New Era for US Financial Regulation on the Horizon

A Congressman’s bold move to reshape U.S. financial regulation, targeting SEC leadership and strategy.

Kikyo

Kikyo

Author: Sam Kessler (CoinDesk); Translator: Wu Shuo Blockchain

It is reported that the Layer 2 blockchain project Movement Labs is investigating an alleged fraudulent market-making agreement. An arrangement originally intended to promote the smooth listing of MOVE crypto tokens eventually evolved into a sell-off scandal that shocked the market. The agreement allegedly handed over the control of 66 million MOVE tokens to an unclear intermediary agency Rentech without the full knowledge of the project party. Rentech played the dual roles of "Web3Port subsidiary" and "foundation agent" in the agreement and was suspected of self-dealing. The arrangement directly triggered a wave of token sales worth $38 million the day after MOVE went online, causing the coin price to fall sharply and leading to a ban on Binance.

Despite clear internal opposition to the agreement, senior management still pushed for the signing, raising serious concerns about governance failure, lack of due diligence and conflicts of interest. Currently, many senior executives and legal advisors are being investigated, and the project's governance structure and cooperation mechanism are being questioned comprehensively. This crisis has revealed deep loopholes in Movement's institutional design, risk control and compliance capabilities, which may have a long-term impact on its future reputation and ecosystem construction.

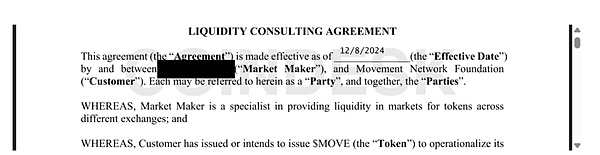

According to internal documents reviewed by CoinDesk, Movement Labs, the blockchain project behind the MOVE crypto token, is conducting an internal investigation into a controversial financial agreement. The agreement may grant a single entity major control over the token market without the full knowledge of the project party, causing structural imbalance.

The agreement directly led to the concentrated selling of 66 million MOVE tokens on December 9, 2024, the day after they were listed on the exchange, triggering a cliff-like drop in the price of the currency and triggering widespread market doubts about "insider trading" and profit transfer. It is worth noting that the MOVE project has been publicly endorsed by World Liberty Financial, a crypto venture capital fund supported by Trump, making this event more politically and industrially influential.

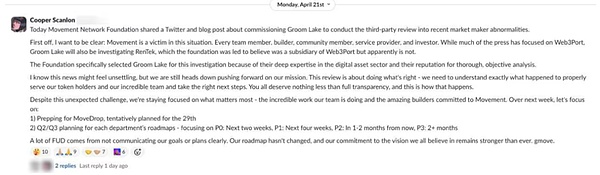

Cooper Scanlon, co-founder of Movement Labs, said in an internal Slack announcement on April 21 that the team is investigating a key issue: how more than 5% of MOVE tokens originally reserved for market maker Web3Port were transferred to an intermediary called Rentech.

The Movement Foundation was allegedly initially told that Rentech was a subsidiary of Web3Port, but an investigation showed that this was not the case. Rentech has denied any misleading behavior.

According to an internal memo from the Movement Foundation, the agreement signed by Movement and Rentech loaned about half of the total circulating supply of MOVE tokens to the single counterparty. This arrangement gave Rentech an extremely unusual market influence in the early stages of the token's listing.

Several industry experts interviewed pointed out that this centralized structure seriously deviates from the decentralized distribution principle that crypto projects usually pursue, and is easily used to manipulate currency prices or achieve unilateral arbitrage.

After reviewing the version of the contract obtained by CoinDesk, veteran crypto industry founder Zaki Manian pointed out that some of the clauses contained in the agreement essentially set clear incentives for "artificially pushing up the fully diluted valuation (FDV) of MOVE tokens to more than $5 billion and then selling them to retail investors for profit."

He bluntly said: "Even if such discussions only appear in written documents, it is shocking." The comment further exacerbated the outside world's doubts about the purpose and moral bottom line of the Rentech agreement.

