Author: Johnnatan Messias, Aviv Yaish, Benjamin Livshits Translation: Block unicorn

Airdrops are a common strategy used by blockchain protocols to attract and expand early user bases. Typically, protocols distribute tokens to specific users as "rewards" for participating in the protocol in the hope of cultivating long-term community loyalty and sustained economic activity. Despite the widespread existence of airdrops, there is a lack of in-depth understanding of the key factors for successful airdrops. This paper outlines the design space for airdrops and presents key results for implementing effective strategies. We evaluate the success of six large-scale airdrops by analyzing on-chain data from them and find that large amounts of tokens are often quickly sold by "airdrop farmers." Based on these analyses, we summarize common pitfalls and provide guidelines for improving airdrop design.

Blockchain protocols often design reward programs to attract new users and enhance the loyalty of existing users. In recent years, distributing tokens minted by platforms, commonly known as "airdrops", has become widely popular. For example, in 2023 alone, the total value of airdropped tokens received by users through various protocols reached $4.56 billion. Despite the widespread use of airdrops in the blockchain space, our preliminary research shows that there is no significant correlation between airdrops and the popularity of platforms relative to existing alternatives. Intuitively, this practice is not ideal and may result in the loss of funds that could have been used to improve the platform's quality of service (QoS).

While the basic concept of airdrops is relatively simple, the design space for such reward schemes is very broad, and the specific implementation may vary depending on the characteristics of the platform. For example, some airdrop mechanisms focus on "core users" and issue them large rewards, hoping that these users will stimulate valuable economic activity and attract more users. However, this approach may bring potential problems: when tokens give users the power to propose changes to the protocol through decentralized governance, a "one token one vote" strategy is usually adopted, and a single user may hold multiple voting tokens. This raises the risk of centralization of voting power, that is, a small number of users hold the majority of decision-making power.

To understand why previous airdrops have not always achieved their intended goals and to quantify their success, we first elaborate on a range of plausible airdrop expectations. We then review previous airdrops, assessing their performance and revealing some interesting insights in the process, comparing them to baseline expectations. Specifically, we analyze data from five popular airdrops (ENS, dYdX, 1inch, Arbitrum, Uniswap) and one fake airdrop conducted by a Sybil farmer (Gemstone). We conclude that the majority of tokens (up to 95%) were sold through exchanges soon after the airdrop, suggesting that these airdrops failed to achieve their intended purpose and that the main beneficiaries were “airdrop farmers” — highly professional users who used complex strategies to increase their share of tokens. In addition, we describe common challenges faced by past airdrops. Given that the airdrop phenomenon is relatively new and understanding of its theory and practice is still in its infancy, previous airdrops may not have been fully successful in the long run. Finally, based on our analysis, we offer suggestions for improving the airdrop mechanism in order to create a fairer airdrop mechanism for honest users.

Block unicorn Note: The "airdrop farmers" referred to in the article are those who interact automatically through computer scripts or manually operate dozens of accounts, which are defined as "airdrop farmers".

Our contributions are summarized as follows:

▶Arbitrum Research

We conducted a comprehensive case study on the Arbitrum airdrop by measuring elements such as transaction volume, token distribution structure, and token value before and after the airdrop. We observed that the total daily fees increased significantly during the airdrop event. However, the number of transactions per address of Arbitrum decreased after the airdrop. In contrast, other protocols without airdrops performed better than Arbitrum.

▶Quantitative Analysis

We performed a quantitative analysis of ENS, dYdX, 1inch, Arbitrum, Uniswap, and a fake airdrop called Gemstone. The results show that most of the funds raised through these airdrops were sold on exchanges rather than used to create dapps or user interactions on the platform. 36.62% of ENS tokens were sold, 35.45% for dYdX, and 54.05% for 1inch. Typically, tokens were sold within an average of 1 to 2.34 transfers after being received, with a median of 2 transfers.

▶ Qualitative Analysis

We performed a qualitative analysis of past airdrops and proposed guidelines for future airdrop design to address the issues we identified. We focus on airdrop farming and distribution of governance tokens via airdrops. To counter these issues, we propose alternative incentives, such as providing users with fee discounts for subsequent interactions in blockchain protocols.

▶ Multi-chain Empirical Data

We collect data on two major Ethereum Rollup networks that are less studied in the literature, Arbitrum and ZKsync Era, and also collect and label data on major airdrops. We plan to share our dataset and scripts in a publicly accessible repository.

Goals of Airdrops

Airdrops are a powerful tool for promoting protocols, acquiring users, attracting new people, and incentivizing existing users to participate in these protocols and their applications. They are widely used for these purposes and there are many cases documented in the literature (see Table 1). Protocols can create tokens and distribute them to users via airdrops. For example, blockchain Rollup solutions such as Arbitrum, Optimism, and ZKsync Era, as well as DeFi applications such as Uniswap, 1inch, dYdX, and ENS, have used airdrops.

Airdrops can come in a variety of forms, with single-round and multi-round distribution being the most common. In a single-round airdrop, tokens are distributed to users all at once, while multi-round airdrops are distributed over multiple rounds, with different strategies in each round. This approach can leverage insights from previous rounds to address challenges encountered, such as mitigating potential Sybil attacks (i.e., multiple accounts controlled by a single entity) by observing past user behavior patterns. The choice of single-round or multi-round airdrops depends on the goals of the protocol and the dynamics of the community.

In addition, the timing of an airdrop has a significant impact on the number of eligible users who receive the tokens. Mature protocols may have a larger user base when they delay airdrops than when new projects airdrop early. This difference in the size of the user base introduces complexity when performing Sybil detection, as there are more accounts to evaluate and potentially protect against. Failure to do so can affect community satisfaction, as the protocol may accidentally reward accounts associated with industrial farming, which may be viewed negatively by the community. To mitigate this issue, LayerZero Labs has implemented a self-reporting mechanism. Under this system, Sybil attackers can choose to self-report and receive their 15% share of token allocations.

Table 1. This table shows the start date, end date, blockchain, airdrop type, and project type for the six airdrop projects.

Next, we break down the high-level goal of the airdrop—starting a user community—into multiple sub-goals. These sub-goals are not independent of each other, and there may be other worthy goals to pursue; we focus on these goals because they reveal interesting problems facing common airdrop mechanisms.

Short-term user acquisition.

Historically, airdrops have been used by emerging blockchain protocols to build an initial user base and provide an initial liquidity boost to the underlying chain and its protocol. Decentralized platforms in particular tend to become more attractive and valuable to users as economic activity increases, promoting long-term participation.

Starting an initial user base is important, but not sufficient to sustain high levels of economic activity over the long term. Ideally, users should become daily active users of the platform. This can be achieved by issuing rewards that can only be used within the blockchain protocol or application, similar to airline frequent flyer points. For example, in layer-2 blockchains, fee discounts on future transactions can be provided. Other measures that may help include multiple rounds of airdrops and rewarding users for completing specific "missions" that provide users with a deep understanding of the functionality provided by the protocol. For example, Linea's airdrop missions provide users with an opportunity to deeply experience its features and use cases.

Target users who create value for the platform.

Airdrops should focus on users who can contribute the most to the long-term sustainability of the platform. In protocols that rely on users to provide liquidity, this may refer to users who provide the most liquidity to lending pools and decentralized exchanges, or users across multiple tokens. In Rollup, particularly valuable users may be "creators" who deploy popular and useful smart contracts, or users who bridge tokens to Rollup across chains. Such users provide additional use cases for the platform, thereby attracting more users.

Post-trade market analysis

The motivation for this quantitative analysis stems from the observation that airdrop recipients often quickly sell their tokens and leave in a short period of time, which obviously goes against the original intention of the airdrop. Analysis of decentralized exchange (DEX) airdrops shows that recipients sometimes sell all of their tokens shortly after receiving them. For example, after the ParaSwap airdrop, 61% of the tokens were sold quickly.

In both cases, most recipients stopped using the relevant blockchain protocol within a few months. This pattern suggests that airdrops are ineffective in maintaining long-term participation of recipients or that there are a large number of Sybil accounts among recipients. Moreover, rapid sell-offs can disrupt the market, especially if the market interprets them as a signal of declining confidence in the future prospects of the protocol. Here, we analyze data related to six airdrops (see Table 1) collected from node archive records of Ethereum, Arbitrum, and ZKsync Era (see Appendix 0.A for details on data collection). To identify exchanges, we used a list of 620 exchange account addresses obtained from Dune and Etherscan.

Table 2: Allocation statistics for the six airdrops. Note that protocols typically send a large amount of airdropped tokens to addresses they control. See Table 4 in Appendix 0.D for details on the top gainers.

Token Distribution Time

Quantitative insights into the distribution of airdropped tokens across the user base are provided in Table 2. Our analysis reveals a large number of recipients for each airdrop, hinting at the possible presence of airdrop farmers (see column 5 of Table 2). In addition, the data shows that tokens are frequently traded on exchanges, which is supported by the observation that the first transfers by recipients after the airdrop are often to sell tokens on exchanges (see column 4 of Table 2). In particular, the case of Gemstone stands out, with 95% of its tokens sold on exchanges. In this case of Gemstone, the airdrop was initiated by a non-open-source decentralized exchange created by airdrop farmers.

In addition, the Gemstone airdrop far exceeded other airdrops in the number of tokens distributed. This large-scale distribution also resulted in a much higher median airdrop per recipient than other airdrops (see Table 2). Notably, Gemstone distributed 99.53% of its total supply in its airdrop campaign. It is important to emphasize that Gemstone was primarily executed as a Sybil attack rather than a legitimate airdrop.

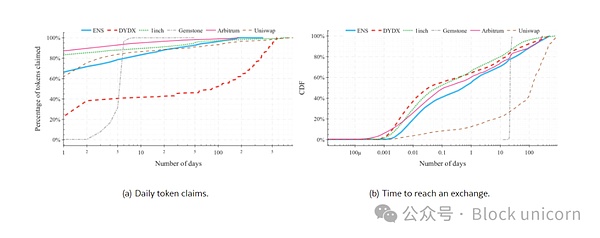

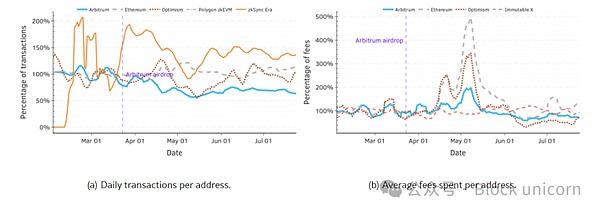

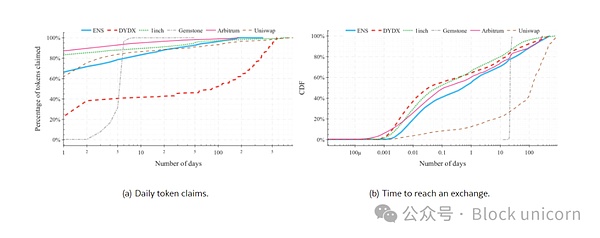

Figure 1: Comparison of token claims and transfer patterns after the airdrop: (a) daily token claims; (b) time required to reach exchanges.

Of all the airdrops analyzed in this study, the Arbitrum airdrop exhibited the fastest speed of user token claims. Figure 1(a) shows the distribution of accounts claiming tokens daily. Arbitrum conducted a massive airdrop, distributing 1,162,166,000 ARB tokens to 625,143 selected accounts. Of these, 583,137 accounts (93.28%) successfully claimed 94.03% of the ARB allocation. Remarkably, 72.45% of accounts completed the token claim on the first day, and another 14.41% of accounts completed it on the second day. Cumulatively, almost 87% of accounts claimed Arbitrum’s tokens within the first day after the airdrop was released, indicating that most participants were highly engaged and acted quickly.

Table 3. Gemstone and 1inch are exceptions, with a median of 1 hop to an exchange, while other protocols show a median of 2 hops to connect airdrop recipients to exchanges.

Users typically interact with exchanges to convert one token to another or to sell them. To assess how often airdrop recipients sell these tokens for a profit through exchanges after receiving them, we analyzed users’ interactions with exchanges after the airdrop. Table 3 shows that the majority of airdrop recipients traded with exchanges, ranging from a low of 83.79% for ENS to a high of 99.93% for Gemstone.

In addition, Table 3 shows the shortest path from each airdrop recipient address to any exchange address in our dataset. Our study found that the transfer of tokens to exchanges typically involved only a few steps, suggesting that airdrop recipients did not make significant efforts to conceal their activities. Gemstone was a notable exception, where all tokens were sold within a single hop. Surprisingly, most accounts reached an exchange via relatively few intermediate steps (typically 2 hops). This observation highlights the critical role of exchanges in the cryptocurrency ecosystem.

Most accounts swapped their tokens within approximately 1 million blocks after the airdrop. Gemstone has significantly higher block counts than other projects due to developer-introduced delays. Given the different block generation times of Ethereum (a new block is generated every 15 seconds) and ZKsync, we normalize block times to days. As can be seen in Figure 1(b), 66.09% of 1inch accounts interacted with an exchange within a day. In comparison, ENS had an interaction rate of 55.15%, dYdX had 64.26%, Arbitrum had 60.34%, and Uniswap had 12.39%. This rapid transaction behavior is inconsistent with one of the main goals of the protocol to conduct airdrops, which is to promote continuous user participation. The rapid redemption of tokens indicates that users may leave the protocol quickly after receiving the airdrop.

Token Distribution Diagram

To better understand the transfer structure that occurs to each address after receiving the airdropped token, we analyzed the transfer network. It is represented as G(V, E), where each node (V) represents an address, and when a token is transferred from one address to another, an edge (E) is established. Specifically, the ENS network contains 184,585 nodes and 608,462 edges, the dYdX network contains 112,853 nodes and 406,027 edges, the Gemstone network contains 20,014 nodes and 240,113 edges, and the 1inch network contains 308,329 nodes and 1,400,913 edges. While Arbitrum contains 2,025,898 nodes and 27,438,608 edges, Uniswap’s network has 1,180,830 user addresses and 3,762,613 token transfer records associated with it.

To make these graphs easier to visualize, we limited the number of jumps in the data to one jump from any address that received a protocol airdrop and plotted their largest components in the first few hours after the airdrop, as shown in Figure 7 in Appendix 0.B. We manually labeled nodes with high in-degree using labels provided by Etherscan, a popular blockchain browser. The results show that, except for Gemstone, the decentralized exchange that received the most transfers (measured by in-degree) across all protocols is Uniswap, followed by SushiSwap.

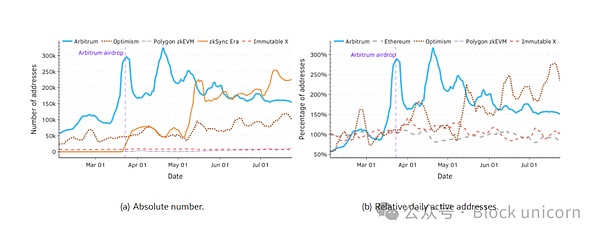

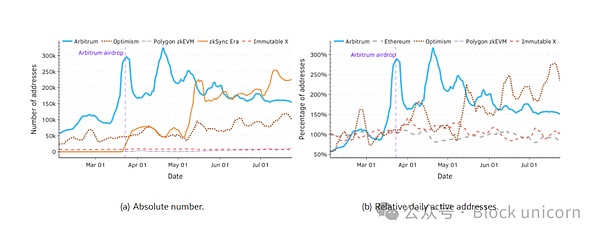

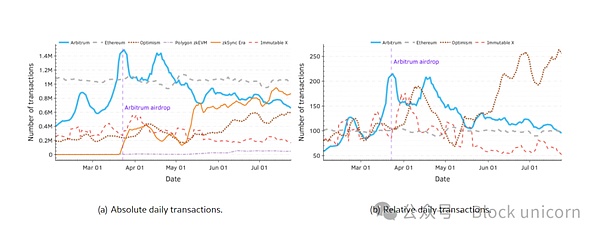

Figure 2: Daily active addresses per protocol, (a) directly shows how many unique users each platform has per day; (b) compares the number of daily active users per platform to the average before the Arbitrum airdrop, giving us a more intuitive view of the impact of airdrop activity on user activity.

For Gemstone, all tokens were sent to the address 0x7aa⋯49ad in one hop. On the other hand, in the dYdX airdrop, a more diverse range of exchange addresses were used. It is worth noting that, as shown in Table 3, some airdrop recipients chose to sell their tokens on exchanges. We see some common exchanges such as Uniswap, Wintermute, and SushiSwap.

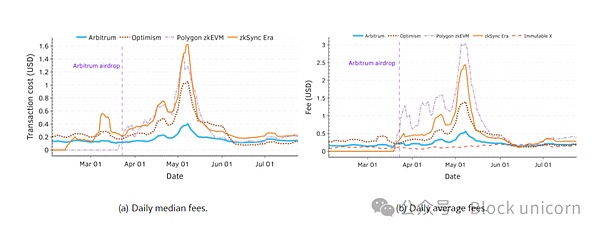

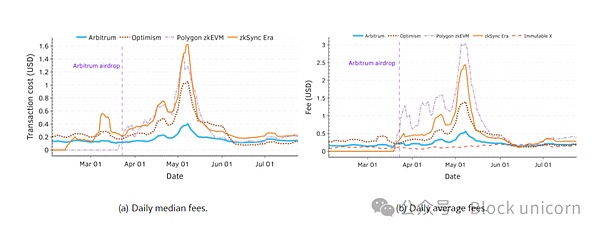

Figure 3: Daily transaction fees (USD), (a) Average fee per transaction.

Measuring Airdrop Uplift

Empirical research shows that some airdrops are successful in attracting users in the short term, at least on paper. While there is some preliminary data suggesting that airdrops perform poorly in achieving other goals, substantive research on this topic remains underdeveloped. In this section, we examine the performance of the Arbitrum airdrop across a number of relevant metrics, such as daily transaction volume, daily active addresses, median transaction fees, total value locked (TVL), fees paid by users, and stablecoin market capitalization. The data we rely on comes from Growthepie. See the Appendix for more details on this data.

Unique Active Addresses

A significant number of protocols performed better without an airdropWhile Arbitrum saw an increase in unique addresses post-airdrop and remain above 50% of pre-airdrop levels, other protocols saw similar growth without an airdrop. For example, Optimism saw a larger address growth in May 2023, which may be related to the launch of Bedrock. Similarly, ZKsync Era surpassed Arbitrum's address count within two months of its airdrop.

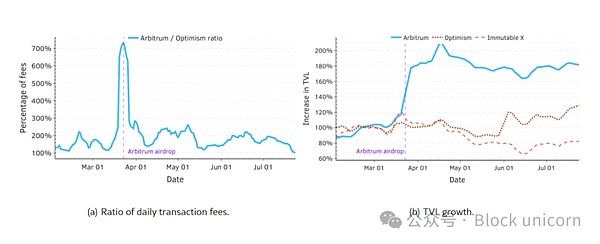

Fees may explain the narrowing gap between Arbitrum and Optimism. Arbitrum has consistently led Optimism in daily active addresses.However, the data shows that this gap is narrowing. Before the airdrop, Arbitrum had 2.6 times more active addresses than Optimism, but over the past 50 days, this ratio has dropped to 1.83 times. Optimism’s lower median transaction fees since June may partially explain this trend (see Figure 3(a)).

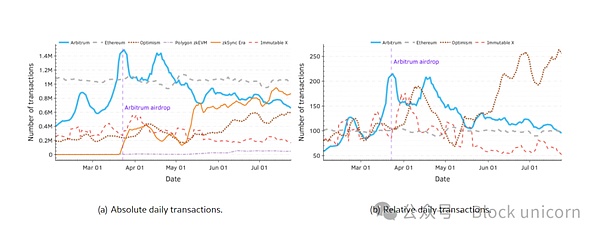

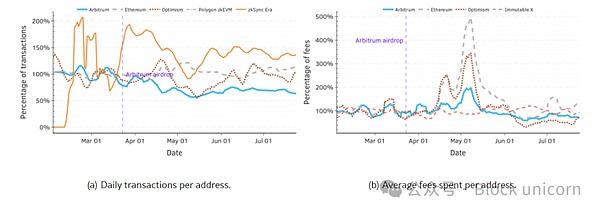

Unique address count fluctuates over time. The number of unique addresses exhibits volatile behavior, rising rapidly, peaking, and then falling. Notably, Optimism and Arbitrum exhibit opposite phases in relative address counts, which may be due to users switching between protocols as fees rise. However, there is no such pattern in median transaction fees, with Arbitrum having consistently lower fees through mid-May 2023. However, the number of unique addresses metric can be manipulated. Based on our analysis, Arbitrum’s airdrop did not lead to long-term user engagement, as the unique address metric is susceptible to manipulation. Users can create multiple addresses to exploit airdrop limits. This makes this metric less reliable as a measure of real activity, as large fluctuations can stem from such behavior. Furthermore, the availability of airdrop software makes it more convenient to automate such activities. Therefore, other more Sybil-resistant metrics should be considered to assess real user participation, such as combining graph network analysis and machine learning techniques. Transaction-related metrics provide a useful alternative to measuring “real” economic activity, as users must pay fees to send transactions, excluding cases of protocols with retroactive kickbacks or operating at a loss. The gap between Arbitrum and Optimism narrows when transactions are considered. Notably, the gap in transaction counts between Arbitrum and Optimism had almost closed by the end of July. Furthermore, the number of daily transactions for Immutable X has almost halved since Arbitrum’s airdrop, while its number of unique addresses has remained relatively stable (see Figure 4(b)). This suggests that user participation in Immutable X has declined despite the number of addresses remaining stable.

Figure 4: (a) directly shows the number of transactions per platform per day, and (b) compares the number of transactions per platform per day to the average before the Arbitrum airdrop, allowing us to more intuitively see the impact of the airdrop activity on the number of transactions.

Arbitrum's transaction volume per address dropped after the airdrop.To assess the impact of Arbitrum's airdrop on user participation in other protocols, Figure 5(a) shows the relative average daily transaction volume per unique address. Since the airdrop, Arbitrum's per-user transaction volume has fallen to less than 75% of its pre-airdrop level. However, transaction volume can be misleading without taking into account fees, so high transaction volume alone does not necessarily reflect true user participation. In this regard, some protocols require users to make multiple transactions to receive airdrops, which leads to inflated activity when fees are low. This is consistent with Goodhart's Law, which states that "when a metric becomes a target, it is no longer a good metric."

Figure 5: (a) Number of transactions per day; (b) Average daily transaction fee

Since June, average transaction fees are similar across all protocols.A good metric should reflect user commitment, and transaction fees can serve as a proxy because it measures the fees users are willing to pay to interact with the protocol. Since June, the average fees per transaction and per unique address are similar across protocols. Comparing the average fee and median fee (see Figure 3) shows that the median fee may be more helpful in understanding changes in user behavior. Another useful metric is the relative average fees per address compared to the 50 days before the Arbitrum airdrop, shown in Figure 5(b). This suggests that user engagement on Arbitrum was not significantly impacted by the airdrop, and generally follows a similar pattern to other protocols.

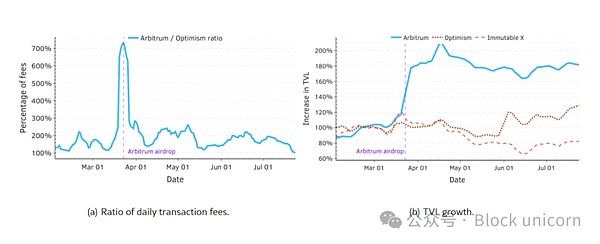

Arbitrum’s total daily fees surged during the airdrop, and Arbitrum’s airdrop did not give it a clear long-term advantage in transaction fees, as shown in Figure 9. Although Arbitrum experienced a spike in fees on the day of the airdrop, this increase was short-lived. In fact, see Figure 6(a), in the 50 days before the airdrop, Arbitrum’s daily transaction fees were on average 1.96 times higher than other protocols, while this ratio shrank to 1.74 in the last 50 days of the dataset.

Figure 6: (a) Daily transaction fee ratio of Arbitrum and Optimism; (b) TVL growth relative to the average of the 50 days before Arbitrum’s airdrop.

Total Value Locked (TVL), a protocol’s TVL is a measure of the total value of all assets stored within the protocol.

Arbitrum’s airdrop had a lasting impact on its TVL, with TVL being the only metric examined to show lasting improvement after the airdrop: Arbitrum’s TVL increased by over 50% immediately after the airdrop and has not declined significantly since then, as shown in Figure 6(b). This is perhaps surprising, as Arbitrum’s airdrop distribution strategy only considers user activity before February 6, 2023.

Common Airdrop Design Challenges

Airdrops, similar to traditional loyalty programs—such as new customer bonuses offered by banks and credit card companies—share several common design challenges. However, the unique context of blockchain technology and the specific mechanisms employed by most airdrops can exacerbate these challenges and even introduce new ones. In this section, we explore three of these challenges.

Airdrop Farmers

These are users who employ complex strategies to maximize the number of airdrop tokens they receive.

Blockchain protocols take a variety of steps to mitigate airdrop farmers from gaming the system, with a common approach being to limit the number of rewards a single user can receive.

As a result, protocols have turned to Proof-of-Humanity (PoH) services, such as Gitcoin Passport. These services typically assign a numerical score to users based on some metric, with the higher the score, the more likely it is that the user is a real person. Gitcoin Passport’s metrics are based on a series of tasks, such as connecting a user’s social media accounts, or holding a certain amount of ETH. These methods can be enhanced by analyzing on-chain data to detect and exclude Sybil attackers, but this can lead to false negatives.

There are other mitigation techniques, such as requiring users to perform tasks, from sending a certain type of transaction, to sharing a post on social media. These tasks can sometimes appear arbitrary, leading to user frustration, and are susceptible to automation and cheap cheating, especially when protocols offer rebates on transaction fees. Additionally, many protocols’ reliance on a limited number of PoH services means that a single investment by an airdrop farmer could result in a lucrative multiple airdrops, and even with biometric authentication, full Sybil resistance cannot be guaranteed.

Another approach taken by protocols is to announce airdrops and retroactively reward users who were active before the announcement. However, farmers can prepare in advance and interact with these protocols even when no airdrop is officially announced, as shown by the dYdX airdrop.

The reward farming phenomenon is not limited to crypto-related airdrops, and similar phenomena have also appeared in "traditional" loyalty programs. In particular, the practice of credit card farming, where users apply for credit cards only to receive rewards for new users, and then cancel the card after receiving the rewards. Given that similar problems exist even in traditional environments, where users can be easily identified and punished, the problem of rewarding airdrop users does not seem to be easy to solve.

Threat of Decentralized Governance

Some protocols distribute governance tokens through airdrops to achieve decentralization of their governance process.However, distributing governance tokens can be risky. These tokens enable holders to participate in the governance of the protocol and make key decisions through voting. Often, these tokens can also be redeemed for other tokens, which may give them monetary value, which may lead to more farmers to acquire these tokens.

Empirical evidence suggests that airdropping governance tokens may outperform non-governance tokens. Recent analysis shows that airdropped governance tokens outperform non-airdropped governance tokens by up to 14.99% in terms of market cap growth. However, the authors also note that this effect is not statistically significant when using common benchmarks.

Despite these potential benefits, airdropping governance tokens carries significant risks if not handled properly. It may concentrate too much power in the hands of a few users, leading to an unfair distribution of decision-making power within the system.Furthermore, some recipients may not consider the best interests of the protocol and may vote to change the protocol to facilitate their own interests, thereby undermining the long-term success of the protocol.

Insider Trading

This problem arises when an individual uses privileged information for financial gain to the detriment of other protocol users. This practice is widely considered a violation of securities laws in traditional financial markets and often triggers negative reactions from the blockchain community.

When someone inside the protocol uses privileged information to increase their own profits, it may trigger community backlash. Insiders may have advance knowledge of the metrics that determine eligibility and rewards for each address and may use this information to their advantage.For example, it was claimed that AltLayer’s head of growth may have used insider information to profit $200,000 from the airdrop, but it was later deemed to be a mere coincidence. However, such incidents may undermine users’ trust in these protocols.

This issue also raises concerns about fairness, as some users have superior and more accurate information than others. Identifying these insiders is a challenging task, so protocols need to provide exhaustive information to their users. In addition, incentivizing blockchain data analysis companies and research groups to conduct post-airdrop data audits can help identify insider traders by analyzing address details and transfer patterns. To achieve this, data availability is essential. Protocols should therefore ensure transparency and encourage in-depth analysis to maintain the integrity and fairness of the blockchain community.

Design Guidelines

The aforementioned design challenges, while concerning, can provide inspiration for future airdrop designers and provide guidance on potential paths to success.

Alternative Incentives to Maintain User Engagement

The long-term benefits of airdrops to protocols may be difficult to quantify, as the potential advantages may be indirect and difficult to measure, while the costs are often immediate and irreversible. In addition, certain costs and impacts, such as those incurred by distributing governance tokens, may be unpredictable. Therefore, instead of using airdrops, communities may consider alternative measures to achieve a more predictable relationship between costs and benefits. A simple alternative is for the community to vote to programmatically reward loyal users with discounts on future interactions. In the context of layer-2 (L2) solutions, these discounts could be applied to transaction fees. This approach encourages users to interact with the protocol again to benefit from the incentives, thus promoting ongoing user engagement. Furthermore, this incentive mechanism is relatively resilient to airdrop farmers, as the discounts have no intrinsic value outside the protocol and the costs to the protocol are only borne by users who actively use the system.

However, the design of the discount mechanism must be careful, including determining the eligibility criteria for users and setting appropriate discount levels. In addition, it is unclear whether discounts can attract users as effectively as the immediate and tangible rewards provided by airdrops. Another option is to conduct multiple airdrops over a longer period of time, rather than a one-time event. While this approach may still face some of the pitfalls of a standard one-time airdrop, it can help ensure long-term community engagement and prevent some protocols from experiencing a drop in user adoption immediately after an airdrop. Blast has taken a more innovative approach by launching a points-based rewards program. Under the program, users accumulate points through a variety of activities, thereby earning rewards, such as bridging tokens to the protocol (i.e., transferring funds from another protocol) and participating in referral programs that add more user points. Notably, Blast received $1.1 billion in deposits before its official launch. This approach provides measurable metrics for user contributions to the protocol, structured around a referral program model.

In addition, innovative allocation mechanisms play a vital role in mitigating the presence of Sybil attacks in whitelisted addresses. For example, Celestia proposes a unique design that uses GitHub commits as a proxy for assessing user contributions to the blockchain ecosystem. However, a concern that may arise is that users or farmers may generate fake activity on GitHub to exploit airdrops from other protocols, adopting similar strategies as Celestia. Therefore, farmers may expect new protocols to use similar selection criteria as past airdrops. To counter this, protocols can focus on metrics that are resistant to programmable manipulation, thereby increasing the difficulty or cost of creating automated user accounts.

Target well-known reputable entities

Instead of rewarding anonymous users, protocols can target developers and projects that are building relevant applications. For example, in Arbitrum’s airdrop, 1.13% of the distributed tokens were allocated to DAO projects. Arbitrum also provides additional incentives beyond airdrops to specific groups, such as university students and technical community members who want to participate in research and develop tools related to the protocol. Optimism implemented another approach by allocating a portion of revenue to successful projects for retroactive funding, essentially introducing the concept of entrepreneurship to the blockchain world. Prioritizing established and reputable entities, including projects, research groups, technical communities, and students building on the protocol, can promote ongoing participation. By funding these entities, the protocol may attract value-driven users and promote long-term participation. Proactive Governance and Community Engagement During the airdrop process, it is critical to continuously monitor and analyze protocol data to prevent malicious exploits. For example, the Linea team discovered a vulnerability that allowed users to manipulate the incentive mechanism. Timely discovery prevented the cheater from claiming more than one-third of the non-fungible tokens (NFTs) provided as incentives.

In addition to technical regulation, protocols should encourage the disclosure of vulnerabilities by maintaining open communication channels and offering bug bounties, regardless of whether the vulnerability has been exploited. For example, a community member of AzukiDAO disclosed a vulnerability, which enabled the protocol to handle it quickly. Regulation should also go beyond on-chain data. For example, social media is often used by scammers who steal user funds by promoting fake airdrops and tricking users into connecting their wallets to scam websites. Even if the protocol does not plan to conduct an airdrop, it may become a target of such scams.

Community active participation in technical discussions can also help improve security. For example, the NFT airdrop of ZKsync Era was retrospectively analyzed by cygaar and potential cost-saving improvements were found. Maintaining transparency and providing insights into the inner workings of the protocol to the community can help enhance trust. When technical problems arise, well-informed users are more likely to respond with understanding.

Rewards should be tied to costs

The impact of Goodhart's Law is evident in many past airdrops. For example, airdrops are often announced by publicly announcing rewards to users for actively participating in interactions (these projects are best not to participate in or are projects where KOLs are calling for everyone to participate). However, these methods can be abused, and users may meet the requirements through meaningless fake transactions, making the standard unable to truly reflect the user's true participation.

The problem is that the operational metrics used to determine eligibility often fail to take into account the actual cost paid by users for each operation. For example, when the number of transactions is the main metric, low transaction fees allow airdrop farmers to meet transaction volume requirements at a very low cost. A potential solution is to adopt a reputation-based mechanism, which can curb the artificial inflation of transaction volume. However, the protocol must carefully define "user reputation" and the appropriate metrics for evaluation.

On the contrary, high transaction fees may weaken the value of rewards received by users and reduce the attractiveness of airdrops. To address these issues, rewards should be adjusted according to the actual costs paid by users to ensure that the distribution of incentives is more fair and effective.

Related Work

Recent research on airdrops has focused on post-mortems and guidelines for designing effective airdrop campaigns.

Airdrop Research Yaish and Livshits proposed a theoretical model of airdrops, considering two groups of honest users and "airdrop farmers", the latter of which have lower airdrop qualification costs and lower intrinsic utility from using the platform that issues airdrops. In their analysis, it is shown that the threat of farmers' false identity attacks leads to infinite issuance costs when the issuer pays a non-zero fixed cost for each recipient. However, they also pointed out that the losses from farmers can be limited by setting the total amount of airdrop tokens in advance and distributing them equally to all recipients. Furthermore, by properly designing the airdrop mechanism, farmers can be used to promote network effects, thereby attracting honest users who might otherwise choose competing platforms.

Makridis et al. explored the impact of governance token airdrops on the growth of decentralized exchanges (DEXs). By analyzing 51 exchanges, they found that such airdrops significantly increased market capitalization and trading volume. Lommers et al. provided a comprehensive overview of various airdrop types, such as base airdrops, coin-holding airdrops, and value-based airdrop models. Their study points out how eligibility criteria, signaling, and implementation strategies affect the success of airdrop campaigns and provides practical suggestions for optimization. Fan et al. conducted a case study on the ParaSwap decentralized exchange and proposed a role classification based on user behavior and airdrop effects. Their study showed that users who received higher rewards were more likely to contribute actively to the community. In addition, they identified arbitrage patterns and pointed out the limitations of current methods for detecting airdrop hunters. On the other hand, graph network analysis and machine learning methods are proposed to address these problems as Sybil attack detection techniques.

Allen conducts nine airdrop case studies (e.g., Optimism, Arbitrum, Blur) and provides insights into aspects such as task-driven claim design. The study highlights the need for dynamic design and feedback loops, and notes that some projects may revert to simpler designs due to the complexity and cost of advanced mechanisms. Allen et al. examine the motivations behind token airdrops, focusing specifically on their role in marketing and decentralization. While airdrops are often viewed as a marketing tool, the authors argue that this rationale is weak, as there is limited evidence of successful airdrops driven by marketing. Instead, decentralization and community building are highlighted as the primary motivations for airdrops.

Technical Aspects of Airdrops Frowis et al. identify the operational challenges and costs of large-scale airdrops on Ethereum. They suggest that up to 50% of the costs could be saved through specific smart contract optimizations, while a claim-based approach could shift the costs to recipients. Overall, however, the total cost is still proportional to the number of recipients.

Wahby et al. address privacy issues in current airdrop mechanisms that leak information about recipients. They propose a zero-knowledge proof-based private airdrop scheme using RSA credentials that achieves privacy preservation while maintaining computational efficiency. Their implementation significantly improves the speed of signature generation and verification.

Conclusion

This study identifies common problems in airdrops and proposes guidelines to improve their effectiveness. Our analysis of six major airdrop projects shows that it is common for recipients to quickly sell their tokens - 36.62%, 35.45%, and 54.05% of ENS, dYdX, and 1inch tokens were traded shortly after distribution, with a median of only two transactions. This suggests that airdrops have failed to maintain long-term user engagement and attract valuable contributors.

For Arbitrum, we observed a surge in daily fees during the airdrop period, but this was accompanied by a drop in transactions per address. Other protocols that did not airdrop outperformed Arbitrum, and transaction fees have converged to be similar across protocols since June 2023, suggesting that airdrops are not a primary driver of user growth.

Finally, we discuss challenges such as airdrop farmers, governance token distribution, and insider trading, and provide insights for future airdrop strategies.

Hui Xin

Hui Xin