Author: Revc, Golden Finance

Foreword

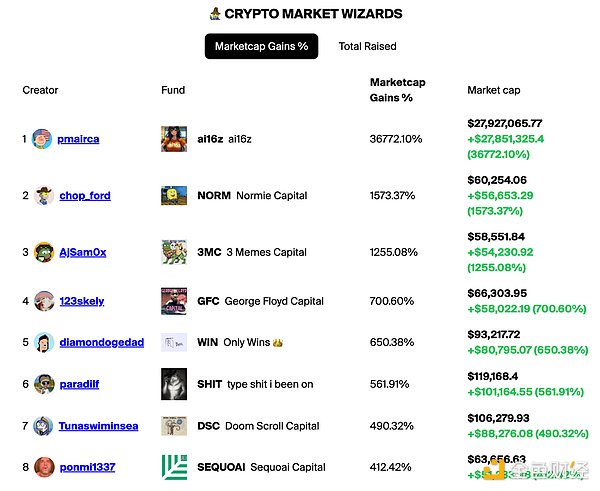

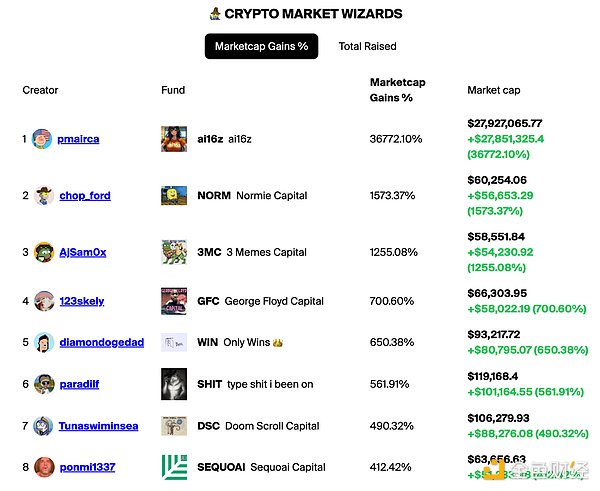

ai16z, with a peak market value of nearly $100 million, is labeled MEME because it has brought hundreds of times returns to early investors. However, we can further explore its implications for collective asset management activities on the chain.

The asset value evaluation system is usually divided into two ways: one is based on the discount of asset cash flow, and the discount rate is determined according to the risk characteristics of the asset or cash flow, which is mainly used for operating entities; while the value evaluation of MEME assets focuses on network communication efficiency and influence consensus, and its sustainability is often placed in a secondary position. This different evaluation method has greatly affected the positioning and design of the Web3 project.

Take Friendtech as an example. Actually, when I first heard about Friendtech, I was thinking about a question: why can't the Holders of the same batch of Keys be an investment group? In that case, there is at least a visible investment cash flow to support the value of the group equity token, but they choose to trade and hype the dialogue opportunity. It may be that the Bonding Curve designed around the Key is more suitable for hype, and finally the stampede of liquidity cannot be avoided. The economic model designed by mostWeb3 projects likes to artificially steepen the supply and demand matching, triggeringFomo emotions. Latecomers are in a weak position, which is not conducive to attracting a wider audience, but matureDeFi protocols are excluded, although there are more liquidity incentives in the early stage.

Back to ai16z, it is the largest project on the Soalna hedge fund protocol Daos.fun, which aims to lower the threshold for hedge funds and realize the democratization of hedge funds.

Daos.funWorking Principle

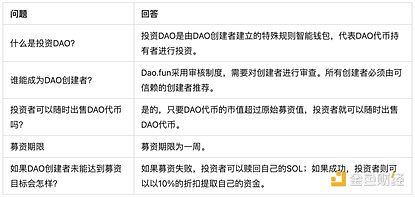

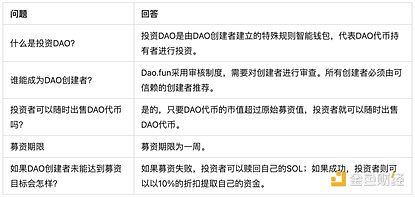

Daos.fun is an investment DAO, which mainly involves fundraising, trading, fund expiration and liquidation, and fund term.

Fundraising:DAO creators have one week to raise the required amount of SOL. DAO tokens are issued fairly, and all participants can purchase tokens at the same price.

Trading:After the fundraiser closes, the creators will invest the SOL raised in the Solana token of their choice and trade it on a virtual automated market maker (AMM). This allows the price of the DAO token to fluctuate based on the trading activity of the fund. While the DAO token price is uncapped, its downside risk is limited by the market value of the fundraiser. Investors can sell their DAO tokens at any time as long as the market value of the DAO token exceeds the original fundraiser amount.

Fund Liquidation:When the fund expires, the DAO wallet will be frozen and the SOL in the profits will be returned to the token holders. Investors can choose to destroy their DAO tokens to redeem the DAO's underlying assets, or sell the DAO tokens directly.

Fund Term:The fund term is set by the DAO creator. For example, the fund term of ai16z is 1 year and it will be liquidated on October 25, 2025; the liquidation date of kotopia is October 27, 2025; DCG (Degen Capital Guild) will be liquidated on April 25, 2025;

The creators of the fund are currently audited by the authorities, and their investment capabilities are basically assessed in a qualitative way. There is no guarantee that they are not driven by other interests. Especially in the case of a changing market, the information gap between creators and investors may lead to investor losses. Whether Daos.fun will require creators to hold at least a certain proportion of the fund's assets still cannot dispel concerns about its operational capabilities, so it is necessary to introduce a pre-investment voting system. As Daos.fun opens up the invitation system, there will be more room for optimization.

Can the democratization of hedge funds change the current situation of the industry where VC coins are rampant?

While VC is expanding wildly, it inevitably has a negative impact on the industry. Due to the mature regulatory system of Web2, VC has a very professional process to evaluate the potential of projects, growth curves and exit links during the investment process. However, in Web3, the industry has not yet developed a sense of self-discipline until it evolves into a more positive equilibrium force to promote the healthy development of the industry.

How to understand the destruction of VC to innovation? Although Web2 is also a radical way of operation, fund managers are responsible to investors, but VC (and CEX) in Web3 has a more harmful effect of entangling and monopolizing the development of the industry. Suppose a new species is born in the early biological community deep in the Amazon rainforest. This new track is developing slowly and has its own micro-ecosystem. Under the perception of market demand and user experience, it has grown its wings. At this time, other parties in the micro-ecosystem also give positive feedback to each other. In the process of continuous growth, the core is condensed and the vitality of the organization is tempered by interaction with the environment. Note that this vitality is crucial for the long-term development and iteration of the project.

But if VCs infiltrate too early and barbarically, what kind of scene will it be? They will drive reinforced concrete and modern construction projects into the Amazon primeval forest, seize the head species of the micro-ecosystem, and change their objective development laws, and feed them with nutrients to accelerate their development. In most cases, this new species will lose the ability to perceive products and markets, and develop in the direction of "giant babies and air", while the entire small ecosystem will be destroyed, breaking the positive feedback loop, being replaced by a monopoly, and suppressing the possibility of competition and evolution in the Amazon rainforest. This is the price that the entire industry and society have to bear.

The current primary market is sluggish, financing is difficult, and the deterioration of the ecology is backfiring on VCs themselves. For VCs, it is necessary to put aside the fantasy of monopoly, focus on decentralized projects with commercial potential, and avoid becoming a promoter of "giant baby" projects. However, VCs themselves are also under pressure to return capital, and the contradiction between operation and capital return needs to be balanced.

Since 2021, the entire crypto industry has been facing the pressure of abnormal regulation. Judicial lawsuits on crypto in the United States have been launched at an unprecedented density. Leading crypto companies such as Coinbase are on the front line of the struggle. It is difficult to find out who is the original sin of the industry development in the entire chain of SEC-CEX-VC-Project, especially in the context of previous interest rate hikes. The industry lacks liquidity, and the voices of crusading against Fud are round after round. What we can do is to establish a self-regulatory organization with a sense of decentralization after the barbaric development, and the developed crypto head companies should avoid engulfing the industry with traffic and user advantages.

However, as a commercial organization, obtaining capital flow and users means extremely high costs. Balancing commercialization and public interests is a long-term issue facing large crypto companies.

The role of on-chain asset management in promoting the industry

The concept of on-chain asset management or investment DAO was proposed as early as 2021, and it has been continuously evolving and implemented. In abstract terms, the Holder of the MEME community is also an investment DAO. On-chain asset management can promote the healthy development of the industry from two aspects.

1. Active management funds focus on projects that are truly decentralized and have clear business models, narrowing the gap between the community and professional investment institutions. This may be a way to solve the proliferation of VC coins and promote "good coins" to become the mainstream of the market. Give full play to DaosFun's more transparent and open operating methods.

2.Short-selling funds. The short-selling target can be a pseudo-Web3 project whose VC accounts for more than 20% of the token share, and a single VC entity accounts for more than 3%. The specific amount depends on the project attributes. That is, if the VC funds attracted by a project exceed its development and promotion needs, then the Web3 industry must examine its decentralized attributes. Like the previous Gamestop short squeeze war and the Occupy Wall Street movement, there seems to be a hint of irrational enthusiasm, but for retail investors, the movement itself only has some revisionist claims. If there is a problem in the industry, it must be faced, using some methods that are not easy to understand at the time but can be verified in the long run. Everyone has the right to take action against the unhealthy development of the industry, but does not want to rise to the level of a certain ideology.

Will the overly revised proposition affect the competition in the industry? The answer is yes. However, looking back at the widespread monopoly phenomenon in the development of Web2, the industry also needs the micro-management at the scalpel level of "Citron Capital or Muddy Waters".

Conclusion

Quote Littlefinger in "Game of Thrones" - "Chaos is a ladder". While freedom is a ladder, it is often accompanied by chaos and monopoly. It is time for the development of the Web3 industry to enter the next stage. Traditional supervision may not be suitable for the Web3 industry, although it is constantly exerting influence.

Back to Daosfun itself, in the short term, we should not hope that the democratization fund can bring influence on industry self-discipline, but the free development opportunities brought by Web3 need each of us to maintain.

Alex

Alex