Deng Tong, Jinse Finance

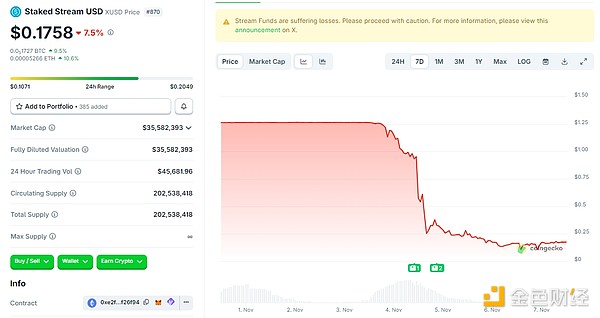

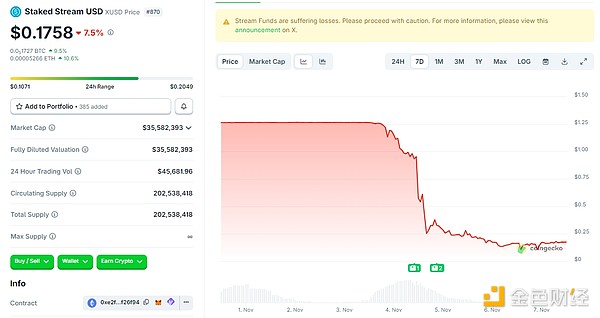

On November 3, 2025, due to the Balancer hack leading to mismanagement, Staked Stream suffered a loss of $93 million. The stablecoin xUSD de-pegged and continued to fall in the following days, reaching only $0.1758 as of press time.

This chain reaction triggered by Stream Finance quickly evolved into a crisis of trust in the "Curator" role in DeFi protocols.

This chain reaction triggered by Stream Finance quickly evolved into a crisis of trust in the "Curator" role in DeFi protocols.

According to DefiLlama data, since October 30th, the total value locked (TVL) in Curator's vaults has plummeted from $10.3 billion to $7.5 billion, with a large amount of capital fleeing in panic, indicating that market concerns about the risks of this model are intensifying. Trump's cryptocurrency advisor, David Bailey, warned that the credit crisis in the DeFi lending sector is evolving into a cryptocurrency liquidity crisis. If collateral cannot be provided to meet margin calls, or if hedging operations fail, the risk of the crisis spreading from decentralized finance (DeFi) to centralized finance (CeFi) is extremely high… Hopefully, things won't develop to this point, but caution is still needed to avoid counterparty risk. Meanwhile, just as the aftermath of the Stream collapse was still unfolding, the crisis at Morpho Labs further exacerbated industry anxiety. Its vaults, worth hundreds of millions of dollars, reached 100% utilization, incurring $700,000 in bad debt due to delays in the liquidation mechanism, forcing it to suspend withdrawals on chains such as Arbitrum and Plume. Aave CEO Stani Kulechov criticized Morpho's custody model for concentrating risk in a shared liquidity pool and compared it to Aave's independent marketplace, sparking a wider DeFi discussion. What is a DeFi Curator? Who are Curators? What are the advantages, disadvantages, and warnings of being a Curator? I. What is a DeFi Curator? A DeFi Curator can be translated as a DeFi manager. A Curator refers to an individual or team within a decentralized finance protocol who, while not part of the core protocol team, has the ability to build and maintain a strategic vault or asset allocation model. In the DeFi space, they use their expertise, analytics, and tools to filter, evaluate, integrate, and present the most valuable information, opportunities, and projects to users. They are like the "museum curators" or "professional buyers" of the DeFi world; therefore, a DeFi Curator can also be translated as a DeFi curator. DeFi Curators play a dual role: they acquire delegated governance power from other token holders and then express their opinions and exercise this power in governance voting. Their role is similar to that of an asset manager. They propose appropriate asset allocation strategies: such as which assets to hold, how to optimize returns, and how to ensure fund security. They must ensure the financial soundness of the Decentralized Autonomous Organization (DAO) while maintaining a balance between spending and investment. Additionally, they have another crucial role: ensuring protocol security. Therefore, such key functions are typically handled by a multi-signature team, composed of team members and reputable external institutions, sometimes in collaboration with professional organizations. DeFi Curators are an emerging force in the market, but currently rely primarily on established reward models: Periodic contracts (monthly or annually) for ongoing tasks (e.g., parameter management); One-time payments for temporary interventions (e.g., code audits); Protocol revenue sharing (e.g., pool fees on Morpho). The inherently low transaction costs and ease of tokenization of blockchain technology support the development of new funding methods for administrators. II. What are some important DeFi Curators on the market? In the current DeFi ecosystem, the DeFi Curator model is widely used in scenarios such as vault management, liquidity mining, and synthetic asset issuance. 1. MEV Capital The DeFi trust crisis triggered by Stream is inextricably linked to MEV Capital. MEV Capital is a leading Curator partner in the Stream Finance ecosystem, with the two forming a deep partnership through a business agreement of "strategy licensing - fund custody - profit sharing." As a key professional institution introduced by Stream, MEV Capital is responsible for managing the asset allocation of its core revenue vault. MEV Capital pushed Stream into crisis with two major actions: First, MEV Capital invested over 60% of its custodial funds (approximately $105 million) in the opaque off-chain cryptocurrency options market, employing a "volatility selling" strategy—earning premiums by selling call/put options, essentially betting on the market maintaining a narrow range of fluctuation. This strategy can generate stable returns during periods of stability, but faces enormous risks in extreme market conditions. Second, by recursively lending, it increased the actual leverage ratio to 5 times, creating a trading exposure of $875 million on $175 million in custodial funds. When the Balancer theft triggered a market crash, its options positions were liquidated on a massive scale, with losses rapidly penetrating the margin layer and directly wiping out users' principal. Stream employs a key mechanism called Recursive Looping. Stream itself states that its strategy includes continuously borrowing and reinvesting assets to improve capital efficiency. However, this also increases systemic risk and leads to leverage risk. An anonymous on-chain trader, "Cbb0fe," warned that Stream's on-chain data showed that xUSD's backing assets were only about $170 million, while the borrowing amount reached $530 million, resulting in a leverage ratio exceeding 4 times through the protocol's "recursive looping" strategy. In a recent article defending this strategy, Stream explained: "Recursive looping refers to the protocol repeatedly using its own assets to obtain interest rate differentials." However, controversy erupted when users discovered that Stream allegedly accumulated an undisclosed "insurance fund" from profits: a user using the pseudonym chud.eth accused the team of retaining "60% of undisclosed fees" and failing to properly separate them from the strategy the team claimed to be preventing. Stream responded that its intention was "to ensure these funds are always used as an insurance fund," citing internal communications and investor updates, but admitted they were "not transparent enough about how the insurance fund operates." 2. Re7 Labs Re7 Labs and MEV Capital are both top curators at Stream. Re7 Labs once managed over 25% of Stream's total locked value, approximately $125 million. This $125 million was primarily allocated to three high-risk areas: $65 million in Balancer liquidity pools, without any decentralized insurance; $40 million deployed in emerging public chain mining, with smart contract vulnerabilities and project collapse risks; and $20 million deployed in off-chain perpetual contracts, using leverage of over 10x for long-short trading. Just yesterday, the liquidity pool managed by MEV Capital and Re7 Labs on the Lista DAO platform reached 99% utilization, triggering mandatory liquidation. K3 Capital positions itself as an institutional-grade curator, focusing on providing compliant on-chain asset allocation and risk management services for institutional and individual users. Unlike yield aggregation platforms like Stream Finance, which focus on retail users, its services are more focused on the sophisticated management needs of professional investors and institutional funds. A landmark case is its deep collaboration with the decentralized leveraged lending protocol Gearbox Protocol. Through Gearbox's proprietary "pool-to-account" model, K3 Capital launched a customized USDT credit market, allowing borrowers to use USDT as collateral to obtain leverage of up to 10x, with funds invested in highly compliant DeFi protocols such as Ethena, Sky, and Pendle. According to ChainUnified data, K3 Capital manages $224.6 million in locked-in funds (TVL) across five major blockchains: Avalanche, Unichain, Binance, Ethereum, and BOB. 4. Gauntlet Gauntlet's core operating logic is to place AI decision-making within a strictly human-controlled framework. Through AI-driven quantitative analysis technology, it provides risk parameter calibration, strategy compliance review, and crisis emergency response services for leading protocols such as Aave, Compound, and Uniswap, filling the gap in "risk control absence" in the traditional Curator model. In the deUSD de-pegging incident, Gauntlet urgently suspended Compound's withdrawal function, using "lock-up to stop losses" to prevent the spread of bad debts. This operation was 3 hours faster than Aave's manual intervention, reducing losses by approximately $120 million. 5. Steakhouse Financial Steakhouse has driven the rise of the tokenized real-world asset industry by introducing US Treasury bonds and private credit assets into MakerDAO. Steakhouse leverages Morpho's infrastructure to create institutional-grade yield strategies by allocating and rebalancing deposits across Morpho's various lending markets. This allows them to focus on their core expertise: stablecoins, sophisticated risk analysis, and portfolio optimization. As a result, Steakhouse has become the largest stablecoin risk management firm on Morpho and a provider for fintech companies, exchanges, and institutions to create robust stablecoin yield products with DeFi backends. Steakhouse Financial is currently the largest manager on Morpho, overseeing 48 vaults on Ethereum, Base, Katana, Polygon, Unichain, and Arbitrum, generating over $500,000 in recurring revenue annually. III. Advantages, Disadvantages, and Cautions of Curators Curators, due to their high level of expertise, can help users lower the investment threshold, allowing them to easily enter the market without needing to understand complex leverage mechanisms. Curators are typically teams with research and modeling capabilities (funds, risk labs, etc.), capable of dynamically adjusting parameters based on market fluctuations, on-chain data, and liquidation risks. For example, K3 Capital's USDT credit market strategy designed for Gearbox allows users to enjoy an annualized return of 8%-12% simply by depositing assets, a 3x increase compared to self-management. However, many Curators use complex cyclical or synthetic asset structures, which increases risk. For example, Stream's key mechanism is recursive looping. This "revolving lending + multi-protocol collateral" structure becomes extremely vulnerable to market confidence crises or external shocks. Curators also suffer from transparency issues. Most curators only disclose historical returns, deliberately concealing crucial risk information. Stream users only learned after the collapse that MEV Capital's actual leverage ratio reached 5x, and that while xUSD backed only $170 million in assets, it had $530 million in borrowings. Curators also face the risk of excessive asset centralization. Before Stream's collapse, MEV Capital and Re7 Labs managed 85% of the total TVL, and both heavily invested in the Balancer protocol. If Balancer was compromised, it would impact Stream itself. Therefore, the future development of DeFi curators must be based on high transparency. Curators should proactively disclose their strategy structure, collateral, leverage ratios, liquidation mechanisms, etc. The true collateral status, debt structure, and re-collateralization chain of assets should be externally verifiable. Curators should also abandon the high-leverage gambler's mentality and focus on long-term value investing. Users need to judge the reliability of Curators through on-chain data.

Conclusion

It has been four days since Stream's collapse, but whether it can restart, properly repay assets, and restore trust remains to be seen. Stream's fate is still uncertain, and the entire crypto industry's trust in DeFi has plummeted.

Bubbles may look beautiful, but they will eventually burst. Curators are a bridge between ordinary users and DeFi finance. Curators should not make maximizing returns their ultimate goal, but should focus on genuine long-term value investing.

Catherine

Catherine

This chain reaction triggered by Stream Finance quickly evolved into a crisis of trust in the "Curator" role in DeFi protocols.

This chain reaction triggered by Stream Finance quickly evolved into a crisis of trust in the "Curator" role in DeFi protocols.