Author: insights4vc Translation: Shan Ouba, Golden Finance

As of the first quarter of 2025, the global stablecoin circulation has exceeded US$215 billion, and the on-chain transaction volume in 2024 reached US$5.6 trillion, equivalent to 40% of Visa's payment transaction volume. Once limited to the crypto market, stablecoins are now widely used in real economic scenarios, including remittances and merchant payments. Their role in cross-border finance has expanded rapidly, especially in emerging markets, while initiatives by institutions such as Visa, Stripe and BlackRock have accelerated their adoption. With the increasing clarity of the regulatory environment and emerging competitors challenging giants such as Tether and Circle, stablecoins are at the forefront of reshaping the global payment system. This article will explore the key trends, risks and opportunities in the evolution of stablecoins between 2025 and 2030.

Global Stablecoin Market Overview (2025)

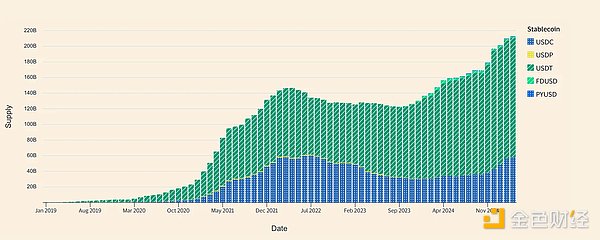

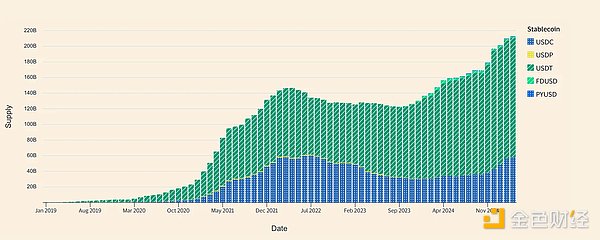

The stablecoin market has grown rapidly, jumping from less than $120 billion at the beginning of 2023 to more than $215 billion at the beginning of 2025. This growth shows that stablecoins have broken through the limitations of the crypto trading circle and become widely used digital cash. Tether (USDT) and USD Coin (USDC) still dominate, with circulation of approximately $140 billion and $55 billion, respectively. However, their combined market share in 2024 (about 90%) is gradually being diluted, and new issuers are emerging.

Average supply of stablecoins (Source: Visa)

It is worth noting that PayPal launched PayPal USD (PYUSD) at the end of 2023, Hong Kong's First Digital USD (FDUSD), Agora's AUSD, Ethena's USDe, and stablecoins such as TrueUSD (TUSD) and DAI together constitute the remaining 10% share. These emerging stablecoins are gradually undermining the dominance of Tether and Circle through differentiation strategies such as transparency, compliance or revenue sharing. It is expected that by the end of 2025, major banks and fintech companies will launch their own stablecoins, reducing dependence on a single issuer.

Adoption and Usage

The appeal of stablecoins continues to rise, as evidenced by the number of users and on-chain activity. In January 2025, more than 32 million unique addresses were using stablecoins for transactions, more than double the number two years ago. This shows that the adoption of stablecoins is growing in tandem among retail and institutional users. Among them, emerging market users choose digital dollars due to high inflation, while crypto-native users use them for DeFi and trading. In addition, the use of stablecoins has gone beyond public chains, with a large number of transactions also occurring in centralized exchanges and custodial wallets.

On-chain transaction volumes have also grown significantly, with adjusted stablecoin volume reaching $5.6 trillion in 2024, compared to just $3.8 billion in 2018. This data, which removes wash trading and bot activity, shows the true economic use of stablecoins, which now account for nearly 40% of Visa payment volume. An increasing amount of volume comes from institutional and corporate users, including corporate treasury management, cross-border liquidity management and instant settlement for fintech applications, rather than just exchange trading.

Wallet distribution is becoming more diverse, with millions of non-exchange wallets holding stablecoins around the world, including merchants and savings platforms. Transaction sizes range from small transfers by individuals (less than $100) to large transfers by institutions (millions of dollars). Regional data also reflects this diversity: in Nigeria, 85% of crypto transfers are below $1 million, indicating widespread use by retail users and SMEs, while in Brazil, large transfers of more than $1 million are increasing, indicating greater adoption by banks and businesses.

Growth Trajectory (2023–2025)

After 2020, the stablecoin market experienced rapid growth, initially driven by crypto trading, but briefly stalled after the TerraUSD crash in 2022. Since 2023, the growth trend has resumed, driven by real-world use cases and institutional support. From 2022 to 2024, stablecoin-related startups received more than $2.5 billion in venture capital, mainly for compliance, cross-border payments, and the development of yield-based stablecoins.

A series of corporate actions indicate increased market confidence. In early 2024, USDC issuer Circle Internet Financial applied for listing in the United States, planning to become the first publicly listed stablecoin issuer, and is expected to complete the listing in 2025, which will provide it with capital support and promote USDC to be more deeply integrated into the mainstream financial system. In addition, Stripe acquired Bridge for $1.1 billion at the end of 2024, one of the largest cryptocurrency M&A transactions to date. Bridge provides stablecoins and blockchain payment APIs, and Stripe's acquisition shows its confidence in the future of stablecoins in the payment field. Stablecoin-related M&A activities in the banking industry have also increased. For example, BNY Mellon has expanded its cooperation with Circle to integrate stablecoin settlement. In addition, high-profile cooperation such as Visa and Mastercard's stablecoin settlement pilot further shows that the industry is gradually maturing and traditional financial institutions are increasingly involved.

World-class application scenarios

Cross-border remittance

Real Case Analysis

Latin America: In 2023, Mexico became the leading recipient of crypto-dollar remittances. According to the Central Bank of Mexico (Banxico), stablecoin remittances into the country reached $63.3 billion, almost accounting for its total remittance inflows. Fintech company Bitso facilitates 10% of US-Mexico remittances, exchanging USDC for pesos, allowing recipients to access funds faster (same-day) at lower fees, rather than relying on bank wires that take days to settle. In Brazil, corporate use of stablecoins for cross-border payments has risen sharply, with large transactions of more than $1 million growing by about 29% by the end of 2023, showing that companies are looking for lower-cost foreign exchange solutions.

Sub-Saharan Africa: The region leads in grassroots adoption of stablecoins. Remittances and B2B transactions in Nigeria and Kenya are increasingly using stablecoins (usually USDT via mobile apps), bypassing traditional channels such as Western Union. Sending $200 via traditional methods may cost 8-12%, while stablecoins combined with local exchanges can reduce fees to less than 3% and arrive instantly. In addition, stablecoins bypass fragile banking infrastructure and allow users to quickly and easily access US dollars on their mobile phones. As of mid-2024, 43% of crypto trading volume in Africa involves stablecoins. In Nigeria, where the total amount of cryptocurrency received each year exceeds $59 billion, stablecoins have played a vital role in the volatility of the Naira. Even in Ethiopia, which has strict capital controls, retail stablecoin transfers have grown by 180% year-on-year after the local currency was devalued in 2023, highlighting people's reliance on USDC and USDT.

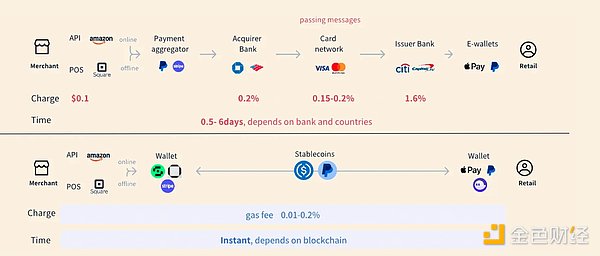

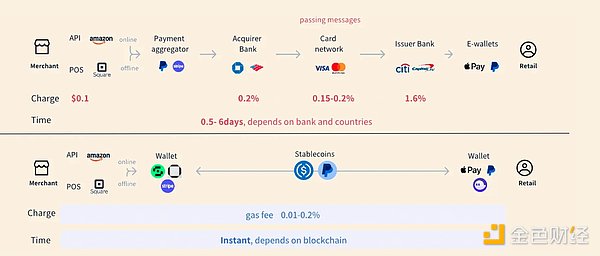

Cost and Time Efficiency

Traditional cross-border remittances take 3-5 days and involve multiple intermediaries, which drives up costs. Stablecoin transfers only require network fees (a few cents on Tron and perhaps a few dollars on Ethereum) and are settled within a single block. For example, a Filipino worker in the United States can use USDC to send money back home and convert it into pesos on the same day through a local exchange or ATM. According to the World Bank, digital remittances, including cryptocurrencies, are driving costs closer to the United Nations' target of less than 3%, and stablecoins play a key role in this process.

