Author: Matt Hougan Bitwise Chief Investment Officer; Translated by: 0xjs@Golden Finance

I have spent most of the past week thinking about Bitcoin's four-year cycle.

Specifically, I have been wondering whether Washington's recent shift in attitude toward cryptocurrencies is enough to be a major catalyst to "break" the four-year cycle and extend the current bull market in cryptocurrencies to 2026 and beyond.

This is a question I have been asked frequently recently. Let's dig deeper.

What is a four-year cycle?

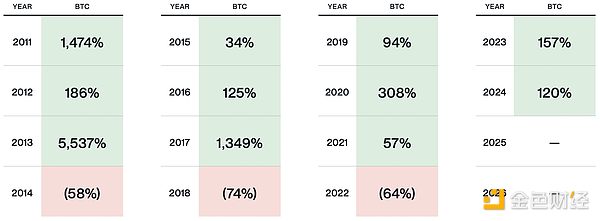

Historically, Bitcoin has moved in four-year cycles, with a three-year surge followed by a correction.

Source: Bitwise Asset Management. Data ranges from December 31, 2010 to December 31, 2024.

Performance information is provided for reference only. Returns reflect the return of Bitcoin itself, not any fund or account, and are exclusive of any fees. Past performance is not an indicator of future performance of any investment strategy. Future cryptocurrency cycles may not be four years in length; the four-year increments used here are based on historical data for illustrative purposes and are not a prediction of future results. This material represents an assessment of market conditions at a particular time and is not a prediction of future events or a guarantee of future results.

Readers who follow this memo know that I have been talking about the four-year cycle since mid-2022, when Bitcoin was in the doldrums and my view was to “wait.”

Sure enough, Bitcoin has done well in 2023 and 2024. By this model, 2025 should also do well, which is what I expect. But investors will naturally start to wonder if the market will reset in 2026.

What causes the four-year cycle?

The four-year cycle in cryptocurrencies is the same force that drives the broader growth and recession cycles in the macroeconomy.

The cycle begins with a catalyst—a technological breakthrough or event that sparks investor interest and brings new money to the market. For example, in 2011, the first companies that enabled individuals to buy Bitcoin (such as Coinbase, Mt. Gox, etc.) were established, bringing new money into the cryptocurrency space from retail investors. Prior to this, only computer scientists knew how to buy Bitcoin. As expected, the price of Bitcoin followed suit.

Once a bull market starts, it builds momentum of its own. Rising prices attract attention, and more money pours in. As the bull market accelerates, investors get greedy and leverage starts to accumulate. Sometimes fraud occurs. In other cases, traditional infrastructure is overwhelmed by demand. In either case, problems eventually occur. In 2014, Mt. Gox, the largest custodian at the time, collapsed; in 2018, the U.S. SEC cracked down on initial coin offerings (ICOs).

Pullbacks are painful, and deleveraging brings desperation. But then, inevitably, a new breakout occurs, restarting the cycle.

I can emphasize again: this cycle is not unique to cryptocurrencies. Some have tried to link it to Bitcoin’s “halvings” every four years, but those halving events don’t coincide with the cycle, and they occurred in 2016, 2020, and 2024.

This is the age-old economic cycle, only amplified by the high volatility of cryptocurrencies.

Current Cycle

The current cycle stems from the massive deleveraging that occurred in 2022 following a series of major scandals and bankruptcies such as FTX, Three Arrows Capital, Genesis, BlockFi, Celsius, and others.

At Bitwise, we call this cycle the “Mainstream Cycle,” and we believe its defining feature is the entry of mainstream investors into the crypto space.

The catalyst that kickstarted the current cycle came on March 10, 2023, when Grayscale won a resounding victory in the first round of arguments in its legal battle against the U.S. Securities and Exchange Commission (SEC) regarding a Bitcoin exchange-traded fund (ETF). Grayscale sued the SEC for “arbitrary and capricious” behavior in rejecting its spot Bitcoin ETF application and asked the court to order the SEC to reconsider.

Grayscale’s victory was complete. Although the verdict was not issued until months later, by then it was clear that a Bitcoin ETF would be launched, which would bring crypto to the masses. Sure enough, the Bitcoin ETF launched in January 2024 and set a record for inflows.

When Grayscale filed its lawsuit, Bitcoin was trading at $22,218. Today it’s trading at $102,674. Mainstream time has arrived.

Washington’s Shift and the Possibility of Breaking the Four-Year Cycle

If the classic four-year cycle is followed, 2025 will be a great year for crypto. I think so: We’ve publicly predicted that Bitcoin will double this year to over $200,000, driven by ETF inflows and corporate and government purchases. That’s probably conservative.

That said, I still see early signs of overheating in the system. Companies are raising money and debt to buy Bitcoin, and there’s been a significant increase in “Bitcoin lending programs” that allow large Bitcoin holders to tap into their wealth without having to sell their Bitcoin holdings. These actions aren’t inherently wrong, but they are forms of leverage and are just the tip of the iceberg. The growth of derivative contracts, leveraged ETFs, and other instruments suggests to me that the market is really starting to heat up.

All of this has led me to believe that the four-year cycle is still going on.

But then President Trump issued an executive order.

Last week, President Trump issued an extremely positive executive order for the crypto space that made me rethink. The executive order lists the development of the U.S. digital asset ecosystem as a "national priority." It points the way to a clear regulatory framework for cryptocurrencies and also considers the establishment of a "National Cryptocurrency Reserve." Combined with the actions of the now crypto-friendly SEC, it opens the way for large Wall Street banks and investors to enter the space in a big way.

In my opinion, the launch of ETFs was a major event, bringing hundreds of billions of dollars from new investors to the crypto ecosystem, which is what is driving the current cycle. But the full mainstreaming of cryptocurrencies - the kind envisioned by Trump's executive order, where banks custody cryptocurrencies alongside other assets, stablecoins are widely integrated into the global payment ecosystem, and large institutions take positions in cryptocurrencies - I firmly believe that this will bring trillions of dollars.

My view on the future

The question I am thinking about is that the positive effects of this executive order and other changes in Washington will be felt in years, not months. In the best case, it will take a year to develop and implement a new regulatory framework for cryptocurrencies. It will take even longer for Wall Street giants to fully adapt to the possibilities that cryptocurrencies present.

If the effects aren’t felt until next year, will we really be in for a new “crypto winter” in 2026? Will investors go dormant even if they know we’ve entered a new world of crypto adoption? If BlackRock CEO Larry Fink is calling for Bitcoin to go to $700,000, will we really see a 70% correction?

I’m guessing we haven’t quite gotten out of the four-year cycle yet. As the bull market progresses, leverage accumulates, markets get overheated, and bad actors emerge. At some point, when markets are overextended, there will likely be a big correction.

But my guess is that any correction will be shorter and shallower than in the past. Why? The crypto space has matured, with more types of buyers than ever before, and more value-focused investors. I expect volatility, but I’m not sure I’m bearish on crypto in 2026.

For now, everything is moving full steam ahead. The cryptocurrency train has set sail.

Aaron

Aaron