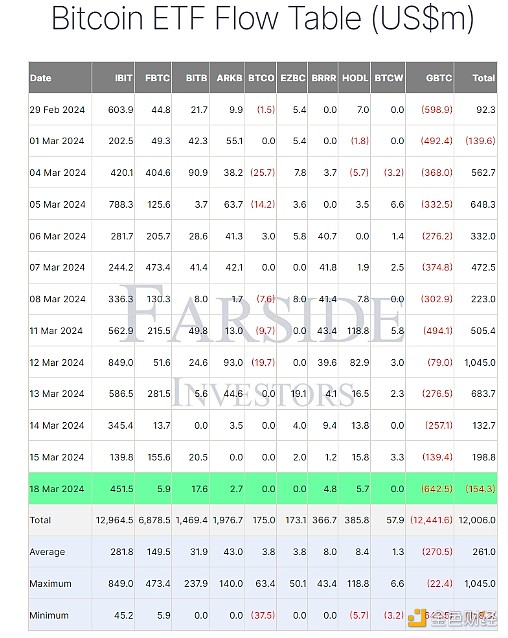

Author: Tom Mitchelhill, CoinTelegraph; Compiler: Deng Tong, Golden Finance

On March 18, more than $640 million worth of Bitcoin flowed out of the spot Bitcoin ETF of crypto asset management company Grayscale. It was the largest day of outflows since the fund converted to a spot ETF on January 11.

Meanwhile, inflows into Fidelity’s Bitcoin ETF, the second-largest fund, plummeted to $5.9 million, the lowest level on record, according to data from Farside Investors.

Grayscale Bitcoin ETF suffered its largest single-day drop in history. Source: FarSide

According to data from CoinGecko, as of press time, Bitcoin price is $63,624 , down 13.75% from the latest all-time high of $73,797 set on March 14.

Some market commentators pointed out that Bitcoin ETF traffic is slowing down and is about to The upcoming halving event and the US Federal Open Market Committee (FOMC) meeting on March 20 are the reasons for the sluggish price trend of BTC in the past few days.

However,Other analysts are optimistic about the liquidity prospects of Bitcoin ETFs manner.

Grant Englebart, a vice president at investment firm Carlson Group, told Bloomberg that only a “handful” of corporate advisers have seen clients allocate funds to Bitcoin ETFs. And noted that in this allocation, the average investment rate is 3.5% of the total funds. Commenting on the interview, Eric Balchunas, an analyst at Allocate to spot Bitcoin ETF.

Balchunas said that only a small number of "early adopters" have received meaningful allocations to Bitcoin ETFs. Source: Eric Balchunas on Balchunas said.

“Advisors have not onboarded the rest of their clients yet. All of this traffic is coming from inbound traffic,” Balchunas added, suggestingInflows into Bitcoin ETFs are likely to continue to increase in the future.

Other commentators pointed out that The number of Bitcoins remaining on the GBTC ledger ( Approximately 370,000 Bitcoin) is reason for the long-term bullish outlook for ETF flows.

"GBTC owns 378,000 Bitcoins and sold 96,000 Bitcoins today. The good news is that they can't continue at this rate for much longer." Crypto money market commentator Allesandro Ottavani wrote in a March 19 X post.

On January 11, Grayscale Bitcoin Trust converted from an institutional fund to a spot ETF, and fund issuers such as BlackRock and Fidelity also approved 9 other spot Bitcoin ETFs.

Anais

Anais