Source: Mankiw Blockchain Legal Services

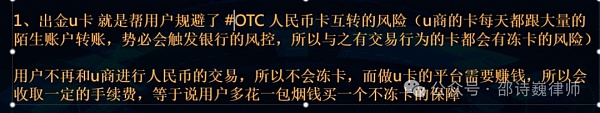

Introduction:

Buying and selling virtual currencies, the most The fear is receiving black money.

Friends who have experienced it all know how difficult it is to unfreeze the card. According to our experience in handling cases, police officers in various places generally have a negative impression of parties involved in the purchase and sale of virtual currencies. Even if the party whose card is frozen is innocent, when communicating with the public security agency to unfreeze the bank card, he will be asked to "refund the victim involved in the case". "Money" is a prerequisite for unfreezing, and even worse, they will be labeled as "crime of trust" and "crime of concealment".

Sohowhow to avoid being blocked? This is a common concern among people in the currency circle, especially those who travel in the currency circle.

Recently, a friend consulted Lawyer Shao and sent me some information he saw online (as shown in the picture). He asked: Can the MasterCard U card used by many people be used? ? Will using a U card to withdraw money prevent my card from being frozen?

So today I will write a short article to talk about various U-cards and the pros and cons of using U-cards, and provide answers to friends who have such questions.

01 What is the U card?

The use of U Card can be simply summarized as sending virtual currency (including but not limited to USDT) from the wallet address to the MasterCard on-chain address. Users can directly use it in China. Use this card to swipe your purchases, or you can directly withdraw cash from the card in RMB at an ATM machine.

Cardholders can bind APPs such as Alipay, Meituan, Ele.me, etc., and use the U card as a payment tool for domestic consumption without having to go through the OTC method to exchange virtual currency for legal currency. process.

According to relevant policies of our country, virtual currencies such as Bitcoin are regarded as a specific virtual commodity and do not have the same legal status as currency. They cannot and should not be circulated in the market as currency in our country. use. Butthe payment method using the international U card seems to magically realize the function of equating virtual currency with legal currency?

This is not the case. The virtual currency that the user recharges into the U card will be settled into foreign currency by the card operator. Users using the U card for domestic transactions are no different from other bank cards with international payment functions. Because of the existence of international settlement agreements, domestic merchants and Alipay What the platform collects is still legal currency.

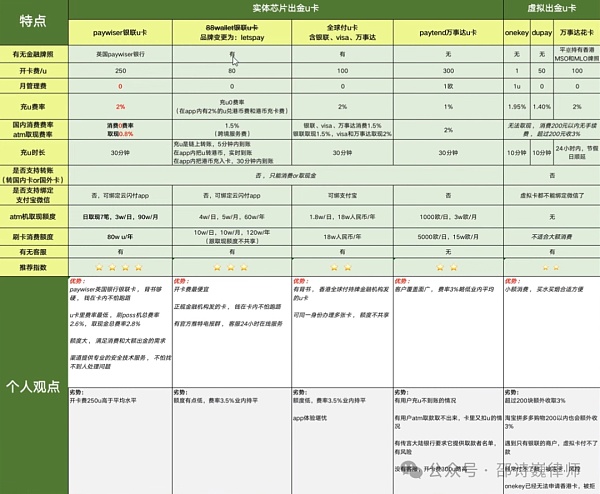

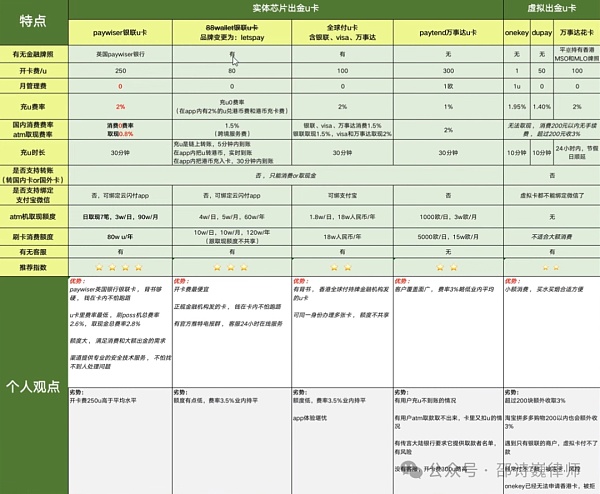

U cards can be divided into physical cards and virtual cards. For example, "UnionPay U Card" and "MasterCard U Card" are physical U cards, and "dupay" is a virtual U card. The rates and usage conditions of various types of cards are slightly different, see the figure below for details.

(Source: upDahuaXianyou)

02 The pros and cons of using U card

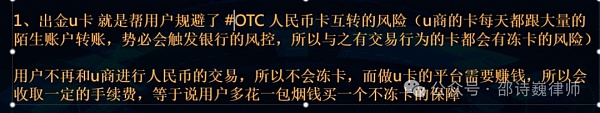

1. You can stay away from the risk of card freezing

We often say that buying and selling virtual currencies is not allowed in China. It’s prohibited, but the risk is indeed quite high, ranging from having your card frozen to being involved in criminal offenses at worst. If you sell your U to someone else, if the money transferred to you is the proceeds of illegal crimes by that person or its upstream partners (such as from pig-killing scams, or money laundering from online gambling scores, etc.), then the probability of your card being frozen is very high.

So, the reasons why your card is frozen are: first, you are using a domestic bank card; second, you received abnormal current funds (legal currency), which triggered the bank's risk control system.

But the U card itself is a foreign bank card, and what is received in the card is not legal currency, but virtual currency. It has nothing to do with domestic banks, and of course it will not be frozen. stuck.

Some people may ask: What if myMastercard U card receives a black card? What are the risks? Will it be frozen?

2. What should I do if my U card receives a black card?

With a U card, you don’t need to convert the U in your hand into legal currency through OTC, and naturally there will be no problem of receiving stolen money. But whether Kali will receive a black U is indeed difficult to completely avoid.

But you need to understand a concept. U itself will not be marked as a black U, only the address will be black. If in a case, the perpetrator transfers funds through U, large exchanges such as Binance and OK will blacklist the addresses involved in the case. If a U is received from an address blacklisted by the exchange, Then the account that received U will be blocked by the exchange, and the coins in the account can only go in and out.

Using a U card to collect U without going to the exchange will not trigger the exchange’s risk control mechanism. Therefore, receiving a black U will not affect consumption and cash withdrawals. Unless the issuers of these U-cards have relevant KYT risk control measures (Know Your Transaction, know your transaction). KYT is a process used by financial institutions to monitor and track financial transactions for fraud or suspicious activities, which can help financial institutions Institutions identify the source and destination of each transaction, assess transaction risks, take appropriate measures, and report suspicious transactions to regulatory authorities). Under this premise, there is a real risk that the card will be frozen when receiving a black card.

According to online rumors, the People’s Bank of China requires international U-cards such as MasterCard to provide a list of customers with abnormal withdrawals, but there seems to be no authoritative official information.

3. Can using U-card transactions avoid criminal risks such as crimes of trust and concealment?

The reason for the crimes of helping and concealing lies in the fact that his bank card received the stolen money involved in the case from upstream. Thereforemany people believe that if the card received is U and there is no bank card collection involved, then there is no criminal risk. But that's not the case.

All types of U-cards do not support transfers and can only be used for consumption or cash withdrawal. Therefore, there is no possibility of transactions with others through the U-card itself, and upstream and downstream transfers in and out, which indeed greatly reduces the possibility of illegal transactions. . However, there are still some people who use U-cards to do arbitrage business: after the two parties agree on the price difference between U-cards and legal tender, they use their U-cards to help others collect U-cards, and the difference between withdrawing cash from the ATM is their own profit. If the transferred U is the proceeds from fraud, the upstream will transfer the ¥ obtained through the fraud → USDT → to your U card → cash out as ¥. What is this whole chain if it’s not concealment?

And, taking the MasterCard U card as an example, the card opening fee is 300U, the monthly management fee is 1 euro, the U recharge rate is 1%, and the ATM cash withdrawal rate is 2%. Even if the cost is so high, someone is willing to give you U Is there something wrong with asking you to cash out for him? This trading model also claims that it is subjective and ignorant? No lawyer can save you. .

4. Legal Risks of Being Confirmed as Illegal Foreign Exchange Trading

Lawyer Shao has written much before about the legal risks of buying and selling USDT involving illegal business crimes. This article has been used to popularize science, so I won’t go into details in this article.

In the transaction chain of USDT → remit to U card → cash out to ¥ , if the upstream U is exchanged for foreign currency, there are two situations: :

① Exchanging RMB is for purely personal use without business purposes. It is an administrative violation. If discovered by the foreign exchange management authority, an administrative fine will be imposed.

② If it is a high-frequency transaction with an unspecified target for the purpose of earning price differences, and is deemed by the judicial authorities as buying and selling foreign exchange or buying and selling foreign exchange in disguised form, it will be classified as an illegal operation. sin.

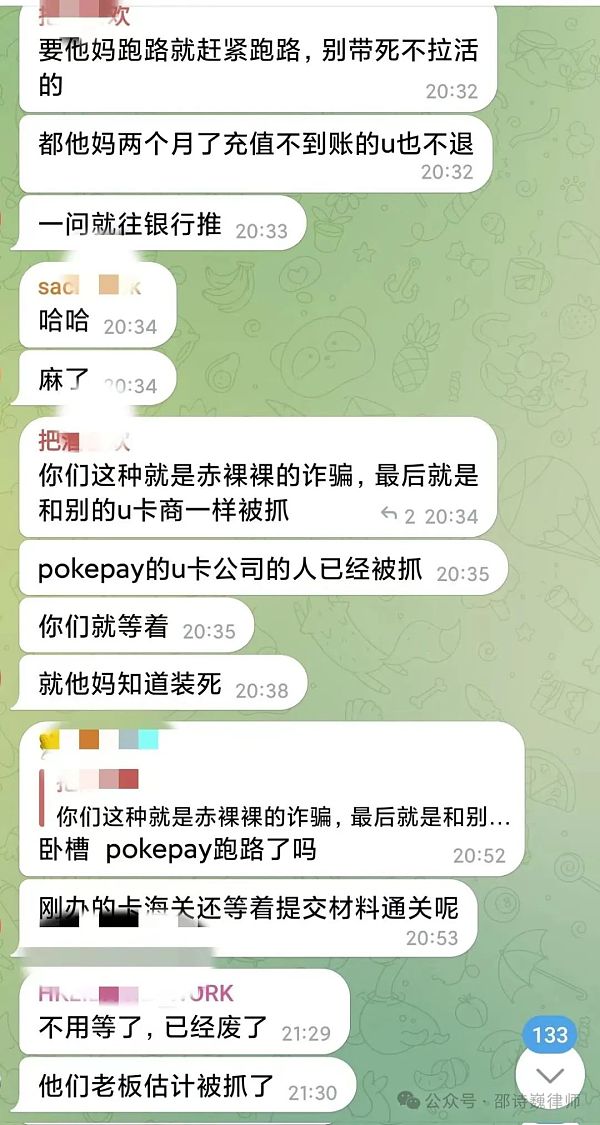

5. U-card scam

There are still certain thresholds for applying for a U-card by yourself, so many novices will go to agents, but so do agents. There is a mixed bag of good and bad people, and if you unfortunately encounter a scammer, it will be difficult to defend your rights. For example, the U card the scammer gives you is a second-hand card. When guiding you to operate the card, the recharge link sent to you is actually an authorization. When you recharge a large amount of U into the card, you will find that the U in the card Was miraculously transferred away.

03 Written at the end

So, back to this article The original question itself: Can USB cards be used? The answer is yes, but only for personal use and to cash out the U in your hand. It is more like a supermarket recharge card, which can be used immediately. If you want to use it for arbitrage or as a tool for currency exchange, the legal risks arising from this are still very high.

The problem is never the tool itself, but the people who use it.

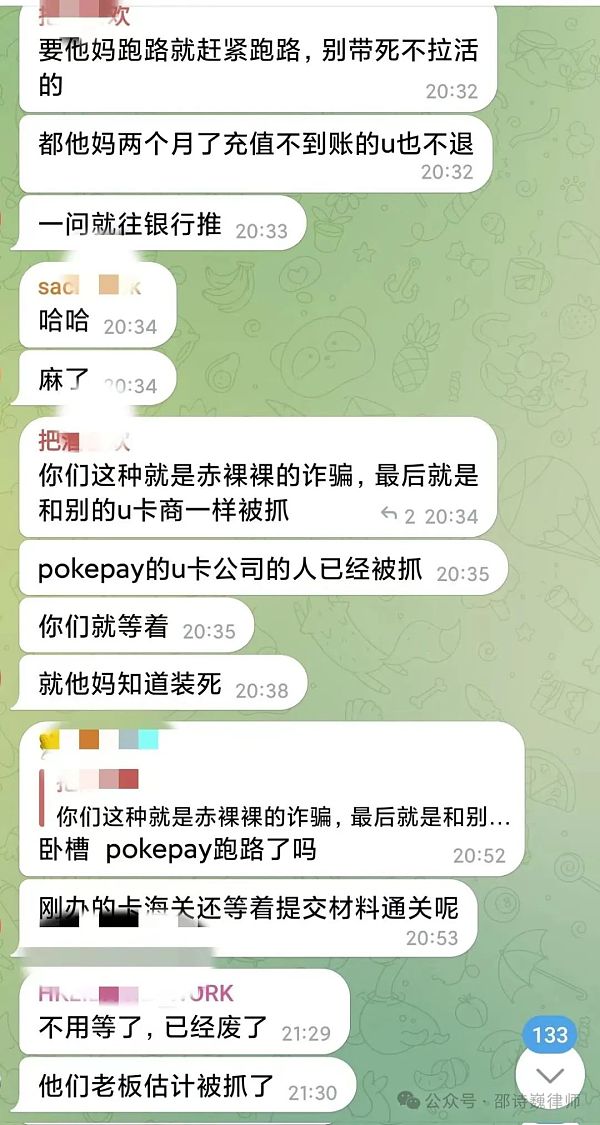

There are also many problems in the domestic U card agency industry. For example, it is promoted that after you have a U card, the card will not be frozen after you issue it. For example, when describing the advantages of the U card, list This card is suitable for online gamblers, card-breaking punishment personnel, and public officials for currency speculation...etc. Isn’t this blatant propaganda just waiting for the state to take action?

(Promotional copy of U card agents on the Internet)< /p>

Lawyer Shao judged that the life cycle of U-cards in our country should not be very long in the future. Very simple reason:

First of all, it increases the usage scenarios of virtual currencies in our country, which is contrary to my country’s long-standing related policies and its negative attitude towards virtual currencies.

Secondly, the country has been cracking down on the "two-card" crime and has carried out the "card-breaking" operation for several years. Has this kind of U-card agent promotion led to "card-breaking punishment"? "What does the person mean by using this card?"

So, this thing can be easily broken.

It is said from the gossip that several U-Card project developers have been slapped on the head by the police in various places. There have been problems with recharges not being credited and ATMs being unable to withdraw cash. I don’t know if it is true or not.

< /p>

JinseFinance

JinseFinance