Author: Ryan Y Yi, Head of Investment at Coinbase Ventures; Translation: Golden Finance xiaozou

The concept of block space and encryption keys/wallets are the two most important ones created in the crypto/web3 world technology. Wallet technology has now evolved beyond self-hosted wallets, and we believe the wallet space will change dramatically over the next 5 years – ushering in the “iPhone” moment for cryptocurrencies. In this article, we’ll take you through the different wallet technologies.

Key points preview:

The crypto ecosystem infrastructure is getting better and better There is a growing trend to serve everyday mainstream applications. While much of the focus has been on innovation in the block space (lowering fees and increasing throughput through L2 and alt L1), there is equally innovative progress in the wallet infrastructure space.

To date, self-hosted wallets have become the primary form of interaction with crypto/web3 applications and networks. Looking ahead, the wallet space is experiencing a major shift in technological innovation with the emergence of embedded wallets (also known as MPC or WaaS [Wallet as a Service]) and smart accounts.

These developments will have a significant impact on how users interact with crypto applications, application adoption, and the positioning of various wallet providers.

If we get right to the core, we can say that wallets are the new identity primitives.

A wallet is a public key level identifier [0x...], but ownership But it has encryption security.

Users can use the wallet to sign on-chain or off-chain transactions.

On-chain transactions mean there are gas requirements, which will pop up on block explorers like Etherscan. Off-chain transactions have no gas requirements and will involve signing (for example, "logging in" to a session on the Dapp's frontend), but will not pop up on a block explorer like Etherscan.

1, The era of self-management

(1) How it works

In a world of self-management Here, the user is responsible for key custody, transaction signing and recovery. Popular wallet brands include Blockchain, Trust Wallet, Coinbase Wallet, Metamask, Rainbow Wallet and Phantom.

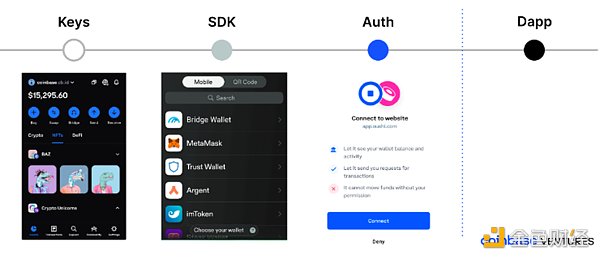

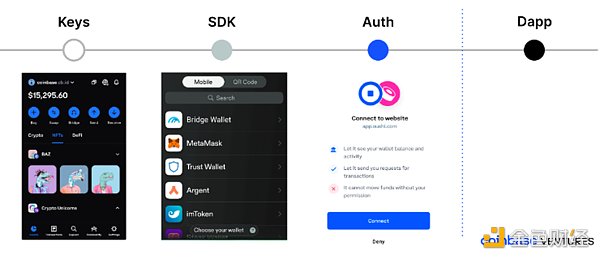

Dapps need to connect to the wallet through each SDK. These SDKs are either native to the wallet or open source (such as WalletConnect). This is important because it is critical to presenting viable options in the user’s crypto journey. We equate this with a web2 application's ability to display login options via Okta Auth0.

Dapps can define a series of off-chain or on-chain approvals for users who start transactions.

( 2) Self-Hosted Wallet Observation

Superapps: Wallets are adding multiple features so that users can access the entire crypto ecosystem through their core wallet . For example: Send/Receive, Swap exchange, bridging, message and notification functions.

Allocation is usually dominated by the application. Recently, popular web3 applications have decided that, given the attention they have and the same mindset as their users, offering wallets directly would be a natural outcome. For example: MagicEden, Aave, Uniswap.

Ecosystem: Wallet providers may choose to take a position in new ecosystems to ensure their first-mover advantage. This allows them to build relationships and integrate technology to achieve success. For example: Phantom on Solana or Kepler on Cosmos.

2, the era of embedded wallets and WaaSWallet as a Service

(1) working principle

In embedded (MPC/WaaS) wallet world where users can log in using their web2 credentials (email, SMS, Twitter, etc.).

The keys themselves can be split between the Dapp, the user device, and/or a third party (centralized or decentralized). Dapps utilize third-party services to handle keys/SDK/parts of the Auth experience. User devices can leverage the underlying Passkeys.

Because the Dapp manages the user flow, SDK/Auth is on the backend for implicit approval.

Dapps and embedded wallet providers can also see the CRM-style key interface and the user's relevant social login data.

(2) Embedded Wallet Observation

Although the embedded wallet trend is still in its very early stages, the improvement in user experience has been significant, especially for For early non-crypto native adopters, it says it all.

User control: For embedded wallets, users still have full control over their wallets. Users can choose to “export” their keys and convert back to a fully self-managed wallet, or they can also convert to a smart account. While many non-crypto-native users may not use this feature, it gives users the freedom to opt out, which is important in mitigating the centralization risks associated with common web2 data silos.

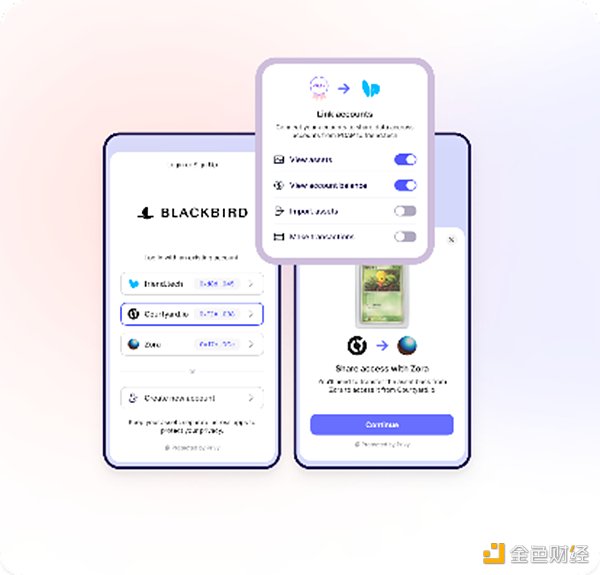

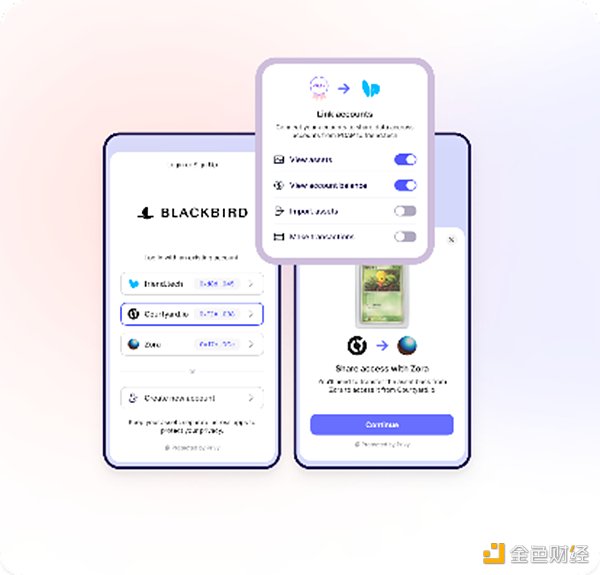

Wallet"Link": If an embedded wallet provider has multiple Dapps to log in to, and a user logs in to these Dapps with a similar login method , then the embedded wallet provider can associate these different wallets to the same user and provide the user with an interface display. Therefore, it may be an important opportunity for embedded wallet providers to win as many Day-1 authorizations as possible.

Data Foundation: Dapps can now leverage their user set database and combine it with other digital footprints to further build web2 databases with web2.5 utility. For example: a Dapp might want to run a DevRel developer relations campaign and want to see authenticated Github users and track their activity.

3 , Smart Account Era

(1) Working Principle

Smart account is a smart contract wallet with "account abstraction" function that supports users Define transactions to be executed by third parties.

(2) Observations

We believe that smart accounts/account abstraction are complementary to the above trends.

Self-hosted wallets can join/mint smart accounts and "link" to the user's other wallets/keys.

Embedded wallet providers can offer smart account selection as a service to dapps interested in contributing benefits (e.g., gas-free experience, etc.).

4, Impact

(1) Certification/Data

Wallet adoption of relevant paths will affect the authentication/authorization method. The authentication/authorization layer defines user sessions, data read/write interactions, and security parameters. Stakeholders are wallets, authentication layers, and Dapps themselves. Whichever side comes out on top will win the race to build and use the circulation network effect and build production activities around that network effect.

Wallet providers typically know nothing about a user’s identity other than information on the Ethereum chain.

The authentication layer will collect various types of information, such as addresses, session data and other related public data (IP addresses, etc.).

Dapps may have the most knowledge about the user’s true identity. For example, OpenSea lets users fill in their email/twitter/social data stored on OpenSea servers. OpenSea knows that [0x...] is John Doe, but the authentication layer only knows that [0x...] interacted with OpenSea.

The embedded wallet solution is responsible for the key and authentication layers - they are bundled together. You no longer need to go through a separate verification to log in to the Dapp. Once you log in through WaaS, you are done in one step. Dapp is also optimistic about this in its cooperation with embedded wallet partners.

Embedded wallet solutions may own the data and may present the data to the Dapp when needed. For example, I logged into OpenSea with my Twitter OAuth (powered by WaaS) and both should see the associated key and social login.

The embedded wallet solution can then provide an overview of the data storage related keys. Dapp 1 may not care who the user of Dapp 2 is - but the WaaS provider can see all overlapping user socials and can expose the public interface. This assumes the user provides data authorization when authenticating using identifiable credentials.

(2) Adoption Pathways

So far, self-hosted wallets have been the primary wallet choice for consumers. At the same time, new technologies offer viable alternatives and have a significant impact on wallet adoption. Ultimately, we believe the outcome will depend on the first Dapp or use case users are exposed to and the corresponding wallet technology.

User Type: Until now, users of crypto applications have had only one viable option, and that was self-hosted wallets. With the emerging wallet technologies mentioned above, there will be a variety of options to choose from. This should also help attract brand new users (possibly non-crypto native users) who are already familiar with the "OAuth" style.

Geographical factors: In some regions, potential regulatory barriers to self-custody may impose unaffordable and significant costs for users to adopt self-custody wallets. And it’s unclear whether embedded wallets (which hold part of the keys) can be classified as custodial services.

(3) Business Model

Wallets can be profitable in different ways. For embedded wallets, it is possible to operate in a freemium or SaaS model - but we expect that over time their pivotal position between users and on-chain activity will enable them to directly participate in on-chain activity growth of.

(4) Wallet form

Will each wallet correspond to a user, or will each Dapp correspond to a wallet?

One wallet rules them all: The form of a self-hosted wallet is "One person → One wallet ← → Super application". Users can create another wallet in the same interface, but it won't look any different.

One wallet per app: Because the embedded wallet is hidden in the backend of the app, it looks/feels like a Dapp (similar to apps on the iPhone). This ultimately leads to the result of “one wallet per Dapp”.

Connected Wallets: We believe the most likely outcome is a middle ground. Wallets can be "linked together" as long as there is a common identifier. The on-chain version can be embodied through smart accounts - smart accounts can delegate control between wallets. The off-chain version may be a public identifier behind the embedded wallet API (for example, [email protected] authenticated across multiple Dapps could be a public identifier).

5 , Summary

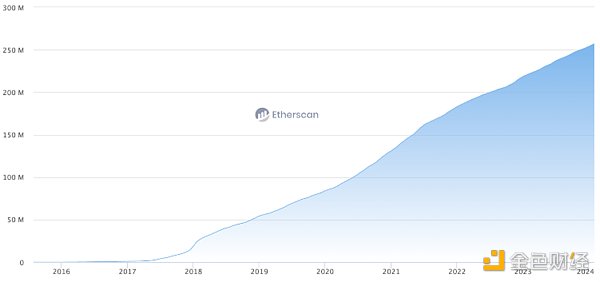

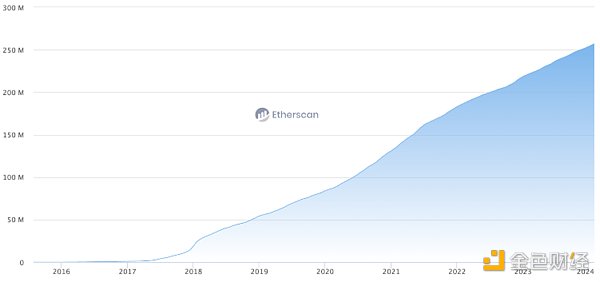

We believe that the number of crypto wallets will grow exponentially in the next ten years. About ten years ago, the total number of unique ETH addresses hovered around 250 million (5 years it was 100 million, and only 2 years it reached 200 million). This is an era where block space is expensive and so are self-hosted wallets.

Looking forward, we believe the arrival of embedded “Wallet as a Service” (WaaS) and smart accounts should reduce the login friction and cost of wallet creation to near zero, L2 and relatively low-cost areas. The emergence of block space technology will drive more crypto activity, and wallets will become the primary way to participate in these use cases.

XingChi

XingChi