Author: blocmates; Compiler: Felix, PANews

Coinbase's acquisition of Echo and its statement that it will not rush into deploying the Base token, coupled with the upcoming launch of the Base app, all indicate that the Base ecosystem will gain strong momentum in the coming months.

Meanwhile, Coinbase is also making strategic moves in other areas, including applying for a banking license, gradually integrating DeFi into its retail applications, and developing a new payment standard called x402.

Coinbase has been so active recently that this article will provide a mini-report on Coinbase.

What is Base L2? Base is a Layer 2 network incubated by Coinbase. It uses the OP Stack, achieves 200-millisecond block times via Flashblocks, and processes transactions for less than a penny. Launched just two years ago, Base has quickly become a leading Layer 2 network, maintaining a near-daily lead in metrics like TVL and transaction volume. Crucially, Base is more than just an Layer 2 network: it’s Coinbase’s testing ground for the future of on-chain technology. If handled correctly, users participating in this "sandbox" could soon receive substantial "airdrop returns." The $BASE token could be a game-changer. After years of denying any token plans, Jesse Pollak announced at the BaseCamp event in September 2025 that they were "beginning to explore network tokens." While information is currently limited, it's possible to trace the process. While nearly all other L2 networks typically conduct TGEs quickly, Base's hesitation is understandable given its direct connection to a US-listed company (Coinbase). During his keynote at BaseCamp, Jesse noted that the company would be working closely with regulators to ensure compliance. Given that the token is still in its exploratory phase, a TGE is clearly not on the horizon. But this is also a good thing, as it gives users ample time to prepare for it. Regardless of when the TGE occurs, it's undeniable that the Base token has the potential to be a massive "wealth creation" event and a significant boost to Base's growth. To achieve this, Base must tie economic activity to the token, as the true value of L1 assets comes from their role as gas tokens and as the second token in AMM trading pairs. ETH and SOL are valuable because they are crucial in providing liquidity for new tokens in AMMs. As these ecosystems expand, demand for the reference currency increases, creating a positive feedback loop. By distributing network fees as rewards to pools using $BASE as the reference currency, $BASE holders can encourage this activity and tie the token's value to network growth. Base can be expected to incentivize key protocols and distribute tokens to them after the token launch. But how can users access the first round of airdrops? Since Base aims to revolutionize blockchain participation and attract new users through its app, actively using the app significantly increases your chances of receiving an airdrop. The Base App: The Frontend for the Entire Base Ecosystem Throughout this cycle, wallets have evolved from simple token storage tools to what some have called "DeFi frontends." As Phantom and other wallets continue to expand the definition of a cryptocurrency frontend—adding features like trading and payments directly within the app—the race to create the ultimate super app has begun. In this race, the Base App stands out. It's an all-in-one app that combines social networking, apps, payments, and finance, allowing users to earn yield, trade, and chat with people around the world from anywhere. The app, which is scheduled for public release this year, has already been a success in beta, receiving rave reviews from beta testers and a waiting list of over 750,000 people. The app includes social features powered by Farcaster, identity verification powered by ens.eth, payments via BasePAY, earnings functionality provided by Morpho, AI agents such as Giza’s Arma and Moonwell’s Mamo, chat functionality powered by Zora, gamification experiences like Dimo, and numerous other mini-apps powered by Farcaster. The current work is to identify projects and tokens that are already on the platform or about to launch that can benefit most from the distribution and exposure this application will bring. In particular, we should focus on applications that Coinbase has invested in, as they will directly benefit from the success of the product. Projects worth noting Within the Base ecosystem, Coinbase typically makes small, strategic investments rather than lead rounds to expand its coverage and maintain neutrality among competing protocols. However, Coinbase has made significant investments in a handful of projects that "own the stack" on Base, including liquidity (Aerodrome), core DeFi credit (Morpho), and creator engagement (Farcaster, Zora). Regardless of investment size, these portfolio companies receive priority treatment on social media, increased business development connections, and rapid listing on the Base app. Here are a few of Coinbase's most promising projects in the Base ecosystem (in no particular order) that are likely to gain significant momentum: Giza. Giza's autonomous agent, Arma, is an AI-powered yield optimizer and is now available in the Base app. With over $2 billion in agent trading volume and approximately $30 million in total locked, it's fair to say that the current token valuation may be undervalued. Avantis, the top-ranked perpetual swap exchange on Base, offers a diverse portfolio of assets, including cryptocurrencies, stocks, indices, and even forex. Investors and the team have allocated 40% of the total supply, with a lock-up period starting in September 2026. Share, a pre-IPO social trading app, recently secured $5 million in funding. Its functionality and logo bear striking resemblance to other social trading apps, and with Coinbase's support, it will undoubtedly receive priority integration with the Base app. Memory aims to build a world where digital identities are freely portable across the internet. Recently, Memory announced the ability to sync your Twitter following with the Base app. Given Base's focus on SocialFi, Memory plays a key role in the transition from traditional social media to the Base app. Coop Records is an on-chain record label that has amassed over 175 artists and over 750 albums since its founding in August 2023. Songs are purchased in ETH and paid to artists in real time, a stark contrast to the traditional music industry, where royalty payments are often delayed for months or even quarters. Brian Armstrong recently stated his advocacy for privacy and revealed that he acquired the Iron Fish team in March of this year. Does this mean the token will perform well in the long term? It remains unclear. If you believe the Internet Capital Markets (ICM) narrative still has legs, Backroom is a protocol worth watching, especially with its partnership with Aerodrome, the largest decentralized exchange on Base. Noice, the winner of the inaugural Base Batches Demo Day, is a social tokenization protocol that integrates Farcaster's programmable social layer and Zora's creator token. It enables users to send micropayments for social actions like likes, comments, and follows, thereby converting engagement into economic value. The Base Batches program is a great way to stay ahead of the curve in the Base ecosystem and discover emerging trends or products. The next event will be held at DevConnect on November 19th. While interacting with the products listed above doesn't guarantee airdrops, and purchasing their tokens doesn't guarantee appreciation, Base's track record of benefiting its portfolio companies suggests new projects may also benefit. With Coinbase pouring hundreds of millions of dollars into the on-chain economy, one has to wonder, what is Brian's ultimate goal? DeFi's "Mullet" Strategy It's no secret that the general public doesn't care about on-chain reputation systems or AI agents engaging in yield farming. Most people simply want to open their Coinbase app and tap the "Earn" tab. Because DeFi offers easier access and higher returns, Coinbase has shown a willingness to introduce these products to a wider audience through its app.

For example, the recently launched on-chain USDC lending feature, powered by Morpho and Steakhouse Financial, allows users to earn up to 10% yield on their stablecoin.

This isn't Coinbase's only integration with Morpho. Earlier this year, Coinbase launched a Bitcoin-backed on-chain lending service through Morpho, allowing customers to borrow up to $1 million in USDC against Bitcoin held on Coinbase.

Additionally, Coinbase supports DEX trading, providing users with access to on-chain tokens.

Coinbase's willingness to integrate DeFi protocols from Base within its retail app demonstrates that the Base app is a key platform for Coinbase to experiment with new features and protocols before rolling them out broadly. On-chain payments are rapidly developing with the launch of Base Pay and the x402 payment protocol. Simultaneously, the company announced on October 3, 2025, that it was applying for a banking charter. The announcement stated: "This charter will continue to open new opportunities for Coinbase, enabling it to launch new products beyond custody, including payments and related services, with regulatory clarity, thereby promoting broader institutional adoption." In practice, this means Coinbase will be able to offer FDIC-insured checking and savings accounts with built-in on-ramps, enable payment functionality, and unlock innovation opportunities within legislative boundaries. While Coinbase works with lawmakers to support payments in its retail app, Base is steadily advancing the possibilities of on-chain payments for a future of agency. X402: A Native Internet Payment Protocol It's well known that online payments have some fundamental problems. Credit cards involve high friction and have prohibitively high minimum payment amounts. Furthermore, they don't meet the programmatic demands of the internet and don't support proxy-based software systems. X402 is an HTTP-based protocol used for proxying, contextual retrieval, APIs, and more. It's Coinbase's solution to this problem, enabling instant, automated stablecoin payments directly over HTTP.

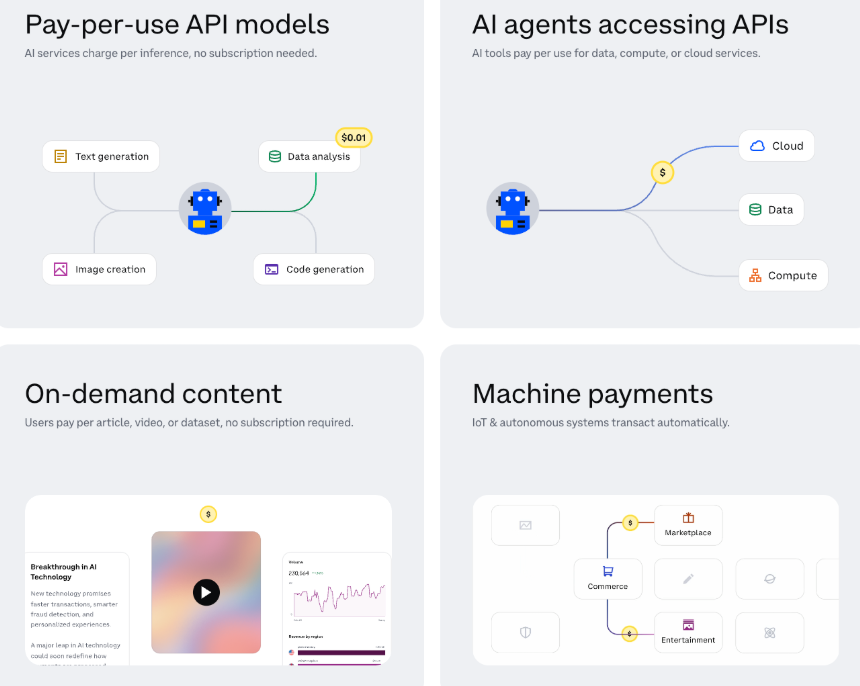

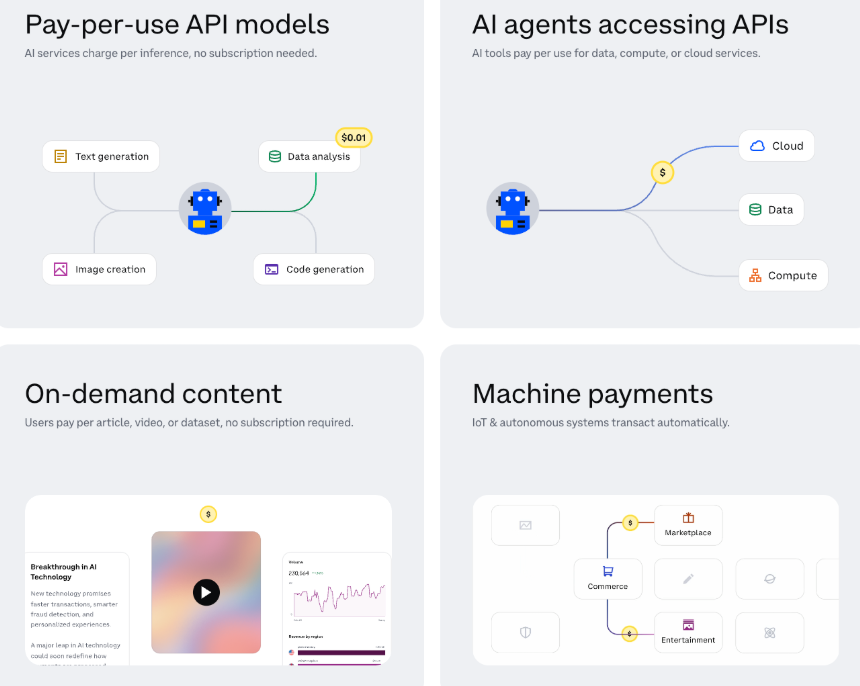

x402 supports a variety of use cases, including:

Pay-per-request API services

AI agents that pay for API access on their own

Digital content paywalls

Microservices and tools that monetize through microtransactions

Aggregating and reselling APIs While the protocol is network-agnostic, the Base ecosystem is a natural fit for its deployment thanks to its integration with Base's AgentKit and MiniKit (Farcaster's MiniApp SDK). The protocol has recently seen a surge in activity, with total transactions approaching 200,000 and value approaching $150,000. The Base app and Coinbase app serve two distinct customer segments, with the former serving as a testing ground for the latter. Together, they create a positive feedback loop that few companies in finance can match. After all, the future of finance lies neither off-chain nor on-chain, but both. While Coinbase is taking the long view with TradFi, gradually pursuing a banking charter that would bring the app closer to a neo-bank than a mere exchange, Base serves as an on-chain laboratory where future prototypes are being designed. Now, with the token's imminent launch, everyone will become a test subject for Coinbase. The main difference lies in who understands the rules of the game better. In this case, that game involves tracking Coinbase's money and determining which projects it has funded.

Anais

Anais