Author: Lim Yu Qian, Coingecko; Compiler: Deng Tong, Golden Finance

What happened to privacy coins?

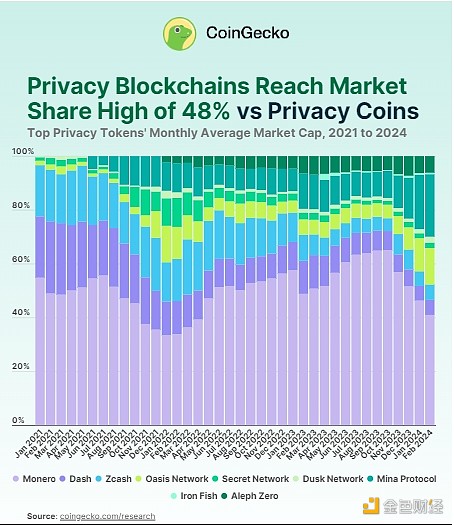

Based on the monthly average coin market capitalization of the leading crypto privacy assets, Since 2021, privacy coins have been Blockchain took away 44.3% of the market share. In January 2021, privacy coins held a dominant 96.6% share of the crypto-privacy market (market cap $4.62 billion), but as of February 2024, currently hold only 52.3% (market cap $3.08 billion). In comparison, privacy blockchain’s market share increased 14 times, from 3.4% (market cap $160 million) to 47.7% (market cap $2.81 billion).

These illustrate the continued progress in the crypto-privacy space: from pioneering privacy tokens that mimic Bitcoin and function primarily as currency, to being built with smart contract functionality and Next-generation privacy blockchain for the broader ecosystem with regulatory considerations.

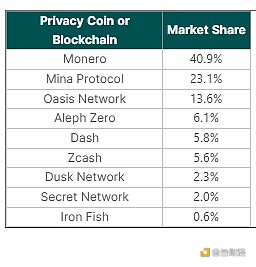

Among the top three privacy coins surveyed, Dash (DASH) has experienced the largest decline in market share, reaching 17.1%, with its market share falling from 2021 to 2021. The 22.7% in January dropped to 5.6% in February 2024. During the same period, Zcash’s market share (ZEC) shrank from 19.1% to 5.8% (-13.3%), while Monero’s (XMR) market share declined relatively slightly, from 54.8% to 40.9% (-13.9%).

At the same time, Privacy blockchain’s Oasis Network (ROSE) market share increased by 11.9%, Secret Network (SCRT) gained 0.6% and Dusk Network (DUSK) gained 1.9%. During this period, three more privacy blockchains entered the market: Mina Protocol (MINA)’s market share increased by 18.4% compared to when the token began trading, Aleph Zero (AZERO)’s Market share increased by 3.9%. Iron Fish (IRON) is the only privacy blockchain to have lost market share since its launch (-1.7%).

Privacy coins plagued by abuse

These early adopters are more oriented toward ideologies such as privacy and anonymity. However, the popularity of privacy coins has since declined due to regulatory scrutiny of illegal or illegal activities and changing demographics of cryptocurrency users.

Over the years, Privacy coins have been hit by regular delistings from centralized cryptocurrency exchanges Such as Upbit in 2019, Bittrex and Coincheck in 2021, Huobi (HTX) in 2022, and OKX and Binance’s European operations in 2023. Key headwinds include U.S. sanctions on cryptocurrency mixer Tornado Cash in August 2022, and the EU’s upcoming tougher anti-money laundering regulations (AMLR).

More recently, XMR’s market share fell by 5.3% month-on-month in February 2024 after Binance announced that it would also be delisted from its wider platform. In other words, exchange delisting usually has a long-term cumulative impact on the market share and market capitalization of privacy coins, rather than an immediate impact.

Who are the top privacy blockchains?

The top three privacy blockchains are Mina Protocol (market share 23.2%), Oasis Network (13.6 %) and Aleph Zero (6.1%), their market capitalization has exceeded Zcash and Dash. Privacy blockchain first emerged around 2021 at a time when privacy coins were facing increasing regulatory issues.

Mina Protocol is currently the largest privacy blockchain by market value, with a market value of US$1.36 billion< /span>, more than half of Monero’s market capitalization of $2.41 billion. This compares to an increase from 10.1% in October 2023 to 23.2% in February 2024.

The second largest privacy blockchain is Oasis Network, with a market capitalization of $800 million, up from January 2021 The market value of US$77.62 million increased tenfold. Oasis' market share surged from 2.9% in January 2021 to a high of 13.6% in January 2022. Although the Oasis network was unable to maintain growth over the next two years, it successfully recovered this year, increasing its market share from 6.7% in November 2023 to 13.6% in February 2024.

Aleph Zero is the third largest privacy blockchain, accounting for 6.1% of the crypto-privacy market. Driven by steady growth, it has consolidated its position in the top three since August 2022. In February 2024, AZERO’s market capitalization had risen to $360.78 million (+153.7%), compared to a market capitalization of $234.7 million when trading began in January 2022. Aleph Zero’s market share first surpassed Zcash in May 2023 before catching up with Dash last November.

The remaining privacy blockchains with the smallest market shares are Dusk Network (2.3%), Secret Network (1.9%), and Iron Fish (0.6%). Dusk Network's market share has fluctuated below 2.0% so far in 2021, and has yet to break through its share high of 2.8% during the same period. Secret's market share peaked at 11.1% in February 2022 and has hovered below 2.0% since June 2023. Iron Fish, meanwhile, launched with a market share of just 2.3% before trending downward.

Over the past three years, the total market capitalization of the top privacy blockchains has grown from $160 million in early 2021 to 2024 2.81 billion US dollars in February 2018, an increase of 1,650.6%.

Market share of top privacy coins and privacy blockchains

Market cap, market share of top privacy coins and privacy blockchains as of February 2024:

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance TheBlock

TheBlock Others

Others Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph