Source: Coingecko; Compiled by Baishui, Jinse Finance

In last month's Coingecko: How did Trump affect the crypto market in January?, I discussed how the cryptocurrency market rose and fell around Trump's presidential actions and meme coins. It wasn't obvious at the time, but the launch of $TRUMP and $MELANIA marked the peak of meme coins as it sucked liquidity and attention away from all other cryptocurrencies. If the launch of these two meme coins wasn't enough to end the meme coin craze, then $LIBRA was the straw that broke the camel's back, breaking the illusion that meme coins were "fairly issued" and exposing the conspiracy groups and insiders who profited from almost everyone else.

Some of my thoughts on this:

1. Meme coins are dead now, but they will come back

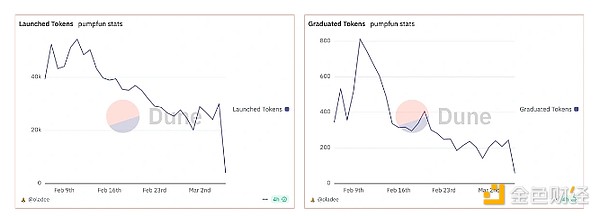

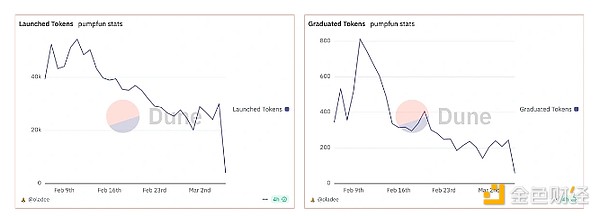

It seems that meme coins are dead now, because the indicators on pump.fun immediately plummeted after the launch of $LIBRA. Since the peak in February, the daily new tokens created on the platform have fallen by more than 90%. On CoinGecko, the market value of the Meme category has fallen by 32% since the peak on February 3, and the trading volume has dropped by a huge 72%.

It is worth noting that Meme coins are always "seasonal", but this also makes those Meme coins that survive and thrive in the cycle particularly rare. Meme coins such as $DOGE, $SHIB, and $BONK have experienced market cycles, providing lessons for Meme coin creators seeking to build long-term assets.

Looking back at Murad’s infamous “Memecoin Supercycle” speech at Token2049 in September, the most successful memes are those that have managed to build cult-like communities that are passionate about a cause, won’t sell out, and can organically create content or stories.

In an age where there is no friction in launching a memecoin, and attention is actually the product, low-quality memes won’t go anywhere. Even “higher quality” memes need to constantly attract users and keep their attention. Those that do that may have a chance to survive.

In the long run, memecoins may follow the extreme case of a power law, where 99.99% of them fail. For the most powerful 0.01%, who knows they might even get a government agency named after them.

2. Are VCs and regulators to blame?

Stepping back, last year’s meme coin craze was actually born out of retail investor disappointment with the so-called “low float, high FDV” VC coins that launched in early 2024. These deals were signed at sky-high prices, and these tokens inevitably need to be issued at higher FDVs to generate returns for early investors.

Could the answer to a successful launch be somewhere in between? One of the most hyped launches in 2024 was Jupiter’s $JUP, which subsequently drew investor ire for its “pump protection” launch mechanism. In addition to the airdrop, the team also set up a pool of funds within a specific price range to provide liquidity to initial buyers and sellers. This meant that the price of $JUP would remain within this price range for the first few days, limiting the volatility that is typically seen in the first few days of an airdrop.

While this meant that $JUP’s price didn’t immediately take off like a rocket, it subsequently reached a high of $2.00, nearly 3x the seed liquidity cap of $0.70, while also not falling below the lower cap of $0.40. For long-term projects, this price stability may be preferable to an “airdrop explosion” followed by a sharp drop.

Other solutions, such as curated angel co-investment platforms like Echo.xyz, have also gained traction, especially with the recent MegaETH round, which allowed retail investors to participate on the same terms as VC and angel investors. However, as the industry works through its own solutions, some of the blame for the proliferation of meme coins should also be placed on regulators, especially in the United States, for failing to facilitate orderly fundraising for any form of utility token.

Without a clear framework for issuing tokens without triggering securities laws, many projects ended up raising money from accredited investors, or struggling to find complex solutions, or simply created meme coins that made no promises to holders. Hopefully, with the new pro-crypto regime in the US, some common sense rules will be implemented and we can all get back to building useful projects with useful tokens.

3. We still believe that everything that can be tokenized will be tokenized

Regardless of your opinion on meme coins, the plethora of token launchpads that have sprung up after the success of pump.fun will only accelerate the tokenization of everything. In addition to meme coins, we now have AI agent launchpads (Virtuals.io), and some other interesting DAO experiments (daos.fun) or "tokenized time" (Time.fun).

That’s not even mentioning the accelerated progress we’ve seen in the RWA space, with major TradFi firms joining the fray. While US Treasuries have been the dominant product over the past few years, the industry looks ready to start looking beyond the risk curve to more exciting products.

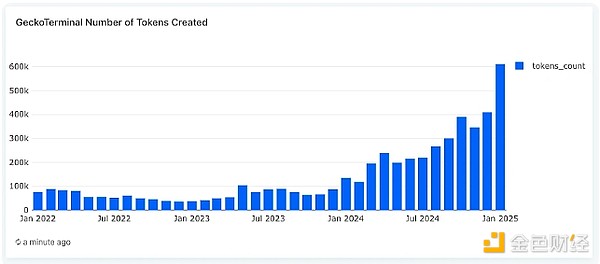

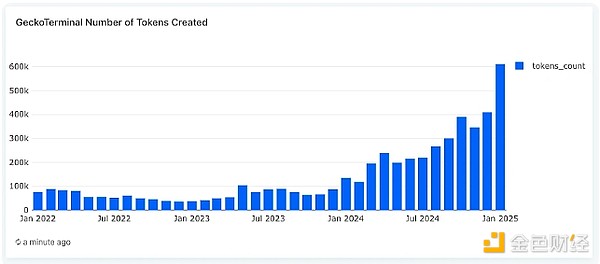

Where does this leave us? On GeckoTerminal, we now track over 5.5 million tokens, with over 600,000 new tokens created in January. At this rate, we’ll easily pass 1 billion tokens in the next five years.

Going back to my earlier point, this means there will be a ton of tokens and projects vying for our attention (and money). It will be interesting to see how these projects stand out. What we have seen with Meme Coin over the past twelve months may just be a precursor to things to come, with only the highest quality projects or tokens making it to the top.

Some Final Thoughts on the Current Market

Trump came into office promising some major reforms to the US government, and he does seem to be moving full steam ahead in implementing some of those reforms, both domestically and on the international stage. While DOGE (Department of Government Efficiency, not the meme coin) and Elon Musk are making massive cuts to the federal government, Trump’s moves in imposing trade tariffs, as well as his ongoing role in the Russia-Ukraine peace talks, have shaken the market.

The S&P 500 has plunged about 5% over the past month, and cryptocurrencies have not been immune. In the same period, Bitcoin has fallen more than 20% from over $100,000 to its current $87,000, and not even Trump’s unexpected remarks about strategic cryptocurrency reserves could stem the losses.

For those who have been around for a while, though, you’ll know that even in a bull market, it’s never a straight line up. Even in the last cycle, $BTC experienced multiple 20%+ pullbacks on the way up to its previous high of $69,000, so volatility is certain to be expected. Some CT folks, including Arthur Hayes, have suggested that the current drop could take it as low as $70,000, which wouldn’t surprise me too much.

I do believe we are still in a bull cycle, we are just experiencing a short term shock. The meme market may die in the short term, but there is strong institutional interest in $BTC. Don't forget, just a month or two ago, institutions like Standard Chartered and Bitwise were calling for $200,000 BTC. There will be more to this cycle, so stay safe and don't go broke too soon.

Weiliang

Weiliang