Author: Link

Recently, China's stock market has experienced a shocking rebound, all due to a series of economic stimulus measures introduced by the government. With the strong rise of the stock market, some market analysts have observed that speculators may be withdrawing from the cryptocurrency market and investing in the A-share market in mainland China. This shift not only affects the trend of the cryptocurrency market, but may also have a far-reaching impact on the global market.

Since last week, the Chinese government has announced large-scale economic stimulus measures. In addition to injecting capital into the stock market, it also strives to save the housing market. The People's Bank of China first cut the reserve requirement ratio by 2 points, released about 1 trillion yuan of liquidity to the financial market, lowered the 7-day reverse repurchase operation rate by 0.2%, and then lowered the interest rate of existing mortgage loans. Shanghai and Shenzhen announced the relaxation of some housing purchase restrictions, and Guangzhou completely lifted the purchase restrictions.

China has launched a series of economic stimulus measures, driving a sharp rebound in the stock market. At the latest closing of the Chinese stock market, the three major A-share indices soared again. In terms of indexes, the Shanghai Composite Index closed at 3336.50 points, up 8.06%, setting a new record for the largest single-day increase since October 2008. The Shenzhen Component Index, the ChiNext Index, and the Beijing Stock Exchange 50 Index closed up 10.67%, 15.36%, and 22.84%, respectively, all setting new records for the largest single-day increase in history.

In terms of volume, the total turnover of the Shanghai and Shenzhen stock markets today was 2.59 trillion yuan, surpassing the 2.36 trillion yuan on May 28, 2015, setting a new record for the largest single-day turnover in history. Among them, 35 minutes after the opening of the morning, the turnover of the Shanghai and Shenzhen stock markets exceeded 1 trillion yuan, setting a new record for the fastest breaking of 1 trillion yuan in history.

In terms of sectors, the three leading industries today were beauty care, computers, and electronics. The corresponding industry indexes rose by 13.53%, 13.24%, and 12.94% respectively, all setting new records for the largest single-day gains in their respective industries.

In terms of individual stocks, 5,336 stocks closed higher, and only 8 stocks fell, setting a new record for the largest number of stocks that rose in history; 713 stocks closed with daily limits, setting a record for the most daily limits since October 2015. Many stocks such as Oriental Fortune, Kweichow Moutai, and Yangtze Power set new records for the largest single-day turnover in history.

Meanwhile, as Chinese stocks have surged in response to the news, fear of missing out (FOMO) has begun to appear on Wall Street. In a note to clients, Goldman Sachs technical strategist Scott Rubner pointed out that the Chinese stock market is in high spirits and may now soar further as international investors begin to pour in.

So far, international investors have largely not participated in the rise in Chinese stocks, making this rise a "painful trade" for foreign investment managers that have previously been short on Chinese stocks. Given that investors previously held a low proportion of Chinese stocks, investors who missed the rise are accelerating their entry. FOMO has begun, and after the US election, the Chinese stock market should become a popular trading target for investors in November and December.

In this regard, David Tepper, the well-known Wall Street bottom-picker and founder of Appaloosa Management, said that he is increasing his holdings of Chinese concept stocks. China's economic stimulus policy exceeds expectations and investment indicators are underestimated, which are all reasons for buying.

However, some institutions hold different opinions. Phillip Wool, head of portfolio management at Rayliant Global Advisors, believes that the stimulus measures are mainly to inject liquidity into the market, but the current situation is that more liquidity alone cannot achieve the sustained recovery that long-term investors want to see. As long as demand remains as weak as before, no one is willing to borrow, and such measures will not produce the expected results. At the same time, Gary Tan, portfolio manager at Allspring Global Investments, also said that investors will only invest new funds if the deflationary outlook and the housing market undergo fundamental changes.

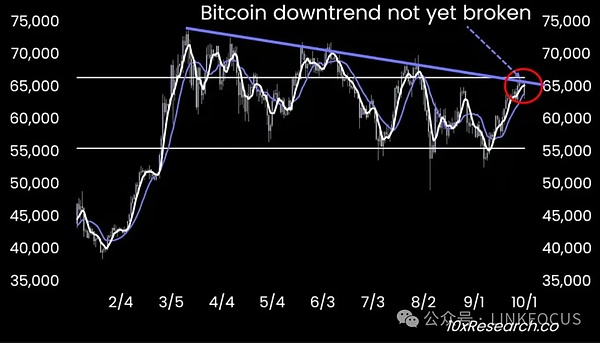

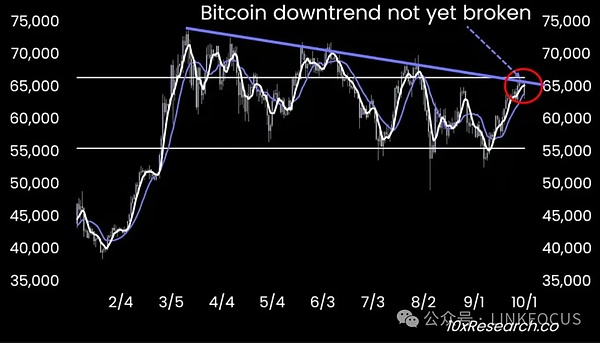

It is worth noting that with the strong performance of the A-share market, many speculators in the cryptocurrency market have begun to turn their attention to mainland stocks. The latest analysis report from 10xResearch shows that Bitcoin's short-term technical indicators are in an overbought state, indicating that it may fall. Therefore, speculators may have turned from cryptocurrencies such as Bitcoin to Chinese stocks in search of higher volatility and returns.

In the past period of time, the cryptocurrency market has faced many uncertainties, including changes in regulatory policies and fluctuations in market sentiment. These factors have caused many investors to lose confidence in cryptocurrencies and look for other investment opportunities. The rebound in the Chinese stock market has provided these speculators with a new investment channel, especially with the support of the current economic stimulus policy.

However, cryptocurrencies still have their unique appeal. The price volatility of major cryptocurrencies such as Bitcoin is still large, and there is still a possibility of a rebound in the short term. The market is going through some major shifts, and while short-term concerns are evident, the larger trends may soon outweigh these concerns.

To sum up, the government's economic stimulus policies have effectively boosted market confidence and attracted a large amount of capital to the A-share market. In the process, speculators' capital flows have also changed, from the Bitcoin market to Chinese stocks, showing market participants' pursuit of high volatility.

In the future, as policies continue to take effect and the market continues to evolve, whether the Chinese stock market can maintain this growth momentum and its impact on global markets will be a focus of attention. In this market environment full of variables, investors need to remain vigilant and flexibly adjust their strategies to cope with potential market fluctuations.

Jixu

Jixu