Author: Shane Neagle, Coingecko; Translator: Baishui, Golden Finance

Bitcoin was launched in the wake of the 2009 financial crisis and has barely undergone macroeconomic stress testing. This is in stark contrast to gold, which has a long history that has survived centuries and different political systems.

However, gold has a pseudo-finite supply, which makes its scarcity unstable. New gold mines are discovered regularly, while Bitcoin's scarcity is mathematically precise and predictable, limited to 21 million Bitcoins (BTC). But does this mean that Bitcoin is a better hedge against inflation than gold?

How does CPI affect Bitcoin prices?

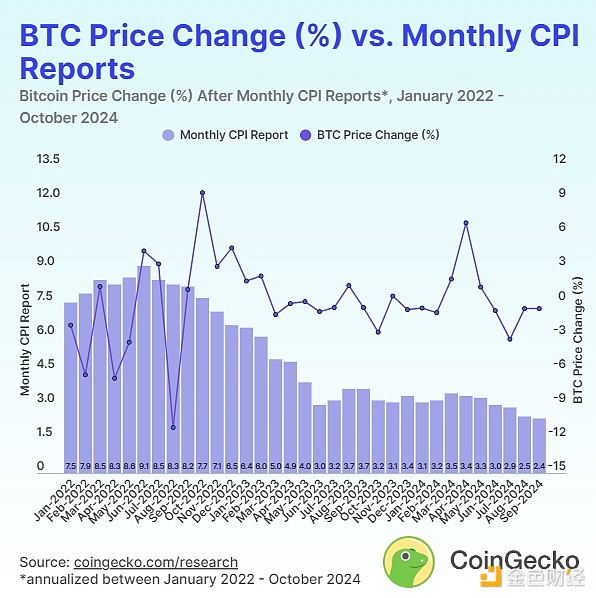

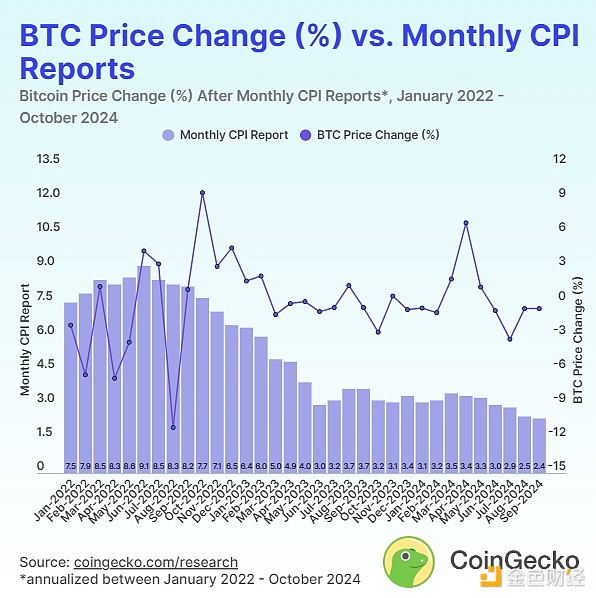

On a daily basis, from the Bitcoin (BTC) opening price on the day of the CPI report to the BTC opening price the next day, the Bitcoin price will fall or rise regardless of the direction of the inflation rate change. For example, when the CPI report showed that inflation fell from 8.5% to 8.3% (annualized) between March and April 2022, the Bitcoin price fell -11%.

Conversely, after the CPI report showed that inflation fell from 8.2% to 7.7% (annualized) between September and October 2022, the Bitcoin price rose 9.68%.

In May 2024, when the BTC price rose 7.02% the day after the CPI announcement, the report showed a slight decline from 3.5% to 3.4% (annualized). Notably, when inflation spiked from 7.5% to 7.9% in the March 2022 report, the Bitcoin price actually fell 6.37%.

In other words, the assumed logic about the relationship between Bitcoin price and CPI announcements is not reflected in the data. This starts to make sense once we look at monthly BTC price changes and the broader drivers that have a greater impact.

Will Bitcoin rise or fall with inflation?

In March 2022, the Federal Reserve began a rate hike cycle to curb inflation. Given the lag in monthly CPI reports, January 2022 will be the starting point for comparisons with Bitcoin's monthly price for two reasons:

Rate hikes have a dampening effect on the economy because borrowing becomes more expensive.

The bill itself puts inflation in the spotlight as a problem that needs to be addressed. As a result, this will further boost Bitcoin's perception as an inflation hedge.

It is clear from these data that the Fed’s rate hike cycle as a way of shrinking its balance sheet has a much greater (depressing) impact on Bitcoin prices than the CPI data. In fact, as CPI data falls, Bitcoin prices tend to rise. This makes sense given these factors:

Bitcoin is also seen as a speculative asset and a hedge against currency debasement. This perception stems from Bitcoin’s limited use in the economy (less than 2%) compared to the ubiquitous US dollar.

Conversely, prior to a Fed rate hike cycle, when the currency is “cheap”, Bitcoin is more likely to receive inflows as a riskier investment.

However, as the Fed continues to raise rates to curb inflation, Bitcoin’s increasingly limited supply offsets this effect. As of October 2024, 94.13% of Bitcoin’s supply is available at an inflation rate of 0.84% after the fourth halving event in April 2024.

It can be argued that Bitcoin is not just an inflation hedge, but a hedge for central banks. This was evident when Bitcoin rallied 9.5% during the US regional banking crisis.

In summary, the impact of CPI announcements on Bitcoin prices is diluted compared to the underlying Bitcoin tokenomics. On top of that, inflation rates above BTC inflation are baked into the central bank pie. That’s why even a downward trend in CPI data cannot hide the fact that after the fifth halving in March 2028, the dollar will continue to depreciate, while Bitcoin will have lower inflation in the future.

In contrast, it is extremely unlikely that the federal government will rein in spending to the point where the Fed stops monetizing the government’s rising debt. In the near term, a Fed rate cut is more likely to open up capital inflows to Bitcoin again, regardless of a downward trend in CPI data.

Why do inflation reports affect Bitcoin prices?

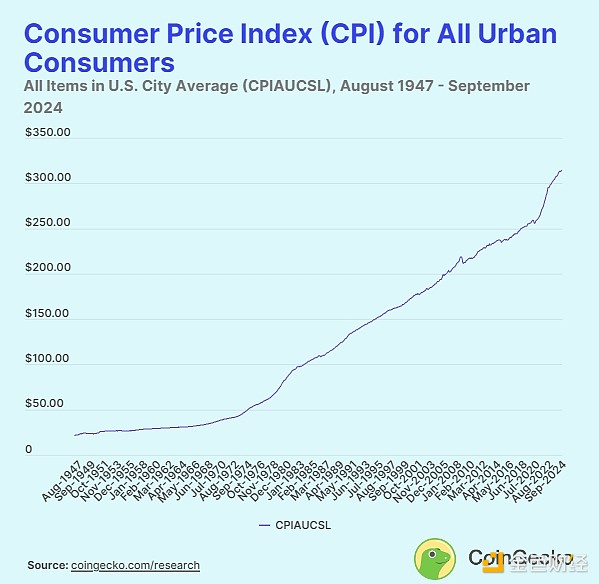

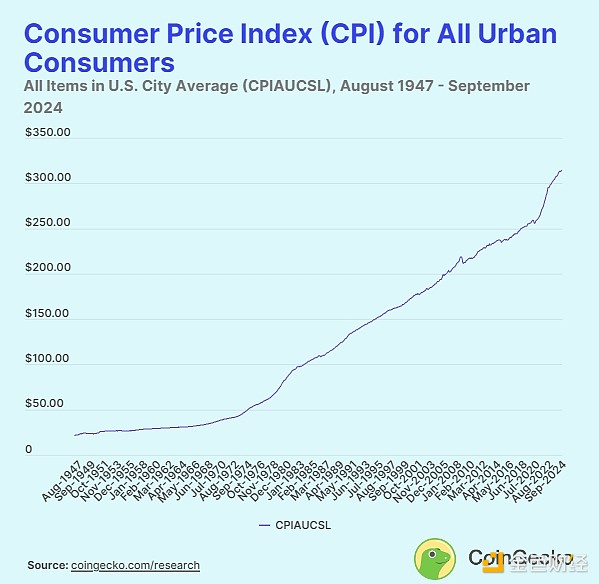

Inflation is a tricky thing to measure, and it is understood as an increase in the prices of goods and services, usually measured by government agencies. In the United States, this is the Bureau of Labor Statistics (BLS) through the Consumer Price Index (CPI).

Diving deeper, however, inflation is best understood as the effect of the central banking system. Specifically, when the Federal Reserve (“Fed”) monetizes debt to pay for government spending, the central bank increases its portfolio of securities. The result is an increase in the money supply, which manifests as inflation.

After decades of increasing monetary plateaus to monetize debt, the most extreme one occurred in 2020. The Fed’s balance sheet swelled from $4.2 trillion at the beginning of 2020 to $7.2 trillion by mid-year. As a result, inflation (CPI) emerged as a lagged effect the following year, peaking at 9.1% (annualized) in June 2022, the highest level since 1981.

In other words, the Fed is constantly devaluing the US dollar currency through constant monetary expansion. Even Fed Chairman Jerome Powell has a hard time explaining why the baseline inflation target (rate of erosion of the dollar’s value) is 2% and not some other percentage.

So this means the following:

In theory, this means that the price of Bitcoin should rise when the CPI reports rise, and fall when the CPI reports fall. However, as examined above, this is not the case.

XingChi

XingChi