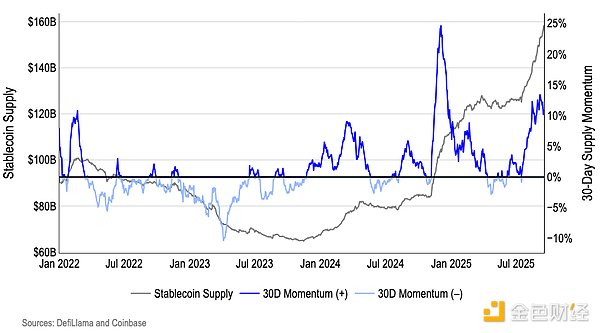

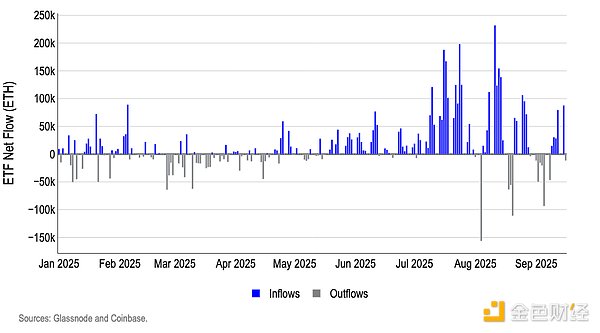

Source: Coinbase; Compiled by Golden Finance. ETH demand indicators are improving, while the supply of ETH available for sale appears tight. Stablecoin supply growth on Ethereum is accelerating, with strong 30-day momentum, and ETF flows remain net positive—both indicators suggest the arrival of new purchasing power (Figures 1 and 2).

Figure 1. Ethereum Stablecoin Supply

Figure 2. Ethereum ETF Net Flow

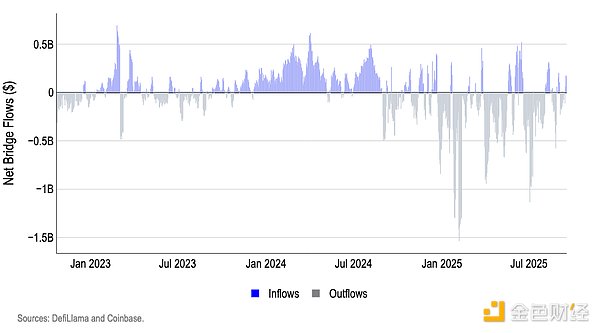

Meanwhile, cross-chain bridge flows have stabilized, with intermittent inflows, suggesting that activity will gradually re-converge towards Ethereum settlement (Figure 3).

Figure 3. Ethereum Bridge Inflows

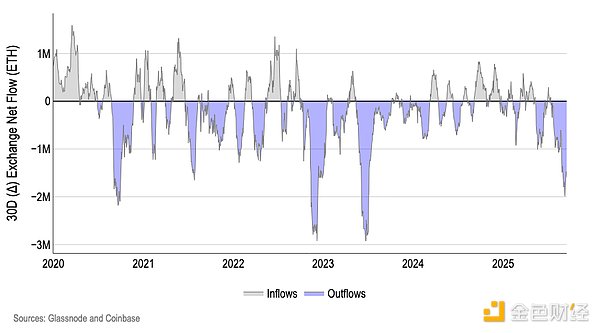

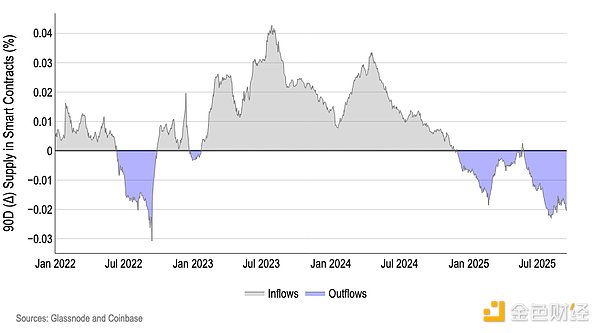

Meanwhile, 30-day net exchange flows are negative, meaning tokens continue to move out of order books, which mechanically reduces short-term selling pressure even as the composition of circulating supply shifts—smart contract balances have been trending downward, suggesting that some tokens are leaving DeFi wrappers but not necessarily returning to exchanges (Figures 4 and 5).

Figure 4. 30-day net exchange holdings change

Figure 5. 90-day change in the supply of Ethereum locked in smart contracts

We believe that the surge in validator exit queues is a special case of Kiln This is driven by a market-driven event that limits sellable supply now but could create uncertain pressure later. Following the disclosure of a partner API related to SwissBorg's staked-SOL vulnerability, Kiln opted to delist all ETH validators as a precautionary measure and return ETH to its (primarily institutional) clients, although Kiln has not yet reported any ETH losses. This idiosyncratic behavior—rather than a shift in system-wide staking risk appetite—sharpened the exit queue and increased wait times (to 45 days), but queued ETH remained illiquid until completion, mitigating immediate selling pressure (Chart 6). Because the surge stemmed from a precautionary exit by a single provider, we view it as akin to concentrated operational churn rather than a shift in system-wide staking risk appetite. This inventory remains unsellable until the exit is finalized, thus adding no immediate float. If the exited ETH is re-staked or returned to institutional custody, we believe the impact will be largely neutral. However, if a significant portion of ETH moves to exchanges, the market will gain new potential supply. Even if the mechanical supply path proves neutral, we believe cognitive effects could still weigh on ETH as allocators price in higher operational or counterparty risk and demand higher risk premiums. This caution could become self-reinforcing during a sell-off: large amounts of stake could clog exit queues and prolong redemptions—effectively forcing people to sell at unfavorable prices. Positioning supports the upside, but also increases vulnerability to shocks. ETH perpetual open interest is near cycle highs, and funding continues to remain positive, suggesting a bias towards leverage, which could both fuel trend continuation and amplify liquidation risk around negative catalysts (Chart 7). Options markets also reflect this balance: the one-month 25 Delta is tilted slightly in favor of puts (although down from last week), while the six-month skew is near flat (and declining), suggesting short-term event hedging and a more neutral medium-term stance—conditions we believe support a "buy the dip" environment (Chart 8). Figure 7. Ethereum Open Interest and Perpetual Funding Rates Overall valuations are slightly warm, but not rosy, making the results vulnerable to a tug-of-war between new demand and supply. The MVRV Z-score compares ETH's market capitalization to its on-chain "cost basis" (realized value) and measures this gap against its own historical volatility (a cycle temperature indicator that measures the gap between price and what holders actually pay). Currently, ETH is in warm territory: holders are profiting, but valuations remain below previous breakout extremes (Figure 9). From this perspective, we believe three levers could sway market direction: (i) Macro Liquidity – We are positive as broader liquidity conditions improve risk appetite; (ii) Asset-Specific Liquidity – We are also positive, with expanding stablecoin circulation and recent positive net inflows into spot ETFs; (iii) Derivatives Positioning – This positioning remains elevated and any liquidation could exacerbate a correction, but we believe the overall portfolio still resembles a “buy the dip” setup rather than a late-cycle breakout. Figure 9. Ethereum MVRV Z-score

YouQuan

YouQuan

YouQuan

YouQuan YouQuan

YouQuan YouQuan

YouQuan YouQuan

YouQuan Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo