Source: Chainalysis; Compiled by Baishui, Golden Finance

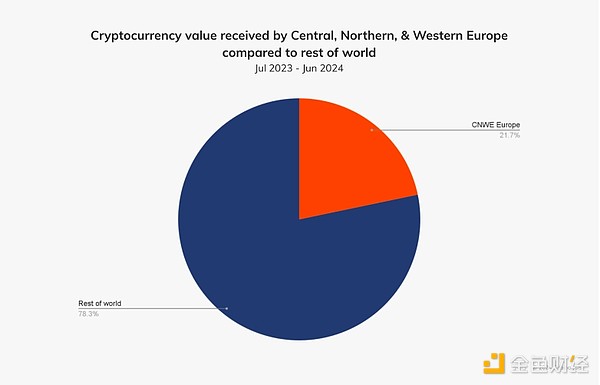

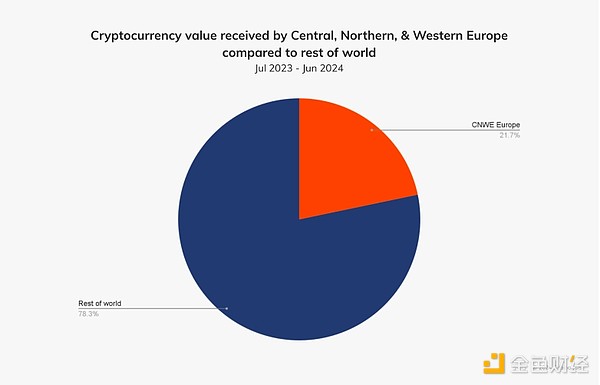

Central Northern Western Europe (CNWE) is the world's second largest cryptocurrency economy after North America, with $987.25 billion in on-chain value between July 2023 and June 2024, accounting for 21.7% of global transactions. Cryptocurrency activity is growing in most countries in the CNWE, with an average year-on-year growth rate of 44%. The United Kingdom (UK) remains the largest cryptocurrency economy in the CNWE, receiving $217 billion in cryptocurrency, ranking 12th in our Global Cryptocurrency Adoption Index.

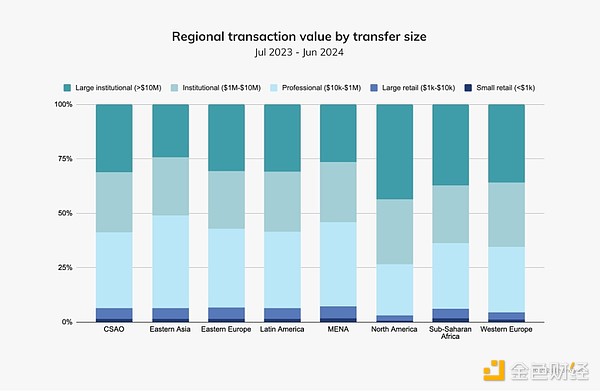

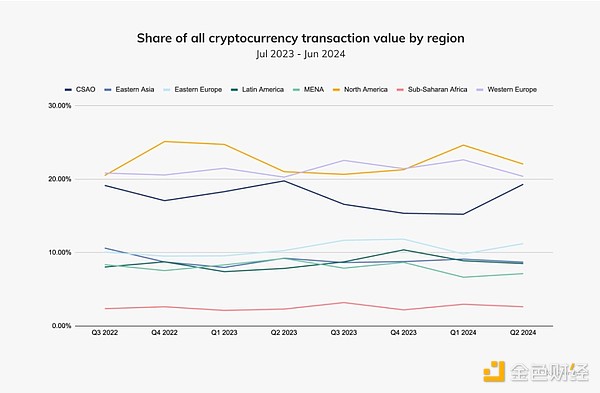

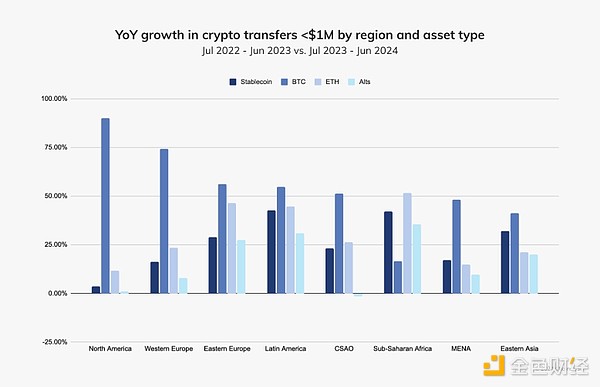

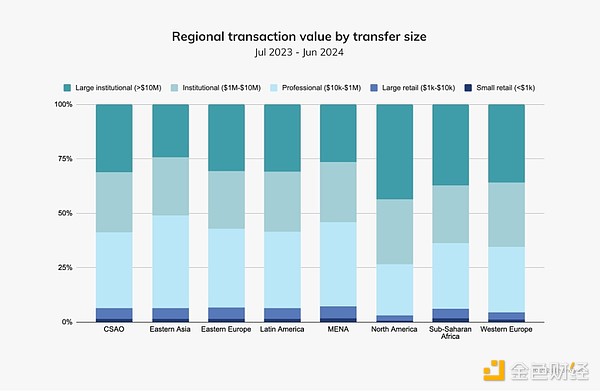

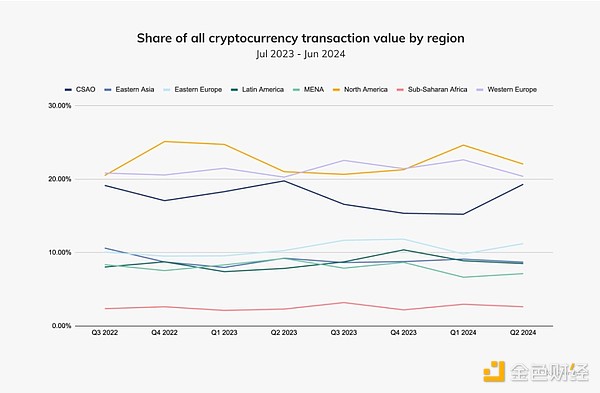

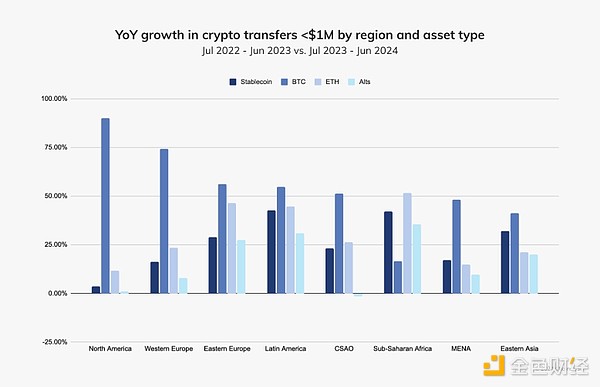

For transactions below $1 million, i.e. professional ($10,000 to $10,000) In the CNWE, Bitcoin (BTC) grew by nearly 75%, the highest of all asset types in the CNWE, for both sub-$1 million and retail (< $10k) transfers. Across all transaction sizes, BTC accounted for $212.3 billion (about one-fifth) of the total value received on-chain in the CNWE. While BTC activity for transactions under $1 million in CNWE grew at a slower rate than in North America (as shown in the chart below), the former outpaced the latter in terms of growth across all other asset types, especially stablecoins.

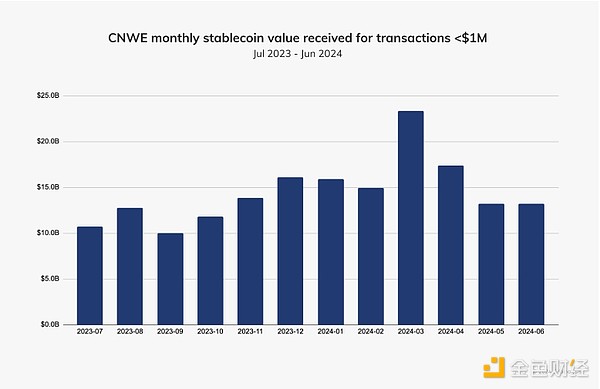

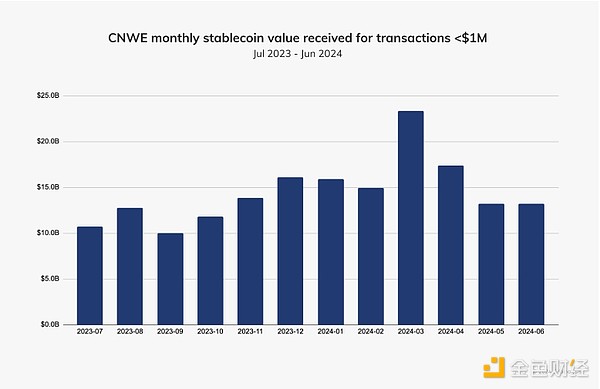

For transfers below $1 million, CNWE found that stablecoin trading volume grew 2.5 times faster than in North America. The value of stablecoins across all transaction sizes in CNWE accounted for almost half of its total cryptocurrency inflows ($422.3 billion). In terms of average monthly inflows, the chart below shows the performance of stablecoin transfers below $1 million over the past year, averaging between $10 and $15 billion per month.

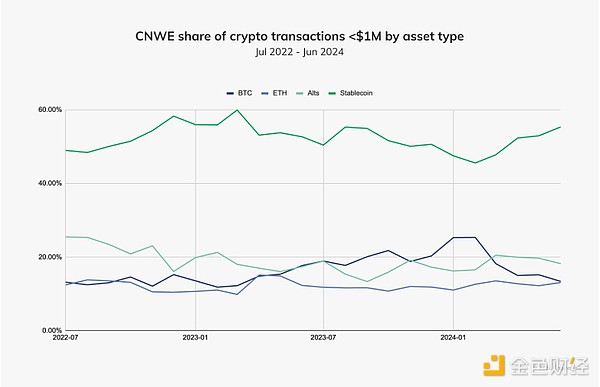

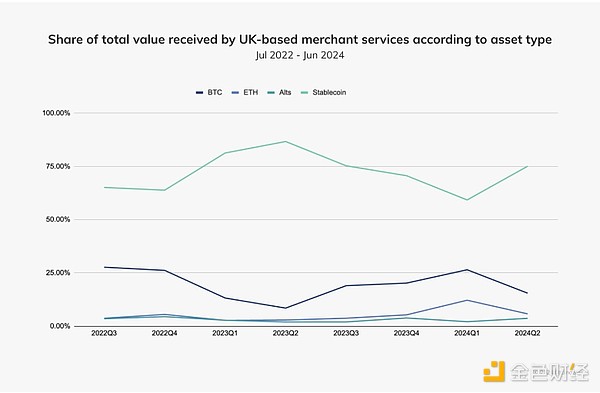

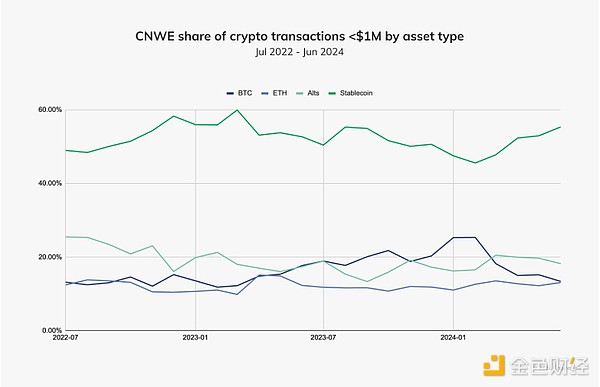

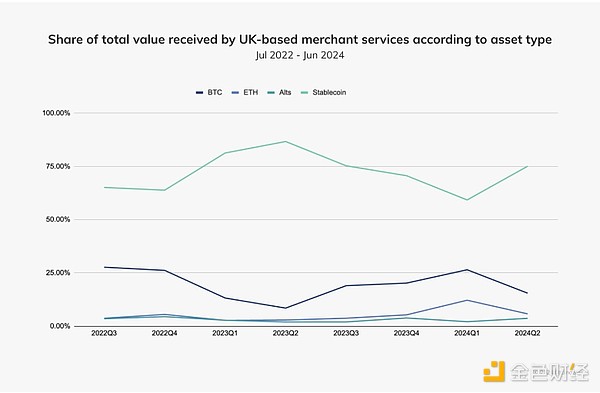

Despite the decrease in inflows in May and June 2024, the share of stablecoin transactions increased, indicating that despite the market decline after the bull run, the use of stablecoins remains strong. Looking further back at the past two years, stablecoins have dominated other asset types. The figure below examines purchases under $1 million by asset type. As we can see, stablecoins accounted for an average of 52.36% of transactions across various asset types between July 2022 and June 2024.

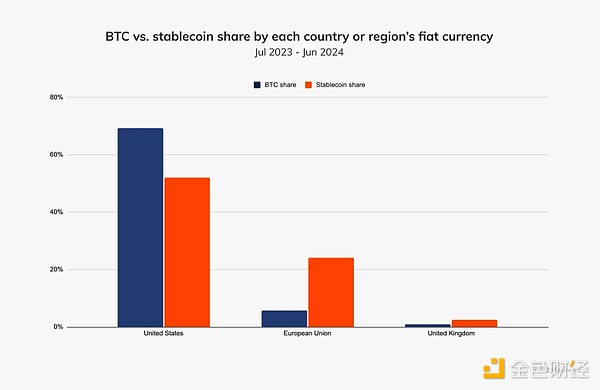

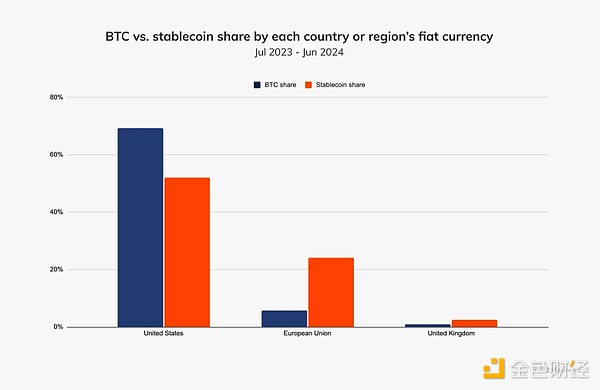

Last year, CNWE's share of stablecoin purchases with fiat currencies far exceeded BTC. The chart below uses order book data (a list of buy and sell orders for an asset or security) to supplement on-chain activity and shows that the euro (EUR) accounts for 24% of stablecoin purchases traded with fiat currencies, but only 6% of BTC purchases. Conversely, the U.S. dollar (USD) accounts for a larger share of BTC purchases than stablecoin purchases.

The data suggests that when it comes to crypto trading with fiat currencies, CNWE is more optimized for crypto users buying stablecoins than buying BTC.

To learn more about stablecoin activity in the region, we spoke to BVNK, a global company that provides a multi-asset platform for stablecoin payments. Chris Harmse, co-founder and chief commercial officer of BVNK, said: "Our fiat business is in service of our stablecoin platform. We see them as co-existing and we need to bridge the gap with the fiat world."

Harmse confirmed that Chainalysis' findings on stablecoin usage in the region are consistent with the company's observations. BVNK's business clients buy stablecoins to meet a variety of payment use cases. For consumers of these businesses, 90% of their payments are made using stablecoins. We will share more about BVNK in the next section.

Business Services Thriving in the UK

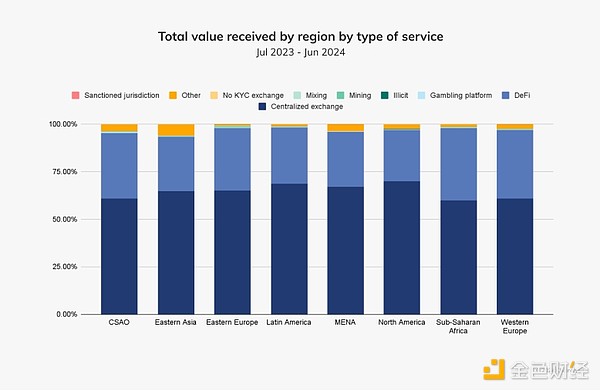

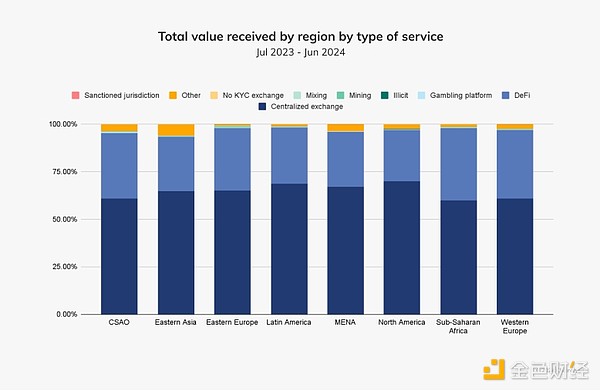

CNWE has the second largest business services market in the world after CSAO, driven primarily by the UK, with year-over-year growth of 58.4%.

Stablecoins are the most commonly used asset type in these services, consistently accounting for 60-80% of the market share each quarter, as shown in the figure below.

As one of the merchant service providers that provide stablecoin transactions to businesses in the UK and Europe, BVNK covers B2B and B2B to Consumer (B2B2C) use cases, such as the following examples:

Settlement: Fintech or payment service providers help merchants settle invoices, providing faster and cheaper payment channels than traditional finance (TradFi).

Payments:When consumers want to pay businesses with stablecoins (e.g., deposit money on an exchange, top up a gaming or sportsbook account, or make an online purchase), BVNK’s corporate clients leverage the API to provide a crypto payment gateway.

Payments:Money Service Businesses (MSBs) use stablecoins to pay contractors or employees, many of whom live in South America, experience currency devaluations, and/or lack access to U.S. dollars.

Speaking of which, citizens in countries like Argentina (with 143% inflation in the second half of 2024) are turning to stablecoins to mitigate the effects of currency devaluations.

“In an emerging market, businesses are starting to see stablecoins as fungible,” Harmse said. “Just like consumers in Argentina can’t access dollars in the market, businesses are hampered by traditional payment channels. They can’t pay their invoices on time, and they are taking advantage of global trade flows by using stablecoins to make those payments.”

The average transaction size that BVNK sees on its platform is between $100,000 and $250,000, and payments in that range are typically large commercial transactions used to settle invoices, as mentioned above. Most of the B2B transactions processed by the company are cross-border payments, with the majority of stablecoin payments going to Latin America. Consumer payments processed through the BVNK platform range from $100 to $1,000.

When asked about new or surprising stablecoin use cases, Harmse mentioned small payments to freelancers in the gig economy — again, these are often cross-border payments that are too costly to make with traditional payment methods. He also mentioned that the region is starting to see more nonprofits and NGOs using crypto payments (particularly stablecoins) in times of crisis to get aid to conflict zones faster.

Payhound is another company in the CNWE that provides commercial services. It is a Malta-based crypto payment processor that serves the country’s online gaming industry and provides settlement and large-value transactions. While the latter is the majority of Payhound’s revenue, the company also recognizes the value and potential of its payment processing products.

“We believe there will be a lot of appetite and interest from online businesses to offer as many options as possible, especially more innovative payment methods,” said Elton Dimech, managing director of Payhound.

Real-world asset tokenization gains traction

This year, regional experts say real-world asset (RWA) tokenization, while still in its nascent stages, is gaining traction in CNWE. Philipp Bohrn is vice president of public and regulatory affairs at Austria-based cryptocurrency exchange Bitpanda. “Across Europe, we see tokenization projects for RWAs gaining traction, especially in areas such as real estate, intellectual property and collectibles such as art, cars or wine,”he said.

We also spoke to Sylvain Prigent, Chief Product Officer at Societe Generale-FORGE (SG-FORGE), a fully integrated and regulated subsidiary of Societe Generale Group. SG-FORGE is paving the way for the adoption of security tokens, notably the first digital green bond issuance registered directly on the Ethereum public blockchain last year, increasing transparency and traceability of ESG data. Prigent believes that security tokens and RWAs in general will create accessible investment opportunities for traditional competitive securities markets. Prigent said that a lot of development work has been done to make this new infrastructure available to TradFi smoothly.

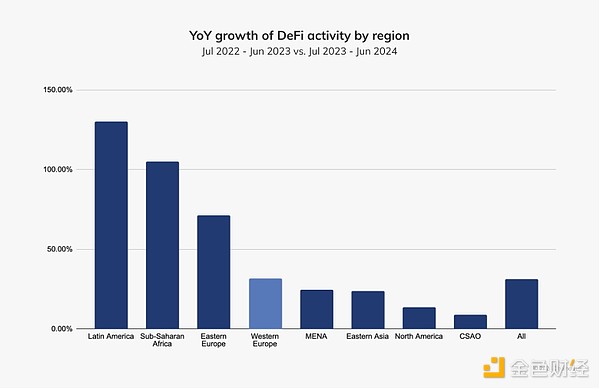

CNWE DeFi Growth Ranks Fourth in the World

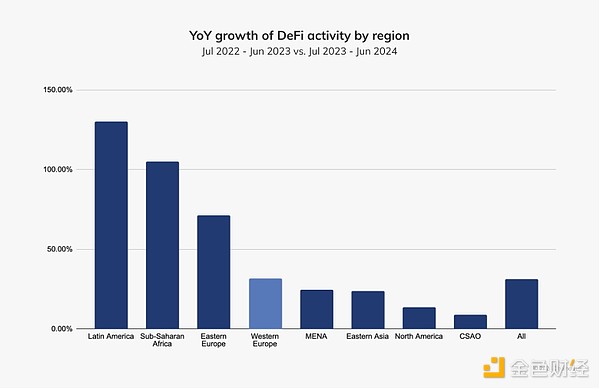

CNWE's DeFi activity over the past year is on par with the global average. The region’s year-over-year growth outperformed North America, East Asia, and MENA, accounting for $270.5B of all cryptocurrencies received in the region.

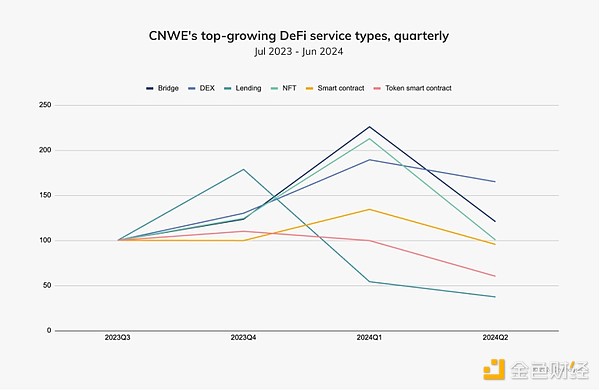

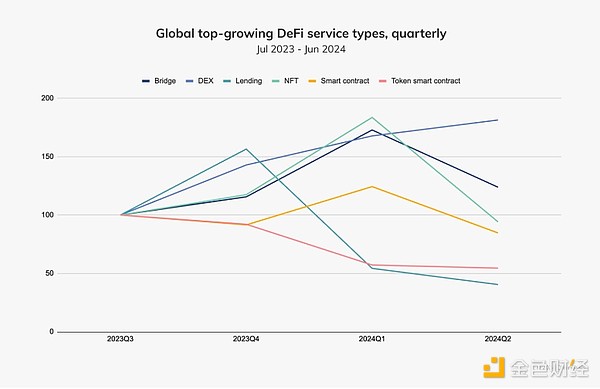

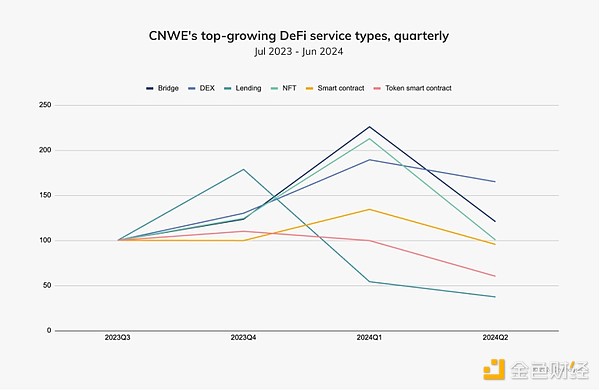

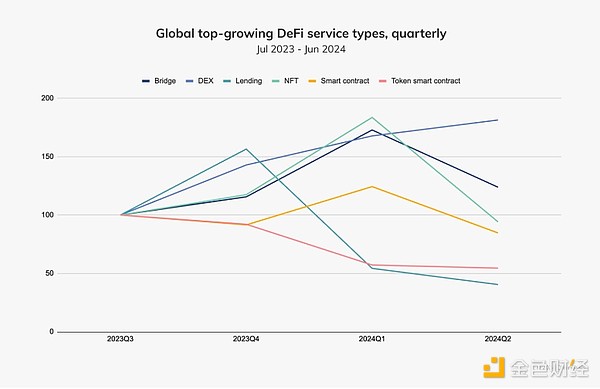

Decentralized exchanges (DEXs) drove CNWE’s DeFi growth, while most other DeFi service categories saw inflows decline in recent quarters.NFTs and bridges saw a brief surge in the first quarter of this year, which then faded and returned to levels of previous years. Loans rose in the fourth quarter of 2023 but fell steadily into 2024 and have yet to rebound.

Although similar growth trends are reflected globally, CNWE's DeFi growth rate is faster than the global level. In CNWE, bridging and NFTs grew at a rate of 2x, while in the rest of the world it was only 1.5x.

The Future of Crypto in Central, Northern, and Western Europe

This summer, the European Union’s (EU) Markets in Crypto-Assets regulation (MiCA) came into effect for stablecoins, which have continued to gain market share in CNWE over the past year. However, the region has yet to feel the impact of MiCA’s regulation for crypto-asset service providers (CASPs), a benchmark that will come into effect in December. We spoke to several experts about the potential regulatory impact of MiCA across the EU.

“A major challenge that remains is regulatory uncertainty and the complexity of cross-border compliance,” said Philipp Bohrn of Bitpanda. “There seems to be an education gap, with many participants unaware of how tokenization projects work and what the possible benefits and risks are. However, we see a huge opportunity here - by bridging this knowledge gap and creating a clear regulatory framework, we can unlock the true potential of asset tokenization, driving innovation and strong growth in global financial markets.”

Elton Dimech of Payhound discussed how MiCA affects payment processors, particularly those servicing the online gaming industry at CNWE. “In Malta we have a strong framework and have to compete with other businesses that have little to no regulation. Therefore, if merchants want an easier way out, we will not be the right choice for them. This will completely change when MiCA comes into effect and I hope that regulators within the EU will enforce this new regulation so that we have a level playing field for all crypto asset service providers.”

With MiCA’s CASP rules set to come into effect in December, compliance teams will be at the forefront of implementation and related control enhancements. Sophie Bowler, group chief compliance officer at UK-based Zodia Custody, a company bridging the gap between TradFi and crypto, echoed the company’s sentiments.

“We believe regulation is key to mainstream adoption of digital assets and further success and innovation,” Bowler said. “Regulatory clarity will not only enable digital asset companies to develop new products with confidence, it will also encourage more traditional financial institutions to participate in digital asset businesses within a clear regulatory framework.”

As MiCA develops in the EU, the UK is also evolving its own regulatory framework.

“For firms that are unable or unwilling to meet the requirements of MiCA, there may be a short-term shift to the UK market,” said Bowler. “However, we believe this will be temporary as UK crypto legislation is expected to be closely aligned with MiCA, and the FCA’s roadmap for crypto legislation, along with an associated consultation document expected to be launched in early 2025, provides us with greater clarity on the timeline for these legislative changes.”

At Chainalysis, we will be monitoring the final stages of the MiCA rollout as well as regulatory developments in the UK and are eager to see how these measures impact cryptocurrency adoption in the coming year.

JinseFinance

JinseFinance