In theory, market makers are employed by the project party to provide liquidity services for newly launched tokens. Their responsibility is to buy and sell on the exchange with the funds provided by the project party to maintain price stability and market depth. However, in practice, this role also has the risk of abuse.

Once there is a lack of supervision or the agreement is not transparent, market makers may become a tool for insiders to manipulate the market and quietly transfer large token holdings without being easily detected by the outside world, thereby seriously damaging the interests of ordinary investors and market fairness.

A series of contract documents obtained by CoinDesk reveals a little-known gray area in the crypto industry: in the absence of effective supervision and legal transparency, blockchain projects originally intended for the public can easily be used as vehicles for a few people behind the scenes to make private profits.

The contents of these agreements show that once the project party neglects structural design and compliance control, the so-called "decentralized" project may also be completely privatized by a few traders through unequal terms, deviating from the original intention of fairness and openness.

In the crypto market, there have been many rumors about the manipulation and abuse of market-making mechanisms, but the specific details of the relevant operations, contract structures and interest arrangements are rarely made public. For this reason, the details of the internal contracts and agreements disclosed by Movement Labs in this incident have become a rare window to observe the black box operation of Web3 projects and the gray area of market making, and have once again focused the industry on the most basic but most often overlooked principle of "transparency."

The market-making contract reviewed by CoinDesk shows that Rentech appeared in two identities in the transaction with Movement Foundation: on the one hand, it acted as an agent of Movement Foundation, and on the other hand, it signed the agreement as a subsidiary of Web3Port. This structure provides Rentech with the possibility of "intermediary dominance" in the transaction, theoretically enabling it to set the terms of the transaction on its own and profit from information asymmetry.

The market-making agreement reached by Movement and Rentech ultimately opened a sell channel for a group of wallets associated with Web3Port. The Chinese financial institution claims to have served MyShell, GoPlus Security, and World Liberty Financial, a crypto fund associated with Donald Trump. These wallets quickly liquidated a total of about $38 million worth of tokens the day after the MOVE token was first launched on the exchange, causing sharp market fluctuations and making the motivation and legitimacy of the agreement arrangement itself face concentrated doubts.

After the incident fermented, the mainstream exchange Binance has banned the market-making accounts involved on the grounds of "improper behavior". At the same time, the Movement project party urgently announced the launch of a token buyback plan in an attempt to stabilize market sentiment and regain community trust.

Similar to the employee option mechanism of startups, most crypto projects set a lock-up period when allocating tokens, aiming to limit the core team, investors and early participants from selling large positions in the initial trading stage of the project.

This mechanism is intended to protect market stability and prevent insiders from taking advantage of information to make profits in advance. However, in the Movement incident, the liquidity arrangement of the relevant tokens to bypass the lock-up restrictions is the core issue that has aroused doubts from the outside world.

Binance's ban on the accounts involved quickly triggered associations in the community. Many observers believe that this may mean that the internal personnel of the Movement project and Web3Port have reached a private agreement to sell tokens in advance by bypassing the normal lock-up mechanism.

In response to this question, Movement denied it and insisted that it had not entered into any illegal transfer arrangements with any third party. However, the information confusion and contract structure defects exposed by the incident still make it difficult to completely eliminate the impression of "insider trading".

Movement is an Ethereum expansion Layer 2 network built on Facebook's open source language Move. Due to its technological innovation and capital support, it has quickly become one of the most discussed emerging projects in the crypto industry in recent years.

The project was founded by two 22-year-old co-founders, Rushi Manche and Cooper Scanlon, who dropped out of Vanderbilt University. It has received $38 million in financing and was selected into the Trump-backed World Liberty Financial crypto portfolio. In January 2025, Reuters reported that Movement Labs was about to complete a new round of financing of up to $100 million, with a valuation of up to $3 billion.

But divisions have emerged over the controversial market-making agreement with Rentech. CoinDesk spoke to more than a dozen people with knowledge of the project, most of whom requested anonymity, who provided conflicting accounts.

Rentech owner Galen Law-Kun denied misleading and said the deal structure was designed in coordination with YK Pek, general counsel of the Movement Foundation. But Pek initially strongly opposed the agreement and denied any involvement in the establishment of Rentech, according to internal memos and communications reviewed by CoinDesk.

Movement Labs co-founder Scanlon said in an internal Slack message: "Movement is the victim in this incident." This statement also indicates that the project is trying to direct the responsibility to external operators.

According to four anonymous sources familiar with the progress of the internal investigation, Movement is focusing on the role of its co-founder Rushi Manche in the Rentech protocol. It is said that it was Manche who initially forwarded the protocol to the team and promoted the implementation of the cooperation within the organization.

Also included in the scope of the investigation is Sam Thapaliya — — he is the founder of the crypto payment protocol Zebec and a business partner of Rentech owner Galen Law-Kun. Although Thapaliya did not hold an official position in Movement, he has long been involved in core affairs as an "informal consultant". His specific influence in this incident has also become one of the focuses of the project's internal audit.

Although it initially rejected the market-making agreement with Rentech, which had significant risks, Movement eventually signed a revised agreement with a similar structure, and the core reliance of the agreement was a verbal guarantee from an intermediary with almost no public resume.

Behind this decision, the shortcomings of the current governance structure of the crypto industry are highlighted. According to common practice, in order to avoid securities regulatory risks, crypto projects usually split their operations into two entities: a non-profit foundation is responsible for token management and community resource allocation, and the other is a for-profit development company responsible for underlying technology development. Movement Labs is the development entity of the project, while the Movement Foundation is responsible for token affairs.

However, internal communication materials reviewed by CoinDesk show that the structure that was supposed to operate independently actually failed in the Movement case. Although co-founder Rushi Manche is nominally an employee of Movement Labs, he played a leading role in key affairs of the non-profit foundation. This overlapping of functions has deprived the dual-entity mechanism, which is supposed to prevent compliance risks, of its due checks and balances.

On March 28, 2025, co-founder Rushi Manche sent a draft market-making agreement to Movement Foundation via Telegram message, stating that the contract "needs to be signed as soon as possible."

On November 27, 2024, Rentech proposed a draft market-making agreement to Movement, which included lending up to 5% of the total MOVE tokens to Rentech. According to the contract, Rentech is the borrower and Movement is the lender. However, the agreement was not signed.

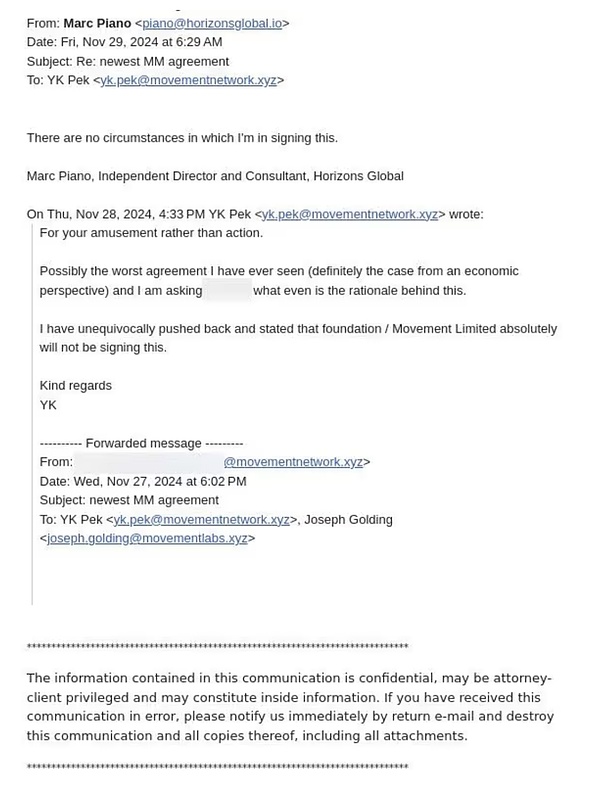

Rentech, a company with almost no public background and on-chain records, immediately aroused internal vigilance within the foundation with its large token loan request. Movement Foundation legal counsel YK Pek said in an email that the document "may be the worst agreement I have ever seen." He further pointed out in another memorandum that if the agreement is implemented, it will be equivalent to handing over the actual control of the MOVE market to an external entity with unclear identity.

In addition, Marc Piano, a director of the foundation registered in the British Virgin Islands, also refused to sign the agreement. The above objections show that Movement's internal risk awareness of the agreement is actually very clear, but it still failed to prevent the agreement from being implemented in a variant form in the subsequent process, further exposing the problem of governance failure.

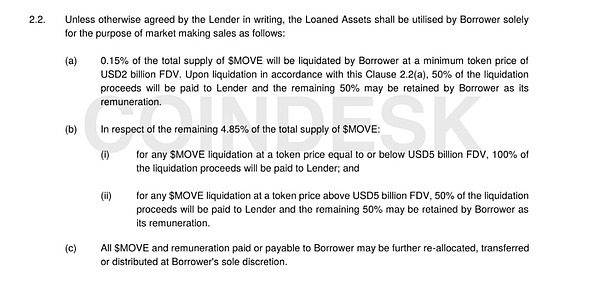

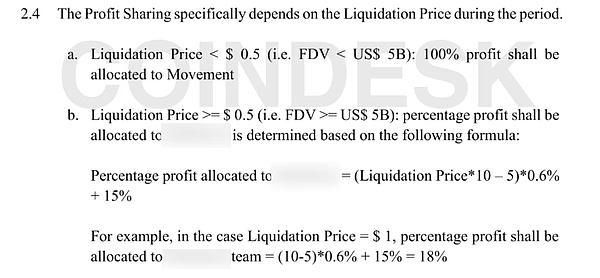

One particularly eye-catching clause in the contract stipulates that once the fully diluted valuation (FDV) of MOVE tokens exceeds $5 billion, Rentech can begin to liquidate its tokens and share the resulting profits with the Movement Foundation in a 50:50 ratio.

Crypto industry veteran Zaki Manian pointed out that this structure essentially creates a "distorted incentive mechanism" that encourages market makers to artificially push up MOVE prices so that they can sell their huge positions in a concentrated manner and make profits when the valuation is inflated. This design not only deviates from the original intention of market making to serve price stability, but is also likely to directly harm the interests of retail investors.

Although the Movement Foundation initially refused to sign a high-risk market-making agreement, its negotiations with Rentech did not stop. According to three people familiar with the matter interviewed by CoinDesk and the legal documents reviewed, Rentech subsequently claimed to the foundation that it was a subsidiary of Chinese market maker Web3Port and offered to provide $60 million in collateral funds, thereby increasing the attractiveness of the agreement.

Driven by the above conditions, the Movement Foundation accepted a revised agreement on December 8, 2024. This version modified some key terms and deleted one of the most controversial contents - if the MOVE token failed to be listed on a specific exchange, Web3Port could sue the Movement Foundation for compensation.

Although the agreement was adjusted in form, this compromise decision showed that the foundation still relaxed its risk prevention stance in the face of pressure and inducements from multiple parties, which ultimately laid hidden dangers for subsequent events.

On December 8, 2024, the Movement Foundation and Rentech officially signed a revised market-making agreement. Although Rentech is clearly marked as "Web3Port" in the agreement (the name has been coded in some documents), its identity as a borrower has not changed, and the foundation is still the lender.

It is noteworthy that the main drafter of the agreement was YK Pek, the foundation's legal adviser who had previously clearly opposed the initial version of the agreement. Although the revision removed some of the most controversial clauses, the core structure remains unchanged: Web3Port can still borrow 5% of the total supply of MOVE tokens and sell them for profit in a certain way.

