Source: Barron's Chinese

In the face of Trump's erratic tariffs, investors should avoid "stress reactions" and remain patient to ride out market fluctuations.

China quickly launched countermeasures in response to U.S. President Trump's decision to impose a 10% tariff on China.

After the U.S. tariffs on China took effect, China announced a 10% tariff on crude oil, some machinery and automobiles imported from the United States, and a 15% tariff on coal and liquefied natural gas products, which will take effect on February 10.

Last weekend, the United States announced tariffs on China, Mexico and Canada on issues such as illegal immigration and fentanyl. On Monday (February 3), Trump postponed plans to impose tariffs on Mexico and Canada for at least a month after the two countries agreed to ensure border security. The question now is whether the United States and China can reach a similar agreement to prevent the trade war from escalating further.

Trump is expected to hold a telephone conversation with Chinese leaders. White House press secretary Karoline Leavitt told reporters earlier on Tuesday that the call would take place "soon."

Julian Evans-Pritchard, head of China economic research at Capital Economics, believes that China's tariffs on the United States may be delayed or canceled before they take effect on February 10. He said: "To a large extent, China's move is a warning to the United States that China will retaliate if necessary, while also leaving room for concessions."

Evans-Pritchard also pointed out that China's countermeasures only target about $20 billion worth of US goods, compared with Trump's $450 billion worth of Chinese goods. In addition, China has not increased tariffs on strategic goods such as semiconductors and pharmaceuticals.

China also said it would launch an antitrust investigation into Alphabet's (GOOGL) Google, a move not directly related to Trump's tariffs.

China has added two U.S. companies to its "unreliable entity list": Calvin Klein parent PVH (PVH) and biotech company Illumina (ILMN).

"The two entities violated normal market trading principles, interrupted normal transactions with Chinese companies, took discriminatory measures against Chinese companies, and seriously damaged the legitimate rights and interests of Chinese companies," Xinhua News Agency reported, citing a statement from China's Ministry of Commerce.

China's Ministry of Commerce said the list only targets a very small number of foreign entities that endanger China's national security, and that honest and law-abiding foreign entities have nothing to worry about.

China also announced export controls on rare metals such as tungsten, tellurium, bismuth, molybdenum and indium that are critical to making electronics. China is a major miner of these materials.

Different views on tariffs have emerged within the U.S. government. Economic advisers such as U.S. Treasury Secretary Scott Bessent have downplayed the issue of tariffs, describing Trump's strategy as "escalating to de-escalate," suggesting that tariffs are a negotiating tool.

Investors welcomed the delay in U.S. tariffs on Mexico and Canada, but tariffs on China could be trickier. Brian Gardner, chief Washington policy strategist at Stifel, said avoiding tariffs appears to be Trump's real plan.

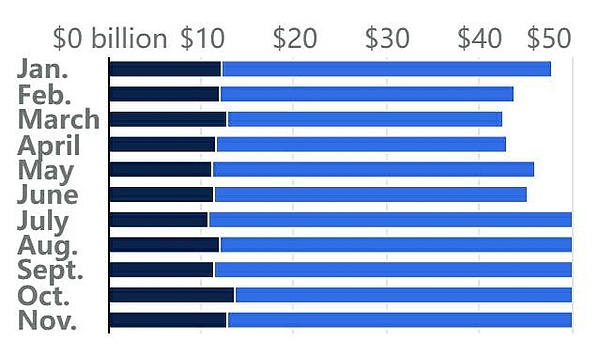

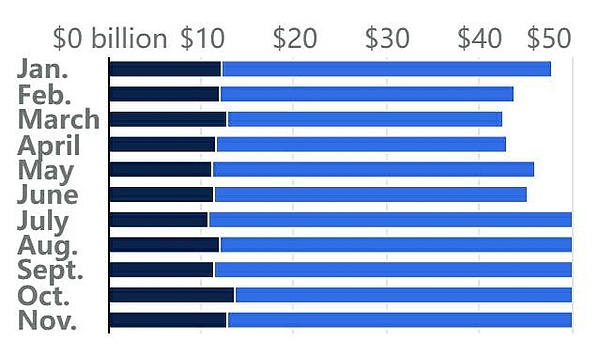

The United States imports more from China than it exports, and this will also be the case in 2024

Black: Exports to China

Blue: Imports from China

Note: Data for December 2024 has not yet been released, source: U.S. Census Bureau

Wall Street immediately fell when the tariff threat became a reality last Friday. The U.S. stock market recovered some of its losses after the U.S. government announced a delay in imposing tariffs on Mexico and Canada, but ordinary investors want a safer and more predictable place for their money.

In the short term, the stock market will not be a safe haven, and there are very few places to hide now. Corporate profits may be hit hard, which in turn leads to higher risks in investing in the stock market, depending on how long the trade tensions last. Strategists at Bank of America estimate that overall earnings for the S&P 500 could fall by as much as 8%.

The view that small-cap companies focused on the US would benefit from Trump's protectionism has also seriously misled investors: the Russell 2000 and S&P 600, two small-cap indexes, have fallen even more than the S&P 500.

The sharp stock market volatility won't go away anytime soon, as Wall Street is unsure whether tariffs are policy or a negotiating tactic, with the VIX fear index surging nearly 12% to above 18 on Monday.

"The uptrend in stocks hasn't changed, but the latest developments in tariffs highlight the potential for interruptions and declines," Michael Skordeles, head of U.S. economics at Truist, and Keith Lerner, chief market strategist and co-chief investment officer, wrote in a research note.

So in this kind of roller-coaster ride, the key is to put money into stocks that can withstand the ups and downs of the broader market, and stocks with rich dividends are a classic example. Procter & Gamble (PG), one of the biggest gainers in the Dow on Monday, has a dividend yield of 2.4%. Stocks that pay handsome dividends, such as UnitedHealth (UNH), Verizon Communications (VZ), Merck (MRK) and IBM (IBM), also rose.

In an interview with Barron's, Julie Biel, chief market strategist at Kayne Anderson Rudnick, said that investors have learned some lessons from Trump's first term, and dividend stocks are a good way to deal with stock market volatility.

Mike Morey, chief investment officer of Integrity Viking Funds, is also bullish on dividend stocks, but he doesn’t think investors have to limit themselves to more conservative defensive stocks.

Broadcom (AVGO) is the top holding of Morey’s Integrity Dividend Harvest Fund, which also holds Corning (GLW) shares, as well as energy and utility stocks such as TC Energy (TRP) and NextEra Energy (NEE), and large banks such as Citigroup (C) and JPMorgan Chase (JPM).

“We try to keep volatility low and focus on companies that not only pay dividends but also plan to increase them,” Morey said. “Dividend stocks have been neglected because of the exciting news in artificial intelligence, so there are a lot of attractive opportunities to be found.”

Investors can also consider traditional safe havens such as U.S. Treasuries and gold. U.S. Treasury yields fell on Monday, a possible sign that investors are flocking to the market amid market turmoil. Gold has been a tried and tested hedge against volatility, recently hitting a record high of $2,850 an ounce.

The dollar is likely to continue to rise as investors seek safety, according to Thierry Wizman, global foreign exchange and interest rate strategist at Macquarie.

The dollar "will attract inflows as a safe haven currency during uncertain times," Wizman wrote in a research note. He also believes that "risk markets will be under pressure if the tariff issue persists, as investors generally believe that tariffs will slow GDP growth, reduce corporate operating profit margins, and lead to higher costs."

However, investors should not "react" to the volatility of Trump's tariffs. Negotiations are a page in Trump's "playbook" and anything can change in an instant, just as Trump postponed tariffs on Mexico and Canada on Monday.

Tony Roth, chief investment officer of Wilmington Trust, said: "It is difficult to know what the final outcome will be. Investors need to remain patient and ride out the market volatility."

Roth believes that for safety reasons, he will not buy consumer staples or non-essential consumer goods stocks. Energy stocks, financial stocks and healthcare stocks can provide effective defense. In the case of increased stock market volatility, these stocks are more likely to present good buying opportunities.

Catherine

Catherine