Source: Coinbase; Compiled by: Deng Tong, Golden Finance

Abstract

Following the approval of a U.S. spot Bitcoin ETF, the dramatic impact on price volatility and trading volume during New York trading hours became even more apparent.

While stablecoin usage appears to be more evenly distributed between European and U.S. daytime hours, on-chain transaction volume and fees are also skewed toward U.S. time.

We believe this distorted activity highlights the significant demand for cryptocurrencies in the United States and the potential for further industry growth and capital inflows.

Although cryptocurrency is a global industry, U.S. market trading hours (and later in the European trading session) has a clearly huge impact on the market's liquidity and price volatility. This was the case before the U.S. spot Bitcoin ETF was approved and has since become even more pronounced, particularly on centralized exchange (CEX) platforms. The increased volume also means greater price volatility during the U.S. and European trading sessions, as well as a greater overall range of market returns throughout the day.

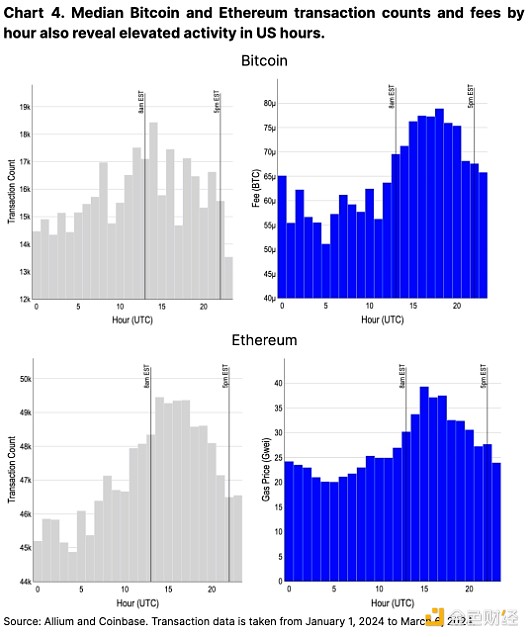

On-chain metrics reflect a similar pattern. Both Bitcoin and Ethereum transaction volumes peak during the US session, with transaction costs increasing by 50% between high and low traffic periods. Decentralized exchange (DEX) trading volume is also comparable to CEX trading volume, although the United States is not as dominant on the chain obvious. During the U.S. and European hours, stablecoin usage appears to be evenly distributed in terms of transfer volume and number of active users.

All in all, we believe this data clearly reveals the significant influence the United States has over transactions and on-chain activity, despite regulatory challenges. The success of spot Bitcoin ETFs in the United States and their significant impact on the broader Bitcoin market is further evidence thatregulatory clarity in the United States is It plays a key role in unlocking new capital flows into the cryptocurrency market.

Centralized exchange

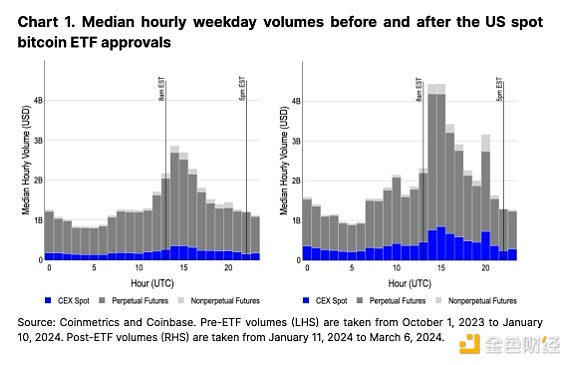

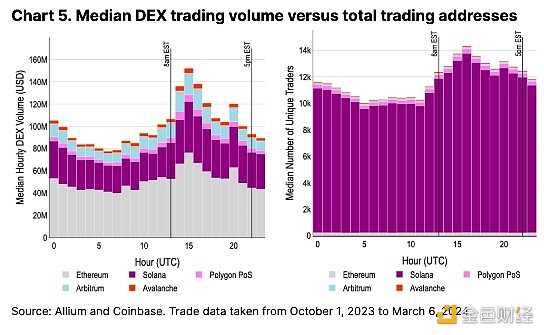

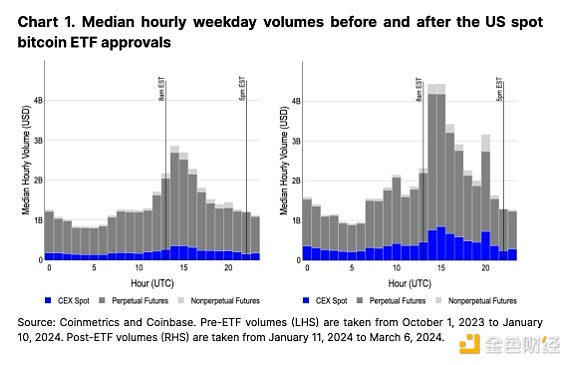

In addition to access to new institutional capital pools, the second impact of the U.S. spot Bitcoin ETF is the increased concentration of CEX trading volume during U.S. trading hours. Before the ETF was approved, peak trading volume had occurred during the U.S. market opening hours of 9 to 10 a.m. ET, roughly twice the opening hours of Asian and European markets (see Figure 1 ). However, following the launch of spot ETFs, U.S. trading volumes across all spot, perpetual futures, and non-perpetual futures products have risen to nearly three times that of other market sessions.

Since January 11, CEX spot trading volume during the U.S. session has increased by 130-200%. Exceeding the 80-120% growth in trading volume in Asia and Europe. U.S. peak-hour perpetual futures trading volume also increased by nearly 70% (2.3 billion to 3.8 billion), while peak-hour trading volumes in Asia and Europe increased by 20% and 50% respectively (respectively 1 billion to 1.2 billion and 1.5 billion). The growth in perpetual futures trading volume is particularly notable as these instruments are traded almost exclusively outside the United States. In our view, this may indicate that offshore participants may be taking advantage of stronger spot liquidity during U.S. hours, or that U.S. traders are Use offshore entities to access these markets.

The launch of spot ETFs also resulted in a new surge in trading volume across all product categories at 3pm New York time. This is largely because ETF issuers want to keep their fund prices in line with their benchmarks, and 6 of the 10 spot ETFs track the CME CF Bitcoin Reference Rate- New York Variant (BRRNY), which at 1:00 p.m. New York time Snapshot taken between 3 o'clock and 4 o'clock. Therefore, at this time authorized participants aim to acquire underlying Bitcoin as part of a cash creation (and redemption) model, often hedging their positions through regulated products such as CME Bitcoin futures (for those without access to foreign permanent markets). In fact, the time between 3pm and 4pm New York time is the most active time for CME Bitcoin futures trading, with trading volume exceeding 60%.

Return Changes

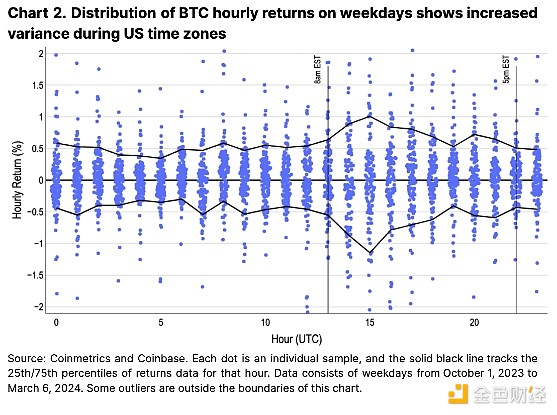

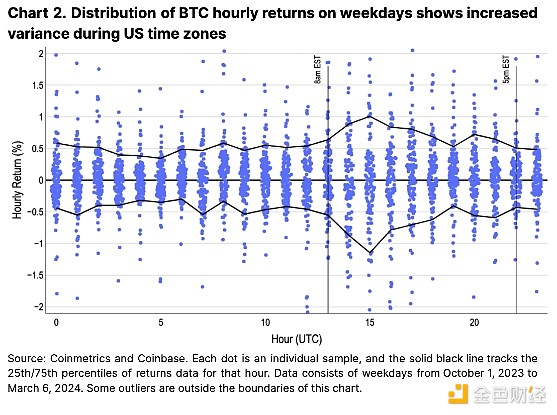

The dominance of U.S. Bitcoin flows is also reflected in its price performance. Figure 2 depicts a strip plot of hourly returns (showing the density distribution of returns) in blue, with a black line demarcating the boundary between the 10th and 90th percentiles. Periods with a wider range of returns correspond to periods on the previous volume chart, indicating that high volumes in the early hours of U.S. markets typically materialize amid larger price moves. This suggests thatthe early hours of the U.S. market offer day traders the best opportunities in terms of liquidity and volatility.

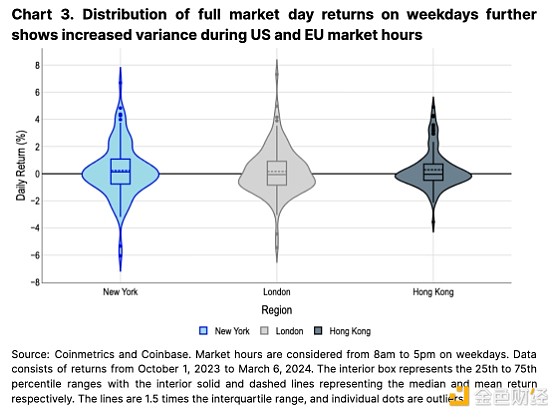

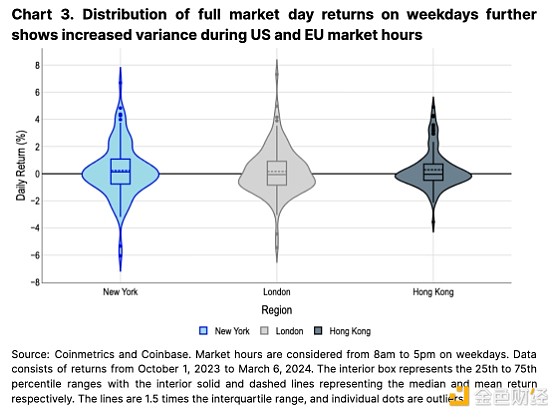

Measuring full market day returns (from 8am to 5pm) in different financial center time zones can also reveal regional differences more broadly. The violin plot of Figure 3 shows that there is a broad distribution of returns for opening hours in New York and London. (The figure shows the reward probability estimated using kernel density, where the width of the "violin" represents the probability of obtaining that reward.) In contrast, Returns during the Hong Kong session are much more concentrated. We believe this further emphasizes the importance of US (and to an extent European) traders in driving Bitcoin prices.

Globally Distributed Networks

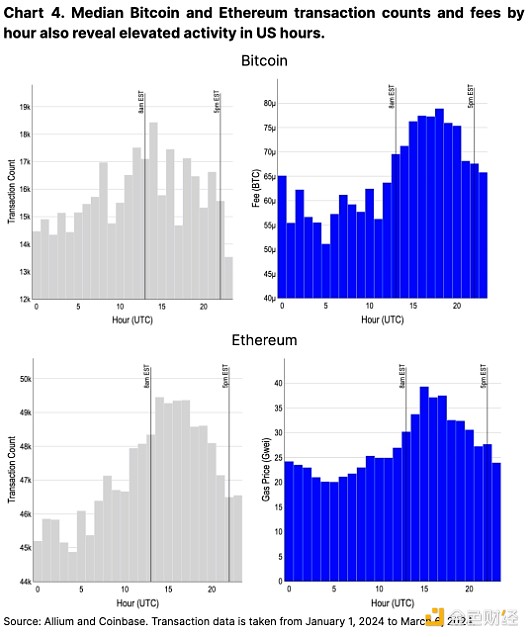

Despite their global accessibility and decentralized nature, Bitcoin and Ethereum’s activity also peaks during U.S. hours. This is evidenced by the fact that trading costs during the US session increased by more than 50% from the lowest point (see Figure 4). On the one hand, we believe that the increase in daypart usage in the United States is due to a large population that is tech-savvy and capital-rich relative to the rest of the world. At the same time, we also believe this activity may be driven in part by US traders managing positions across wallets and exchanges (consistent with the increase in CEX trading volume during this time).

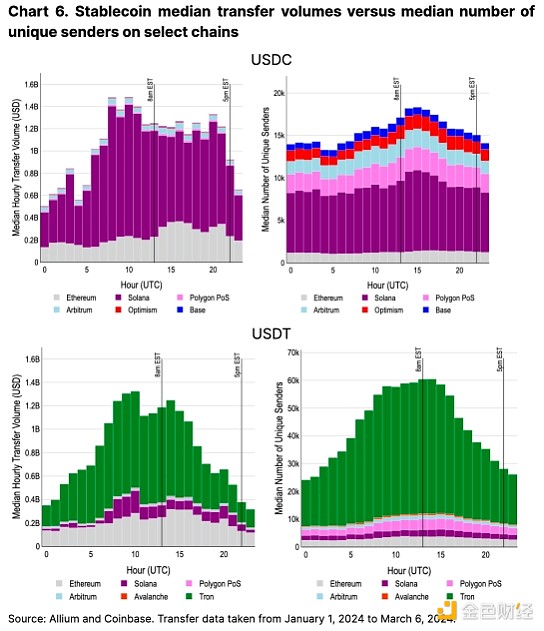

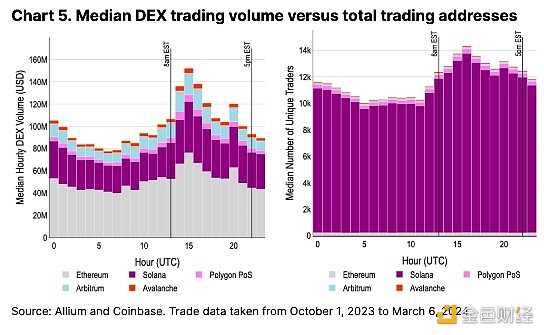

On-chain DEX trading The volume further confirms the pattern of peak activity during US market hours, although the difference is less pronounced compared to the CEX difference. DEX trading volumes surge significantly during Asian market opening hours (UTC 0), reaching about 70% of US peak hours, while CEX trading volumes are less than 30% of US peak hours (see Figure 5). This volume ratio did not change meaningfully before and after ETF approval.

We believe that Due to the relative newness of DEX and the completely different market structure that supports it (such as the traditional central price limit) Order books and automated market makers), the difference in DEX trading volume is not as obvious as CEX. This creates a newer and more level playing field that was highlighted in 2019 Flash Boys 2.0 post about profitable on-chain trading strategies (and more broadly maximum extractable value )’s seminal paper.

In addition, we believe that the number of unique transaction addresses does not clearly represent regional usage. The numbers are skewed due to airdrop mining, especially on Solana where transaction fees are low. Solana’s airdrop from leading DEX aggregator Jupiter has released only the first of four rounds. It has not yet committed to specific dates for the next rounds, so we think the metric may continue to deviate quite a bit for some time.

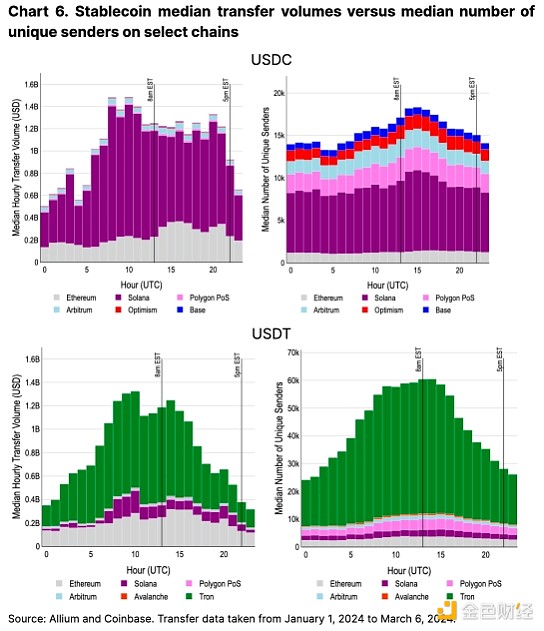

In addition to DEXs, we believe stablecoin transfers are another key indicator of cryptocurrency usage by time zone. Importantly, stablecoin transfer usage statistics are generally not distorted by short-term airdrop incentives in the same way that DEX activity is. It is also interesting to note that this is the first instance where there is no serious activity bias towards US market hours.

Although Ethereum-based trading volume is biased towards the US session, Solana USDC transfers, which account for the majority of trading volume, were The peak was reached during the European session (see Figure 6). That said, the total number of unique senders did see a soft spike earlier in the US time, albeit not by much (active senders per hour peaked at 17,000, while active senders per hour hit a low of 1.3 Ten thousand). USDT trading volume also peaks during European market hours, and the number of unique senders reaches consistently high levels during European daytime hours. This shows us that adoption of USD-denominated stablecoins has reached higher global penetration, especially where USD assets are not A region that integrates seamlessly into the local financial orbit.

Conclusion

The overall dominance of the U.S. (and to a lesser extent Europe) in the cryptocurrency market may be somewhat surprising given the generally challenging U.S. regulatory environment over the past few years. . That said, we believe the U.S.’s outsized influence in the cryptocurrency space has broader implications due to its strong capital base, market investment culture, and tech-savvy population.

The landmark approval of a U.S. spot Bitcoin ETF unlocks a significant new source of capital and leads to further market gains American activities as the center. We believe this highlights the enormous importance of U.S. regulations and policies in shaping the cryptocurrency market. We also believe these findings underscore the relevance of U.S. investor sentiment relative to other regions as a key driver of market movements. As shown by the approval of the U.S. Spot Bitcoin ETF, we believe further regulatory clarity in the U.S. and smoother access to U.S. cryptocurrencies May continue to strengthen U.S. dominance in the cryptocurrency market.

JinseFinance

JinseFinance