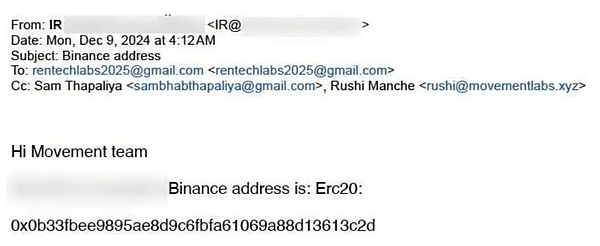

Further technical information reveals the deliberate nature of the operation behind the agreement — — the domain name "web3portrentech.io" registered under the email address of a Rentech director was registered on the day the agreement was signed.

According to three people familiar with the incident, when the Movement Foundation signed the formal agreement on December 8, 2024, it was unaware that Web3Port had signed a similar cooperation agreement with the nominal "Movement" several weeks earlier.

This "preliminary agreement" not only did not go through the formal process of the foundation, but also bypassed the due compliance review and governance mechanism.

According to a contract dated November 25, 2024 obtained by CoinDesk, Web3Port had signed a highly similar market-making agreement with Rentech long before the Movement Foundation officially signed the contract. In the agreement, Rentech was marked as the lender, Web3Port was the borrower, and Rentech was directly referred to as the representative of "Movement" in the document.

This "shadow agreement" almost replicated the original proposal that the foundation subsequently rejected, indicating that some key arrangements had already been implemented in informal channels without the foundation's approval process. This discovery confirms the existence of multiple "power channels" within the project.

This early agreement signed on November 25 is highly consistent in structure with the contract that was rejected on November 27, and the core terms still clearly allow market makers to perform liquidation operations when the price of MOVE tokens reaches a certain threshold.

This setting is regarded by industry insiders such as Zaki Manian as a core mechanism that is "highly manipulative" - that is, to extract profits by artificially pushing the price to reach the target and then selling it in a concentrated manner. This shows that even in the subsequent versions that have been superficially modified, some key stakeholders behind the project have always been promoting a set of operating paths with built-in arbitrage incentives, without substantially eliminating the underlying risks.

Several sources close to the Movement project told CoinDesk that there is still a lot of speculation about the real planner of the Rentech protocol. The initial version of this agreement, which is believed to have directly led to the massive sell-off and public opinion storm of MOVE tokens in December, was circulated internally by co-founder Rushi Manche, who pushed it into the decision-making process.

According to Blockworks, Manche was briefly suspended last week due to the agreement in question. Manche himself responded that in the process of selecting market makers, MVMT Labs has always relied on the foundation team and multiple consultants to provide advice and assistance, "but it now appears that at least one member of the foundation represents the interests of both parties to the agreement, which has become the focus of our current investigation."

At the same time, another key figure, Sam Thapaliya, has also attracted great attention. Thapaliya is the founder of the encrypted payment protocol Zebec and a long-term consultant to Manche and co-founder Scanlon. He was copied in many emails between Web3Port and Movement, and appeared in important communication links with Rentech and Manche.

This clue reinforces the outside world's suspicion that Thapaliya may play a "behind-the-scenes" role in the design of Rentech's structure - he may not be a simple consultant, but a "shadow co-founder" who dominates the protocol architecture and deeply intervenes in decision-making.

According to several Movement employees, Zebec founder Sam Thapaliya may play an actual role in the project that far exceeds his advisory status. One person called him “Rushi’s (Manche) close advisor and kind of shadowy third co-founder,” noting, “Rushi was very secretive about the relationship and we only heard his name occasionally.” Another employee said, “There were many times when we had agreed on something and there was always a last minute change, and we usually knew it was probably Sam’s opinion.” Three witnesses confirmed that Thapaliya was at Movement’s San Francisco offices on the day the MOVE token went live to the public. CoinDesk also reviewed multiple Telegram screenshots showing that co-founder Scanlon had commissioned Thapaliya to help screen the MOVE airdrop list — a highly sensitive part of the project’s community token distribution mechanism.

Such arrangements have further deepened the impression of some team members: Thapaliya's actual influence on the project is far deeper and more hidden than his public identity suggests. In response to this, Thapaliya said in a response to CoinDesk that he met Manche and Scanlon in his early college years and has been involved in the project as an external consultant since then, but he "does not hold shares in Movement Labs, does not receive tokens from the Movement Foundation, and does not have any decision-making power."

Rentech, which is at the center of the MOVE token controversy, was founded by Galen Law-Kun — a business partner of Zebec founder Sam Thapaliya. Law-Kun told CoinDesk that Rentech is a subsidiary of his Singapore-registered financial services company Autonomy, which aims to build a financing bridge between crypto projects and Asian family offices.

Law-Kun claimed that YK Pek, the general counsel of the Movement Foundation, not only helped set up Autonomy SG, but also served as the general counsel of the company (or its affiliate) Rentech. He also said that despite Pek’s strong internal opposition to the Rentech agreement, he actually helped design Rentech’s structure and participated in drafting the initial version of the market-making agreement, “which was almost identical to the contract version he later formally drafted for the foundation.”

However, CoinDesk’s investigation did not find direct evidence that Pek worked at Autonomy or drafted any Rentech-related contracts in that capacity.

In response, Pek said: “I have never been and have never been the general counsel of Galen or any of its entities.” He explained that a corporate secretarial services company he co-founded did provide secretarial services to two companies under Galen, but these two companies were not Rentech, and they both declared “no assets” in their 2025 annual audits.

Pek further stated that he had spent two hours in 2024 reviewing Galen's consulting agreement with a project, and only provided free advice on the FTX case deadline and NDA documents. "I completely don't understand why Galen claimed that I was his general counsel, which made me confused and uneasy."

Pek also pointed out that the legal team of Movement Foundation and Movement Labs learned about GS Legal, the lawyer hired by Rentech, through the introduction of co-founder Rushi Manche.

According to Galen, Pek was introduced to 10 different projects as "Autonomy's legal advisor" and never denied the title; as for GS Legal's involvement, "it was just a formal process completed at the request of Movement."

After the incident broke out, Movement Labs co-founder Cooper Scanlon emphasized in an internal Slack notice that the company has hired an external audit agency, Groom Lake, to conduct a third-party independent investigation into the anomalies in the recent market-making arrangements. He reiterated: "Movement is the victim in this incident."

This series of mutual denials and accusations exposed the intricate interpersonal and legal relationships behind Rentech, and also pushed the MOVE incident further from a market event to the core vortex of trust crisis and governance fault.

A Congressman’s bold move to reshape U.S. financial regulation, targeting SEC leadership and strategy.

Kikyo

KikyoNFPrompt merges AI and NFTs, introducing a unique token ecosystem and sustainable roadmap.

Brian

BrianCardano ADA is on the brink of a significant milestone, with debates circulating about its potential to hit the $1 mark. The anticipation surrounding this benchmark has piqued the interest of investors and analysts, acknowledging the psychological impact such an achievement could have on ADA's trajectory.

Joy

JoyLeverFi's new BRC20 Launchpad, LeverPro, signifies a major step in decentralized finance, offering innovative trading features and robust security, with a promising roadmap for 2024 focused on DeFi development and token integration.

Brian

BrianxPet.Tech combines virtual pets with blockchain for interactive gaming, trading, and community engagement on the Arbitrum chain.

Alex

AlexA Trailblazer in Gaming and AI In essence, Sleepless AI stands as a pioneering force in the confluence of AI, gaming, and blockchain. Its success hinges on the execution of its vision and its ability to stand out in the AI and blockchain technology arena. For enthusiasts at the intersection of these fields, Sleepless AI is a venture to observe in the forthcoming years.

Alex

AlexGBA Capital Fund announces over $10 billion investment in Web3, focusing on Metaverse, NFTs, and RWAs.

Alex

AlexRekt Builder's investigation reveals Ledger Live's covert user activity tracking, raising serious privacy concerns for Ledger hardware wallet users.

Kikyo

KikyoBitcoin Ordinals' website experiences its first DDoS attack amidst ongoing debate about its impact on the Bitcoin network.

Brian

BrianPrior to this consultation, the HKMA had issued a Discussion Paper on Crypto-assets and Stablecoins in January 2022, inviting feedback from various stakeholders.

Davin

Davin