Trump is elected president. Bitcoin price surges to $100,000 per coin. (*Laszlo's 2010 pizza order is now worth $1 billion.) Bitcoin climbs to $109,000 in anticipation of U.S. executive order supporting cryptocurrencies. Clearly, support from U.S. officials is good for bitcoin prices. Last year, the top U.S. securities regulator approved the launch of regulated funds that hold the cryptocurrency, paving the way for pension funds, endowments and other large money managers to invest in the token. They have been encouraged to do so by the Trump administration's strong support for the cryptocurrency industry. "This was basically unthinkable two years ago," said Yesha Yadav, associate dean of Vanderbilt University's law school. She added that before Trump's return to Washington, bitcoin's price "was driven by novelty and excitement, and this time there's real institutional support." Many believe prices can rise further. Larry Fink, the billionaire founder of BlackRock, the world’s largest asset manager, recently said that if more sovereign wealth funds considered holding Bitcoin, its price could reach $700,000.

“Bitcoin has found a way to work with the government,” said Matt Hogan, chief investment officer of cryptocurrency asset manager Bitwise, adding that Trump’s support “removes the last existential threat to Bitcoin.”

Now, some lawmakers are pushing the government to go further. Senator Cynthia Loomis of Wyoming is leading the charge to create a strategic reserve of Bitcoin.

Strategic Reserve

A reserve asset is typically a critical resource that can be used in times of crisis. For example, the United States currently has an emergency oil reserve that can be used to deal with oil supply shocks, while many countries have gold reserves.

Loomis said Bitcoin’s rising value could be used to cut U.S. debt. In July, she introduced a bill seeking to have the U.S. buy 200,000 Bitcoins from the market each year for five years until the reserve reaches 1 million.

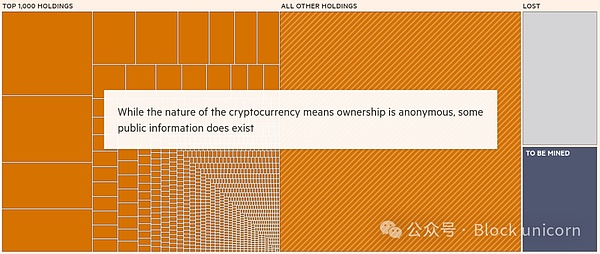

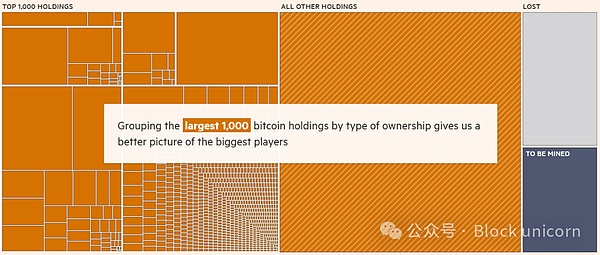

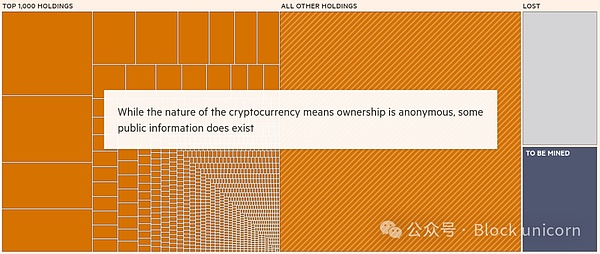

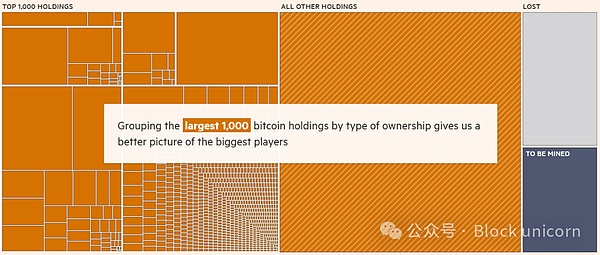

Because cryptocurrencies are largely anonymous, it would be extremely difficult to track who Washington is buying bitcoin from — and criminals and hostile governments could profit from those purchases.

Danielle Bryan, executive director of the nonprofit watchdog Project on Government Oversight, said the U.S. government’s interest in cryptocurrencies raises significant “national security implications because the types of investors involved are inherently problematic.”

“It’s a very bizarre idea,” said Hilary Allen, a professor at American University’s Washington College of Law. “We need something that’s not going to be eroded by inflation, we need hard currency and real reserve assets. And the funny thing is, there’s nothing less ‘hard’ or less real than Bitcoin,” she added.

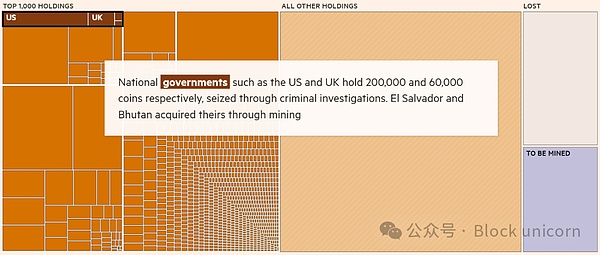

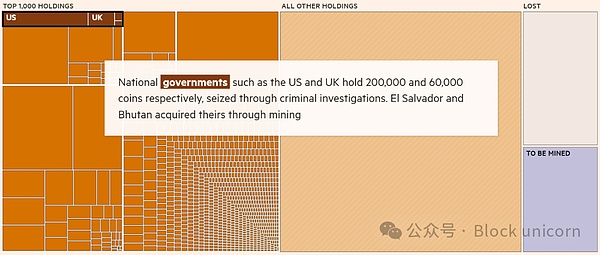

The U.S. government currently holds nearly 200,000 bitcoins, tokens seized through criminal investigations. The U.S. government has previously sold some of its holdings through auctions — however, many hope the government will now resist selling those coins.

More optimistic voices like Loomis hope the U.S. will start actively buying more bitcoins, which could drive up the price. "Any action is bullish as long as it doesn't sell existing reserves," Hogan said.

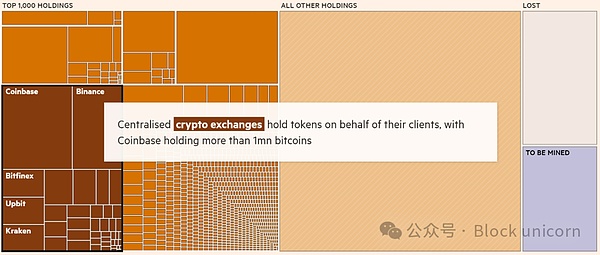

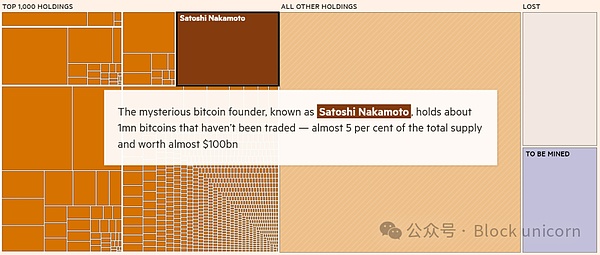

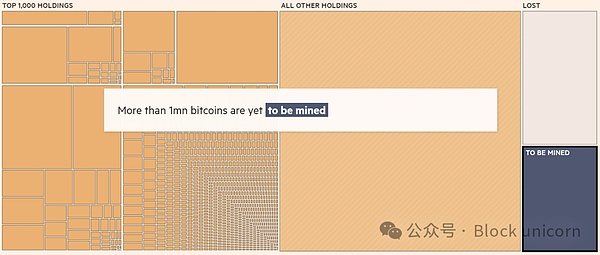

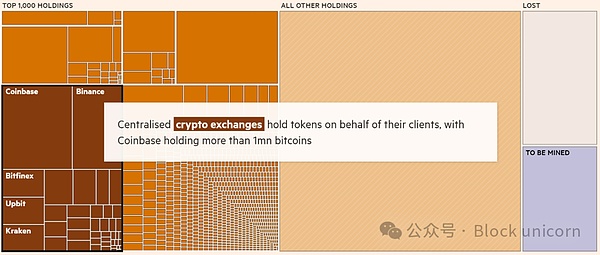

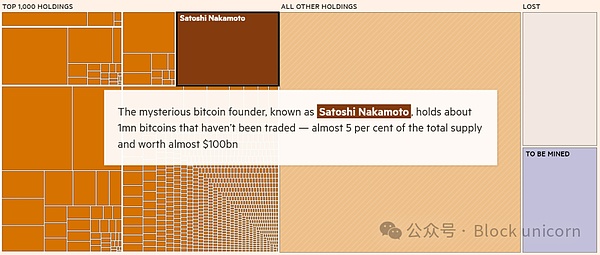

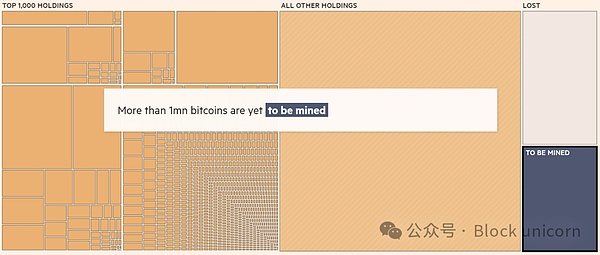

Proponents say bitcoin will be an effective reserve asset because it has a limited supply. Due to algorithms written into the bitcoin production code, there will always be only 21 million bitcoins. They argue that this scarcity increases the value of bitcoins because holding them now means they will be worth more in the future - which also distinguishes it from other cryptocurrencies.

Governments of countries such as the United States and the United Kingdom hold 200,000 and 60,000 bitcoins, respectively, which were confiscated through criminal investigations. El Salvador and Bhutan obtained bitcoins through mining.

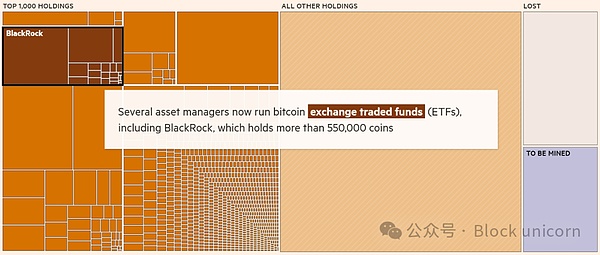

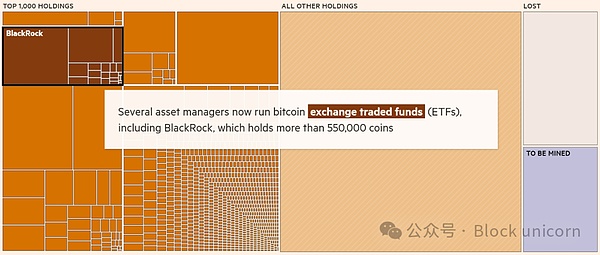

Several asset managers, including BlackRock, now operate Bitcoin Exchange Traded Funds (ETFs), with BlackRock holding more than 550,000 Bitcoins.

The US isn’t the only country considering investing in cryptocurrencies. The Czech central bank is considering adding bitcoin to its reserves, but other countries are shying away.

ECB President Christine Lagarde recently said she was “confident” that “bitcoin will not enter the reserves of any central bank that is a member of the ECB’s governance.”

She added that “reserves must be liquid, safe and reliable” and that “they should not be subject to suspicion of money laundering or other criminal activities.”

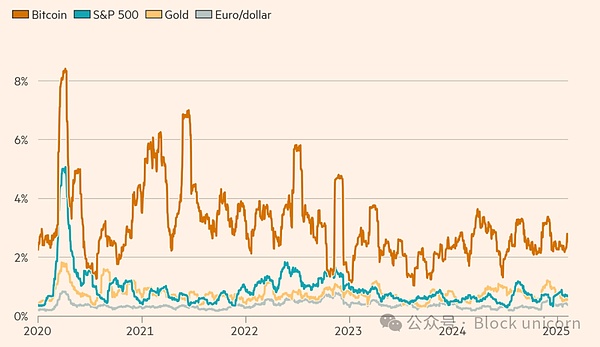

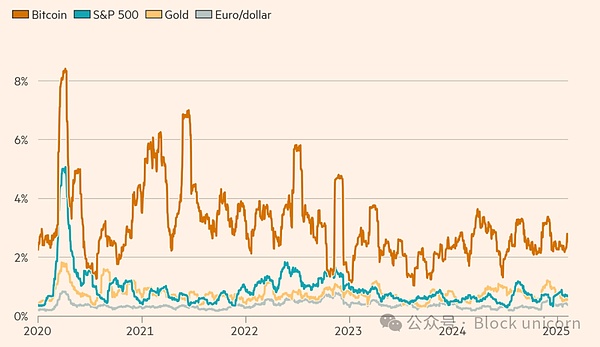

Bitcoin’s volatility is much higher than other financial assets

30-day rolling standard deviation of price and index levels (%)

Source: Financial Times calculations, London Stock Exchange Group • Bitcoin and gold prices in US dollars

Source: Financial Times calculations, London Stock Exchange Group • Bitcoin and gold prices in US dollars

Few people still consider Bitcoin as a currency. Its historical extreme volatility is the primary problem - we need coffee to cost the same in the morning and afternoon, for example, which requires the currency to remain stable so that users can trust its value.

Second, Bitcoin holders are generally reluctant to spend their Bitcoins when they think the price will continue to rise. Bitcoin’s blockchain also struggles to scale because it cannot handle a large number of transactions in a short period of time.

As a result, the experiment of using it as a legal tender has failed. El Salvador tried to do so in 2021, but was met with strong opposition and poor take-up.

“The original vision was to be peer-to-peer electronic cash, not an asset that was part of a balanced portfolio,” said Christine Smith, CEO of the Blockchain Association, a lobbying group.“Over time, it’s changed a bit… I don’t see bitcoin as a payment method very much,” she added.

Instead, bitcoin is most likely to be used as an investment.

“Historically, its price has always gone up, and you can’t deny that, even though there have been a lot of cases where people have said, ‘This is the end of bitcoin,’” said Omid Malekan, an adjunct professor at Columbia Business School.

Institutional investment

Making bitcoin a mainstream financial asset would require massive participation from Wall Street banks, fund managers, pension plans and other large institutional players.

Until recently, most people wouldn’t dare hold the tokens for themselves or their clients, fearing they would face backlash from regulators.

Now, under Trump, who wants to make the U.S. the world’s “bitcoin superpower,” those concerns are receding. “We’re probably going to see further integration of cryptocurrencies with traditional finance,” Allen said.

U.S. regulators have made it easier for banks and asset managers to custody cryptocurrencies and have begun to scale back lawsuits against digital asset companies. Meanwhile, Trump’s cryptocurrency task force is looking at issues like how best to regulate token offerings and facilitating access to banking services for crypto companies and traders, all moves that would bring the industry more in line with traditional finance.

“If the rules come out and make it happen … the banking industry is going to move in big on the trading side,” Bank of America CEO Brian Moynihan said recently, underscoring Wall Street’s eagerness to make money from cryptocurrency trading.

Bitcoin transactions surge in 2024

Number of Bitcoin transfers, daily total and 30-day rolling average (millions)

Source: CCData

Source: CCData

Investors have bought Bitcoin indirectly through regulated exchange-traded funds launched last year, which have attracted more than $110 billion.

"Investors have gone from thinking it was a mistake to hold a position in cryptocurrencies to realizing it's a mistake not to have an outlook on Bitcoin," Smith said.

Bitcoin has shifted from its original mission - to build an alternative financial system away from the prying eyes of governments and big companies. Now, Bitcoin believers are cheering acceptance by perhaps the biggest institution of all: the U.S. government.

But policymakers worry that if systemically important investors such as pension plans and central banks start holding bitcoin and its price collapses, the impact on the rest of the financial industry would be broad, with cryptocurrency companies at risk of needing bailouts.

Crypto’s volatility, risk of price collapse and use of leverage mean that as it becomes more mainstream, it “could destabilize the broader financial system” and generate “systemic risks … with severe negative consequences for the real economy,” the New York Federal Reserve has warned.

A cryptocurrency crash could affect the broader U.S. and global economies if the value of governments’ holdings plummets and investments are seen as unwise. Spillover effects to bond markets are a possible risk.

“The origin story of all this is a rejection of central banks and traditional finance, and ultimately my concern is that it ends up being propped up by central banks and governments,” Allen said.

Weiliang

Weiliang