Author: Tanay Ved & Matías Andrade Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points:

Currently, the total market value of meme coins is $60 billion, and they are occupying an increasing market share in layer 1 networks such as Ethereum and Solana, and layer 2 networks such as Base.

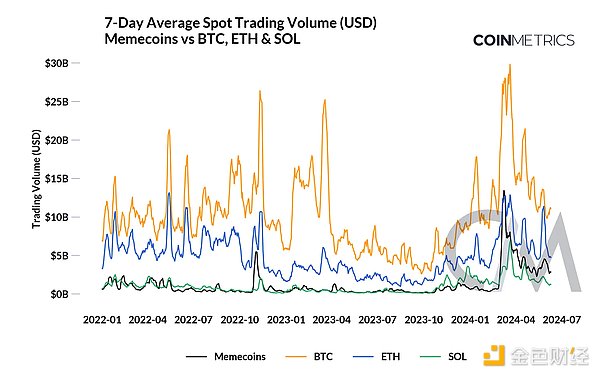

In March, the spot trading volume (7-day average) of meme coins on exchanges reached $13 billion, surpassing major blue-chip crypto assets such as Ethereum (ETH) and Solana (SOL).

The high concentration of meme coins indicates that the assets are mainly concentrated in the hands of a few holders, bringing potential market manipulation and liquidity issues.

Introduction

Memes have become an important part of human culture, constantly changing and adapting over time through various media. The term "meme" was coined by British evolutionist Richard Dawkins in his seminal 1976 book The Selfish Gene, describing it as a unit of cultural transmission, including "tunes, ideas and catchphrases", emphasizing their similarity to genes in biological evolution.

The spread of memes has changed significantly throughout history, influenced by social, cultural and technological changes. In ancient times, folk tales and religious symbols were early forms of memes, spread orally or in manuscripts. During World War II, the graffiti meme "Kilroy was here" was widely circulated to symbolize the presence of American soldiers. In the digital age, memes have found new vehicles through viral videos and image macros (such as "Doge"), spreading rapidly across the internet and social media platforms, allowing cultural ideas to spread more widely than ever before.

Recently, memes have further expanded into phenomena such as meme stocks, exemplified by GameStop's dramatic increase in value as a result of collective efforts on Reddit's /r/wallstreetbets forum. Similarly, meme coins like Dogecoin and Pepe have gained huge traction in the world of crypto assets, creating digital forms of value through blockchains and on-chain communities. Memes are part of human nature, reflecting our desire to seek connection and belonging through shared ideas.

In this week’s Coin Metrics State of the Network report, we aim to explore the surge in memecoin activity on networks like Ethereum and Solana, highlighting key market trends driven by the memecoin industry.

The State of Memecoins

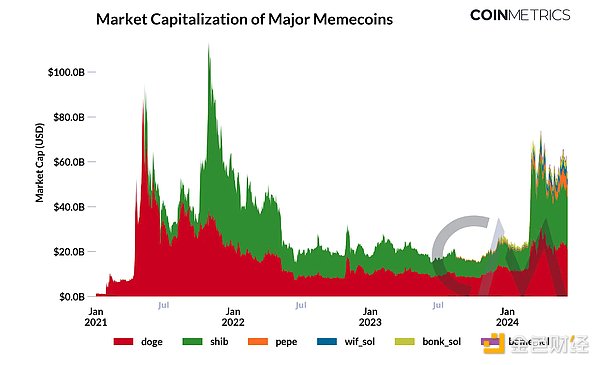

Since the advent of Dogecoin in 2013, the memecoin industry has expanded rapidly, with the total market capitalization having swelled to $60 billion as of June 2024. The industry is characterized by crypto assets representing familiar animals, characters, and more recently, politicians, with an element of humor to attract attention and drive community engagement. Their growth is primarily driven by being highly speculative and driven primarily by market sentiment rather than intrinsic value.

(Note: Solana’s meme coin and other SPL tokens will be released soon as an extension of Solana network data)

The most valuable meme coins today include Dogecoin (DOGE), which runs as an independent proof-of-work blockchain, and ERC-20 tokens such as Shiba Inu (SHIB) and Pepe (PEPE), whose market value exceeded $100 billion in 2021. Solana has recently become a hot topic for meme coins, which have spawned meme coins like dogwifhat (WIF) and Jeo Boden (BODEN) due to low transaction fees, a growing ecosystem, and easy token creation through platforms such as pump.fun.

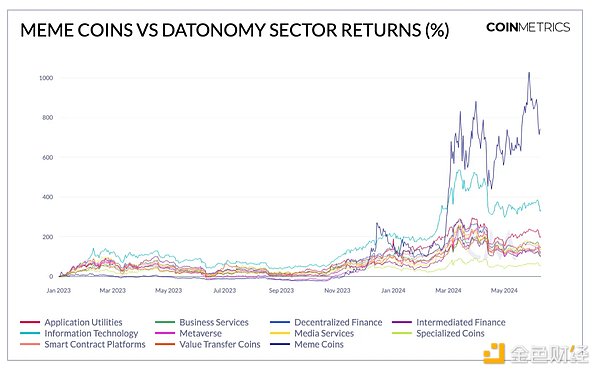

According to Coin Metrics’ datonomy™ classification, the meme coin industry has performed well compared to other sectors of the cryptoasset ecosystem. Meme coins have shown strong relative strength compared to major blue-chip cryptoassets and have also surpassed the information technology sector, which has gained ground due to developments at the intersection of decentralized computing and artificial intelligence (AI) applications.

Memecoins were particularly notable, with an average return of 740% from October 2023 to 2024. This has also driven the growth of memecoin indices, such as the GMCI Meme Index, reflecting efforts to quantify the sector’s performance. While correlated to the speculative phase of the market cycle, this performance reflects the sector’s recent growth in mind share among retail and institutional investors.

Memecoin Market Activity

Increasing attention surrounding the memecoin space has further driven activity in the digital asset market. While trading volumes have generally been in line with broader market trends, in March, memecoin spot trading volume (7-day average) on centralized exchanges reached $13 billion, even surpassing major assets such as Ethereum (ETH) and Solana (SOL). Decentralized exchanges (DEXs) have also played a key role in the memecoin ecosystem, providing the basic infrastructure for pool creation and asset trading, facilitating liquidity and accessibility for a wide range of users.

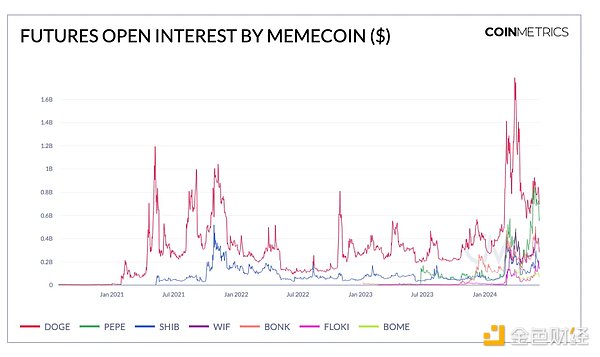

From a relative trading volume perspective, the influence of established meme coins like DOGE and SHIB appears to be waning, while PEPE and a host of new Solana meme coins have gained popularity, collectively representing more than 50% of trading volume. This reflects investors' recent preference for new meme coins, stemming from their growing communities, blockchain ecosystems, and potential for higher returns. Nonetheless, the liquidity and long track record of existing meme coins remain important factors for potential investors to consider. Similarly, high futures open interest indicates significant market presence and shows a high level of speculative trading activity. DOGE’s open interest recently hit a record high of $1.8 billion, while PEPE’s open interest surged nearly 50% in May to $850 million. This surge in open interest, totaling more than $3 billion, indicates increased price volatility and highlights that investors are gradually using futures positions to hedge their memecoin risks. Tracking open interest is one of the fundamental tools for understanding speculative capital flows, especially in volatility instruments, which can be a precursor to a shift in market interest or liquidation.

Memecoin User Growth and Risk

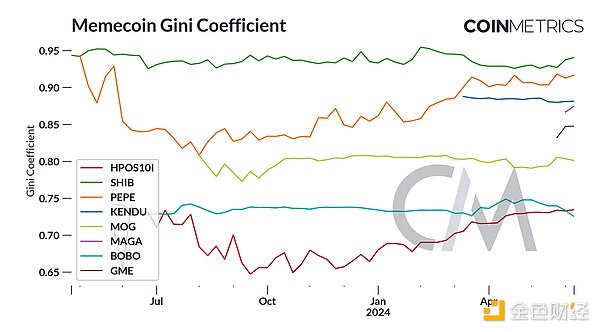

While the market presence and user growth of memecoins go hand in hand, it is important to be aware of the risks associated with this area. The Gini coefficient is a measure of the distribution of income or wealth among a population, ranging from 0 (perfect equality) to 1 (maximum inequality). In the context of memecoins, the Gini coefficient can be used to assess the distribution of token holdings among different addresses.

High concentrations of token holdings increase the risk of market manipulation. Large holders, often referred to as "whales," can significantly affect token prices by buying or selling large amounts at once, causing volatility. Additionally, if a small number of addresses hold the majority of tokens, this could lead to liquidity issues, which could be exacerbated in decentralized exchanges where a small number of entities control liquidity provision.

The high Gini coefficients (around 0.8) for these meme coins highlight the significant concentration of token holdings. This concentration presents a variety of risks, including potential market manipulation, liquidity issues, and investor vigilance, which should all be carefully considered when evaluating these tokens. Understanding these dynamics is critical to assessing the stability and potential risks of these digital assets before considering any investment in the meme coin industry.

Conclusion

The meme coin industry has shown significant growth and influence in the cryptocurrency market, finding a solid foothold on the blockchain due to the viral nature of memes and the ease with which they spread. Since the launch of spot ETFs, the industry has performed strongly alongside Bitcoin, highlighting its growing appeal among retail and institutional investors. However, a high Gini coefficient of 0.8 indicates a significant concentration of token holdings, bringing risks such as market manipulation and liquidity issues, in addition to volatility that most investors cannot tolerate. As the industry continues to develop, understanding these dynamics is critical to assessing the evolution and potential risks of meme coins.

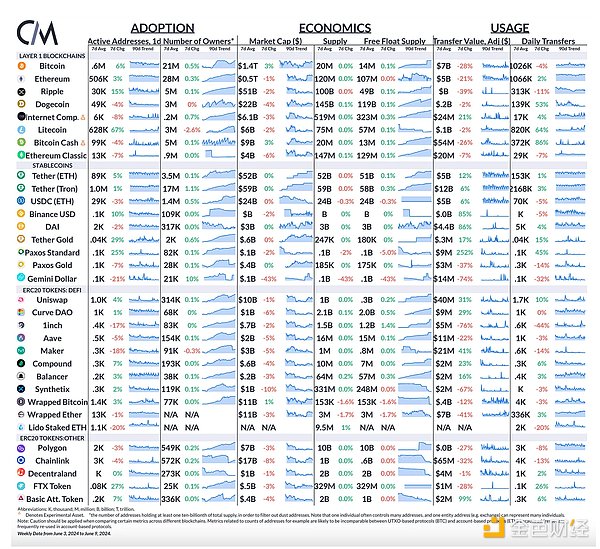

Network Data Insights

Compared with last week, the transfer amount (adjusted) of the Bitcoin network fell by 28%, and the transfer amount of the Ethereum network fell by 21%. The number of active addresses of Bitcoin increased by 6%, and the number of active addresses of Ethereum increased by 3%

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine dailyhodl

dailyhodl Bitcoinist

Bitcoinist Coinlive

Coinlive