Author: Matías Andrade Source: Coin Metrics Translation: Shan Ouba, Golden Finance

2024 Q4 State of the Network Report: Special Analysis of Mining Data

Key Takeaways

• The 2024 Bitcoin halving has had a significant impact on miner profitability, and while BTC revenue per terahash (TH/s) of mining power has fallen sharply, this has been partially offset by the recent surge in Bitcoin prices to over $105,000.

• Publicly traded Bitcoin mining company stocks have exhibited higher volatility than Bitcoin price fluctuations. Companies with stronger balance sheets and more efficient mining equipment, such as Hut8, Bitdeer, and Core Scientific, outperformed their peers.

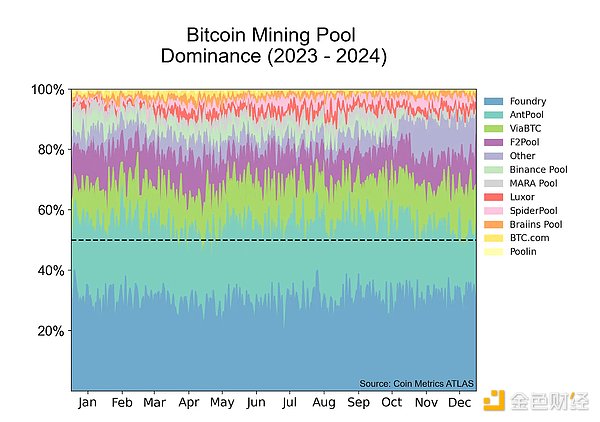

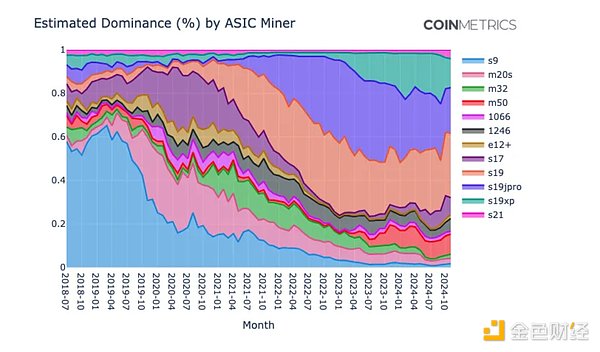

• Analysis of the distribution of ASIC hardware on the Bitcoin network shows a notable shift in the dominance of mining hardware. The market is currently dominated by S19 series machines, reflecting the rapid pace of efficiency improvements in mining hardware, with operators continuously upgrading their equipment to remain competitive.

• Looking ahead, Bitcoin miners’ ability to adapt to network supply adjustments, optimize operations, and take advantage of technological advances will be critical to their long-term competitiveness and profitability.

Introduction

The global Bitcoin mining industry has evolved into a complex and geographically distributed industry. Miners are constantly searching for the most favorable conditions to support their energy-intensive operations. Contrary to the idealistic vision of a borderless, 24/7 cryptocurrency network, the reality is that Bitcoin mining activity is highly sensitive to regional energy policies, climate conditions, and even cultural preferences.

This article will take a deep dive into the changing patterns and trends in the global Bitcoin mining industry. Through a detailed analysis of Bitcoin hashrate and mining difficulty data, we will reveal the distribution of mining hashrate and its evolution over time, leveraging the unique insights provided by Coin Metrics data.

Halving Review

One of the most important events in the Bitcoin ecosystem is the periodic halving of block rewards, with the most recent halving occurring in April 2024. This highly anticipated event, which occurs approximately every four years, cuts the rewards received by Bitcoin miners in half, effectively reducing the supply of new BTC entering circulation.

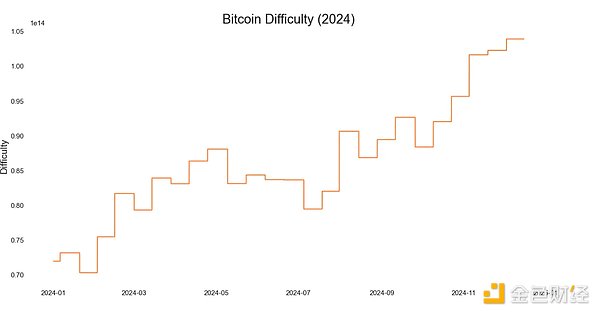

As expected, the 2024 halving had a significant impact on the Bitcoin mining industry. Our analysis of mining difficulty adjustments (shown in the chart below) shows that in the months leading up to the halving, difficulty rose sharply as miners competed to maximize their rewards before the reduction.

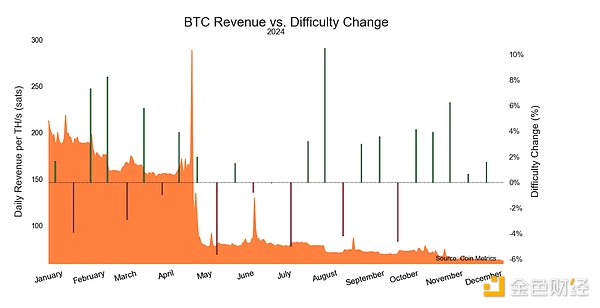

The reduction in block rewards directly affects Bitcoin miners’ revenue, as shown in the chart below. Our data shows that immediately after the halving, revenue per terahertz (TH/s) of mining power denominated in BTC fell sharply, as miners had to endure only half of the previous reward for each block they successfully verified.

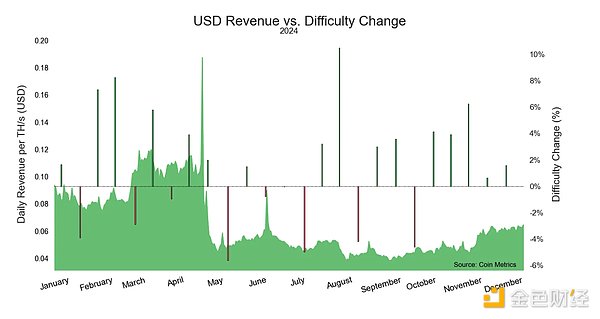

While revenue denominated in BTC has declined, the recent rise in Bitcoin prices to over $107,000 has partially offset the impact, as shown below. USD revenue per TH/s of mining power has recovered but remains below pre-halving levels as miners face challenges maintaining profitability amid reduced block rewards.

These trends highlight the resilience and adaptability required of Bitcoin miners in the face of the network's planned supply adjustments. As the industry continues to evolve, miners need to optimize operations, find the most cost-effective energy sources, and take advantage of technological advances to remain competitive in the changing cryptocurrency mining landscape.

Publicly Traded Bitcoin Mining Companies

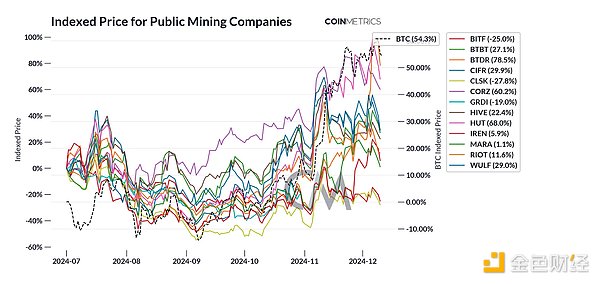

The performance of publicly traded Bitcoin mining stocks has shown a strong correlation with Bitcoin's price action, but with significantly higher volatility. As Bitcoin hit an all-time high in 2024, mining companies have seen a sharp rise in price, though the moves vary depending on factors such as operating efficiency, debt levels, and mining capacity.

Major mining companies such as Marathon Digital Holdings (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) have seen their share prices surge by hundreds of percentage points from their 2023 lows. However, this appreciation has not been uniform across the industry. Companies with stronger balance sheets and newer, more efficient mining equipment have generally outperformed their peers. Since July 2024, as shown in the chart below, the biggest gainers have been Hut8, Bitdeer, and Core Scientific, which have risen 68%, 78.5%, and 60.2%, respectively.

Several factors are driving this price action. Mining companies have high fixed costs for equipment and electricity, which means that a rise in the price of Bitcoin can lead to a greater increase in profitability. This also explains why mining stocks tend to be more volatile than Bitcoin itself, which has appreciated in value by 54.3% over the same period.

The Bitcoin halving event is affecting valuations as investors factor in both the reduction in mining rewards and the historical pattern of price increases after previous halvings. Finally, many miners are holding onto the Bitcoin they mined during the crypto winter, essentially leveraging the price of Bitcoin. As the value of Bitcoin rises, these assets have appreciated significantly, strengthening their financial profiles.

It is important to note that these stocks face unique risks beyond Bitcoin price volatility. Energy costs, obsolete equipment, and regulatory issues could have a significant impact on their performance. Additionally, competition in the mining industry continues to increase, and profit margins could be under pressure even in an environment of rising Bitcoin prices, which could lead to M&A activity and consolidation in the mining industry.

ASIC Distribution

By analyzing the patterns of random numbers in mined blocks, it is possible to track the evolution of Bitcoin mining hardware, providing insight into the technological advancement and security features of the network. Each ASIC manufacturer employs a different random number scanning method that creates an identifiable signature that allows researchers to determine which machines may be responsible for mining a particular block. This method, pioneered and perfected by Coin Metrics, has become an important tool for understanding the makeup of the Bitcoin mining ecosystem.

Data shows that the dominance of mining hardware has undergone several major shifts over the past six years. The Antminer S9 miners that dominated before 2019-2020 have been almost completely phased out as the network has undergone a major technology upgrade cycle. The current landscape is dominated by S19 series machines, including XP, JPro and Standard Edition, which together represent the majority of the network hash rate. This shift shows that the efficiency of mining hardware has increased rapidly as operators continue to upgrade to remain competitive in an increasingly industrialized mining environment.

Conclusion

The 2024 halving event, which reduces miner rewards by 50%, has had a significant impact on the profitability and operations of Bitcoin miners around the world. While revenue per terabyte of hashpower immediately fell in BTC, the recent surge in Bitcoin prices has helped offset some of the negative impact, allowing miners to maintain a degree of profitability. However, the industry still faces challenges in adapting to the network's programmatic supply adjustments.

As the Bitcoin ecosystem continues to evolve, the mining industry will need to demonstrate resilience, adaptability, and a keen eye for optimizing operations to stay ahead of the curve.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph