Author: Shaun Paul Lee, Coingecko; Translator: Tao Zhu, Golden Finance

What is the market value and trading volume of Ordinals and Runes?

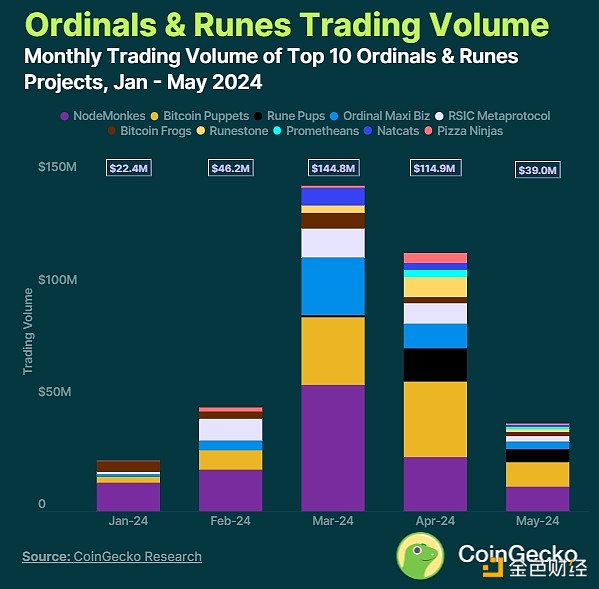

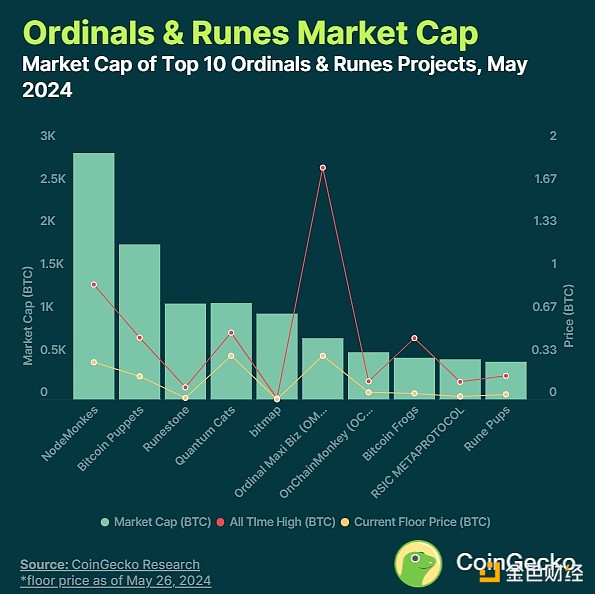

The total market value of the top 10 Bitcoin-based non-fungible tokens (NFTs), including Ordinals and Runes, has soared to $1.03 billion, with an average daily trading volume of $2.25 million in May 2024, proving their growing prominence in the Web3 world. This volume was driven primarily by the most popular projects on the chain, such as NodeMonkes ($198.25 million or 2,880 BTC in May 2024), Bitcoin Puppets ($144.12 million, 1,815 BTC), and Runestone ($87.85 million, 1,124 BTC).

These collectibles, along with many others, also performed well in terms of sales volume, further demonstrating their popularity. As of May 2024, NodeMonkes averaged $520,000 in daily trading volume, while Bitcoin Puppets averaged $510,000 in daily trading volume.

In terms of user adoption, from January to May 2024, the number of unique holders of Bitcoin Puppets increased by 15.3% month-on-month (from 38,000 to 67,000), while the number of unique holders of NodeMonkes increased by 10.1% month-on-month (from 38,000 users to 56,000). The increase in the number of unique holders indicates that interest in the most popular projects in the Ordinals ecosystem is indeed increasing. For example, Runestone distributes shards from the collection to wallets with three or more Ordinals inscriptions. The average number of unique holders in May 2024 was 77,000, the largest among the most popular projects in the ecosystem.

How popular are Bitcoin NFTs and Ordinals?

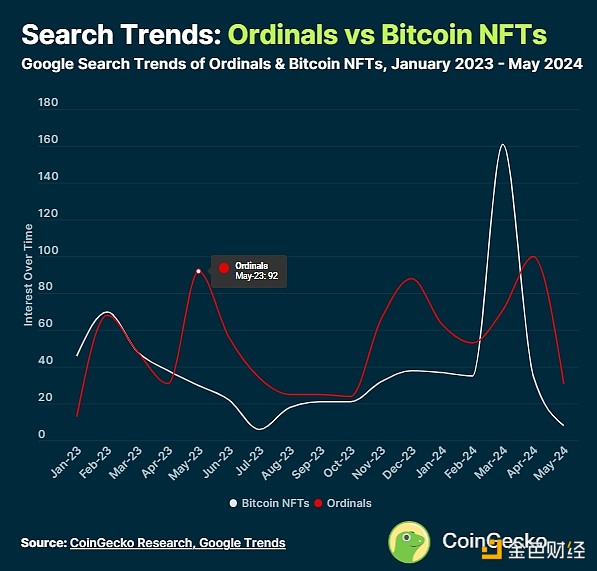

While sales of individual NFTs are still relatively low compared to the Ethereum ecosystem, global interest in Ordinals is rising rapidly. Google searches for “Ordinals” hit an all-time high in April 2024, up 58% since January 2024, while Google searches for “Bitcoin NFTs” hit an all-time high in March 2024, indicating growing interest and adoption of the Bitcoin NFT ecosystem this year.

While Bitcoin-based NFTs still lag behind Ethereum, Solana, and Ronin in terms of sales volume, statistics show that the number of NFT buyers on Bitcoin is significantly lower than other chains, which means there may be room for growth in user adoption.

Early adopters of Bitcoin-based NFTs have also reaped considerable financial benefits if they invest at the right time and price. For example, minters who participated in the NodeMonkes Dutch auction-style minting (starting at 0.21 BTC, with prices dropping by 0.005 every 6 blocks) are up 426% from the project’s all-time high of 0.895 BTC, and up 38% from the average selling price at the time of writing (0.29 BTC).

A Brief History of Ordinals, BRC-20, and Runes

Now that we’ve looked at the numbers behind Bitcoin-based NFTs, let’s dive into the history behind Ordinals and Runes. Launched in January 2023 by engineer Casey Rodarmor, Ordinals’ main difference from NFTs is that all of an Ordinal’s data, whether text, images, or smart contracts, is “burned” directly on-chain. As a result, in the words of its creators, Ordinals are more like digital artifacts than NFTs. This creates a lot of appeal for Ordinals as a PFP project and art collectible, as all data is stored on-chain, allowing NFTs to exist almost indefinitely.

As Ordinals usage continued to grow, an anonymous developer within the community named Domo eventually created a token standard called BRC-20, which was then further refined by Rodarmor to create Runes. Runes were originally created to improve efficiency and solve the problem of too many unspent transaction outputs (UTXOs). UTXOs are essentially unspent outputs from past transactions on the Bitcoin blockchain that users can use in new transactions. Due to the underlying approach of the protocol, widespread adoption of BRC-20 tokens has led to a large increase in UTXOs, causing blockchain bloat. Runes optimize this process by identifying and reusing these dormant UTXOs for new transactions, thereby increasing efficiency and relieving network congestion. This opens up amazing new possibilities for scalability and improved user experience.

The Rune Protocol has just been launched, and there are many potential projects and use cases that may emerge in the future using the Rune Protocol. With its ability to optimize transactions on the Bitcoin network and achieve new levels of efficiency, Rune offers exciting possibilities for developers to conceive new decentralized applications (DApps), tokenized assets, and other novel solutions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph