Author: insights4vc Translation: Shan Ouba, Golden Finance

Between November 5 and 6, Coinbase Global (COIN) stock price rose 31% from $193.96 to $254.31, influenced by the election results. This report provides an in-depth analysis of Coinbase's current financial situation and the performance indicators of its layer 2 blockchain Base.

Coinbase Core Team:

Co-founder and CEO: Brian Armstrong

Co-founder and Director: Fred Ehrsam

President and COO: Emilie Choi

Chief Financial Officer: Alesia Haas

Chief Talent Officer: LJ Brock

Chief Legal Officer: Paul Grewal

Income analysis

Revenue

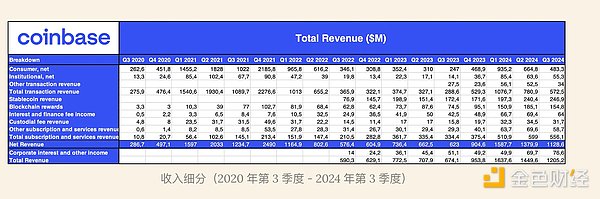

Total revenue in the third quarter of 2024: US$1.2052 billion, lower than the second quarter of 2024 ($1.4496 billion), but up year-on-year from the third quarter of 2023 ($772.5 million).

Revenue trend: After reaching a peak in the fourth quarter of 2021, total revenue has been stable in the lower range since the second quarter of 2022.

Broken Down by Segment

Consumer Trading: $483.3 million in Q3 2024, down from $664.8 million in Q2, highlighting sensitivity to market volatility, but still a core revenue driver.

Institutional Trading: Down slightly to $55.3 million from $63.6 million in Q2 2024, less volatile but contributing a smaller share of revenue.

Blockchain Rewards: $154.8 million in Q3 2024, down from $185.1 million in Q2, but up year-over-year, providing stable revenue tied to blockchain growth.

Stablecoin Revenue: $246.9 million, remaining stable across quarters, highlighting Coinbase’s strategic role in the digital currency space.

Interest and Finance Expense: $64 million in the third quarter, demonstrating stability and providing a reliable revenue stream despite market changes.

Subscriptions and Services: $556.1 million in the third quarter, down from $599 million in the second quarter, indicating growth in services, but facing current market pressures.

Expense Analysis

Transaction fees: $171.8 million (15% of net revenue), down 10.3% from the second quarter of 2024.

Technology and Development: $377.4 million, up 3.6% sequentially.

Sales and Marketing: $164.8 million, down slightly by 0.3%.

General and Administrative Expenses: $330.4 million, up 3.2%.

Other operating income, net: -$8.6 million, indicating net income for this category.

Total operating expenses: $1,035.7 million, down 6.4% from Q2 2024.

Transaction volume and asset income contribution

Total transaction volume in Q3 2024: $185 billion, down from $226 billion in Q2 2024 and down from Q3 2023 ($92 billion).

Consumer transactions: $34 billion, down from $37 billion in Q2 2024.

Institutional Trading: $151 billion, down from $189 billion in Q2 2024.

Asset Revenue Breakdown

Bitcoin: 37% of total volume, up from 35% in Q2 2024

Ethereum: Volume stabilized at around 15%, indicating steady interest.

Notes: Solana has been highlighted as the third-largest asset over the past two quarters, increasing its share of total trading revenue from 10% to 11%.

Other assets: Declined to 33% in Q3 2024, reflecting diversification efforts, but the current focus is on Bitcoin and Ethereum.

Resource Allocation and Investment Analysis

Liquidity Overview

USDC holdings: $508 million in Q3 2024, slightly lower than $589 million in Q2 2024. This suggests that USDC remains a stable source of liquidity, while its decline may indicate strategic asset redeployment.

Corporate cash in third-party venues: $92 million, slightly lower than $97 million, which means that third-party risk exposure is minimized.

Money Market Funds and Government Bonds: Increased to $6.088 billion in Q3 2023 from $4.068 billion, indicating a conservative shift toward lower-risk, liquid instruments amid market volatility.

Corporate Cash: Decreased to $1.544 billion from a peak of $3.549 billion in Q2 2022, likely due to strategic investments or operational needs.

