Source: Coinbase; Compiled by: Tao Zhu, Golden Finance

Abstract

In December 2024, on-chain lending usage reached an all-time high. We believe that this area will continue to grow as the overall on-chain economy expands.

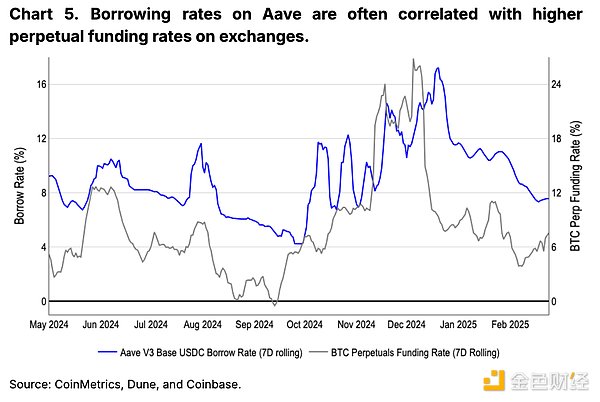

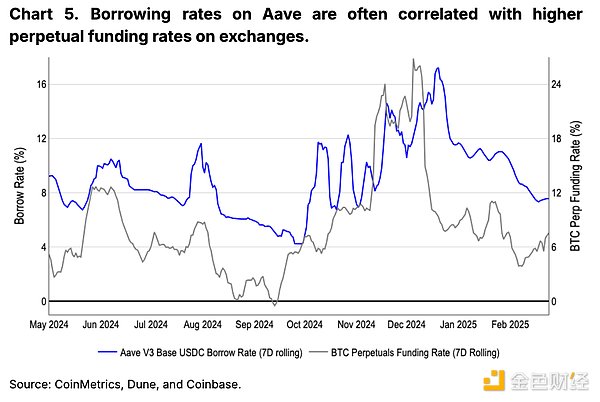

Most on-chain lending markets have floating interest rates based on liquidity utilization thresholds. Therefore, historically, rising lending rates have been associated with other signs of leverage in the market, such as high perpetual futures financing rates.

We believe that programmatic lending protocols will continue to be adopted, especially at the level of new innovations such as interest rate trading and custodial vaults. That being said, we believe that traditional funding channels remain important, especially for institutions.

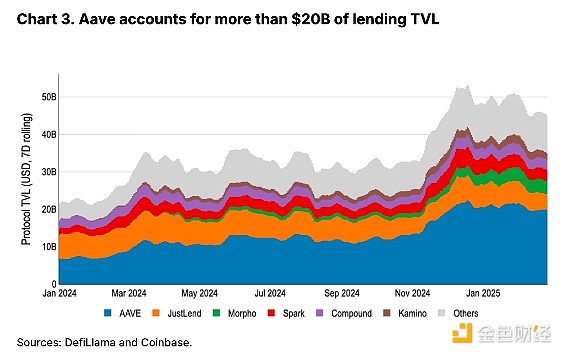

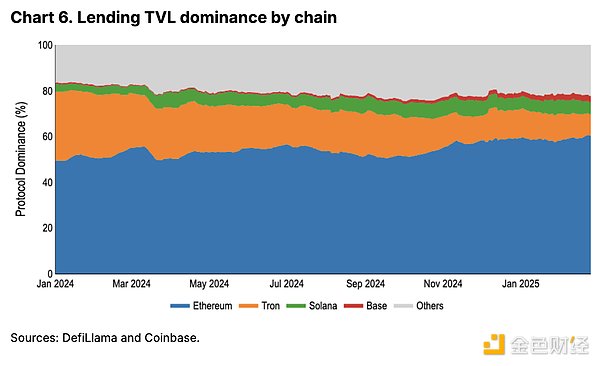

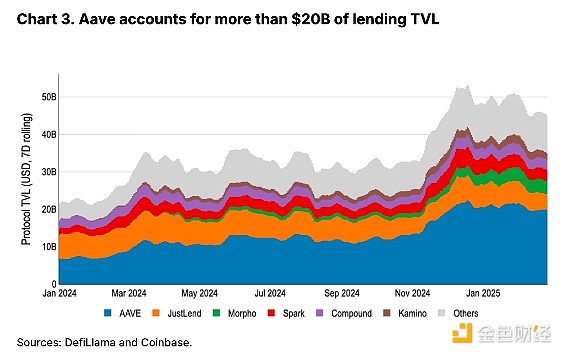

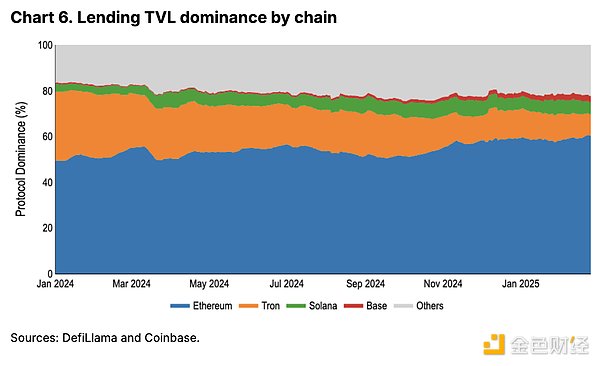

Lending solutions are a core part of the cryptocurrency market structure and have been one of the pillars of the on-chain economy since the early days of decentralized finance (DeFi). It is critical that DeFi lending protocols enable access to funding in a programmatic and permissionless manner and operate 24/7. As the industry matures, the total value locked (TVL) in DeFi lending protocols reached an all-time high of $55 billion in December 2024.

In addition to funding utility, we believe the transparency of the on-chain lending market also makes it a useful indicator for market positioning. Borrowing demand (especially for stablecoins) is proxied through floating interest rates, which generally reflect the demand for leverage. We find that stablecoin lending rates correspond to other popular market indicators, such as perpetual futures funding rates. Overuse of certain assets, such as ETH, as collateral may also affect their performance during volatile periods.

We believe that the on-chain lending industry will continue to grow as the diversity of collateralizable on-chain assets continues to increase. On-chain protocols are increasingly integrated into existing platform interfaces, such as BTC-backed loans on Coinbase. Meanwhile, at the forefront of the DeFi market, we believe that interest rate trading and custodial vaults may be two drivers of future growth. That being said, we also believe that traditional financing solutions remain important to investors, especially institutions, as they have more predictable and discretionary rates and different risk profiles.

Overview of Lending Mechanisms

Lending markets play a core role in traditional financial markets, namely driving liquidity and capital efficiency, allowing businesses to expand, individuals to invest, and institutions to manage risk. These services have historically been provided by banks or other financial intermediaries. But in the early days of crypto, limited institutional participation drove the need for crypto-native lending markets. This led to the DeFi lending market built on blockchain rails.

DeFi lending platforms operate through smart contracts that programmatically control the end-to-end lending process. Borrowers obtain loans by depositing crypto assets such as ETH as collateral, which they use to borrow other assets such as stablecoins. The amount that can be borrowed is determined by the loan-to-value ratio (LTV) of the collateralized assets.

For example, based on the current 80.5% LTV ratio on Aave V3, a borrower who deposits $10,000 in ETH can obtain a loan of up to $8,050 in USDC. (The LTV ratio of the collateralized assets can be adjusted through governance on Aave.)Some protocols support multi-asset collateralization and lending, where collateral and lending valuations are aggregated in a single account. Other protocols may segregate lending pools to better manage risk management, while others operate a hybrid model of segregated pools and cross-margin pools.

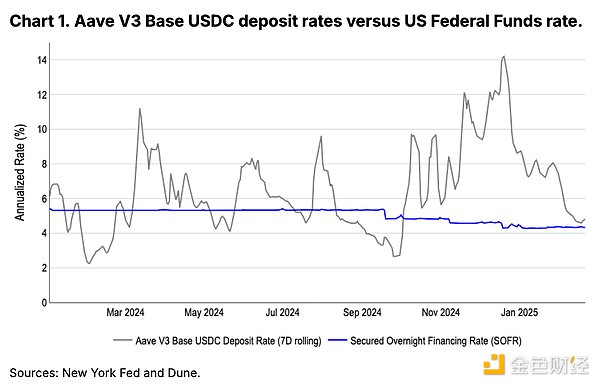

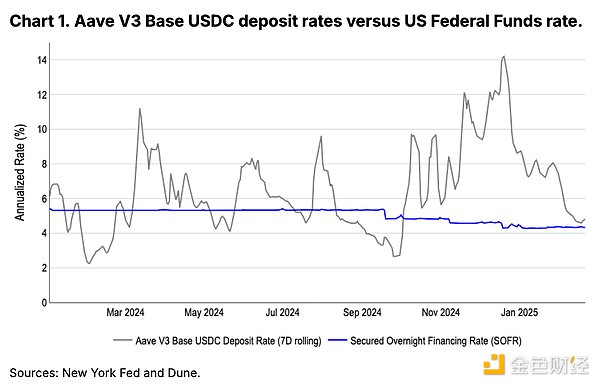

On the other side of the market, lenders provide assets to liquidity pools to earn a yield, which is paid by borrowers in the form of interest. Historically, these yields have often far exceeded the interest rates on short-term U.S. Treasury bills, making them an ideal place for crypto-native investors to earn yield on stablecoins (which typically do not accrue interest). See Figure 1.

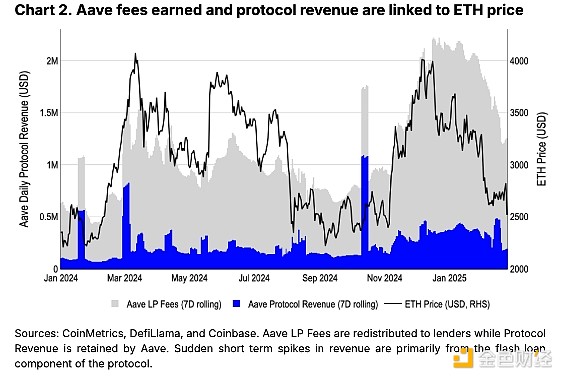

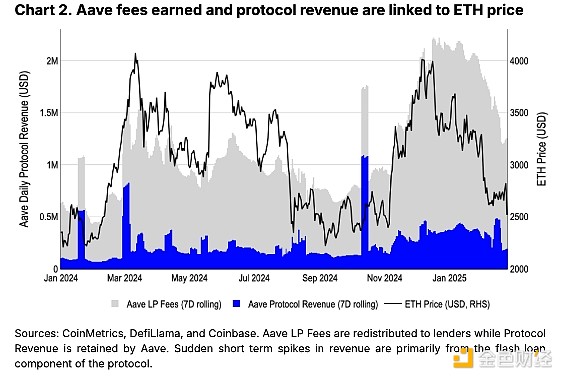

Smart contracts enforce repayment terms and interest accrual, while taking a portion of the interest fees as protocol revenue. Aave, the leading DeFi lending market, earned $395 million in fees in 2024, of which $86 million went to the protocol. (Note: Flash loan fees also contribute to these numbers.) Aave fees appear to be correlated with ETH price performance. We believe this is due to increased demand for leverage as the market heats up (more on this below).

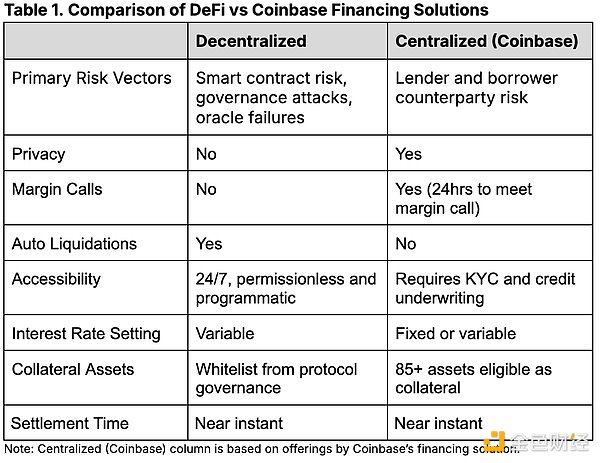

If the collateral value falls below a certain threshold, the protocol solvency is enforced through automatic liquidation. Unlike traditional financing solutions, where lenders may make margin calls before selling collateral assets to repay the loan, DeFi lending protocols automatically auction collateral when the LTV ratio exceeds a predefined threshold. In the event of a default, liquidators are incentivized to purchase the borrower's collateral to repay the borrower's debt. Collateral assets are sold at a price below market value to help liquidators bear market risks (such as slippage) and incentivize more people to participate. Liquidation bonuses (i.e., discounts) can be up to 8.5%.

Variable Rates and Leverage Signs

To optimize asset utilization, borrowing rates on most major lending markets fluctuate based on market conditions. When borrowing utilization is low, rates are lowered to attract borrowers. Conversely, when utilization is high, rates are raised to attract more lenders. While variable rate calculations vary by protocol, we believe Aave's calculation mechanism is worth highlighting as it accounts for nearly half of all borrowed TVL. (Note: We focus on Aave V3.)

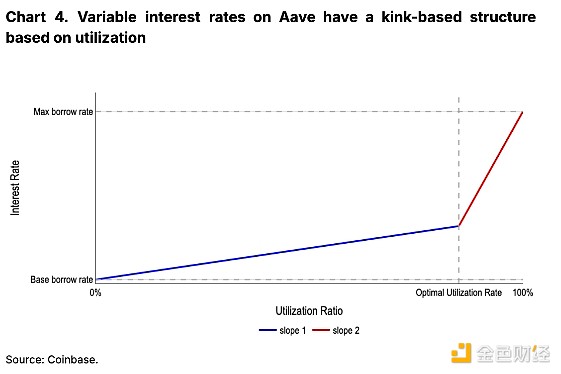

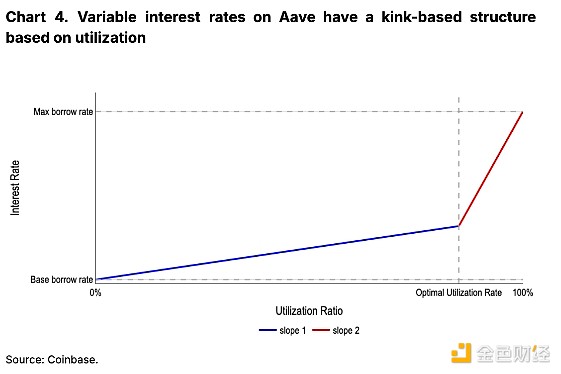

Each liquidity pool (i.e., asset) on Aave has several key parameters, including the base borrow rate, the maximum borrow rate, and the optimal utilization rate. (Utilization rate is equal to the borrowed assets divided by the total liquidity.) Before reaching the optimal utilization rate, the effective borrow rate gradually increases in a linear manner relative to the utilization rate. However, after exceeding the optimal utilization rate, the borrow rate increases sharply, although it is still linear. The exact growth rate of each component (i.e., slope 1 and slope 2) is determined by governance. This gives the borrow rate a kinked structure as shown in Figure 4. The kink structure helps explain why stablecoin borrowing rates can quickly spike during periods of demand — exceeding optimal utilization, rates rise dramatically.

We believe that borrowing demand, especially in the stablecoin market, may be an indicator of leverage in the cryptocurrency market. Investors can deposit the asset they are long on as collateral, borrow stablecoins, and buy more assets to go long. In fact, investors are actually able to short the borrowed asset with the collateralized asset. In our view, rising stablecoin lending rates (especially rates above the best utilization rate) are a sign of a hot market. Figure 5 highlights the relationship between USDC lending rates on Aave and the ETH perpetual funding rate. (The funding rate is the annualized fee for holding a long position in the perpetual market.)

Collateral Concentration

The reliability, security, and overall maturity of the Ethereum DeFi ecosystem are such that lending TVL is concentrated entirely on the network.In particular, Ethereum’s stability ensures reliable access to liquidity during periods of market volatility, when access to lending facilities (and liquidation processing) is most needed. While Solana’s network stability has improved materially over the past two years, its contribution to lending TVL is still 5.2%, compared to Ethereum’s 60.4%.

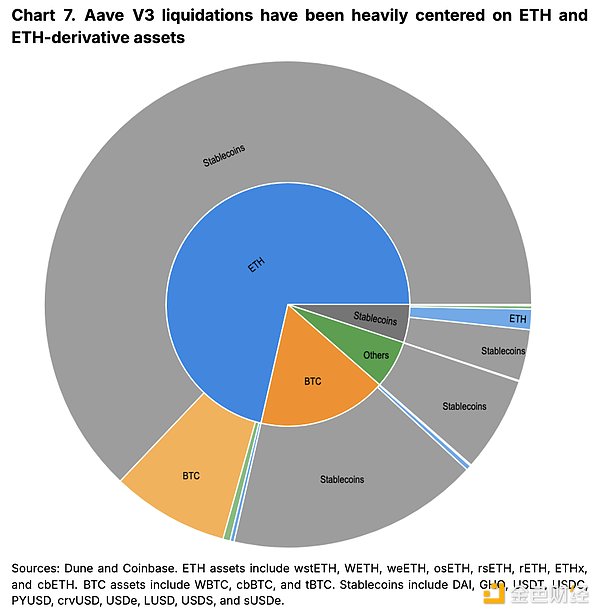

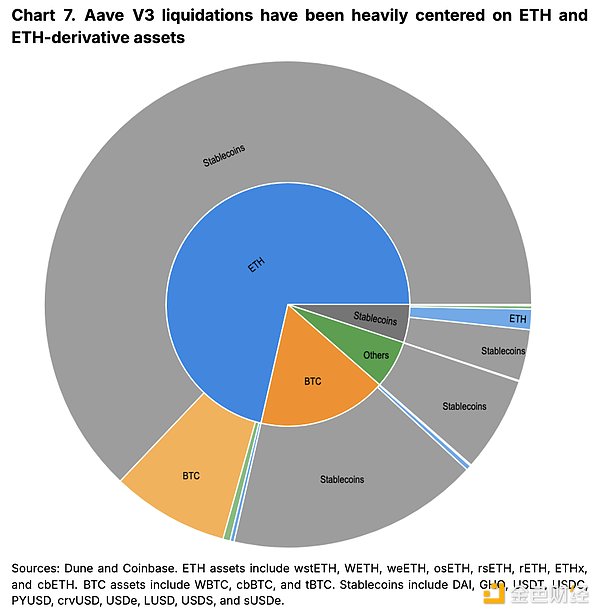

However, a side effect of this is that ETH has become the most widely used collateral asset for DeFi lending. This has led to it frequently experiencing larger liquidation events during sharp market contractions (due to programmatic selling in liquidations). In our view, this partly explains why ETH may perform poorly during periods of large cryptocurrency liquidations.

Figure 7 shows an aggregate summary of all liquidations on Aave V3 on Ethereum since January 1, 2024. The inner circle shows liquidated assets by collateral type, while the outer circle shows debt positions (i.e. borrowed assets) that have been repaid. 71% ($575 million) of all liquidated assets on Aave since the beginning of 2024 are ETH or ETH derivatives such as Liquid Collateralized ETH. Meanwhile, stablecoins account for 89% ($655 million) of borrowed assets in liquidated positions across all product types.

Frontier Developments

While lending protocols are now a staple of the on-chain market, integration and innovation are still happening at a breakneck pace. In terms of integration, more and more companies and protocols are building on top of core DeFi lending facilities. For example, Coinbase has enabled permissionless BTC-backed loans powered by Morpho. As lending smart contracts become more battle-tested and trusted, protocols involving more complex and streamlined financial products are being built. We think interest rate trading and custodial vaults may be two key areas to watch here.

Since lending markets currently operate on a variable rate model, it is possible to speculate whether future interest rates will be higher or lower than they are currently. A new area of the yield trading market, such as Pendle, has created a two-sided market that allows investors to understand how yields change over time. While the underlying yield assets are beyond the scope of the lending market (and into points farming tokens, etc.), we believe that they may become more important to the lending market as more mature players enter the market and more assets are enabled in the lending market.

Meanwhile, the custodial vault architecture helps depositors simplify the yield earning experience on protocols such as Morpho. Yield opportunities may differ across protocols, liquidity pools, and lenders. Custodial vaults enable depositors to contribute assets to a single vault where managers design strategies and rebalance positions across multiple lending pools. Managers earn fees and depositors also receive excess returns.

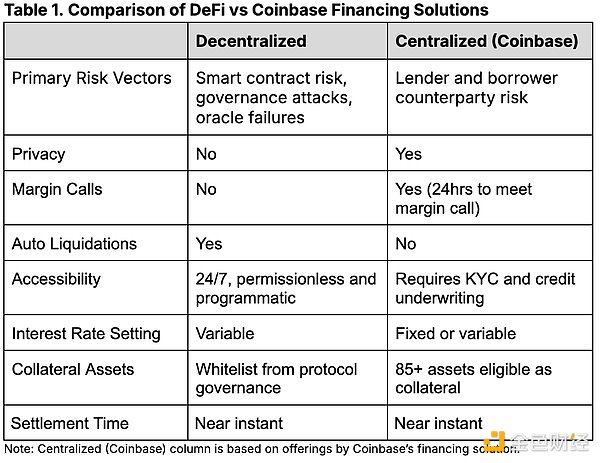

Comparison with Traditional Funding Channels

While we believe that DeFi lending platforms will continue to grow in usage over the next year if market conditions remain the same, we believe that traditional funding channels will continue to play a key role in the market due to their greater flexibility and different risk profiles.For example, agent lending solutions like Coinbase enable clients to generate income on their assets by acting as a fully outsourced lending agent to match borrowers and lenders on both sides of the market.

This may have certain advantages for some institutions that may not be willing to settle transactions purely on-chain, especially during periods of market volatility when liquidations are most likely to occur. Clearly defining counterparty and jurisdictional boundaries is also a key consideration for risk-conscious institutions. Additionally, DeFi lending protocols and user location data are public, making it difficult to conceal the lending activities of large market participants. Sophisticated participants may be able to identify key liquidation thresholds or other positions that institutions wish to remain cautious of.

Conclusion

The opportunities for yield in the cryptocurrency space are diverse. Traditional financing is important to crypto because it is particularly suited to the needs of institutional investors - providing clearer borrowing costs, greater discretion, and clear counterparty risk. However, the increase in on-chain lending usage highlights the growth and maturity of the DeFi industry. As the total value locked in DeFi lending protocols reaches new heights, these programmatic and permissionless solutions are increasingly important to provide flexible financing options. We believe that innovations such as interest rate trading and custodial vaults are promising signs of further development in the space.

Miyuki

Miyuki