Source: Chaogan Investment Research

First show the power of compound interest.

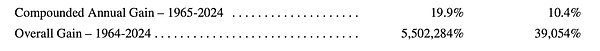

On the left is Berkshire's annualized return rate of 19.9% over the past 60 years, and on the right is the S&P 500's annualized return rate of 10.4% over the same period.

The gap is huge, but it is not so amazing intuitively, but the cumulative rate of return over 60 years is a world of difference.

If someone invested $10,000 in Berkshire and S&P 500 in 1965 and held it, the balances in his two accounts at the end of 2024 would be $550,228,400, or $550 million, and $3,905,400, or $3.9 million.

This is what Mr. Buffett often said about the amazing effect of compound interest when it is superimposed for a long enough time. It's a pity that we can't travel back in time, so we still have to make the right decision for the current investment.

Now is obviously the era of technology stocks. But looking back at the recent tortuous plunge in US technology stocks caused by the Deepseek impact, although technology stocks are the place for high-speed growth in the future, due to overcrowding, large fluctuations, and a very tortuous path of growth, it is not only difficult to say when the financial reports will be good, but even good financial reports will find it difficult to continue to exceed high expectations. Excellent companies such as applovin also fell 28% in less than 2 weeks (as of the close of February 25).

Can these star companies go from being excellent at the moment to long-distance champions? In the first half of 2024, AMD was still the hope of the whole village to challenge Nvidia. By the end of the year, the matter had been settled and no one mentioned it anymore. When is the turning point? It is really difficult to grasp. AMD's stock price peaked in early March 2024, and has been falling since then, long before the market reached the above judgment.

If chasing Internet celebrity stocks can really make the most money, then the investment master that the market admires should be Cathie Wood instead of Buffett. From the results, Cathie Wood's flagship fund ARKK has an annualized return of -3% in the past three years.

Berkshire, hedge funds, index funds, and ARK all have their own niches. The strategy that can survive in the long run is actually to do well on the road of differentiation and to become a part of the allocation choice of funds in the market.

Today we will analyze Berkshire's differentiated path and allocation value .

1. Berkshire is a company whose operating income exceeds investment income

1. Berkshire's dual-engine model

The relationship between operating business and investment business

Berkshire Hathaway operates a unique dual-engine business model, which organically combines operating business and investment business. The operating business provides stable cash flow and provides ammunition for the investment business; the investment business enhances the overall performance through capital appreciation and dividends.

The significance of operating income of $47.437 billion vs. investment income of $41.558 billion in 2024

The 2024 financial report data reveals a key fact: Berkshire's operating income ($47.437 billion) exceeds investment income ($41.558 billion). This phenomenon shows that although the market often regards Berkshire as an investment tool, it is actually a holding company with a strong operating entity.

Operating income is a more stable and predictable source of value

Investment income fluctuates greatly: a loss of $53.6 billion in 2022, a profit of $58.9 billion in 2023, and a profit of $41.6 billion in 2024.

In contrast, operating income has grown steadily, from $37.4 billion in 2023 to $47.4 billion in 2024, an increase of 27%. Buffett has repeatedly emphasized that the evaluation of Berkshire's value should focus on the stable growth of operating income.

2. Berkshire's unique corporate structure

Extremely decentralized holding company model

Berkshire has nearly 190 independent subsidiaries from about 90 industries, forming a rare degree of diversification. These businesses cover almost all economic sectors such as insurance, railways, energy, manufacturing, retail and services, providing the company with cross-cycle stability.

Extremely decentralized management philosophy

The most striking thing is Berkshire's "extremely decentralized" management model. The headquarters has only about 25 employees, managing a huge corporate empire with nearly 400,000 employees. The subsidiary management team has almost complete operational autonomy, which is in sharp contrast to the centralized management of most holding companies.

Long-term holding and non-selling acquisition strategy

Berkshire almost never sells acquired companies and adheres to the concept of "buy and hold forever". Buffett often says: "We don't buy companies that we want to change, but companies that we don't want to change." This is completely different from the "buy-improve-sell" model of private equity companies, which attracts many family business owners who don't want to be resold.

3. The dual value of the insurance business: an important source of operating income and a funding engine

Berkshire's insurance business not only provides investment funds, but is also an important source of operating income. In 2024, the insurance business contributed more than $11 billion in underwriting profits, demonstrating its strong strength as an independent profitable business.

The float model and its unique advantages

After collecting premiums, insurance companies can use these funds (i.e., "float") before paying claims. As of 2024, Berkshire's float will reach approximately $171 billion, equivalent to a long-term "loan" at zero or negative cost. This unique source of funds provides Berkshire with huge advantages in investment and acquisitions.

GEICO's Recovery

GEICO is a bright spot in the insurance business. Under the leadership of Todd Combs, GEICO has experienced a leap in improvement, with underwriting profits increasing from $3.6 billion in 2023 to $7.8 billion in 2024, an increase of more than 116%. This not only proves the importance of management capabilities, but also demonstrates Berkshire's ability to improve acquired companies.

4. Diversified performance of non-insurance businesses

Berkshire's non-insurance businesses showed a solid and diversified performance.

BNSF, one of the largest railway networks in the United States, contributed stable earnings of $5.03 billion; the energy sector (BHE) performed strongly, with earnings increasing by 60% to $3.73 billion, reflecting its forward-looking layout in renewable energy; although the huge manufacturing, service and retail sectors declined slightly, they still generated considerable earnings of $13.07 billion, covering a wide range of business areas from furniture to jewelry, aviation to food.

This diversified operation has built Berkshire's economic "all-weather" defense system:when energy prices fluctuate, consumer goods businesses may remain stable; when manufacturing faces a cyclical downturn, utility revenues remain reliable. During a recession, insurance and highway transportation may suffer, but electricity demand and basic consumer goods are relatively strong.By investing in industries that perform differently in different economic cycles, Berkshire ensures that no matter how the market environment changes, there will always be business units that can maintain cash flow, which not only resists systemic risks, but also reserves sufficient ammunition to seize investment opportunities in adversity, forming a solid foundation for the company's long-term and stable growth. 5. Operating synergies and compound returns How operating businesses strengthen investment businesses The stable cash flow and float generated by operating businesses provide sufficient "ammunition" for investment, enabling Berkshire to seize opportunities during market downturns. During the 2008-2009 financial crisis, Berkshire relied on this financial advantage to provide key funds to Goldman Sachs and Bank of America, obtaining extremely attractive investment conditions.

How Investment Business Feeds Back to Operating Business

Successful investments have increased Berkshire's capital base, enabling the company to acquire more high-quality businesses. For example, the appreciation of Apple's stock has provided Berkshire with a large amount of capital to support subsequent business acquisitions. This virtuous cycle continues to expand the company's business scale.

The long-term compounding effect created by the dual-engine model

The stability of the operating business combined with the growth potential of the investment business creates a unique risk-return configuration. This dual-engine model is one of the key factors that have enabled Berkshire to achieve an annualized return of 19.9% over 60 years, demonstrating the power of combining stable operations with wise investments.

II. Interpreting Berkshire's unique advantages through investment in Japan

1. Global Vision

Buffett's investment in Japanese trading companies demonstrated a unique strategic vision. He overcame the cultural and language barriers faced by most American investors, decisively laid out when Japanese assets experienced a 30-year downturn and foreign investors withdrew one after another, and flexibly adopted a minority shareholder strategy that was completely different from the US market.

2. Penetrating the appearance to identify the true value: the hidden assets of trading companies

The underestimation of Japanese trading companies stems from the market's misunderstanding of the nature of their business.These century-old companies are not simple trade intermediaries, but controllers of global resource networks.Three reasons for the underestimation: complex financial statements conceal the true value, the unique value creation model is not understood by Western investors, and the pessimism about Japan's macroeconomics conceals the global nature of these companies.

Buffett identified the core value of trading companies: the ability to maintain and increase the value of resource assets, the information advantage brought by the global trade network, and the risk management capabilities tempered over the centuries. He saw that trading companies had transformed from low-profit trade intermediaries to strategic investors and operators, and that they could obtain a larger share of value chain profits by holding shares in upstream and downstream companies. This transformation made future profitability far exceed market expectations.

Most importantly, Buffett discovered the "hidden assets" of trading companies - a large number of resource assets valued at historical costs, with book values far lower than market values. Some mining interests acquired decades ago may only have symbolic value on paper, but their actual market value may be several times higher. While the market is focusing on quarterly fluctuations, Buffett is evaluating the true asset value of century-old companies.

3. Strategic layout at the turning point of Japan's economic cycle

Buffett's investment in Japan reflects the clever use of the dislocation of the global economic cycle. When investing in 2019, the United States was in the late stage of expansion and valuations were high; Japan had just shown signs of emerging from deflation and asset prices were at a historical low. This cycle dislocation created a rare value window - when the trend of asset bubble in the United States was obvious, Japan was at the starting point of a possible long-term recovery.

He accurately captured the three major signals of the turning point of Japan's economy: corporate governance reforms showed real results, and the return on capital and dividend yield both increased; the Bank of Japan faced pressure to shift its policy, and monetary normalization would bring about asset revaluation; the yen was severely undervalued and at the bottom of historical purchasing power parity, with long-term appreciation space. 4. Make good use of the yen at almost zero cost Buffett's yen strategy is like a shrewd shopping game. Imagine that you found a special rule of a store: you can shop with vouchers borrowed at almost zero cost, and the purchased goods can also be automatically rebated at 6% per year. This is exactly what Buffett did in Japan - he borrowed yen at almost zero interest (by issuing yen bonds) and used these yen to buy Japanese trading company stocks that paid a 6% dividend every year. This strategy also has a clever insurance mechanism. If the yen gets stronger (appreciates against the dollar), Buffett will need to pay more money (in dollars), but the value of the Japanese stocks he bought (in dollars) will also increase accordingly; if the yen gets weaker, he will need to pay less, and most of the company's income comes from global business, which is limited by the depreciation of the yen. This is the so-called "natural hedge" - no matter how the currency fluctuates, the risk is greatly reduced.

To put it simply, Buffett is doing "move money arbitrage".

Summary: Individual investors can enjoy the investment dividends of Japan

Instead of missing out on the historic investment opportunity of Japan's way out of deflation, or taking the risk of investing directly in Japanese stocks and bearing complex exchange rate risks, individual investors should hold Berkshire to accurately grasp the investment opportunities in Japan. Berkshire has built a perfect exposure to the Japanese market for investors: it has selected the five most strategically valuable trading companies, established a clever yen debt hedge, and used its institutional influence to obtain extraordinary investment terms. By holding Berkshire shares, investors can not only share the fruits of the Japanese market recovery and the revaluation of trading companies, but also avoid currency risks that are difficult for individual investors to manage, while enjoying Buffett's first-class capital allocation capabilities and the safety margin of Berkshire's diversified businesses. This is the wisdom of ordinary investors to obtain global investment opportunities - standing on the shoulders of giants is more stable and efficient than groping on your own.

Summary: Achieve the best allocation between index funds, individual stocks, Berkshire and ARK and other active management products of different strategies

Individual investors should seek a balanced allocation among various investment tools to achieve an investment portfolio with low correlation, controllable volatility and satisfactory winning odds. Index funds provide market average returns and low-cost advantages, and are suitable as core assets for long-term holding; selected stocks can obtain excess returns in specific areas, and are suitable for investors who can conduct in-depth research to make targeted layouts; value-oriented holding companies such as Berkshire provide steady growth and implicit hedging for investment portfolios, while seamlessly obtaining global market opportunities; and innovative funds such as ARK focus on disruptive technology fields, which, although volatile, provide access to future growth engines.

The wise approach is to build an appropriate proportion between these different investment strategies, which can not only maintain resilience in different market cycles, but also find growth points in various macro environments. For example, when the technology bubble bursts, Berkshire-type assets may perform well, while ARK-type products may lead the way during the period of accelerated innovation. This diversified allocation not only diversifies risks, but more importantly, it captures the complementarity of different investment philosophies and market cycles, allowing the investment portfolio to continue to obtain cross-market and cross-cycle compound returns while maintaining a reasonable risk level. This is the core wisdom of transcending the limitations of a single strategy and building a truly all-weather investment portfolio.

Brian

Brian

Brian

Brian Brian

Brian Joy

Joy Brian

Brian Kikyo

Kikyo Joy

Joy Brian

Brian Joy

Joy Joy

Joy Kikyo

Kikyo