There are two main solutions for the decentralized derivatives track from the perspective of protocol types:

The Vault model represented by GMX, where LP is the counterparty of the trader, and the transaction price is determined by the Oracle price feed.

The order book model represented by dYdX, where off-chain matching and on-chain settlement.

Although these two solutions are widely adopted by the market, there are some potential risks. The Vault model is prone to Oracle price manipulation and causes losses; and the off-chain matching and on-chain settlement of the order book lack transparency.

Among the many decentralized derivatives protocols currently in operation, the influence of a single protocol is limited. The entire on-chain derivatives trading market is still in the wild era, and the market structure is undetermined. How to win in this competition is a huge challenge for each existing protocol to determine the future.

ZKX, a derivatives protocol based on the Starknet ecosystem, also adopts the order book model, but through differentiated deployment, it provides users with an on-chain trading experience and security that is comparable to or even exceeds the fluency of CEX. OG Trade and Pro Trade provide a variety of trading options for users of different levels; ZKX AppChain records all trading processes on the chain, combining transparency and security; ZKX accounts and Starkway provide seamless onboarding channels and simplified procedures for new users.

ZKX Background Information

ZKX was founded in 2021. Two of its founders, Eduard and Naman, previously held leadership positions at SOSV, one of the world's top venture capital firms with more than $1.2 billion in assets under management. The main team has experienced personnel from companies such as PayTM, Flipkart and Byju's, spread across 8 countries.

ZKX received funding from StarkWare (Starknet's parent company) in April 2022. In July 2022, ZKX raised $4.5 million in seed round financing from investors including StarkWare, HashKeyAmber Group, Crypto.com, and DragonFly Capital general partner Ashwin Ramachandran.

ZKX provides users with a more interesting trading experience by providing gamified trading options, making trading social. Using ZKXAppChain, ZKX combines the efficiency of CEX with the self-custody and trustlessness of DeFi to provide wider scalability and high-speed APIs. ZKX is currently deployed on Ethereum and Starknet. According to the official data released by X on June 5, in the past 30 days, ZKX's trading volume reached 2.3 billion US dollars, the number of ZKX account creation was 24.6K+, and the number of transactions exceeded 2 million. The trading volume of STRK alone exceeded 300 million US dollars.

ZKX's protocol token $ZKX TGE will be held on June 19, and it has been confirmed that it will be launched on Kucoin and Gate at the same time. The first airdrop promised to users has also been distributed to users' accounts at 3 pm on June 17.

OG Trade & Pro Trade

General on-chain derivatives platforms all use static trading pages, and traders of different levels are forced to use the same interface, leaving users with no choice. ZKX innovatively divides trading into OG Trade and Pro Trade for users of different levels.

OG Trade & Pro Trade

By introducing gamification elements, short-term and swing traders can have a simpler and more interesting trading experience. OG Trade offers 30-minute trading competitions and provides visual real-time trading data on the interface to help entry-level users make trading profits in a short period of time.

Profits, losses, and trading volumes can all receive unique gold, silver, and bronze badges, each unique to each category. These badges mark the value of the user as a trader in the OG trading competition.

Pro Trade is designed for more experienced intermediate and advanced traders, including all types of orders, complex trading functions, public APIs, advanced tools, etc. Professional traders, big money players and proprietary trading companies can easily trade in Pro Trade.

OG Trade and Pro Trade meet the needs of different types of traders in two different ways. Despite this, users still don’t need to worry about liquidity and depth issues, because the two trading methods share the same on-chain order book on ZKX.

ZKX AppChain bridges the gap between performance and security

Some on-chain derivatives protocols use the order book model to improve performance, such as dYdX, Aevo, etc., but this form is operated in an off-chain matching and on-chain clearing mode. The off-chain matching process lacks transparency and has a certain risk of malicious behavior. ZKX perfectly bridges the gap between performance and security through ZKX AppChain.

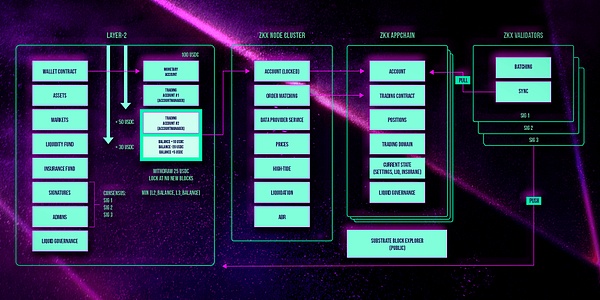

ZKX Appchain is a full-chain layer developed using Substrate SDK, which seamlessly connects users to ZKX through multiple L1s and Rollups. There is an intermediate layer in its stack that is responsible for synchronizing assets and status data between Starknet and the parallel Rollup built using its SDK and ZKX AppChain. Therefore, ZKX AppChain is actually an L3 public chain based on the Starknet ecosystem.

ZKX order books all run on ZKX AppChain. Transactions on ZKX are not limited by any on-chain speed and gas cost. Even if there is congestion on the chain, ZKX users can still enjoy smooth gas-free transactions and continuous liquidity and operability.

On Appchain, the order book and Substrate manage transaction processing and verification. Any transaction record is traceable and queryable, which further enhances the decentralization and transparency of ZKX and provides the possibility for safe and reliable on-chain derivatives transactions.

ZKX has expanded to 3 blocks per second and supports more than 2,000 API requests every 10 seconds. This gas-free and efficient transaction can provide users with a trading experience comparable to CEX while ensuring the security of user assets.

ZKX AA Account

Although most on-chain derivatives protocols are using various strategies to attract new users, the threshold for on-chain operations is extremely high, which is the most fundamental reason why new users cannot transfer transactions from CEX to on-chain. How to lower the entry threshold for new users and allow these users to seamlessly experience the decentralized trading system is the current focus.

Account abstraction has a seamless experience similar to CEX, while also having the security and privacy provided by DEX, which is a necessary condition for the large-scale adoption of blockchain. ZKX is the first platform in the decentralized derivatives protocol to integrate account abstraction. Leveraging Starknet’s native account abstraction and Starkway as an L1 to L2 bridge. ZKX AA accounts are currently deployed on the Starknet mainnet using Cairo 1.0. In the future, they will be expanded to other L1s and more Rollups to provide users with a seamless full-chain trading experience.

Using ZKX AA accounts simplifies the process of recording private keys for users and simplifies the process of entering funds. As a decentralized account on Ethereum L2, users can seamlessly bridge to Starknet and start gas-free transactions directly using ZKX AppChain without multiple complicated steps. ZKX AA accounts will also become a one-stop DeFi application hub for users, with features for staking and other DeFi products in addition to perpetual transactions, all included in a user-centric DApp.

Starkway Native Cross-Chain Bridge

In the multi-chain era, cross-chain bridges are important infrastructure for connecting blockchains. Starkway consists of Solidity smart contracts on Ethereum and Cairo contracts on Starknet. Through the L1-L2 messaging mechanism provided by Starkware, Starkway can help users seamlessly transfer funds between L1 and Starknet through a trustless and transparent mechanism.

Currently, users can use Starway to easily deposit directly from Ethereum L1 to ZKX AA accounts on Starknet, and can also be used in ZKX activities such as airdrops and clan NFTs. Starkway also has a messaging function, and ZKX can check the eligibility of L1 wallets and distribute rewards accordingly.

Through Starkway, ZKX has opened up the in and out channels of funds. Different chains are no longer barriers to funds, and users can seamlessly experience any services provided by ZKX.

Written in the end

The decentralized derivatives trading market is on the eve of an explosion, with a potential for trillions of dollars of growth. At present, the overall pattern of on-chain derivatives protocols has not yet been finalized, which provides a valuable breakthrough opportunity for innovative projects and is also a critical moment for competing for market share.

ZKX's core advantage lies in the use of a decentralized order book, which has the characteristics of high performance and large liquidity. Combined with ZKX AppChain and ZKX AA accounts, it enables all chain users to use ZKX services securely and seamlessly in a simplified process. Provide users with smooth and gas-free transactions comparable to CEX, while also having the security and decentralization of DEX.

Through a unique differentiation strategy, ZKX is committed to solving problems and risks in existing protocols and is a strong competitor in the decentralized derivatives track.

ZKX tokens will be available for trading on June 19. The total amount of $ZKX tokens is 100 million. The initial circulation is relatively small. The IDO valuation is 50 million US dollars, which is reasonable. You can pay attention to the price after listing.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Sanya

Sanya Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph