Source: LXDAO

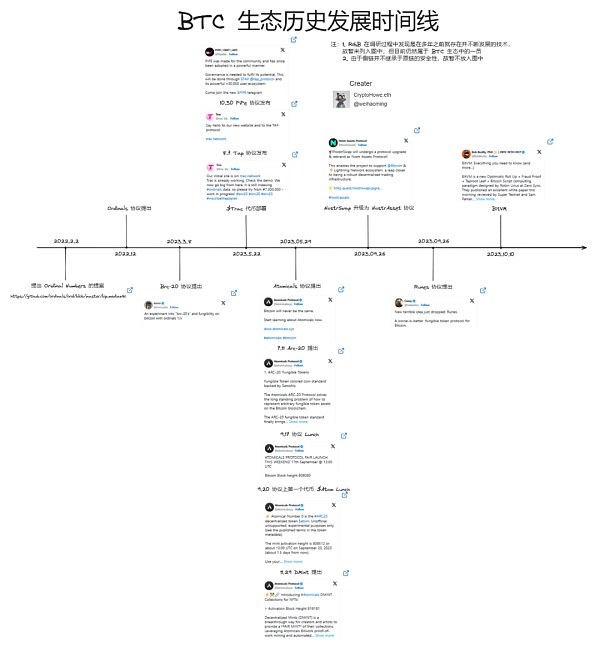

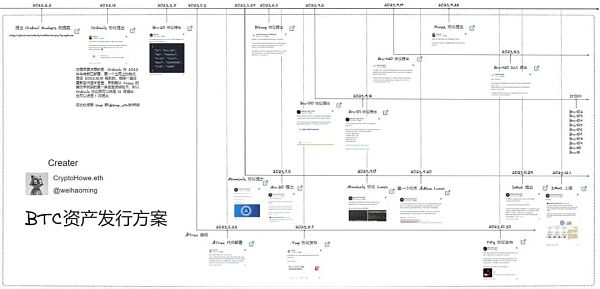

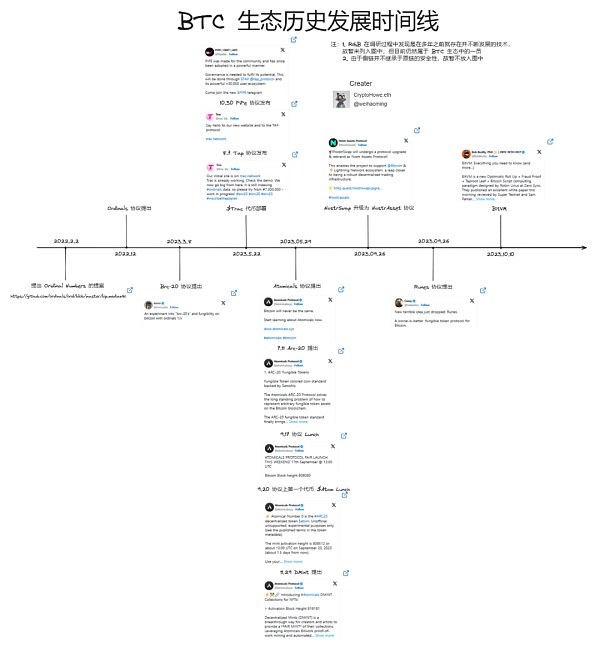

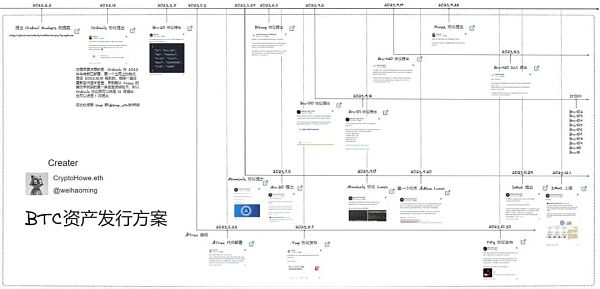

This article is written by LXDAO Member Howe . It uses a timeline to let everyone understand the BTC asset issuance plan. For the ins and outs, before reading, you can take a look at the BTC historical development line and the BTC asset issuance plan development timeline chart for better reading effect.

Foreword

BTC historical development line

BTC Asset Issuance Plan Development Timeline

At the same time, this article refers to many articles. During reference and research, the author found that some articles may be relevant to some protocols/projects. There are errors in the time, so the author of all timelines in this article has attached relevant materials. If there are any errors, please point them out to the author, thank you.

Chapter Ⅰ — The gears of fate begin to turn

『1』Ordinal Numbers

Many existing articles start from the Ordinals protocol, but in the official documents of Ordinals, the first thing mentioned is the Ordinal Numbers theory, starting from This can also be inferred that Casey should also get some inspiration from it and create the Ordinals protocol.

As we all know, the smallest unit in the Bitcoin world is Satoshi (sat), and the Ordinal Numbers theory can be simply understood as artificially numbering these sats. What we can summarize from the motivation part of the BIP proposal is that the theory wants to provide Bitcoin with a way to act as a stable identifier that prevents ownership transfers or key rotations without requiring any changes to the Bitcoin network.

Of course, there are some objections to this theory, such as reducing user privacy, increasing the size of UTXO sets, dust attacks, etc. For details, please see the BIP proposal.

『2』Ordinals Agreement

Agreement proposed

The Ordinals protocol was proposed and published by Casey, in which he proposed the following idea:

"Can we arrange these "sats" in a certain order and assign them a Satoshi between 0 and 2,100,000,000,000,000 Ordinal numbers, then, connect them to other information: pictures, text, videos or even a string of code. Each Satoshi thus becomes unique and irreplaceable. This is equivalent to giving Bitcoin the native ability to create NFTs. ”

The Ordinals protocol was deployed at the end of 2022, and the first mainnet inscription was inscribed on 2022.12.14 UTC (https://ordinalswallet.com/inscription/6fb976ab49dcec017f1e201e84395983204ae1a7c2abf7ced0a85d692e442799i0) , during this period The agreement has been updated and iterated but has not been officially announced. The first official announcement tweet that can be found from Casey’s Twitter is as follows, so the Ordinals agreement can be considered to have been proposed in December or January. . (I would also like to thank Brother Shep for the clues provided here)

Protocol Features

1. The number and rarity of sat Division

Human beings are born collectors. Since Ordinal Numbers artificially numbers sats, why not classify these sats into high and low ones, so there is rarity The distinction between degrees. There are currently 6 types of rarity:

This rarity is similar to what we call "leopard banknotes", "serial banknotes", etc. when playing with banknotes in real life. They are essentially banknotes, and their actual value is the The face value of banknotes has a higher collection value because people have given it a special meaning, and there is also a premium, which is what we often call "consensus generates value."

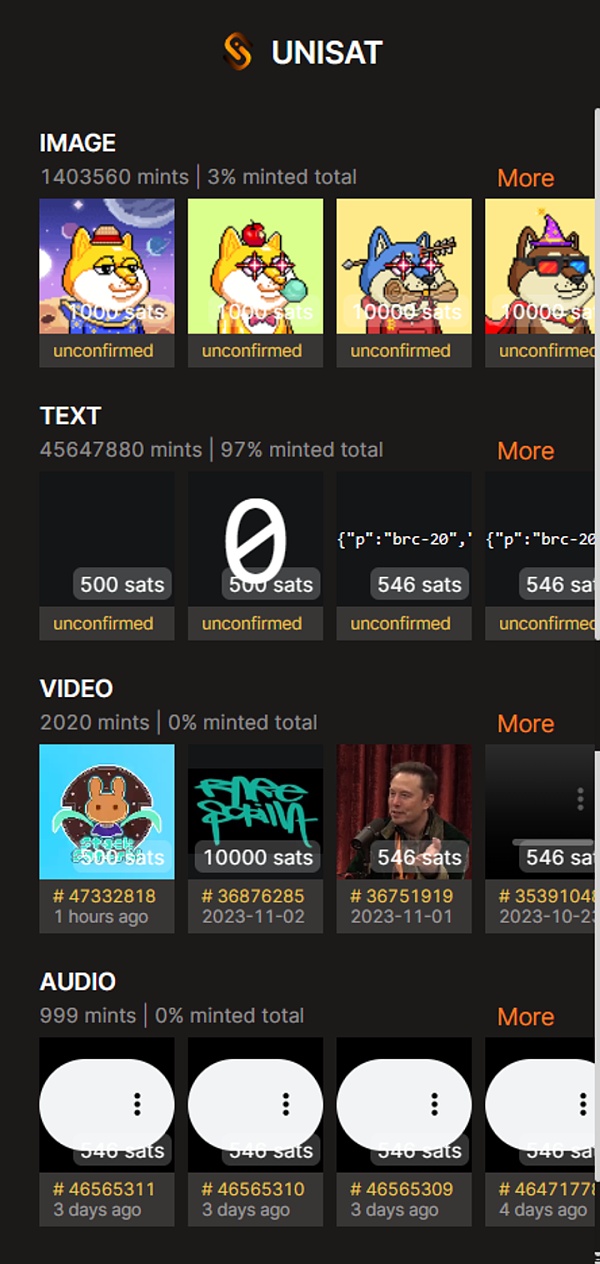

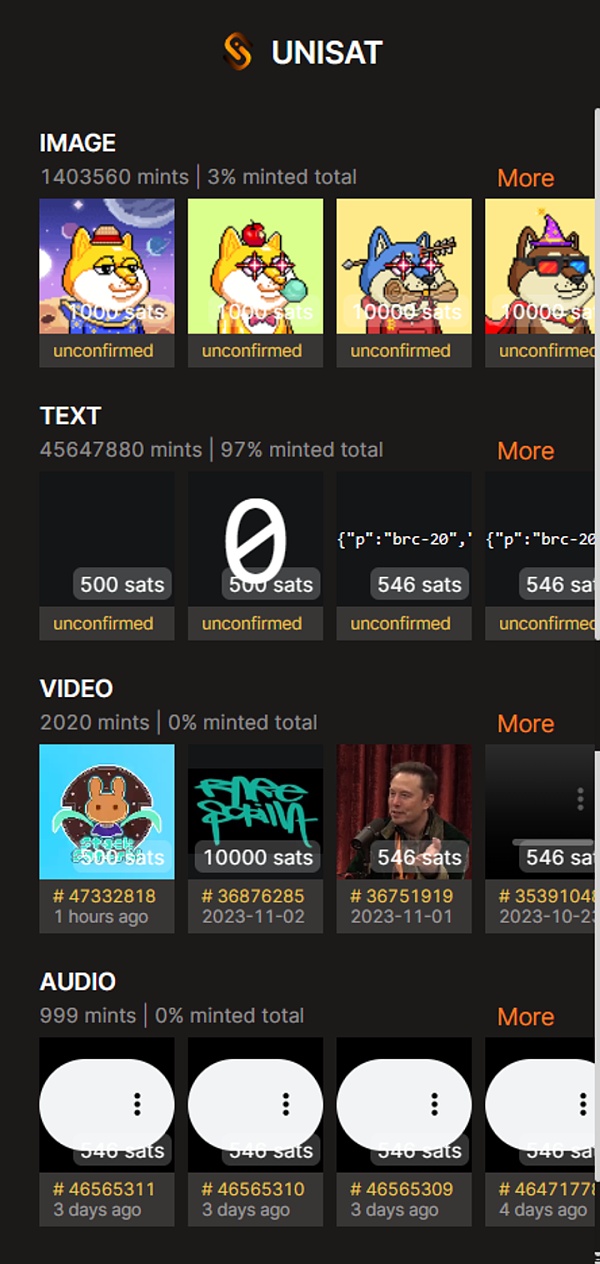

The Ordinals protocol is in While assigning a specific rule number to each sat and tracking it in the transaction, it also allows anyone to attach additional data such as image, text, video, audio, etc. through the Ordinals protocol. Etc. At that time, early players were mostly creating NFTs on it. Founder Casey's initial positioning for it was also to let people store some eternal things on Bitcoin, the oldest chain with the strongest consensus. Therefore, for a period of time, many people will equate Ordinals with "Bitcoin NFT". We can still see them in Unisat Wallet today.

2. Transaction First in, first out

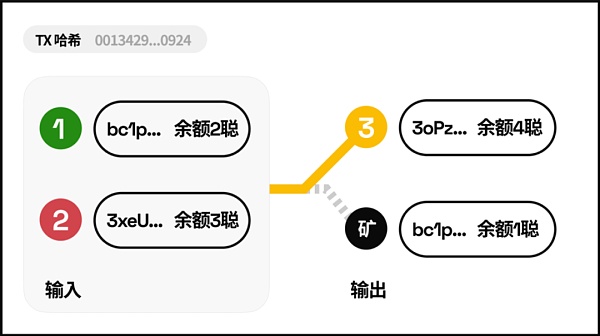

In order to ensure that the sats with serial numbers will not be out of order during the transaction, the first in first out method of transaction is adopted. Here is an example from Teacher Wang Yishi’s article (https://yishi.io/a-beginner-guide-to-the-ordinals-protocol/) to explain the first-in-first-out feature:

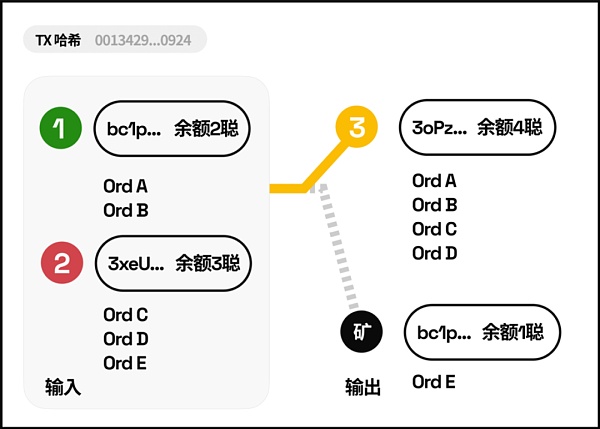

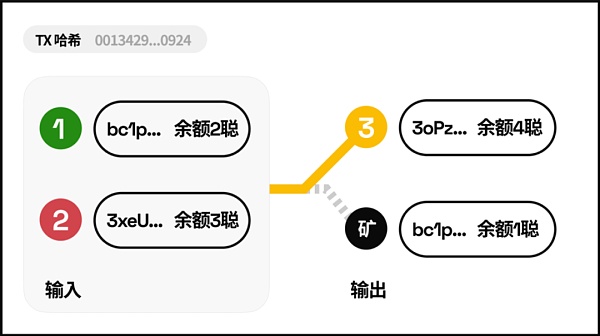

In the picture below , there are two Inputs on the left, address 1 and address 2 have a total of 5 satoshis. In this transaction, 4 satoshis were sent to an address starting with 3oPz, and 1 satoshi was left as a miner fee to pay the miners.

Source: https://yishi.io/a-beginner-guide-to-the-ordinals-protocol/

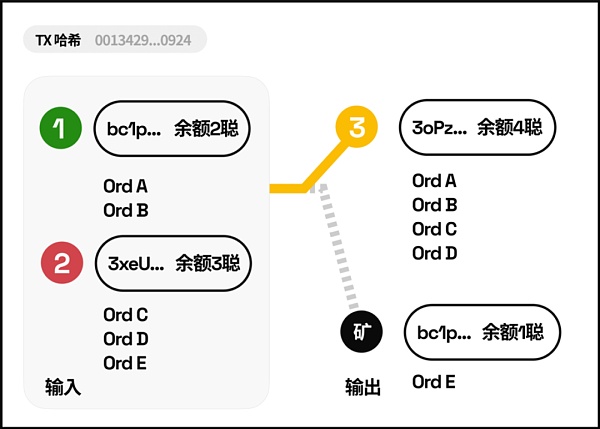

< p> Assume that in the above transaction, we secretly use the Ord protocol to assign an identity (serial number) to each satoshi. Then after the transaction is completed, the four numbered satoshis Ord A->D at address 1 and address 2 will run At address 3, the last satoshi is given to the miner.

The so-called "first in, first out" means that the number ordering of each satoshi is determined according to its index in the transaction output. For example, in the transaction output (Output) in the figure below, address 3 is ranked in front of the miner's address. Then the satoshi transferred from address 1 and address 2 will be inherited by address 3 first, and then the miner's address.

Source: https://yishi.io/a-beginner-guide-to-the-ordinals-protocol/

Protocol Principle

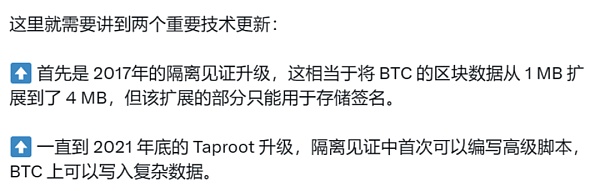

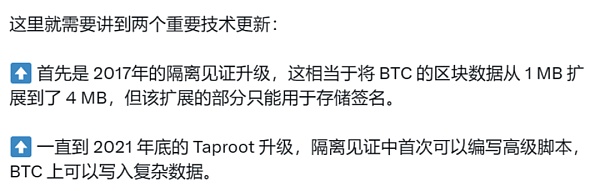

Friends who are more familiar with Bitcoin know that Bitcoin has existed as a peer-to-peer electronic currency system since its birth. The programming language it uses is a non-Turing complete scripting language, so it is almost impossible to implement some complex functions. However, the two major updates of BTC in 2017 and 21 allow us to implement some complex logic on BTC. function.

Source: https://twitter.com/blockpunk2077/status/1719321676989771801

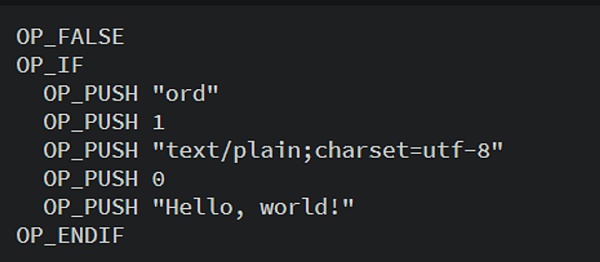

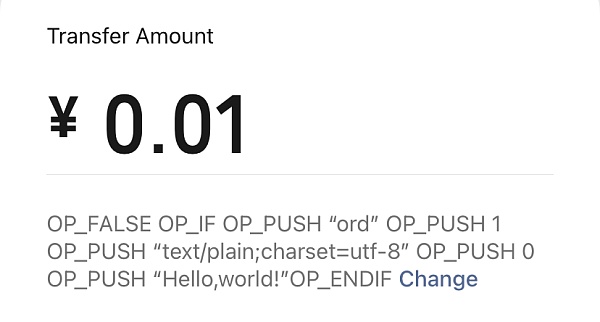

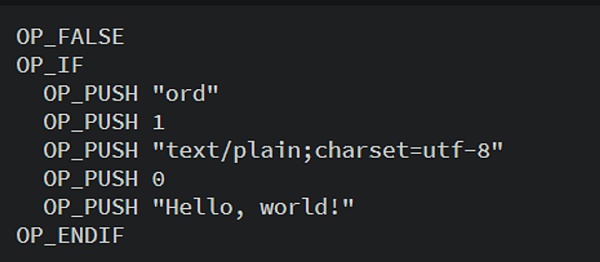

Based on the above development premise, The Ordinals protocol achieves viewing and transfer effects by writing its inscription content into the Taproot script and passing it through UTXO. Since Taproot script consumption can only be done from existing Taproot Outputs, a commit/reveal two-stage process is used to implement engraving. First, in the submission transaction, we need to create a Taproot Output containing the script of the inscription content. Secondly, in the reveal transaction, spend the previously created submission transaction to reveal the content of the inscription on the chain. In this process, we also need Perform a series of serializations on the content of the inscription:

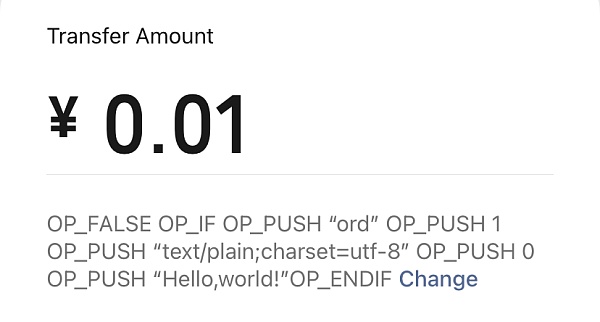

Source: https://docs.ordinals.com/inscriptions.html< /p>

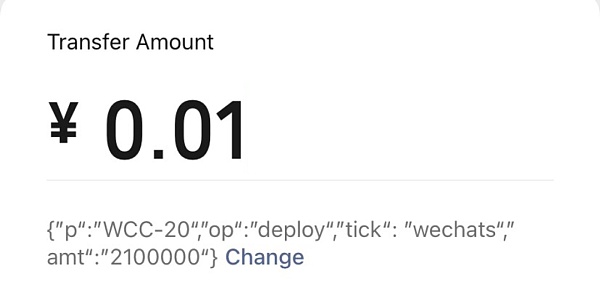

So to explain it in plain English, it is equivalent to you initiating a WeChat transfer. During the transfer process, we need to write down the content of the inscription you created in the note (Taproot Output), and then Then send the transfer** (spend and submit the transaction), then after the sending is completed, we can let the other party see what you wrote in the note in the chat box (reveal the transaction)**. If there is no note written on this transfer or the transaction is canceled, the content of this inscription will not be uploaded to the chain.

Chapter Ⅱ — The blooming of BTC ecological asset issuance

『1』BRC-20 protocol

Protocol proposed

After the Ordinals protocol came out, early players were playing with NFT, and anonymous developer domo released an experiment on 2023.3.8 Sexual Standard - Based on the BRC-20 protocol improved by the Ordinals protocol and officially deployed the first BRC-20 $ordi, which allows anyone to issue tokens in the Bitcoin network, similar to ERC-20 tokens on Ethereum gameplay.

https://twitter.com/domodata/status/1633658974686855168

Note:

< p>1. Domo’s earliest tweet about BRC-20 was 2023.3.9, but judging from the deployment time of $meme and $ordi, it should be 2023.3.8 Launched. 2. $meme is the first BRC-20 deployed, and $ordi is the first officially released BRC-20. 20, which can be inferred by looking at their deployment times.

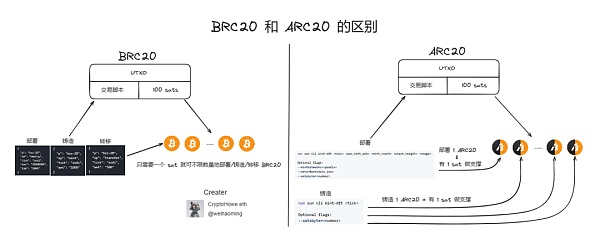

Protocol Principle

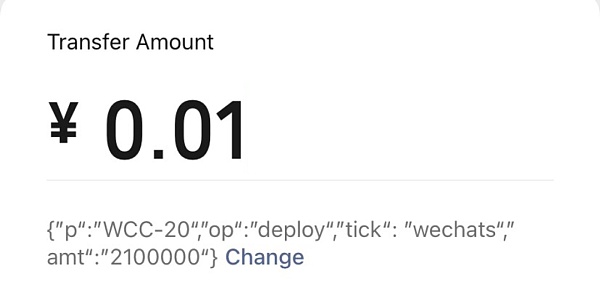

The BRC-20 protocol develops a series of standards To realize the deployment, casting, and transfer of BRC-20 tokens based on the Ordinal theory. The format standard of this protocol is derived from the format of the Sats Name project (the first DID project based on the Ordinals protocol):

Source:https://gamma.app /docs/Copy-of-Ordinals-and-Bitcoin-NFT-8xnob1mzvgup38w?mode=present#card-qm5vgu6uussxft9

Similarly, if explained in vernacular, it is the same as the Ordinals protocol when you initiate a WeChat transfer, but the remarks Content varies.

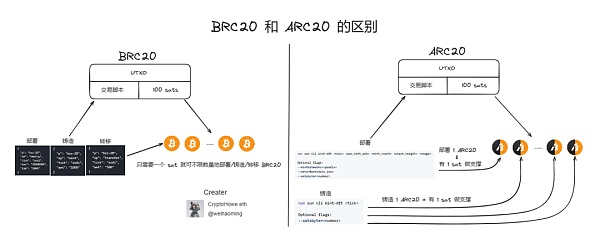

Extension

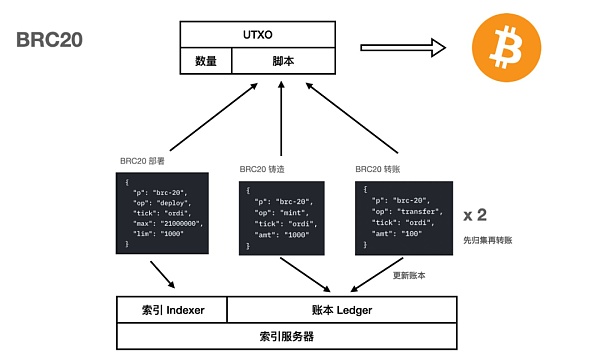

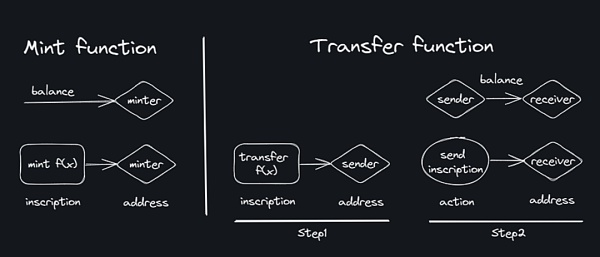

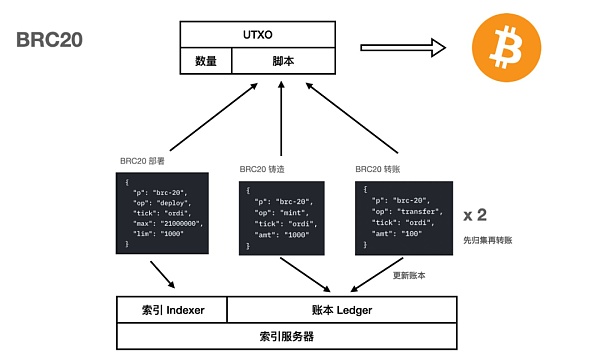

Although this method of the BRC-20 protocol allows for the free issuance of homogeneous tokens on the Bitcoin chain, it does not exist because Bitcoin does not have an account model and the content of BRC-20 is placed in Segwit's Taproot script prevents us from directly calculating the BRC-20 balance of each account on the chain. Therefore, the current method is to build an index server off-chain to achieve BRC-20 token information acquisition, balance calculation, transaction transfer, etc., but this method will have the risk of centralization.

Souce: https://twitter.com/blockpunk2077/status/1725513817982136617

First of all, you can understand BTC one There are three main parts of the layer protocol: the protocol stipulates the rules for writing data on Bitcoin, the indexer provides the ability to query and parse these data, and the ledger records the token balance and handles transfers.

For BRC-20, the index server first needs to identify each BRC-20 deployment to read the token information. This part is called the "index".

At the same time, since the balance of BRC-20 is engraved into the script and cannot be recognized by the BTC network itself, the index server of BRC-20BRC-20 must build a local ledger to record the balance of BRC-20 . Every time a transfer occurs, whether the transaction can be carried out (there are enough coins), the local ledger needs to be checked and updated.

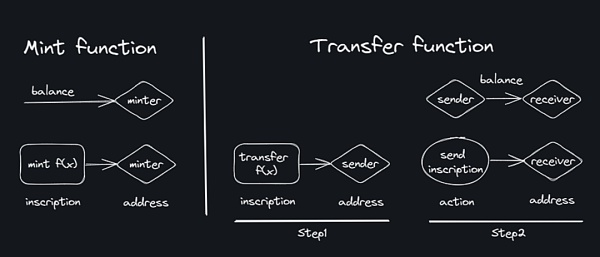

So BRC- 20 Two transactions need to be sent during the transaction:

The first transaction reads the latest ledger data in the local ledger and calculates the balance< /p>

Transfer the second transaction.

The Ordinals protocol is essentially designed for NFTs. Based on its improved BRC-20, the transaction complexity increases recursively. The BRC-20 indexer also takes on the work of the ledger, which exists completely off-chain without Bitcoin. The indexer must accurately record every balance change to ensure the integrity of the ledger.

So as time accumulates, the indexer ledger will accumulate, and the pressure on the nodes will increase. If the indexer is not continuously incentivized, it will be difficult to sustain. If the indexer ledger is no longer in service, BRC-20 will become completely unusable.

『2』TRAC Systems

Source: https://twitter.com/trac_btc /status/1722648122269012428

$TRAC

$TRAC was launched by Benny on 2023.5.3 and official on 2023.5.22 Deploy an online BRC-20 Token.

Trac Core

Trac core is the oracle and decentralized indexer of Bitcoin inscriptions, solving the problem of inscription ecological data indexing, retrieval, Price feed and other issues.

For example, in terms of indexers, although inscription data is stored on the Bitcoin chain, this is only information about related inscriptions, and data updates and audits need to rely on third-party centralized indexers, so security is always will be criticized (for example, the market’s ordi index accounting error on Binance at the end of November), so Trac can allow the Inscription ecosystem to inherit the security of Bitcoin to a greater extent, collect, organize and sort all data on Bitcoin, and plans to introduce data in the future. Hundreds of indexer nodes.

At the same time, as the number of nodes increases, Trac Core also integrates the role of oracles, obtaining necessary reliable data from external sources to input into the blockchain, which is the basis for the subsequent construction of upper-layer protocols such as Inscription's native DeFi. And the API of the Trac oracle is free and can be called.

Therefore, Trac core’s ecological position of having both a decentralized indexer and a Bitcoin oracle can be said to be ahead of most inscription projects.

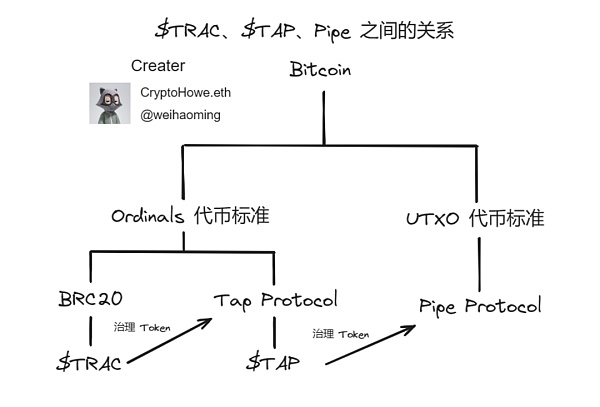

Tap Protocol

Tap Protocol is an improved protocol based on Ordinals released by the $TRAC team on 2023.8.7. We can regard it as an upgraded version of the mirror BRC-20 protocol. It is a compatible and upgraded protocol for BRC-20. It has the following four characteristics:

OrdFi protocol with unique token standards

Compatible with BRC-20 tokens, easy for market integration, and breaks through the name length limit of BRC-20 , the BRC-20 token length is fixed at 4 digits, while the Tap token length is 3 or 5-32 digits (cannot be 4 digits)

Supports batch transfers and pledges Asset, token swap and other functions. Improve transaction efficiency without relying on L2 chain

The first protocol to support cursed inscriptions

Use the previously deployed $TRAC as The governance token of its protocol(not quite a feature, but I’ll explain it here)

Currently the official version of Tap Protocol Two tokens, $TAP and $-TAP, were issued. $TAP was minted by BennyTheDev on August 6, 2023 but was not circulated; $-TAP was opened to community mint, with a total of 21,000,000 tokens (that is, 21,000 pieces). , according to Shep's research, $-TAP was deployed 30 minutes earlier than $TAP, and is the real first native token in the protocol.

Pipe

The Pipe protocol was proposed by Benny, the author of $TRAC. This protocol was improved by Benny on the Runes protocol. The Pipe protocol can be said to have preempted the Runes protocol in a corner, because the Runes protocol was proposed by Casey, the founder of the Ordinals protocol, but its main focus is on the Ordinals protocol, so the development progress of the Runes protocol has been relatively slow, and Benny is finishing learning the Runes protocol. After thinking about it, the Pipe protocol was launched in just about a month

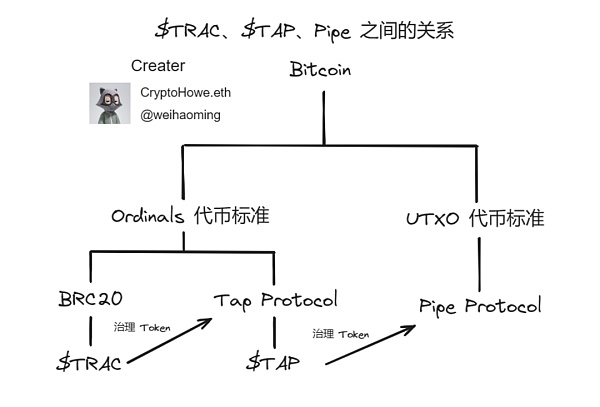

The connection between the three

Here we can see Benny has launched 3 projects in less than half a year, and these 3 projects are also closely related to each other, like nesting dolls. Let us use the picture below to understand the relationship between them.

Generally speaking, the governance token of a project is chosen to be the native token of its protocol. However, Benny uses this governance token method to achieve that three projects can promote and restrict each other, which is extremely rare. At present, the specific functions of these governance tokens have not been officially announced, so in the next development, we can see whether this will produce some different exciting collisions.

『3』Atomics Agreement

Proposal

< p style="text-align: left;">The founder of the Atomicals protocol tried to develop a DID project on the Ordinals protocol in February, but during the development process he found that the limitations of the Ordinals protocol led to what he wanted. Some functions could not be implemented or were a bit awkward, so the first idea about the Atomics protocol was posted on Twitter on May 29, 2023. Finally, after several months of development, the protocol was launched on September 17, 2023.

https://twitter.com/atomicalsxyz/status/1663169464802725889

The initial launch of the Atomics protocol did not stir up much excitement in the Bitcoin ecosystem, because at that time due to the Ordinals protocol and BRC-20 With the launch of the protocol, a large number of improved protocols based on them have emerged on different chains. However, when we look at the documentation of the Atomics protocol, we will find that it is a completely different protocol.

Theoretical basis - Digital Matter Theory (DMT)

DMT theory (Digital Matter Theory) refers to digital matter theory and digital information Rather than just random numbers and letters, it can actually be considered its own "substance", such as wood or metal. DMT in blockchain data can be transactions, bytes, or any other pattern of blockchain data that can be turned into a valuable digital item or asset.

Here is also a quote from Dr. Jingle for everyone to better understand:

Some physicists claim that information is a new form of matter that may eventually defeat all matter on earth. Everything becomes dominant (and very controversial). At current growth trends, in about 350 years, more digital information than physical atoms may be used on Earth, highlighting the exponential growth and importance of digital information.

The physicist’s idea has encouraged many people to turn it into an executable protocol and parse valuable information from the Bitcoin blockchain to create “non-arbitrary tokens”. Utilizing digital matter theory has the potential to revolutionize the creation of digital value, making it more non-arbitrary and meaningful. By leveraging data in the context of digital matter theory, new mechanisms can be created to identify and derive new sequences of value in the data, opening up possibilities for new forms of tokens.

For example, some people even compare Bitcoin to an application of DMT. Bitcoin is also a non-arbitrary token and has its own specifications, such as 21 million coins, one block every 10 minutes, etc. . Through the exchange of digital information on the Bitcoin network, value can be transferred and stored. Although Bitcoin only exists in the digital world, its value and influence can have significant real-world impacts, just like traditional physical currency.

However, DMT is not without controversy. Some critics argue that digital information cannot be compared with basic physical entities such as matter and energy because digital information itself cannot directly change the real world. However, DMT advocates believe that although digital information cannot directly change the real world. However, digital information can change the world indirectly through human actions and decisions, such as the application of cryptocurrency.

Problems faced by existing Bitcoin builders

Proprietary API Various problems caused by:

Service lock-in, high interaction cost, the same on-chain data will have different manifestations, competition among developers

- < p>Unreliable indexer:

Asset security issues, frequent changes, positive and negative numbers of Ordinals

Lack of top-level design:

< p>Difficulty combining protocols and developing proprietary facilitiesLimitations of on-chain metadata:

Example: Collections must be manually uploaded to Github repositories, and they must be updated manually on dozens of markets, with no on-chain response being achieved Consensus

Errors cannot be fixed or are expensive to fix

The data structure of the Ordinals protocol relies heavily on the use of a single file, which Means the existence of off-chain conventions and proprietary indexes in different markets

Lack of control:

If powerful and high-performance decentralization is not accessible indexer and more services/indexer locks, then data portability will be an issue

Lack of benefits:

Reliance on these specific services And the market and its proprietary services such as indexers and APIs will lead to reduced profits

The first three points are issues for developers, and the last three points are issues for creators

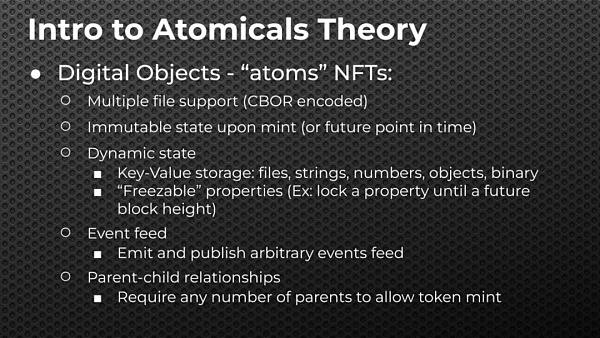

Atomic Theory

The Atomics protocol is a simple and flexible protocol for unspent transaction output (UTXO) blocks for Bitcoin and others Chain mints, transfers and updates digital objects (traditionally known as NFTs).

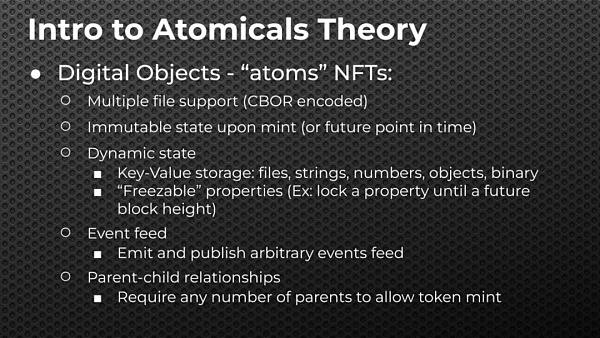

1.Digital Objects—“atom” NFTs

Atomical (or “atom”) is a new type of NFT that can be used in Bitcoin Cast, transfer and update. The main difference is that there is no need to use a centralized service or a trusted third-party indexer. It does not require any changes to Bitcoin to run, nor does it require sidechains or any L2. It’s time to take back control of our digital lives for good.

Source: https://twitter.com/atomicalsxyz/status/1702867266008719582

2.BitWork — Micro-workload proof PoW

The most interesting improvement of the Atomicals protocol is that the CPU computing link is added to the token minting process. This link is called BitWork. The minter needs to exhaustively calculate the hash value that matches the specific prefix characters before casting.

PoW can make token minting relatively fair, with both the value injection of energy and time and the presence of random luck.

Unlike the traditional PoW algorithm, which is computationally difficult, Bitwork achieves fine-grained adjustment of mining difficulty by changing the prefix matching method. It can add a number between 1 and 15 after the prefix. , such as: "7777.1" or "7777.15" or any number in between, this number represents the allowed variation range of the character.

How it works is that the number after "." is called a semi-wildcard and is used to match any 5th character starting from that number. Take "7777.10" as an example: the first 4 txid characters (hexadecimal) must be "7777", and the 5th character can be the number 10 (hexadecimal) and above.

So the 5 digit number can be a, b, c, d, e or f. This allows the entire system to not only have 16x to choose from every time the difficulty increases, but to have a range of 2x to 16x to choose from.

At the same time, BitWork also brings some novel use cases:

This way we can rank content based on energy consumption such as electricity

When you have a really cool When a reference or prefix is used, a relevant community can be organized through consensus

Incorporate a random element of luck into the casting process

Organize the community around vanity TXIDs and REFs

Content ranking based on expensive signaling theory

Throttling and limiting tokens Minting — Spam Filter

3.Container NFTs — NFT Standard

Container ) is a collection standard for representing NFTs and metadata. It can be used to add/modify/delete the content of any protocol such as Atomicals, Ordinals, Bitmaps, etc. You can also choose **Permanent "Sealing"** to lock the content into a container and then give the "key" that can open the container. Destroyed so as to maintain the sealed state and cannot be modified.

Container name service:

The container name starts with the hashtag # symbol, and each name is unique and non-repeatable, and is minted on a first-come, first-served basis

The name is in the 3-64 character range, and Bitwork is used to slow down the registration of container names

Container name examples: #bitcoin-funks, # gemini-warriors,...

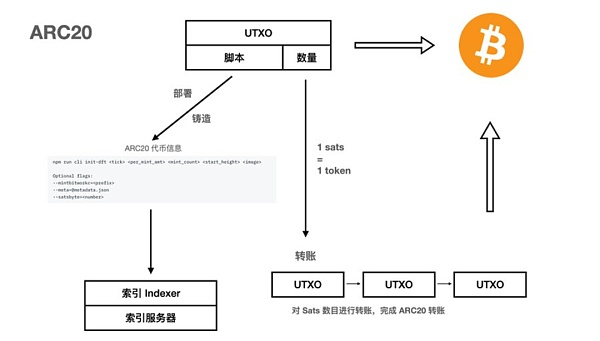

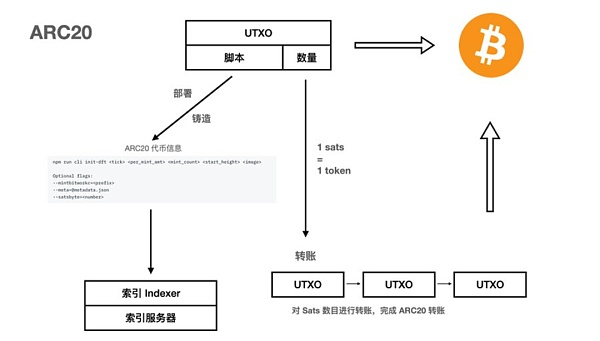

4.ARC20 — Colored Coins

Atomicals protocol based on bits The smallest unit of currency, sat, is the basic "atom". The UTXO of each sat is used to represent the Token itself, that is, the balance of ARC20 is the number of sat, 1 token = 1 sat.

ARC20 is a colored currency model, and the registration information is recorded in the transaction script. By binding information with UTXO, the programmability and decentralization of the token can be improved. At the same time, the security of the transaction is guaranteed by the BTC main network. In terms of tracking transactions, calculating balances, etc., no off-chain system is required. , to calculate the balance of ARC20 tokens, because the token balance is consistent with the number of sat in UTXO. This is the biggest difference from the BRC-20 protocol.

< /p>

< /p>

Source: https://twitter.com/blockpunk2077/status/1725513817982136617

When deploying ARC20, the token name, total amount, quantity limit, Difficulty settings, starting blocks, images, and more.

When users mint ARC20, they write the name of the token into the UTXO script. The amount is directly determined by the number of sats in UTXO, 1 sat = 1 token.

To transfer ARC20, users no longer need to deposit any data into BTC. They only need to use the UXTO that continues to hold the token as transaction input and output it to other addresses.

For ARC20, we only need an index to help us read the token registration information and identify mint transactions to confirm and verify which UTXO is ARC20.

The benefits of this are:

Greatly It reduces the cost of index servers. Almost anyone can make their own index servers. The system is highly decentralized

Transfers completely rely on the BTC network and will not repeatedly create junk transactions. , the security of ARC20 transfer itself is guaranteed by BTC

The atomicity of ARC20 is consistent with the atomicity of BTC, and is suitable for implementing many native applications

-

When deploying ARC20, the token name, total amount, quantity limit, difficulty setting, starting block, image and other information.

When users mint ARC20, they write the name of the token into the UTXO script. The amount is directly determined by the number of sats in UTXO, 1 sat = 1 token.

To transfer ARC20, users no longer need to deposit any data into BTC. They only need to use the UXTO that continues to hold the token as transaction input and output it to other addresses.

Of course, the design of colored coins also brings some disadvantages, because the balance is not written in the data, but is tied to Sat is determined, so the minimum split precision of ARC20 balance is 1.

This also makes it impossible for users to conduct fine-grained transactions under the minimum 546 sat transaction limit set by the BTC main network itself to prevent dust attacks. However, the Atomics protocol has currently provided a specific split plan and is actively developing it.

Here is a picture to show the most essential difference between BRC-20 and ARC20:

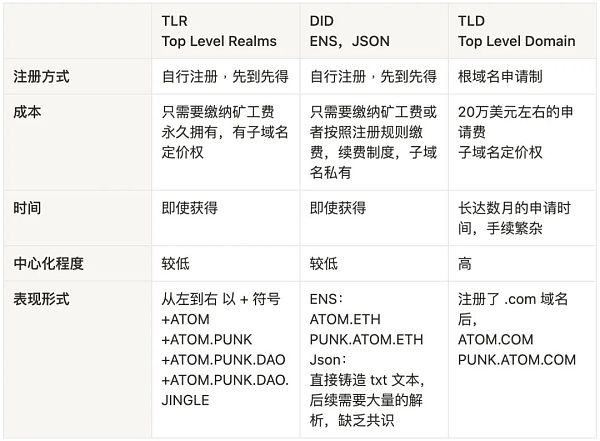

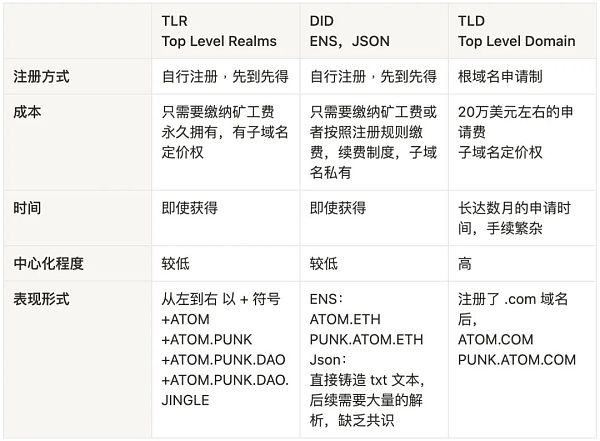

5.Realm Name System (RNS ) — Realm Domain Name System

RNS is known as the true rival of DNS domain name system and aims to become a global alternative to DNS and other blockchain domain name systems.

Realm Name is a human-readable identifier that can be used to associate network addresses with resource information. Realm names start with the plus sign + and have at least one alphabetic character, such as +alice and +agent007 , which are both valid names (top-level — realm or TLR in the Realm Domain Name System (RNS)).

Realm names are self-owned and self-managed directly on the Bitcoin blockchain using the atomic digital object format, which basically means there are no middlemen or centralized registrars.

6.Subrealm Minting — Subrealm Minting

Manage and tokenize the community by issuing subrealms under any Realm. The specific rules are as follows:

Give a popular example :

Beyond that, Subrealm can be used for social media organization, identity verification, loyalty rewards, and more.

First we registered a field +ATOM

When we want to form a community about Punk NFT in this field, we can create a sub-field +ATOM.PUNK based on the +ATOM field

- < p>After we want to form a DAO in the Punk community, we can create a sub-domain +ATOM.PUNK.DAO

Everyone in the DAO is assigned a DID , you can create a subdomain +ATOM.PUNK.DAO.JINGLE

Any domain or subdomain can publish subdomains

All subdomains can inherit the same characteristics and publish their subdomains based on the subdomain

Everyone is a registrant of the domain they own, there is no center Mechanism

Protocol Characteristics

Through the atomic theory above, we can know Atomics The main features of the protocol include:

Using satoshis as the basic unit to represent tokens

Allows the creation, transfer and updating of digital objects on Bitcoin

Provides a decentralized and Bitcoin culturally compliant tokenization method

Utilize Proof of Work (POW) to increase fairness and decentralization of the minting process

Aims to expand the functionality of Bitcoin and support a wider range of applications

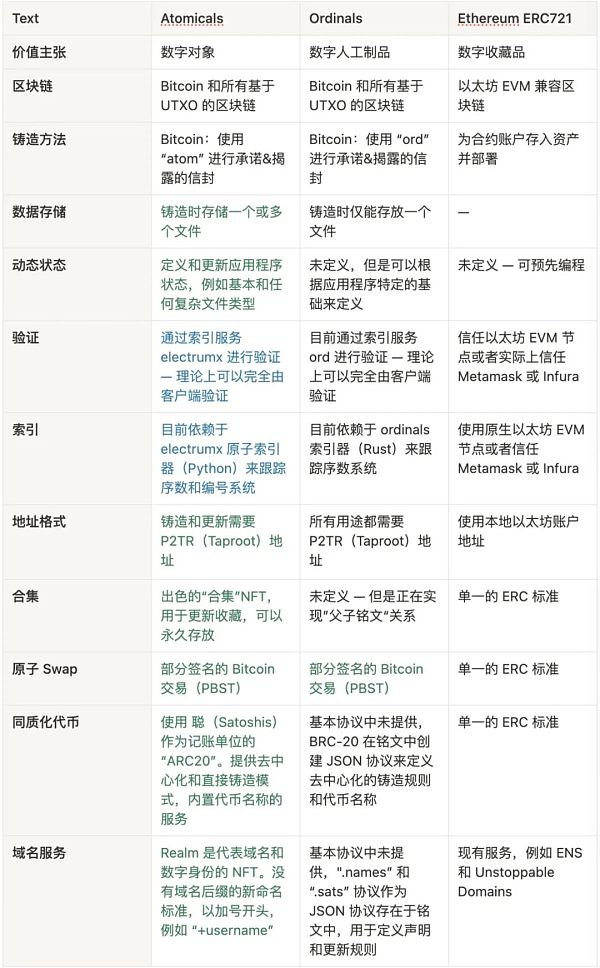

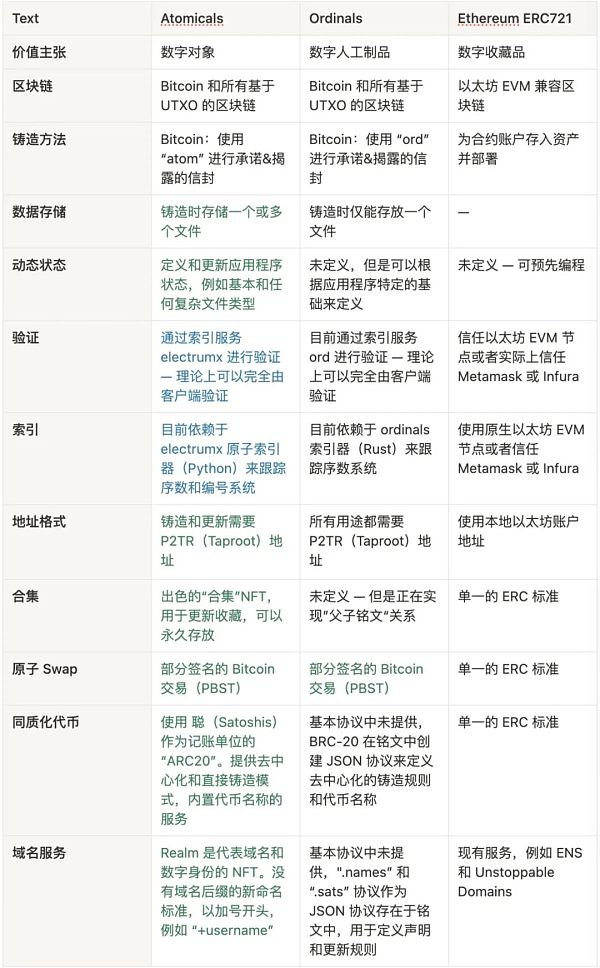

Key differences from other protocols

The best way to understand the differences in the Atomics protocol is to Compare with other popular NFT protocols:

< /p>

< /p>

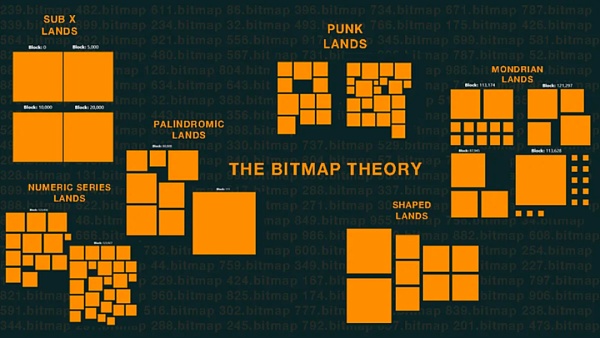

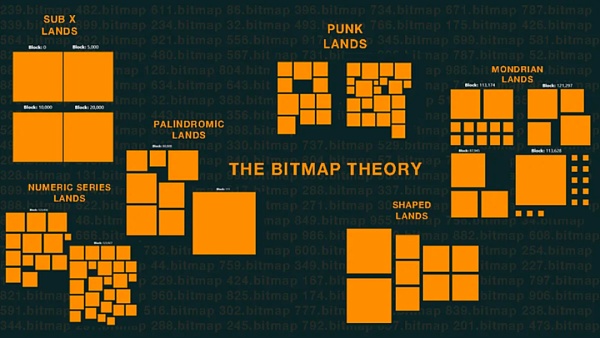

「4」Bitmap Agreement

Proposed Agreement

Bitmap.land It is the first Metaverse project in the Bitcoin ecosystem. It is based on Ordinals theory and Bitmap theory.

Bitmap theory was proposed by Twitter user @blockamoto on June 5, 2023.

This theory maps each transaction input in the Bitcoin block into a parcel (Parcel), forming a block or area (District). The difference in size of different transaction inputs results in different sizes of mapped plots.

https://twitter.com/blockamoto/status/1665704582863810560

Protocol Concept

Buyers of Bitmap.land are affected by Decentraland and The Sandbox, using the method of dividing land and drawing patterns on the map, which is similar to the logic of buying land on these two platforms. Users gain ownership of specific Bitcoin blocks by inscribing data into Satoshi, similar to free minting.

Source: https://share.foresight-news.com/article/detail/48677

In Bitcoin On the blockchain, each block is divided into four parts to represent different halving cycles. Users can view the number and color of each block on the Bitmap.land website. Different colors represent different selling statuses.

The offering of Bitmap.land is closely related to ordinal theory, similar to the virtual land offering of Decentraland and The Sandbox, which relies on the ERC-721 standard. Ordinal theory is similar to the principle of early colored coins, but in the context of Bitcoin’s current narrative, consensus, ecology, and infrastructure, the two are different. While ordinal theory is not as innovative as ERC-721, BRC-20's approach is more original.

Bitmap theory adds a new interpretation to Bitcoin blocks, providing a topicality despite lacking practicality. It changes the connection between Bitcoin and the Metaverse, giving each block of the Bitcoin blockchain a new dimension and making it part of the Metaverse by allowing users to own and record individual blocks.

Bitmap theory attracted the attention of the Ordinals community and inspired the inscription craze. Any block on the Bitcoin blockchain can become part of the Metaverse through Bitmap, bringing new creation and ownership opportunities to the community.

Bitmap.land blurs the lines between Bitcoin and the Metaverse through bitmap theory, paving the way for ownership, creativity, and community development. As the inscription craze continues, it means huge potential for those looking to carve out a niche in the digital realm.

Interested students can also go to the official browser to view various Bitmaps: https://bitmap.game/

『5』BRC-100 Agreement

Proposal

As we all know, Bitcoin-based protocols such as the Ordinals protocol and BRC-20 have brought a lot of imagination to the development of the Bitcoin ecosystem through the "on-chain declaration, off-chain analysis" mechanism. And a large number of Bitcoin NFTs and tokens have been issued, but the development of decentralized applications such as DeFi is still lagging behind. Therefore, Mikael.btc released a protocol to support decentralized computing: BRC-100 on 2023.9.2.

https://twitter.com/MikaelBTC/status/1697930690653036895

Protocol Introduction

BRC-100 is a protocol based on Ordinals A theoretical extension protocol designed for implementing various decentralized applications on Bitcoin Layer 1. This protocol not only inherits the basic functions of BRC-20 on Bitcoin, such as creation, minting, and transactions, but also introduces the concept of decentralized computing.

This means that based on the BRC-100 protocol stack, various decentralized applications such as DeFi, SocialFi and GameFi can be developed, bringing true decentralization and trustlessness to the first layer of Bitcoin. , censorship-resistant and permissionless application scenarios.

A major feature of the BRC-100 protocol is its interoperability. It not only allows all protocols and applications within its protocol stack to be compatible with each other, but also supports BTC, BRC-20 or other third-party protocols. Layer 1 chains such as Ethereum and Stacks interact. In addition, the protocol also introduces the UTXO model and state machine model to enhance its security and computing capabilities.

Protocol Characteristics

Because the BRC-100 protocol is an extension of the Ordinals theory, BRC-100 itself has all the characteristics of BRC-20 , and also introduced some innovative features:

Stream saving: It is based on the BRC-100 protocol for various extensions such as airdrop protocol, governance protocols, relay protocols, etc., we can understand that Mikael wants to introduce various DeFi gameplay into BTC.

Protocol inheritance

BRC-100 protocol The concept of inheritance is introduced. Protocols that inherit directly or indirectly from BRC-100 are called BRC-100 extension protocols. BRC-100 extension protocols must inherit from only one protocol. An extended protocol will inherit the properties, operations, and calculation operations of the parent protocol, and can only extend properties and calculation operations.

This is similar to how when we make ceramics, it is just a clay embryo at the beginning. Slowly, by polishing and shaping it, it gradually has more expanded functions such as decoration. , hold things, etc.

BRC-100 Protocol Stack

The BRC-100 protocol and all its extensions and improvements are collectively referred to as the BRC-100 protocol Stack, based on this protocol stack, all tokens/applications can be compatible with each other, which means that one token/application can be used anywhere by other applications.

Protocols and Applications

In the BRC-100 protocol stack, protocols describe the properties, operations and calculations of applications operating standards. Applications are instances of the protocol that are created after being deployed to the Bitcoin network via Inscription.

An application is essentially a token with computing power and status. The computing capabilities of the application are detailed in the agreement. Without adding sub-applications, applications cannot have computing capabilities not described in the protocol. The added sub-application can only have the computing power of the protocol, otherwise the public indexer cannot verify the status of the application, resulting in inconsistent status between users and applications.

Application Nesting

Applications deployed based on BRC-100 and its extended protocols can be nested, that is, under one application You can create another application, called a child application.

The ticker of the sub-application starts with "parent application ticker:". Multiple applications can be created under one application to complete multiple independent calculation logics. For example, in the classic AMM DEX scenario, multiple LP sub-applications/tokens need to be created in one DEX application, such as "amm_dex:LP_BRC100_BTC".

Application status and address

In addition to the UTXO model, the BRC-100 protocol also introduces a state machine model to extend The computing power of the protocol.

Applications, sub-applications, and addresses can all have state. For example, applications can hold tokens and addresses can have balances within the application. UTXO and state conversion are completed through the burn2/burn3 and mint2/mint3 instructions.

Computational operation (cop) is used to represent specific calculation logic, that is, the conversion logic of application and address states.

For example, address A destroys 10 token1 to the application via burn3 inscription. At this point the application owns this UTXO and 10 token1. The application can allocate these 10 tokens by changing any address or the application's internal state through its computational logic. Then the address or application in the application that owns token1 can mint it via the mint3 command.

Permissions

The BRC-100 protocol introduces two roles: owner and administrator.

The address with the application deployment inscription is called the owner. Owners can track UTXO transfers deploying inscriptions. The owner of all child applications is the owner of the parent application.

Administrators are managed by owners, and administrators cannot manage other administrators. Owner and administrator permissions are strictly limited. They cannot censor users, they can only do: manage applications that do not start DAO and complete mint2/burn2 calculation operations.

The administrator can be an address, application or sub-application. Applications and sub-applications are mutual administrators by default and no additional settings are required, but sub-applications are not mutual administrators.

The inscription for burn2/burn3 needs to be sent to the deployer of the application to be processed correctly. The "mint2" directive requires that a portion of the tokens minted can only be allocated by the application/sub-application logic, and the application/sub-application needs to be the administrator of the tokens. The "burn2" directive has similar logic. The inscriptions for burn2/burn3 need to be sent to the deployer of the application in order to be processed correctly according to the logic of the computational operation.

Decentralized governance of applications

The BRC-100 protocol stack introduces a governance protocol: BRC-101, which Applications that implement the BRC-100 or its extended protocol standards can be managed. After the application starts the DAO, it needs to complete governance through decentralized voting.

The management of applications includes: updating the properties of applications and sub-applications, deploying sub-applications, and stopping applications. Application governance is on-chain governance. After the on-chain vote is passed, the application should be notified through the calculation operation:egov, and then the application will automatically perform governance after the time lock.

Deploying applications/Token

In the BRC-100 protocol, there are two ways to deploy applications: 1. One is to deploy directly using deployment instructions, and the other is to deploy through the governance protocol: BRC-101.

The first is used to deploy parent applications and child applications that do not require governance, and the other is used to deploy child applications that require governance.

Minting Tokens

The BRC-100 protocol provides three minting instructions: mint, mint2, mint3, for Mint tokens in different scenarios.

When deploying the application, you need to set the number of tokens that the user can mint (using the "mint" command). The remaining tokens will also be minted using the “mint” command.

"mint": User minting, fair minting, anyone can mint tokens for users, but the total number minted by the "mint" operator cannot exceed the "max" and "mma" attributes of the application set up. After minting, the circulating supply of the token will increase.

"mint2": Whitelist minting, the application records the number of users or applications that can mint, anyone can mint2 tokens for users or applications under the application rules. After mint2, the circulating supply of the token will also increase.

"mint3": Mint from the treasury, mint3 is the balance of users or applications in other applications, anyone can mint3 tokens for users or applications under application rules. After mint3, the circulating supply of the token will not increase.

Token destruction

Destruction is a newly introduced operation in the BRC-100 protocol. Users can inscribe a destroy operation and then transfer the inscription to the deployer of the application, similar to the semantics of a transfer operation. The burned tokens will then be destroyed or transferred to the application's balance.

Similar to the definition of the mint operation, there are three burn operators: burn, burn2, and burn3, which logically correspond to mint, mint2, and mint3 respectively. No additional configuration is required, all applications/tokens support these three burn instructions.

"burn": Public destruction, everyone can use instructions to destroy tokens. After the token is successfully destroyed, the circulation will be reduced, and the destroyed token cannot be minted again.

"burn2": whitelist destruction, according to the preset rules of the application, after the burn2 tokens are transferred to the application, the user's balance will be reduced, the status of the application will be updated accordingly, and the circulation will be reduced . In practice, logic such as liquidity removal in AMM DEX can be implemented through burn2.

"burn3": The treasury is destroyed, burn3 will reduce the user's token balance and increase the balance of the "to" application. In practical applications, mint3 can be used to complete the logic of exchanging tokens and increasing liquidity in AMM DEX.

Transaction Tax and Deflation

The BRC-100 protocol introduces a new token trading mechanism: transaction tax and deflation. The application can set the transaction tax percentage, tax recipient and transaction black hole percentage. These settings only take effect when trading on AMM-based decentralized exchanges. Normal transfer, minting and burning operations will not trigger transaction taxes and deflation.

Computational operations

Computational operations are extended computing behaviors of the BRC-100 protocol. It is represented by the cop attribute and is the smallest unit of the protocol's computing power. When used with the op operator: burn2/burn3/mint2/mint3, it can be understood as a state transition function, which defines how the status of the application and the user is updated under the corresponding op operator.

Oracles

Oracles are a common requirement for blockchains to interact with off-chain parties, and in Ethereum It has been well implemented and applied on the blockchain. Without oracles, smart contracts on the blockchain would be completely limited to on-chain data. But compared with blockchain, the BRC-100 protocol has very special characteristics.

It not only has the computing power of the blockchain, but also relies on off-chain indexers to complete the calculations. At the same time, off-chain indexers are able to communicate directly with other blockchains or meta-protocols, but blockchains cannot do this, which means that the indexer can verify any data off-chain or on-chain with enough attestation data Meets the requirements of Oracle BRC-100 protocol.

For example: verifying the transfer of BTC or BRC-20 assets, verifying the ETH price on a certain block of Ethereum, etc.

In other words, in the BRC-100 protocol, the oracle has a new paradigm: proof and verification, in which users submit proof data and the indexer serves as an Oracle Verifier to verify the out-of-protocol proof data submitted by the user. , no separate Oracle service is required.

In the BRC-100 protocol, the burn2/burn3/mint2/mint3 instructions natively support the proof attribute, which is used to submit proof data outside the protocol. The indexer can verify the proof data to ensure the consistency and correctness of the state. The proof can be a transfer proof, a Merkel tree proof, a zero-knowledge proof, a price proof, etc. It can be used in scenarios such as bridging assets, airdrops, and Bitcoin layer 2 , loan settlement, etc.

Relay Protocol

The meta-protocol on Bitcoin is heterogeneous and cannot communicate with each other. Different protocols are similar to different blockchains, they share the security of the Bitcoin blockchain and have different computing power. Additionally, the meta-protocol cannot communicate directly with other blockchains: such as Ethereum, nor can it use assets on other blockchains.

Therefore, the BRC-100 protocol stack requires a relay protocol to complete the communication between Bitcoin, meta-protocol, blockchain and BRC-100 protocol, bridging assets on other protocols or blockchains Go to BRC-100 and participate in decentralized applications such as DeFi. At the same time, BRC-100 will have multiple relay protocols due to the diversity of protocols and blockchains.

First, we will release: BRC-103, responsible for bridging assets between Bitcoin, BRC-20 and BRC-100. When bridging an asset from a meta-protocol or blockchain (source) to the BRC-100 protocol (destination), in order for the indexer to verify the correctness of the transfer, proof data needs to be submitted using the "mint2" instruction, which is called a proof of transfer. Transfer proof means that when minting anchor assets on the target protocol (BRC-100), you need to submit the transfer data on the source side (such as Bitcoin, BRC-20 or other blockchains) as proof at the same time, which can be a transaction hash. Or inscription ID. So that all BRC-100 indexers can verify the correctness of the minting of the anchored asset.

Transfer Proof is a very important application of the Oracle BRC-100 protocol.

Protocol use cases

Since BRC-100 is extended from BRC-20, So essentially all the application scenarios of BRC-20 are available, but the application scenarios of BRC-100 are far more than that. We can still expand on the BRC-100 protocol. Here are some officially listed extension protocols, some of which are already under development:

BRC-101 (Released)

BRC-100 decentralized on-chain governance protocol for the protocol stack, defining how to update properties of parent/child applications/tokens, Stop the application and add sub-applications.

In addition, BRC-101 can also complete off-chain governance through decentralized voting.

BRC-102 (under development)

Automated liquidity protocol, which defines how to use automated market makers (AMMs) to ) algorithm to exchange tokens of the BRC-100 protocol stack. The calculation logic will be similar to Uniswap on Ethereum.

BRC-103 (under development)

Relay protocol between BTC, BRC-20 and BRC-100 . Meta-protocols on Bitcoin are heterogeneous and cannot communicate with each other. Different protocols are similar to different chains. They share the security of the Bitcoin blockchain and have different computing capabilities.

Therefore, the BRC-100 protocol stack will publish multiple relay protocols to complete the communication between meta-protocols, different chains and BRC-100, and bridge other protocols and assets on the chain to BRC-100 On the Internet, participate in DeFi and other DApps.

BRC-104

Liquidity mining protocol defines how to obtain token rewards after staking tokens.

The staking token can be any BRC-100 based token, such as the BRC-103 protocol’s liquidity pool token, or it can be the same token as the reward token. Additionally, BRC-104 will support lock-up periods to lock staked tokens.

BRC-105

The airdrop protocol defines how to efficiently airdrop tokens to multiple addresses.

The protocol will use Merkle Tree to complete airdrops to save transaction fees since all original airdrop data does not need to be made public on Bitcoin. Users only need to submit Merkle Proof to prove that they have airdrops during "mint2", and then all indexers can verify the correctness to complete the airdrop.

BRC-106

The decentralized stablecoin pool protocol defines how to generate stablecoins through collateral.

The calculation logic will be similar to MakerDAO3’s DAI on Ethereum.

BRC-107

The lending pool protocol defines how to borrow assets through collateral.

The calculation logic will be similar to Aave on Ethereum.

BRC-108

An automated liquidity protocol for stablecoins.

BRC-109

Decentralized trading protocol for perpetual futures.

BRC-110

EVM is a relay protocol between compatible blockchains and BRC-100, defining how Bridge assets on EVM compatible blockchains to BRC-100.

BRC-111

Bitcoin layer 2 verification protocol, defining how to act like layer 2 on Ethereum Smart contracts also verify Bitcoin Layer 2 proof data.

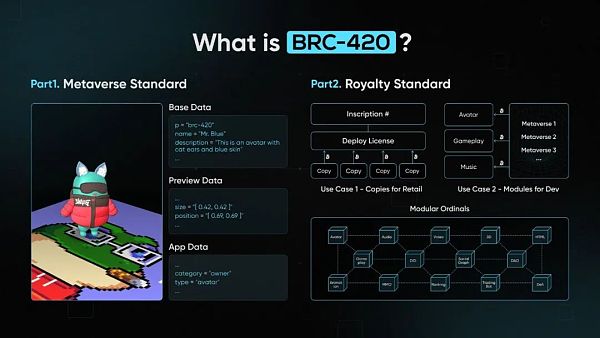

『6』BRC-420 Agreement

Proposal

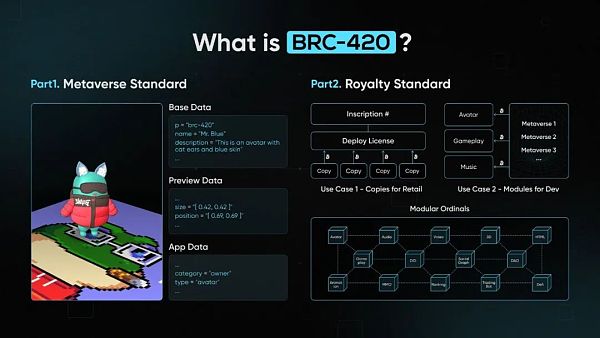

After the BRC-20 protocol was proposed, another new experimental protocol BRC-420 appeared on 2023.9.19, also known as the Metaverse protocol.

https://twitter.com/rcsvio/status/1704118288845013117

Protocol Concept

BRC-420 is an interesting experiment , it is the first metaverse protocol in the Ordinals protocol and is an asset protocol based on the Bitmap protocol.

By combining multiple inscriptions into a complex asset, such as a game item, animations and effects, or a game module in the Metaverse. Created assets ranging from small characters and pets to full game scripts and virtual machines.

Because of the open source nature of these assets on the chain, any client can run or verify them, fully embodying the "Client Agnostic" spirit of the full-chain game.

Source: https://twitter.com/rcsvio/status/1704118288845013117

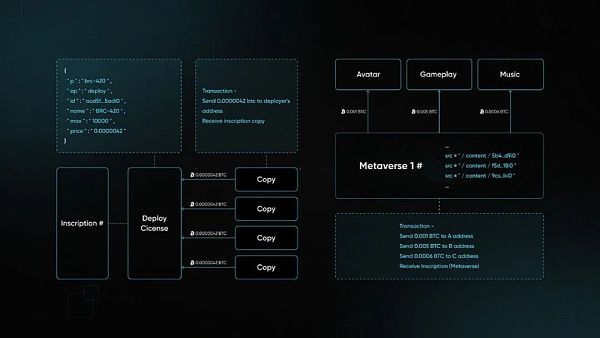

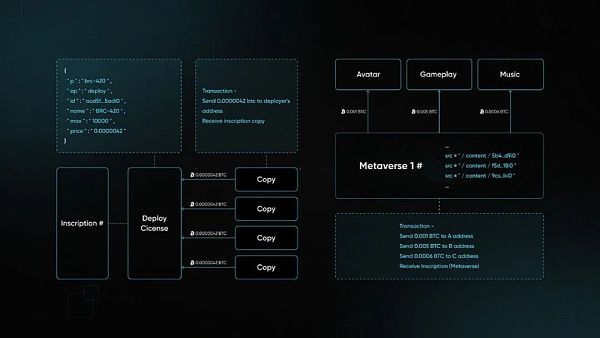

The BRC-420 protocol contains two The first is the Metaverse Standard, and the second is the Royalty Standard. The former defines an open format for assets in the Metaverse, while the latter sets an on-chain protocol for the creator economy.

Source: https://l1f.discourse.group/t/brc-420-introduction-to-brc-420/88

BRC-420 opens up possibilities for Ordinals’ on-chain gaming and modular blockchains. Different creators can contribute different modules, and new creators can innovate based on the innovations of their predecessors. This has led to a proliferation of various innovations within the Ordinals ecosystem, benefiting all participants.

Protocol Development

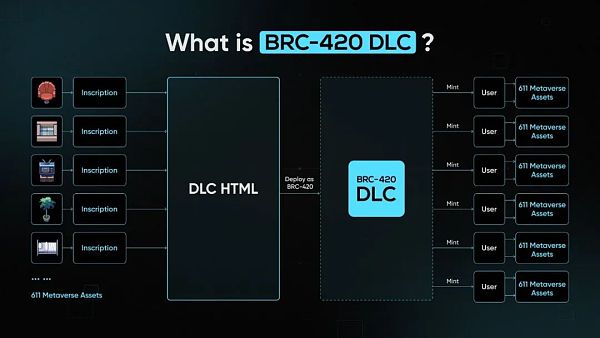

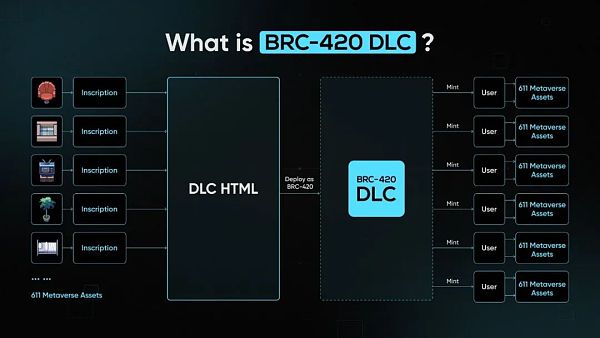

Currently, BRC-420 released the BRC-420 DLC on 2023.11.3, which can convert thousands of meta-inscriptions Integrated into 1 DLC. After deployment, users can earn thousands of meta-assets in a single minting.

Source: https://twitter.com/rcsvio/status/1720444100124831867

7》Runes Protocol

Protocol Proposed

After the BRC-20 protocol came out, Casey felt that it was important to use Bitcoin in Creating fungible tokens on the Internet is not a good idea, 99% of fungible tokens are scams and are not going away anytime soon. Creating a good fungible token protocol for Bitcoin could bring significant transaction fee revenue, developer attention, and users to Bitcoin.

Therefore, Casey proposed the Runes protocol based on UTXO technology on September 26, 2023.

https://twitter.com/rodarmor/status/1706438248606904382

The design of the Runes protocol may also be influenced by ARC20. It chooses to write Token data directly in the UTXO script, which includes Token’s ID, output and quantity.

Obviously, the implementation of Runes is very similar to ARC20, and the token transfer is directly handed over to the BTC main network for processing. The difference is that Runes writes the number of Tokens in the script data, which gives it higher accuracy than ARC20.

But at the same time, the complexity has become higher, making it difficult to directly utilize the composability of BTC UTXO like ARC20.

Protocol development

After the launch of the Runes protocol, since Casey’s development energy was mainly on the Ordinals protocol, the development of the Runes protocol has been It is relatively slow, which is why Benny quickly overtook and developed the Pipe protocol after the release of the Runes protocol.

During the Taiwan Blockchain Week in December, Casey also announced the time when the Runes protocol would be launched on the mainnet at an event in Taipei. At block height 840,000, which is the time of the next BTC halving, Probably at the end of April 2024.

Summary

After researching BTC asset issuance plans, I fully feel their charm, so Let me also share some of my subjective opinions:

1. The issuance of BTC assets has ignited the explosive development of the BTC ecosystem this year, although everyone has mixed opinions about them. But when we look at the development of the BTC ecosystem in the abstract, it is actually inseparable from an important thing - "narrative."

As I mentioned in my previous thoughts, the product needs a good narrative to support it, otherwise it will be easy to face the embarrassing situation of only having the product but no users. This is also proven by major asset issuance plans, such as first is first, the various imaginations that the protocol brings to the ecosystem, official endorsements, etc., which are all concrete manifestations of the narrative.

2. Similarly, we cannot deny the contribution this wave of asset issuance has made to the BTC ecosystem. Although from a technical perspective, most asset issuance solutions may not have any substantial breakthroughs in the limitations of Bitcoin, they not only provide a rare stress test for major public chains, but also bring about some possible routes for Bitcoin's future development.

Through these waves of inscription craze this year, the long-tail effect brought by inscriptions has gradually expanded from the initial Bitcoin to inscriptions on other public chains. With the popularity of inscriptions among the people, we have also felt some shortcomings of the current Bitcoin main network, such as high gas fees, slow transaction speed, etc. This also shows the necessity of BTC expansion plan.

3. Even though the expansion plan has been planned by project parties a long time ago, it has always been tepid. Now more and more users are paying attention to the BTC ecosystem under the craze of Inscription, and This also accelerates the development of BTC expansion plan in disguise.

The current expansion solutions are mainly divided into three categories: side chain/lightning network/native L2, but there is no certain direction that has determined its leading edge, and it is still in the stage of competition with each other. As for the future We can look forward to whether it will blossom more or whether it will be a blockbuster in a certain direction. At the same time, this is also the direction that can be focused on in the future.

4. In the research on asset issuance solutions, there is a very obvious trend, from the launch of the Ordinals protocol at the beginning, to the subsequent BRC-20 improved protocol based on Ordinals, and then to protocols such as BRC- 100 Decentralized Computing Protocol (wanting to continuously expand based on this to introduce the gameplay of the DeFi ecosystem into Bitcoin), BRC-420 Metaverse Protocol (bringing the possibility of introducing games, music, etc. into Bitcoin), ARC-20 (with BRC-20 parallel new asset issuance scheme) and so on.

The asset issuance plan has evolved from making some basic improvements to the existing asset issuance protocol to targeting the needs of the BTC ecosystem (such as oracles, DeFi, games, etc.) based on a certain asset issuance protocol. Make some large-scale ecological layout or even release a new asset issuance agreement to formulate rules.

5. The ecological development of BTC is still in its early stages. Whether it is in Web2 or Web3, there is a phenomenon that whoever masters the power to formulate rules first can have users. Therefore, there are still many wealth opportunities. We must take a comprehensive look at the development of the BTC ecosystem. The craze for inscriptions will eventually cool down. We cannot just focus on the tail of asset issuance, but we should also look at how to use asset issuance. Accelerate the development of the entire BTC ecosystem in other aspects.

Of course there are some different opinions on this aspect, such as teacher NingNing’s views on BTC L2 https://twitter.com/0xNing0x/status/1737010523374563744 , rational discussion.

6. Although it is still in the stage of rushing first and then researching, everyone’s butt determines their head. But I still want to remind everyone to pay attention to risks when investing, and write down your own investment logic clearly. Whether you are pursuing the short term or looking at the long term, different logics and different strategies. When it comes to investing, we should try our best to integrate knowledge and action. I believe in the saying "You will never make money beyond your knowledge, even if you make it now, you will spit it out later."

Finally, thank you for reading this. The original intention of the article is to let everyone have a better and more comprehensive understanding of the development of the BTC ecosystem. If you have any ideas, you are welcome to leave a message directly. interactive.

JinseFinance

JinseFinance

< /p>

< /p>

< /p>

< /p>