Original title: Weekly: What to expect in Q2?, Author: David Duong (Head of Institutional Research),

David Han (Institutional Research Analyst)

Release date: March 29, 2024

Summary: We believe that in the second quarter of 2024, the Crypto market will perform well under many favorable conditions. In addition, competition for on-chain derivatives is heating up.

Quick Overview

Despite some liquidity disruptions from US holidays and corporate month-end rebalancing, the cryptocurrency market as a whole has held up well.

Many of the headwinds we identified earlier this month are now a thing of the past, and looking ahead, we believe the overall market picture presented in Q2 2024 appears to be more favorable for Crypto performance.

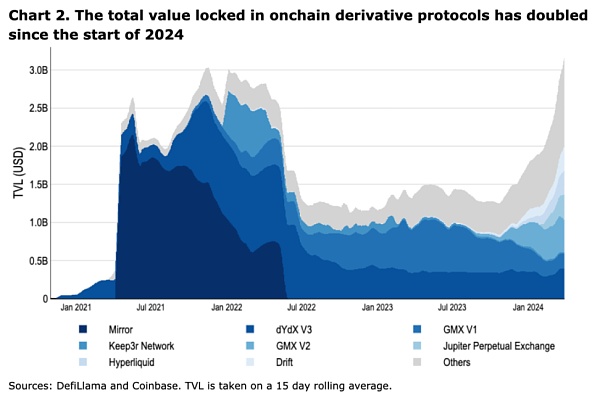

Meanwhile, the total value locked (TVL) of on-chain derivatives has reached an all-time high of $3.4 billion, although the TVL of the entire DeFi market is still about 50% below its peak in the previous cycle.

Market Highlights

Despite liquidity disruptions from US holidays and corporate month-end (and quarter-end) rebalancing, the crypto market has held up well. USD demand typically picks up at this time of the month/year. Tax season remains a potential catalyst for earnings in the near term. Additionally, we believe that speculators shorting MicroStrategy (MSTR) and long Bitcoin may have contributed to the recent market volatility. On the other hand, many of the headwinds we identified earlier this month are now a thing of the past, and looking ahead, we believe the overall market picture presented by the second quarter of 2024 appears to be more favorable for Crypto. Nonetheless, we believe these positive factors may only begin to become more clearly apparent in the second half of April.

For example, the upcoming Bitcoin halving (estimated to be sometime between April 16 and 20) remains a big event to watch on the supply side, which we have already covered in depth in the article "Coinbase: In-depth Analysis of Bitcoin's Trends after This Halving". But on the demand side, the 90-day review period used by many large securities firms when conducting due diligence on new financial products (such as spot Bitcoin ETFs) may end as early as April 10. That said, large broker-dealers typically conduct a rigorous 360-degree assessment before allowing wealth advisors to allocate client assets. Their assessment thoroughly examined (1) whether such products meet investment minimums and liquidity thresholds, and (2) whether the necessary daily trading, custody, and regulatory reporting activities pose any insurmountable operational challenges to their existing infrastructure.

That said, large securities firms like Morgan Stanley, Bank of America, UBS, and Goldman Sachs are not the only wealth gatekeepers here. Outside of these large financial groups, there are also some mainstream wealth management platforms operating in the United States. While money managers like LPL Financial typically (and explicitly) have a three-month observation period, some platforms have shorter or longer observation windows. We believe this could unlock a large amount of capital for spot Bitcoin ETF trading in the United States in the medium-term timeline.

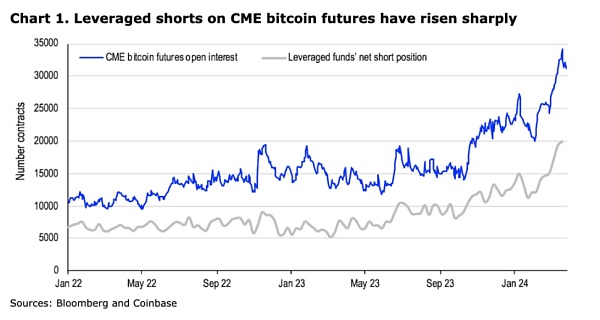

Meanwhile, according to the latest data from the U.S. Commodity Futures Trading Commission (CFTC), as of March 19, the level of leveraged short positions in CME Bitcoin futures has climbed to a record high of 19,917, which seems to indicate that institutional interest in this space remains high. In comparison, total open interest in CME Bitcoin futures is 33,196 contracts with a total value of $100.5 billion (as of that date). We use leveraged funds’ net short position in CME Bitcoin futures as a proxy for Bitcoin basis trading activity, similar to the proxy for U.S. Treasury futures basis trading activity cited by the Bank for International Settlements (BIS). Many institutions that do not have direct access to cryptocurrency spot often use this spread to gain long Bitcoin exposure. Interestingly, the basis (30-day) between Bitcoin spot and CME futures averaged approximately 16% annualized in March, only slightly higher than 14% in February, making this trade profitable for many market participants despite the capital requirements.

On-chain: The dawn of derivatives

In addition, the increased availability of high-throughput and low-cost block space (following the focus on infrastructure construction throughout the bear market) enables new forms of on-chain products. This has been reflected in the field of on-chain derivatives, whose total value locked (TVL) has reached an all-time high of US$3.4 billion, although the TVL of the entire DeFi market is still about 50% lower than the high point of the previous cycle. It is particularly noteworthy that the collateral deposited in these protocols is generally limited to major L1 tokens and stablecoins.

The use of centralized limit order books (CLOBs) in many derivatives protocols is a direct result of cheaper block space, as it allows orders to be created and canceled quickly with minimal cost, which is critical for liquidity trading achieved through more traditional market making strategies. In fact, one of the original design considerations for early automated market makers (AMMs) was that providing liquidity through order books was not only too costly, but also generally unfeasible given the long and discrete block intervals and uncertainty in transaction ordering.

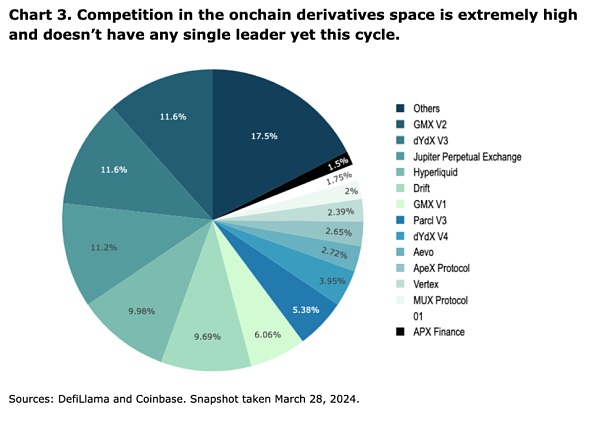

When measuring trading volume relative to TVL, CLOBs generally have the advantage of being more capital efficient than AMMs. For example, according to DeFiLlama, the two leading derivatives protocols by TVL, GMX and dYdX, have similar levels of aggregate TVL in their versions ($610 million and $520 million, respectively). Yet dYdX trades over 20x the volume of GMX on a similar capital base (~5B/wk for dydx vs ~200M/wk for GMX). In part, the difference in capital efficiency is because GMX leverages an underlying AMM for liquidity, while dYdX runs on CLOB. This results in less price impact and slippage, and potentially lower fees.

That said, volumes can be easily distorted in the short term due to trading incentives such as credits and airdrop farms, temporary fee waivers, and broader market volatility. Additionally, for many CLOB architectures, it is difficult to distinguish market making activity from organic trading. As such, we view the growth in TVL as a clearer indicator of sticky interest in protocols at an early stage, though volume and revenue will ultimately determine the long-term success of protocols.

From a TVL perspective, derivative protocols are more diverse this cycle than the last. At the pre-TVL peak in 2021 and early 2022, the top 4 protocols controlled over 85% of TVL in derivatives protocols. Now, the largest protocol, GMX, controls 17.7% of the market TVL across its V1 and V2, while dydx controls a total of 15.6% (see Figure 3). While certain protocols have an early lead and accrued trust due to their longevity, we believe the clear winners in the space have yet to be determined.

Various scaling strategies will impact ease of onboarding, liquidity bridges, and long-term technical scalability. Different approaches, such as dydx’s proprietary appchain based on Cosmos, GMX’s integration into Arbitrum rollup, Aevo’s proprietary app rollup, and Drift’s deployment on Solana, all require various trade-offs. At the same time, competition from centralized derivatives exchanges will continue to put performance pressure on these decentralized protocols.

Crypto and Traditional Data

(As of 4pm EST on March 28)

AssetPriceMkt Cap24 hour change7 day changeBTC correlationBTC$70,807$1.29T+3.40%+8.20%100%ETH$3,568$427B+2.24%+2.24%85%Gold (Spot)$2,220-+1.17%+1.80%49%S&P 5005,254.35-+0.11%+0.25%19%USDT$1.00$104B---USDC$1.00$32.1B---

--

AssetMTD flow (US$B)YTD flow US$B)AUM (US$B)Bitcoin held (BTC M)Spot BTC ETFs (US)$4.4B$11.9B$57.1B0.83M

Source: Bloomberg

Coinbase Exchange and CES Insights

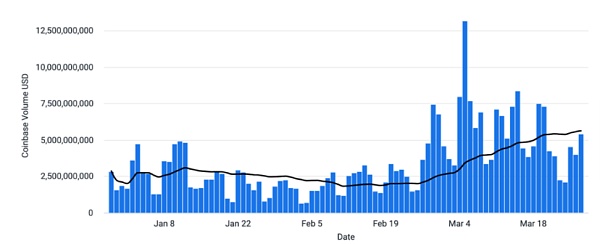

Crypto markets moved higher over the past week on increased volume. Traders are once again adding to leveraged long positions as a short-term bottom may have been in place. Annualized funding rates for BTC and ETH perpetual contracts have climbed from 15% to 50% over the past week. Open interest in major currencies also continues to climb and is at its highest level in over a year. With the overall trend up, traders are parsing altcoins, looking for ways to outperform the rising market. However, there is no single narrative that has emerged as a winner, so we are seeing capital circulating across sectors at a high speed.

Coinbase platform trading volume (USD)

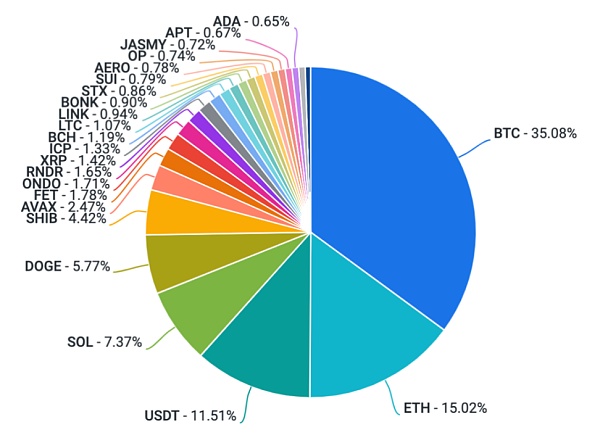

Coinbase platform trading volume (asset ratio)

Funding rate

3/28/2024TradFiCeFiDeFiOvernight5.35%5.00% - 10.75%9.12%USD - 1m5.50%5.25% - 11.00%USD - 6m5.75%5.50% - 11.50%BTC1.50% - 5.00%ETH3.00% - 8.00%1.33%

Notable Crypto News

Institutional

BlackRock’s New Tokenized Fund Brings Traditional Finance and Crypto Closer (Coindesk)

BlackRock Will Push Forward with Spot Ethereum ETF If Ethereum Gets Security Designation (The Defiant)

Regulatory

KuCoin Faces Criminal Charges in the US (The Defiant)

SEC Faces Lawsuit Seeking to Exempt Airdrops from Securities Classification (Decrypt)

Regular

Fetch.ai, SingularityNET, and Ocean Protocol Token Prices Soar Following Announcement of Proposed Merger (The Coinbase How to stay safe this tax season (Coinbase) Global Perspectives Europe European Parliament approves ban on anonymous crypto trading (CryptoBriefing) EU markets regulator one step closer to finalizing MiCA rules (CoinDesk) Patrick Hansen clarifies EU regulatory misinformation: no ban on self-hosted wallets (bitcoin.com) Euronext CEO Stephane Boujnah says exchange has no plans to introduce crypto trading without regulators’ support UK Treasury releases latest report on tokenization of funds (The Block) Asia Singapore’s DigiFT launches US T-Bill RWA token Avalanche announces partnership with Chainlink and Australia and New Zealand Banking Group to explore on-chain asset settlement (AVAX)

South Korean investors petition to further delay cryptocurrency taxation (The Block)

Big events in the coming week

April 1April 2April 3April 4April 5Notable MacroUS ISM ManufacturingUS Fed Chair Powell SpeaksUS ISM ServicesUS Non-Farm PayrollsNotable EarningsCrypto

Beincrypto

Beincrypto

Beincrypto

Beincrypto decrypt

decrypt dailyhodl

dailyhodl Others

Others The Crypto Star

The Crypto Star Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph