Author: Digital Legal Currency Research Society

Applicants: Suzhou Chutianlong Digital Technology Co., Ltd., Bank of Beijing Suzhou Branch

The "Jinghua Suyun" digital currency smart contract application solution was created by Suzhou Chutianlong Digital Technology Co., Ltd. (hereinafter referred to as "Suzhou Chutianlong") and Bank of Beijing Suzhou Branch. It is the first domestic digital RMB 2.5-layer institution (digital currency cooperation institution) to use the umbrella wallet model and the enterprise-level digital currency contract platform.

"Jinghua Suyun", with Suzhou Chutianlong as the main body, has settled in the Digital RMB APP, and piloted high-quality and featured merchants to use the "Jinghua Suyun" wallet fast payment capabilities as a pilot scenario, which is limited to the purchase of appointment consumption services.

The pilot high-quality and distinctive merchants will settle in the "Jinghua Suyun" reservation consumption platform, and use the smart contract reservation consumption service technology to issue digital RMB consumption cards to support individual users to consume in the pilot high-quality and distinctive merchants. Users choose to use the "Jinghua Suyun" consumption card for verification, and the pilot high-quality and distinctive merchants will transfer according to the member's single service amount. If the balance on the consumption card is insufficient, the deduction will fail. The verification funds after consumption are transferred through the umbrella wallet solution jointly developed by Bank of Beijing and CCB.

Scheme background

1. Industry and policy background

General Secretary Xi Jinping proposed to accelerate the construction of a financial power, emphasizing that a financial power has a series of key core financial elements, including a strong currency and a strong central bank. In October 2022, the Digital Currency Research Institute of the People's Bank of China published the "Solidly Carrying out the Research and Development Pilot of Digital RMB", which pointed out that since the 19th National Congress of the Communist Party of China, the People's Bank of China has taken Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era as its guide, and has carried out various research and development pilot projects of digital RMB in a solid manner, adhering to the principles of people-oriented, market-oriented and rule of law. After three stages of theoretical research, closed-loop testing and open pilot, it has promoted the digital RMB to embark on a development path that conforms to China's national conditions; at the same time, it proposed to use smart contracts to realize programmable features and build an open source ecological platform. The "Decision of the Central Committee of the Communist Party of China on Further Comprehensively Deepening Reforms and Promoting Chinese-style Modernization" reviewed and approved by the Third Plenary Session of the 20th Central Committee of the Communist Party of China made a decision on "steadily promoting the research and development and application of digital RMB", which is not only an affirmation of the past work of digital RMB, but also provides a fundamental follow-up and action guide for further promoting the development of digital RMB with the spirit of reform and innovation.

2. Industry difficulties and scene pain points

In commercial transactions, prepaid models are widely used, such as prepaid cards and prepaid services. However, there are many problems with the traditional prepayment method. Merchants frequently embezzle funds and run away with money. Consumers' rights are repeatedly infringed, and the industry's trust has fallen to the bottom. At the same time, the digital transformation is lagging behind, and there is a lack of mature technical solutions to integrate payment, fund management and rights protection, which restricts the healthy development of the industry.

Consumers face difficulties such as difficulty in refunding and recovery, and the safety of prepaid funds is not guaranteed; merchants have complex fund management, cumbersome collection and refund processes, and high operating costs. In addition, the information asymmetry between the two parties leads to constant transaction disputes.

3. The application potential of smart contracts in the prepayment field

Smart contracts can provide a new solution for the prepayment model. By writing prepayment rules into smart contracts in the form of code, the funds can be automatically managed, released and settled according to conditions, effectively reducing risks and improving the security and transparency of transactions. At the same time, smart contracts can also be combined with other financial technology means, such as big data and artificial intelligence, to provide users with more personalized and intelligent prepayment services.

Solution Goals

1. Solve the pain points of the scenario

Use the characteristics of digital RMB, which are controllable, anonymized, tamper-proof, and loadable smart contracts, to create a safe "safe" for prepaid funds, accurately transfer prepaid funds according to smart contract rules, solve the problems in the field of prepaid consumption, and protect the rights and interests of consumers.

Provide merchants with digital operation tools, optimize business processes, improve operational efficiency, reduce operating costs, and lead the prepaid consumption industry to develop in the direction of digitalization and intelligence through technologies such as smart contracts. At the same time, with the help of smart contracts and umbrella wallets, the flow of funds can be clearly traceable, and the efficiency of merchant fund management can be improved.

Relying on the credibility of the central bank's digital RMB legal currency, the entire transaction process is transparent and traceable, eliminating information gaps and enhancing consumers' trust in merchants.

2. Project implementation goals

Establish an industry benchmark in Suzhou, form a replicable "Beijing-Suzhou Charm" model, and radiate to the fields of "food, housing, transportation, travel, shopping, entertainment, medicine, education, agriculture, and finance".

Promote the application scenarios of digital RMB in Suzhou and a wider range, improve the awareness and acceptance of digital RMB among ordinary people, expand application scenarios, and enrich the digital RMB ecosystem.

Solution features

1. Advantages compared to similar products

(1) Pioneering model: As the first domestic digital RMB 2.5-layer institution (digital currency cooperation institution), it uses the umbrella wallet model to cooperate with the enterprise-level digital currency contract platform, and innovatively uses the umbrella wallet and smart contract technology to achieve the management of prepaid funds. Bank of Beijing relies on its rich financial resources and professional merchant service capabilities to ensure the robustness of financial services; Suzhou Chutianlong takes advantage of its scene construction and is responsible for platform construction. The two sides complement each other's strengths and work together to build a digital RMB application ecosystem, opening up new paths for cross-industry cooperation to explore innovative applications of digital RMB, which has reference value and demonstration significance.

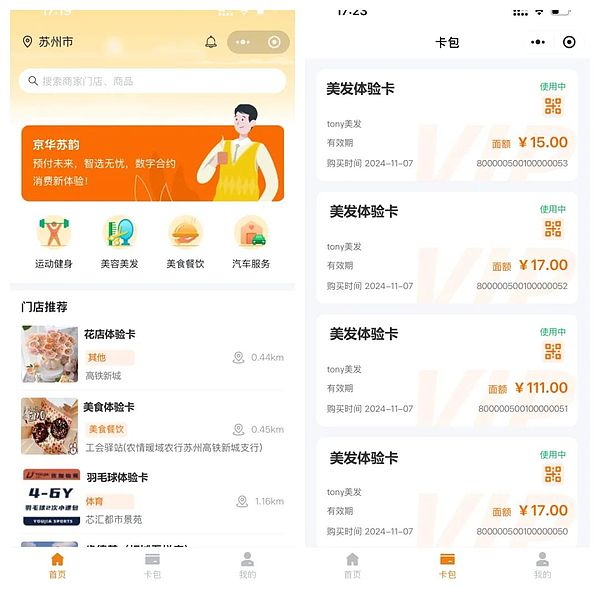

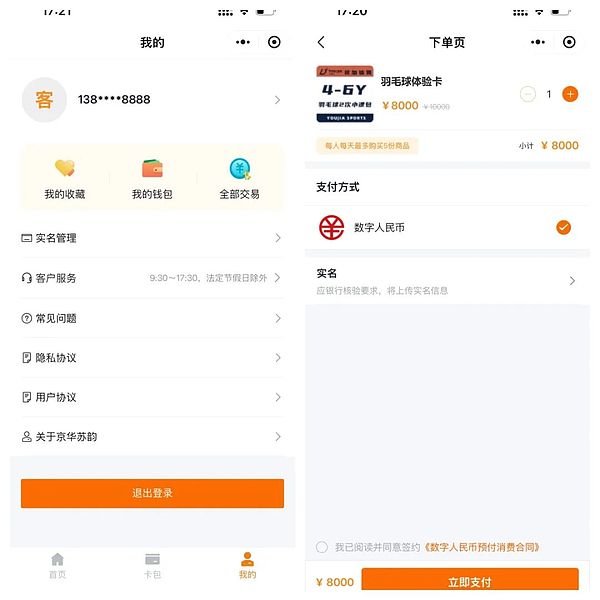

(2) Functional completeness: Online card purchase, inquiry, card return and refund, card code display and other functions are all available, and the operation is simple and convenient. Mini programs are provided for merchants to help merchants conduct digital operations such as store management and member management.

(3) Technology driving force: Use advanced blockchain, cloud native and other digital technologies to improve the security, convenience and intelligence of financial services.

(4) Service differentiation: Create personalized and customized financial service products to meet the needs of different customer groups.

2. Pain points solved

Reduced financial risks: Digital RMB smart contract technology ensures the safe management of prepaid funds. At the same time, the management of funds through the umbrella wallet solution effectively reduces financial risks.

Improved operational efficiency: Under the traditional prepaid consumption model, the procedures for purchasing cards, consumption, and returning cards are cumbersome, inefficient, and involve financial risks. Through Jinghua Suyun, functions such as online one-click card purchase, convenient verification, and quick card return are realized, which improves operational efficiency and reduces operating costs.

Merchant empowerment: Aiming at the pain points of merchants, we provide digital transformation solutions to resolve the complexity of fund management, help reduce costs and increase efficiency, and at the same time use digital tools to attract customers and reshape market competitiveness.

3. Industry influence

(1) Setting standards and leading the way: It provides a digital transformation model for the prepaid consumption industry. By demonstrating how to use digital RMB smart contract technology to solve the pain points of traditional industries, other prepaid consumption merchants can follow suit, thereby promoting the digital upgrade process of the prepaid consumption industry.

(2) Fusion-driven: We can learn from the model of integrating multiple resources, building an ecosystem, and customizing services according to customer needs, deeply combining the application of digital RMB with the business of various industries, and promoting the deep integration of digital finance and the real economy.

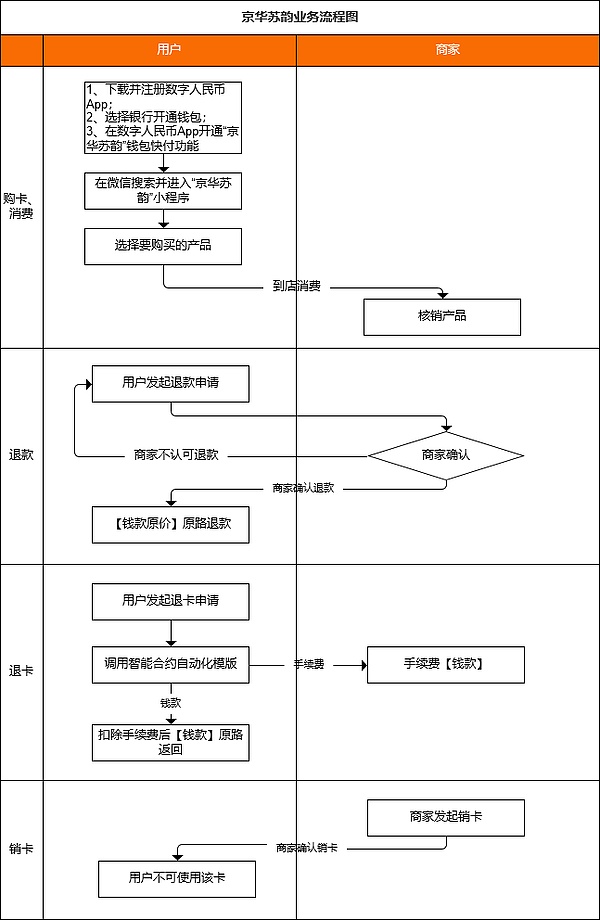

Business process diagram of the solution

Function display

Solution cases and effects

1. Achievements

2. Classic Case

Pilot high-quality and distinctive merchants to settle in the platform. This pilot work will be carried out in two phases. The face value of a single card is 5,000 yuan, and a single user is limited to 2 cards. The total number of cards issued for the overall project will reach tens of thousands.

3. Expected Results

(1) User level: During the pilot phase of the project, the total number of cards issued for the project will reach tens of thousands, providing users with a safe, convenient and preferential consumption experience, enhancing users' trust in and stickiness to the digital RMB, and cultivating users' digital RMB consumption habits.

(2) Merchant level: Help merchants to achieve digital operation upgrades, improve fund management efficiency, reduce fund risks, expand customer groups, and drive other merchants in the industry to actively follow up on digital transformation.

(3) Industry level: Set a digital operation model for the prepaid consumption industry, promote the standardized development of the industry, form a replicable and popularizable business model and operation model, promote the application of digital RMB in more scenarios, and improve the digital level and financial service quality of the entire industry.

(4) Social level: Through the digital RMB smart contract technology, consumer rights will be protected, consumer disputes will be reduced, and the healthy and stable development of the consumer market will be promoted. At the same time, strong support will be provided for the comprehensive promotion of the digital RMB, helping the deep integration of the digital economy and the real economy, and promoting the innovative development of the regional economy.

Future Outlook of the Solution

1. Solution Improvement Direction

(1) Functional expansion: Further expand the functions of the platform, such as adding more prepaid consumption scenarios, such as education and training, beauty and hairdressing, catering and entertainment, etc.

(2) Technology upgrade: Continue to follow the development trend of digital technology, such as the application of artificial intelligence in risk prevention and control and user profiling, and continuously improve the technical level and security of the platform to provide users with better services.

(3) User experience optimization: Based on user feedback and behavior data, further optimize the platform's interface design, operation process and interactive experience to enhance user stickiness and satisfaction.

2. Market demand forecast

As a consumption model, prepaid consumption has become an indispensable part of consumer life, playing a certain role in facilitating payment, promoting consumption and prospering the market. Prepaid cards are widely used in service industries such as sports and fitness, education and training, elderly care services, childcare, medical beauty, etc., and are showing a trend of gradual expansion.

In recent years, prepaid card institutions have been actively exploring a transformation path that suits them. In order to reassure customers and comply with regulatory requirements, some prepaid card institutions are actively exploring business innovation.

According to relevant statistics, there are more than 100 million prepaid card operators nationwide, with an annual prepaid card amount of more than 10 trillion yuan; more than 10 million in the Yangtze River Delta region, with an annual prepaid transaction amount of more than 1 trillion yuan; more than 1 million in Shanghai, with an annual prepaid transaction amount of no less than 100 billion yuan. Observing the direct economic volume, the scale of the prepaid card market has exceeded 20% of the total retail sales of consumer goods.

The "2023 Single-Purpose Commercial Prepaid Card Market Development Report" pointed out that by the end of 2023, there were 7,472 registered card issuing companies nationwide, an increase of 3.69% over the previous year. The registered companies issued a total of 1,594,422,800 cards throughout the year, an increase of 39.37% over 2022; the cumulative amount of cards issued was 739.113 billion yuan, an increase of 15.13% over 2022.

3. Policy Forecast

The government will continue to increase its support for the promotion and application of digital RMB, introduce more policies to encourage financial institutions and enterprises to carry out innovative cooperation, and promote the in-depth application of digital RMB in the real economy. This will provide a good policy environment for the sustainable development of the "Jinghua Suyun" digital currency smart contract application platform, help the platform to be promoted and applied in a wider range of fields and regions, and form a greater scale effect and demonstration driving role.

Aaron

Aaron

Aaron

Aaron Joy

Joy Catherine

Catherine Kikyo

Kikyo Joy

Joy Catherine

Catherine Aaron

Aaron Hui Xin

Hui Xin Alex

Alex Snake

Snake