Author of the article:Marco Manoppo Article translation:Block unicorn

Background

"Madness is rare among individuals, but the norm among groups, parties, nations and ages." —— Friedrich Nietzsche

Markets are turbulent. As Singaporean Prime Minister Lawrence Wong has said, the US is effectively abandoning the economic system it created. What was once the cornerstone of the global economic system is now being effectively dismantled. I think if this is not resolved soon, more will fall apart.

Cryptocurrency has always been a macro-first asset. Bitcoin.

In short – Bitcoin as an asset is a hedge against geopolitical uncertainty as it is the strongest form of money, supposedly stronger than gold. So far, this thesis has not panned out, with Bitcoin trading more like the beta of the Nasdaq and being massively outperformed by gold during turbulent times. Will this time be different?

Tariffs Simplified

If you want to witness intellectual ego-gratification, there is no better time than to browse Twitter at a time like this, as everyone suddenly becomes a macro expert. I am not here to confuse your mind further, so let me offer some facts and observations.

TariffsTariffs—by their very nature—create inefficiencies, raise consumer prices, and distort free markets, leading to retaliatory economic actions and escalating conflicts.

A notable example occurred in the 1980s, when President Ronald Reagan, although he initially implemented tariffs on certain industries, later recognized their drawbacks. In a 1987 radio address, Reagan noted: ”Protectionism becomes destruction; it costs jobs.”

Why Tariffs Aren’t Great

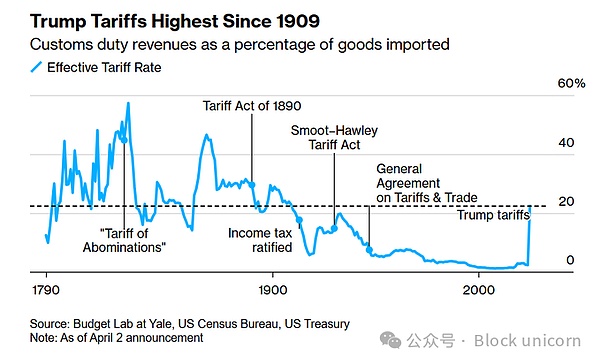

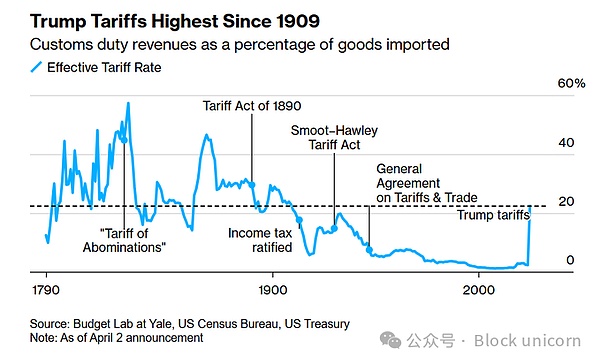

First, Trump’s current effective tariffs are the highest in more than 100 years — but the arguments against them go far beyond that:

Economic impact and inflation. At their core, tariffs are taxes on imported goods, paid by domestic importers, with those costs often passed on to consumers. Historical and contemporary evidence consistently shows that tariffs directly lead to higher prices for consumers. For example, recent U.S. tariffs will result in an average tax increase of more than $2,100 per household, according to the Tax Foundation. The Yale Budget Lab estimates the impact could be as much as $3,800 per household per year.

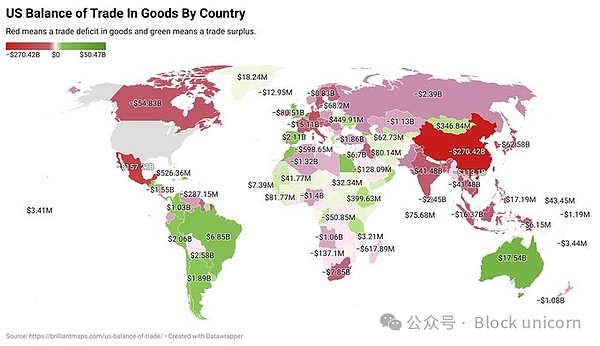

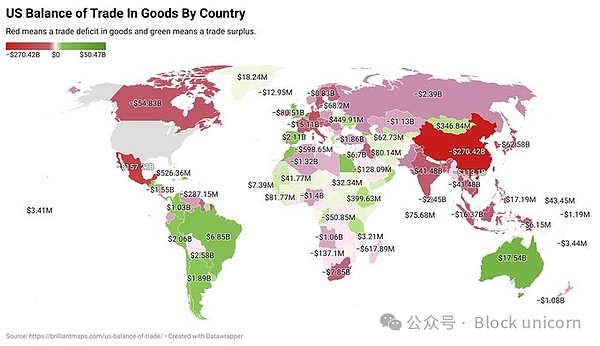

Misunderstanding of trade deficits. One of the core arguments made by tariff supporters is the existence of large trade deficits. However, trade deficits in themselves do not mean that the economy is weak or exploited.

They simply indicate that a country is importing more goods than it exports, a situation that is often driven by strong consumer demand, a strong currency or a comparative advantage in services rather than goods.

For example, the United States has long enjoyed significant surpluses in high-value services such as finance, technology, and advanced manufacturing. Imposing tariffs to correct a goods trade deficit, especially when many countries simply do not have the wealth or demand to import American products, would only artificially raise prices for American consumers.

Even countries with trade surpluses with the US are being hit by tariffs.

Historical consequences of tariffs. Historically, protectionist tariffs have often led to recessions rather than booms.

Famous examples include the Tariff Act of 1828 and the infamous Traditional governments even have difficulty accurately tracking digital services and intangible economic activity in their surplus and deficit calculations. Cryptocurrency takes this to a whole new level, covering digital activities and transactions that transcend national borders, tariffs, and political frictions.

Technically, we still need to figure out how to properly combine the on-chain properties of cryptocurrencies with new business models (quoting my previous argument), but this is still a work in progress.

Finally, in a world where it is unclear how governments will act, or whether they will act in the best interests of their constituents, how do sovereign individuals around the world decide how to allocate their resources?

Long live Bitcoin and stablecoins - and other altcoins, you have a lot of work to do.

Weiliang

Weiliang