In 2024, the cryptocurrency market ushered in recovery and structural changes, with a total market value exceeding 3.8 trillion US dollars, a year-on-year increase of 110%. Among them, the price of BTC broke through the 100,000 US dollar mark this year, setting a record high. This is not only an important node in the development of the crypto market, but also a year of comprehensive rise in the derivatives market.

Behind these "milestone" data is the superposition of multiple positive factors in the industry. In January, the SEC approved the listing of 11 Bitcoin spot ETFs, including products from asset management giants such as BlackRock and Fidelity Investments. In July of the same year, the approval of the Ethereum spot ETF further enriched investors' choices and injected more liquidity into the market. At the same time, Tesla CEO Elon Musk's public support at the "Bitcoin 2024 Conference" has injected more confidence into the market. He called Bitcoin "gold in the digital age" and reiterated his long-term belief in DeFi. This statement further consolidated the position of crypto assets as a mainstream investment category.

Driven by macro benefits, the derivatives market has become another important growth engine for the crypto industry in 2024. According to Coinglass statistics, the global crypto derivatives market transaction volume rose sharply in 2024, and the amount of open contracts hit a record high, showing investors' high interest in leveraged products and market price fluctuations. Major exchanges have demonstrated their unique competitiveness in the derivatives and spot markets, among which:

Binance leads the market with an average daily mainstream contract transaction volume of US$40 billion, consolidating its industry leadership with its strong liquidity and broad user base.

OKX ranks second with an average daily mainstream contract transaction volume of US$19 billion, and has laid a solid foundation for the sustainable development of the platform through its leading asset reserve proof mechanism.

Bybit ranks second in the global exchange spot market with an average daily mainstream spot trading volume of US$2.3 billion, and will have an inflow of more than US$8 billion in 2024.

Crypto.com has found breakthroughs in specific areas and won market share through innovative functions and user experience.

Deribit dominates the options track, accounting for 82.2% of the Bitcoin options market share, establishing its leadership in the field of professional derivatives.

Hyperliqud , as the leader of on-chain exchanges, promotes the industry to develop in a transparent and efficient direction with decentralized perpetual contracts and margin trading.

These platforms not only drive the growth of trading volume, but also provide valuable observation samples for the global crypto market. As the industry's leading contract data analysis platform, Coinglass will analyze how major exchanges gain advantages in the global landscape from data such as derivatives markets, spot trading volume, asset transparency, and transaction fees, and explore the core driving forces of the crypto market in 2024, providing forward-looking insights and thinking for investors and the industry.

1. Derivatives Market

In 2024, the cryptocurrency derivatives market experienced historic growth and became an important part of the cryptocurrency market. The global crypto derivatives market set a new record, with an average daily trading volume of more than 100 billion US dollars and a monthly trading volume of more than 3 trillion US dollars, far exceeding the trading volume of the spot market. This significant growth reflects the increased demand for leveraged products among investors, especially during periods of high market volatility. As the market matures and the regulatory framework improves, more and more institutional investors - such as hedge funds and asset management companies - are pouring into the derivatives market, driving further development of the market. In addition, the participation of retail investors is also growing rapidly. Easy-to-use trading platforms have lowered the entry barrier, while the high leverage characteristics of derivatives have attracted a large number of retail users seeking short-term returns.

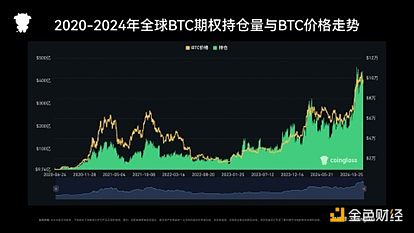

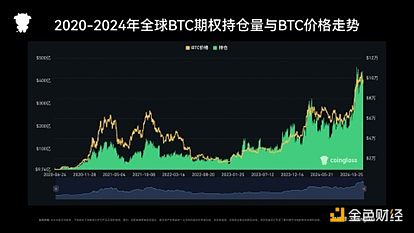

By the end of 2024, the total amount of open BTC contracts in the global crypto derivatives market exceeded 60 billion US dollars, showing the market's continued demand for risk management tools and leveraged products.The impact of derivatives trading on the market cannot be ignored. First, it significantly improves market liquidity. Traders can leverage a larger market size with less funds, reducing the impact of large transactions on spot prices, making the market more efficient. Second, the derivatives market plays an important role in price discovery, especially in periods of market volatility, when the prices of futures and perpetual contracts often guide the price trend of the spot market. In addition, derivatives also provide hedging tools for institutional investors, reduce the volatility of asset portfolios, and attract more long-term capital inflows. Ultimately, trading in the derivatives market promotes the efficiency of market pricing, reduces the volatility of cryptocurrency assets, enhances the overall stability of the market, and lays the foundation for the maturity and healthy development of the cryptocurrency market.

In 2024, the trading volume of the cryptocurrency derivatives market accounted for a significant share of the total trading volume, and the market distribution among major exchanges also showed obvious differences. According to the contract trading volume data of Coinglass,Binance continued to lead the market, with the total trading volume of the top ten contract currencies reaching146,855USD by 2024, far exceeding other competitors, demonstrating its unrivaled advantage in the field of crypto derivatives trading.OKX ranked second in the world with a trading volume of70,648USD, also demonstrating its core position in the global derivatives market. OKX’s users are mainly concentrated in the top five currencies, including BTC, ETH, SOL, DOGE, and PEPE, further consolidating its market dominance in these high-demand currencies. Although Bitget and Bybit ranked third and fourth, respectively, and performed very well, there is still a significant gap between their trading volumes and Binance and OKX, indicating that the competition landscape in the global market is still relatively concentrated. The competition situation between different exchanges is obviously differentiated. Platforms such as OKX and Binance have consolidated their leading position in the global market by optimizing trading products and improving user experience, while Bitget and Bybit have demonstrated unique competitiveness in specific fields or currencies. In 2024, the price of BTC exceeded the $100,000 mark, driving significant growth in the BTC options market. As the price of Bitcoin climbed, the activity of options trading increased significantly, with the total amount of open contracts reaching $41.127 billion, further consolidating its core position in the global market.

As of December 19, 2024, the total open interest in the BTC options market was $41.127 billion, and that of ETH was $10.072 billion. The BTC market is four times larger than that of ETH, reflecting BTC's position as a core asset for crypto market liquidity.

In the competitive landscape of the BTC options market, Deribit continues to dominate, holding 82.2% of the global market share. Meanwhile, OKX has performed well with its flexible product strategy and strong liquidity, ranking third with $2.927 billion in open interest, accounting for 7.1% of the global market share. This performance highlights OKX's rapid rise in the options market and its potential for continued growth.

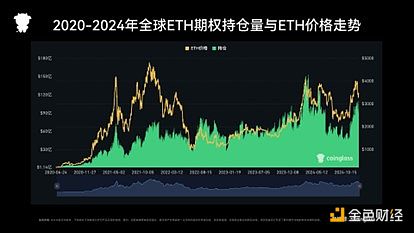

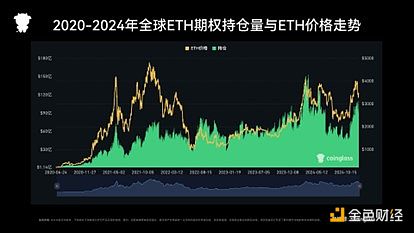

In 2024, the Ethereum (ETH) options market continued to grow, with the total open interest reaching $10.072 billion. With the further development of the smart contract ecosystem and the promotion of staking activities, the ETH options market has shown a steady growth trend.

The ETH price broke through the high of $4,000 in 2024, driving the expansion of market demand. In the market landscape, Deribit continues to dominate, while other platforms have gradually expanded their share with their respective market strategies. Data shows that among the top-ranked platforms, some exchanges have a market share of more than 10%, showing the active layout of competitors in this field.

2. Spot Trading Volume

In 2024, the cryptocurrency spot trading market showed a trend of centralization, and the market share gap between major exchanges further widened. In 2024, Binance ranked first with a mainstream spot trading volume of over 2.15 trillion US dollars, occupying an absolute dominant position in the market. Following closely behind were Bybit and Crypto.com, with mainstream spot trading volumes of 858 billion US dollars and 810 billion US dollars respectively, forming the second echelon, indicating that they have certain competitive advantages in the mid-sized market. Coinbase and OKX ranked in the top five with trading volumes of $635 billion and $606 billion, respectively, consolidating their solid position in the market. In contrast, Kraken's trading volume was $133 billion, Bitstamp's was $67 billion, and Bitfinex's was $58 billion. These exchanges have relatively small market scales and their user groups are more concentrated in specific regions or professional investors. Gemini's trading volume was only $18 billion, ranking low among major exchanges, reflecting its market positioning of focusing more on serving institutional clients and long-term investors.

3. Transparency of asset holdings

Transparency is gradually becoming the key for centralized exchanges to win user trust. The collapse of FTX in 2022 exposed the industry's deep-seated problems in asset transparency and risk management, which directly led to a crisis of market trust. It is difficult for users to verify the true financial status of the exchange, and internal governance defects have exacerbated the risk of asset loss. The industry's credibility has been severely damaged, and market uncertainty has increased significantly, posing a severe challenge to the long-term development of the cryptocurrency industry.

After the FTX incident, the market's demand for transparency increased rapidly, and CEX began to rebuild trust through asset disclosure and technology upgrades. Top exchanges including OKX have taken the lead in launching proof of asset reserves (POR) and adopted advanced encryption technologies such as zk-STARK, allowing users to independently verify asset status and balance transparency and privacy protection. This trend not only reshapes the industry's trust foundation, but also establishes new development standards for CEX, laying an important foundation for the future of the crypto market.

In addition, the transparency of exchanges is inseparable from a clear and quantifiable indicator system. According to DefiLlama data, "assets" and "clean assets" have become the key to assessing the health of exchanges:

The first is Assets, which includes all assets held by the exchange, but does not include IOU assets that have been counted on other chains. For example, the anchored BTC on the Binance Smart Chain (BSC) has been recorded in the Bitcoin chain, so it will not be counted repeatedly.

The second is Clean Assets: reflects the total locked value (TVL) of the exchange, excluding the exchange's own assets (such as platform coins), and more truly measures the asset quality and liquidity of the exchange.

Through these two indicators, users can more clearly evaluate the robustness and transparency of the platform.

Binance ranks first in the industry with total assets of US$165.29 billion. Faced with increasingly severe regulatory pressure, Binance's transparency and asset quality issues have attracted widespread attention from the market.

In 2024, OKX's capital inflow and transparency performance became important data points in the crypto industry. According to DefiLlama data, OKX ranks first in the industry with a net inflow of $4.602 billion, and total assets of $28.86 billion, of which $28.72 billion are clean assets, with a clean asset ratio of up to 99.5%. Net inflow data shows that OKX is at the leading level among similar exchanges, showing a significant increase in user trading activity and capital flow. The clean asset ratio indicates that the vast majority of assets held by the platform are uncollateralized or loaned assets, reflecting a high level of capital security and liquidity. Bybit's net inflow of $8 billion is growing rapidly. Crypto.com and Bitfinex faced net outflows of $220 million and $2.3 billion, respectively, reflecting a further decline in their market share.

IV. Transaction Fee Indicators

(I) Spot Transaction Fee

With the increasing competition in the spot trading market, major exchanges have attracted users by optimizing fees, adjusting user thresholds, and implementing differentiated strategies, and the market has shown a clear trend of stratification. At the level of ordinary users, the fee strategies of major exchanges remain consistent, all adopting a 0.1% Maker and Taker fee rate.

At the VIP user level, the competition is even more intense. OKX provides a very competitive fee structure for the highest level of VIP users: the maker fee is negative -0.01%, and the taker fee is 0.02%. This is better than the 0.011% maker and 0.023% taker rates offered by Binance for top users. Bybit's fee structure in this area is relatively conservative, with a taker fee of 0.015% and a maker fee of 0.005%. Although the overall fee rate is higher than the other two exchanges, it is still competitive in the market. In terms of the trading volume threshold required to achieve these preferential rates, OKX has the highest requirement, requiring a trading volume of more than US$5 billion within 30 days. Binance's requirement is more than US$4 billion, while Bybit has the lowest threshold of only US$1 billion. This differentiated setting of thresholds reflects the different strategies and market positioning of various exchanges in the battle for high-end users.

(II) Contract Transaction Fees

With the rapid development of the derivatives market, contract trading has become the core battlefield for competition among major exchanges. Each platform competes among different user levels through refined fee structures and differentiated threshold strategies.

At the level of ordinary users, the market-leading exchanges show significant consistency in the basic fee level. Binance and OKX adopt a unified fee structure (maker fee of 0.0200%, taker fee of 0.0500%), reflecting the price consensus of mature markets. Bybit slightly adjusted the taker fee to 0.0550% while maintaining the same maker fee (0.0200%), reflecting its strategy in terms of revenue structure.

At the VIP user level, the competition is more intense and differentiated. OKX stands out with the most aggressive fee strategy, offering negative maker fees (-0.0050%) and highly competitive taker fees (0.0150%) to top VIP users. Binance adopts a relatively conservative strategy, offering VIP users a combination of maker 0.0000% and taker 0.0170%, reflecting its solid position as a market leader. Bybit's fee strategy (maker 0.0000%, taker 0.0180%) is close to that of Binance.

In terms of entry barriers, the three exchanges show a clear gradient. Binance maintains the highest standard, requiring a 30-day trading volume of $25 billion, highlighting its market leadership; OKX follows closely behind, setting a threshold of $20 billion, echoing its aggressive fee strategy; Bybit adopts a relatively friendly threshold of $5 billion, showing its strategic intention to expand its market share. This differentiated setting of thresholds not only reflects the market position of each platform, but also reflects their different concepts in user screening and risk control. These fee designs reflect the strategies adopted by each platform in attracting different user groups. As market competition intensifies, the difference in fees between platforms will become an important factor affecting user choices.

(III) Contract Funding Rate

As the core mechanism of perpetual contracts, the funding rate maintains the balance between the contract price and the spot price by regularly exchanging fees between long and short parties. A positive funding rate means that longs pay shorts and vice versa. This indicator not only reflects market sentiment, but is also an important reference for measuring market leverage preferences. (Note: The analysis in this article is based on 8-hour rate data, and the annualized calculation method is: 8-hour rate × 3 × 365. For example, an 8-hour rate of 0.01% is approximately equal to an annualized rate of 10.95%.)

The overall crypto market remains optimistic in 2024, as can be seen from the funding rate data. Coinsafe maintained a positive funding rate for 322 days in 2024, followed by Bybit with 320 days, and OKX with 291 days (based on the BTC-USDT Coinglass contract data at 0:00 daily). This continuous positive funding rate indicates that the market bullish sentiment dominated for most of 2024.

In 2024, the funding rates of major exchanges continued to fluctuate with changes in market conditions.

First Quarter: ETF-Driven Carnival

At the beginning of 2024, market sentiment was high. In early January, the 8-hour funding rate of the three major exchanges once reached about 0.07%, about 76.65% annualized, reflecting extremely optimistic market expectations. This is highly consistent with the major event of the approval of the Bitcoin spot ETF. Among them, OKX hit a single-day high of about 0.078% in early March, about 85.41% annualized.

Second quarter to third quarter: rational return period

From April to August, the market entered a cooling-off period. The funding rate fluctuated at a low level, mostly maintained below 0.01% (below 10.95% annualized), and even negative values appeared in some periods. This shows that market speculation has cooled down and tended to be rational.

Fourth quarter: policy expectation promotion period

November ushered in another peak, and the funding rates of the three major exchanges generally rose to the range of 0.04%-0.07% (43.8%-76.65% annualized), and the market once again showed strong bullish sentiment. This may be related to the policy expectations at the end of the year and the entry of institutional funds.

The head exchanges have further opened up their advantages in market competition through differentiated fee strategies. It not only effectively improves the efficiency of user funds, but also provides more targeted service options. This trend not only reflects the immediate changes in the supply and demand relationship in the market, but also reflects to a certain extent the trading platform's continuous exploration and refined operation capabilities in liquidity management, risk control and user experience optimization.

Binance: As the world's largest cryptocurrency exchange, Binance's funding rate trend has shown significant stability. The fluctuation range of the fee rate is relatively narrow throughout the year, with the lowest frequency of extreme values, and the annualized fee rate is usually maintained in a rational range of 5%-15%. This feature confirms its status as a "market vane".

OKX:In contrast, OKX shows stronger market sensitivity. Its funding rate fluctuates the most, with an annualized range ranging from -20% to 85%. This feature makes it an important reference for predicting changes in market sentiment, especially for high-frequency traders who seize short-term market opportunities, or can be regarded as a "keen market barometer".

Bybit:Bybit's funding rate changes are usually between Binance and OKX, with an annualized fluctuation range of -10% to 60%. This "balanced market positioning" feature allows it to maintain its market competitiveness while also providing users with a relatively stable trading environment.

V.CoinglassExchange Rating

As an authoritative data analysis platform for the cryptocurrency market, Coinglass has established a comprehensive exchange rating system, which comprehensively evaluates major global cryptocurrency exchanges from multiple dimensions such as transaction scale, platform reputation, security and transparency. This rating system not only provides investors with an objective reference for platform selection, but also promotes the entire industry to develop in a more standardized and transparent direction.

Specifically, the rating system is mainly based on the following aspects:

Transaction scale performance

In terms of spot and contract trading volume, the market shows a clear stratification effect. According to Coinglass data statistics, Binance leads the market with an average daily trading volume of 40 billion US dollars for mainstream contracts, and the average daily trading volume of mainstream spot is an astonishing 6 billion US dollars. OKX, which follows closely behind, also performed well, with an average daily mainstream contract trading volume of 19 billion US dollars, showing strong market vitality. These data fully reflect the dominant position of the top exchanges in the market. This scale advantage not only reflects the trading depth of the platform, but also reflects the trust of users in the platform.

Platform Reputation Evaluation

In 2024, after experiencing multiple tests in the previous market, the industry reputation and social influence of the top exchanges have been further consolidated. The total coverage of users on social media of major platforms has exceeded 10 million, and the community activity and platform trading volume show a significant positive correlation. Head exchanges such as Binance and OKX have established a professional and reliable brand image among user groups through continuous product innovation and service upgrades. The daily interaction and information transparency of the platform on mainstream social media such as X have also become an important way to enhance user trust.

Security and Transparency Performance

In the post-FTX era, security and transparency have become the primary considerations for users to choose trading platforms. Head exchanges generally adopt advanced security measures such as multi-signature and cold wallet storage, and no major security incidents occurred throughout the year, showing the effectiveness of the risk control system. It is particularly noteworthy that OKX has set a new standard for industry transparency through the regularly released Proof of Reserve (PoR) system. Its 99.5% clean asset ratio not only demonstrates a high-quality asset structure, but also highlights the platform's professional ability in risk management.

Under Coinglass's scoring system, Binance and OKX stand out in the market with their respective advantages. Binance continues to maintain its global leading position with its strong market size and complete ecosystem. The platform has the largest user base, with an average daily mainstream contract trading volume of US$40 billion and a mainstream spot trading volume of US$6 billion, which fully demonstrates its market dominance. At the same time, its user fee structure is also very competitive in the market.

OKX followed closely behind and ranked second in the world with a comprehensive score of 78 points. This achievement is due to the balanced development of the platform in multiple fields. In terms of trading ecology, OKX provides a high-quality trading environment for users at different levels through a flexible fee structure (VIP users can enjoy a maker fee of -0.0050%) and a complete derivatives tool chain. In terms of risk control and transparency, the leading asset reserve proof mechanism and efficient risk management system have laid a solid foundation for the sustainable development of the platform. At the same time, the professional trading interface design and comprehensive product matrix also ensure excellent user experience.

Coinglass's scoring system reveals the development trend of the current cryptocurrency trading market: trading scale is no longer the only criterion for measuring the strength of a platform. Asset transparency and security are increasingly becoming the core indicators of user concern, while product innovation capabilities and user experience have become the new focus of platform competition.Binance, OKX's distinctive development strategies have brought healthy competition to the market. Binance focuses on expanding the market scale and improving the ecosystem, whileOKX seeks breakthroughs in innovative products and user experience. This differentiated competitive landscape ultimately benefits the entire industry and promotes the entire industry to develop in a more standardized, transparent and professional direction.

Sixth, Summary

In 2024, the cryptocurrency market showed the characteristics of structural transformation and qualitative change. Driven by the entry of institutional funds and the gradual improvement of the regulatory framework, the market has not only achieved breakthroughs in quantitative indicators, but also has undergone profound changes in market structure, trading mechanisms and risk control.

In terms of market structure, the competition between the top exchanges has shifted from simple scale expansion to a multi-dimensional comprehensive strength contest. Binance continues to lead the market with its strong ecosystem and $2.15 trillion in mainstream spot trading volume throughout the year, while OKX has established a unique advantage among professional traders through product innovation and precise market positioning, with a net capital inflow of $4.602 billion and a clean asset ratio of 99.5%. This differentiated competitive landscape has promoted the overall improvement of the industry in terms of product depth, technological innovation and risk management. The rapid development of the derivatives market has become one of the most significant structural changes in 2024. The daily average trading volume exceeded $150 billion, reflecting the fundamental change in institutional investors' demand for crypto asset allocation. The prosperity of the options market is particularly noteworthy. The total open interest of Bitcoin options reached $41.127 billion and that of Ethereum reached $10.072 billion, indicating that market risk management tools are becoming increasingly sophisticated and institutional-level trading infrastructure is gradually maturing.

From the perspective of industry development trends, asset transparency and platform security have become core elements of market competition. The popularization of the Proof of Reserve (PoR) mechanism and the establishment of an innovative risk control system indicate that the industry is moving from wild growth to standardized operation. Mainstream exchanges have established new industry standards in compliance, transparency and risk management through technology upgrades and process optimization.

Looking ahead to 2025, the cryptocurrency market is ushering in a new round of innovation cycle. First, the continued approval of ETFs will deepen the integration of crypto assets and traditional financial markets and bring more institutional-level liquidity to the market. Secondly, the technological breakthroughs of DEX may reshape the market microstructure and promote the evolution of trading models towards a more efficient and transparent direction. In addition, the acceleration of the wave of asset tokenization will expand the boundaries of the crypto market and bring new business growth points to exchanges.

Weatherly

Weatherly