Author: DeMan

In the fierce competition in the cryptocurrency market, the stable currency QCAD quickly stood out. On April 30, Coinbase Assets announced that it would add QCAD to its currency listing roadmap, a move that significantly enhanced QCAD’s market position.

QCAD is issued by Canada Stablecorp, a joint venture between crypto asset management company 3iQ and blockchain development company Mavennet Systems. Since 2020, QCAD has provided services through partners such as DVeX, Newton, etc., supporting trading pairs such as BTC, ETH and USDC. QCAD maintains a 1:1 ratio to the value of the Canadian dollar, ensuring its stability through reserves of cash and equivalents.

In the stablecoin market, QCAD’s stability and reliability make it an option worth paying attention to. The following will explore QCAD’s core strengths and its role in the global crypto economy.

With the overall warming of the market, the transaction volume and supply of stablecoins have shown a steady growth trend

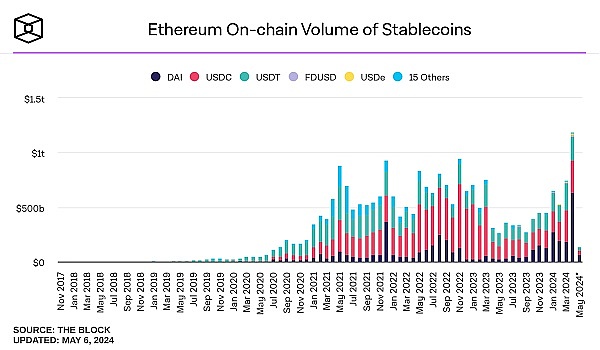

The recent performance of the stablecoin market has attracted attention, especially in the cryptocurrency industry. Against the background of market capitalization fluctuations. In April 2024, both transaction volume and supply of stablecoins showed significant growth trends, even as the overall crypto market faced declines. According to the latest market data, stablecoins, especially DAI, USDT, and USDC, have seen increased activity over the past few months, reflecting continued market demand for stable assets.

USDT and USDC, as the main stablecoins in the market, continue to grow in supply, showing the steady flow of capital into the crypto market. In addition, stablecoin trading volume also hit a new high in April, driven in part by the widespread use of stablecoins on cryptocurrency trading platforms and financial technology applications.

High demand for stablecoins stems in part from their function as a bridge between liquidity and stability in crypto markets. In an uncertain market environment, investors and traders tend to use stablecoins to protect asset values and avoid risks caused by price fluctuations. In addition, the application of stablecoins in the field of decentralized finance (DeFi) has also continued to expand, further promoting the improvement of its market position.

Despite downward pressure on the market, stablecoins have remained strong, demonstrating their central role in the cryptocurrency ecosystem.

Comprehensive understanding of QCAD’s application scenarios and core elements such as financial preparation: hosted by Tetra Trust Company

QCAD, as the first fully compliant Canadian dollar stablecoin, aims to provide The broad market offers a stable digital “Canadian dollar” solution. This section will discuss in detail the working principle of QCAD, the mechanism to maintain stability, and its diverse application scenarios.

1. Stability and compliance analysis:

The main mechanism for QCAD to maintain its value equal to one Canadian dollar (1 CAD) is through the buying and selling operations of authorized traders. Authorized traders can buy or sell QCAD for 1 CAD from Stablecorp Digital Currencies Inc. This mechanism ensures that if the market price of QCAD deviates from 1 CAD, the price will be adjusted back to 1 CAD through arbitrage opportunities.

To enhance market confidence in the continued ability of authorized dealers to buy and sell QCAD, Stablecorp provides monthly statements and annual audits of QCAD reserves. In addition, Stablecorp has established extensive compliance and governance infrastructure to ensure that QCAD is always held in cash or equivalent assets by the custodian at a ratio of 1:1 (or higher).

2. Introduction to the application scenarios of QCAD:

QCAD is not only a payment method, but also promotes crypto assets on multiple blockchain platforms such as Ethereum, Algorand and Stellar. transactions, borrowings and loans. Other applications of QCAD include: as an on-chain FX solution through digital-to-crypto transactions, particularly with connections to the Circle and USDC ecosystem; as a fast and low-cost transfer/payment channel within and outside Canada; and as a crypto Instant Canadian dollar-denominated bridge asset between assets and fiat currencies.

All QCAD transactions are securely recorded on the blockchain, ensuring the non-tamperability, transparency and auditability of transactions, and achieving seamless settlement and complete traceability.

3. Purchase channels and financial reserves:

QCAD tokens can be purchased through institutions called "authorized dealers", which have passed strict customer entry and anti-money laundering/ Client authentication check. QCAD’s fiat currency reserves are hosted by Tetra Trust Company, which maintains dedicated “trust accounts” at Canadian financial institutions to segregate QCAD reserves. These fiat currency reserves are separate from Stablecorp's other assets, and Stablecorp exists solely to operate QCAD and manage these fiat currency reserves.

Through these measures, QCAD not only provides a stable Canadian dollar digital asset, but also brings innovative payment and transaction solutions to the digital currency market, promoting the integration between crypto assets and the traditional financial system. Bridge construction.

Looking back at the development history of QCAD: the Canadian dollar stable currency implies Canada’s ambition to enter the Web3 world

On February 11, 2020, Canada Stablecorp Inc announced the launch of the Canadian dollar stable currency "QCAD", which symbolizes It is an important development in the Canadian digital asset market. QCAD is now available through ecosystem partners such as DVeX, Newton, Bitvo, Netcoins and Coinsmart, supporting trading pairs with major cryptocurrencies such as Bitcoin, Ethereum and USDC. QCAD is fully supported by cryptocurrency custodians Balance and Bitgo, with payment and settlement integration through Bidali and Gilded Finance.

QCAD is the first product launched by Canada Stablecorp, a joint venture created by 3iQ, Canada’s leading crypto asset management company, and Mavennet Systems, a pioneer in blockchain development. As a digital asset based on the ERC-20 standard of the Ethereum blockchain, QCAD guarantees seamless settlement and full traceability, and the company plans to expand this asset to other networks in the future.

As the first Canadian dollar stablecoin on the market designed for the masses, the launch of QCAD plays a key role in promoting the digital transformation of Canada’s capital markets and providing powerful payment and settlement solutions. Jean Desgagne, CEO of Canada Stablecorp, has said that QCAD provides the market with a new financial infrastructure and sets a new standard for digital currencies, which will help promote trust and widespread adoption of stablecoins.

Digital asset markets are traditionally known for high volatility, and stablecoins serve as a critical link between traditional financial infrastructure and the digitally native world by providing an anchored price point. The market size of stablecoins has expanded rapidly over the past few years, from $2.4 billion in 2018 to more than $4.94 billion in 2019.

In addition, Kesem Frank, President of Mavennet Systems, emphasized that QCAD has established the necessary connection between the Canadian financial market and the world of digital assets. Fred Pye, President and CEO of 3iQ Corp, believes that the launch of QCAD is a logical step for Canada’s capital markets to move towards a digital future, in which QCAD will play a key settlement role.

To sum up, the launch of QCAD not only enhances Canada's competitiveness in the global financial market, but also lays a solid foundation for the widespread acceptance and application of digital currencies.

Stablecorp will receive strong support from Coinbase. Will the future prospects be as good as industry expectations?

Stablecorp, a joint venture between 3iQ, Canada’s largest crypto asset management company, and Mavennet Systems, a leader in blockchain development, successfully promoted the issuance of the Canadian dollar stablecoin QCAD. As the first fully compliant Canadian dollar stablecoin designed for the mass market, QCAD represents not only technological innovation but also the market’s response to the need for stability and compliance.

The team’s leadership is composed of industry experts, including CEO Alex McDougall, COO Julie Paterson, Chief Compliance Officer Paul Burak, and Chairman of the Board Jean Desgagne, etc. Their joint efforts ensure Responsible for QCAD’s strategic execution and marketing. In addition, experts from different fields, such as legal consultant Ross McKee and financial technology developer Eugene Tay, also provide solid support for QCAD’s stable operations and compliance.

Recently, Coinbase Assets announced the addition of QCAD to its currency listing roadmap on the X platform. This move heralds the further expansion of QCAD’s market acceptance and application prospects. This decision not only enhances QCAD's liquidity, but also provides Canadian and global investors with more trading and investment options.

As the digital asset market continues to mature, QCAD’s compliance and stability features may attract more users and institutions seeking hedging and transaction efficiency. However, as an innovative digital asset, QCAD still needs to prove its continued value and usefulness in future markets. Whether it can maintain its leading position in the increasingly competitive stablecoin market remains to be further tested by the market.

How will the future of QCAD unfold, and how will the market respond to this innovative Canadian digital solution?

Beincrypto

Beincrypto

Beincrypto

Beincrypto decrypt

decrypt dailyhodl

dailyhodl The Crypto Star

The Crypto Star Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph