Author: YettaS, Partner of Primitive Ventures Source: X, @YettaSing

USDT has become the most important liquidity tool in the offshore market with its wide circulation and huge asset scale around the world, but our questions about Tether have never stopped: Why is Tether the de facto central bank of our industry? Why is the attitude of US regulators so torn - neither completely suppressing it nor giving clear support? What does its existence mean to the US financial market? In this tug of war, where is its breaking point? This article will help you think about the significance of stablecoins from a more macro perspective, which is the premise for breakthroughs in this field.

What kind of good business is Tether?

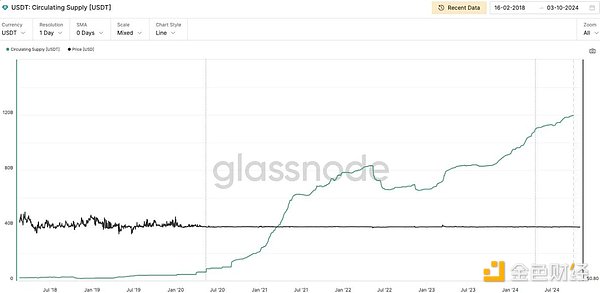

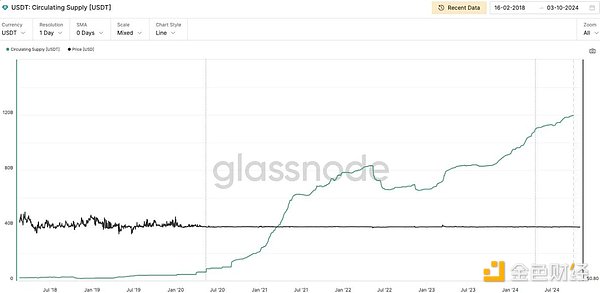

Tether's latest Q3 data shows its super profitability. As of Q3, its total assets reached $125bn, of which US debt was about $102bn, Q3 net profit was $2bn, and the annual cumulative profit was $7.7bn. In comparison, BlackRock's Q3 profit was $1.6bn, Visa's was $4.9bn, and Tether's staff was less than one percent of theirs, but its labor efficiency was more than 100 times theirs.

In fact, Tether did not have a very explosive start, it started with a small demand. At that time, all exchanges were trading BTC pairs, and the prices on both sides were floating, making settlement very inconvenient. Bitfinex discovered this problem and launched USDT as the unit of account (UoA), which was the first scenario it found. In 2019, Sun Ge discovered the demand for stablecoins across exchanges. It was expensive and slow to convert ETH to U, while it was cheap and fast on Tron. Sun Ge immediately began to subsidize the market on a large scale, spending hundreds of millions of yuan (of course from Tron node income) to subsidize TRC20-USDT exchange deposits and withdrawals. At that time, deposits and withdrawals could basically enjoy a 16%-30% return. As a medium of exchange (MoE) for transfers between exchanges, this was the second scenario it found. Everyone knows the subsequent story. USDT was widely adopted by the off-chain world, used as a store of value (SoV) in countries with hyperinflation, and as a medium of exchange (MoE) in various gray areas. Becoming a shadow dollar was its third scenario. After three evolutions, Tether grew with the market value and liquidity of USDT.

Currently, more than 80% of Tether's assets are invested in U.S. bonds, which makes Tether almost have the characteristics of a U.S. government money market fund, that is, high asset security and sufficient liquidity. As a SoV, it is safer than deposits. Deposits have bank asset risks. The impact of SVB's bankruptcy on USDC is an example, while government bonds are the lowest-risk financial products.

At the same time, it is also better than money funds, because money funds do not have a currency settlement function. They are just products for sale and cannot become currency circulation itself. This is also the reason why Tether is so efficient. USDT as MoE is far superior to existing cross-border settlement or payment channels in reducing the friction of currency circulation. As the nominal shadow dollar and the most consensus UoA, various channels and exchange platforms have become Tether workers to help it spread its network to the world.

This is the charm of the currency business. Tether combines payment, settlement, and treasure management to become the actual Federal Reserve in our industry. These are unimaginable before crypto. Its network effect expands with the expansion of liquidity. This is not something that can be subverted by distributing 5% of the yield to users and using token vampire attacks.

Speaking of this, we can understand why Paypal wants to issue stablecoins, because with the expansion of its business, it has realized capital precipitation and payment and settlement, and stablecoins are the best carrier for all of this. From another perspective, wouldn't American banks and monetary funds be jealous of this business?

From Too Big to Fail to Too Deep to Fail

It is actually very simple for the United States to get rid of Tether, because the custody of U.S. debt is very centralized, and Tether has been investigated by the Department of Justice since 2021, and was transferred to Darmian William, a popular fried chicken prosecutor in the Southern District of NY at the end of 22 (basically all high-level crypto crime cases are in his hands, including the SBF case), so it is not that they cannot, but that they do not want to. So what is the reason for not wanting to?

First, there is the liquidity risk of the U.S. debt market. 80% of Tether's assets are U.S. Treasury bonds. If the regulator takes extreme restrictive measures on it, causing Tether to have to sell U.S. debt on a large scale, this may trigger turmoil or even collapse in the U.S. debt market. This is too big to fail.

More importantly, USDT is the global expansion of the shadow dollar. In areas with severe inflation around the world, USDT is regarded as a means of storing value; in areas with financial sanctions and capital controls, USDT becomes a circulating currency for underground transactions; it can be seen in terrorist organizations, drugs, fraud, and money laundering. When USDT is used in more countries, more channels, and more scenarios, its anti-fragility will be greatly improved. This is deep but not falling.

The Federal Reserve must be happy to see this. On the surface, the Federal Reserve has the dual mission of maintaining price stability and achieving full employment, but at a deeper level, it is to strengthen the hegemony of the US dollar and control global capital flows. It is the widespread circulation of USDT and USDC that has helped the US dollar expand offshore liquidity. USDC is a regulated US dollar on/offramp tool, while USDT has penetrated the US dollar into the world with its extensive channels. USDT's underground banking system and gray remittance services are actually facilitating the circulation of US dollars and cross-border payments. This helps the United States continue to play a leading role in the global financial order, and the hegemony of the US dollar has been further deepened.

Where does the resistance to Tether come from?

Although Tether has helped the continuation of US financial hegemony in many ways, its game with US regulators still exists. Hayes once said that "Tether can be closed by the US banking system overnight, even if it does everything according to the rules."

First, it cannot support the monetary policy of the Federal Reserve. As a fully reserve stablecoin, Tether will not adjust liquidity with the Federal Reserve's monetary policy and cannot participate in the Federal Reserve's quantitative easing or monetary tightening like commercial banks. Although this independence has enhanced its credit, it also makes it difficult for the Federal Reserve to achieve its monetary policy goals through it.

Second, the Ministry of Finance should be wary of it causing turmoil in the US bond market. If Tether collapses due to an unexpected event, it will have to sell a large amount of US debt, which will bring great pressure to the US debt market. This was widely discussed at the Treasury Borrowing Advisory Committee on October 29. Is it possible to tokenize US debt directly through some methods to reduce the impact of USDT on the US debt market?

Finally and most importantly, Tether is actually squeezing the living space of banks and money funds. The high liquidity and high returns of stablecoins have attracted more and more users, and the deposit absorption capacity of banks and the attractiveness of money funds have been greatly challenged. At the same time, Tether's business is too profitable, so why can't banks and money funds do it? The Lummis-Gillibrand Payment Stablecoin Act was proposed in April this year, which encourages more banks and trust institutions to participate in the stablecoin market. This is a strong proof.

The development of Tether is actually a magnificent struggle history. The regulatory arbitrage with original sin has given it huge development opportunities and space. Now there are finally some wrestling to start competing with the old forces. No one can say where it can go, but any breakthrough innovation is a redistribution of the power and interest structure of the past.

The possibility of a super-sovereign monetary system

To surpass the US dollar system, Tether's future is not only to maintain the global payment and liquidity role, but also to think more deeply about how to build a real super-sovereign monetary system. I think the key lies in its peg to BTC. In 2023, Tether took the lead in taking this step and used 15% of its profits to configure Bitcoin. This is not only an attempt to diversify its asset reserves, but also a fact that makes BTC an important part of supporting its stablecoin ecosystem.

In the future, as Tether's payment network expands and BTC deepens as a super-sovereign currency in the global market, we may witness a brand new financial order.

A revolution often starts from the edge, sprouting in the cracks of the decaying faith in the old era. The worship of Rome has made the dominance of Roman civilization into a "self-fulfilling prophecy". The birth of new gods may be random, but the twilight of old gods is already doomed.

Catherine

Catherine