Author: Sean, Techub News

Recently, the cryptocurrency market has experienced a long-awaited rise. , Bitcoin has increased by 23% in a single month, Ethereum has increased by 24% in a single month, and some altcoins have even increased several times or even dozens of times.

While the market is in full swing, some institutional investors have begun to operate in the opposite direction. Ark Invest, a well-known international investment management institution, has recently been frantically selling shares of Coinbase (COIN), the largest cryptocurrency exchange in the United States. stock. How much did it sell off? Does this mean that Ark Invest is no longer optimistic about the sustainability of Bitcoin and the cryptocurrency market’s rise in the short term?

Ark Invest has reduced its holdings of Coinbase stocks by more than 100 million US dollars this month< /strong>

In just 20 days, Ark Invest sold more than $150 million worth of Coinbase shares (COIN).

On December 4, 2023, Ark Invest made its first selloff of COIN of the month, with Ark Invest selling 7,248 shares at a closing price of $140, for a total value of approximately $1.01 million.

On December 5, Ark Invest sold 201,711 shares at a closing price of $140.10, for a total value of approximately $28.46 million.

On December 6, Ark Invest continued to sell COIN. Its three funds, ARKK, ARKW, and ARKF ETFs, sold a total of 180,422 Coinbase shares at the closing price of $134.63 that day. This time, Ark Invest sold Received $24.3 million.

On December 8, Ark Invest executed the largest COIN sell-off since July this year. Ark Invest sold 335,860 Coinbase shares at a closing price of $146.62, most of which came from ARKK. This sale In exchange for cash flow of US$49.2 million.

However, the cash raised from the sale was slightly less than the cash raised from the July sale. In July Ark Invest sold 480,000 Coinbase shares for $50.5 million in cash.

Beginning on December 11, Ark Invest sold 13,687 Coinbase shares at a closing price of $137.35 for $1.88 million in cash.

On December 12, Ark Invest made $11.5 million from the sale of 82,255 Coinbase shares at a closing price of $139.62.

On December 15, Ark Invest raised $1.796 million from the sale of 12,142 Coinbase shares at a closing price of $147.9.

On December 19, Ark Invest raised $4.615 million from the sale of 28,638 Coinbase shares at a closing price of $161.16.

On December 20, Ark Invest raised $21.492 million from the sale of 132,782 Coinbase shares at a closing price of $161.86.

According to incomplete statistics, as of press time, Ark Invest has sold more than $150 million worth of Coinbase shares since December.

When should a position be opened for a sold stock?

Ark Invest has been increasing its holdings of Coinbase (COIN) stocks since January this year. The time and price of some of its large positions are as follows:

2023 On January 11, Ark Invest purchased 74,792 shares of Coinbase stock at the closing price of $43.79.

On February 10, 2023, Ark Invest purchased 139,105 shares of Coinbase stock at the closing price of $57.09.

On February 23, 2023, Ark Invest purchased 181,972 shares of Coinbase stock at the closing price of $61.18.

On February 24, 2023, Ark Invest purchased 128,396 shares of Coinbase stock at the closing price of $58.44.

On March 9, 2023, Ark Invest purchased 301,437 shares of Coinbase stock at the closing price of $58.09.

On March 23, 2023, Ark Invest purchased 230,599 shares of Coinbase stock at the closing price of $66.30.

On March 24, 2023, Ark Invest purchased 158,833 shares of Coinbase stock at the closing price of $67.83.

On June 6, 2023, Ark Invest purchased 329,773 shares of Coinbase stock at the closing price of $51.56.

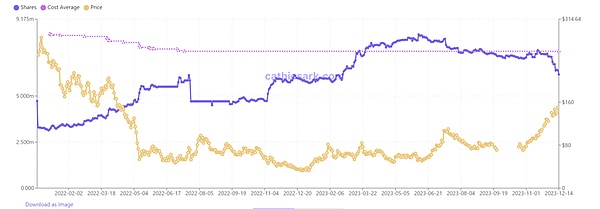

According to Cathie's Ark data, since the beginning of the year, Ark Invest has been The largest number of Coinbase shares is held on a daily basis, reaching 8.34 million shares. As of December 20, Ark Invest still held 6.19 million Coinbase shares.

Cathie's Ark data also shows that Ark Invest's average holding cost of Coinbase stocks is $254.65. Interestingly, Ark Invest has begun to sell Coinbase stocks one after another since July this year.

It is worth noting that, in addition to Ark Invest, on July 6 this year, several Coinbase executives, including Coinbase CEO Brian Armstrong, sold a total of 88,058 Coinbase shares. Profit was approximately US$6.9 million. Among these executives, Coinbase Chief Accounting Officer Jennifer Jones even sold 74,375 shares as early as June 29, making a profit of $5.2 million.

Cathie Wood: Reducing holdings does not mean that we are not optimistic about the market outlook

Cathie Wood said when asked "the reason for selling Coinbase stock" at the Bloomberg Daybreak Asia conference , "Ark Invest is very optimistic about Coinbase, especially considering the outcome of the U.S. court's ruling on the Ripple vs. SEC case. Ark Invest took this action to achieve investment returns and reallocate funds to other investors."

So is Cathie Wood really "adjusting positions", or is she just "feinting" to continue cashing out?

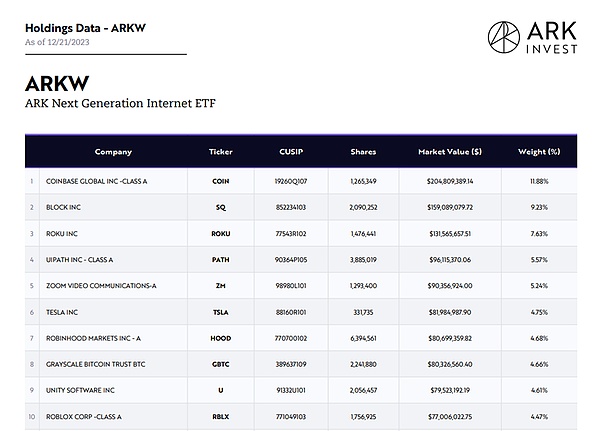

There is a set of data that may truly reflect Cathie Wood’s thoughts. The latest ARK Next Generation Internet ETF position statistics show that although Ark Invest has reduced its holdings of some COIN, Ark Invest’s position allocation to Coinbase stocks is still It ranks first, accounting for 11.88%.

At the same time, we can also find from the position ratio that Ark Invest has Degree Bitcoin Trust’s holdings accounted for 4.66%, which means that its investments in Coinbase (COIN) and Grayscale Bitcoin Trust accounted for more than 16% of the total position. This seems to show that Ark Invest has not lost confidence in the cryptocurrency market. It's just a move to adjust positions in response to market conditions.

Bitcoin has started a wave of surge since the second half of this year. The first factor may be the rising market expectations for U.S. regulators to approve the country’s Bitcoin spot ETF, thus expanding the potential for cryptocurrency investors. Investment volume; the second factor may be the rapid increase in expectations for the Federal Reserve to cut interest rates in 2024.

At the same time, Ark Invest is competing with other traditional giants in the financial industry (BlackRock, Fidelity, Invesco, etc.) to be the first to apply for a spot Bitcoin ETF. Since Ark Invest submitted its application before other financial institutions, it may be the first to receive approval for a Bitcoin spot ETF application.

Based on Ark Invest’s position data, Cathie Wood’s personal remarks, and Ark Invest’s buying and selling of Coinbase stocks, it can be seen that Ark Invest’s buying and selling behavior of Coinbase stocks is most likely just “buy low, sell high.” part of a trading strategy. In fact, leading international investment management institutions generally have profit as their primary goal. Therefore, Ark Invest’s trading behavior on Coinbase stocks can be regarded as a normal event without obvious subjective emotions.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan Others

Others Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph