Author: David Duong (CFA), Global Head of Research, Coinbase; Colin Basco, Research Assistant, Coinbase; Translator: Jinse Caijing xiaozou

Key Points:

We forecast crypto markets to strengthen in early Q4 2025 due to resilient liquidity, a favorable macro backdrop, and supportive regulatory developments, with Bitcoin expected to outperform.

Technical demand for digital asset treasuries (DATs) is expected to continue supporting the crypto market, even as the industry enters a competitive "player versus player" phase.

Our research indicates that historical monthly seasonality (particularly the "September effect") is not a significant or reliable predictor of crypto market performance.

1. Overview

We believe the crypto bull market has room to continue into early Q4 2025, primarily driven by a resilient liquidity environment, a favorable macro backdrop, and supportive regulatory developments. We believe Bitcoin, in particular, is poised to continue outperforming market expectations, as it directly benefits from existing macro tailwinds. In other words, barring significant energy price fluctuations (or other factors that could negatively impact inflation trends), the immediate risk of disruption to the path of US monetary policy is currently quite low. Meanwhile, technological demand for digital asset treasuries (DATs) should continue to provide strong support for the crypto market.

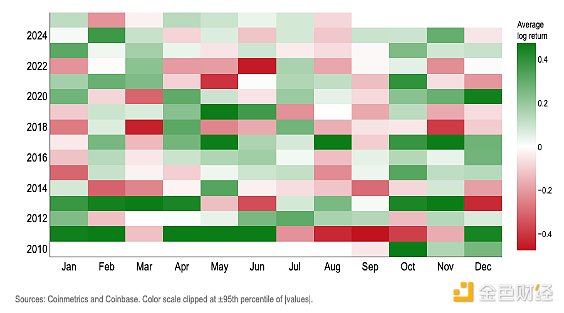

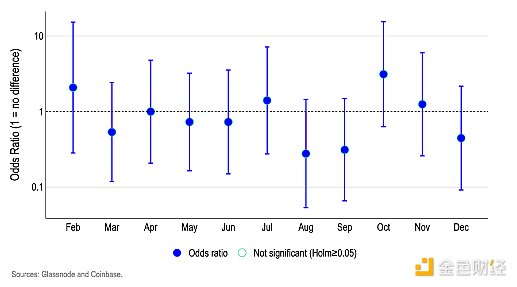

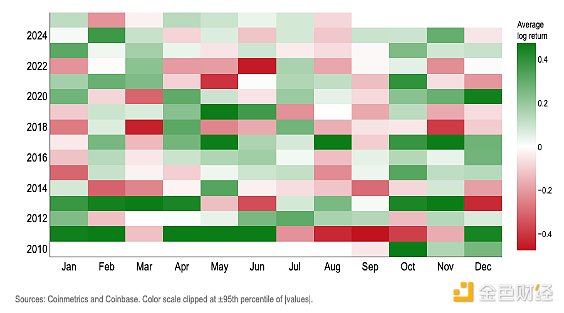

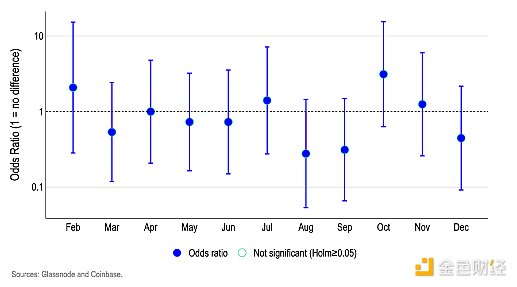

However, seasonal concerns continue to plague the crypto space—historically, Bitcoin declined against the US dollar in September for six consecutive years between 2017 and 2022. While this trend led many investors to believe that seasonality significantly impacted crypto market performance, this assumption was disproven in 2023 and 2024. In fact, our research suggests that small sample sizes and potentially wide distributions of results limit the statistical significance of such seasonal indicators. The more critical question for the crypto market is: Are we in the early or late stages of the DAT cycle? As of September 10th, public DATs held over 1 million BTC ($110 billion), 4.9 million ETH ($21.3 billion), and 8.9 million SOL ($1.8 billion), while latecomers have begun targeting altcoins further down the risk curve. We believe we are currently in the "player versus player" (PvP) phase of the cycle, which will continue to drive capital flows to larger crypto assets. However, this may also signal an impending consolidation phase for smaller DAT participants. 2. The Outlook Remains Positive. Earlier this year, we predicted that the crypto market would bottom out in the first half of 2025 and reach a new all-time high in the second half of 2025. This was a divergent view at the time, as market participants worried about a potential recession, questioned whether rising prices signaled an irrational market surge, and worried about the sustainability of any recovery. However, we found these views to be misleading, and therefore return to our unique macroeconomic perspective. Entering the fourth quarter, we maintain a positive outlook for the crypto market, anticipating continued support from strong liquidity, a favorable macroeconomic environment, and encouraging regulatory developments. On monetary policy, we expect the Federal Reserve to implement interest rate cuts on September 17 and October 29, as the US labor market has shown strong evidence of weakness. Rather than forming a localized peak, we believe this will actually activate sideline funds. Indeed, we noted in August that falling interest rates could prompt a significant portion of the $7.4 trillion in money market funds to exit their wait-and-see stance. However, a significant shift in the current inflation trajectory, such as rising energy prices, would pose risks to this outlook. (Note: We believe the actual risk from tariffs is far less than some estimates suggest.) However, OPEC+ recently agreed to increase oil production again, and global oil demand is showing signs of slowing. However, the prospect of additional sanctions against Russia could also push oil prices higher. Currently, we do not expect oil prices to breach the threshold that would plunge the economic scenario into stagflation. 3. The DAT Cycle is Maturating. On the other hand, we believe that technological demand for digital asset treasuries (DATs) is expected to continue to support the crypto market. In fact, the DAT phenomenon has reached a critical inflection point. We are no longer in the early adoption phase that characterized the past 6-9 months, nor do we believe we are nearing the end of the cycle. In fact, we have entered the so-called "player versus player" (PvP) phase—a competitive phase where success increasingly depends on execution, differentiated strategies, and timing, rather than simply copying MicroStrategy's operating model. While early adopters like MicroStrategy once enjoyed significant premiums to net asset value (NAV), competitive pressures, execution risks, and regulatory constraints have led to a compression of mNAV (market capitalization to net asset value ratio). We believe the scarcity premium that benefited early adopters has dissipated. Despite this, Bitcoin-focused DATs currently hold over 1 million BTC, representing approximately 5% of the token's circulating supply. Similarly, the top ETH-focused DATs collectively hold approximately 4.9 million ETH (US$21.3 billion), representing over 4% of the total circulating supply. In August, the Financial Times reported that 154 US listed companies had raised approximately US$98.4 billion for crypto asset purchases in 2025, a significant increase from the US$33.6 billion raised by the top 10 companies this year (based on Architect Partners data). Capital investment in other tokens is also growing, particularly SOL and other altcoins. (Forward Industries recently raised $1.65 billion to establish a digital asset treasury based on SOL, backed by Galaxy Digital, Jump Crypto, and Multicoin Capital.) This growth has led to increased scrutiny. In fact, recent reports indicate that Nasdaq is strengthening its oversight of DATs, requiring shareholder approval for certain transactions and advocating for enhanced disclosure. However, Nasdaq clarified that it has not issued any official press release regarding new rules for DATs. We currently believe that the DAT cycle is maturing, but it is neither early nor late. What is certain is that, in our view, the era of easy profits and guaranteed mNAV premiums is over—in this PvP phase, only the most disciplined and strategic players will thrive. We expect the crypto market to continue to benefit from the unprecedented influx of capital into these vehicles, boosting returns. 3. Does seasonal risk really exist? Meanwhile, seasonal fluctuations are a constant concern for crypto market participants. Bitcoin declined against the US dollar in September for six consecutive years between 2017 and 2022, with an average negative return of 3% over the past decade. This has led many investors to believe that seasonal factors significantly impact crypto market performance and that September is generally an unfavorable time to hold risky assets. However, trading based on this assumption was disproven in both 2023 and 2024. In fact, we believe that monthly seasonal fluctuations are not a valid trading signal for Bitcoin. Verification using various methods, including frequency distribution plots, logistic odds ratios, out-of-sample scores, placebo tests, and control variables, consistently concludes that the month of the year is not a statistically reliable predictor of positive or negative monthly log returns for BTC. (Note: We use logarithmic returns to measure geometric or compound growth because it better reflects long-term trends and takes into account the higher volatility of Bitcoin.)

Figure 2. Bitcoin monthly logarithmic return heat map

Figure 4. Logistic Regression — Probability Ratio of Positive and Negative Monthly BTC Log Returns Relative to January (Benchmark)

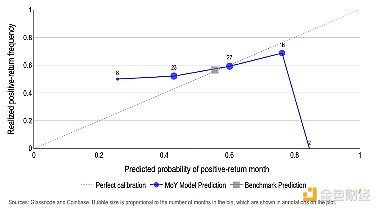

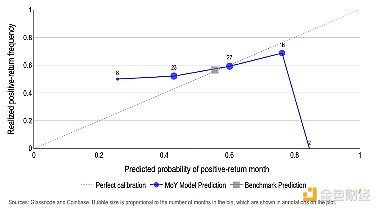

(3) Out-of-Sample Forecasts

At each step, we re-estimate both models using only the data available up to that month (initially trained on half the dataset):

Figure 5: Out-of-sample prediction accuracy of the month effect (MoY) logistic regression model

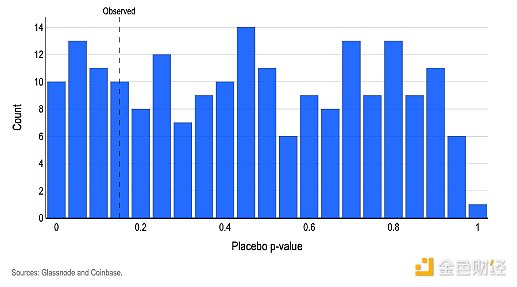

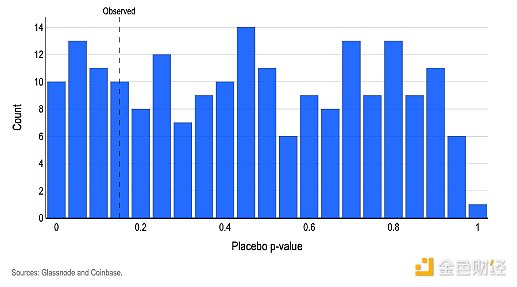

(4) Placebo randomization test

Figure 6. Distribution of placebo p-values resulting from randomly shuffling the "month" labels in the logistic model

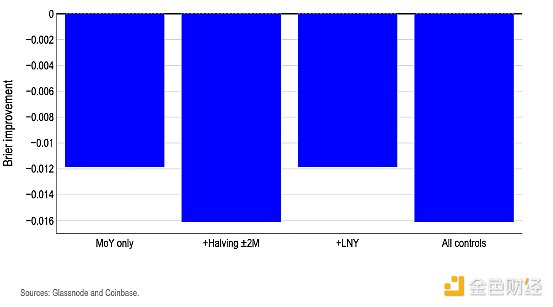

(5) Control variable tests

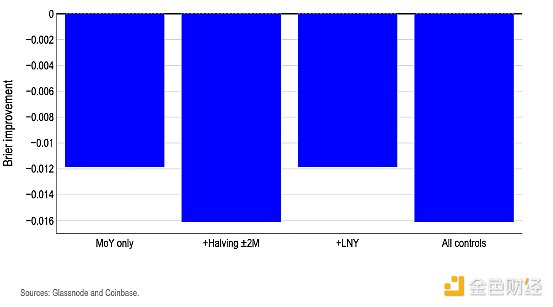

Figure 7: Brier improvement score of the logistic regression model with control variables in out-of-sample forecasting

4. Conclusion

The concept of market seasonality has a harmful shackle on the minds of investors and may form a self-fulfilling prophecy. However, our model shows that simply assuming monthly probability of gains or losses roughly aligns with the long-term historical average outperforms all calendar-based trading strategies. This strongly suggests that calendar patterns do not contain useful information for predicting Bitcoin's monthly direction. Since calendar months cannot reliably predict the direction of log returns, their ability to predict the magnitude of returns is even more remote. Previous synchronized September declines and even Bitcoin's legendary "October surge" may be statistically interesting, but neither is statistically significant.

Catherine

Catherine