Author: Earl Cho, Declan Kim Source: DeSpread Research

Key Points

CBDC and stablecoins are complementary rather than alternative, reflecting the digital continuation of the traditional dual monetary system of central bank money and commercial bank money.

As demonstrated by projects such as Project Agorá, CBDC is critical for cross-border settlement in terms of legal finality, monetary sovereignty, and governance neutrality.

Bank-issued stablecoins serve institutional use cases that require wholesale settlement and regulatory trust, while non-bank stablecoins are optimized for the retail economy and Web3 ecosystem, forming a parallel structure.

To balance monetary sovereignty and innovation, South Korea should adopt a dual-track approach: allowing non-bank stablecoin experiments within the regulatory sandbox while promoting institutional stablecoins led by commercial banks.

Introduction

This report analyzes the structural role and coexistence possibility of central bank digital currency (CBDC), commercial bank-issued stablecoins, and non-bank-issued stablecoins as core monetary tools in the digital currency era, and proposes a Korean version of the institutionalization strategy. The dual structure of the traditional monetary system (central bank currency + commercial bank currency) continues in the digital age, and the newly added non-bank currency issuance structure on this basis makes the digital currency system evolve towards a "three-axis" model.

There are essential differences between various currencies in terms of issuing entities, technical infrastructure, policy acceptance, and regulatory feasibility. Therefore, it is necessary to design a coexistence policy of functional differentiation and parallel structures rather than integrating them into a single order. Through global experimental cases, this report examines the public functions and technical limitations of various digital currencies, with particular emphasis on the role of CBDC as a core means of international settlement and protection of monetary sovereignty, the function of bank stablecoins as a traditional financial digital tool, and the status of non-bank stablecoins as a retail economy and Web3 ecological innovation tool.

Given the high attention paid by South Korea's policy environment to monetary sovereignty, foreign exchange management, and financial stability, the report proposes a realistic strategy of focusing on cultivating bank-led stablecoins and restricting non-bank stablecoins to limited experiments within the regulatory sandbox framework. In addition, the report also proposes a hybrid structure that can ensure technical neutrality and interoperability between public chains and private infrastructure, which can become a bridge between the traditional financial system and private innovation.

By analyzing the digital currency institutionalization path and technical infrastructure strategy that South Korea can choose, this report proposes a policy direction that can both align with the global policy order and ensure the sustainable development of the country's monetary system.

0. Report Purpose and Scope

This report aims to analyze the global issuance and circulation model of digital assets anchored by legal tender, and propose a set of institutional development directions suitable for Korean policymakers and industries. For readers in other regulatory regions, please refer to the content of this report in conjunction with the local policy background.

This report first clarifies two concepts that are often used interchangeably: central bank digital currency (CBDC) and stablecoin. Although both claim to be pegged to legal tender at a 1:1 ratio, there are essential differences in definition and use. Based on this, the report further explores how CBDC, bank-issued stablecoins, and non-bank-issued stablecoins can achieve functional complementarity and institutional coexistence in an on-chain environment with the three pillars of digital currency.

Note: The "stablecoin" discussed in this report refers specifically to stablecoins that are fully collateralized with legal tender at a 1:1 ratio. Other forms of stablecoins, such as overcollateralized, algorithmic or yield-based, are not within the scope of this report.

1. CBDC vs. Stablecoins

1.1. Digitalization of the Dual Currency System

The modern monetary system has long relied on a "dual structure" consisting of money issued by the central bank (such as cash and reserves) and money created by commercial banks (such as deposits and loans). This architecture strikes a good balance between institutional trust and market scalability. In the era of digital finance, this structure continues, represented by central bank digital currencies (CBDCs) and bank-issued stablecoins. With the in-depth development of digitalization, non-bank stablecoins issued by fintech companies or cryptocurrency companies are emerging as the third pillar of the monetary system, further reshaping the digital currency landscape. The current digital currency system can be summarized as follows:

CBDC: Digital currency issued by the central bank, which is an important tool for achieving monetary policy, financial stability, and payment and settlement infrastructure upgrades.

Bank stablecoin: Digital currency issued by banks with customer deposits or treasury bonds, cash, etc. as collateral. Among them, deposit tokens are a form of 1:1 deposits on the chain, which has a high legal certainty and regulatory relevance. In addition, it can also be issued based on assets other than deposits (cash, treasury bonds, etc.), including models such as stablecoin projects jointly launched by multiple banks.

Non-bank stablecoin: Digital currency usually issued by entities outside the banking system such as fintech companies and cryptocurrency companies, and circulated on the public chain. In recent years, a hybrid model has also emerged through cooperation with trusts, custody, and entrusted banks to try to ensure the basic nature and institutional acceptance of deposits.

BCG (2025)classifies digital currencies into three categories based on the difference between the issuer and the underlying assets: CBDC, deposit tokens and stablecoins. Among them, CBDC is issued by the central bank and serves as the base currency, assuming the public trust and final settlement functions; deposit tokens are the form in which commercial banks tokenize deposits and put them on the chain, which is highly compatible with the traditional financial system. Stablecoins are digital assets issued by private institutions and collateralized by physical assets such as legal currency or government bonds, and are mainly circulated and settled in the decentralized technology ecosystem.

However, this classification method is not always adopted by the regulatory systems of various countries. Taking Japan as an example, its regulatory design focuses more on "whether the issuer is a bank" rather than the technical distinction between "deposit tokens and stablecoins". Although the Japanese government explicitly allowed the issuance of stablecoins by revising the Funds Settlement Act in 2023, eligible issuers are limited to banks, fund transfer institutions and trust companies, and collateral assets are limited to bank deposits in the initial stage. Currently, it is being explored to allow up to 50% of the collateral to be Japanese government bonds, showing the possibility of coexistence of deposit tokens and stablecoins. However, from the perspective of the restrictions on issuance authority, Japan's institutional framework still clearly tends to be a bank-centric model, which is directionally different from BCG's classification based on technology types.

In contrast, the United States' non-bank dollar stablecoins have already dominated the global market and have strong market demand. Therefore, the classification of stablecoins centered on private entities in the United States is more in line with reality. In contrast, countries such as South Korea and Japan, which have not yet formed any digital token system, may be more reasonable to use the model with the credibility of the issuance structure and the coordination with monetary policy as the core standards from the initial stage of institutional design. This is not just a comparison of technology types, but also reflects the differences in policy value judgments.

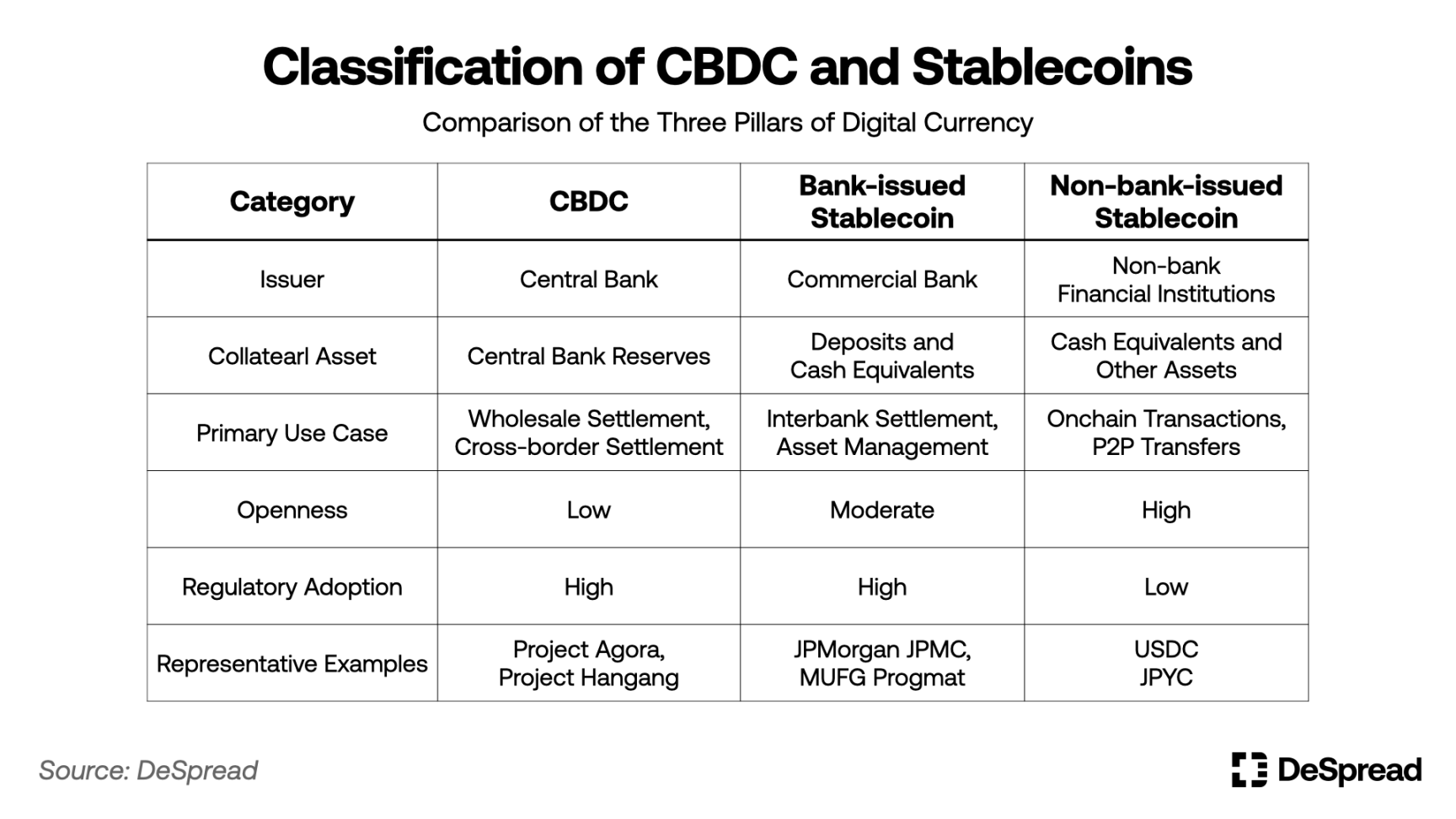

Based on this, this report proposes to redefine digital currencies into three categories: CBDC, bank stablecoins and non-bank stablecoins based on policy acceptability, issuance structure trust mechanism, and monetary policy fit.

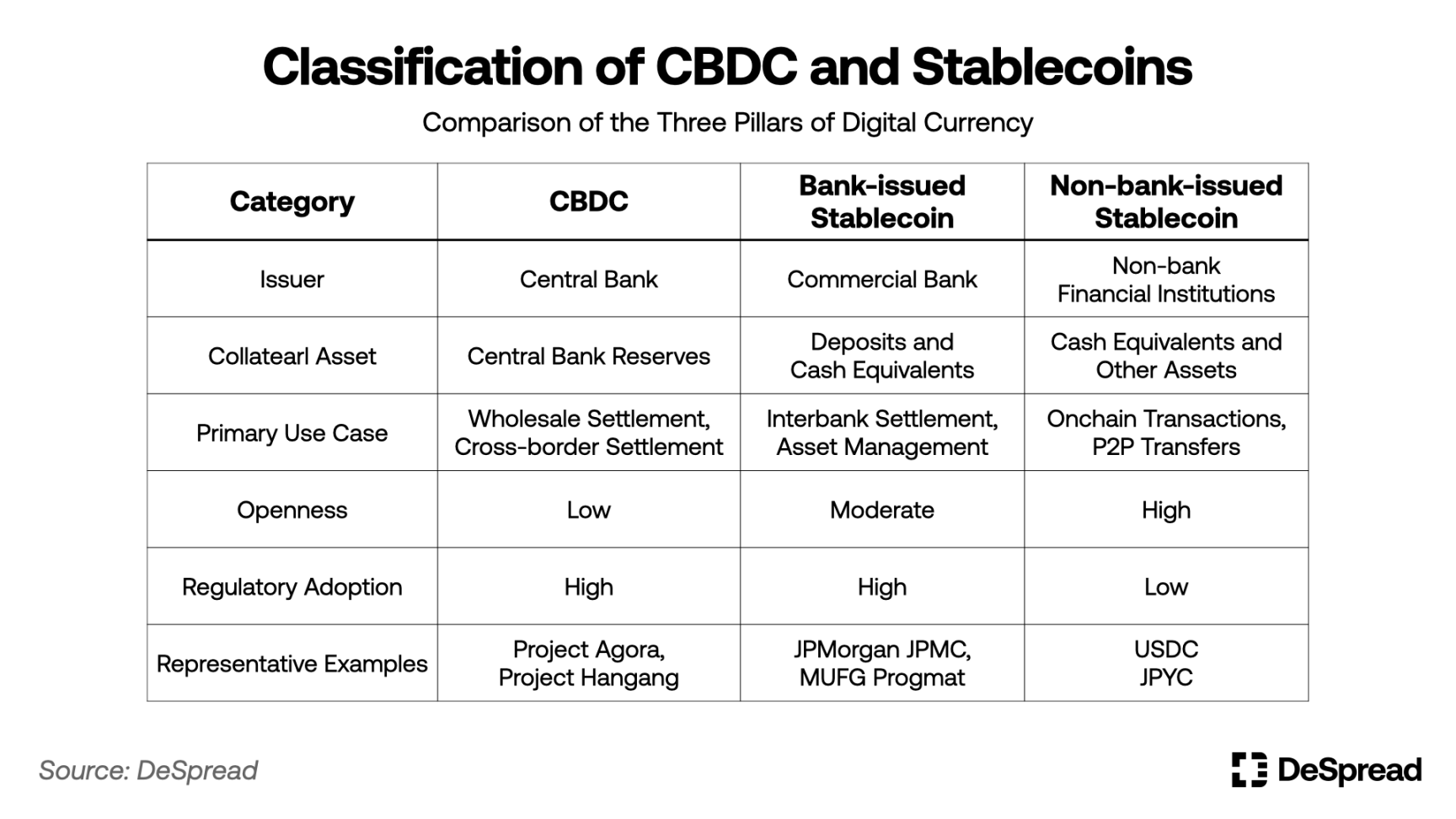

Table 1: Differences between CBDC and stablecoins

CBDC and stablecoins are not just differences in technical implementation methods. There are essential differences in their role in the economic system, the possibility of monetary policy implementation, financial stability and the scope of governance responsibilities. Therefore, the two digital currencies should be understood as complementary rather than alternative.

However, some countries are already trying to redesign this structural framework. For example, China's digital RMB (e-CNY) is used as a monetary policy implementation tool, India's Digital Rupee aims to transform to a cashless economy, and the UK's Project Rosalind experiments with retail CBDCs that can directly reach ordinary users.

The Bank of Korea is also experimenting with the boundaries of CBDC and the digitization of private deposits. The Bank of Korea's recently implemented "Project Hangang" aims to verify the linkage mechanism between the "wholesale CBDC" issued by the central bank for institutional use and the "deposit tokens" generated by commercial banks by converting customer deposits 1:1. As part of the CBDC issuance experiment, the project aims to achieve digital management of commercial bank deposits, which can be interpreted as the South Korean government's attempt to integrate deposit digitization into the CBDC system and avoid institutionalizing private digital currencies alone.

On the other hand, in April 2025, major Korean commercial banks (KB, Shinhan, Woori, Nonghyup, Enterprise Bank, and Suhyup) and the Korea Financial Settlement Service are promoting the establishment of a joint venture to issue a joint won stablecoin. This is a private digital currency experiment on a different track from deposit tokens, indicating that in future institutional discussions, the boundary between deposit tokens and bank-issued stablecoins may become more important.

1.2. Globalization trend of hybrid structure

Major countries such as the United States, Europe, and Japan, as well as international organizations such as the Bank for International Settlements (BIS) and the International Monetary Fund (IMF), will focus on the digital inheritance of the dual currency structure. In particular, large American banks such as Bank of New York Mellon, Bank of America, and Citibank are jointly studying wholesale stablecoin projects, proposing a new infrastructure that can support real-time interbank payments and collateral clearing without the intervention of the central bank.

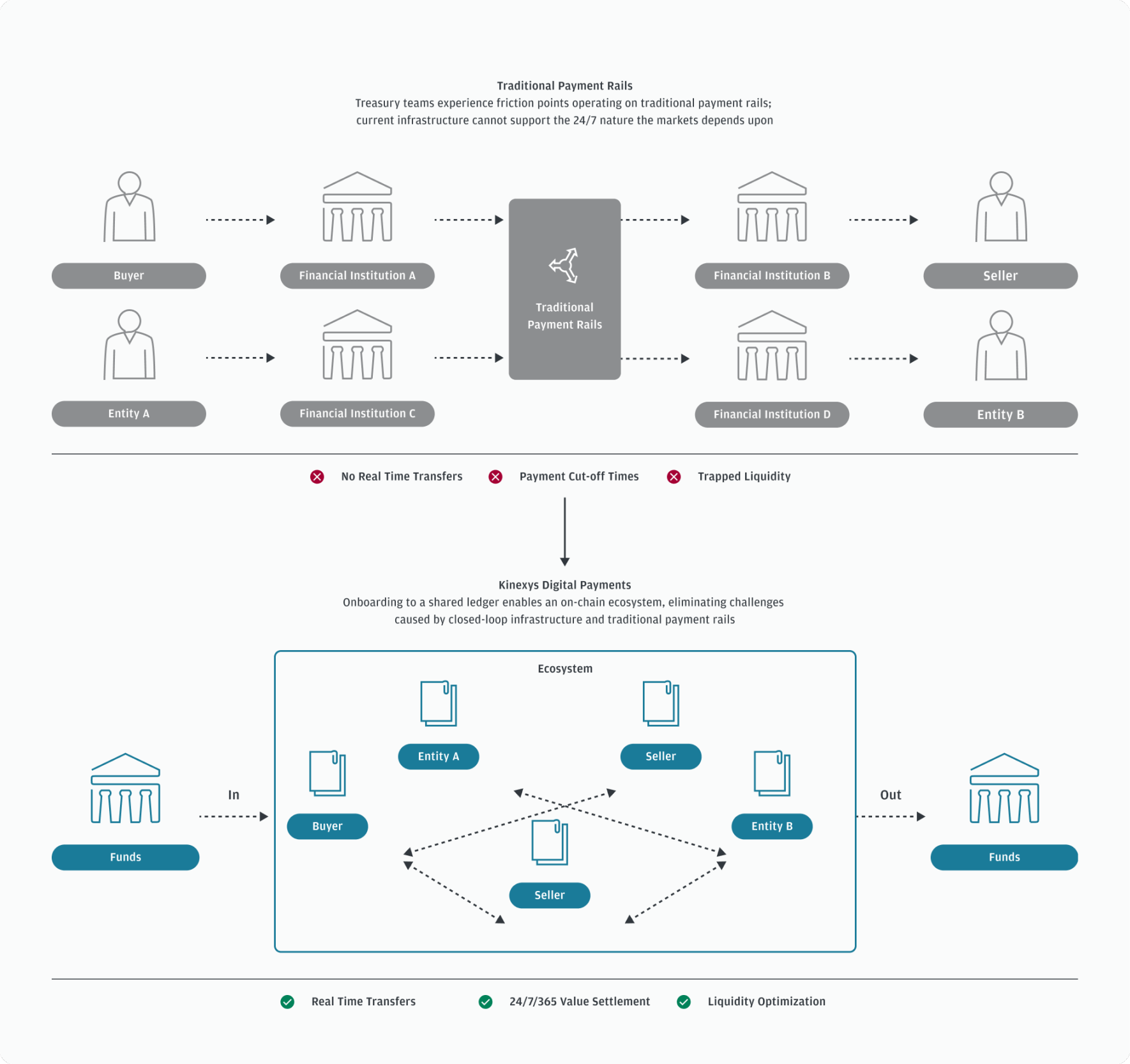

According to the BCG (2025) report, when stablecoins meet regulatory requirements, especially in countries where CBDC is difficult to launch in the short term, private-led wholesale digital payment infrastructure can play an alternative role. This can be confirmed by the cases of private infrastructure such as JPMorgan Chase's "Kinexys", Citibank's RLN, and Partior achieving high-credibility digital settlement without CBDC.

1.3. Necessity of CBDC

Against the background of the increasing recognition of the view that wholesale stablecoins issued by banking and financial institutions can build an efficient payment and settlement system, people have begun to question the necessity of CBDC in wholesale payments and settlement between financial institutions.

"Is CBDC still necessary?"

The author's answer to this question is "yes". The limitations of the private model are not limited to technical perfection or commercial coverage. There are fundamental constraints on the ability to perform public functions such as monetary policy, legal status, and international settlement neutrality.

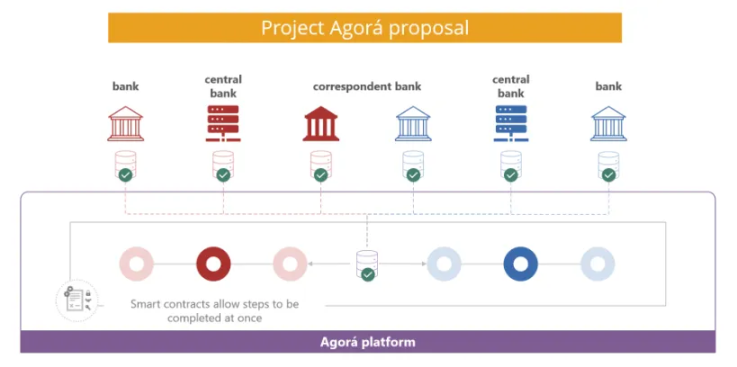

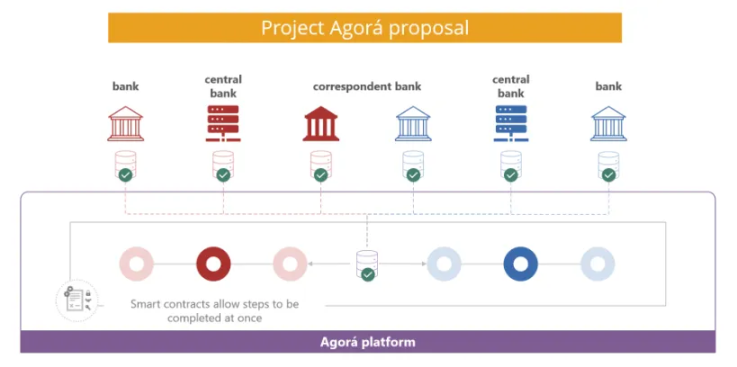

A representative case for system policy verification is Project Agorá (2024), jointly initiated by BIS, the European Central Bank (ECB), the Monetary Authority of Singapore (MAS), the International Monetary Fund (IMF), seven central banks and several international commercial banks. The project experiments with the structure of using CBDC and deposit tokens in parallel in cross-border wholesale payment systems. The report aims to enhance the interoperability of public currency (CBDC) and private currency (deposit tokens) while exploring design principles that can safeguard the independence and supervision of the monetary systems of various countries.

Through this experiment, BIS implicitly revealed the following policy implications:

Legal finality differences: As a liability of the central bank, CBDC naturally has legal finality in settlement. Deposit tokens are essentially claims against commercial banks, which may have legal uncertainty in cross-border transactions, leading to settlement risks.

Asymmetric governance structure: CBDC operates under a public and transparent rules and regulatory system, while private tokens have significant differences in technical architecture and governance models due to different issuers, which constitutes institutional risks in multi-currency, multilateral clearing networks.

Monetary sovereignty and judicial restriction mechanism: In order to safeguard national monetary sovereignty, the Agorá project adopts the principle of jurisdictional isolation, restricts the use of deposit tokens within the domestic financial system, and does not allow direct cross-border circulation, thereby avoiding the impact of disorderly diffusion of private currencies on domestic monetary policy.

Regulatory coordination and policy linkage: In the project, BIS focused on how to embed policy tools such as anti-money laundering, foreign exchange controls, and capital flows into digital payment networks. As a public asset, CBDC has a natural advantage in institutional linkage and regulatory integration, which is significantly better than private token solutions.

Table 2: The necessity of CBDC proposed by Project Agorá

Figure 1: Project Agorá

Ultimately, the significance of Project Agorá is that it designs a dual structure, CBDC Responsible for public trust and regulatory coordination in the international digital payment system, deposit tokens are responsible for agile transaction interfaces between enterprises, thus clearly distinguishing their respective roles and limitations.

For South Korea, which is highly sensitive to monetary sovereignty, this structural design is particularly important. The Bank of Korea also participated in Project Agorá to experiment with digital clearing based on deposit tokens. Lee Jong-yeol, deputy governor of the Bank of Korea, emphasized at the "8th Blockchain Leaders Club" held on May 27: "Protecting monetary sovereignty from infringement is the core of Project Agorá. South Korea's deposit token design ensures that it will not be directly used in other countries." This shows that South Korea is not only introducing technology, but also clearly recognizes the importance of protecting the principle of its own monetary sovereignty in the digital clearing structure.

If Project Agorá verifies the necessity of CBDC as an international settlement means and its coexistence structure with deposit tokens, then Project Pine, jointly implemented by BIS and the Reserve Bank of Australia (RBA) in 2025, proves that the central bank can digitize monetary policy implementation means and liquidity supply functions through CBDC.

Project Pine designed a structure for the central bank to automatically execute conditional liquidity provision with digital treasury bonds as collateral through smart contracts. This experiment is not just about digital currency transfers, but also shows that the central bank can directly adjust the money supply, inject or withdraw liquidity in real time, and automate these functions on the chain.

This goes beyond indirect policy signaling methods such as benchmark interest rate adjustments, and suggests new possibilities for implementing central bank policy execution through smart contracts and "coding" financial system governance. In other words, CBDC is not just a payment and settlement tool, but also an institutional infrastructure for the central bank to accurately and transparently digitize monetary policy.

1.4. A new paradigm for the parallel structure of CBDC and stablecoins

We need to regard the parallel structure of CBDC and stablecoins as a new paradigm. CBDC is not a simple "public stablecoin", but should be seen as a policy implementation tool, clearing infrastructure, and the core pillar of system trust in the digital financial era; private stablecoins should be seen as flexible and fast financial assets for general user needs.

The key to the problem is not "why both are needed". We are already operating under the dual structure of central bank currency and commercial bank currency. Even in the era of digital assets, this structure will only change at the technical level and be inherited. Therefore, we expect that the parallel structure of CBDC and private stablecoins will become the new monetary policy order in the digital era.

2. Bank stablecoin VS non-bank stablecoin

In the process of the parallel structure of CBDC and private stablecoins gradually being established as a policy order, we can further refine the following discussion. Regarding the internal structure of private stablecoins, there is currently an important focus of debate: whether bank stablecoins and non-bank stablecoins should develop in parallel, or should only one of them be institutionalized.

Although both types have a 1:1 anchoring structure with legal tender, there are clear differences in issuing entity, policy acceptance, technical implementation method, and usage scenarios. Bank stablecoins are digital currencies issued by regulated financial institutions based on deposits or government bonds, and the use of public chains is relatively limited. In contrast, non-bank stablecoins are mainly circulated on public chains, and most of them are issued by Web3 projects, global fintech companies, and cryptocurrency companies.

2.1. Goals of bank stablecoins

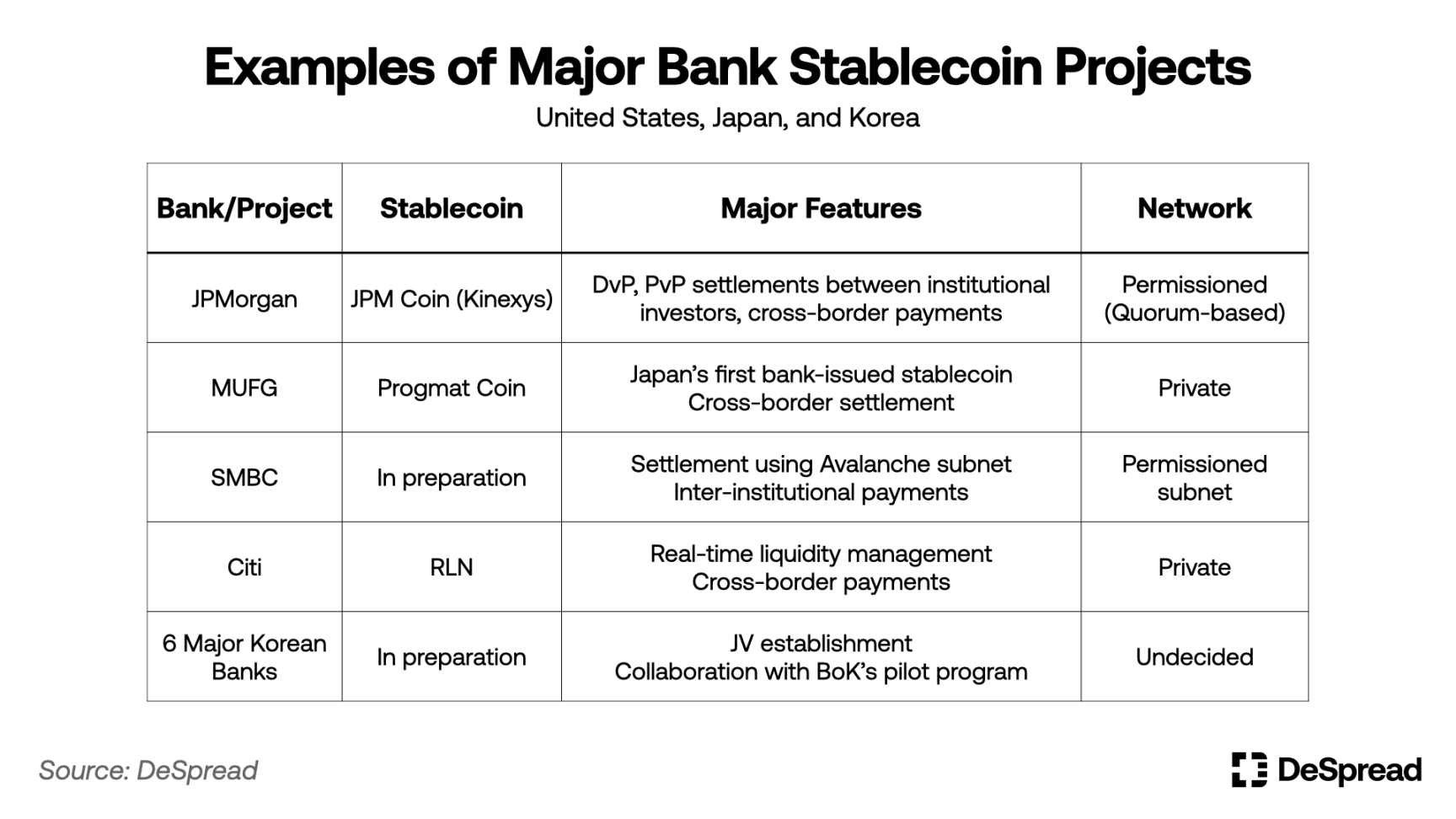

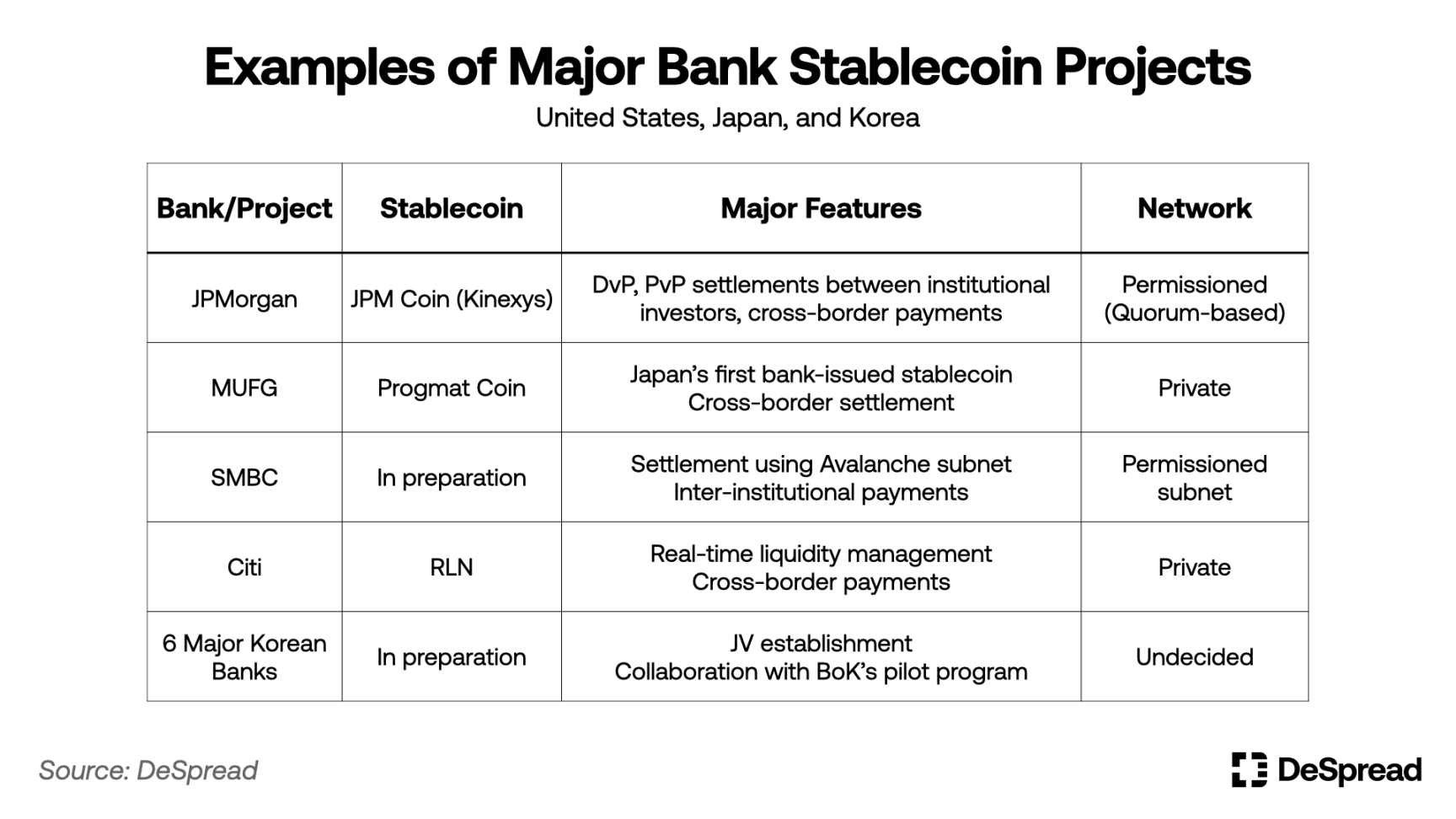

Bank stablecoins reproduce the role of deposits in the financial system within the traditional system on the chain. JPMorgan Chase's JPM Coin, Japan's MUFG's Progmat Coin, Japan's Sumitomo Mitsui Banking Corporation's yen stablecoin, Citibank's RLN, etc. are all stablecoins based on bank accounts, operating within the regulatory framework of AML, KYC, depositor protection, financial soundness, etc.

These stablecoins are used as digital cash that meets both institutional stability and the flexibility of smart contract automation in scenarios such as DvP and FvP settlement between institutional investors, trade fund clearing, and portfolio management. They have the characteristics of legal certainty, KYC-based participant control, and the possibility of linkage with central bank reserves.

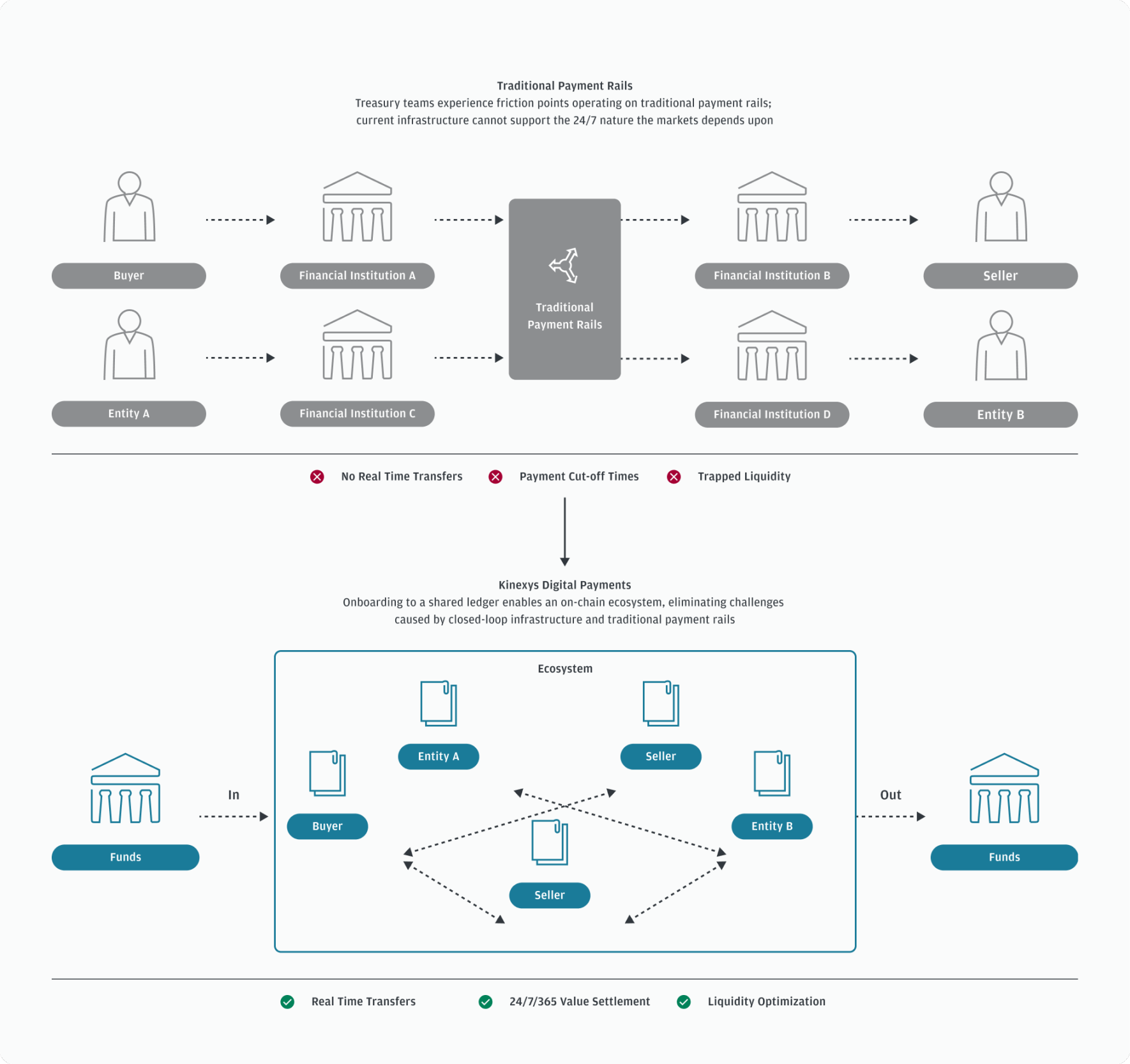

In particular, the cases of JPMorgan Chase's Kinexys and Citibank's RLN are operated on permissioned networks, which only allow transactions between institutions that have pre-verified their identities, transaction purposes, and sources of funds, so the legal responsibility structure and regulatory response are very clear. In addition, these networks have designed deposit-based stablecoins to achieve real-time payment and settlement through centralized node structures and inter-bank consensus protocols, enabling on-chain financial activities to get rid of the volatility and regulatory risks of public chains.

Figure 2:JPMorgan Chase Kinexys Structure

Commercial banks in major countries such as the United States, Japan, and South Korea are actually issuing or promoting the introduction of deposit-based stablecoins. In addition to the deposit base, the trend of banks issuing stablecoins collateralized by cash equivalents such as government bonds and money market funds can also be found in various countries. In the United States, large bank alliances such as Zelle and The Clearing House are discussing the joint issuance of stablecoins, foreshadowing the spread of the regulated stablecoin model issued by commercial banks. The Financial Services Agency of Japan is studying the expansion of the proportion of government bonds in the collateral assets of stablecoins, considering setting an upper limit of up to 50%. In South Korea, six major banks including KB Kookmin, Shinhan, Woori, Nonghyup, Enterprise Bank, and Suhyup, and the Korea Financial Settlement Service are jointly establishing a legal entity to issue Korean won stablecoins, which is carried out in parallel with the Bank of Korea's wholesale CBDC experiment (Project Hangang), suggesting the coexistence of deposit tokens and stablecoins.

This trend shows that putting deposits on the chain is no longer just a simple technical experiment, but is introducing substantial automation to the financial payment and clearing structure within the system. At the same time, major countries are expanding the types of collateral assets acceptable to bank stablecoins, including cash equivalents, to strengthen the liquidity supply function of stablecoins within the regulatory system.

Table 3: Major Bank Stablecoin Cases

2.2. Objectives of Non-Bank Stablecoins

Non-bank stablecoins are a new type of currency user interface that emerged to achieve technological innovation and global scalability. Typical representatives include Circle's USDC, PayPal's PYUSD, StraitsX's XSGD, etc. These stablecoins are widely used in small payments and programmable financial environments such as e-commerce payments, DeFi, DAO rewards, game props trading, P2P transfers, etc. They are freely traded on the public chain, providing accessibility and liquidity to users outside the traditional financial infrastructure. In particular, it plays the role of standard currency in the Web3 ecosystem and the DeFi ecosystem.

There is also differentiation within the non-bank stablecoin ecosystem: some entities pursue disruptive innovation on the public chain with the premise of breaking away from the existing financial system; while others aim to accept regulation and integrate into the institutional system. For example, issuers such as Circle are actively seeking to integrate into the traditional financial system by preparing for MiCA licenses and cooperating with US regulators; on the other hand, some also exist in experimental models centered on decentralized communities.

Therefore, the field of non-bank stablecoins is a field of coexistence between innovation and institutionalization, and future policy design and market regulation methods will largely affect the balance between the two.

2.3. Optimism: Functional differentiation and coexistence

Regarding whether bank and non-bank stablecoins can replace each other, it should be considered from the perspective of politics, policy and industrial strategy rather than from the technical perspective. The two models have different institutional constraints and application scenarios, so the prospect of coexistence under the premise of functional differentiation is gradually gaining recognition from the policy community and the market.

Bank stablecoins rely on their legal certainty and regulatory compliance, mainly serving the fields of inter-institutional settlement, asset management and wholesale payments. JP Morgan's Kinexys has been in operation for more than four years, while Citi's RLN and MUFG's Progmat Coin are also in the actual verification stage.

Non-bank stablecoins are more suitable for scenarios such as small payments, global retail services, on-chain incentive systems and decentralized applications (dApps), and have become the de facto universal currency standard in the public chain ecosystem.

Non-bank stablecoins are a key means to promote digital financial inclusion and innovation. Compared with the identity verification, residence information, credit record and minimum deposit threshold required for bank stablecoins, public chain stablecoins only need a digital wallet to use, which is very attractive to "Unbanked". Therefore, non-bank stablecoins provide the only scalable financial access method outside the traditional financial system and are an important bridge for building inclusive finance and technological democratization.

The reason why bank stablecoins are not issued on the public chain reflects the regulatory authorities' institutional exclusion of non-bank stablecoins from running on the public chain. For regulators, untraceability, anonymity, and lack of control over the off-ramp are all factors that constitute core compliance risks. Ultimately, digital currencies that are acceptable to the institutional system must have a certain degree of programmable control and export control functions. The logic of public chain maximalism, such as anti-censorship, is bound to conflict with the real financial regulatory order. Even so, the non-bank stablecoin market is still composed of technical entities pursuing disruptive innovation and corporate entities seeking to ensure stability through supervision, indicating that the gradual institutionalization and experimental evolution of the fintech industry are advancing in parallel. The GENIUS Act, which recently passed a procedural vote in the U.S. Senate, is one of the U.S. government's efforts to institutionalize this trend. The bill allows the issuance of non-bank stablecoins under certain conditions, leaving room for discussion within the institutional framework for the market access possibilities of innovative companies. Circle is also trying to shift to a regulatory-friendly model through the MiCA licensing process and accepting U.S. SEC supervision; Japan's JPYC is also working with MUFG to advance the process of switching from prepaid payment methods to electronic payment methods. All of this shows that non-financial entities also have the possibility of gradually entering the institutional track.

Non-bank stablecoins that use smart contract programming to implement functions such as AML, KYC, regional restrictions, and transaction conditions have the potential to coordinate the openness of public chains with the requirements of the institutional system. However, the technical complexity of smart contracts and the concerns of regulators about public chains remain issues to be resolved. In this context, public chain stablecoins that aim to be "accessible and compliant to anyone" have also attracted much attention.

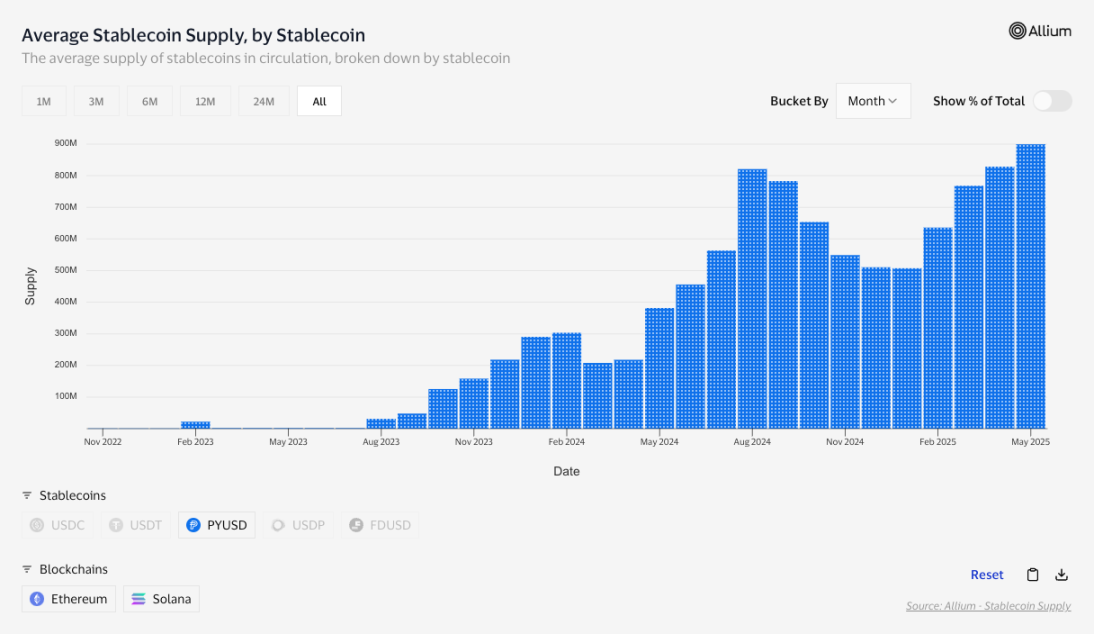

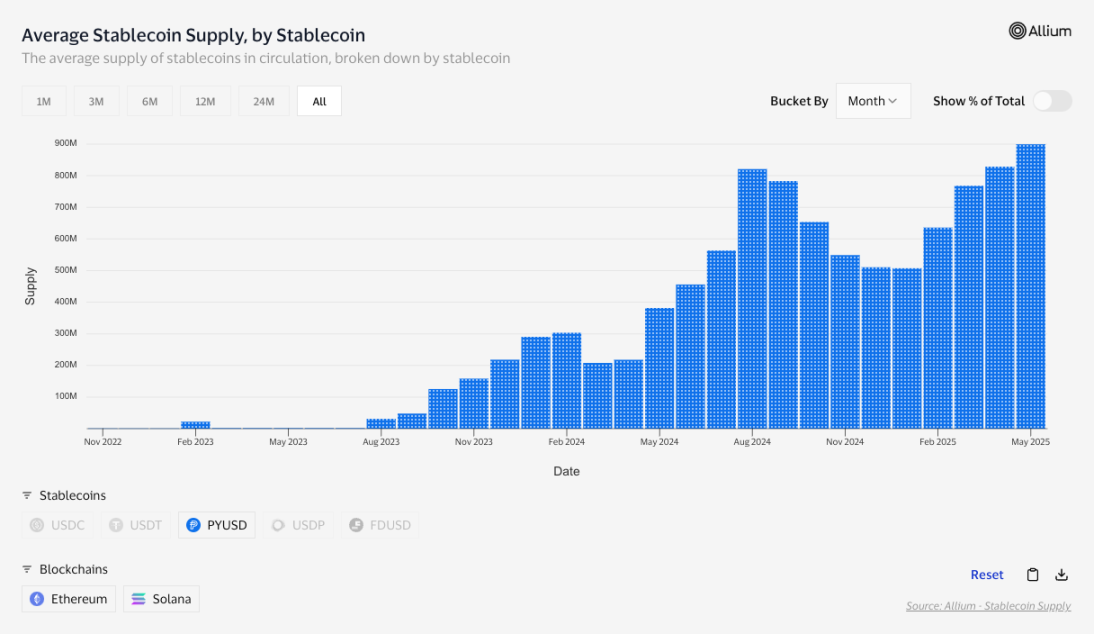

PayPal and Paxos' PYUSD are examples of achieving this goal. PYUSD circulates on public chains such as Ethereum and Solana, and at the same time achieves the coordination of regulatory compliance and openness through Paxos' 1:1 US dollar collateral reserve management and PayPal's KYC and transaction monitoring. Since 2024, PYUSD has expanded its influence in DeFi and the retail economy, demonstrating the potential of regulatory-friendly stablecoins.

Figure 3:PYUSD Supply

At the South Korean National Assembly policy discussion meeting in May 2025, Yoon Min-seop, director of the Korea Consumer Finance Agency, emphasized that "the innovation of stablecoins can be realized through the participation of multiple entities such as financial technology and IT companies," and proposed a multi-level institutionalization strategy. In addition, this trend can also be confirmed from the fact that Korean financial technology companies such as KakaoPay are exploring blockchain-based payment methods, and the Financial Commission is promoting discussions on stablecoin supervision.

The ultimate key in this scenario is that non-bank stablecoins do not conflict with or replace the institutional system, but fill in areas that the existing financial system has not yet included, showing the possibility of coexistence. In particular, the inclusion of unbanked, practical applications in the public chain-based Web3 ecosystem, and fast and low-cost global payment methods cannot be achieved only through bank stablecoins. Therefore, the two are the result of functional differentiation in their most suitable roles. Rather than a competitive relationship, they form a balanced and collaborative structure.

2.4. Pessimism: Reintegration of Traditional Industries

Some people are pessimistic about the continued possibility of the current "functional coexistence". After all, many technologies that initially set off innovations in niche markets are often gradually integrated and incorporated by traditional industries during the development process. And traditional companies have indeed begun to take the stablecoin market seriously and will never sit idly by.

Large US banks have begun preliminary discussions around Zelle and The Clearing House on jointly issuing stablecoins. This is a strategy to preempt potential losses such as foreign exchange fees, retail payment fees, and loss of user wallet dominance by issuing their own stablecoins in conjunction with the possibility of passing the Genius Act.

In this case, even if non-bank stablecoins achieve technological advantages or user diffusion, they may eventually face the risk of being absorbed or marginalized by bank-dominated infrastructure. In particular, banks can use central bank reserves as collateral assets for stablecoins, so they are likely to have a competitive advantage over general collateral-based stablecoins in terms of credibility and efficiency. In other words, public chain-based stablecoins face the risk of structural disadvantages in terms of institutionalized networks and collateral capabilities.

Although Visa, Stripe and BlackRock do not issue stablecoins directly, they have absorbed the technology and functions of the stablecoin market into the existing financial infrastructure by integrating USDC into the payment network or through their own tokenized funds (such as BUIDL), thus redefining digital currency innovation into a form suitable for the institutional system. This is a strategy to maintain the stability and credibility of traditional finance while leveraging the potential of stablecoins.

The above trend is also clearly reflected in the case of StraitsX's XSGD. Although the SGD-based stablecoin XSGD is issued by a non-bank financial institution, it is based on a deposit guarantee 1:1 collateral within DBS Bank and Standard Chartered Bank and is implemented on the closed network infrastructure of Avalanche Subnet.

Subnet: An enterprise-grade network structure that allows full customization for openness, consensus mechanism, privacy level, etc., and is designed to meet regulatory compliance.

In particular, XSGD enters the public chain through Avalanche's C-chain and circulates in various networks. This is a special case that benefits from Singapore's open policy environment. It is expected that the same structure will be more difficult to apply to countries with conservative regulation. In this case, not only the issuance structure, but also the circulation channel is likely to be unable to enter the public chain and be restricted to the regulated permission structure. Ultimately, although XSGD is a symbolic case that demonstrates the compromise balance between the institutional system and technology, in more conservative countries, due to practical constraints, the advantages of the commercial bank model may be more consolidated.

Through Kinexys, JPMorgan Chase clearly demonstrated the case that asset management and settlement will eventually converge into a digital financial network controlled by banks. BCG's analysis also believes that stablecoins based on public chains have structural limitations that are difficult to accept regulation, and only models based on financial institutions can survive in the institutional system for a long time.

Although Europe's MiCA is formally open to all issuers, in fact, due to factors such as capital requirements, collateral management, and issuance limits, it has formed a structure that is difficult for financial institutions to enter the system. As of May 2025, there are few cases of formal registration as electronic currency tokens, except for the license that Circle is preparing.

In Japan, the Payment Services Act, revised in 2023, restricts the issuance of electronic payment means-type stablecoins to banks, trust companies, and money transfer operators. Tokens based on public chains can only circulate on some exchanges and cannot be recognized as official means of payment.

Although the "programmable regulatory compliance stablecoin" model mentioned in the optimistic theory seems to be able to improve the acceptance within the system, the actual realization of this model requires solving complex institutional problems such as international regulatory coordination, legal acceptance of smart contracts, and risk responsibility attribution. In particular, even if such a design becomes possible, regulators are likely to use the credibility, capital strength, and controllability of the issuing entity as core criteria.

Ultimately, non-bank stablecoins that are acceptable to regulators are likely to be attributed to "private entities that operate like banks." In this case, the innovations of decentralization, inclusiveness, and censorship resistance originally provided by the public chain will inevitably be diluted. In other words, the optimism that functional coexistence will be guaranteed in the long term may be too idealistic. The digital currency infrastructure may eventually be attributed to a reintegration centered on entities with scale, trust, and institutional guarantee capabilities.

3. Korean Stablecoin Strategy

3.1. Policy Environment and Basic Preconditions

South Korea is a country with strong policy priorities such as monetary sovereignty, foreign exchange management, and financial supervision. The interest rate-based monetary policy centered on the central bank has always been the core mechanism for effectively controlling private liquidity. The Bank of Korea attaches importance to achieving predictability and monetary stability through policy interest rates. Under this structure, with the emergence of new forms of digital liquidity, concerns have been raised about possible challenges to the monetary policy transmission mechanism and the existing liquidity management system.

For example, stablecoins issued by non-bank entities with government bonds as collateral, although not based on the base currency (M0) issued by the central bank, may have the effect of creating money in the private sector by performing monetary functions on the chain. If these digital cash equivalents circulating outside the institutional system are not captured by money supply indicators (M1, M2, etc.) or affect the interest rate transmission path, policy authorities may regard them as "shadow liquidity".

Concerns about this policy risk have also recurred internationally. FSB (2023) pointed out that the disorderly spread of stablecoins may threaten financial stability, and specifically listed cross-border liquidity transfers, AML/CFT avoidance, and inefficient monetary policy as major risks. BIS (2024) analysis also believes that in some emerging countries, stablecoins may trigger informal dollarization and reduce the effectiveness of monetary policy due to the outflow of bank deposits.

In response to this, the United States adopted a pragmatic institutionalized strategic response through the Genius Act. The Act allows the issuance of private stablecoins, but proposes a conditional licensing structure through high credit collateral requirements, federal registration obligations, and qualification restrictions. This is not to ignore the warnings of the FSB and BIS, but a strategic response to absorb risks into the regulatory framework for control.

The Bank of Korea has also made a clear position on such policy risks. At a press conference on May 29, 2025, Governor Lee Chang-yong mentioned that "stablecoins are privately issued currency substitutes that may undermine the effectiveness of monetary policy" and expressed concerns that stablecoins based on the Korean won may lead to capital outflows, damage to the trust of the payment and settlement system, and evasion of financial supervision. He clearly emphasized that "first of all, we should start with the regulated banking industry."

However, the Bank of Korea did not ban it completely, but managed and reviewed the institutionalization direction under the condition of controllable risks. In fact, in addition to CBDC, the Bank of Korea is also promoting a payment experiment based on deposit tokens issued by commercial banks (Project Hangang), and conditionally accepting private-led digital liquidity experiments.

In short, stablecoins may play a role as a new monetary policy variable. The vigilance of international institutions and Korean authorities is not about the technical possibility itself, but about how to accept this technology under what conditions within the monetary system. Therefore, the Korean version of the stablecoin strategy should not be an unconditional open or technology-centered design, but should be a structure that builds a policy and technical prerequisites based on the acceptance of the institutional system.

3.2. Policy judgment on stablecoins collateralized by government bonds

3.2.1 Relationship with monetary policy

Stablecoins issued with government bonds and other cash equivalents as collateral appear to be digital currencies based on safe assets, but from the perspective of monetary policy, they may play a role as a private currency issuance structure that the central bank cannot directly control. This goes beyond the scope of a simple means of payment and may have the effect of bypassing the path of base money (M0) and creating liquidity close to broad money (M2).

The Bank of Korea usually guides the deposit interest rate and credit supply of commercial banks by adjusting the benchmark interest rate, thereby indirectly affecting the structure of broad money (M2). However, cash equivalent-collateralized stablecoins may not go through this monetary policy transmission path, forming a mechanism for non-bank entities to directly supply liquidity to the private economy through digital assets. In particular, in this process, it is not subject to traditional monetary management measures such as capital supervision, liquidity ratios, and deposit reserves, which poses a structural threat from the perspective of the central bank.

More importantly, government bonds were originally a means of clearing issued liquidity through government fiscal policies. Using this as collateral again to allow the private sector to issue another type of liquidity (stablecoin) means forming a secondary generation structure of currency issued by non-central banks, which is actually close to the result of "double monetization". Therefore, liquidity in the market may expand without the interest rate signal of the monetary authority, and the transmission power of the benchmark interest rate may be weakened.

BIS (2025) analysis confirmed that the funds flowing into stablecoins caused the yield of US short-term Treasury bonds (3-month Treasury bonds) to drop by 2-2.5 basis points within 10 days, while the funds flowing out increased by 6-8 basis points, showing an asymmetric effect. This shows that in the short-term funding market, the liquidity flow of stablecoins alone may form an interest rate before the central bank's interest rate policy, which may cause the monetary policy centered on the benchmark interest rate to fail to have a leading impact on market expectations.

This structure may also affect the actual interest rate. If the liquidity formed by stablecoins begins to have a substantial impact on asset prices and short-term interest rates in the financial system, the effectiveness of the benchmark interest rate adjustment policy will be weakened, and the central bank's monetary policy will no longer be a "leading interest rate determiner" but will become a "market reactor".

However, it is difficult to conclude that all Treasury bond-collateralized structures will immediately invalidate monetary policy or pose a serious threat. In fact, the U.S. Treasury Department interpreted it as "digital conversion of assets within existing currencies" in April 2025, claiming that it would not affect the total money supply. Treasury-backed stablecoins may have different effects depending on their operating structure and policy environment, so they need to be carefully evaluated based on the structural background rather than being judged uniformly.

Therefore, Treasury-backed stablecoins have a dual structure of risk and practicality. Whether or not policies are accepted depends on how their structure is connected to the existing monetary system and whether they can be designed in a way that does not undermine the predictability and credibility of policy instruments.

3.2.2. Global comparison

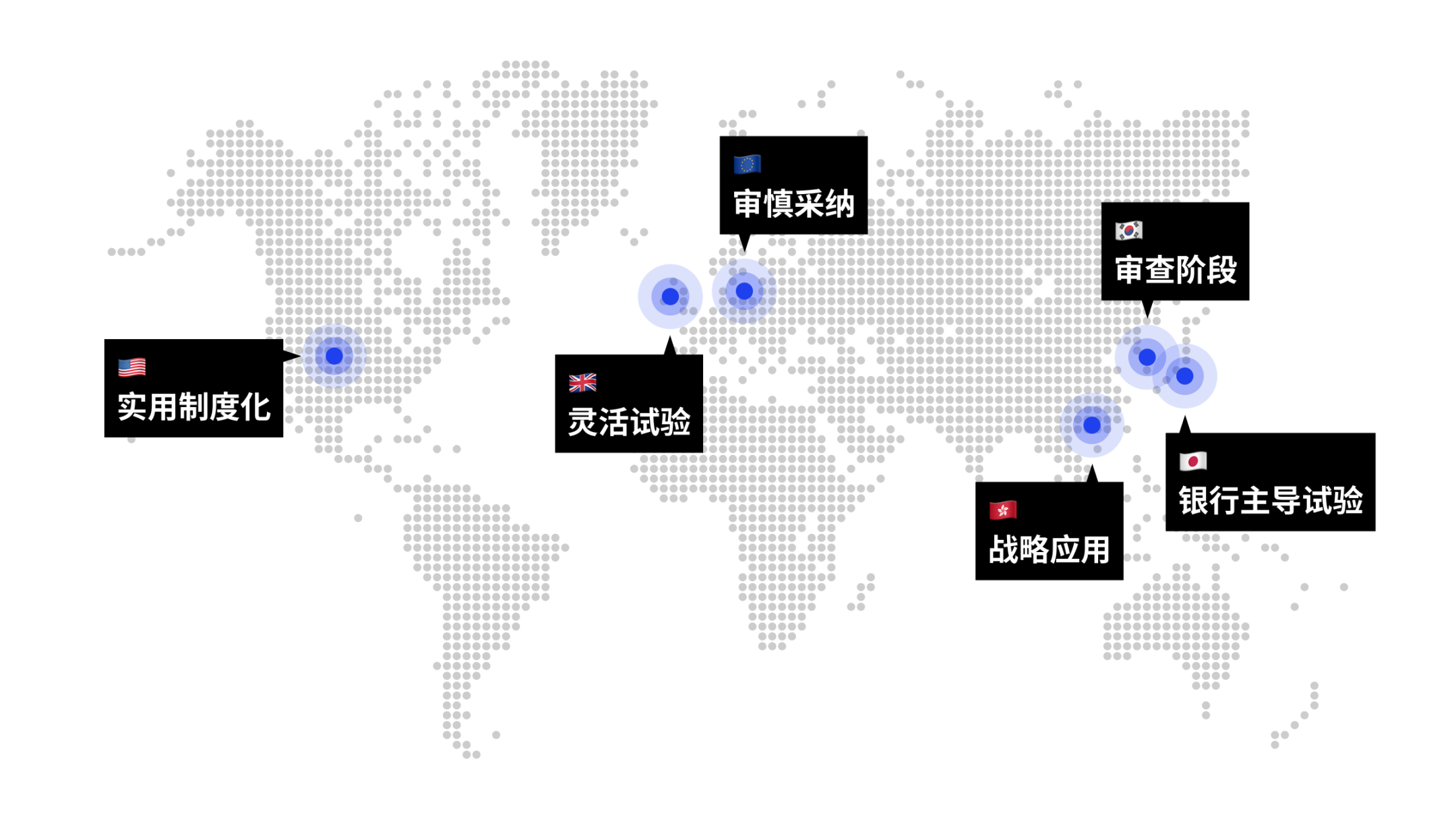

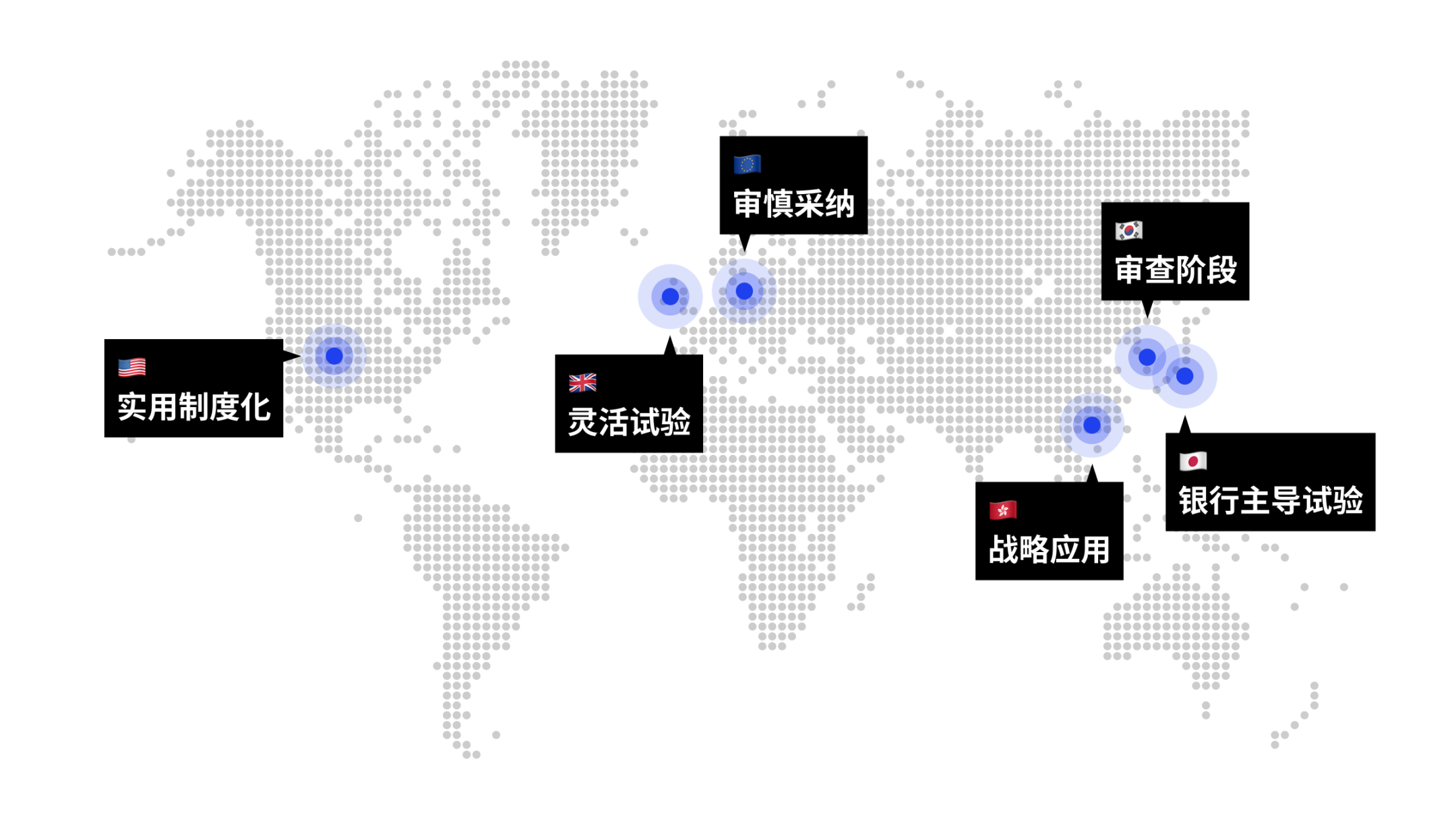

Countries' policies on cash equivalent-backed stablecoins vary due to their own monetary system structures, capital market depth, complexity of interest rate transmission mechanisms, and regulatory concepts for digital assets. In particular, the United States, Europe, Japan, and South Korea have different ways of dealing with the conflict between the institutionalization of stablecoins and monetary policy.

Figure 4: Comparison of stablecoin policies in major countries

United States: The capital market is deep and has a multi-level interest rate transmission structure consisting of the Federal Reserve System, money market funds, deposit institutions, etc. It is generally believed that treasury bond-collateralized stablecoins will not immediately threaten monetary policy. Circle's USDC, BlackRock's sBUIDL, Ondo's treasury bond fund-based tokens, etc. all demonstrate the liquidity operation structure that connects digital assets and money market funds, and are regarded as asset securitization and financial innovation means. The recently proposed Genius Act is a legislative trend to formalize private stablecoins under the conditions of incorporating institutional systems such as high credit collateral requirements and issuer registration requirements.

Europe: The European Central Bank (ECB) maintains a more conservative and restrictive attitude towards private stablecoins. MiCA strictly requires institutional capital, redemption request rights, and transparency of collateral operations, which essentially implies that only financial institutions can issue them. The ECB is wary of private stablecoins that may become a competitive means of the digital euro and a detour for monetary policy, and tends to prioritize institutional stability rather than technical experiments.

Japan: Due to the ultra-low interest rate environment and the bank-centered credit creation structure, the operating space of monetary policy is limited. Therefore, Japan tends to use private stablecoins as an auxiliary means of digital credit expansion. The discussion on bank issuance model is the most active, and a stablecoin structure that allows holding government bonds with a certain proportion of reserves and using this as collateral is also being considered. Preference is given to permissioned structures based on private chains, focusing on building a regulatory-friendly environment.

South Korea: South Korea is one of the countries with greater monetary policy concerns about government bond-collateralized stablecoins due to its interest rate-centered monetary policy and relatively shallow capital market characteristics. The Bank of Korea has pointed out in multiple reports since 2023: "In the case of regulating liquidity through policy interest rates, the inflow of digital currencies may weaken the credibility of monetary policy." Governor Lee Chang-yong also said in May 2025: "Private issuance of stablecoins may play a similar role to currency, and non-bank institutions should be cautious in issuing them." Currently, wholesale CBDC experiments are being promoted, and payment experiments based on deposit tokens issued by commercial banks are being promoted at the same time.

UK: In a consultation document released in May 2025, it was stated that stablecoin collateral assets can not only use short-term government bonds, but also allow some long-term bonds. This has attracted much attention as an institutional experiment that recognizes market flexibility and private autonomy by giving issuers a wider range of discretion in asset composition.

Hong Kong: Based on the HKD-USD peg structure, allowing the use of USD-based assets such as US Treasury bonds as stablecoin collateral assets is not a simple financial experiment, but a connection with the policy purpose of expanding the national foreign exchange structure strategy. It can be seen as a design that reflects the central authorities' intention to expand the HKD-USD peg structure to digital liquidity through stablecoins.

The stablecoin policies of various countries are not only risk management or maintaining the effectiveness of monetary policy, but are also closely related to macroeconomic goals such as the characteristics of the country's capital market, foreign exchange strategy, and positioning as a global financial center. The cases of the United Kingdom and Hong Kong demonstrate the importance of this strategic approach. This suggests that Korean policymakers should not only regard stablecoins as "control objects", but should examine from multiple perspectives how to use them as "strategic tools" for the long-term growth momentum of the Korean economy, such as deepening the capital market, improving the efficiency of international settlements, and strengthening the national foreign exchange strategy. This requires an opportunity-grasping perspective that goes beyond simple risk aversion.

3.3. Bank-led stablecoin cultivation

3.3.1. Institutional role and the importance of deposit-based stablecoins

Deposit-based stablecoins (deposit tokens) issued by banks are regarded by policies as one of the most credible digital liquidity structures. This model is issued based on the balance of deposits already held, and digital circulation is achieved without increasing the money supply or distorting interest rate policies. It has a high degree of acceptance within the institutional system.

However, deposit-based stablecoins are not completely risk-free. Bank liquidity risk, capital adequacy issues, and the expansion of usage scenarios outside the scope of deposit insurance protection are all factors that need to be considered in institutional design. In particular, when large-scale on-chain circulation occurs, it may affect the bank's liquidity structure or the way the payment network operates, so a risk-based approach needs to be adopted in parallel.

Nevertheless, the policy maintains a relatively friendly stance towards deposit-based stablecoins for the following reasons:

It is linked to the depositor protection system and is conducive to consumer protection.

It can be managed within the control of the deposit reserve system and interest rate policy.

It is easy to comply with AML/CFT and foreign exchange supervision under the commercial bank supervision system.

Some believe that non-bank stablecoins based on government bond collateral can promote innovation in the fintech ecosystem. But this can also be achieved to a large extent through a deposit-based structure. For example, if global fintech companies need a Korean won stablecoin, it is entirely feasible for domestic banks in South Korea to issue it based on deposits and provide it in the form of an API. At this time, the API provision method can include multiple functions beyond the simple remittance function, such as stablecoin issuance, redemption, transaction record query, user KYC status confirmation, custody status confirmation, etc. Fintech companies can use these APIs to integrate stablecoins as a means of payment and transfer into their own services, or build an automatic clearing system linked to the user's wallet.

This method operates within the banking regulatory system, which can not only meet depositor protection and AML/CFT requirements, but also realize the flexible and innovative user experience design of fintech companies. In particular, when banks are the issuers, they can adjust the circulation volume under a risk-based approach, and when necessary, through the on-chain payment API that is connected to the internal clearing network in parallel, while pursuing stability and scalability.

From this perspective, the deposit-based stablecoin model can respond to the needs of private innovation without affecting the right to issue currency or monetary policy, and can be evaluated as a realistic alternative that seeks a balance between institutional stability and technical scalability.

For non-bank stablecoins based on public chains, policies remain cautious. Especially in an environment like South Korea, where the financial infrastructure is highly developed and the proportion of the unbanked population is low, it can be considered that it is difficult to prove innovation and necessity based on the public chain technology alone.

JP Morgan and MIT DCI (2025) pointed out that the existing stablecoins and ERC standards still have technical limitations that cannot fully meet the actual payment requirements of banks. Therefore, the report proposed new token standards and smart contract design guidelines with regulatory-friendly functions. These global discussions have become an important reference standard for South Korea to review whether to introduce payment tokens based on public chains. Therefore, first verifying the banking industry stablecoin with technical and institutional matching, and then discussing the possibility of expansion on the public chain in stages while observing the trend of global standard establishment, is more conducive to balancing the pursuit of policy stability and market innovation.

In addition, it is no longer necessary to use traditional fully closed private chains such as Corda, Hyperledger, and Quorum. After all, there are now technical structures that can customize closedness and openness, achieve interoperability between private environments, and connect with public chains according to needs and purposes. That is, the hybrid infrastructure based on flexible design is not a one-way closed system, but a foundation for the coexistence of institutional systems and private innovation.

In this case, in order to continue the empirical policy discussion on stablecoins based on public chains, it is necessary to combine specific business projects, circulation payment roadmaps, and technical implementation plans to prove in advance that public chain stablecoins can indeed ensure liquidity creation and innovative uses at the same time. Otherwise, the situation of limited liquidity pools being isolated like JPYC on Uniswap may be repeated, which will reduce the possibility of acceptance by the institutional system.

In the end, the persuasiveness of the policy does not lie in the simple "because it must be on the public chain", but in what substantive needs the structure meets and what industrial application possibilities and spillover effects it demonstrates.

3.3.2. Top priority areas for blockchain

If bank-issued deposit-based stablecoins become the core pillar of digital liquidity within the system, then the areas of financial infrastructure where such stablecoins should be introduced first will be clear. This should not be a simple digitization of payment methods, but a technological transformation to solve structural issues such as trust coordination among multiple institutions, cross-border asset transfers, and ensuring interoperability between systems.

Especially for domestic inter-institutional transactions and payment infrastructure that has been highly developed through centralized systems, the necessity and utility of introducing blockchain may be limited. On the contrary, in cross-border asset and payment flows, or in complex structures that require inter-institutional interoperability, blockchain can become a powerful means of efficiency.

(1) Clearing and Settlement Networks

Deposit-based stablecoins can be used first in cross-border payment and settlement infrastructure, including:

Foreign exchange settlement: In interbank foreign exchange transactions, stablecoins can improve settlement speed, automation and certainty by replacing traditional processes that involve delays, high intermediary costs and settlement risks. PvP structures that support smart contracts on the blockchain can significantly improve efficiency.

Reference Case - Project Jura

Overview: A joint project of the BIS Innovation Center, the Bank of France and the Swiss National Bank. The project experimented with using a wholesale CBDC (wCBDC) to perform EUR-CHF FX settlement on a permissioned blockchain, using an automated PvP mechanism.

Progress: Successfully completed at the end of 2021, the project demonstrated that legal finality can be achieved without relying on a central bank RTGS system.

Key Outcome: Demonstrated the feasibility of real-time FX PvP using smart contracts, with the central bank playing only a triggering and guaranteeing role, not a settlement processor.

Implications for South Korea: In the South Korean context, integration with BOK-Wire+ is critical to ensure finality. As the Bank of Korea directly operates the RTGS system, a more active and direct integration model than Jura’s “trigger role” may be required. Similar structures could be developed using deposit-based tokens instead of wCBDC.

Trade Finance: Through a permissioned and interoperable blockchain network, the process of conditional payments based on electronic letters of credit (e-LC) or electronic invoices can be automated between Korean banks and foreign institutions or companies that adopt similar technical standards.

Reference Case - Project Guardian

Overview: A public-private partnership project led by the Monetary Authority of Singapore (MAS) that demonstrated the use of deposit-based tokens for smart contract-based conditional payments.

Progress: Successfully completed on-chain pilots for bond settlement and fund subscription as of 2024.

Key Outcome: Validated the scalability and reliability of a smart contract-based conditional payment system.

Implications for Korea: Integration with existing digital trade infrastructure (e.g., KTNET, K-SURE, Korea Exim Bank) could enable automated settlement of B2B trade using deposit tokens. This would be particularly beneficial for SMEs, improving payment certainty and reducing documentation burden.

Lessons from Contour and TradeLens

Explanation: Despite their technological advancement, platforms such as Contour (electronic letters of credit via Corda) and TradeLens (digital bills of lading via IBM-Maersk) have not been commercialized due to limited participant networks and fragmented standards, not due to technical shortcomings.

Implications: Network adoption, not just technology, is key. South Korea should coordinate with countries that are actively testing the deposit token model (such as Japan), join the Global Interoperability Forum, or consider launching its own collaborative platform.

Enhancement of cross-border RTGS: Add a blockchain-based clearing and liquidity coordination layer as a complementary structure without completely replacing national RTGS systems such as BOK-Wire+, using stablecoins as settlement tokens.

Reference Case - Project Agorá

Overview: A multi-country project initiated by the BIS Innovation Hub to establish cross-jurisdictional PvP settlement using wholesale CBDC and stablecoins issued by commercial banks without directly connecting to domestic RTGS systems.

Progress: Multi-party FX settlement trial announced in 2024 involving nine global banks, including Citi and JPMorgan.

Key Results: Demonstrated that clearing, settlement instructions and liquidity netting can be automated via smart contracts on the blockchain while keeping the core RTGS system intact.

Implications for South Korea: Final KRW settlement will continue to be conducted via BOK-Wire+, but on-chain instruction processing and interbank liquidity netting using deposit tokens could improve efficiency and interoperability of cross-border flows.

(2) Securities Clearing and Asset Management

Commercial bank deposit-backed stablecoins can also play an important role in streamlining the securities settlement and asset management infrastructure in the capital market:

Securities Settlement: South Korea’s current T+2 securities settlement cycle can be upgraded to T+0 in a delivery-versus-payment (DvP) structure using deposit-based stablecoins. The phased implementation of a DLT-based real-time settlement system can be achieved through integration with central infrastructure such as the Korea Securities Depository (KSD) and the Korea Exchange (KRX), accompanied by reforms to market practices and liquidity management frameworks.

Reference Case - DTCC Ion Project and Smart NAV

Overview: The Ion Project, being developed by the Depository Trust & Clearing Corporation (DTCC), is a central clearing system based on permissioned DLT designed to support T+0/T+1 settlement. Smart NAV enables real-time on-chain dissemination of fund net asset value (NAV), aiming to automate asset management and securities clearing.

Progress: As of 2023, the Ion Project runs in parallel with DTCC's clearing system, processing more than 160,000 transactions per day. Smart NAV is conducting proof of concept with companies such as Franklin Templeton and Invesco.

Key Results: Demonstrated that real-time settlement instructions and DvP operations can be automated via DLT while maintaining central clearing functionality.

Implications for Korea: Existing infrastructure (KSD, KRX) can be retained, but specific functions such as T+0 settlement instructions and automated collateral transfer using deposit tokens can be implemented on-chain. Initial use cases may include CMAs, MMFs, and ETFs, where real-time settlement is critical.

Tokenized Asset Management (RWA Integration): By combining institutionally issued deposit tokens with RWA, an on-chain asset management structure that supports real-time settlement, collateral transfer, and NAV sharing can be achieved. This infrastructure increases accessibility to alternative investments (e.g., private equity, real estate), improves liquidity, and automates manual processes, transforming the investment experience for institutions and individuals.

Reference Case - JPMorgan Kinexys

Overview: Kinexys is an institutional digital financial network that integrates deposit tokens and ODA-FACT token standards to automate asset management, payments, collateral transfers, and portfolio rebalancing within a single platform. It ensures transaction integrity and regulatory compliance (AML/KYC) without the need for a central clearing party, and strengthens on-chain data privacy through the EPIC project (2024), which features private ledgers and identity verification services.

Progress: Brand launch in 2024, partnerships with global institutions such as Apollo Global Management, Citibank, and WisdomTree. By 2025, processing more than $2 billion in assets per day through its real-time digital settlement infrastructure.

Key Results: Real-time portfolio management and settlement using deposit tokens. ODA-FACT standard supports T+0 asset swaps and rebalancing, maximizing liquidity and operational efficiency. Regulatory compliance structures (account locks, sanctions enforcement) build institutional trust.

Implications for South Korea: South Korean banks can issue deposit tokens to enable real-time settlement and asset swaps for MMFs, ETFs, and real estate funds. Public fund structures can adopt standardized minting/burning processes (such as ODA-FACT) under the upcoming STO platform regulation in 2025. Technologies such as the privacy and identity verification features of the EPIC project are necessary to comply with South Korea's privacy and capital market laws. Full smart contract automation with T+0 settlement will require integration with KSD's infrastructure, real-time NAV calculations through KRX data feeds, and regulatory clarity on securities classification and collateral recognition.

(3) Other potential application areas

On-chain securitization: By leveraging repetitive cash flows and a deposit token-based structure, real-time ABS and ABCP issuance and redemption mechanisms can be designed using smart contracts. In particular, for securitization products backed by overseas assets or cross-border income streams, blockchain architecture offers clear advantages in terms of legal contract transparency, repayment traceability, and settlement finality.

Cross-border securities settlement efficiency: For example, when Korean investors trade U.S. stocks, the settlement process involves multiple intermediaries, resulting in delays and additional costs. By moving to an on-chain DvP settlement model using deposit-based stablecoins, significant improvements can be achieved in settlement speed and operational efficiency, opening up the possibility of automatic dividend distribution and future on-chain investment through tokenized ADRs. However, integration with global custodians and institutions such as DTCC, as well as legal and tax coordination, remain prerequisites.

These are all areas where the existing system has clear limitations in terms of cost, time, and risk management, and are also high value-added areas that can be structurally addressed through blockchain.

More importantly, if the same structure as the blockchain infrastructure already adopted by overseas financial institutions is utilized, the possibility of realizing direct connection of Korean digital finance to the global network will also increase.

Furthermore, if the permissioned blockchain structure adopted by Korea develops into an internationally interoperable technical standard, it can be expanded to direct connection with overseas financial institutions, foreign exchange swaps, trade settlements, joint issuance and circulation of securities, etc. Cross-border financial interoperability will go beyond a mere technical choice and become a digital strategic asset for the national economy.

3.3.3. Applicable technical infrastructure requirements

As the application areas of deposit-based stablecoins issued by banks become clearer, the technical infrastructure requirements to support their implementation also need to be further specified. The key lies in how to achieve blockchain advantages such as on-chain automation and global interoperability while meeting the necessary conditions of institutional finance such as regulatory friendliness, transaction privacy, system control, and high-performance processing.

The most promising solution is to build a customizable permissioned blockchain system, each of which can be customized according to the needs of the user and can achieve native interconnection between sub-chains. This allows connections with external chains to be realized as needed while meeting AML/KYC, regulatory-level privacy protection, and high-performance clearing processing.

A typical case is the Avalanche Subnet architecture. The structure combines the controllability of private chains with cross-chain interoperability, and its main features are as follows:

Access control and regulatory compliance: Network participants are limited to pre-approved institutions or partners, and all transactions can only be executed after passing KYC/AML verification.

Data privacy protection: User real-name information will not be uploaded to the chain, and a regulated pseudo-anonymous model is adopted, which can be tracked under regulatory requirements.

Optional external interconnection: If necessary, it can be interconnected with public chains or other subnets.

SMBC is planning to issue Japanese yen stablecoins based on Avalanche Subnet, building a closed system that is only accessible to authorized partners. As the major Japanese bank begins to actually use Subnet-based stablecoin transactions, if South Korea also issues stablecoins with the same architecture in the future, it will be expected to form an experimental environment that can verify the interoperability of wholesale stablecoins between JPY and KRW in real time.

JPMorgan Chase's Kinexys issues deposit-based stablecoins on its autonomous permissioned chain (based on Quorum), which has automated specific financial businesses such as FX trading, repurchase transactions and securities settlement. Although Kinexys has been running on Quorum for a long time, it has recently begun testing the privacy enhancements of Avalanche Subnet through Project EPIC, especially trying to modularize it into specific application scenarios such as portfolio tokenization. However, Kinexys' overall infrastructure has not yet been migrated, and Avalanche technology is introduced into the existing architecture in a "module integration" manner.

Intain operates its structured finance platform IntainMARKETS based on Avalanche Subnet. The platform supports on-chain automation of the entire process of ABS issuance, investment and settlement, and currently manages more than $6 billion in assets. The platform runs on a licensed network that complies with AML/KYC and GDPR requirements, realizes a multi-party participation structure, and effectively reduces the issuance cost and time of small-scale ABS, becoming a representative case of the successful implementation of blockchain technology in structured finance.

In short, stablecoins issued by banks are not only payment tools, but can also be developed into the core infrastructure of compliant financial digitalization. The connection of public chains should not be a short-term goal, but should be promoted as a medium- and long-term direction after regulatory coordination. At present, a more realistic path is to build an infrastructure compatible with the existing institutional financial system in terms of wholesale payment, securities settlement, and international liquidity management.

3.4. South Korea’s response strategy

South Korea’s policy environment does not prioritize speed in the digital currency transition, but rather institutional acceptance and policy control. In particular, the three policy pillars of monetary sovereignty, foreign exchange regulation, and financial stability require a gradual acceptance strategy centered on the central bank and commercial banks, rather than private-led diffusion. Therefore, the South Korean response strategy follows the following three directions:

(1) Promote institution-centered stablecoins

Establish a permissioned infrastructure centered on bank-issued deposit-based stablecoins to achieve full coverage of wholesale and retail payment use cases and lay the foundation for potential interoperability with international settlement networks.

In line with global precedent, implement a permissioned framework first and consider optional interoperability with other systems as technological maturity and regulatory conditions evolve.

Web3 partnerships should be introduced in a limited manner through APIs or white label structures, selectively embracing innovation while maintaining institutional stability.

(2) Operating a regulatory sandbox for conditional flexibility

Experimental issuance by non-bank entities may be permitted on a limited and controlled basis, following a thorough analysis of the potential impact on monetary policy effectiveness, capital flows, and financial stability.

Such experiments must be conducted entirely within the regulatory sandbox framework, with mandatory prior approval and ex post reporting requirements for all aspects, including issuance volume, circulation boundaries, and redemption mechanisms.

It must be clearly stated that this measure is intended to improve the responsiveness of institutions to technological changes and should not be interpreted as an endorsement of the widespread adoption of non-bank stablecoins.

(3) Global docking and technical standardization

South Korea should refer to major international policy frameworks such as the US Genius Act, the EU MiCA, and the Bank of Japan-led model to establish functional distinctions and interoperability standards between CBDCs, deposit tokens, and private stablecoins.

This approach will help create touchpoints between South Korea’s institutional financial system and the global Web3 ecosystem, laying the foundation for a long-term transition to a comprehensive digital payment infrastructure.

In short, the bank-based licensed stablecoin model is the most executable and institutionally acceptable digital currency strategy in South Korea. This will become the technical basis for the efficiency of cross-border financial transactions, the interoperability of institutions, and the circulation of digital assets under institutional control in the future. On the contrary, non-bank issuance structures should be limited to experiments outside the system, and the basic direction is to maintain the dual structure of digital currencies centered on the central bank and commercial banks.

Anais

Anais