Traditional global payments and stablecoin payments (Source: SevenX Ventures)

Global salary payments (remote worker salaries)

Stablecoins are disrupting cross-border salary payments for freelancers and remote workers. Companies can now use digital dollars to pay salaries, avoiding delays and high fees for international wire transfers. For example, Remote.com, in partnership with Stripe, will launch a stablecoin payroll service in December 2024, covering 69 countries, using USDC and running on a low-cost blockchain. U.S. businesses can pay overseas contractors in USDC through the Remote platform, with the funds arriving almost instantly (e.g. on Coinbase’s Base network), while the employer’s account is debited in dollars. This avoids bank intermediary fees and lengthy processing times, and is particularly useful for workers in countries with weak banking systems.

Impact on Freelancers

In developing countries, freelancers often have difficulty accessing global banking services, and wire transfers are either expensive or unavailable. Stablecoins provide an instantly available USD asset. Users can hold USDC (which is more valuable in an inflationary environment), spend it directly (at merchants that accept stablecoins), or exchange it for local currency through exchanges or P2P platforms. For example, freelancers in Nigeria can reduce remittance fees from 10% for bank channels to less than 2% for USDC transactions. In addition, settlement times are significantly reduced - what could previously take a week now takes just minutes for on-chain transactions.

Efficiency on the Enterprise Side

For employers, stablecoin salary payments simplify financial management. Enterprises can make 24/7 global payments from a single USD stablecoin pool without having to maintain multiple foreign currency accounts or be limited by bank wire transfer times. Remote.com also ensures compliance (KYC, tax documents), solving the regulatory challenges of crypto salary payments in the past. Stripe expects that stablecoin salary payments will attract businesses that want to improve payment efficiency. Adoption is particularly high in the technology industry - open source contributors, designers, and content creators are increasingly choosing USDC. Traditional outsourcing companies may also follow suit to avoid local currency fluctuations and payment delays.

Financial inclusion

In countries like Argentina or Turkey, stablecoin salaries offer individuals a way to dollarize and hedge against inflation. Workers can gain access to a stable store of value, convert it on demand, and access a “debanked” dollar account through their smartphones without having to rely on the local banking system. This greatly expands participation in the global economy and enables highly skilled workers in underbanked areas to access their salaries efficiently and securely.

Capital Market Settlements

Stablecoins are optimizing capital markets,by instantly settling securities trades on-chain, eliminating traditional T+2 settlement delays, and reducing reliance on intermediaries.Governments and institutions are now using stablecoins (like USDC) to make payments in tokenized bonds and money market funds, such asHong Kong’s 2023 green bond pilot and BlackRock’s USD Digital Liquidity Fund (based on Ethereum) in 2024. In addition, Paxos's T+0 settlement pilot with Credit Suisse and DTCC's Project Ion also demonstrate the regulatory acceptance of this model. Visa has also supported USDC settlement, driving the trend of institutional adoption. In addition, tokenized U.S. Treasury bonds and JPMorgan Chase's JPM Coin have been used for real-time collateral settlement and 15-minute repo transactions, improving liquidity and releasing billions of dollars of idle capital.

On-chain financial management

More and more large companies and institutions are beginning to use stablecoins for financial management and liquidity allocation. Holding stablecoins - rather than depositing them in local banks - can speed up cross-border payments and provide DeFi income opportunities.

Institutional Finance Use Cases: In 2024, Tesla disclosed that part of its cash held digital assets (including stablecoins) to accelerate the transfer of funds between subsidiaries around the world. Stripe uses USDC for instant cross-border payments, and businesses such as Latin American exporters also use USDC as a tool to hedge against the depreciation of their own currencies, holding stablecoin assets before converting them into operating funds.

Yield Strategies:Stablecoins allow treasurers to earn 4-5% yields on DeFi protocols such as Aave, Compound, or tokenized T-bill funds, which is much higher than traditional bank rates. Facebook (Meta) reportedly tried to use part of its $44 billion cash reserves for short-term DeFi lending, indicating that mainstream corporate interest in DeFi is rising.

Financial system integration:Platforms such as Fireblocks and Coinbase Custody provide secure multi-user stablecoin management systems similar to corporate banking standards. SAP plans to support USDC transactions in 2025, allowing finance departments to convert US dollars to USDC directly in the ERP system and use it for on-chain transactions or supplier payments while maintaining compliance.

Case Study - Stripe Financial Management: After Stripe acquired Bridge, its finance department allowed merchants to hold stablecoins instead of exchanging them for fiat currency. This provides a new way for global companies to manage funds, making stablecoins the "working capital" of the Internet economy and connecting traditional finance and decentralized finance.

Dollarization and Financial Inclusion

In economies with high inflation and controlled capital, stablecoins drive grassroots dollarization by providing stable value and a medium of exchange. In Argentina, facing inflation of over 100% and a devaluation of the peso in 2023, stablecoin use has surged—USDT is widely accepted as digital cash, while USDC is used as a savings vehicle. Turkey currently ranks first in the world in stablecoin trading volume as a percentage of GDP, with local citizens using USDT to hedge over 50% of inflation and manage foreign exchange needs. In Africa, people buy USDT through peer-to-peer (P2P) markets due to dollar shortages; in Nigeria, importers use USDC to bypass bank delays, and 33% of Nigerians use stablecoins for payments or savings in 2024. Stablecoins also drive financial inclusion, enabling unbanked groups, refugees, and small and medium-sized enterprises to use mobile, low-cost financial services, including aid and remittances. However, the International Monetary Fund (IMF) has warned that widespread stablecoin use could undermine monetary policy and tax administration, but its real-world impact in volatile economies is still growing.

Regulatory Environment: March 2025 Update

Stablecoin regulation has quickly moved from the discussion stage to actual action. As of March 2025, major jurisdictions have implemented or proposed comprehensive stablecoin regulations. This section will review key developments in the United States, Europe, and Asia Pacific and analyze their impact on the industry.

United States

As of March 2025, there are no federal-level stablecoin laws in the United States, but bipartisan bills discussed in 2024 (including the Payment Stablecoin Clarity Act proposed by Rep. McHenry and a proposal by Rep. Waters) show that consensus is emerging. The bills all require 100% reserve backing (cash or U.S. Treasuries), impose prudential regulation, and establish a two-year moratorium on algorithmic stablecoins. The main divergence is over who will be responsible for regulation: One option allows banks and licensed non-banks (such as Circle) to issue stablecoins under state or federal regulation, while the other (Senator Hagerty’s bill) assigns regulation to the Federal Reserve (Fed), the Office of the Comptroller of the Currency (OCC), or state regulators, depending on the type of issuer. Issuers would face mandatory audits, instant redemption rights, capital requirements, and could be prohibited from paying interest to holders to avoid shadow banking risks. Although no bill has yet been passed, the legislative process is expected to make progress by the end of 2025. Meanwhile, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have taken actions under existing law, such as the SEC’s 2023 charges against Paxos for issuing BUSD and the CFTC’s commodity classification ruling on USDT, leading to increased legal uncertainty. Although regulators remain cautious, clarity at the industry level is expected to increase, driving broader institutional adoption.

Europe (EU) - MiCA Regulation Implementation

The EU implemented the Markets in Crypto-Assets Regulation (MiCA) in 2023, with stablecoin rules effective from June 2024, establishing a comprehensive legal framework for "asset-referenced" tokens and "electronic money tokens". Issuers of stablecoins pegged to the euro or foreign currencies must be EU entities and obtain regulatory approval, while publishing detailed disclosures on governance and reserves. MiCA requires 100% reserve backing, prohibits borrowing or re-hypothecation of reserves, stipulates regular audits, and prohibits interest payments to token holders to avoid securitization classification. Stablecoins with daily trading volume of €5 million or market capitalization of €500 million will be subject to increased supervision by the European Banking Authority (EBA), and regulators can limit issuance to protect monetary policy. Companies like Circle are applying for MiCA licenses, while EU banks can use existing banking licenses to issue stablecoins. MiCA’s clear regulatory framework is expected to drive fintech and public sector adoption, making Europe a global regulatory benchmark, although issuers’ profits may be squeezed by the ban on revenue sharing.

Asia Pacific

Stablecoin regulation in the Asia Pacific region is developing rapidly, led by Japan, Hong Kong and Singapore. Japan relaxed restrictions in February 2025, allowing issuers to invest up to 50% of their reserves in government bonds or time deposits, thereby generating safe yields.Foreign stablecoins such as USDC are now traded locally (e.g. through SBI VC Trade) and are subject to strict custody and auditing rules to ensure consumer protection. Hong Kong hopes to become a hub for stablecoin issuance, with the Hong Kong Monetary Authority (HKMA) introducing a mandatory licensing regime in late 2024 requiring local custody of reserves and the imposition of MiCA-like governance standards, which is expected to be implemented in 2025. The Monetary Authority of Singapore (MAS) finalized a stablecoin regulatory framework in 2023, requiring 100% low-risk asset backing, instant redemption and capital requirements, while allowing both bank and non-bank issuers. Regulated tokens must meet MAS standards to use the "stablecoin" label to ensure quality and user trust. Elsewhere, South Korea and Australia are drafting stablecoin regulations, India remains strictly restricted, and China bans RMB-pegged stablecoins, but Hong Kong offers a workaround for Chinese companies. These developments make the Asia-Pacific region an important market for the growth of regulated stablecoins.

Compliance Costs and Global Arbitrage

The new regulations will significantly increase the compliance costs of stablecoin issuers, requiring funds for audits, regulatory capital, and reporting systems. Smaller or opaque issuers may face difficulties, leading to market concentration in large, well-capitalized companies. Issuers may need to set up compliance teams and legal counsel in multiple jurisdictions. Yet clearer regulations could expand adoption, attracting businesses and fintechs that have shied away in the past due to legal uncertainty.

Regulatory arbitrage remains. Issuers often choose jurisdictions with light regulation, such as Tether’s early success in Hong Kong and the Caribbean, which took advantage of a regulatory vacuum in the United States. As the United States, the European Union, and the Asia-Pacific region advance their regulatory frameworks, the choice of “safe havens” is shrinking. But there are still differences: the European Union prohibits the payment of yields to token holders, while places such as Bermuda or the UAE may allow yield-bearing stablecoins. Issuers may choose flexible bases to offer such products, as long as global market access remains open.

Profitability will depend on regulatory requirements. Capital requirements or reserve asset restrictions (such as allowing only short-term Treasury bills or non-interest-bearing Federal Reserve cash) will reduce interest income, which is equivalent to a tax on profit margins. Companies such as Circle seem willing to sacrifice some profits in exchange for scale and compliance. While Tether is currently highly profitable under lax regulation, it will face pressure if stricter jurisdictions block unlicensed stablecoins—either to comply (reducing profit margins) or to restrict operations to less regulated markets.

Business Model and Revenue Changes

Early stablecoin models focused more on growth than profitability, but as interest rates rise and the market matures, the focus has shifted to profitability. Issuers now have multiple sources of revenue and face a changing competition for revenue distribution.

Issuer Revenue Composition

Reserve Interest

In the current high-interest environment, reserve interest is the main source of revenue. When a user deposits $1 in exchange for 1 stablecoin, the issuer invests the reserves in short-term U.S. Treasuries, money market funds, or bank deposits. Under large-scale operation, the returns are considerable, for example, an annual yield of 5% can bring $1 billion in annual revenue with $20 billion in reserves. In 2024, Tether's net profit reportedly reached $13 billion, mainly from reserve interest, even exceeding some large banks and BlackRock. Circle earned about $770 million in the first half of 2023, and the average USDC reserve was $30 billion. Unlike banks that pay interest to depositors, stablecoin issuers usually retain most of the interest income to support operations and profits. But as competition intensifies, some of the revenue may need to be shared with users or partners.

Minting/destruction and transaction fees

Stablecoin transfers on the blockchain usually do not charge issuer fees, but institutional users may have to pay fees when redeeming. For example, Tether charges 0.1% ($1,000 minimum). Circle has no standard fee for USDC, but platforms using its API may charge a fee. Retail transactions are generally fee-free, but corporate clients may be subject to fees. Paxos reportedly charges a small basis point fee on trades of white label stablecoins (e.g., BUSD, PYUSD). Issuers may also profit from custody or financial management services, such as the corporate account services provided by Circle.

Partnerships and Other Revenues

Stablecoin issuers enter into revenue-sharing partnerships with fintech companies, exchanges, and banks. For example, in 2023, Coinbase and Circle reached an agreement to share interest income on USDC, allowing Coinbase to offer up to 4% APY (annual percentage yield) to USDC holders. In addition, issuers may pay referral fees or rebates to wallets and payment companies, and profit from foreign exchange services (such as USDC exchange for MoneyGram and Stellar). Other sources of revenue include premium services, such as Circle's charges for merchant API use. These collaborations have both promoted the popularity of stablecoins and achieved revenue sharing.

The impact of on-chain money market funds and new competitors

With tokenized money market funds (MMFs) launched by institutions such as BlackRock (BUIDL) and Franklin Templeton (BENJI) offering a yield of about 5% and maintaining a stable value, stablecoin profit margins have been squeezed. These MMFs are integrated into crypto wallets, allowing users to exchange USDC for yield assets while maintaining a peg to the US dollar. The RWA (real world asset) craze in the DeFi space has attracted billions of dollars into tokenized treasuries, forcing Circle (which already offers USDC rewards through Coinbase) and Tether (which has not yet shared revenue) to consider giving back to users, otherwise they may lose customers. At the same time, new players such as PayPal's PYUSD, bank-issued tokens, and Agora's AUSD provide returns or incentives, intensifying market competition. DeFi native stablecoins such as Overnight's USD+ directly embed the revenue model, which means that zero-yield stablecoins will face the risk of being eliminated if they don't adapt.

Technological Innovation

Stablecoins can now circulate seamlessly across chains. Early stablecoins were limited to a single network. Today, USDC and USDT can be issued natively on multiple blockchains such as Ethereum, Tron, Solana, Polygon, Arbitrum, Avalanche, Binance Chain, etc., allowing users to use the same assets in different ecosystems (1:1 exchange for US dollars). For example, USDC is suitable for DeFi on Ethereum, while it can be used for fast payments on Solana. Currently, the platform with the largest supply of USDT is Tron, which is popular in the Asian market due to low-cost transfers, while USDC mainly circulates on Ethereum and the second-layer network.

The new protocol supports stablecoin exchanges without cross-chain bridges. For example, Circle's CCTP allows USDC to be destroyed on one chain and atomically minted on another chain, improving cross-chain compatibility. Stablecoins are also integrated into wallets such as MetaMask and Phantom, as well as Stripe's fintech applications, and even used for Telegram robot transfers (such as USDT). Traditional financial institutions are also connecting to stablecoin payments, such as Visa's Universal Payment Channels and Visa VTAP plans to connect blockchain payments with bank settlements, allowing merchants to accept stablecoins and convert them into fiat currencies.

Ultimately, stablecoins are becoming more common and interchangeable: no matter which blockchain they are on, they can maintain the same functions, achieve cross-chain arbitrage, and maintain stable prices globally.

Programmability: Smart Contracts and Automation

As programmable currencies, stablecoins can achieve innovative applications through smart contracts.

DeFi composability:Stablecoins are at the core of lending, trading, and yield protocols. Users can deposit USDC to earn interest or lend assets, and smart contracts can combine multiple functions to achieve yield tokenization and automatic returns.

Real-time payments:Protocols such as Superfluid support streaming payments, such as real-time payroll or per-minute service fees. Some DAOs (decentralized autonomous organizations) have adopted this model to pay contributors, and Visa is also piloting automatic payments on Ethereum smart contracts, simulating the recurring billing of a subscription model.

Escrow and conditional payments:Stablecoins can be used in smart contract escrow to automatically release funds based on preset conditions. For example, payment after confirmation of freelancer delivery of work, or parametric insurance triggered by oracles (such as automatic compensation for flight delays).

Complex financial instruments:Stablecoins can be used as collateral and settlement assets for derivatives, liquidity provision, and trade finance. Smart contracts can automatically pay after IoT (Internet of Things) devices confirm the delivery of goods, replacing the traditional clearing model.

Visa’s VTAP and Institutional Integration

Visa launched its Tokenized Asset Platform (VTAP) in October 2024, providing banks with stablecoins as a service, supporting APIs for stablecoin minting, destruction and management, and ensuring compliance, secure issuance and cross-chain interoperability. The first partner, BBVA, plans to pilot the issuance of euro and US dollar stablecoins on Ethereum in 2025. VTAP enables banks to integrate tokenized payment systems without blockchain expertise, supports cross-border transactions (such as SGD to USD stablecoin), and promotes use through Visa’s 80 million merchant network, supporting fiat or stablecoin settlement. Building on the 2021 USDC pilot, VTAP also supports programmable finance, including automatic loan issuance and instant settlement of tokenized assets, making Visa a neutral infrastructure connecting stablecoins and traditional finance.

Security Improvement

As stablecoins scale, security is critical. Currently, measures such as smart contract audits, formal verification, and multi-signature casting controls are being promoted to reduce risks. For example, Circle's USDC uses a "circuit breaker" mechanism that suspends transactions when abnormally large transfers are detected to prevent hacker attacks. At the same time, project parties are also developing insurance and custody solutions, such as Nexus Mutual's insurance service for custody risks and Fireblocks' MPC custody for institutions.

The scalability of stablecoins is also improving, and Layer-2 networks such as Arbitrum and Optimism have achieved faster and lower-cost transactions. In addition, the security of cross-chain bridges is improving. For example, Circle's CCTP reduces the risk of hacker attacks by eliminating locked bridge contracts.

Risks and Challenges

The stablecoin market remains highly concentrated, with Tether (USDT) accounting for about two-thirds of the supply, and Tether and Circle controlling more than 90% in total, forming a systemic single point of failure. If USDT loses market trust, it may trigger market turmoil more serious than the $40 billion collapse of TerraUSD (UST) in 2022.

In addition, stablecoins rely on off-chain reserves (such as bank deposits), exposing users to counterparty risk. For example, the collapse of Silicon Valley Bank (SVB) in 2023 caused USDC to fall to $0.88. Redemption interruptions (such as Tether's redemption restrictions after the FTX incident) and blacklist mechanisms further expose centralization risks. Price anchoring is not stable, and the USDC/USDT trading price was close to $0.90 when the market fluctuated. Technical vulnerabilities are also challenges, such as Acala's $120 million miscast and Wormhole's $300 million cross-chain bridge hack. In addition, regulatory uncertainty limits industry development, as evidenced by Paxos' termination of BUSD issuance. To reduce risks, regulators are promoting reserve audits, redemption guarantees, and emergency shutdown mechanisms to ensure that stablecoins maintain financial stability as they become systemic assets.

Future Outlook (2025–2030)

In 2025–2030, stablecoins may be deeply integrated into the global financial system, or they may face challenges from strict regulation and central bank digital currencies (CBDCs). In 2024, on-chain stablecoin transactions reached $5.6 trillion, and are expected to exceed $20 trillion by 2030, potentially surpassing credit card networks in cross-border payments. The most likely scenario is that stablecoins will complement the traditional financial system and become a settlement tool for banks and payment platforms such as Visa and Stripe. Although the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) have warned of stablecoin risks and promoted CBDC solutions, it is more likely that they will coexist under strict supervision.

Market concentration remains a concern - USDT's share is about 66%, and if it collapses, it may trigger systemic risks similar to the $40 billion collapse of TerraUSD. However, institutional investors' expectations for tokenized assets remain optimistic. Blackstone expects the market size to reach trillions of dollars, and McKinsey reports that tokenized assets have reached $120 billion in 2024. Stablecoin market capitalization forecasts range from $300 billion (if regulation is tightened) to $2-3 trillion (optimistic scenario), and dollarization in emerging markets may drive higher growth. The future of stablecoins depends on CBDC design: wholesale CBDCs (for interbank transactions) may enhance stablecoin reserves, while retail CBDCs may compete directly with stablecoins.

By 2030, tokenized deposits and bank-issued stablecoins may become financial settlement infrastructure, while stablecoins play a role in aid disbursement, cross-border remittances, and new monetary instruments in areas of high inflation.

Conclusion

By 2030, stablecoins are expected to occupy a core position in the global financial system, especially in cross-border payments, corporate settlements, and digital asset trading. Their market value may grow from hundreds of billions of dollars to trillions of dollars, while being strictly regulated to ensure financial stability. Despite a more "controlled" market environment, stablecoins will still promote broader financial innovation and mark the evolution of a more efficient and inclusive monetary system. The next five years will be a critical period for the evolution of stablecoins from niche products to global infrastructure.

Weiliang

Weiliang