Total Liquidity Resources: Increased to $8.232 billion in Q3 2024, indicating a solid financial foundation and readiness for strategic opportunities or market downturns.

Investing and Financing Activities

Cash Flow from Operations: $687 million in Q3 2024, demonstrating resilience and strong ability to generate cash from core operations.

Capex: Low at $19 million, reflecting a conservative approach to fixed costs, supporting financial flexibility.

Strategic Investments: Minimal outflows, including $14 million in venture capital (details of Coinbase Ventures’ activity can be found in a Google Sheet), $18 million in cryptocurrency investments, and $173 million in fiat loans and collateral, emphasizing prudent risk management.

Financing Activities: No new long-term debt was issued in Q3 2024, demonstrating the strategy’s focus on organic growth and use of internal liquidity.

Workforce Metrics and Alternative Data

Total Employees: 3,672 in Q3 2024, up from 3,486 in Q2 2024.

Monthly Transacting Users (MTUs): 7.8 million, down 4.9% from Q2 2024 and down 16.4% from the same period last year.

Web Traffic: Declined to 37.8 million in Q2 2024 from 40.7 million, indicating a possible waning of interest or seasonality.

Google Trends: Peaked at 74 in September, indicating a fluctuating trend in public interest.

App Downloads: Declined to 8,928 in September from 14,189 in August, indicating a slowdown in new user acquisition.

Job Postings: Declined to 818 in October, possibly indicating stable hiring or restructuring.

Financial Ratios

Note: The following explanations provide insights based on current data and are not definitive conclusions. We recommend an independent review of the data, which can be found in Google Sheets.

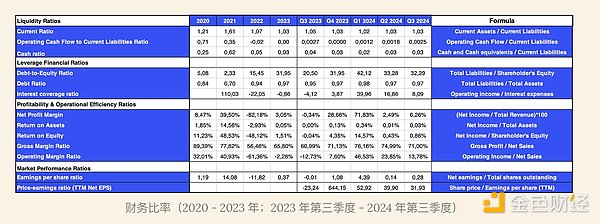

Liquidity Analysis

Current Ratio (Q3 2024: 1.03): Remains stable, indicating a small buffer of current assets to liabilities.

Operating cash flow to current liabilities ratio (Q3 2024: 0.0025): Slightly increased, reflecting some recovery in cash flow generation.

Cash ratio (Q3 2024: 0.03): Low and unchanged, highlighting the need for strict cash management.

Leverage ratio

Debt to equity ratio (Q3 2024: 32.29): High leverage ratio implies increased financial risk.

Debt ratio (Q3 2024: 0.97): Liabilities are almost equal to assets, indicating a high reliance on debt.

Interest Coverage Ratio (Q3 2024: 8.09): Positive, indicating that operating income is sufficient to cover interest expenses.

Profitability and Efficiency Ratios

Net Profit Margin (Q3 2024: 6.26%): Improved from a loss in Q3 2023, reflecting an increase in net income.

Return on Assets (ROA) (Q3 2024: 0.03%): Asset utilization is moderate, indicating possible inefficiencies.

Return on Equity (ROE) (Q3 2024: 0.86%): Slightly increased but still low, indicating suboptimal return on equity.

Gross Profit Margin (Q3 2024: 71.00%): Improved, indicating effective cost control.

Operating Profit Margin (Q3 2024: 13.78%): Significantly improved, indicating stronger control over operating expenses.

Market Performance Ratios

Earnings Per Share (EPS) (Q3 2024: $0.28): Recovery from negative earnings highlights improved profitability.

Price-to-Earnings (P/E) Ratio (TTM Net EPS) (Q3 2024: 31.93): The mid-range P/E ratio suggests cautious investor optimism.

Summary and Outlook

Balance Sheet Strength: USD resources increased by $417 million to $8.2 billion, including $1.3 billion in crypto assets, for total available resources of $9.5 billion. In October 2024, the Board approved a $1 billion share repurchase program. Strategic Initiatives: Expand product offering, including new U.S. cryptocurrency futures and deeper USDC integration. Base Network leads Layer 2 networks in transactions and value. Regulatory Advocacy: Engage with policymakers, support Fairshake and StandWithCrypto, and continue litigation with the SEC to push for regulatory clarity. Regulatory Environment: Bipartisan attention to cryptocurrency could lead to favorable legislation after the 2024 U.S. election, and advocacy efforts will expand the industry’s influence.

Risks & Challenges: Market volatility, regulatory uncertainty and high operating costs remain key challenges impacting revenue and profits.

Outlook: Fourth quarter revenue is expected to be between $505 million and $580 million, and technology and administrative expenses are expected to be between $690 million and $730 million, with a focus on product, market and regulatory growth.

According to

For a detailed overview of Base's origins and development, please refer to our June Newsletter. Under the leadership of Jesse Pollak, Base officially launched on July 13, 2023.

Overview

Platform Mission: Base is Coinbase's layer 2 solution on Ethereum, aiming to create a global on-chain economy that prioritizes innovation, creativity, and economic freedom in a secure, low-cost environment for decentralized application (dApp) development.

Infrastructure and Governance: Base is built on the OP Stack for scalability and cost-efficiency, and has confirmed that it will not issue a native token (CEO Brian Armstrong said on December 1, 2023). In partnership with OP Labs, Base is actively working on decentralized governance and research projects, including EIP-4844 and the op-geth client, in line with Coinbase's progressive decentralization vision.

Ecosystem Development: Base has seen strong developer adoption, with a focus on substantive product innovation rather than token-based incentives. Coinbase’s internal teams use Base for smart contract deployment, to enhance consumer and institutional-facing products, and to drive on-chain adoption through accessible onboarding and an intuitive interface.

Core Products: Base is positioned as a decentralized “app store” that provides an open platform for developers, including Base Names for simplified on-chain identities, and Smart Wallet for secure, programmable asset management for users.

Strategic Positioning: Base will not only compete in the Layer 2 ecosystem, but will also compete with traditional online platforms by providing an on-chain experience designed to rival traditional web applications.

Key Metrics

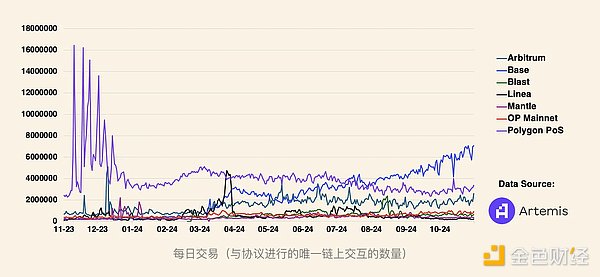

In Base’s app activity, the DeFi category is leading, with a significant increase in address activity from 143.6K in Q2 2024 to 405.7K in Q3. However, revenue decreased from $24.2M in Q2 to $7.3M in Q3. Stablecoin transfer volume grew significantly, from $97.8B in Q2 to over $415B in Q3, indicating increased trading demand. The ratio of new to returning users has also changed: from 107K to 278K in Q2, to 420K to 450K in Q3, and now to 509K to 827K in Q4. Sybil addresses decreased to 178K in Q4, while non-sybil addresses were 1.2M, while Q3 recorded 550K sybil addresses and 320K non-sybil addresses.

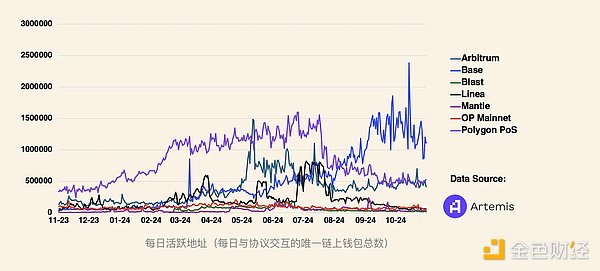

As can be seen in the chart below, Base is the leading layer 2 blockchain as of November 7th. A few weeks ago, it surpassed Arbitrum in terms of total locked value (TVL) and has maintained its first position in layer 2 in the daily active addresses and daily transactions categories for several months in a row.

Brian

Brian

Brian

Brian Alex

Alex Kikyo

Kikyo Alex

Alex Alex

Alex Brian

Brian Kikyo

Kikyo Kikyo

Kikyo Alex

Alex Hui Xin

Hui Xin