Source: Coinbase; Compiled by: White Water, Golden Finance

Abstract

< li>Restaking is laying the foundation for new decentralized financial products on Ethereum, but the complexities surrounding this new revenue stream are not trivial.

The rise of liquid re-staking tokens based on these processes not only reflects these complexities, but may also bring hidden risks to the ecosystem.

That said, we believe that restaking will play a central role in incentivizing validators in the long term, as local staking issuance is likely to decrease in the future.

Ethereum’s proof-of-stake (PoS) consensus mechanism is the largest economic security fund in cryptocurrency, totaling nearly $112 billion. But validators who secure the network don’t just earn base rewards on locked ETH. Liquid Staked Tokens (LST) have long been a way for participants to bring their ETH and consensus layer earnings into the DeFi space – which can be traded in other exchanges or re-staked as collateral. Now, the advent of re-staking has introduced another layer in the form of Liquidity Re-staking Tokens (LRT).

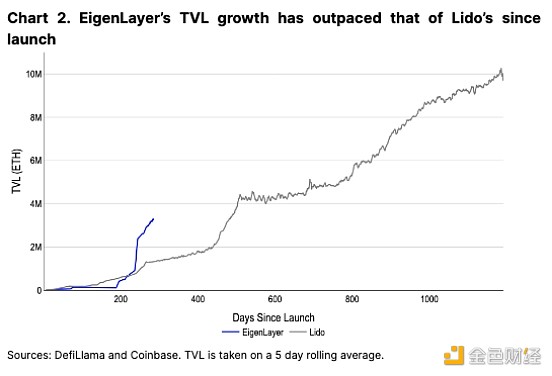

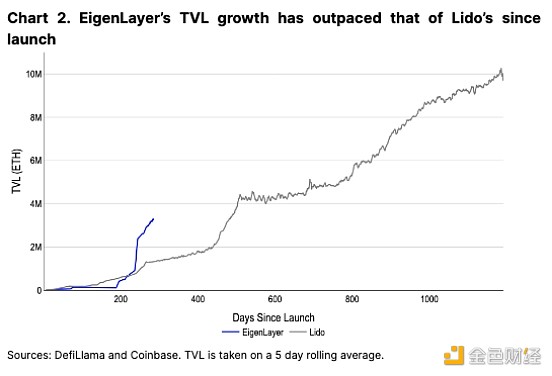

Ethereum’s relatively mature staking infrastructure and excess security budget have enabled EigenLayer to grow into the second-largest DeFi protocol in the ecosystem (with a total value locked (TVL) of $12.4 billion). EigenLayer enables validators to earn additional rewards by re-staking ETH to secure the Active Validation Service (AVS). As a result, intermediaries in the form of liquidity re-hypothecation protocols have become increasingly common, driving the proliferation of LRT.

That said, we believe that is comparable to existing staking products from a security and financial perspective. However, re-hypothecation and LRT may bring additional risks. As the number of AVSs grows and LRT strategies differentiate, these risks may become increasingly opaque. Nonetheless, staking (and staking) rewards are laying the foundation for a new class of DeFi protocols. If these proposals are implemented, separate discussions around reducing staking issuance to minimum viable issuances (MVIs) may also further increase the relative importance of long-term restaking yields. As a result, an undue focus on recapturing opportunities is becoming one of the biggest crypto themes of the year.

Ethereum re-staking basics

EigenLayer’s re-staking protocol will be launched on the Ethereum mainnet in June 2023, and AVS will be in the next phase of its multi-stage deployment ( Q2 2024). In factEigenLayer's "re-staking" concept establishes a way for validators to secure new Ethereum features, such as the data availability layer , Rollup, bridges, oracles, cross-chain messages, etc., and may receive additional rewards in the process. This represents a new revenue stream for validators in the form of “security as a service”. Why has this become such a hot topic?

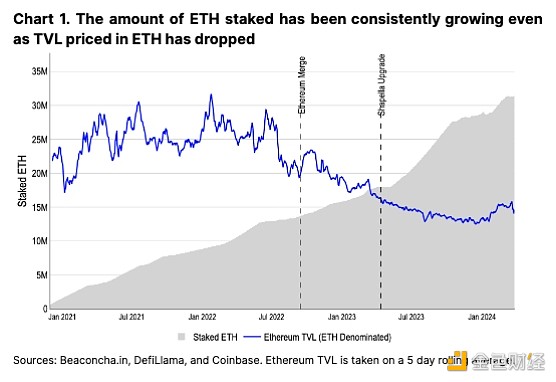

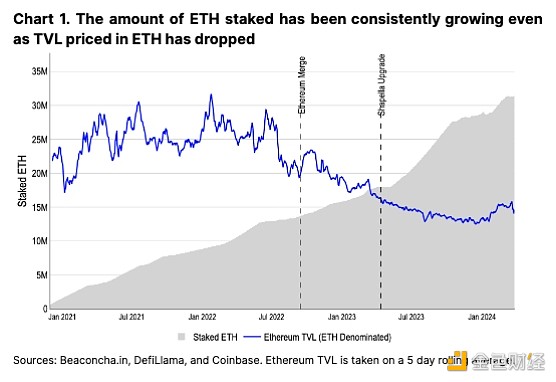

As the largest PoS cryptocurrency, ETH currently has a huge economic base to protect its network from malicious majority attacks. However, at the same time, the continued growth of validators and staked ETH has arguably exceeded what is needed to secure the network. At the time of the merger (September 15, 2022), 13.7 million ETH were staked, presumably enough to secure the network’s TVL of 22.1 million ETH at the time. As of our upcoming announcement, approximately 31.3 million ETH are currently staked, tripling the amount denominated in ETH, but Ethereum’s TVL in ETH is actually lower (less than in late 2022) at 14.9 million ETH (see picture 1).

Excessive pledges The security, liquidity, and reliability of ETH and the underlying assets make it uniquely positioned to help facilitate the security of other decentralized services. In other words, we believe restaking as a concept is largely inevitable as an extension of ETH’s inherent value. However, there is no free lunch. To ensure the correctness of these services, redstaking is used for behavioral verification and may be subject to seizure or slashing penalties, similar to traditional staking. (That is, when the first set of AVS launches in Q2 2024, reduction will not be enabled.) As with staking, restaking operators receive additional ETH (or AVS tokens) for their services.

Liquidity Staking

EigenLayer’s TVL growth to date is astounding, second only to Lido (Ethereum’s leading liquidity pledge agreement). EigenLayer achieves this while retaining deposit caps for most processes, and also before any live AVS is launched. That said, it’s difficult to decouple continued re-staking demand from user interest in short-term points and airdrop mining. Although the amount of re-staking ETH may continue to grow as the protocol matures, we believe that when point mining ends or early AVS TVL may experience short-term declines when rewards are lower than expected.

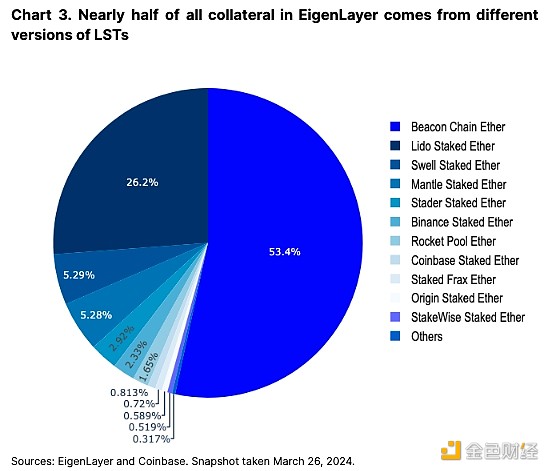

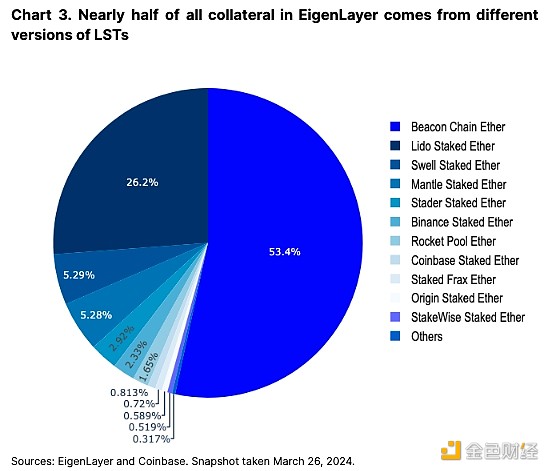

EigenLayer builds on the existing staking ecosystem by staking various underlying LST pools or natively staking ETH (via EigenPods). Programmatically, validators point their withdrawal addresses to EigenPods to earn Eigen Points, which will be redeemed for protocol rewards in the future. LST locked in EigenLayer (1.5M ETH) represents approximately 15% of all LST, while the total amount of ETH locked in EigenLayer represents nearly 10% of all ETH used for staking (3M, 31.3M ETH total). (LST itself accounts for 43% of all staked ETH in the ecosystem.) In fact, we believe that the recent interest in new validators joining has been driven by re-staking, after staking demand stabilized after October 2023. In February 2024, over 2 million new ETH were staked, coinciding with the temporary suspension of EigenLayer deposit caps. In fact, some LST providers are increasing their target APY as a way to capitalize on restaking interest to attract new users to their platforms.

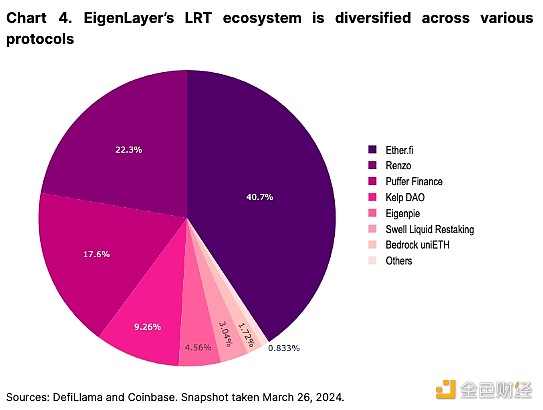

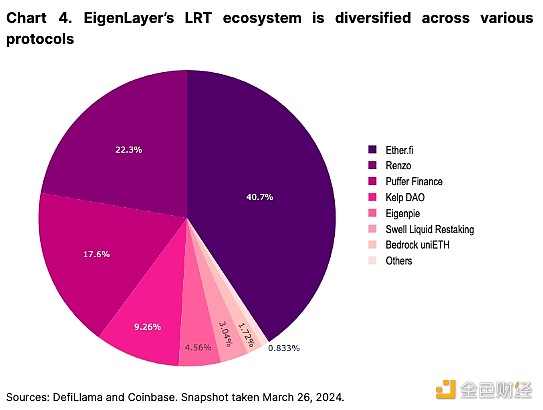

Building on the popularity of LST, a rich LRT ecosystem has developed, with more than six protocols offering liquid re-staking tokens with various points and airdrop options. coin version. Of the 3M ETH secured in EigenLayer, approximately 2.1 million (62%) are encapsulated in secondary protocols. We have seen similar patterns before in the liquidity staking market and believe that diversification of alternatives will be important as the industry grows.

In the long run ,If the native staking issuance decreases due to increased staking participation (as more validators join, the yield will decrease), Re-staking may become an increasingly important avenue for ETH yields. Separate discussions to reduce natively staked ETH issuance may further increase the relevance of restaking yields (although this is still early in the discussion phase).

Nonetheless, AVS yield is expected to be relatively low after launch, which may give LRT a boost in the short term bring challenges. For example, Ether.fi, the largest LRT, charges a 2% annual platform fee on its TVL for "treasury management." However, not all LRTs have the same fee structure, so there is room for competition in this regard. But if we use this 2% fee as a metric for calculating break-even costs, AVS would need to pay approximately $200 million per year for EigenLayer's security services (based on a re-pledge value of $12.4 billion) to break even - more than Aave or Maker Even more were charged in the past year. This raises the question: How much business does AVS need to generate to increase overall returns for ETH stakers.

The emergence of active verification services

As of today, it has not yet been launched in the main Launch any AVS online. The first AVS to be released (early Q2 2024) will be EigenDA, a data availability layer that can serve a similar role to Celestia or Ethereum’s blob storage. Following the success of the Dencun upgrade in reducing Layer 2 (L2) costs by more than 90%, we believe EigenDA will become another addition to the modular tool arsenal. A tool that enables cheaper L2 transactions. However, building or migrating L2 to leverage EigenDA is a slow process that can take months before generating meaningful revenue for the protocol.

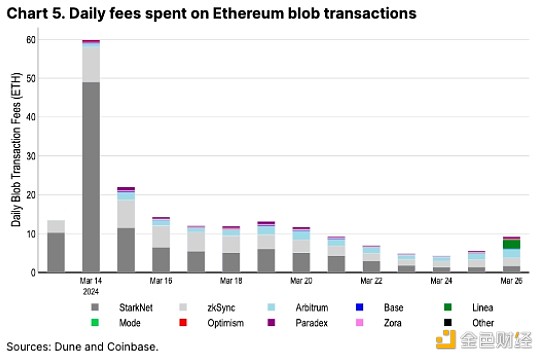

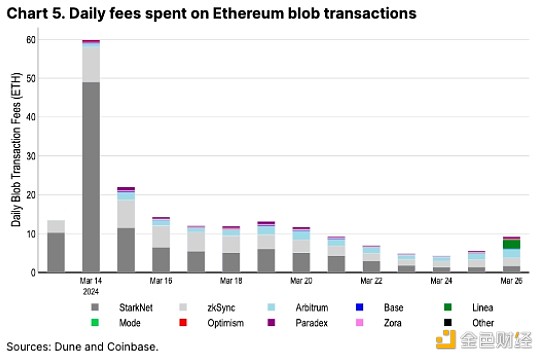

To estimate the initial benefits of EigenDA, we can compare to Ethereum blob storage costs. Currently, approximately 10 ETH per day is used in blob transactions from a number of major L2s, including Arbitrum, Optimism, Base, zkSync, and StarkNet (see Figure 5). If EigenDA saw similar levels of usage, our conservative estimate would be that the annualized rate of restaking rewards would be around 3.5k ETH, equivalent to ~0.1% of additional rewards. We believe that while adding multiple AVSs may quickly increase earnings, expenses in the first few months may be lower than expected.

In the EigenLayer ecosystem Other AVS built include an interoperability network, a fast final layer, a proof-of-position mechanism, a Cosmos chain secure bootloader, and more. The opportunity space for AVS is extremely broad and growing. Restakers can selectively choose which AVS they want to secure with ETH collateral, although this process becomes increasingly complex with each new AVS.

Dark Corner

This raises a question: How different LRTs will handle (1) AVS selection, (2) potential slashing, (3) eventual token financialization. In traditional staking, the one-to-one mapping between validator responsibilities and revenue is clear, making LST a relatively simple matter, all things considered. But through rehypothecation, the many-to-one structure adds some non-trivial complexity (and diversity in terms of LRT issuers) in how gains (and losses) are accumulated and distributed. LRT not only pays out basic ETH staking rewards, but also pays out rewards for earning a set of AVS. This also means that the potential returns paid by different LRT issuers will vary.

Currently, many LRT models are not yet completely clear. However, since there is only one LRT per project, all token holders in a given protocol may be subject to uniform AVS incentives and slashing conditions. The design of these mechanisms may vary between LRT providers.

One suggestion is to adopt a tiered approach, whereby LRT issuers could adopt a range of “high” and “low” risk AVS, although this would require the establishment of risk criteria that are yet to be defined. Additionally, depending on the architectural design, the final reward for token holders may still be paid out as the sum of all AVS, which we believe defeats the purpose of the risk tiering framework. Alternatively, a decentralized autonomous organization (DAO) could decide which AVS are selected, but this raises questions about who the key decision-makers are within these DAOs. Otherwise, the LRT provider can act as an interface to EigenLayer and allow the user to retain decision-making authority over which AVS to adopt.

Emerging Risks

However, at launch, the re-staking process should be Relatively simple, since EigenDA will be the only AVS that needs to be protected. However, a feature of EigenLayer is that ETH invested in one AVS can be further reinvested into other AVS. While this can increase returns, it can also heighten risks. Submitting the same re-staking ETH to multiple AVS presents challenges when it comes to sorting out the hierarchy of slashing and claim conditions between services. Each service creates its own custom slashing conditions, so there could be situations like this: An AVS is slashed for misconduct and then pledged of ETH, while another AVS wants to recover the same re-staked ETH as compensation for the damaged participants. This may lead to eventual cutback conflicts, although as mentioned, EigenDA will not have cutback conditions when first launched.

To further complicate this setup, EigenLayer's "pool security" model (where AVS utilizes a public pool of staked ETH to secure its service) can be secured via "vesting" Security" further customized. That is, individual AVS can acquire (additional) re-staking ETH that is used solely to secure their specific services – a form of insurance or safety net that pays premiums for the AVS. Therefore, as more AVS are introduced, the operator's role becomes technically more complex and the curtailment rules become more difficult to follow. The scaling of LRT, in addition to the complexity of this re-staking, abstracts away many potential strategies and risks from token holders.

This is a problem because we think people will ultimately go where these LRT providers offer the highest returns. Therefore, LRTs may be incentivized to maximize their yields in order to gain market share, but this may come at the expense of a higher (albeit hidden) risk profile. In other words, We believe it is risk-adjusted returns that are important rather than absolute returns, but it may be difficult to maintain transparency in this regard . This may result in additional risk, as LRT DAOs will be incentivized to re-stake as many times as possible to remain competitive.

Additionally, LRT could also create downward selling pressure on non-ETH AVS rewards if LRT payouts were entirely in ETH. That said, if LRT requires conversion of native AVS tokens to ETH (or ETH equivalent) in order to redistribute rewards to LRT token holders, the value of restaking may be limited by recurring selling pressure.

In addition, LRT also has valuation risks that cannot be ignored. For example, if the staking withdrawal queue lengthens (the validator churn limit has been reduced from 14 to 8 following the Ethereum Dencun fork), LRT may temporarily drift away from its base value. If LRT becomes a widely accepted form of collateral in DeFi (such as LST in lending protocols), this could inadvertently exacerbate liquidations, especially in illiquid markets.

This assumes that these DeFi protocols can correctly assess the collateral value of LRT in the first place. In effect, LRTs represent different portfolio holdings whose risk profiles may change over time . New constituents may be added or removed, or the earnings or solvency risks of AVS itself may change. Hypothetically, we may see a situation where a market downturn could affect multiple AVS simultaneously, thus destabilizing the LRT and amplifying the risk of forced liquidation and market volatility. Recursive lending only magnifies these losses. On the other hand, protocols that can decompose LRT into its principal and return components can help mitigate this risk to a certain extent, Because the tokenized principal can be used as original collateral, and the tokenized proceeds can be used for interest rate swaps.

Finally, as Ethereum co-founder Vitalik Buterin emphasized, in some cases, A major glitch in the re-staking mechanism could threaten Ethereum’s underlying consensus protocol. If the amount of ETH restaking is large enough relative to all staked ETH, there may be a financial incentive to enforce bad decisions that could lead to network instability.

Summary

EigenLayer’s re-pledge agreement is promising Become the cornerstone of a variety of new services and middleware on Ethereum, which in turn can generate a meaningful source of ETH rewards for validators in the future. AVS from EigenDA to Lagrange could also greatly enrich the Ethereum ecosystem itself.

That is, adopting an LRT wrapper around the underlying protocol may lead to hidden risks due to opaque redistribution strategies or temporary misalignment of the underlying protocol. How different issuers select AVS to protect and allocate risks and rewards to LRT holders remains an open question. Additionally, AVS's initial yield may not meet the extremely high expectations set by the market, but we expect this to change over time as AVS adoption grows. Nonetheless, We believe that restaking supports open innovation on Ethereum and will become a core part of the ecosystem infrastructure.

Anais

Anais