Abstract

Digital Asset Treasury (DAT), or Digital Asset Treasury Company (DATCO), has evolved from an avant-garde financial experiment into a force to be reckoned with in global capital markets.

This article aims to comprehensively analyze the concept, origins, current status, key cases, and future prospects of the DAT sector, and provide clear strategic responses for market participants.

This article will explain how DATs have evolved from their initial "coin hoarding" model, where listed companies used digital assets as core reserves, to a complex financial engineering strategy.

We will trace the "financial flywheel" model pioneered by MicroStrategy, analyze the current market landscape dominated by listed companies, with a total value exceeding US$100 billion, and delve into the unique position and opportunities of the Hong Kong market in this trend.

By analyzing local case studies such as Boyaa Interactive and examining the models of ecosystem builders like HashKey Group, this article will reveal the strategic differentiation within the DAT sector. Finally, the article will explore the broad prospects for the integration of DATs with the tokenization of real-world assets (RWAs) and provide systematic strategic advice for businesses and investors on risk management, compliance planning, and capital operations as they navigate this emerging sector. Concept Analysis: A New Paradigm of "Coin-Stock Fusion" 1.1 Core Definition of DAT A digital asset treasury (DAT) is a strategy for publicly listed companies that prioritizes the accumulation of digital assets as their core and primary business function. This definition clearly distinguishes DAT companies from those that merely hold small amounts of cryptocurrency on their balance sheets, where digital assets are not central to their strategy. For DAT companies, their corporate value, strategic direction, and market narrative revolve around the digital assets they hold. This model represents the first level of "coin-equity integration," bridging the gap between traditional equity and crypto markets through the "hoarding" of listed companies. Its core value proposition lies in providing a regulated, convenient investment channel for institutional investors (such as pension funds and family offices) who are unable to directly purchase cryptocurrencies due to compliance, custody, or investment authorization restrictions. 1.2 Strategic Drivers Companies' adoption of the DAT strategy stems from a response to macroeconomic pressures and a forward-looking approach to future technological trends. Store of value and inflation hedging: Viewing digital assets with limited supply, such as Bitcoin, as "digital gold" to hedge against the inflation risk of fiat currencies and macroeconomic uncertainty is the primary driving force. Transitioning to Web3: For many companies, especially those in the tech and gaming sectors, purchasing and holding cryptocurrencies is a crucial step and foundation for their business development and strategic transformation into the Web3 space. Diversifying Asset Allocation: Incorporating digital assets into treasuries can optimize a company's asset allocation, capture the growth potential of emerging asset classes, and signal to the market that the company is forward-thinking. 1.3 Comparison of DAT and Spot ETFs While spot ETFs provide direct exposure to crypto assets, DATs employ fundamentally different strategies, making them an active investment tool.

Origin and Evolution — From Bitcoin Pioneers to Diversified Ecosystems

2.1 Origin: MicroStrategy’s “Financial Flywheel”

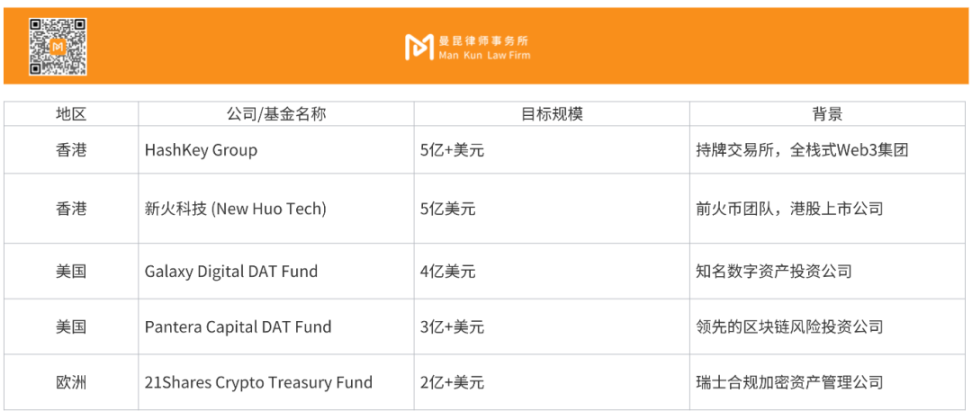

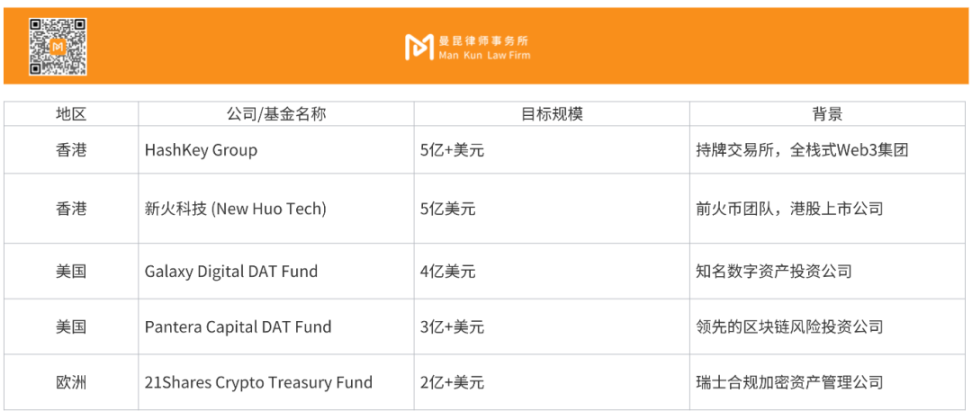

The birth of the modern DAT movement can be attributed to MicroStrategy, led by Michael Saylor. In August 2020, the company made a groundbreaking decision: to purchase $250 million worth of Bitcoin as its primary reserve asset, viewing Bitcoin as a superior means of storing value to cash. At the heart of MicroStrategy's success lies a sophisticated "financial flywheel" model, a self-reinforcing positive feedback loop: 1. Holding Bitcoin: The company holds a significant amount of Bitcoin on its balance sheet, forming the foundation of its core value. 2. Generating a share price premium: By providing investors with convenient and compliant Bitcoin exposure, its share price began trading at a premium to the net value (NAV) of its Bitcoin holdings. 3. Capitalizing on the premium: The company leverages its overvalued share price to raise capital through the issuance of convertible bonds with extremely low interest rates or through market-based equity offerings. 4. Purchasing more Bitcoin: The proceeds from financing are used to purchase more Bitcoin. 5. Strengthening the Narrative and Premium: Increasing Bitcoin holdings further reinforce the market narrative of Bitcoin as a "Bitcoin proxy," thereby maintaining or even increasing the share price premium and creating conditions for the next round of financing. 2.2 Evolution: From a Single Asset to a Diversified Treasury The initial wave of DATs centered on Bitcoin, but as the market matured, the trend has expanded to encompass multiple digital assets, each serving different strategic objectives. Ethereum (ETH): As an income-generating asset, ETH attracts companies seeking cash flow. By staking, companies not only gain capital appreciation but also earn stable block rewards. Companies like SharpLink and BitMine have transitioned to pure Ethereum holding and staking. Solana (SOL): Its high performance and attractive staking yields of approximately 6-8% have attracted investment from companies such as DeFi Development. SUI and XRP: Some companies have chosen to partner with foundations of specific public chains (such as Mill City Ventures and the Sui Foundation) or prioritize the potential of specific tokens in areas like payments (such as XRP), forming more specialized treasury strategies. Market Status — Global Expansion and the Rise of Hong Kong 3.1 Global Market Overview As of mid-2025, the total value of digital assets held by DAT companies worldwide has exceeded $100 billion. Bitcoin treasuries dominate, totaling over $93 billion, while Ethereum-centered treasuries have also rapidly grown to over $4 billion. The total amount of Bitcoin held by publicly listed companies has reached nearly 1 million, representing approximately 4% of the circulating supply. While the United States remains the core of DAT activity, the rise of companies like Metaplanet in Japan and a number of companies in Hong Kong signal the rapid spread of the DAT model to major Asian capital markets. 3.2 Unique Opportunities in the Hong Kong Market Amidst the tightening global regulatory environment, Hong Kong, with its clear regulatory framework and strong government support for the Web3 industry, is becoming a hotbed for the development of DAT companies and funds. Regulatory Certainty: Hong Kong has established a clear licensing system for virtual asset trading platforms and has approved the listing of spot Bitcoin and Ethereum ETFs, providing compliance assurance for institutional participants. Policy Support: The Hong Kong government views the development of Web3 as a key strategy to enhance its status as an international financial center, creating a favorable business environment for related companies. Institutional Concentration: Numerous licensed financial institutions, family offices, and technology companies converge in Hong Kong, providing a rich source of capital and application scenarios for the development of the DAT model. Case Study Analysis 4.1 Hong Kong Web3 Pioneer: Boyaa Interactive (0434.HK) As a listed chess and card game developer with a 20-year history, Boyaa Interactive is a prime example of a Hong Kong company fully transitioning to Web3. Strategic Transformation: The company has clearly defined "establishing a pure-play and leading Web3 listed company" as its strategic goal. Purchasing and holding cryptocurrency is considered an "important foundation and initiative" for implementing this strategic transformation. Asset Allocation: Starting in 2023, Boyaa Interactive began acquiring digital assets on a large scale. By 2025, the company held approximately 3,670 Bitcoin and 15,445 Ethereum. Digital assets once accounted for as much as 75% of its total assets, demonstrating its commitment to transformation. Dual Logic: The company views Bitcoin as "digital gold" and a core strategic reserve asset, used to hedge against macroeconomic uncertainties and achieve long-term value preservation and appreciation. These assets also lay the foundation for its future development of Web3 games and the building of related ecosystems. Financing and Compliance: The company's cryptocurrency purchases were authorized by the shareholders' meeting and utilized the company's idle cash reserves, adhering to the compliance requirements of listed companies. 4.2 Ecosystem Builder: HashKey Group's DAT Fund Model HashKey, Asia's leading digital asset financial services group, has demonstrated a more advanced DAT strategy—evolving from direct "coin hoarding" to ecosystem building. Fund Model: In September 2025, HashKey announced the launch of Asia's largest multi-currency DAT ecosystem fund, with an initial fundraising of over US$500 million. The fund focuses on investing in outstanding global DAT projects, initially focusing on the Bitcoin and Ethereum ecosystems. Beyond Investment: Unlike simple financial investment, HashKey's strategy is to deeply participate in the operations of DAT companies and the development of the industry ecosystem. It aims to create a positive flywheel loop of "capital investment - ecosystem application - market capitalization capture - liquidity exit." "Coin Utilization" Vision: Leveraging its diverse businesses, including a licensed exchange, public blockchain, and cloud services, the market expects HashKey's DAT Fund to not only "hold" coins but also deeply integrate with its own business, exploring innovative financial approaches to "coin utilization," such as incorporating platform coins into the fund and contributing to the public blockchain ecosystem. Compliance Bridge: HashKey positions itself as an "institutionalized bridge" connecting traditional financial capital and on-chain assets. Its DAT strategy is premised on compliance and fully leverages Hong Kong's regulatory advantages. 4.3 Global DAT Fund Wave 2025 witnessed the emergence of a significant number of DAT funds, signaling the evolution of DAT from a single corporate activity to an asset strategy recognized by mainstream investment institutions.

Future Prospects — Towards Productive Treasury and RWA Tokenization

The future evolution of the DAT track will go beyond passive asset accumulation and move towards more productive and broader asset classes.

5.1 From Passive Holding to Active Value-Added

Future DAT companies will participate more extensively in on-chain economic activities, transforming the treasury from a static value container into a dynamic engine that can generate continuous cash flow. This includes:

Staking: Staking your PoS tokens (such as ETH and SOL) to earn network rewards.

Liquidity Provision: Providing liquidity in decentralized finance (DeFi) protocols to earn transaction fees.

On-chain Governance: Using governance tokens held to participate in protocol decision-making and influence ecosystem development.

$5.2 Trillion Opportunity: Tokenization of Real-World Assets (RWAs)

The tokenization of real-world assets (RWAs)—converting ownership of traditional assets such as real estate, private credit, bonds, and art into digital tokens on the blockchain—is considered the next big thing. It's predicted that by 2030-2033, the market could reach $16 trillion to $19 trillion. DATs, with their extensive experience in regulatory compliance, secure digital asset custody, and capital market operations, are ideally positioned to become a key player in this emerging market. Future DATs may no longer solely hold cryptocurrencies, but rather a diversified portfolio comprised of tokenized government bonds, real estate funds, and private equity, truly becoming a critical bridge between the traditional economy and the future tokenized economy. Strategies We Need to Address Facing the opportunities and challenges of the DAT sector, both companies planning transformation and institutions seeking investment must adopt a prudent and clear strategy. 6.1 Strategic Recommendations for Enterprises: Clarify Strategic Intent and Governance Framework: Define Objectives: The board must clearly articulate the strategic intent for holding digital assets—is it as a short-term hedge, a long-term store of value, or a comprehensive Web3 business transformation? Establish Policies: Institutionalize the strategic intent by developing formal treasury policies covering asset types, exposure limits, purchase, custody, and disposal procedures, and obtain shareholder authorization. Build a Strong Risk Management System: Security and Custody: Digital asset security is paramount. Establishing an institutional-grade security system, including multi-signature wallets, cold storage solutions, and partnering with reputable, licensed custodians, is essential to protect against hacker attacks and insider risks. Market Risk: High volatility in digital asset prices is the biggest risk facing the DAT model. Companies must prepare for a potential bear market and avoid excessive leverage to prevent a liquidity crisis caused by a reversal of the "financial flywheel." Compliance Risk: Closely monitor global regulatory developments, particularly in the United States, where exchanges like Nasdaq have begun to strengthen their scrutiny of crypto investments by listed companies. Operating in jurisdictions with clear regulatory frameworks, such as Hong Kong, offers significant compliance advantages. Selecting the Right Capital Operation Model: Flexible Financing: Comprehensively evaluate various financing instruments, including equity issuance, convertible bonds, and PIPEs, to identify the financing combination that best suits the company's goals and market conditions. Leveraging the Hong Kong Capital Market: Hong Kong-listed companies can learn from Boyaa Interactive's experience, leveraging existing capital reserves for launch and raising funds for subsequent Web3 development through placements and other methods. Actively explore ecosystem integration: Go beyond "hoarding" coins: Drawing on the HashKey model, consider how to integrate digital asset treasuries with the company's core business, create synergies, build a closed ecosystem, and achieve the transition from "hoarding" to "using" coins. 6.2 Strategic Recommendations for Investors Conduct in-depth due diligence: Investment decisions should not be based solely on the stock price premium relative to NAV. A thorough analysis of the management team's expertise, the company's capital structure, risk management capabilities, and the sustainability of its business model in a bear market is essential. Differentiate strategic archetypes: Deeply understand the risk-return differences between different DAT companies. "Accumulators" essentially make leveraged bets on asset prices, while "Yield Generators" and "Ecosystem Builders" focus more on on-chain cash flow and long-term ecosystem value. Pay attention to regulatory developments: Changes in regulatory policy can completely alter investment rationales overnight. Closely monitoring regulatory developments in the jurisdictions where a company operates is crucial. Focus on long-term value: View DAT companies as strategic tools for participating in the future digital economy and the RWA tokenization wave, rather than simply as targets for short-term trading. Conclusion: The digital asset treasury (DAT) sector is moving from fringe innovation to mainstream visibility. It is not only reshaping traditional concepts of corporate treasury management but also opening up new paths for the integration of traditional capital markets with the Web3 world. From MicroStrategy's big bet on Bitcoin to today's global market encompassing multiple assets and strategies, the evolution of the DAT model reflects the growing maturity of digital assets as an emerging asset class. In Hong Kong in particular, DATs are experiencing unprecedented development opportunities thanks to a clear regulatory framework and forward-looking industrial policies. Transforming companies like Boyaa Interactive and ecosystem builders like HashKey demonstrate Hong Kong's enormous potential in this field. Looking ahead, the meaning of DAT will continue to expand, evolving from passive value storage to active value creation, and ultimately potentially becoming the core vehicle for managing trillions of tokenized real-world assets (RWA). For all market participants, now is a critical time to understand and position themselves in this arena. By developing clear strategies, building robust risk management systems, and actively embracing compliance innovation, companies and investors will be well-positioned to capitalize on this corporate finance revolution driven by digital assets.

Brian

Brian