This Thursday, the most important IPO in the crypto market after Coinbase is coming.

Circe, the issuer of the USD stablecoin USDC, will be listed on the New York Stock Exchange, with an estimated maximum fundraising of $896 million, and the stock code is CRCL.

However, on the eve of the listing, the share price of a Hong Kong-listed company, China Everbright Holdings, continued to rise, up 44% in 5 days, involving a secret Circle China story.

Everbright Holdings and IDG Capital jointly invested in Circle in 2016 and became its shareholder.

Even in 2018, domestic media reported that Cicle might be injected into a domestic A-share listed company, which prompted the Shenzhen Stock Exchange to send a letter of inquiry, and finally the listed company had to come forward to refute the rumor.

Circle's frequent contacts with Chinese companies are also a witness and epitome of its historical development. From encrypted wallets to exchanges to stablecoins, Circle's youthful years were full of hardships and twists and turns.

This article takes you through Circle's historical process and its relationship with China.

The initial dream: Alipay in the United States

In 2013, Jeremy Allaire and Adobe Chief Scientist Sean Neville co-founded Circle, headquartered in Boston, which was his third formal startup.

Before that, he founded two listed companies, software company Allaire and online video platform Brightcove in 1995 and 2012, respectively, and accumulated deep connections.

When Circle was first established, it received $9 million in Series A financing, setting a record for the highest amount of financing ever raised by a cryptocurrency company at the time.

Investors include Jim Breyer, Accel Partners and General Catalyst, all of whom were investors in Allaire's previous company, Brightcove. Rather than investing in Circle as a company, it is better to say that they are investing in Jeremy Allaire as a person.

Circle did not initially get involved in stablecoins, but was determined to create an "American version of Alipay."

Circle's initial product form was a digital currency wallet, which mainly provided cryptocurrency (Bitcoin) storage and legal currency exchange services, and used Bitcoin to achieve rapid fund transfers.

For example, international transfers using SWIFT require 3-5 working days of confirmation, but using Circle, you can quickly transfer money by relying on the path of "cash-bitcoin-cash". In this process, Bitcoin becomes the middle channel.

At this time, Allaire was a firm believer in Bitcoin and believed that it was only a matter of time to realize a cross-border payment system. He wanted users to be able to transfer money and pay without too many obstacles, just like using emails and short messages.

Then, Circle continued to sing.

In August 2015, Circle received $50 million in financing led by Goldman Sachs Group and IDG Capital.

Why did IDG Capital participate in the lead investment in Circle?

This may be inseparable from Jim Breyer, an early investor in Circle, who is famous for his early investment in Facebook. He also has another identity - IDG's investment partner in the United States.

IDG's investment also laid the groundwork for Circle's future relationship with China.

In September, Circle obtained the first digital currency license BitLicense issued by the New York Department of Financial Services, which means that Circle can provide digital currency services in New York State with a license.

In the same year, China's mobile payment market was in turmoil. WeChat quickly squeezed out Alipay's market share by relying on WeChat red envelopes. Circle on the other side of the ocean did not just wait and see, but also launched social payment at the end of the year.

At that time, this was a bold attempt at innovation. Now, it may be due to its unclear positioning, which laid the groundwork for the subsequent multiple transformations.

China Destiny

In 2016, Circle became connected with many Chinese VCs.

In June, the sun was scorching, and Circle successfully joined hands with a number of Chinese capitals and announced the completion of a US$60 million Series D financing, led by IDG Capital, the lead investor in Series C. In addition, Chinese companies such as Baidu, Everbright, CreditEase, Wanxiang, and CICC Jiazi followed suit.

Among them, IDG Capital led Circle's Series C and D consecutively and joined its board of directors. IDG Capital founder and partner Xiong Xiaoge once commented on the investment:

Nowadays, domestic investment in Internet companies is basically in applications, not technology. A very important reason is that there are more innovations in business models in China, but relatively few in technology. The American technologies invested by IDG Capital, such as Circle's Bitcoin blockchain technology, are basically of the type that "the United States can do it, but China cannot do it at present, or it is not as good as the United States." However, although the technology is invested abroad, IDG Capital's original intention is to bring cutting-edge technology to China one day and achieve long-term development. This is our "Chinese perspective" when investing in an American company.

Not only has Circle introduced a lot of Chinese capital, but it also has a "dream of entering China."

In early 2016, Circle established an independently operated Circle China company - Shike China, with Tianjin Shike Technology Co., Ltd. as the main body, which means "payment that can be used all over the world." The company's CEO is Li Tong, the EIR (entrepreneur in residence) of IDG Capital at the time, and Xiao Feng of Wanxiang Group is a director.

Founder Allaire said that Circle will conduct business under China's regulatory framework and will not rashly launch products without government approval.

In addition, Circle has been communicating and sharing information with Chinese regulators, banks and other institutions. However, my country attaches great importance to financial security, and a third-party payment license is required to conduct payment business in China. Therefore, Circle's business in China has been stagnant for a long time, with no substance in name only.

According to Qichacha information, on August 15, 2020, Tianjin Shike Technology Co., Ltd. applied for simple cancellation, and was officially cancelled on September 7, withdrawing from China.

Circle's entry into China ultimately became a pipe dream.

Difficult transformation

In 2016, as the debate over Bitcoin forks and expansion intensified, Allaire gradually became dissatisfied with the stagnant development of Bitcoin. "Three years have passed, and the development of Bitcoin has slowed down a lot," Allaire said in an interview before.

On December 7, Circle issued an announcement announcing that it would "abandon its Bitcoin business" and retain the transfer business of Bitcoin and legal currencies such as the US dollar, but users could not buy and sell Bitcoin, and said that "Circle will shift its business focus to social payments."

But in fact, Circle's overall development strategy has shifted from payment to trading. "Allaire downplayed the role of Bitcoin (payment) in Circle's business and started to do more about making money," Coindesk once reported.

In the field of cryptocurrency, what business is the most profitable? Exchange.

In 2017, Circle stated that although it had cancelled the function of directly buying and selling Bitcoin in the APP, it still made markets for large exchanges and launched Circle Trade, which provides large-scale crypto asset OTC services for institutional clients.

In February 2018, Circle announced the acquisition of Poloniex, an encrypted asset exchange, for $400 million, officially entering the field of cryptocurrency exchanges.The financing of this acquisition was led by its major shareholder IDG Capital.

In May, Circle continued to announce financing news, announcing that it had received $110 million in financing, led by Bitmain, and followed by IDG Capital, Breyer Capital and other old shareholders.

It is worth noting that Bitmain, the lead investor, was also invested by IDG Capital. According to TechFlow, it was IDG Capital that came forward to make Bitmain the lead investor. At this time, IDG was already Circle's largest institutional shareholder.

This investment is extraordinary for Circle. On the one hand, it is a financing based on the ultra-high valuation of 3 billion US dollars after the investment. Less than a year later, its valuation fell by 75%.

Secondly, in the second half of 2018, the crypto market ushered in a tragic bear market. Both Circle and Bitmain will face a life-and-death test. With this money, it has helped Circle to overcome difficulties to a certain extent.

With the capital injection, Circle began to attack everywhere and tried to blossom in all aspects.

In July 2018, Circle launched the stablecoin USDC anchored to the US dollar. Looking back, this is undoubtedly a historic moment. Circle made the most important decision for it.

In addition to the core exchange and stablecoin business, Circle's layout has also begun to extend outward.

In October 2018, Circle acquired the equity crowdfunding platform SeedInvest and established Circle Reseach to output cryptocurrency industry news and reports.

So far, driven by capital, Circle has become a comprehensive cryptocurrency group with exchanges as the core and stablecoins and OTC diversified development: Poloniex provides trading services; Circle Pay provides transfers; SeedInvest is used to raise funds; Circle Trade provides over-the-counter trading services; USDC is a US dollar stablecoin.

Everything looks good, but as everyone knows, the cold winter has arrived, and this diversified layout is extremely dangerous.

2019 was the darkest year in Circle's history.

In February, Cointelegraph Japan first disclosed that Circle was valued at $705 million on the SharesPost stock trading platform. Nine months ago, Circle was valued at $3 billion after receiving a $110 million investment from Bitmain. In less than a year, its valuation plummeted by 75%.

In May, Coindesk reported that Circle had laid off 30 employees, about 10% of its total employees, and later three executives left in succession.

But perhaps the biggest headache for Allaire is the failure of Poloniex, which he acquired with a lot of money.

On May 13, 2019, Poloniex announced that it would remove 9 cryptocurrencies from the pages of US users. Because according to US law, these tokens are close to the concept of securities, but they are not registered with the SEC, which poses a risk of violation. In October, 6 cryptocurrencies were removed from the shelves again, losing a lot of profits.

For this reason, Allaire publicly expressed his dissatisfaction with US regulators several times, but he had no choice but to transfer Poloniex's business entity to Bermuda, where the regulatory environment is more relaxed. On July 23, Circle announced that Poloniex (P Network) will obtain a Bermuda digital asset business license.

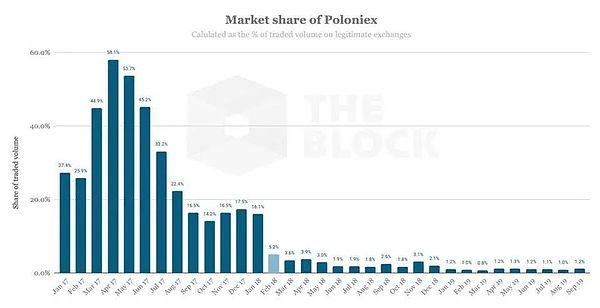

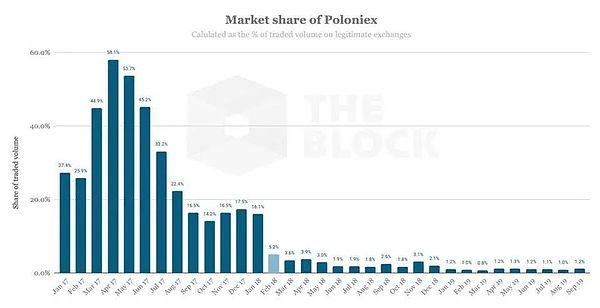

But this still cannot stop Poloniex from losing market share. From a market share of nearly 60% (among compliant exchanges) in 2017, to a market share of only 1% in September 2019.

Valuation plummeted, core business suffered setbacks, talent loss...Circle once again stood at the crossroads of fate.

At the moment of life and death, Circle chose to cut off its arms to survive, and gradually divested its core businesses from the second half of 2019 and focused on the stablecoin USDC.

In June 2019, Circle announced that from July 8, the Circle Pay service will gradually cancel support for user payments and charges, and finally completely cancel all support for Circle Pay on September 30.

On September 25, Circle announced the suspension of the Circle Research project.

In October, to everyone's astonishment, Circle sold its exchange business Poloniex to "Polo Digital Assets", which was operated by an Asian investment company. The actual controller behind it is Sun Yuchen, the founder of TRON.

According to SPAC documents disclosed later, Circle lost more than $156 million in its acquisition and subsequent sale of Poloniex.

On December 17, Circle sold its OTC desk Circle Trade to the exchange Kraken.

In 2020, Circle's crypto investment and trading app Circle Invest was sold to Voyager Digital in the form of equity.

So far, after a series of downsizing, Circle has transformed from a diversified cryptocurrency group to a stablecoin issuer focusing on the US dollar stablecoin USDC.

Dollar Ambassador

Circle's business model for issuing stablecoins is simple and profitable:the company issues USDC stablecoins anchored 1:1 to the US dollar, and invests user deposits mainly in short-termU.S. Treasury bonds, thereby earning almost risk-free returns.

Currently, USDC issuance exceeds $61 billion, equivalent to more than $61 billion in reserves, invested in U.S. Treasuries (85% managed by BlackRock's CircleReserveFund) and cash (10-20% deposited in global systemically important banks).

According to financial statements, in 2024, Circle generated approximately $1.6 billion in interest income from investing in U.S. Treasuries, accounting for 99% of Circle's total revenue.

However, its net profit fell from $268 million to $156 million, and one of the hidden risk points is the bloodsucking of its partner Coinbase.

In 2018, Circle and Coinbase co-founded the Centre Alliance to launch USDC.

In 2023, the Centre Alliance was dissolved, Coinbase acquired Circle's equity, and Circle completely controlled the USDC ecosystem, but Coinbase still retained the right to dividends on part of the income.

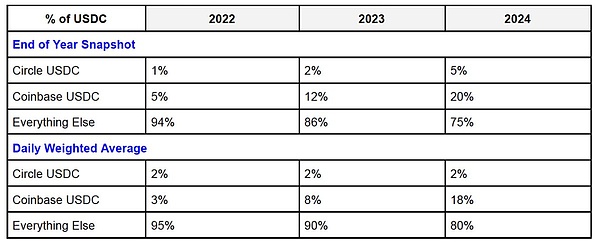

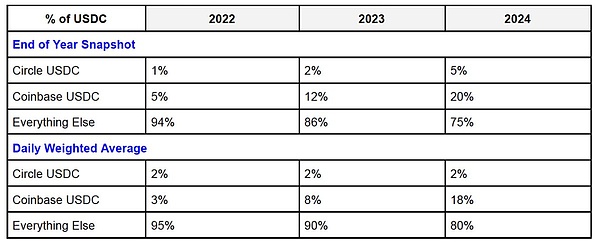

The total supply of USDC can be divided into three parts: Coinbase's USDC, Circle's USDC, and USDC on other platforms.

· Coinbase: including Coinbase Prime and USDC held by exchanges.

· Circle: including USDC held by Circle Mint.

· Other platforms: USDC held by decentralized platforms such as Uniswap, Morpho, and Phantom.

According to Circle's S-1 filing, Circle and Coinbase have the following profit sharing agreement:

USDC on the Coinbase platform : Coinbase obtains 100% of the reserve income.

USDC on Circle platform: Coinbase obtains 100% of the reserve income.

USDC on non-Coinbase platforms: Coinbase and Circle each obtain 50% of the reserve income.

Coinbase's share of the total supply of USDC is growing rapidly, reaching about 23% in the first quarter of 2025, and USDC is currently Coinbase's second largest source of revenue, accounting for about 15% of revenue in the first quarter of 2025, exceeding staking revenue.

With the stable currency leader USDT difficult to shake in the short term, and the adverse impact of the Fed's expected rate cuts, and Coinbase's blood-sucking profits, Circle is not stable, but its IPO is "just in time."

The United States Stablecoin Act (GENIUS Act) was passed by the Senate on May 21 and is currently under review by the House of Representatives. Once formally passed, it will bring significant strategic benefits to Circle.

The core content of the GENIUS Act happens to be Circle's advantage:

First, it requires that each stablecoin issued must be backed by an equivalent amount of US dollar cash or US debt;

Second, stablecoin issuers must register with the US federal government and disclose their reserves monthly to ensure the safety of funds, and must also comply with anti-money laundering and anti-crime regulations;

Third, if the issuing company goes bankrupt, stablecoin holders will have priority in redemption.

After the bill is passed, compliance-first companies like Circle will obtain legal status certification, thereby enhancing the trust of institutional investors and ordinary users in USDC.

In the past, traditional financial institutions' concerns about regulatory uncertainty have always been the main obstacle to their adoption of stablecoins, and the GENIUS Act will eliminate this obstacle, opening up new opportunities for Circle to cooperate with banks, payment service providers and large companies, and expanding the application scenarios and market share of USDC.

And in the future, Circle will also shoulder its strategic responsibilities: become an important executor of the dollar globalization strategy and at the same time provide strong support for the U.S. Treasury bond market.

This is also the core narrative after its IPO and

Catherine

Catherine