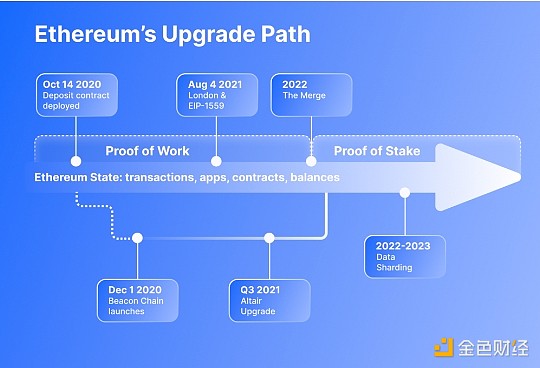

Ethereum has undergone several major developments since it was proposed by Vitalik Buterin in 2013. Initially based on the PoW (Proof of Work) mechanism, its design enables miners to earn rewards by consuming computing power. However, the high energy consumption and transaction speed bottleneck of PoW prompted Ethereum to gradually turn to the Proof of Stake (PoS) mechanism and launched a series of improvements including The Merge, Shanghai Upgrade and Cancun Upgrade. The core goals of these upgrades are to improve network efficiency, reduce energy consumption and gas fees, and make the Ethereum ecosystem more suitable for decentralized applications.

Although these upgrades have made some progress, they have also brought new challenges. In particular, in terms of governance centralization, economic incentive structure and technical implementation difficulty, Ethereum faces a series of structural defects that may affect its decentralized concept and long-term development. This article will start from the core defects of the upgrade and analyze its potential risks to the Ethereum ecosystem.

1. The original intention of Ethereum upgrade: efficiency and scalability brought by PoS

Ethereum initially adopted the PoW mechanism. Although this mechanism ensures the security of the network, the accompanying high energy consumption and scalability bottlenecks gradually emerge. With the increase in users and transaction volume, the resource consumption and transaction congestion problems of the PoW mechanism have become increasingly obvious. In order to improve energy efficiency, reduce transaction costs and increase network speed, Ethereum completed the "Merge" upgrade in 2022, switching the consensus mechanism from PoW to PoS.

The introduction of the PoS mechanism aims to replace the mining process that consumes computing power by "staking" ETH. The stakers obtain verification rights and rewards by locking ETH in the network, which not only greatly reduces energy consumption, but also alleviates the resource competition problem caused by the PoW mechanism to a certain extent. In addition, Ethereum has also adopted a variety of strategies in terms of scalability, including the introduction of Rollup technology and sharding plans, in order to improve transaction processing capabilities by moving some calculations and data processing outside the main chain or dividing them into different shards.

However, although these technical upgrades can theoretically bring higher efficiency and lower energy consumption, Ethereum's PoS mechanism and scalability solutions have also caused a series of problems such as centralization and economic structural fragility, which may affect the decentralized nature of the network and have a profound impact on the future development of Ethereum.

Second, the centralization risk of PoS

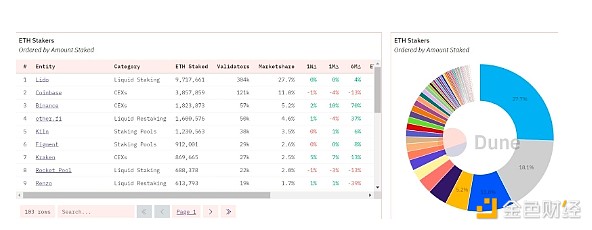

After the transition from PoW to PoS, Ethereum verifies the network by staking ETH. The verification weight of a node directly depends on the amount of ETH it stakes, which means that large households or institutions with a large amount of ETH can have a greater say in network governance. Although this mechanism reduces energy consumption, it also inevitably leads to the centralization risk of the network.

Currently, there is a huge trend of centralization in the Ethereum staking ecosystem. For example, large staking service providers such as Lido and Coinbase control a large amount of ETH in the staking pool, resulting in the gradual concentration of network governance and verification rights to a few nodes. The resulting risk is that Ethereum's governance gradually tends to be oligopolistic, which not only weakens the participation of ordinary users and small nodes, but also may cause the governance direction to deviate from the original intention of decentralization. What’s more serious is that if these few large nodes choose to withdraw in the future for economic interests, political or technical reasons, the stability of the entire network will face great challenges.

In addition, the centralization of the pledge structure also brings potential security risks. If large pledge nodes control too much verification power, it may form a "single point of failure" in the Ethereum network. Once attacked or failed, the overall security and reliability of the network will be threatened. This hidden danger makes it difficult for Ethereum to achieve true decentralization under the PoS mechanism.

It is also worth noting that Ethereum developers plan to activate the Pectra upgrade on the mainnet in the first quarter of 2025. The EIP 7251 proposal in this upgrade will increase the maximum effective balance of validators from 32 ETH to 2048 ETH, and allow existing validators with a maximum effective balance of 32 ETH to merge their stakes. It is expected that this will greatly reduce the number of validators on Ethereum and aggravate the centralization problem.

Three, the economic and security flaws of the Rollup structure

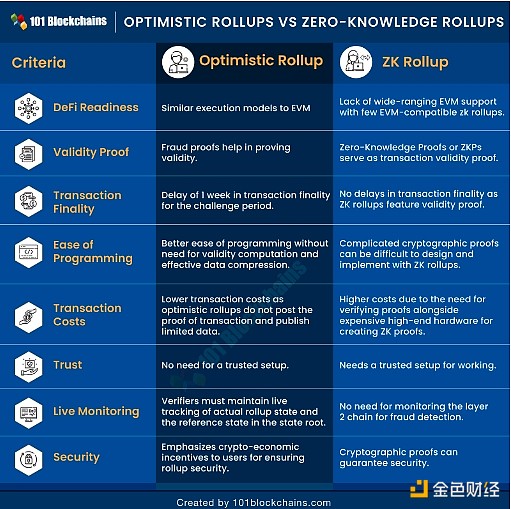

Another key strategy of Ethereum in recent years in terms of scalability is the adoption of Rollup technology. Rollup is a technology that processes transactions in layers, moving some calculations and data processing outside the main chain to increase transaction speed and processing efficiency. Although Rollup can effectively alleviate Ethereum's scalability problems in theory, its complex economic structure brings some new risks.

The design of Rollup requires the establishment of a complex incentive mechanism to ensure the liquidity and security of the network. The current Rollup ecosystem is highly dependent on external pledges and funding support. This dependence makes the entire system highly vulnerable to economic fluctuations. Once the market fluctuates violently, the liquidity of funds in the Rollup ecosystem may be seriously affected, which in turn leads to a decline in user experience and network stability. Rollup's dependence on the main chain also means that when problems arise on the Ethereum main chain, the Rollup ecosystem will also be impacted by a chain reaction.

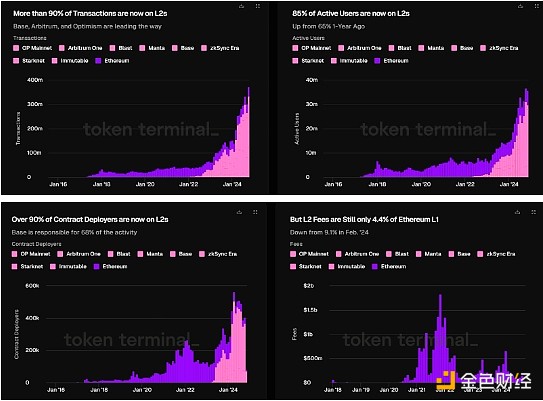

In addition, the economic model of Rollup has not been verified by the long-term market. Projects based on the rollup solution, such as OP Mainnet, Arbitrum, base, starknet, zksync, linea and many other L2 projects, in addition to poor interoperability leading to poor user experience, also have a high degree of overlap with the main chain functions.

Previously, the main function of ETH was the settlement layer, and the clearing and settlement of large DeFi all occurred on the main chain. Now, a large amount of demand has been diverted to L2. L2, which "parasitizes and sucks blood" from Ethereum, divides up Ethereum's liquidity but only provides very little value capture to Ethereum, resulting in a serious loss of Ethereum's liquidity and on-chain transactions. The ETH mainnet has been unable to recover, internal disputes continue, and community consensus has gradually collapsed. Data shows that Ethereum's revenue and ETH supply destruction have significantly decreased after Dencun. Total revenue is 69% lower than the average of the 150 days before the upgrade; ETH destruction is 84% lower than the average of the 150 days before the upgrade.

In terms of security and stability, the sequencer in the Rollup architecture, as the core component of the L2 network node, is responsible for receiving transaction requests, determining the execution order, packaging them into batches and passing them to the L1 smart contract, playing an important role in improving transaction processing efficiency and user experience. However, if the sequencer crashes or reports an error before this process is completed, the user's transaction will remain in L2 and will not be completed in L1. It is not difficult to see that the use of a single sequencer may face hidden dangers such as transaction delays and crashes, and this situation has indeed happened.

This centralized sorter will significantly weaken the control of the Ethereum main network over L2 in the settlement layer dimension, and it is prone to malicious review of user transactions, errors, MEV extraction, preemption, traffic fragmentation, and even forced shutdowns (such as Linea and Blase shutting down directly due to asset theft), which will affect the stability and security of the entire Rollup system. In short, this centralized design gives the sorter too much power and has become the focus of concern in the industry.

Fourth, potential risks in the future: the trade-off between technical difficulty and decentralization

In the future, Ethereum also plans to further improve network performance through sharding technology. However, as an expansion solution that decomposes the network into multiple small fragments, sharding is extremely technically difficult and requires data consistency and security between different shards. The successful implementation of sharding requires not only overcoming technical difficulties, but also involves how to balance security and scalability. This technical complexity may lead to poor data synchronization between shards, and even cause network splits in extreme cases.

In addition, the combination of sharding and Rollup makes the governance and economic structure of the network more complex. The distribution of shards and the design of Rollup require higher data consistency between each shard and Rollup, which brings more technical challenges to developers and node validators. If the parallel use of sharding and Rollup fails to balance the relationship between decentralization and performance improvement, it may cause a decline in user trust and even lead to community division.

Overall, in the process of continuous pursuit of technological innovation, Ethereum inevitably faces the dilemma of centralization, economic fragility and technical complexity. These problems not only affect the current ecological development of Ethereum, but also pose risks for future upgrades.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Huang Bo

Huang Bo JinseFinance

JinseFinance Miyuki

Miyuki Bernice

Bernice Finbold

Finbold Coinlive

Coinlive  Bitcoinist

Bitcoinist