Source: Coinbase; Compiled by Tao Zhu, Golden Finance

Summary

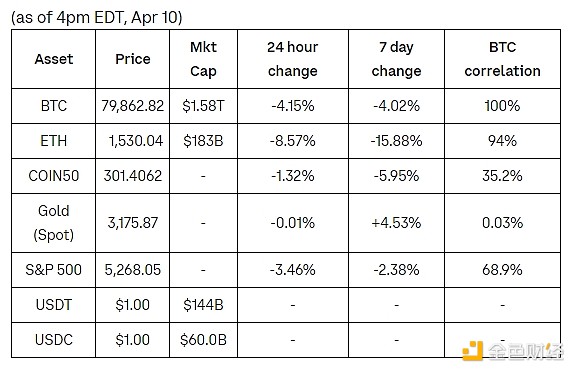

Affected by the news of US tariffs, market volatility continued to increase, the S&P 500 Volatility Index (VIX) broke through 60 on Monday, and the stock market fluctuated sharply during the session.

Against the backdrop of increasing recession concerns, market participants look forward to potential guidance from the Federal Reserve, but we believe that in the current economic environment, the Federal Reserve is unlikely to take preemptive action as they are more focused on the inflation aspect of their dual mandate.

However, cryptocurrency-related catalysts remain strong. The U.S. Securities and Exchange Commission (SEC) announced that non-interest-bearing stablecoins will not be considered securities and will continue to hold roundtables with industry insiders. On-chain data further shows that long-term holders are increasing their holdings of Bitcoin (BTC).

Affected by the news of US tariffs, market volatility continued to increase. Stocks saw significant intraday volatility on Monday as the S&P 500 Volatility Index (VIX) broke above 60. Volatility hit its highest level since August 5, 2024, driven by the unwinding of yen carry trades and jobless concerns. The last multi-day trading window with similar volatility levels (VIX above 50) was in March 2020. Notably, Bitcoin prices have remained relatively resilient this week – both up and down – despite the heightened volatility in the stock market.

While President Trump’s announcement of a 90-day suspension of country-specific tariffs for non-retaliatory regions (maintaining only a 10% baseline increase in global imports) has eased concerns about an unbridled tit-for-tat tariff escalation, there is still a lot of uncertainty about how the long-term situation will play out. Especially after China imposed an 84% tariff on US goods, tariffs on China were raised again to 125%. While the blanket suspension of tariffs on most countries is positive for short-term market stability, the long-term impact of a rapprochement between the U.S. and China remains a primary concern. Beyond the direct impact of tariffs, escalating tensions could have other effects, such as the sale of TikTok to a U.S. entity. This could have indirect implications for the development of technology regulation and national security issues, both of which are closely tied to the cryptocurrency industry. Meanwhile, market participants are focused on potential guidance from the Federal Reserve amid growing recession fears, with Goldman Sachs pricing in a 45% chance of a U.S. recession. Even so, we believe the Fed is unlikely to take preemptive action in the current economic environment as they are more focused on the inflation side of their dual mandate. We also believe an emergency rate cut would send the wrong signal to investors about financial market fragility. In the minutes of the March FOMC meeting released on April 9, Fed staff highlighted that “core inflation declined less than expected last year” and that “changes in trade policy could put more upward pressure on inflation than … assumed”. That said, we believe it is unlikely that the Fed will take decisive action in the near term simply based on fulfilling its inflation mandate. However, amid macro uncertainty, catalysts specific to the crypto space remain strong. US crypto policy continues to advance, with the US Securities and Exchange Commission (SEC) announcing that “covered stablecoins” (i.e., stablecoins backed by low-risk, liquid assets and easily redeemable for US dollars) will not be considered securities. The statement explicitly excludes yield-generating stablecoins, noting that a decision on this asset type will be made in the future. Notably, this is also a difference between the US House (Stable Act) and Senate (Genius Act) bills on stablecoins, with the former explicitly prohibiting yield-generating stablecoins while the latter does not. The SEC will also continue to host industry roundtables, with the next discussion on April 11th focusing on cryptocurrency-specific trading regulations.

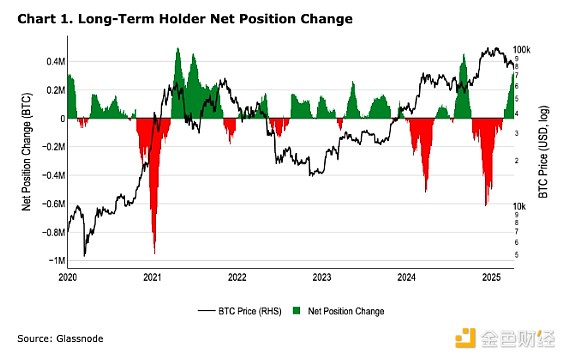

Given the macro uncertainty and strong regulatory tailwinds, on-chain data shows that long-term Bitcoin holders have begun to steadily accumulate more BTC since BTC fell below $90,000 in late February. Prior to this, long-term holders had been in a net accumulation state before the US election in the fall of 2024, and did not begin to actively sell until BTC broke through $100,000 in December. While the accumulation of long-term holders does not necessarily indicate an imminent price increase, we do believe that this indicates that more and more "fair value" buyers are viewing the current BTC price level as a buying opportunity.

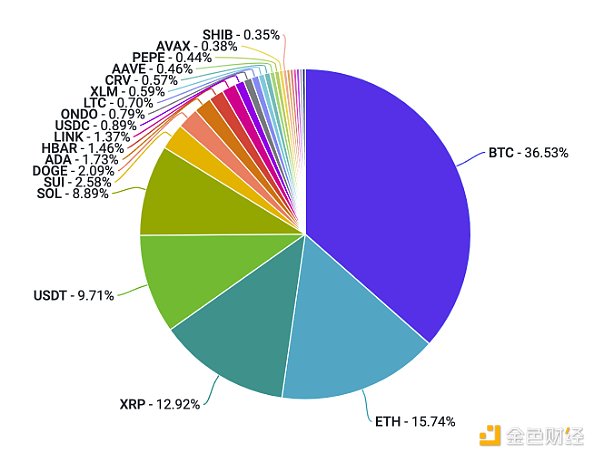

Overview of Cryptocurrency and Traditional Assets

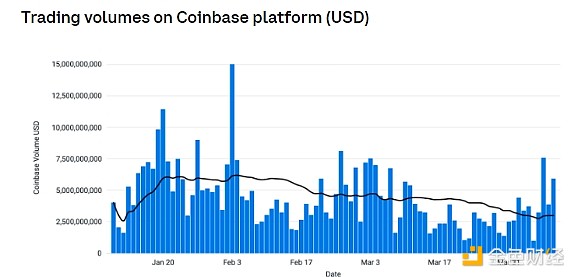

Coinbase Exchange and CES Insights

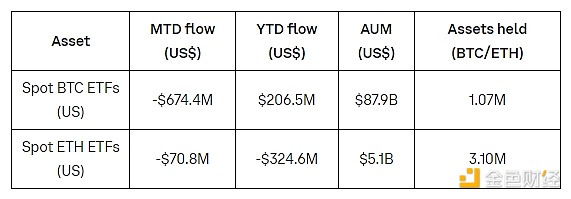

Markets have been volatile over the past week, with Bitcoin trading between $74,400 and $83,600 and Ethereum between $1,385 and $1,810. Cryptocurrencies have shown a high correlation with broader risk markets, reacting to the tariff news in lockstep with the stock market. Active funds have adopted a cautious strategy to avoid overtrading amid heightened price volatility. Long-term investors have taken advantage of market weakness to add to their positions in BTC, SOL and other projects they see as valuable. But overall, funding rates for altcoins remain negative, suggesting some of the riskier sectors of the market remain cautious.

Kikyo

Kikyo

Kikyo

Kikyo Jixu

Jixu Jasper

Jasper Joy

Joy Jixu

Jixu Aaron

Aaron Catherine

Catherine Hui Xin

Hui Xin Aaron

Aaron Davin

Davin