On May 30, the Hong Kong government published the Stablecoin Ordinance in the Gazette, marking the countdown to the official issuance of the Hong Kong version of stablecoins. For those who are concerned about the Hong Kong version of stablecoins, I think the most concerned issues may be these two: First, I have a certain amount of capital and experience. Do I have the opportunity to become a Hong Kong version of stablecoin issuers and participate in this lucrative business? Second, as a user, how can I effectively use the Hong Kong version of stablecoins to facilitate my life?

How to become an issuer of the Hong Kong version of stablecoins

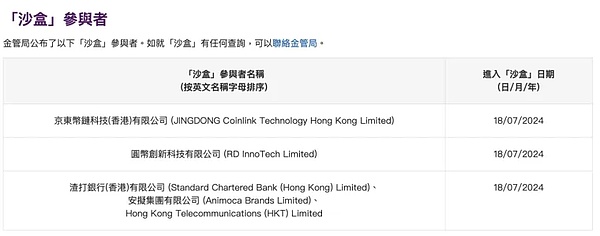

According to the currently public information, the Hong Kong Monetary Authority has selected three entities as potential issuers of the Hong Kong version of stablecoins, namely JD CoinChain Technology (Hong Kong), Yuancoin Innovation Technology, and Standard Chartered Bank (Hong Kong) and Animoca, Hong Kong Telecom. Since July 18, 2024, the Hong Kong Monetary Authority has allowed the above three entities to test their stablecoin issuance plans within a specific scope through the "regulatory sandbox" and communicate with regulators in real time. So far, the Hong Kong Monetary Authority has not announced any new participants other than the three entities. According to the requirements, the issuance of stablecoins in Hong Kong or the issuance of stablecoins pegged to the Hong Kong dollar outside Hong Kong requires the permission of the Hong Kong Monetary Authority.

Figure 1 Sandbox Participants

1. Key points of application conditions

Applicant: A company registered in Hong Kong or a recognized corporate body registered outside Hong Kong must provide its main business address and contact information in Hong Kong.

Personnel requirements:The CEO, directors, stablecoin managers and other management of the licensed company need to have appropriate knowledge and experience.

Capital requirements:Minimum paid-up capital of HKD 25 million or equivalent currency, and sufficient high-quality, high-liquidity reserve assets to ensure the full redemption capacity of stablecoins under any circumstances. In principle, an applicant can issue multiple categories of stablecoins, and the corresponding reserve assets should be held with the same reference assets as the stablecoins of that category. In other words, if the Hong Kong dollar stablecoin is issued, the corresponding reserve assets should generally be Hong Kong dollar assets.

Asset custody:The reserve assets are deposited in a custodian approved by the government and isolated from other categories of assets.

Redemption mechanism:Disclose the redemption mechanism to the public in a timely manner, do not restrict redemption, and do not charge redemption fees other than handling fees.

Risk control system:Have AML&CTF compliance plans and measures, and security risk control policies for user information and records.

Information disclosure:Publish a white paper for each type of stablecoin issued, and disclose monthly and annual reports (financial status, reserve asset status), and notify the HKMA in advance of major changes in operating conditions (including loss of debt repayment ability, change of filing address, difficulty in maintaining the minimum standards for licensing, etc.).

Audit requirements:Accept independent audits every year.

Compliance requirements:Including paying the license fee within the prescribed time, displaying the license number on the market promotion materials, always meeting the minimum standards for the issuance of the license, timely reporting when unable to fulfill the repayment obligations, timely reporting of address changes, and timely reporting of major changes in business conditions.

2. Application procedures

Competent authority: Hong Kong Monetary Authority.

From the information currently published, if you want to become the issuer of the Hong Kong version of the stablecoin, you generally need to go through the following two steps.

The first step is to apply to become a participant in the "regulatory sandbox". The HKMA will consider a series of factors in assessing the "Sandbox" application, mainly including: the applicant has a genuine intention and reasonable plan to issue a legal currency stablecoin in Hong Kong, the applicant has a specific plan to participate in the "Sandbox", and the applicant has a reasonable expectation of meeting regulatory requirements.

The second step is to apply for a stablecoin issuance license. The applicant must submit the application materials in accordance with the above application conditions.

3. Application results

The HKMA may approve the license unconditionally, approve the license conditionally, or reject the application based on the applicant's application. Once issued, the approved license will remain valid unless revoked.

How to use the Hong Kong version of stablecoins to facilitate production, operation and life

At present, there is no official introduction on how to exchange and use the Hong Kong version of stablecoins, whether from the Hong Kong Monetary Authority or the three entities selected to participate in the "Regulatory Sandbox". However, from the interview with Liu Peng, CEO of JD.com CoinChain Technology, after the Hong Kong Legislative Council passed the Stablecoin Bill on May 21, we can see some of the general operating modes of JD.com Stablecoin.

It is reported that JD.com Stablecoin is based on the public chain. The first phase of the plan is to issue stablecoins anchored 1:1 between the Hong Kong dollar and the US dollar. It has entered the second phase of sandbox testing and provides mobile and PC application products for retail and institutions, mainly including cross-border payment, investment trading, retail payment and other applications. JD.com Stablecoin is positioned to become a global payment infrastructure.

In the field of cross-border payment, the transaction speed can be achieved in seconds at the fastest, eliminating most of the intermediate costs of cross-border payment, and providing services uninterrupted throughout the year.

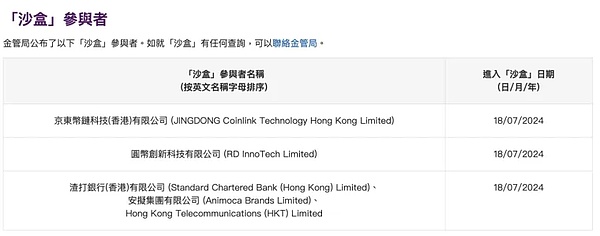

In the field of investment and trading, JD.com Stablecoin will provide services through cooperation with leading compliant exchanges. It is worth noting that as of now, the Hong Kong Securities and Futures Commission has issued a total of 10 virtual asset exchange licenses, and there are 8 applicants waiting for the approval of the Hong Kong Securities and Futures Commission for licensing.

Figure 2 Licensed virtual asset exchanges announced by the Hong Kong Securities Regulatory Commission

In the field of retail payment, JD Stablecoin is mainly connected and tested through acquiring scenarios such as JD Hong Kong and Macau.

Pay attention to the risks of differences in regulatory policies between the Mainland and Hong Kong

Currently, the legislation and testing of stablecoins in Hong Kong are in full swing, and the official issuance of the Hong Kong version of stablecoins is no longer far away. The Hong Kong courts have also clearly protected the legitimate rights and interests of parties involved in currency disputes through many cases.

Typical cases include: in the case of investors suing JPEX platform for compensation, the judge determined that the platform violated its fiduciary duty and ordered the platform to compensate investors for their losses; in the case of WORLDWIDE A-PLUS LIMITED suing two wallet addresses for fraud, the Hong Kong court approved the injunction against the wallet address holder when the plaintiff could only provide the defendant's wallet address but did not know the defendant's true identity, and sent the injunction to the wallet by tokenizing it. Any behavior of trading with the wallet address without complying with the injunction constitutes contempt of court.

In contrast, the current regulatory attitude of the mainland towards virtual currencies, including stablecoins, has not shown a trend of relaxation or shifting. In the mainland, virtual currencies are still not regarded as currencies under any circumstances. Once disputes arise about the sale, investment, and trade settlement of virtual currencies, the vast majority of courts still tend to not accept or reject the claims and require the parties to bear the risks themselves. This is particularly evident after the relevant guiding cases were launched in the People's Court Case Library, which is a great test of the skills of the lead lawyers in representing related disputes. However, for criminal cases involving theft, fraud, and robbery of virtual currency, the public security department will generally regard virtual currency as an asset and will file a case.

Anais

Anais