In recent years, the crypto world has gradually developed into one of the most dynamic investment fields, but in this rapidly developing digital territory, risks and opportunities coexist, and security issues need to be vigilant at all times.

Based on this, Binance conducted a questionnaire survey on "Crypto User Security and Anti-Fraud Awareness", and collected a total of 7,967 Chinese questionnaire results.

TechFlow analyzed the data results of this survey and produced this report, aiming to help users find their way and move forward safely in this crypto jungle.

This survey has an in-depth understanding of users' security awareness and ability to deal with risks in crypto asset transactions, aiming to help users improve their anti-fraud capabilities and strengthen their risk management awareness, so as to better protect their assets. Binance's industry survey not only provides users with practical educational resources, but also reflects its continued investment and commitment to user security education, and highlights Binance's responsibility and commitment as an industry-leading platform in promoting the construction of crypto ecological security.

Highlights:

Crypto users have shown strong security awareness, such as taking corresponding protection measures, improving risk identification capabilities, and being good at using the risk control mechanism of centralized trading platforms:

80.8% of Binance users have enabled 2FA identity authentication.

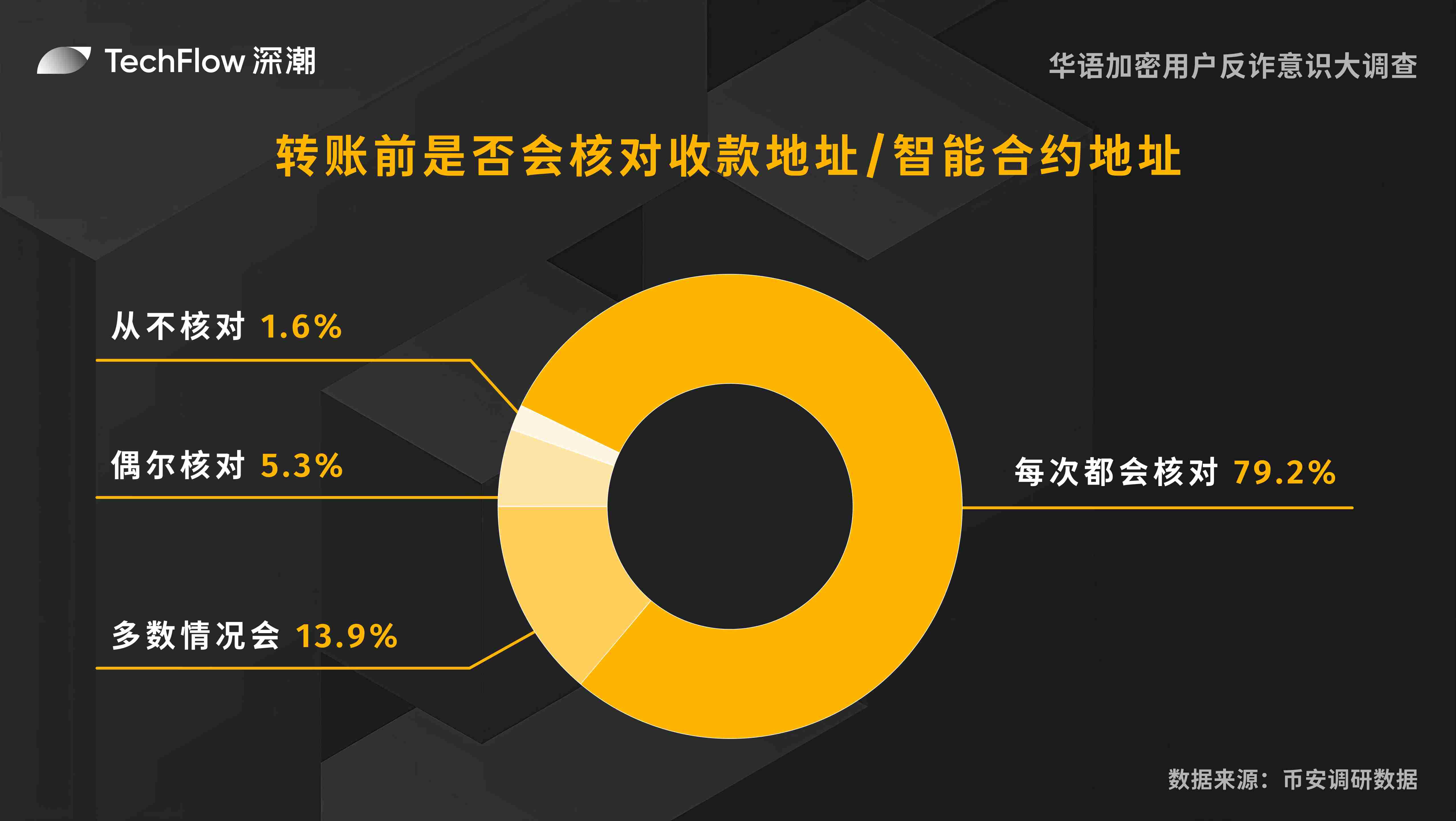

Nearly four-fifths of users will carefully check the receiving address or smart contract address before each transfer.

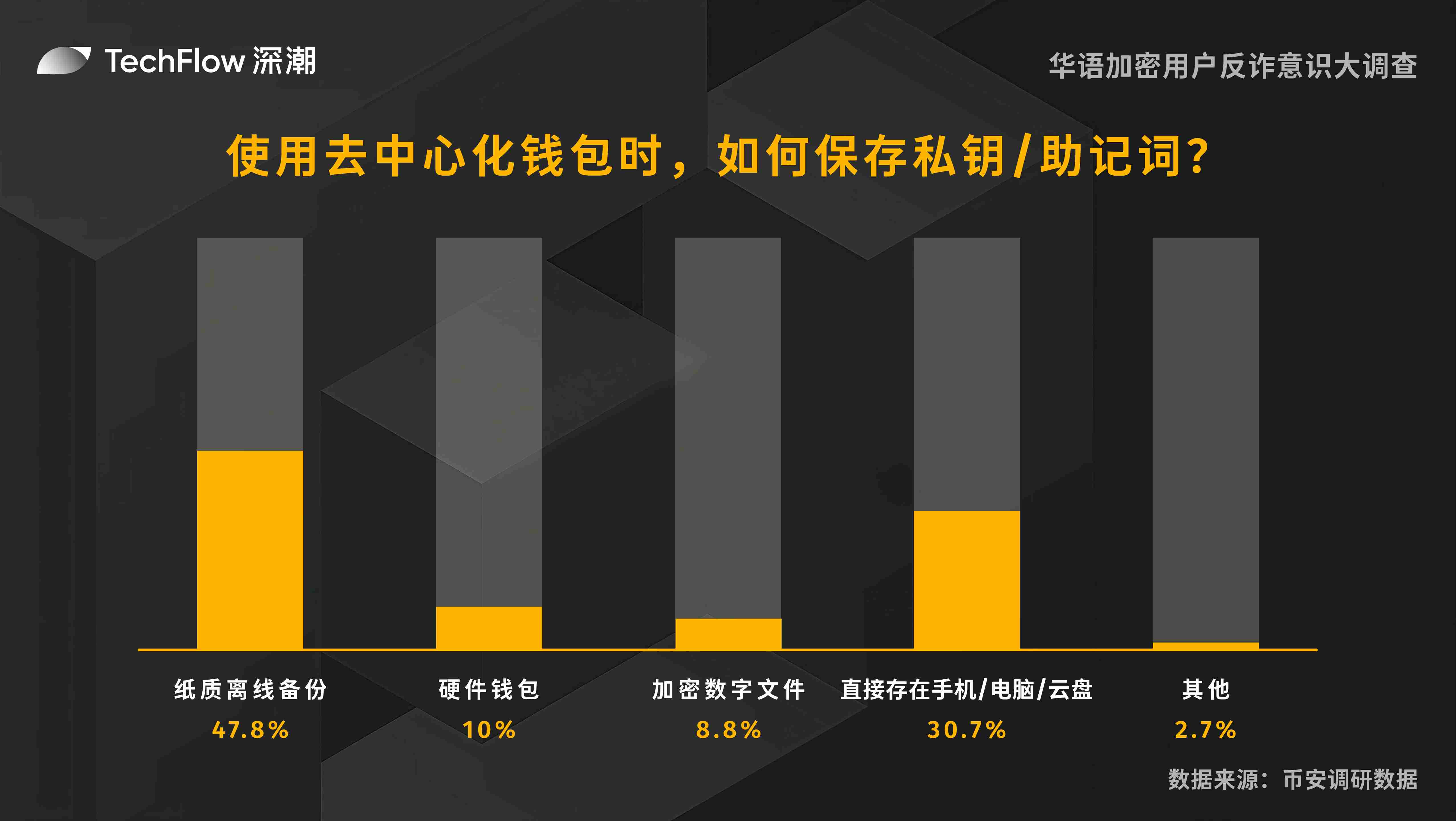

The proportion of users who use paper media to save private keys/mnemonics (47.8%) far exceeds the proportion of users who store them on electronic devices (30.7%).

58.9% of users will first contact the exchange to freeze their assets after being defrauded, which shows that they have a significant trust in the exchange.

85.5% of respondents said that they trust the exchange's protection mechanism (such as the SAFU "Binance Emergency Fund").

Up to 97.2% of users are willing to participate in the anti-fraud simulation test organized by the trading platform.

In the face of new fraud methods, it is necessary to continuously strengthen security education for users and enhance their awareness of potential threats:

X (formerly Twitter, 63.9%), Telegram (38.7%) are the most common channels for spreading fraud information recognized by most people.

77.4% of users have seen phishing links, and 60.8% of users have been tempted by insider information and shouting orders from "authorities".

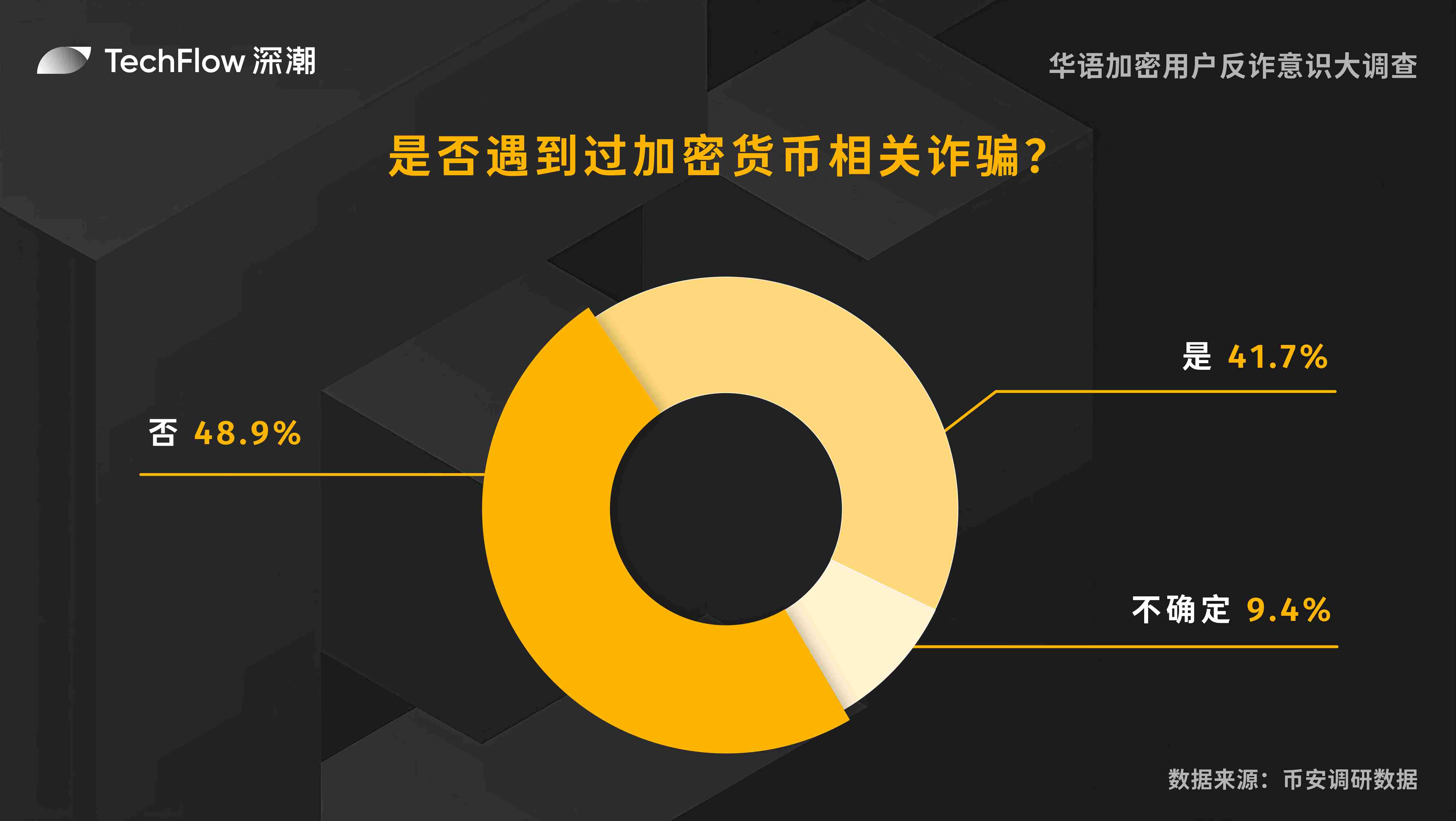

Less than half of users (48.9%) clearly stated that they had not been exposed to fraudulent information.

Chinese Crypto User Security Survey Report

This report is divided into the following fiveparts:

Part 1: Overview of the Survey Population

Part 2: Security Awareness and Behavioral Habits

Part 3: Experience and Response to Fraud

Part 4: Demand for Exchange Security Services

Part 5: Security Features and Education Preferences

Part I: Overview of the Survey Population

This chapter aims to draw a comprehensive portrait of the respondents by collecting and analyzing basic information such as trading experience, trading frequency, and asset size of cryptocurrency traders. This will provide strong support for subsequent research and analysis.

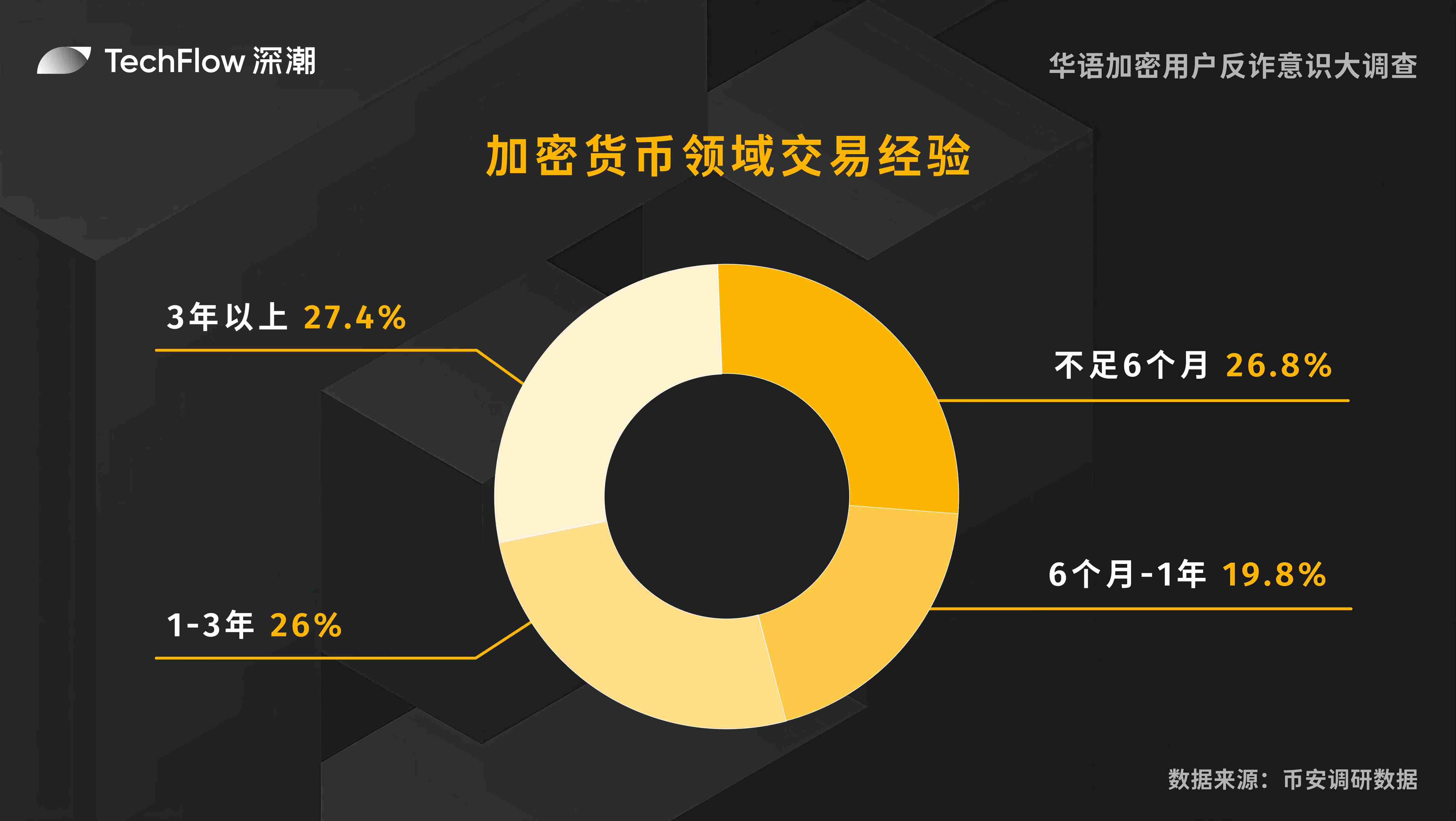

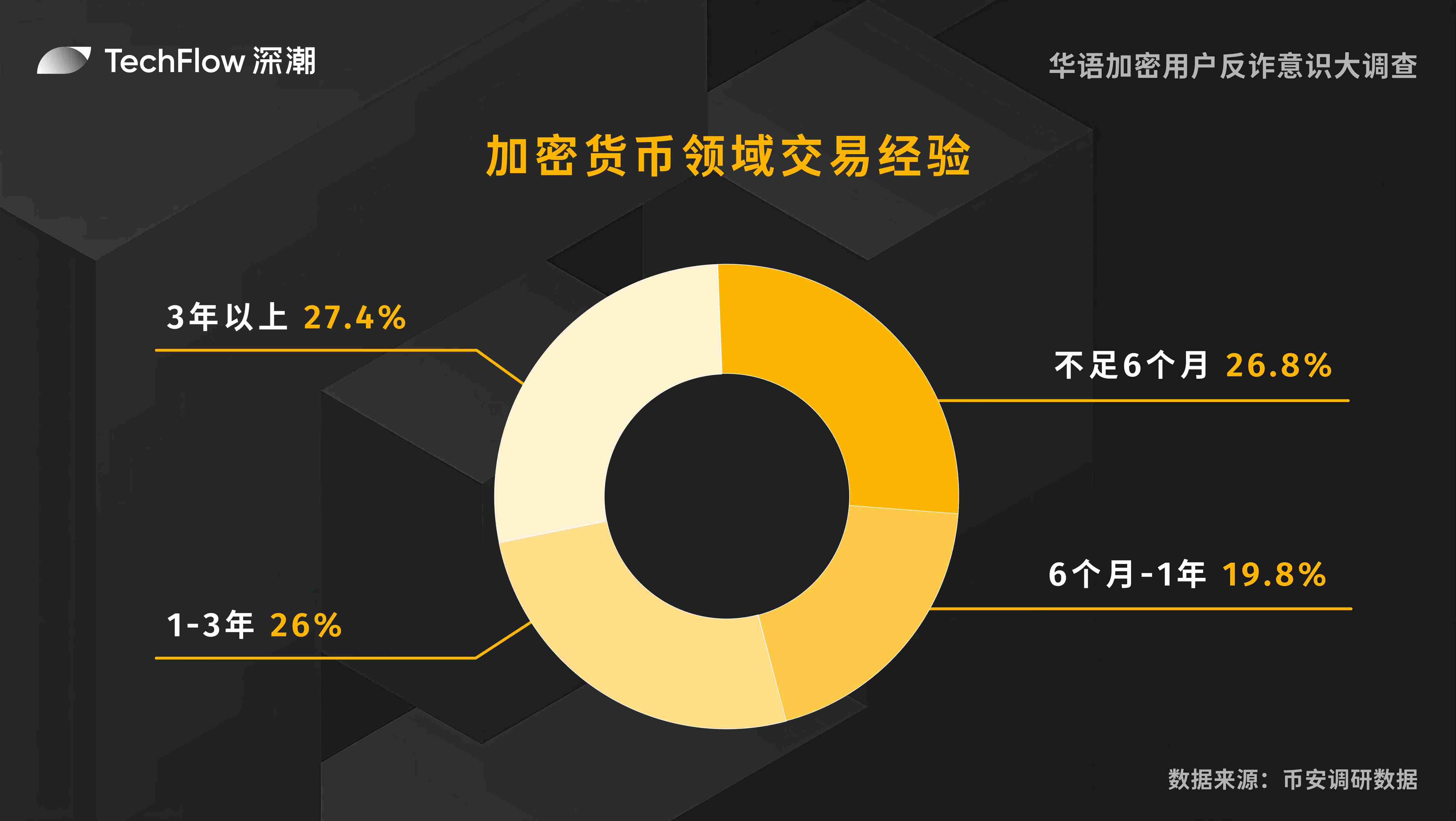

Cryptocurrency Trading Experience

In this survey, we collected statistics on the cryptocurrency trading experience of the respondents. The data shows that the experience distribution of Chinese users in the field of crypto trading experience is relatively balanced, providing a solid and diverse user base for the Chinese crypto market, which is conducive to the long-term development of the market.

Specifically: respondents with more than 3 years of trading experience accounted for the highest proportion, reaching 27.4%; followed by respondents with less than 6 months of experience, accounting for 26.8%; and respondents with 0.5-1 year and 1-3 years of experience accounted for 19.8% and 26% respectively. This phenomenon of new users entering the market and old users sticking to it reflects the dynamics and vitality of the market.

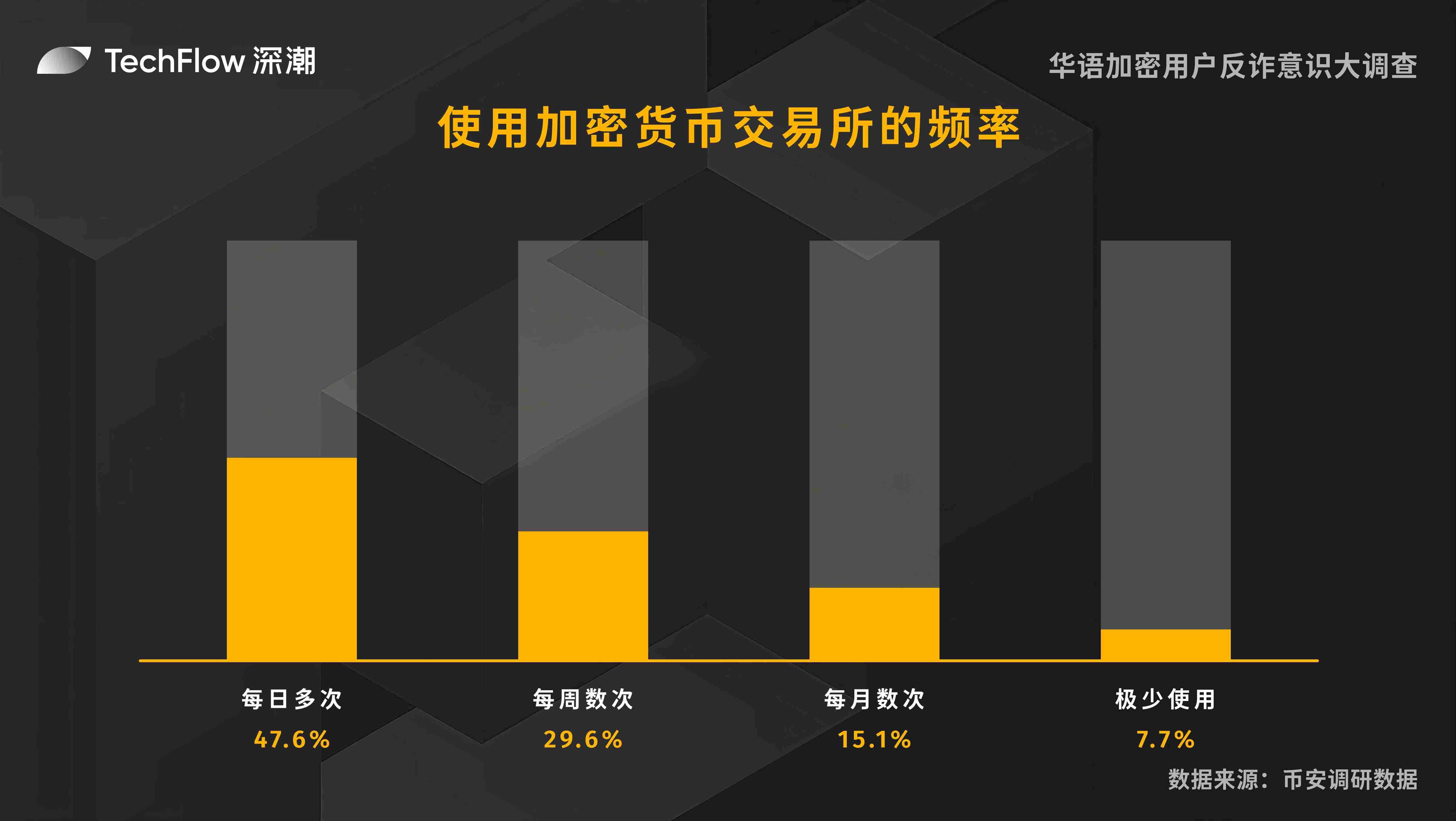

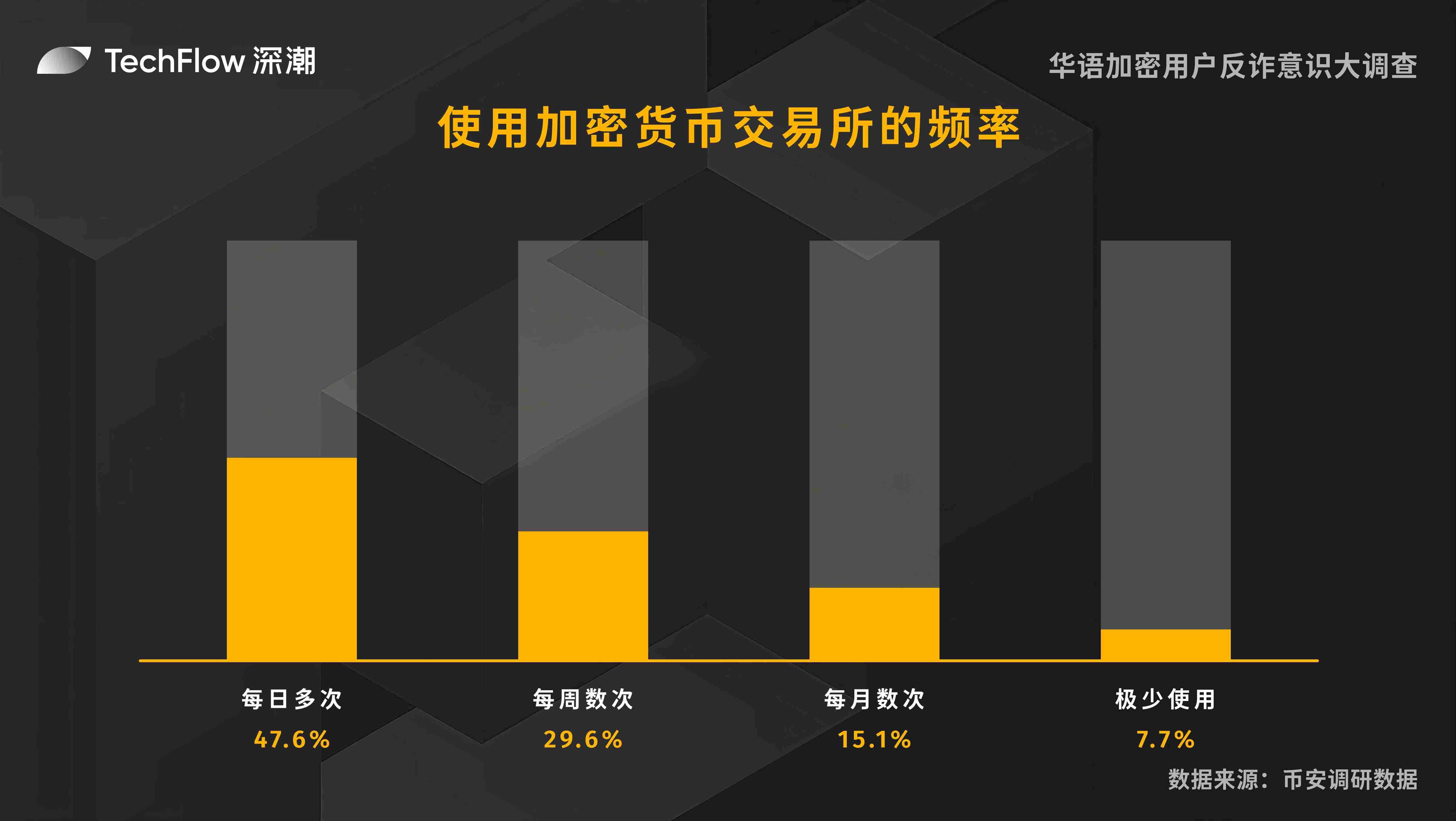

Frequency of using cryptocurrency exchanges

In this survey, we conducted a statistical analysis of the frequency of cryptocurrency traders using exchanges. The data shows that users who use exchanges multiple times a day account for the largest proportion, and most traders are highly dependent on exchanges.

Specifically: 47.6% of respondents use cryptocurrency exchanges multiple times a day, 29.6% use them several times a week, 15.1% use them several times a month, and only 7.7% use them very rarely.

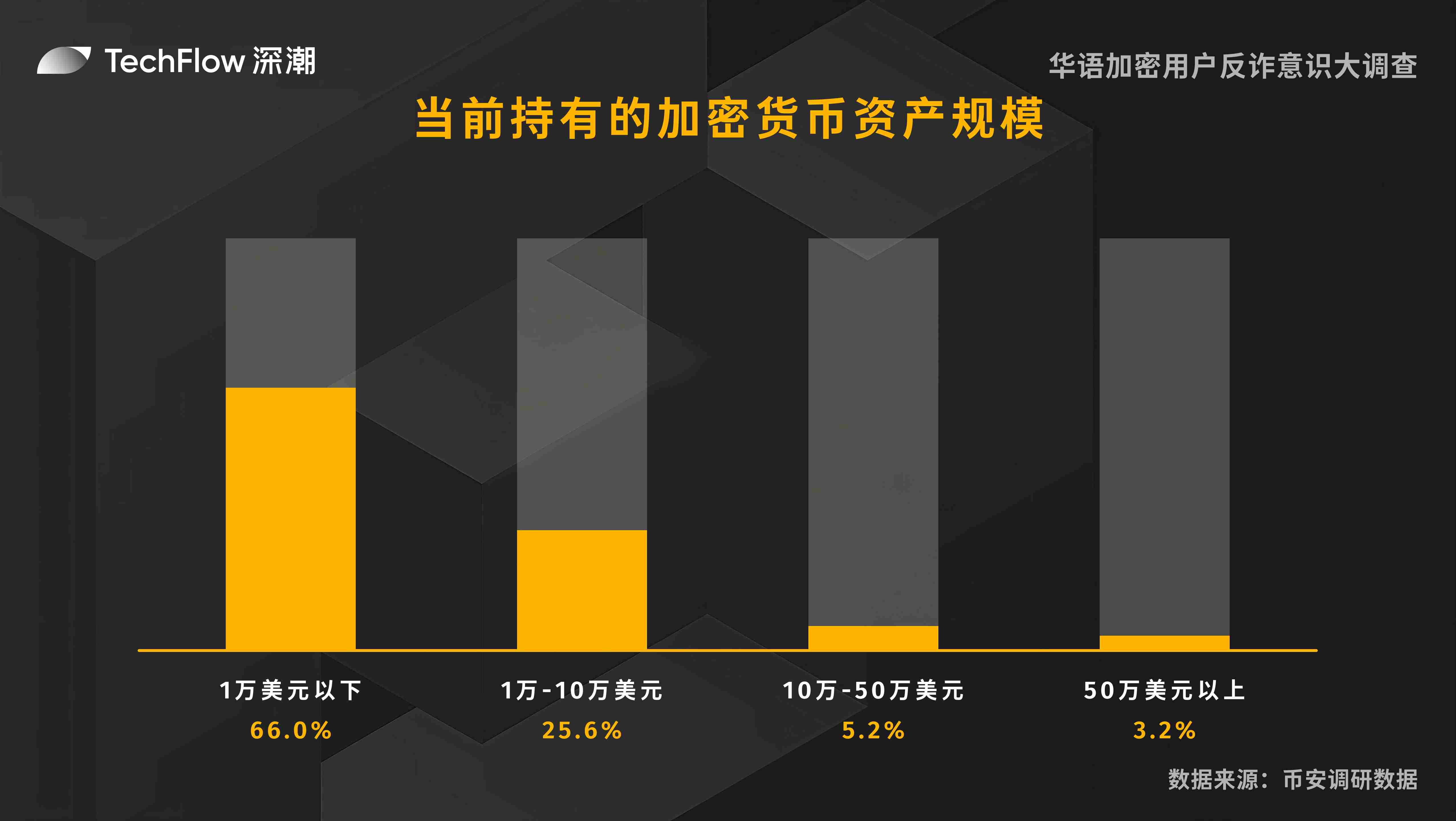

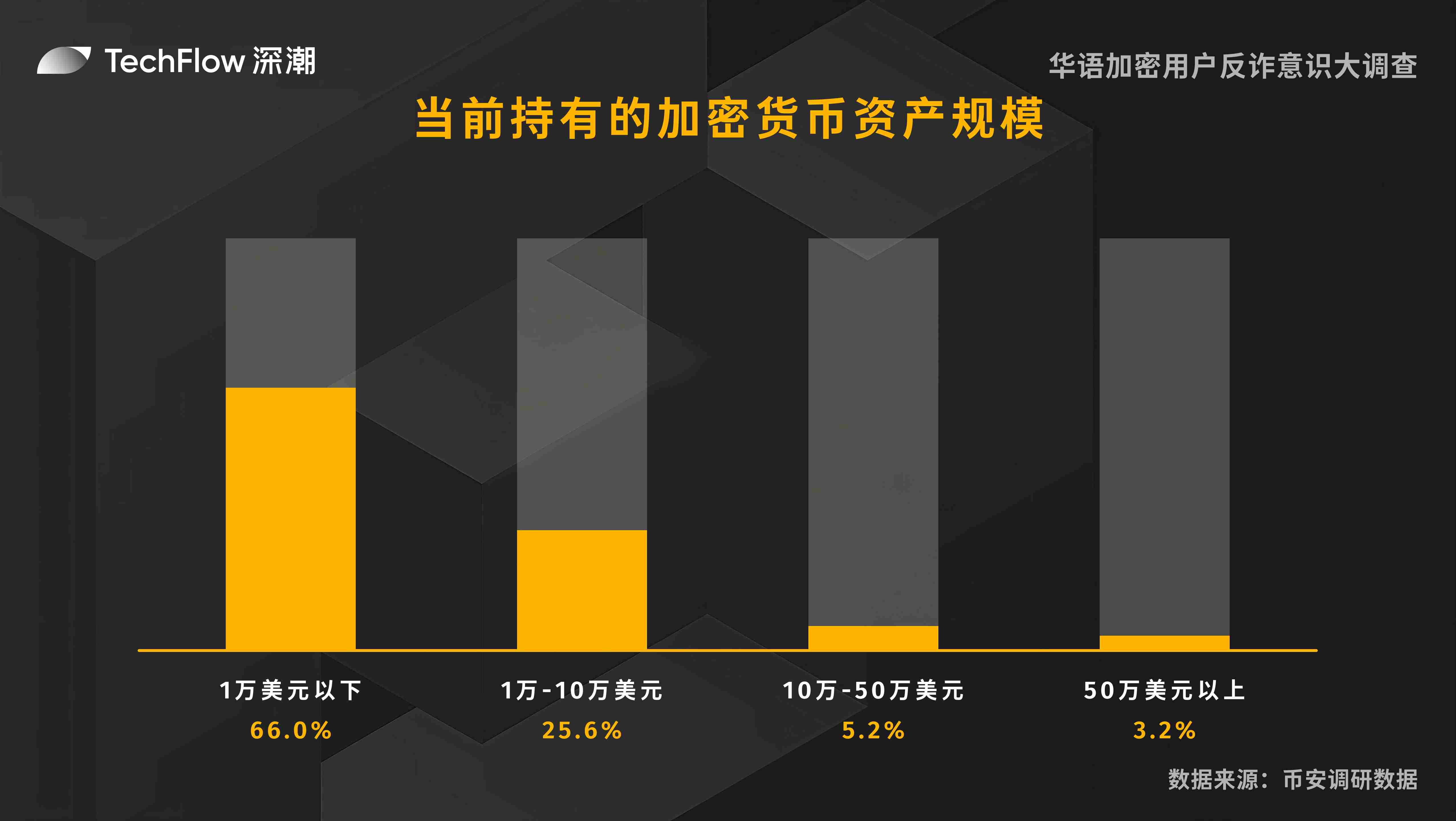

Current cryptocurrency asset size

Among cryptocurrency holders, most people have assets below $10,000, accounting for 66.0%. This shows that most investors are still in a more cautious investment stage, possibly due to high market volatility or limited investment experience.

Investors holding assets between $10,000 and $100,000 account for 25.6%. This group may have a deeper understanding and confidence in the market and are therefore willing to invest more money. Investors holding between $100,000 and $500,000 account for only 5.2%, and high-net-worth investors holding more than $500,000 account for only 3.2%.

Part 2: Security Awareness and Behavioral Habits

In the field of cryptocurrency, security and trust are among the issues that users are most concerned about. This section collects and analyzes the security measures enabled by respondents in their Binance accounts, and provides an in-depth understanding of users' security awareness and strategies, involving issues such as enabled security measures, ways to save private keys, and types of fraud encountered, revealing the security challenges in users' cryptocurrency transactions.

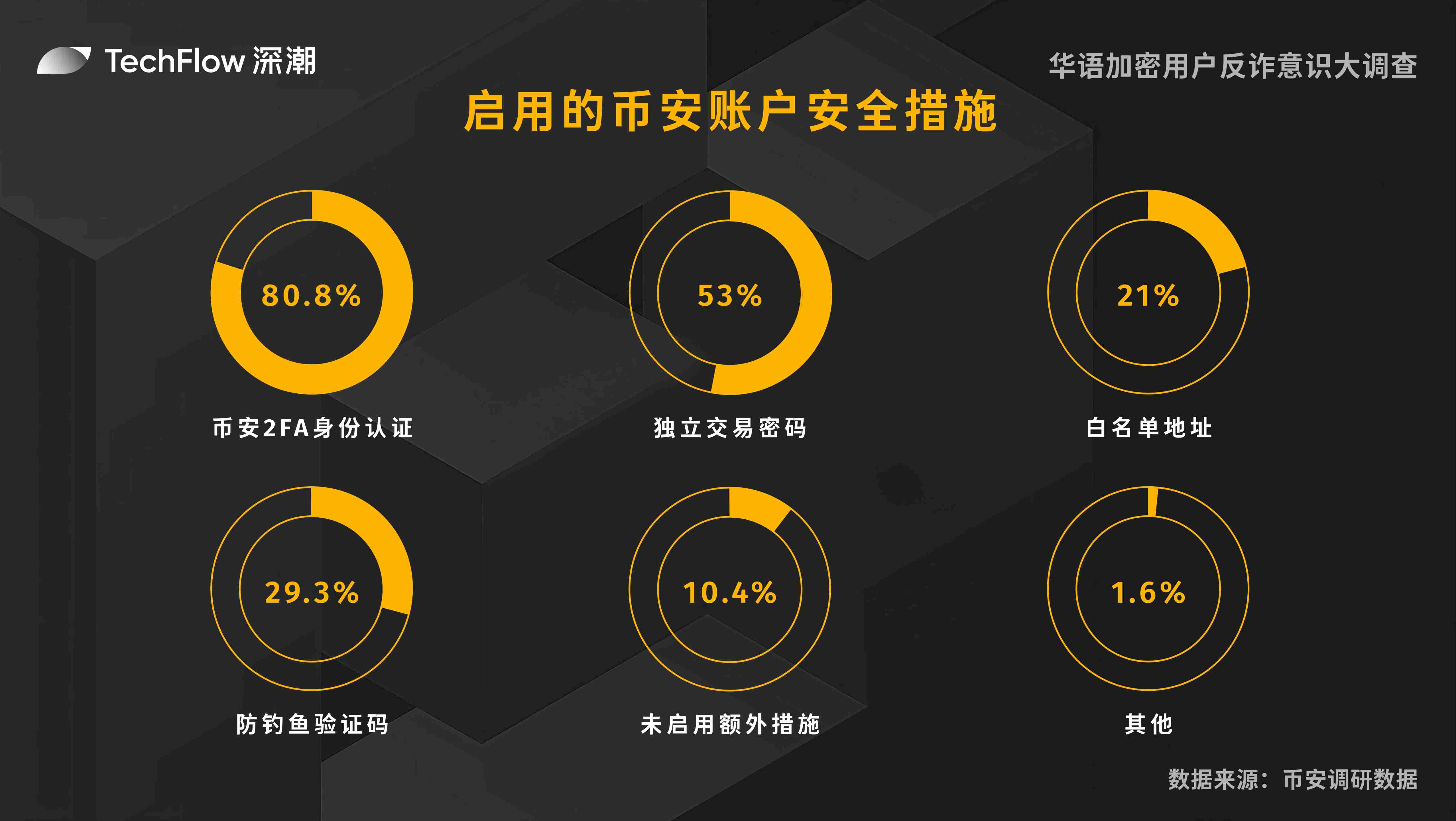

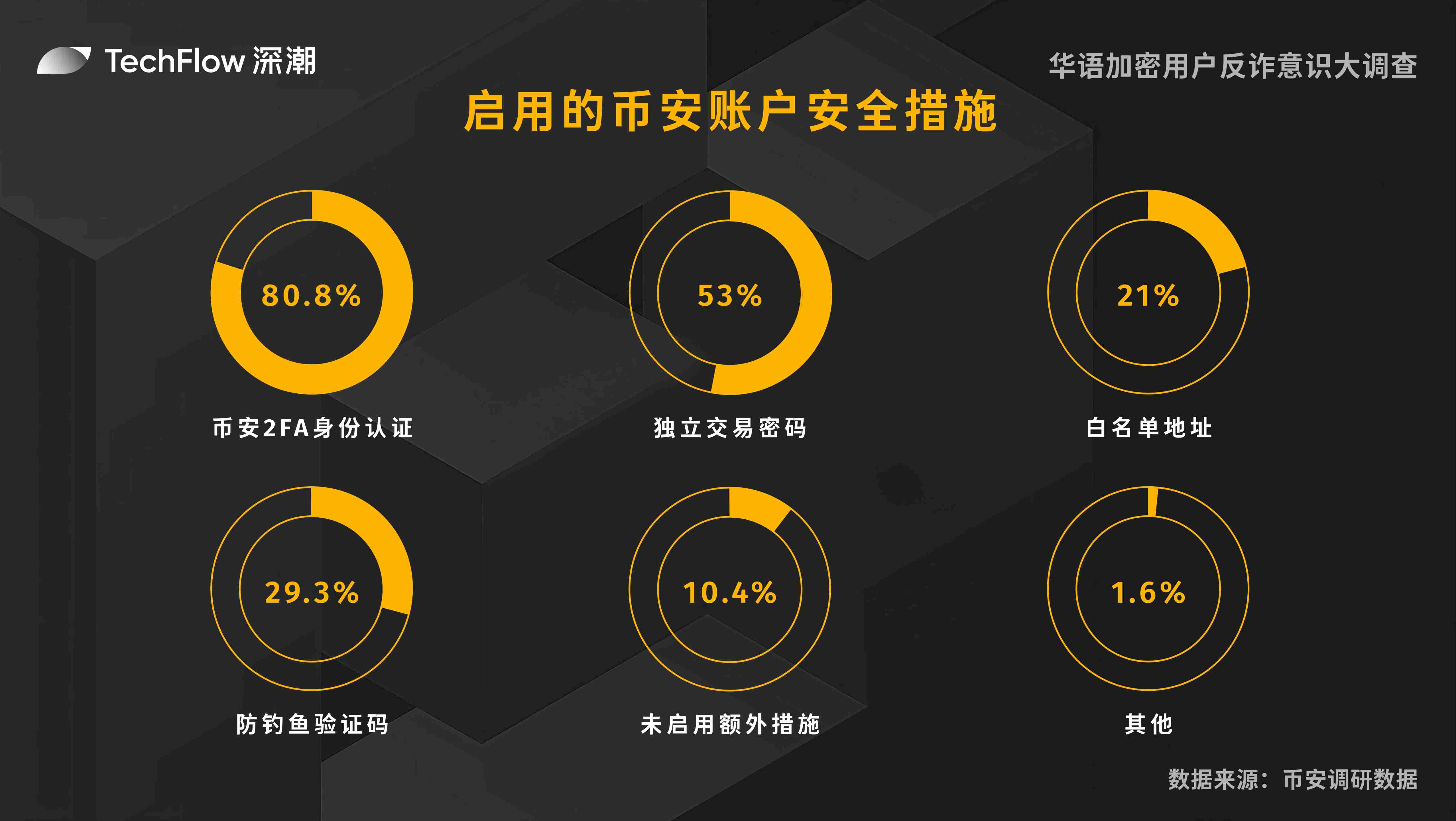

Enabled Binance Account Security Measures

In this survey, we conducted a detailed statistical analysis of the Binance account security measures enabled by the respondents. This question is a multiple-choice question, and each respondent can select multiple options. Specifically:

The highest proportion of enabling 2FA identity authentication reached 80.8% - such a high proportion shows that most users are aware of the importance of two-factor authentication and give priority to this measure to protect account security. In addition, independent transaction passwords are also valued, and more than half (53%) of the respondents have set independent transaction passwords. The proportion of users who enable whitelist addresses is 21%, which can effectively prevent funds from being transferred to unauthorized addresses. The use rate of anti-phishing verification codes is 29.3%, which shows that some users have a certain degree of awareness of prevention against phishing attacks. In addition, 1.6% of users chose other security measures, showing the diversity of users' security strategies.

However, 10.4% of users still do not enable any additional security measures, which may be due to a lack of security awareness or the belief that security measures are too complicated to set up.

Overall, most users have taken a variety of security measures to protect their Binance accounts, but some users still need to strengthen their security awareness and measures.

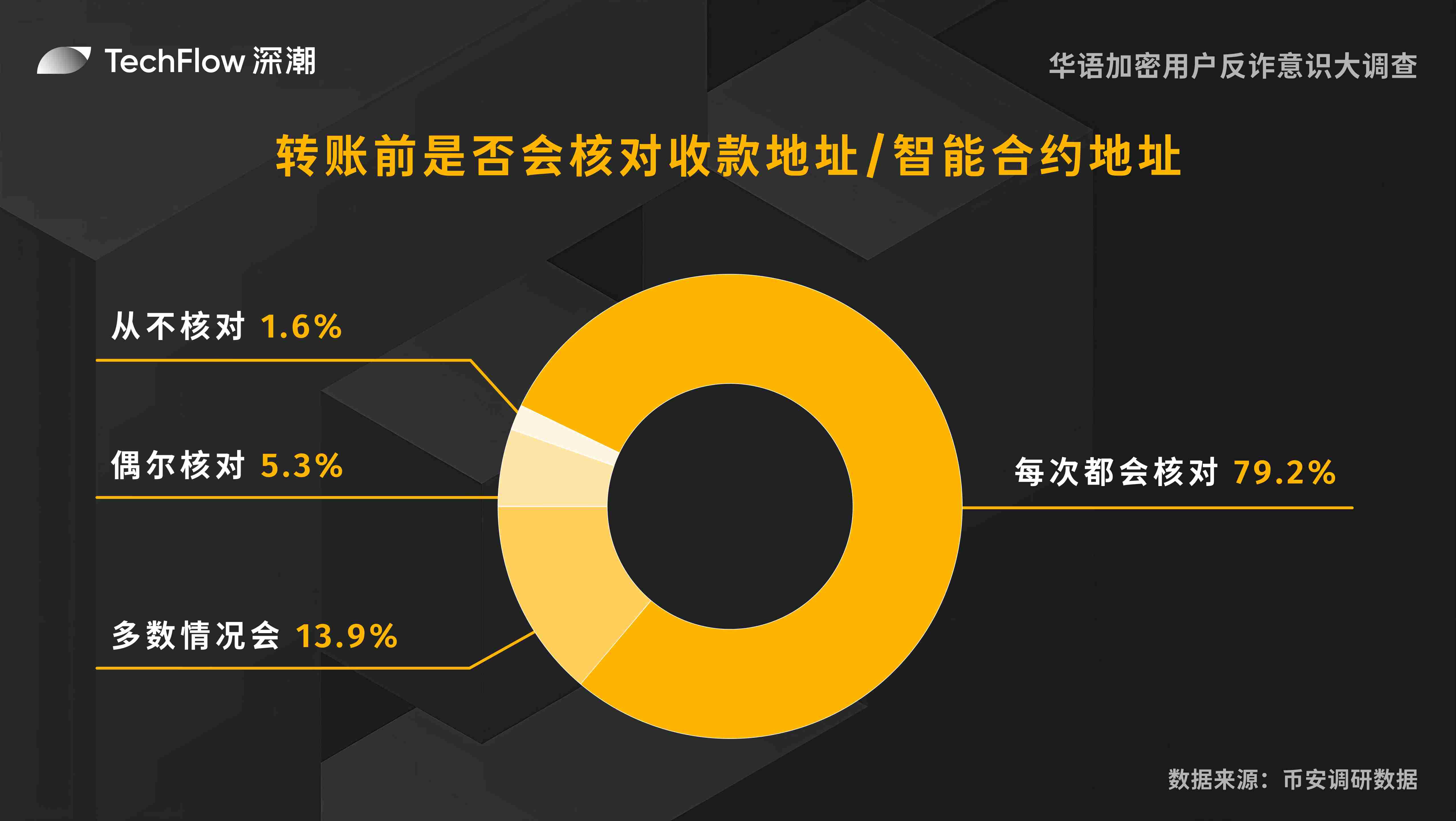

Do you check the receiving address/smart contract address before transferring money?

According to the survey data, most users will carefully check the receiving address or smart contract address before transferring money, accounting for 79.2%, indicating that users are generally aware of the importance of checking addresses to avoid transfer errors and possible fund losses.

13.9% of users are cautious most of the time, but may not check the address in some cases.

Users who occasionally check addresses account for 5.3%. These users may be aware of the importance of checking, but have not developed a stable habit.

From the overall data, the vast majority of users will check the receiving/smart contract address before transferring money, reflecting their high attention to fund security. It is worth noting that there are still 1.6% of users who never check the transfer address, and need to strengthen their attention to transfer security.

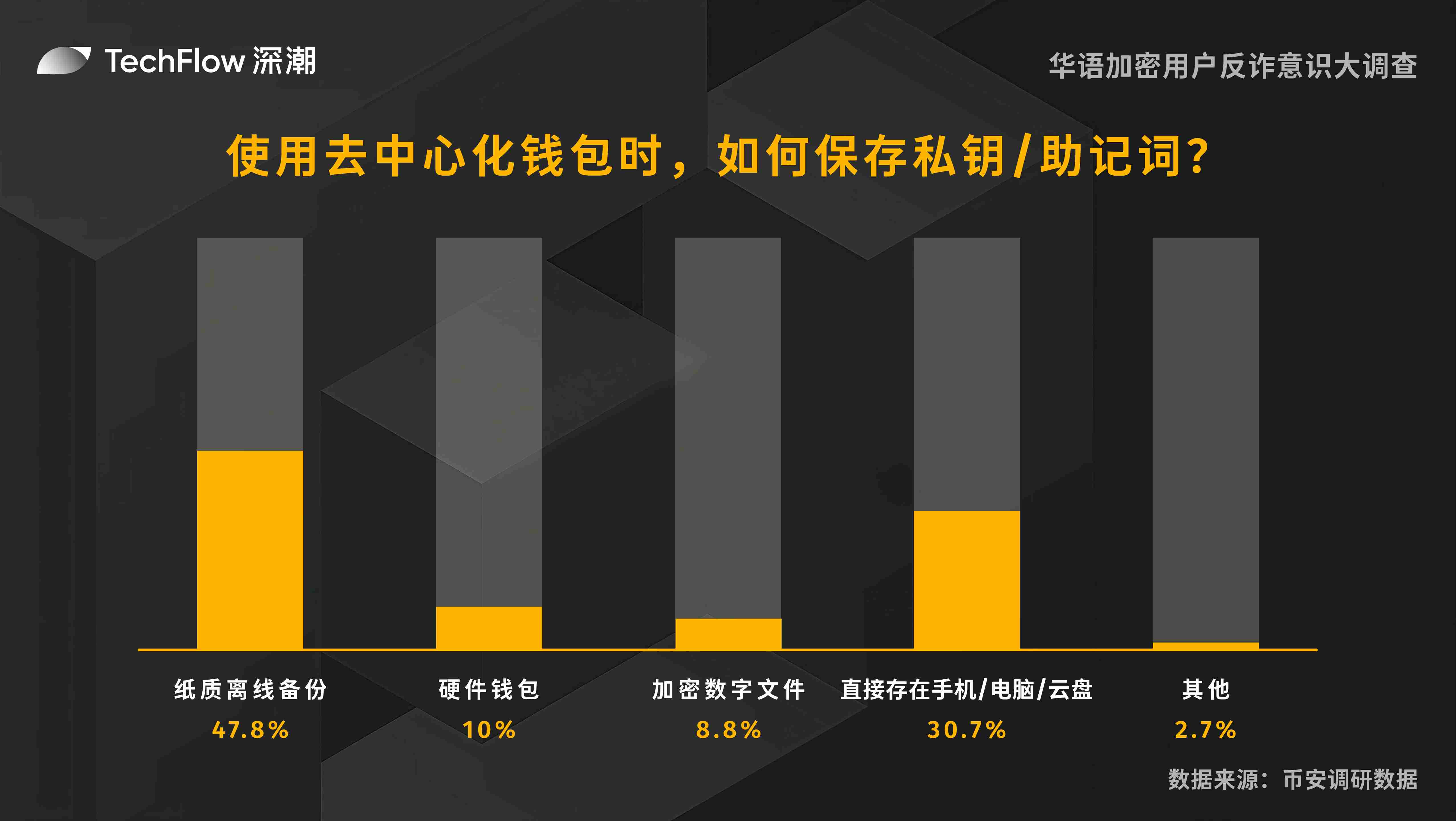

How to save private keys/mnemonics when using decentralized wallets?

Decentralized wallets allow users to fully control their private keys and assets, but they also face management difficulties and the risk of losing private keys. In the survey, 47.8% of users chose paper offline backup when using decentralized wallets, which is a traditional and safe way to effectively prevent digital device failures or network attacks. 10% of users use hardware wallets to store private keys or mnemonics, and these users prefer to use specialized devices to enhance security. At the same time, 8.8% of users choose to use encrypted digital file storage, which provides convenient access while protecting privacy.

A large proportion (30.7%) of users choose to store private keys or mnemonics directly on mobile phones, computers or cloud drives. Although this method is convenient, there are security risks such as device theft or cyber attacks.

In addition, 2.7% of users choose other storage methods, showing the diversity of users' security strategies.

Overall, most users tend to use a safer way to save private keys or mnemonics, but some users still need to improve their security awareness to avoid potential risks.

Types of frauds seen

In this questionnaire survey, we counted the types of cryptocurrency frauds that respondents have seen. The survey shows that although the types of frauds are increasing, phishing link fraud is still the most common fraud method. This question is a multiple-choice question, and each respondent can choose multiple options. The proportion of each option is:

77.4% of users have seen phishing links, which is a common means of online fraud that usually steals user information by disguising as legitimate websites.

60.8% of users have encountered so-called insider information or shouting orders from "authorities". This scam uses users' trust in authority to mislead investment decisions.

51.7% of users have seen scams that leak private information, such as passwords, private keys or mnemonics. This type of attack directly threatens the security of users' assets.

56.6% of users have seen scams of fake airdrops, giveaways or token pre-sales. This scam uses users' pursuit of free or preferential treatment to commit fraud.

51.6% of users have seen fake exchange apps or fake wallets. This scam defrauds users of assets by disguising as legitimate applications.

48.8% of users have encountered Ponzi schemes and pyramid schemes, which attract investors by promising high returns, but actually rely on the funds of subsequent investors to pay previous investors.

33.2% of users were victims of malware attacks, which implant malware to steal user information or control user devices.

False investment promises (such as high-yield mining pools) are also a common scam, which has been seen by 44.9% of users. This scam often attracts investment with unrealistically high returns.

2.3% of users have seen other types of scams. The means of fraud are becoming increasingly diverse and difficult to prevent.

Part 3: Fraud Experience and Response

The focus of this section turns to the actual fraud incidents encountered by the respondents. The survey covers the amount of loss, remedial measures after encountering fraud, and common fraud information channels. By comprehensively counting these real scenarios, we aim to help users be more vigilant and prevent cryptocurrency fraud more effectively.

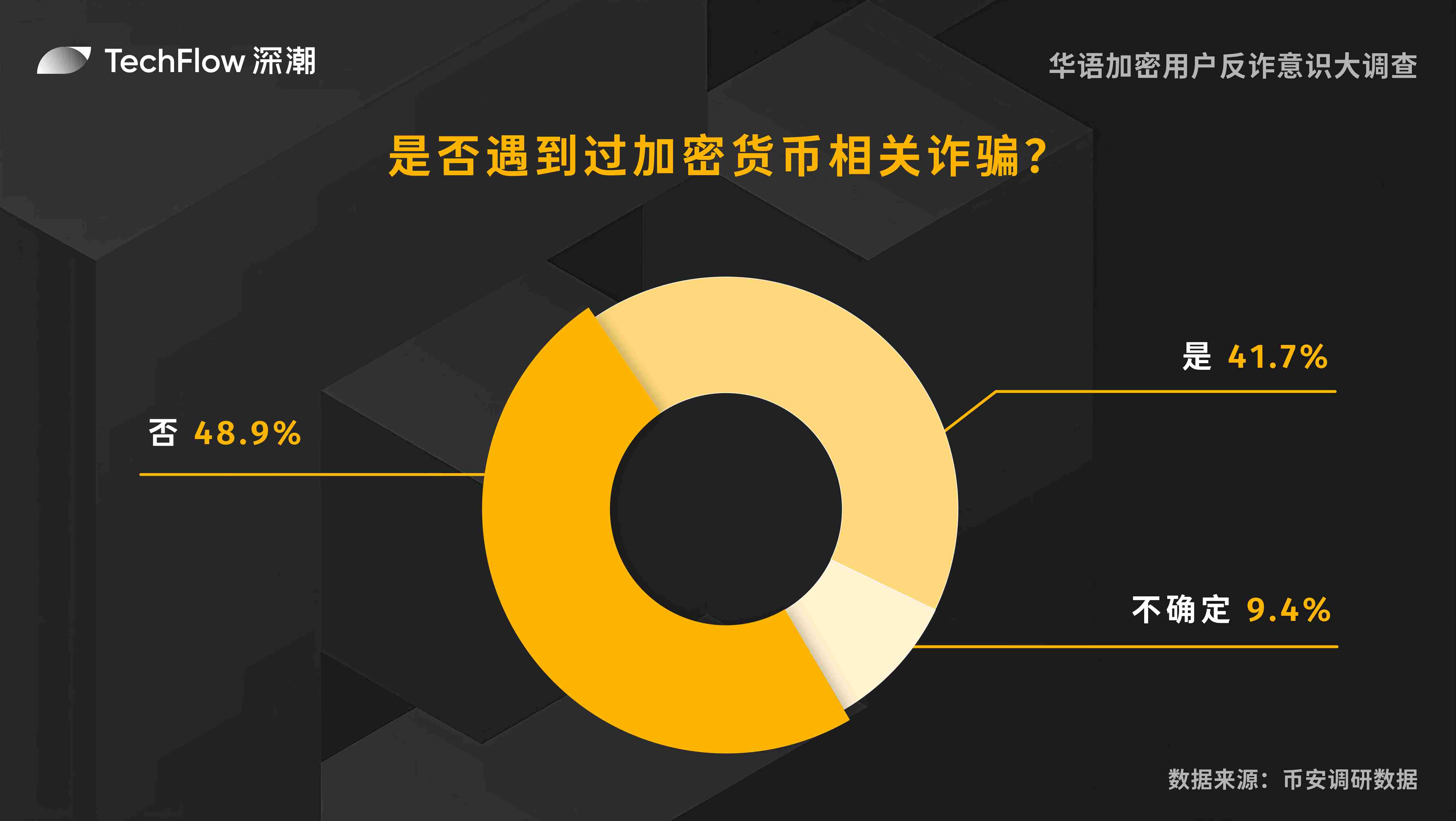

Have you encountered cryptocurrency-related fraud?

We investigated whether users had ever encountered cryptocurrency fraud. Surprisingly, nearly half (41.7%) of users had encountered cryptocurrency-related fraud; among the remaining users, 9.4% were not sure whether they had encountered fraud, and only 48.9% of users clearly stated that they had not encountered fraud.

Overall, cryptocurrency fraud is still an important security issue today, and users need to improve their vigilance and identification ability.

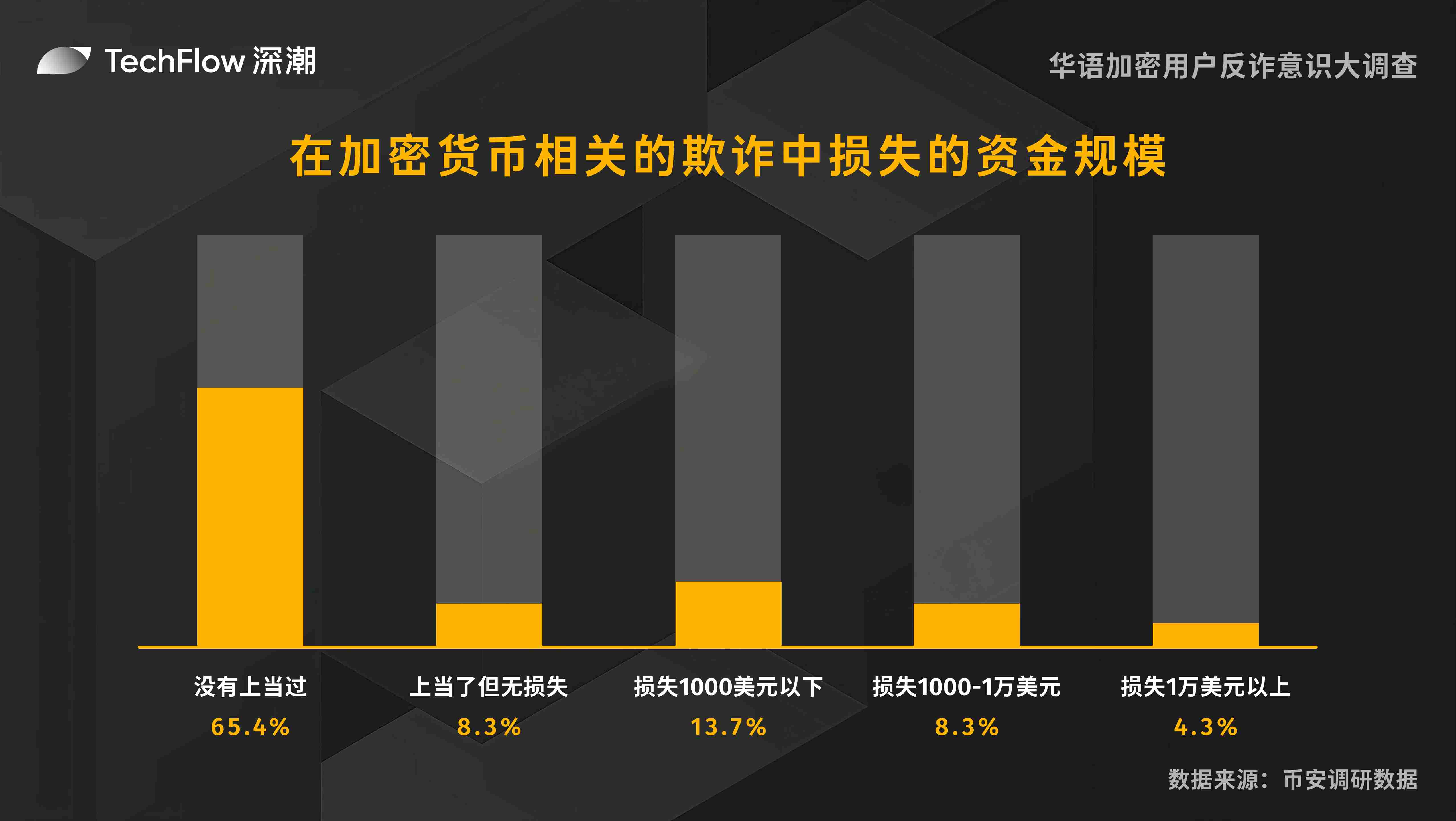

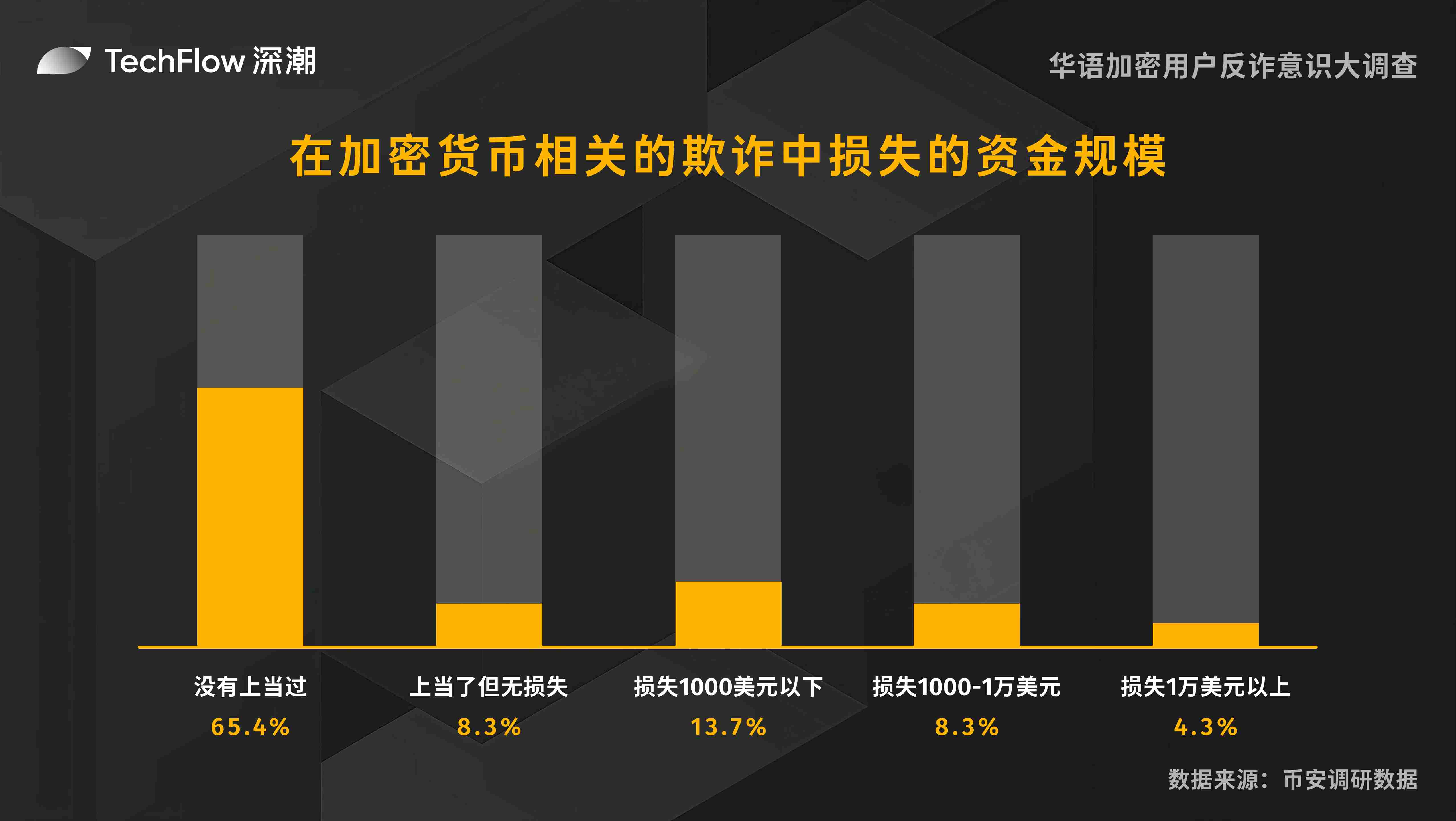

The scale of funds lost in cryptocurrency-related frauds

We investigated the scale of funds lost by users in cryptocurrency-related frauds. The data shows that:

65.4% of users were not deceived, showing a strong awareness of prevention.

Although 8.3% of users were deceived, they did not suffer any losses and may have taken remedial measures in time.

13.7% of users lost less than $1,000, indicating that small losses are more common.

8.3% of users lost between $1,000 and $10,000, indicating that medium-sized losses also exist.

4.3% of users lost more than $10,000, indicating that a small number of users suffered serious financial losses.

Overall, although most users did not suffer losses, they still need to strengthen prevention to avoid potential economic losses.

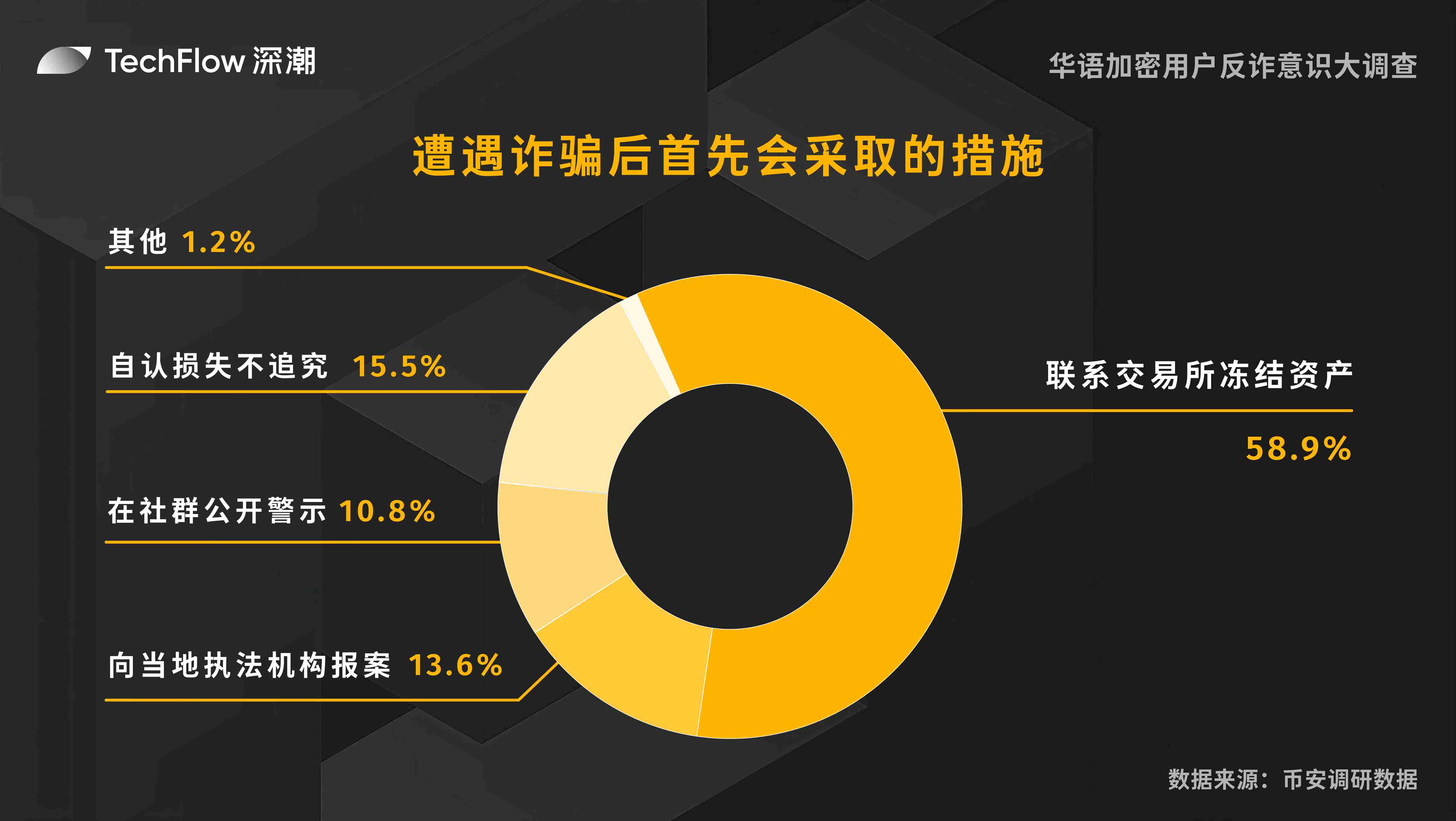

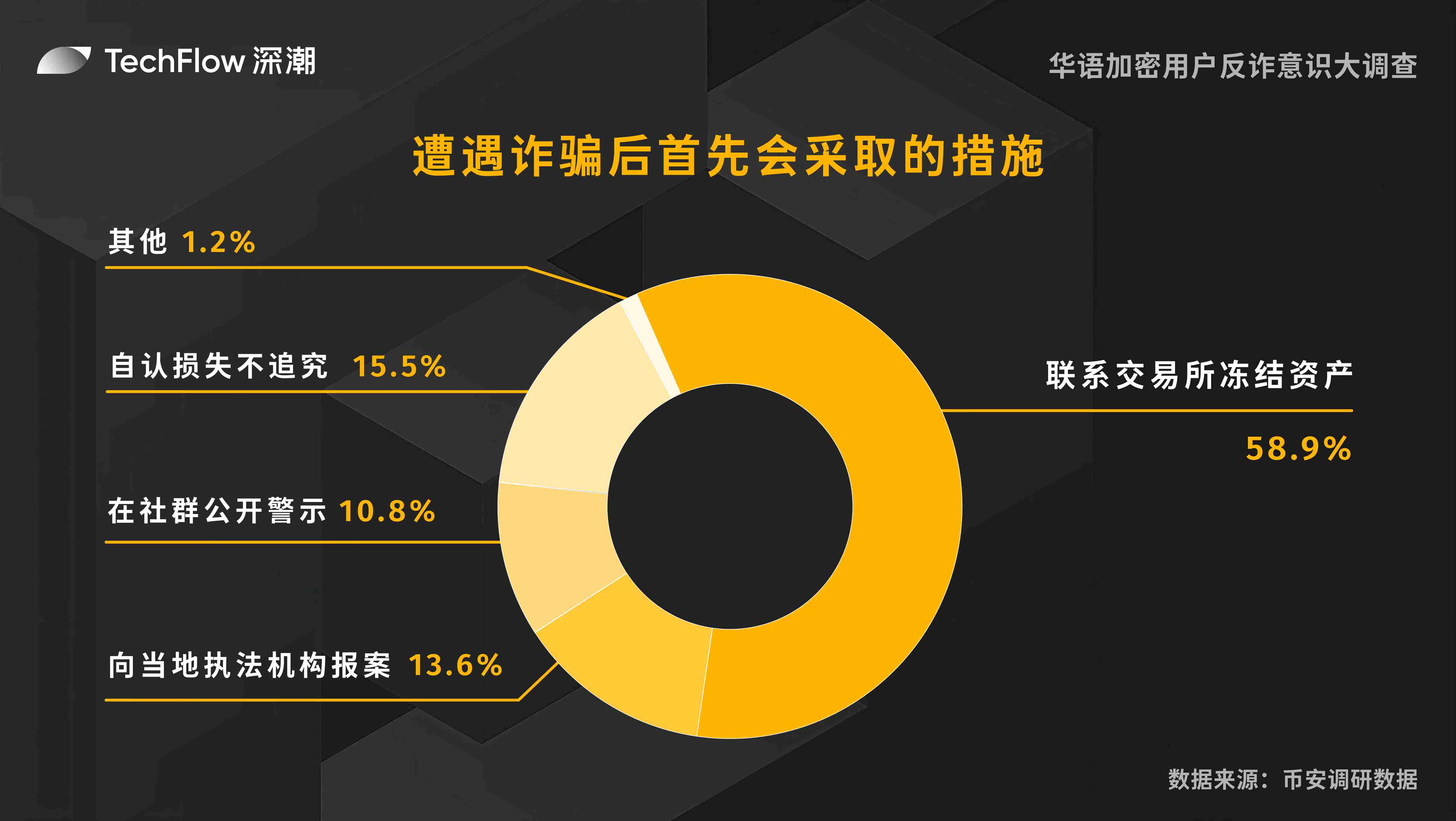

What are the first measures to take after being defrauded?

Due to the decentralized nature of blockchain, stolen cryptocurrencies are often difficult to recover. Our survey shows that more than half of users will first contact the exchange to freeze their assets after being defrauded. It is worth noting that the proportion of users who choose to admit their losses and not pursue them ranks second. The specific data is:

58.9% of users will first contact the exchange to freeze their assets, showing their attention to protecting the safety of funds.

13.6% of users chose to report the case to local law enforcement agencies, indicating that they hope to solve the problem through legal means.

10.8% of users publicly warned in the community, intending to remind others to pay attention to similar risks.

15.5% of users do not pursue their losses, perhaps because the losses are small or they think that there is no hope of pursuing them.

1.2% of users took other measures, showing the diversity of coping methods.

Overall, most users tend to take active measures to protect their own interests. Contacting exchanges is the choice of most users, which shows that users trust exchanges led by Binance; but some users still choose to accept losses, which also reflects the difficulty of recovering cryptocurrency fraud, which deserves more attention.

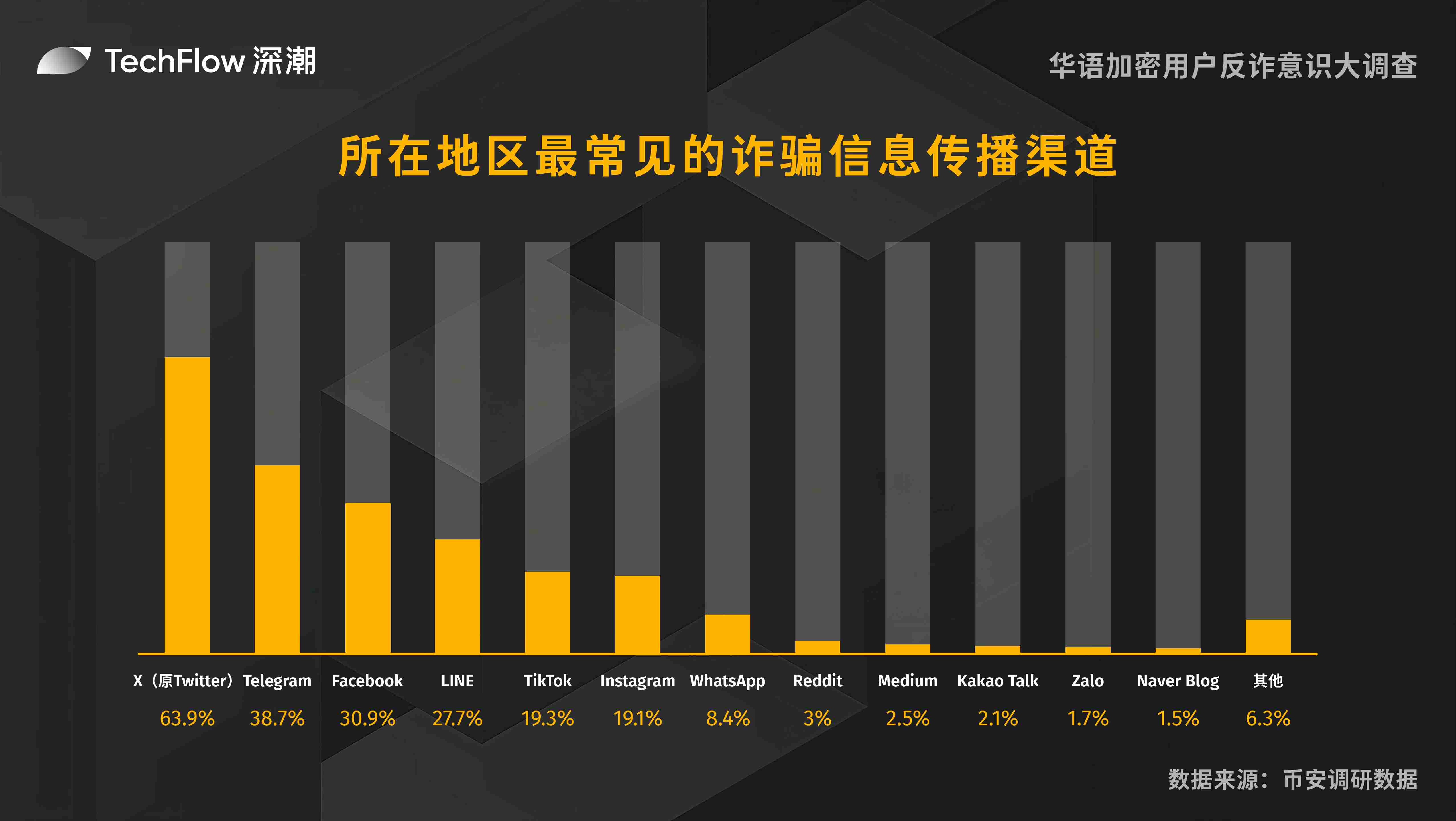

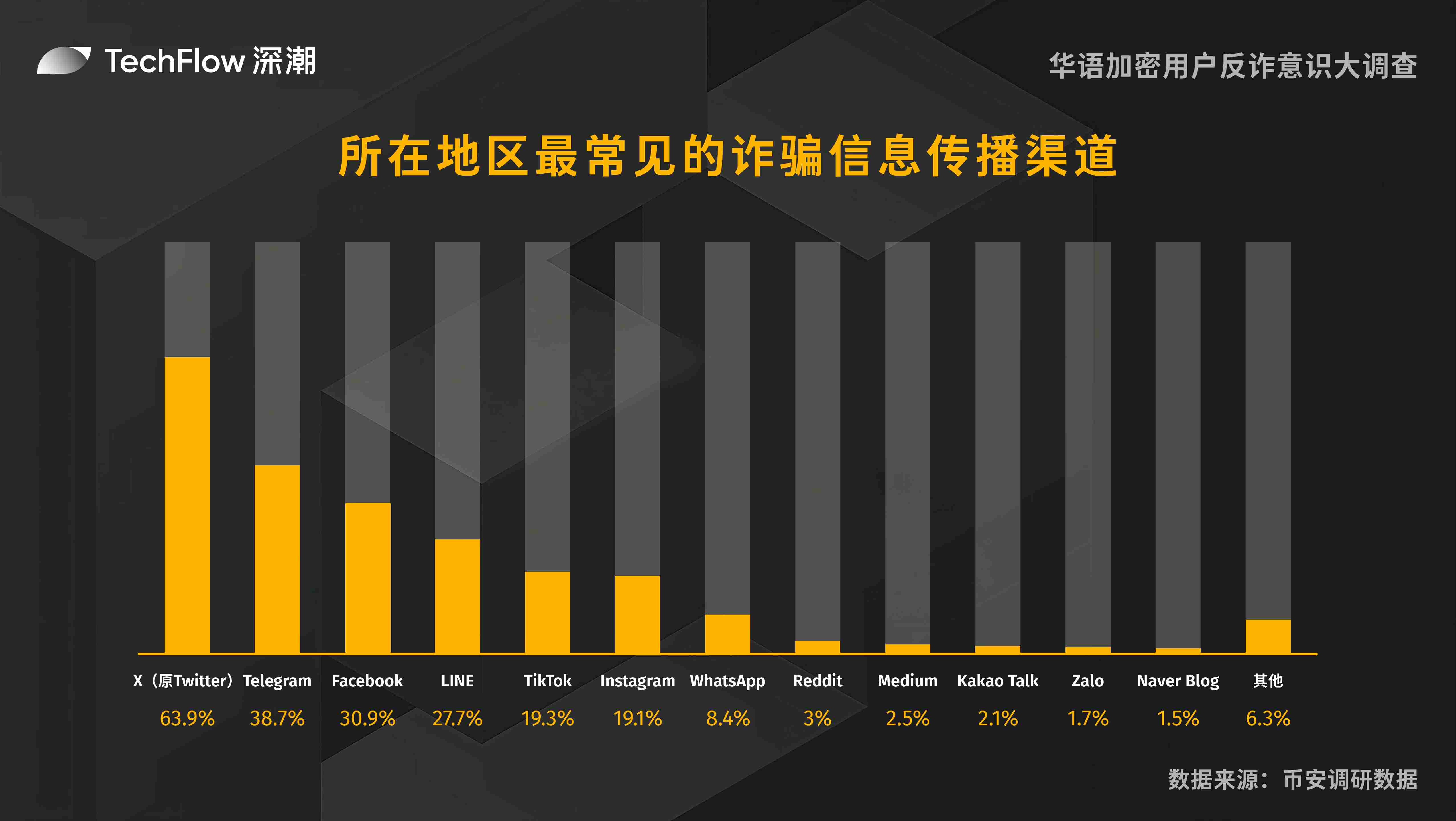

Social media channels where fraudulent information is most commonly spread in the area

In this survey, we conducted a detailed statistical analysis of the most common fraudulent information dissemination channels in the respondents' area. This survey helps us understand the influence of different social media platforms in spreading fraudulent information. This question is a multiple-choice question, and each respondent can select multiple options.

Main channels:

X (formerly Twitter): 63.9% is the most common channel for spreading fraudulent information, showing its strong influence in information dissemination.

Telegram: 38.7% also accounts for a large proportion, indicating its widespread use in the cryptocurrency community.

Facebook: 30.9% and LINE: 27.7% are also frequently mentioned, showing the popularity of these platforms in certain regions.

Secondary channels:

TikTok: 19.3% and Instagram: 19.1% show that these visual content platforms have also become channels for spreading fraudulent information.

WhatsApp: 8.4% and Other channels: 6.3% reflect that users occasionally encounter fraudulent information on other platforms.

Less mentioned channels:

Reddit: 3%, Medium: 2.5%, Kakao Talk: 2.1%, Zalo: 1.7%, Naver Blog: 1.5% The lower proportion of channels such as these shows the difference in usage preferences of these platforms among users in different regions.

Overall, although some platforms such as X and Telegram dominate the spread of fraudulent information, other social media platforms cannot be ignored. Users need to be vigilant on each platform to prevent fraudulent information.

Part 4: Demand for Exchange Security Services

This chapter focuses on the role of Binance in helping users deal with cryptocurrency fraud. The questions range from Binance's official verification channels, identifying the authenticity of Binance information, seeking Binance's help, hoping that exchanges/decentralized wallets will strengthen their security measures, to Binance's security products and anti-fraud education, depicting Binance's attempts to prevent cryptocurrency fraud.

Binance Official Verification Channel

Binance Official Verification Channel is a method provided by Binance for users to verify the identity of employees. Users can enter a website, email address, mobile phone number, Telegram or social media account to check whether the source is verified and from Binance official. In this survey, we counted whether respondents knew that they could confirm whether someone is an official Binance employee through the "Binance Official Verification Channel" page.

The data shows that 50.5% of respondents said they knew that they could confirm the identity of employees through the "Binance Official Verification Channel". While 49.5% of respondents said they did not know about this verification channel.

Although half of users are aware of the verification channel, there is still a need to strengthen the promotion of the official verification method.

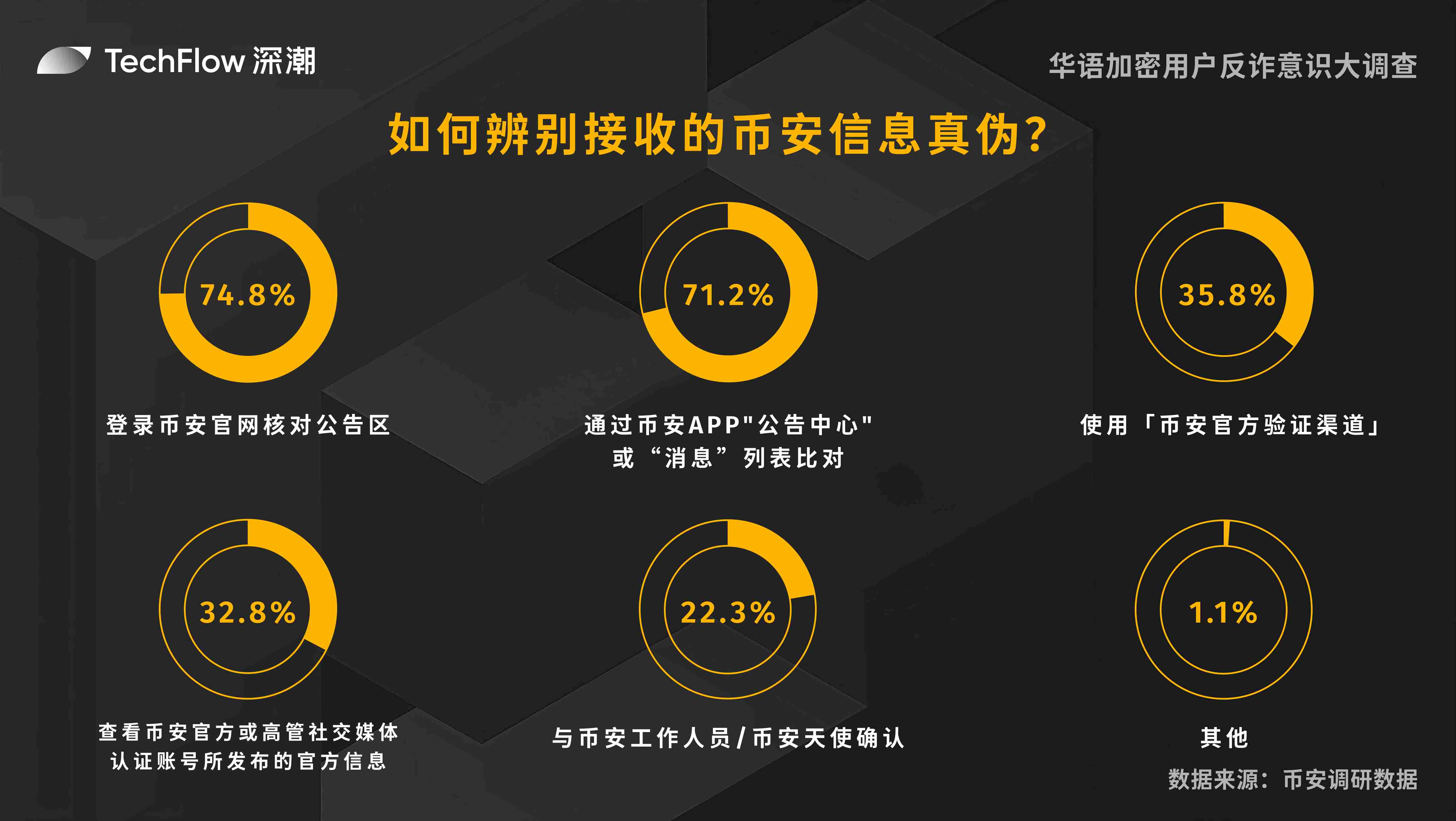

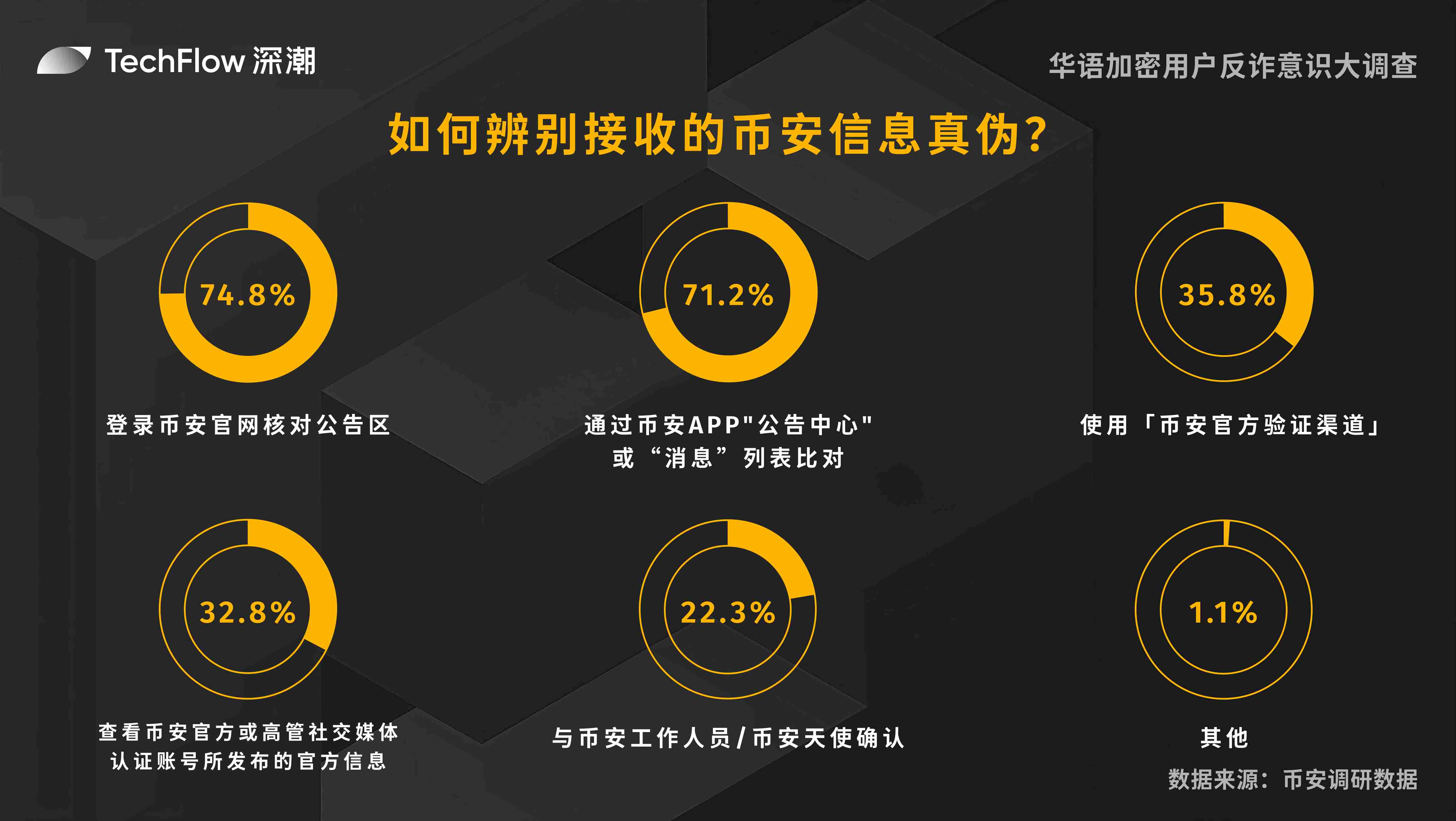

Distinguishing the authenticity of received Binance information

In this survey, we conducted a detailed statistical analysis of the methods used by respondents to distinguish the authenticity of Binance information. This survey helps us understand the different measures taken by users to confirm the authenticity of information. This question is a multiple-choice question, and each respondent can select multiple options. According to the survey results, we divide the users' identification methods into three categories:

Main identification method:

Log in to Binance official website and check the announcement area:The most commonly used method, most users (74.8%) tend to obtain authoritative information through the official website.

Compare through the Binance APP "Announcement Center" or "Message" list:Chosen by 71.2% of users, authoritative official announcements are often the most trusted verification method for users.

Secondary identification method:

Verify the sender information in the "Binance official verification channel":Although it is also an official channel, only some users (35.8%) chose it, which is probably because they are not familiar with this channel.

Check the official information released by Binance official or executive social media verification accounts:32.8% of users will rely on social media to obtain information.

Other methods:

Confirm with Binance staff or Binance Angels:22.3% of users choose to communicate with staff in the community to confirm the information.

Others: A very small number of users (1.1%) will use other unique methods for verification.

Overall, most users rely on official channels and applications to confirm the authenticity of information, but some users still conduct multiple verifications through social media and direct communication. This shows that in terms of information identification, users have adopted a variety of strategies to ensure the accuracy and reliability of information, but more users will confirm the official website information as soon as possible and follow the official website announcement.

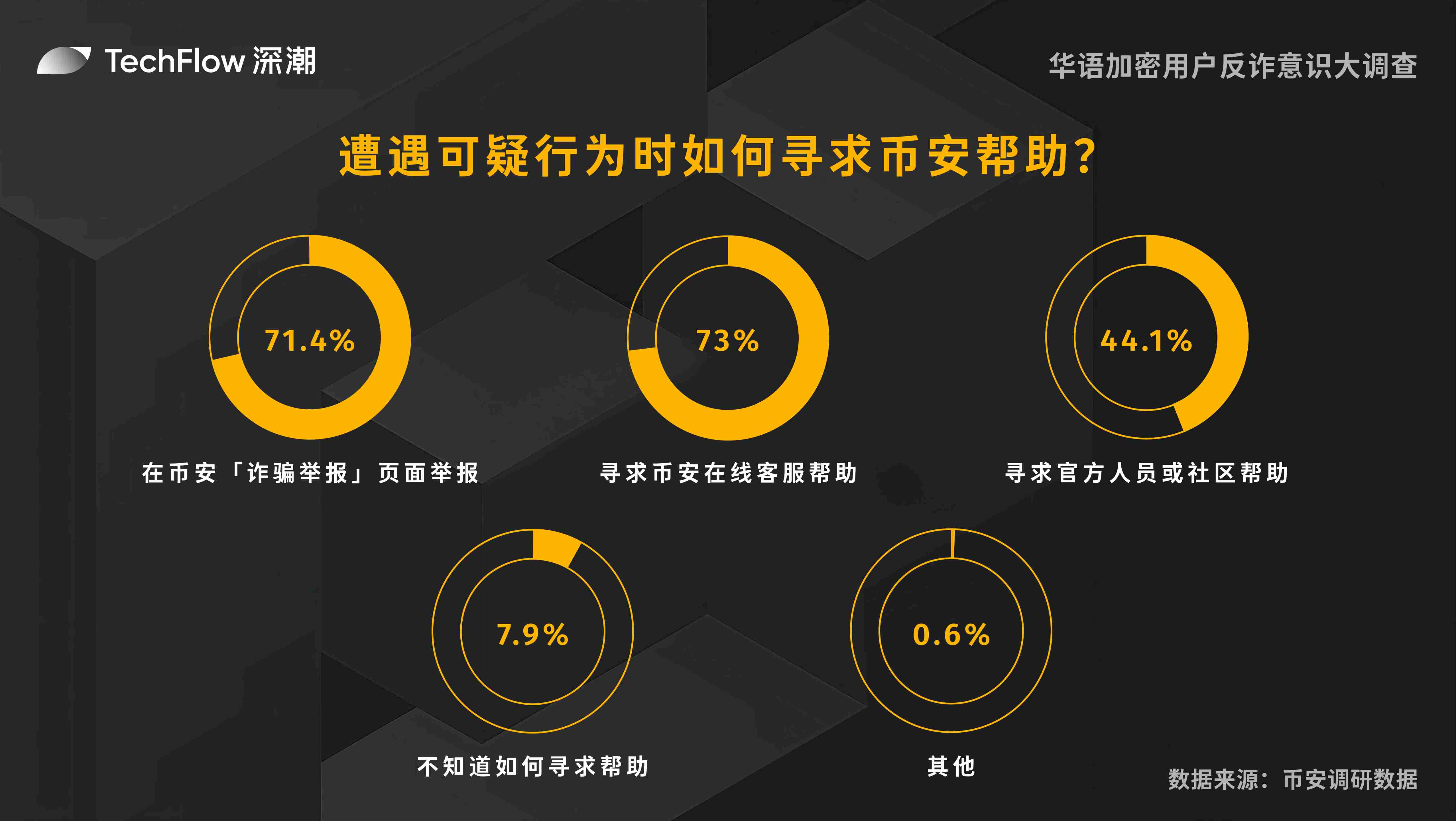

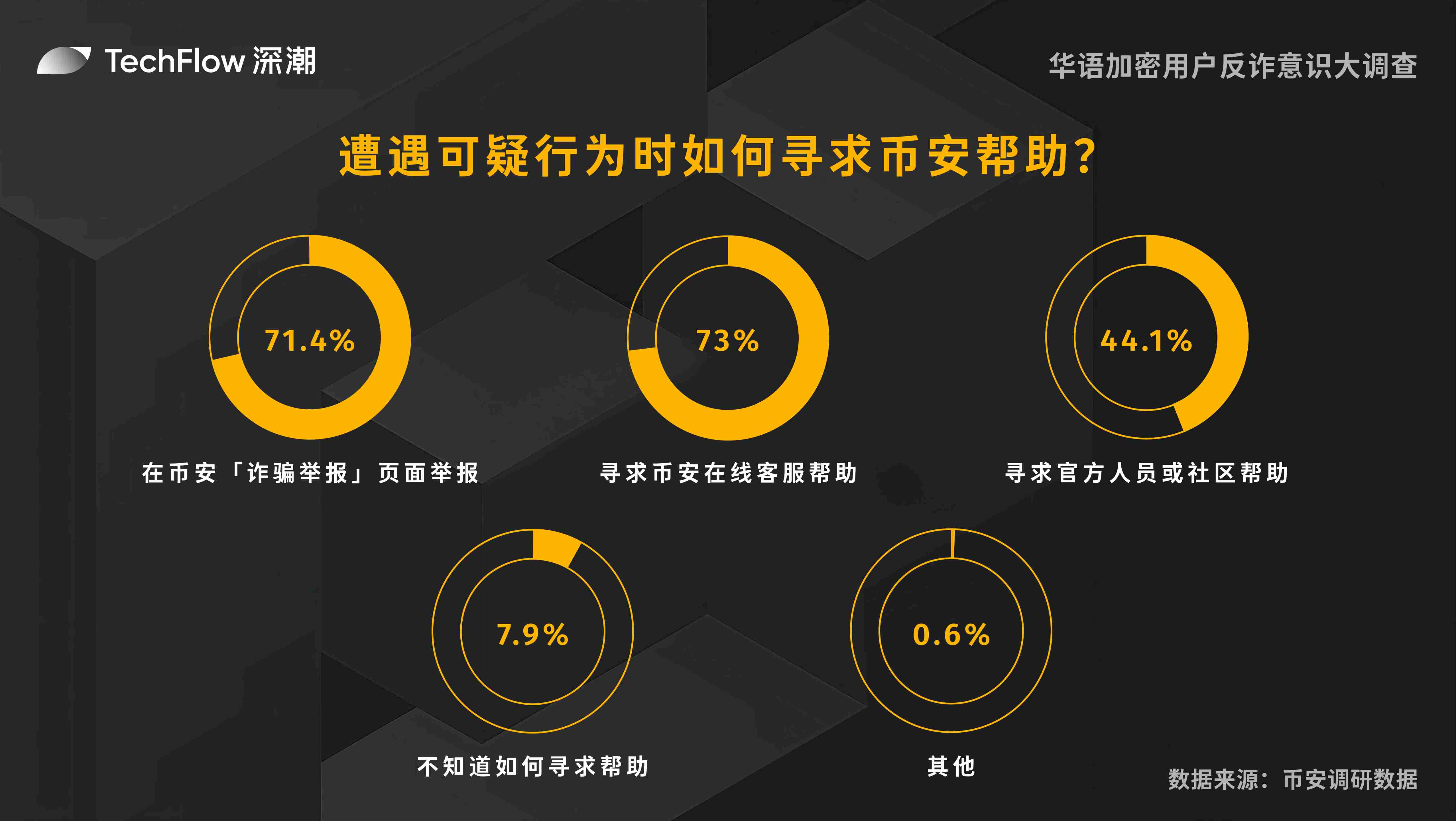

How to seek help from Binance when encountering suspicious behavior during trading?

In this survey, we conducted a detailed statistical analysis of the methods respondents used to seek help when encountering suspicious behavior during trading. This survey helps us understand how users respond to potential risks. This question is a multiple-choice question, and each respondent can select multiple options. We divide users' methods of seeking help into three categories:

Main method of seeking help:

Secondary method of seeking help:

Other methods:

Overall, most users tend to seek help through official channels such as customer service and reporting pages. Binance's "Scam Report" link is also familiar to and selected by more users, but some users still rely on community support or are not clear about how to deal with it, indicating that user safety education still needs to be strengthened to ensure that all users can get help in time when they encounter problems.

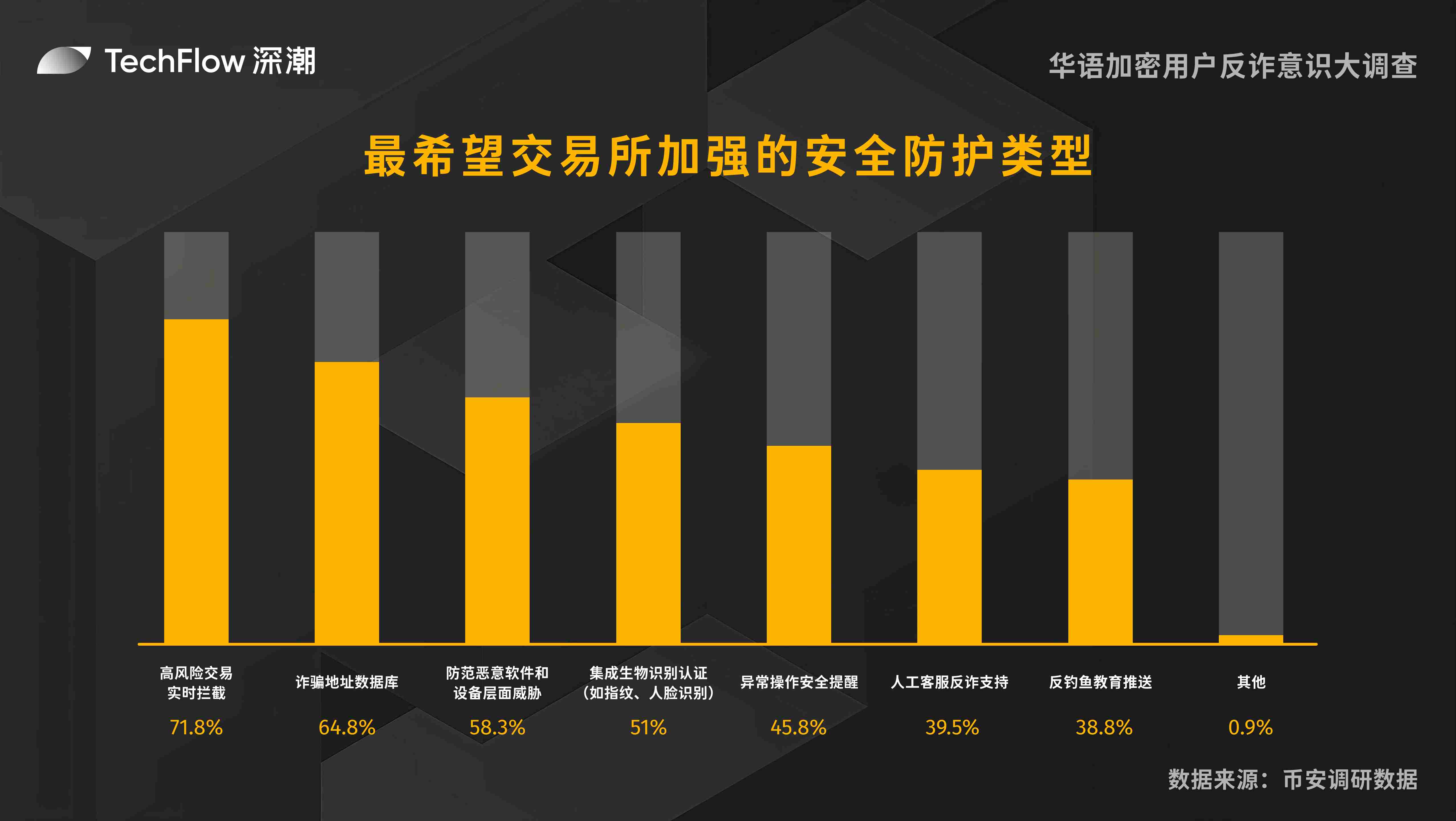

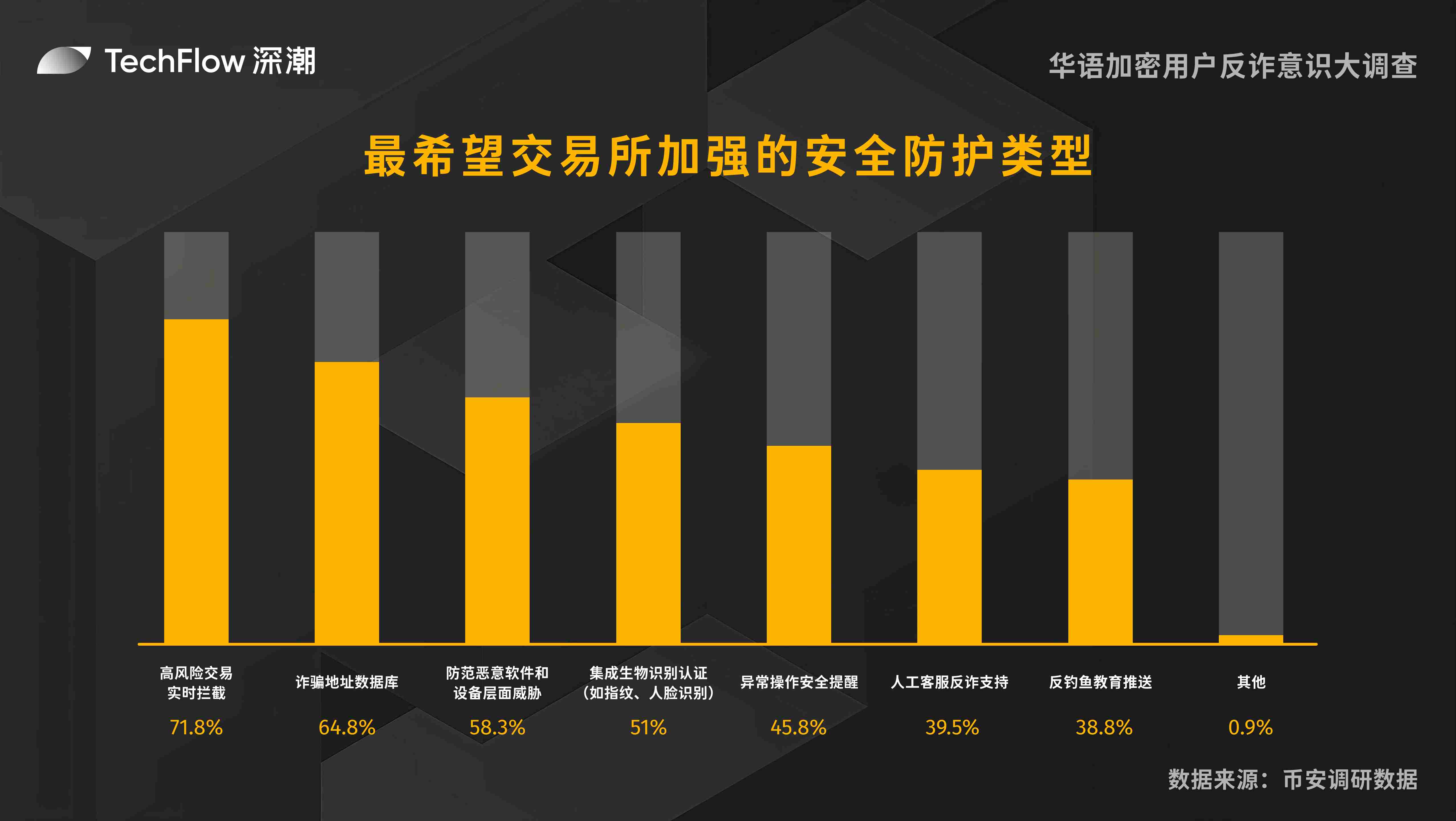

The most desired security protection type for exchanges

In this survey, we conducted a detailed statistics on the types of security protection that users hope exchanges will strengthen. This survey helps us understand the specific needs of users for improved security during trading. This question is a multiple-choice question, and each respondent can select multiple options. We divide the results into three categories according to their priority:

Main concerns:

71.8% of users hope that exchanges can conduct real-time interception of high-risk transactions, which shows that users have a strong awareness of the immediate risks that may occur during the transaction process and hope that exchanges can proactively identify and prevent potential threats.

64.8% of users hope that exchanges can provide a comprehensive library of fraudulent addresses for verification before trading. This reflects users' awareness of known fraud methods and their need for exchanges to provide preventive protection.

Secondary concerns:

58.3% of users are concerned about device security and expect exchanges to provide solutions to prevent malware. This shows that users are aware of the importance of device security to overall transaction security.

51% of users show interest in improving security through biometric technology and hope that exchanges will strengthen integrated biometric authentication, indicating that users are positive about the application of new technologies in identity authentication.

Other concerns:

45.8% of users hope to receive reminders when abnormal operations occur, which shows the expectation that exchanges can promptly notify users of potential risks.

39.5% of users hope that there will be manual customer service to provide anti-fraud support, emphasizing the importance of human support in complex fraud scenarios.

38.8% of users hope that exchanges can provide more anti-phishing education, indicating that users have a certain demand to improve their own security awareness.

0.9% showed other specific personalized security needs.

Overall, users' security protection needs for exchanges are mainly focused on real-time monitoring, preventive measures and the application of emerging technologies. They also hope to enhance their security awareness through education and manual support. This shows that exchanges need to take a two-pronged approach in technology and services to meet users' diverse security needs.

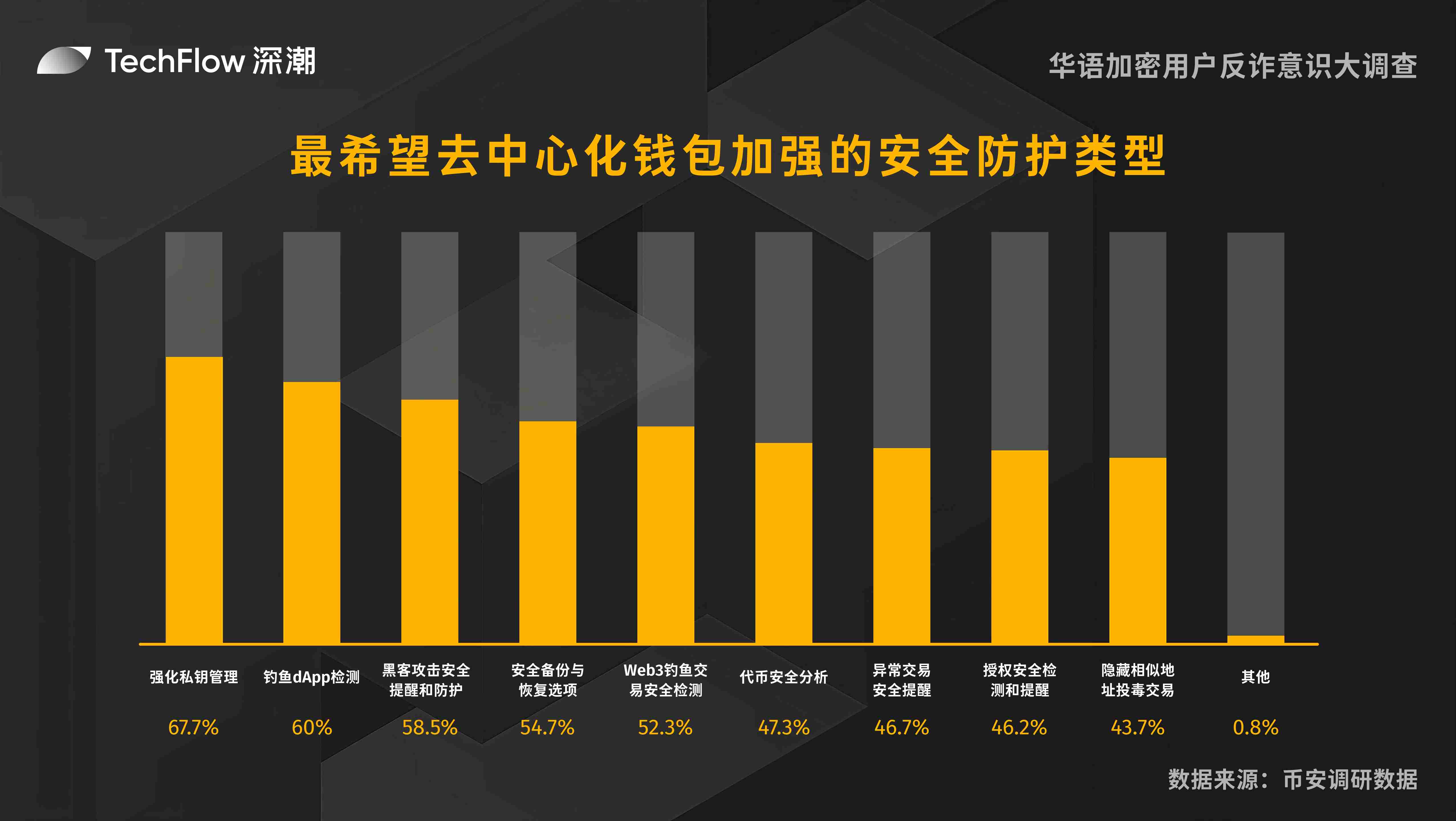

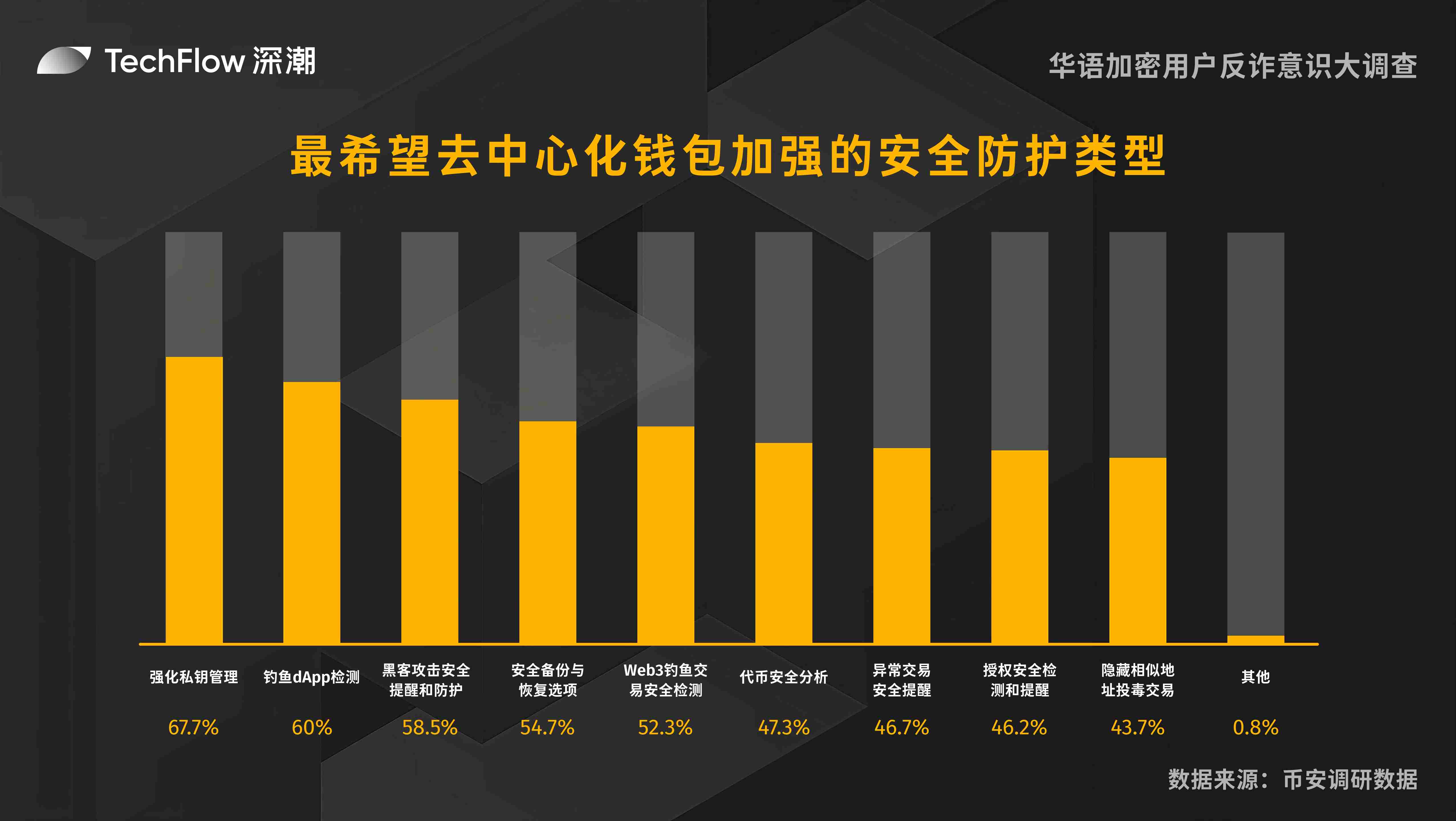

The most desired type of security protection for decentralized wallets

We investigated users' specific needs for wallet security protection. This question is a multiple-choice question, and each respondent can select multiple options.

On the wallet side, 67.7% of users hope that the wallet can strengthen private key management, and 54.7% of users hope to strengthen security backup and recovery options.

Regarding external risks, 60% of users emphasized the importance of phishing dApp detection, 52.3% of users hoped to enhance the detection of phishing transactions, and 58.5% of respondents hoped to identify hacker attacks more efficiently. In addition, 47.3%, 46.7%, 46.2% and 43.7% of users hoped to strengthen the monitoring of tokens, transactions, authorizations and similar address poisoning transactions.

0.8% of users proposed other personalized security requirements.

These data show that users have many requirements for the security functions of decentralized wallets, especially in private key management and phishing attack prevention, which provides a direction for subsequent optimization of the platform.

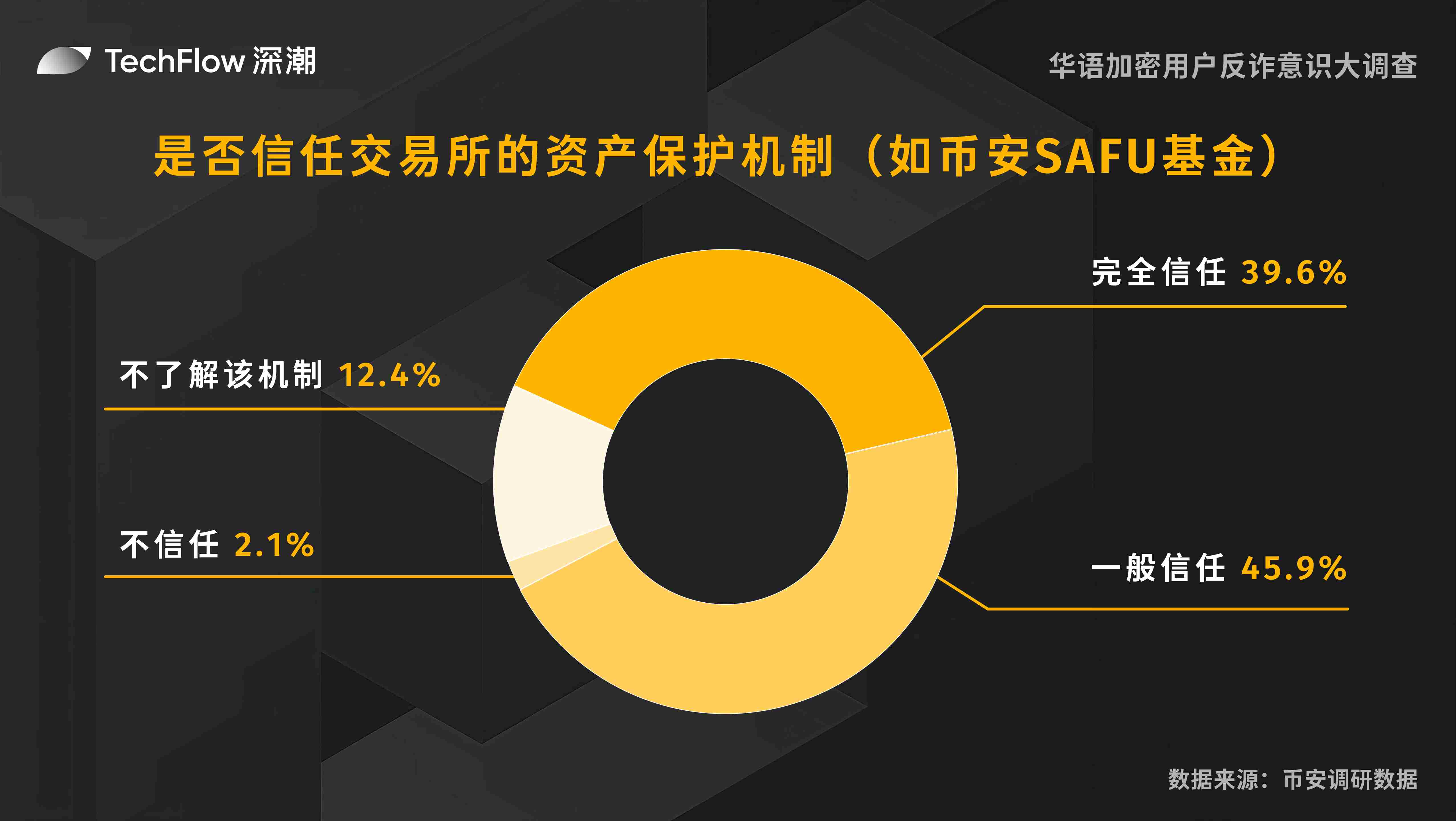

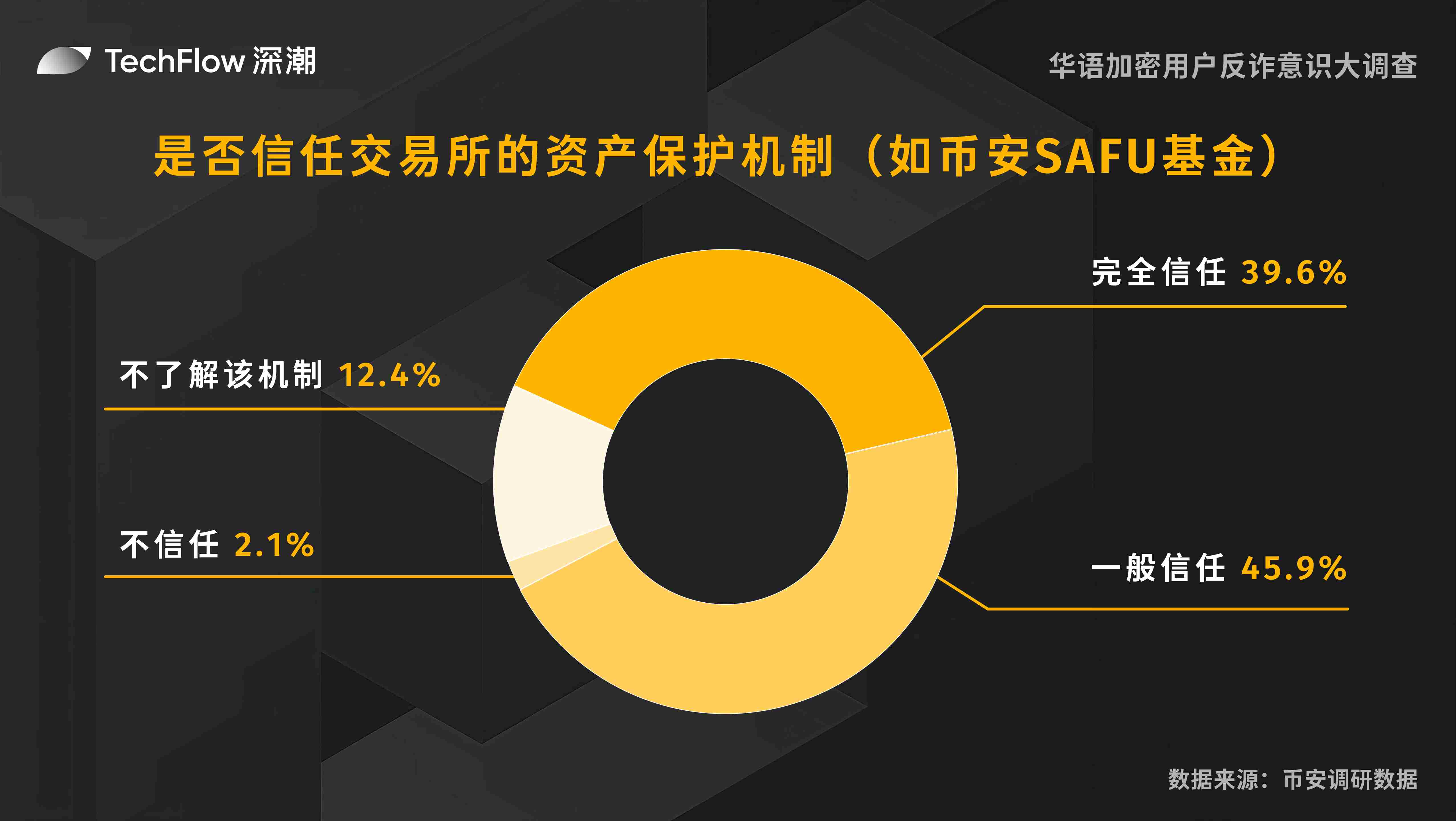

Do you trust the asset protection mechanism of the exchange (such as Binance SAFU Fund)?

In cryptocurrency trading, the asset protection mechanism of the exchange (such as Binance's SAFU Fund) plays an important role. We surveyed users' trust in these mechanisms.

Specifically, 39.6% of users expressed full trust in the asset protection mechanisms of exchanges; 45.9% of users had a general trust attitude; only 2.1% of users expressed distrust, and 12.4% of users said they did not understand these mechanisms.

The survey results show that the vast majority of users have a certain degree of trust in the asset protection mechanisms of exchanges. However, there are still some users who need more information to enhance their understanding and trust in these mechanisms. Exchanges can further enhance users' confidence in their security measures through transparent information disclosure and user education.

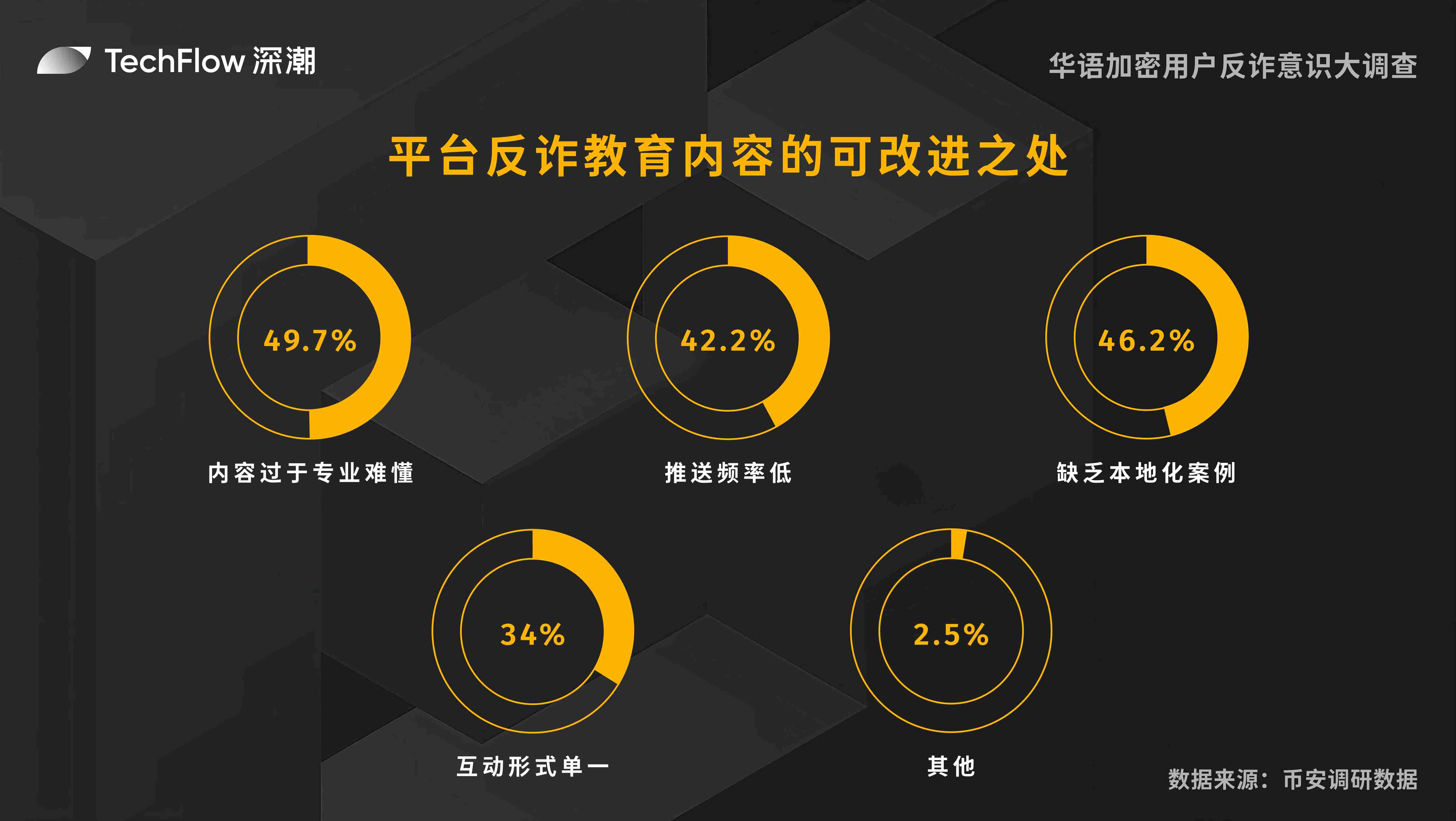

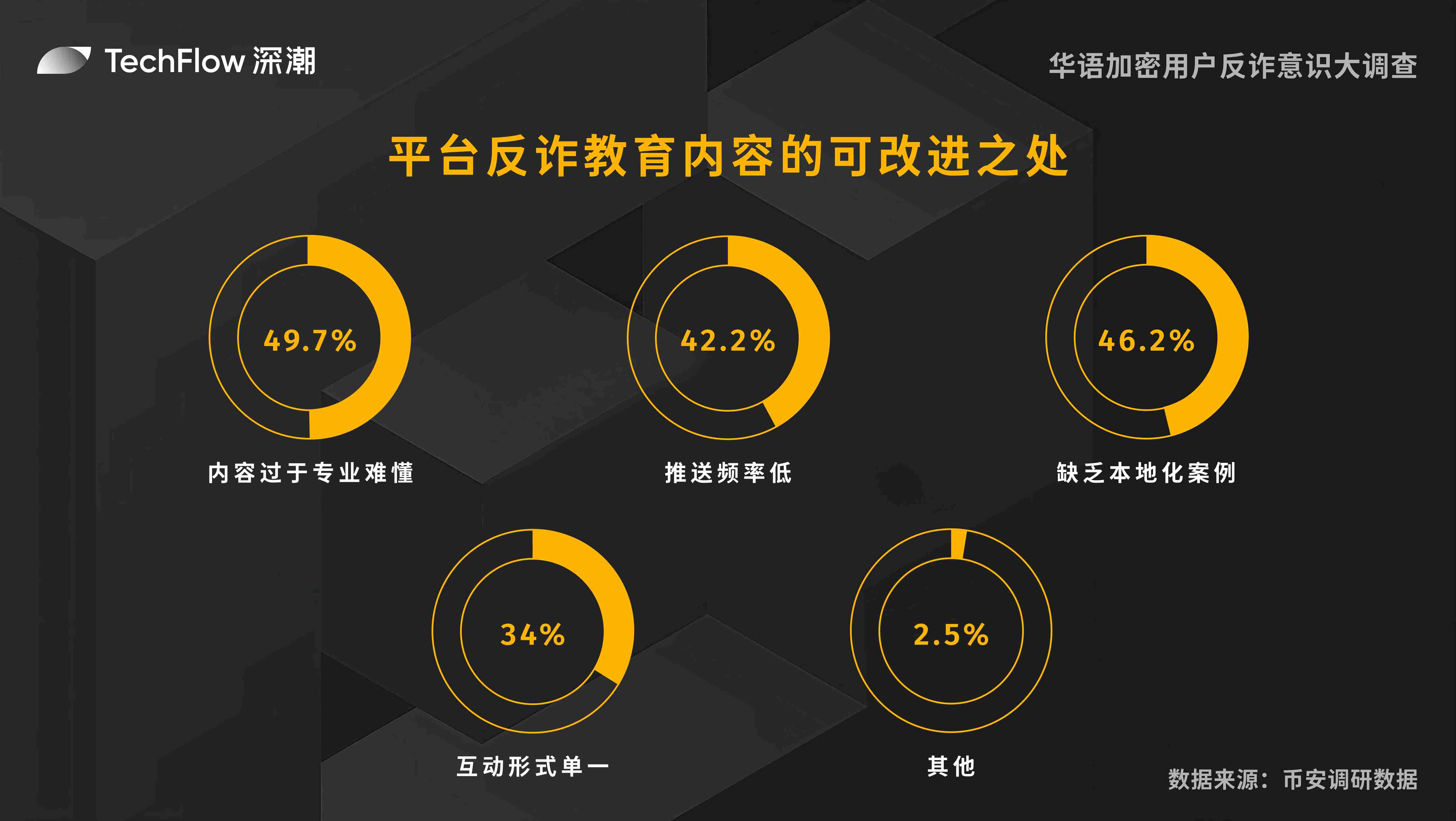

Possible improvements in the platform's anti-fraud education content

With the continuous escalation of cryptocurrency-related fraud methods, the importance of platform anti-fraud education content has become increasingly prominent. We investigated several aspects in which users believe these contents can be improved. This question is a multiple-choice question, and each respondent can select multiple options.

49.7% of users believe that the anti-fraud education content is too professional and difficult to understand, and nearly half of users hope that the content can be more easy to understand so that they can better understand and apply it.

42.2% of users said that the push frequency of anti-fraud content was too low, and suggested increasing the push frequency to improve users' vigilance and knowledge level.

46.2% of users pointed out that anti-fraud education content lacked localized cases, and hoped to see real cases related to their own living environment to improve the relevance and practicality of the content.

34% of users believed that the current interactive form was too single, and suggested adopting more diversified interactive methods to enhance user participation and learning effects.

In addition, 2.5% of users put forward other improvement suggestions, showing users' personalized needs for anti-fraud education content.

The survey results show that users' understanding and acceptance of the platform's anti-fraud education content needs to be improved, and the efficiency of anti-fraud education should be improved in a way that better caters to user needs, helping users better identify and prevent online fraud.

Part V: Security Features and Education Preferences

This chapter focuses on users' anti-fraud awareness, focusing on users' tendency to accept security warnings and their willingness to participate in anti-fraud simulation tests organized by the platform, which will help the platform more effectively help users identify cryptocurrency-related fraud and prevent it before it happens.

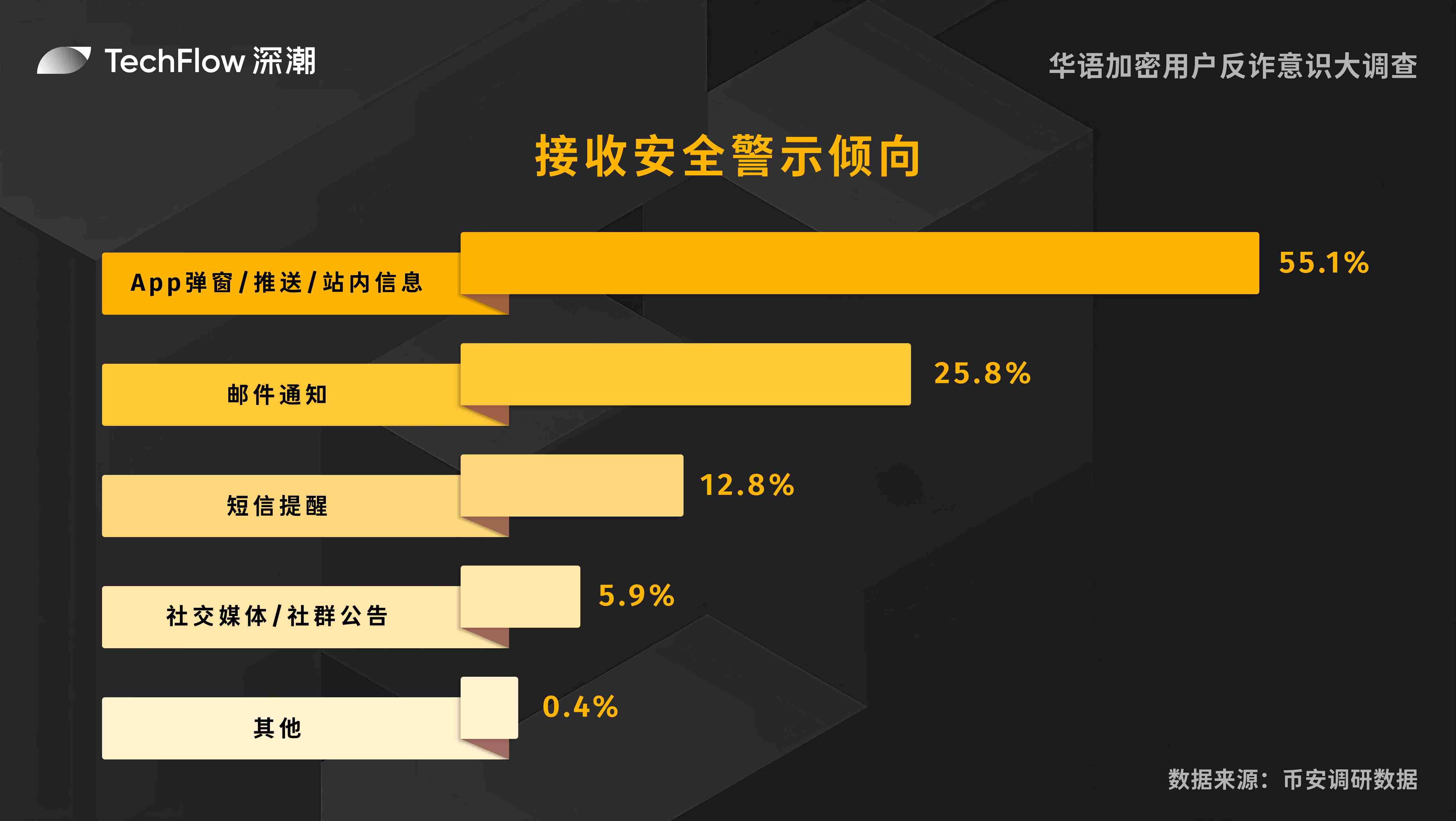

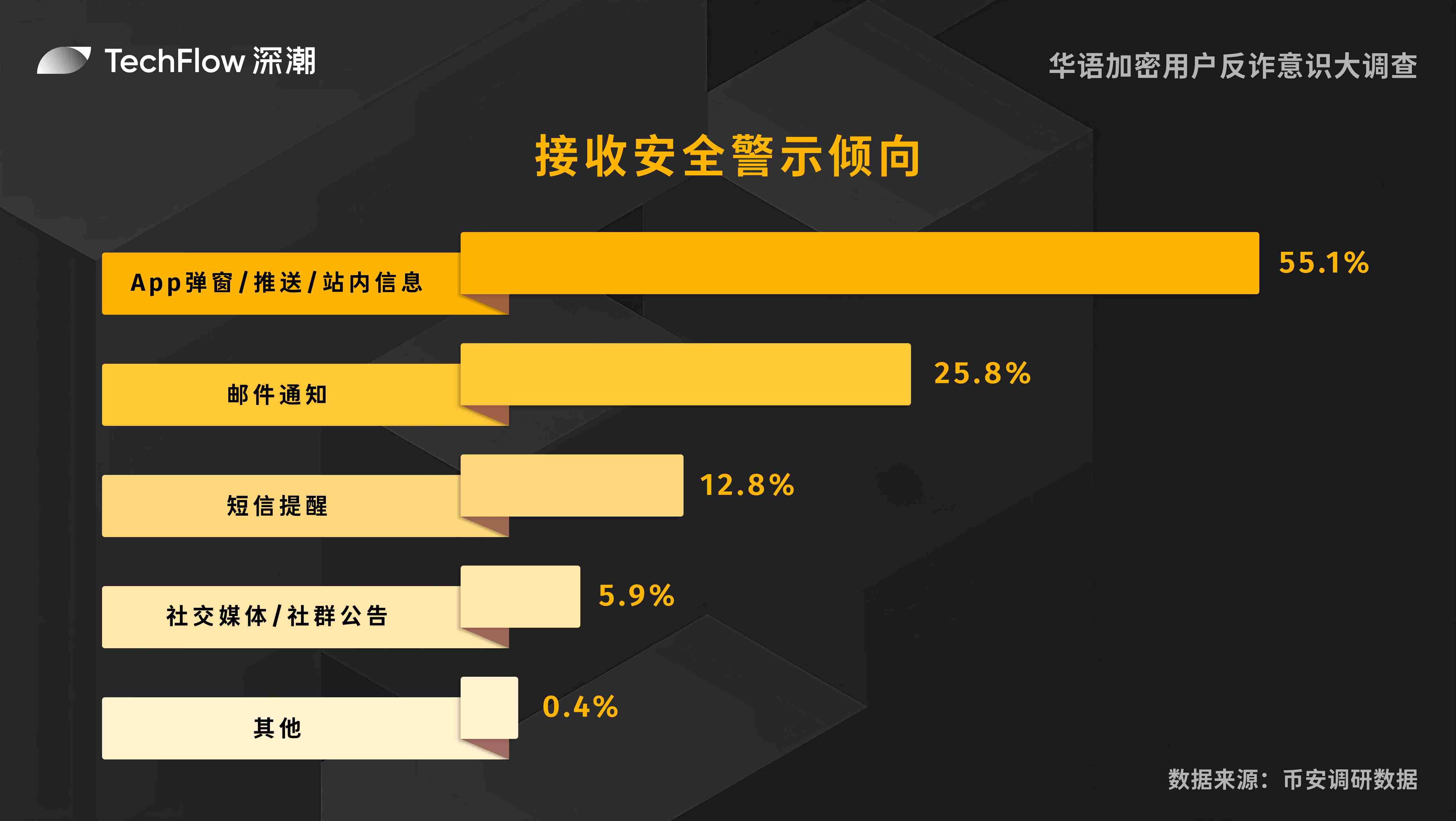

Preference for receiving security alerts

As information security becomes increasingly important, users have different preferences for how to receive security alerts. We investigated users' specific preferences in this regard.

55.1% of users prefer to receive security alerts through App pop-ups, push notifications, or in-site messages. This instant notification method is considered by most users to be the most effective reminder method.

25.8% of users prefer to receive security alerts via email. This method is suitable for users who are accustomed to checking emails frequently at work or in daily life.

12.8% of users choose SMS reminders, reminding us that traditional methods are often not to be ignored.

5.9% of users prefer to receive safety alerts through social media or community announcements. The reason why this method is not widely accepted may be that users cannot get information in the first time.

0.4% of users suggested other ways of receiving, showing the personalized needs of a few users.

The survey results show that most users prefer to receive safety alerts through instant App notifications. However, in order to meet the preferences of different users, the platform can provide multiple notification methods to ensure that safety information can be conveyed to all users in a timely and effective manner.

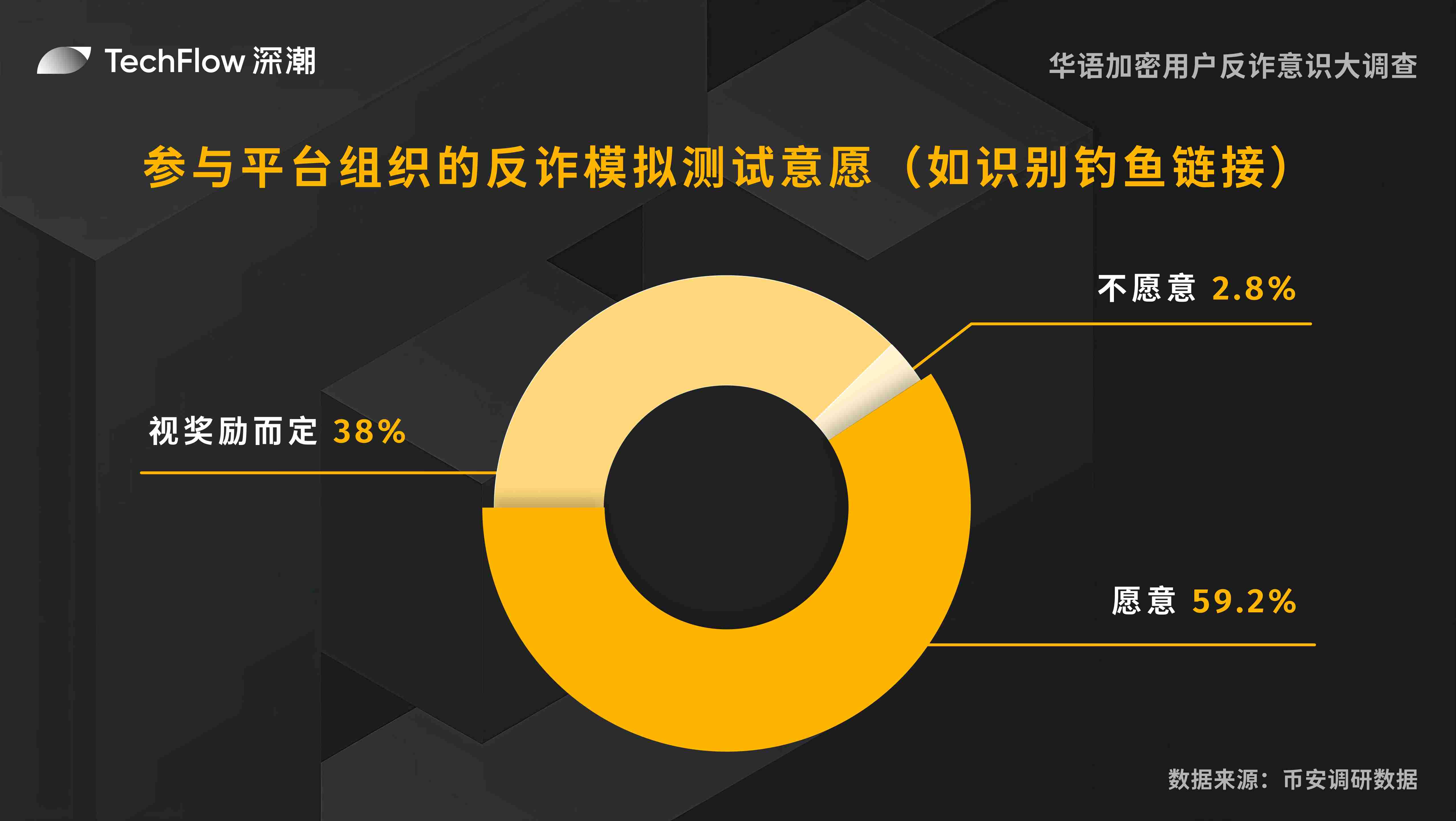

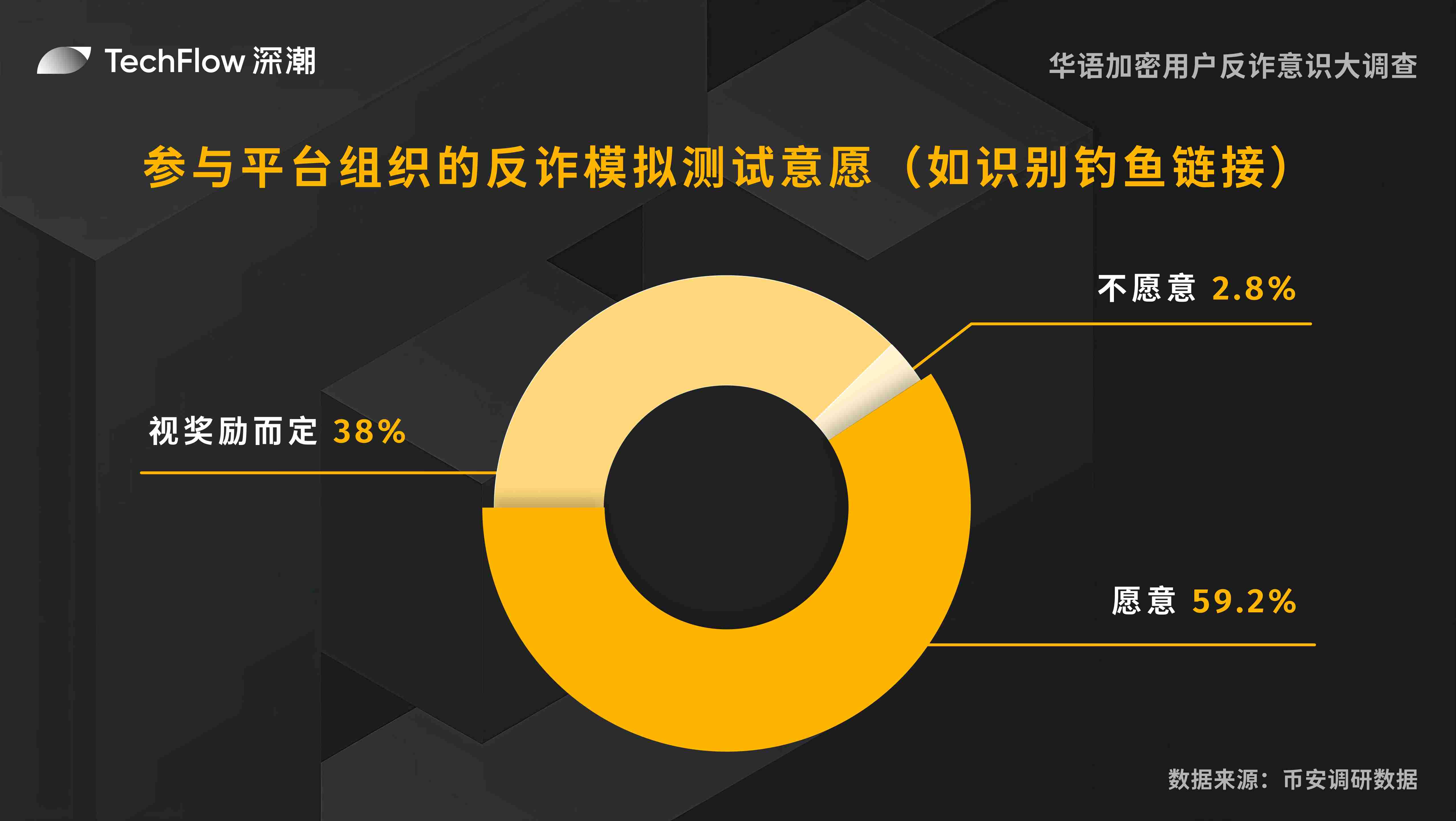

Willingness to participate in anti-fraud simulation tests (such as identifying phishing links) organized by the platform

Anti-fraud simulation tests are an important means to improve users' security awareness and skills. We investigated users' willingness to participate in anti-fraud simulation tests organized by the platform.

Specifically, 59.2% of users expressed their willingness to participate in anti-fraud simulation tests, 38% of users' willingness depended on rewards, and only 2.8% of users were unwilling to participate.

This shows that the vast majority of users are open to participating in such tests. The platform can also improve user participation by designing a reasonable incentive mechanism, thereby enhancing users' security prevention capabilities and awareness.

Joy

Joy